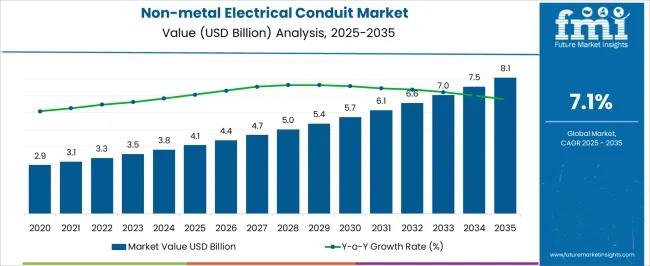

The non-metal electrical conduit market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 8.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

From 2020 to 2024, the market moves from USD 2.9 billion to USD 3.8 billion, reflecting steady gains driven by the increasing adoption of non-metallic conduits in residential, commercial, and light industrial construction. Annual increments such as USD 3.1 billion in 2021, USD 3.3 billion in 2022, and USD 3.5 billion in 2023 highlight consistent progress supported by rising demand for lightweight, corrosion-resistant, and cost-effective alternatives to metal conduits. By 2025, the market reaches USD 4.1 billion, marking the transition into its scaling phase.

Between 2026 and 2030, values expand from USD 4.4 billion to USD 6.1 billion, contributing nearly 40% of the total projected growth. This stage is shaped by rapid urban infrastructure development, expansion of smart cities, and growing use of conduits in renewable energy projects, where ease of installation and flexibility offer clear advantages. From 2031 to 2035, the market grows from USD 6.6 billion to USD 8.1 billion, accounting for about 35% of total growth. Demand in this phase is reinforced by maintenance cycles, ongoing retrofits, and integration with advanced electrical systems in both developed and emerging economies. The non-metal electrical conduit market is positioned for strong and sustained expansion, driven by construction growth, material advantages, and evolving electrical infrastructure needs.

| Metric | Value |

|---|---|

| Non-metal Electrical Conduit Market Estimated Value in (2025 E) | USD 4.1 billion |

| Non-metal Electrical Conduit Market Forecast Value in (2035 F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The non-metal electrical conduit market occupies a crucial position within the global electrical infrastructure landscape, capturing approximately 25–27% share of the broader conduit and wiring protection segment due to its resistance to corrosion, lightweight design, and ease of installation in residential, commercial, and industrial projects. Within the building and construction wiring ecosystem, non-metallic conduits hold nearly 20–22%, supported by growing adoption in new constructions, retrofitting projects, and compliance with electrical safety codes. In industrial automation and process facilities, the share is around 15–17%, driven by chemical-resistant PVC, CPVC, and HDPE conduits suitable for corrosive and high-moisture environments.

Within utility and public infrastructure applications, the segment accounts for roughly 12–14%, reflecting its role in underground and outdoor installations where metal alternatives may be prone to degradation. Growth is being propelled by increasing infrastructure investments, regulatory emphasis on safety standards, and demand for low-maintenance solutions across North America, Europe, and Asia. Challenges such as fire resistance requirements, mechanical strength limitations, and compatibility with advanced cable systems persist, yet the ease of handling, lower cost, and flexibility in installation ensure continued adoption. Over the long term, non-metal electrical conduits are expected to consolidate their position as a preferred solution in modern electrical distribution, where durability, chemical resistance, and regulatory compliance remain central.

The non-metal electrical conduit market is expanding rapidly due to urban infrastructure growth, residential construction trends, and regulatory mandates for safe, corrosion-resistant wiring solutions. Non-metal conduits offer cost-effective, lightweight, and flexible alternatives to metallic systems, especially in indoor and low-stress applications.

As demand surges for smart homes and electrical safety, the market benefits from adoption across residential, commercial, and light industrial sectors.

The popularity of PVC as a durable, low-maintenance material and the prevalence of mid-range trade sizes further streamline installation and compliance efforts.

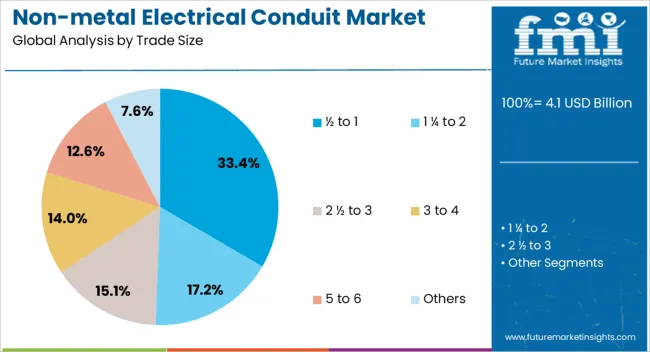

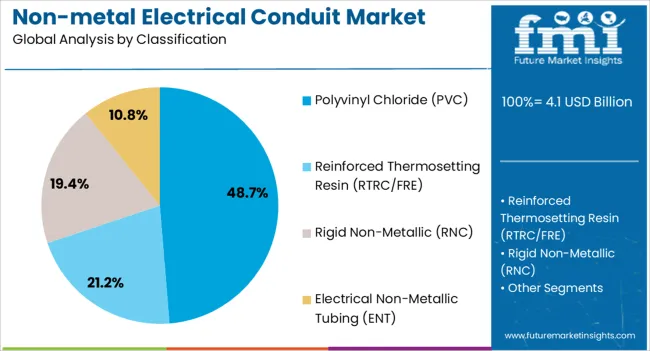

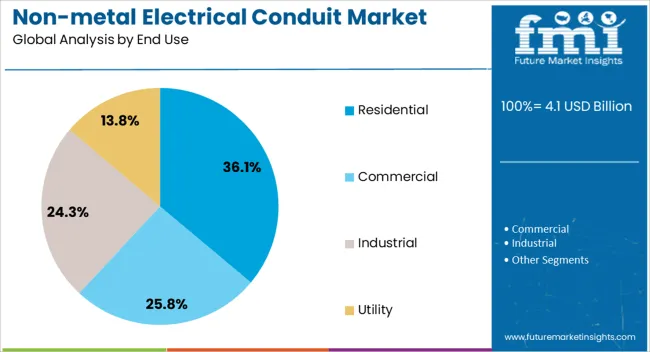

The non-metal electrical conduit market is segmented by trade size, classification, end use, and geographic regions. By trade size, non-metal electrical conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others. In terms of classification, non-metal electrical conduit market is classified into polyvinyl chloride (PVC), reinforced thermosetting resin (RTRC/FRE), rigid non-metallic (RNC), and electrical non-metallic tubing (ENT). Based on end use, non-metal electrical conduit market is segmented into residential, commercial, industrial, and utility. Regionally, the non-metal electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size segment is projected to lead the market with a 33.4% share by 2025. These mid-range conduit sizes offer optimal balance between current-carrying capacity and space-saving installation. Widely used in residential wiring and light commercial systems, they support cost-effective deployment in retrofitting and new build projects. Their adaptability to various fittings and ease of cutting without special tools enhances on-site installation efficiency.

PVC is expected to dominate the market with a 48.7% share by 2025, owing to its fire resistance, chemical stability, and affordability. It is highly favored for indoor electrical wiring where moisture and mechanical strain are minimal. Its smooth internal surface allows easy wire pulling, and availability in multiple diameters supports varied applications. As codes and builders prioritize corrosion resistance and electrical insulation, PVC’s dominance is further reinforced.

Residential construction is forecasted to lead with 36.1% share in 2025, driven by rising urban housing development, electrification programs, and retrofitting demand. Non-metal conduits are widely chosen in home installations for their affordability, ease of handling, and insulation properties. Growth in smart home devices and distributed energy systems also increases wiring complexity, making reliable conduit solutions a residential priority.

Non-metal electrical conduits are gaining traction across residential, commercial, industrial, and utility sectors due to durability, corrosion resistance, and ease of installation. Regulatory support and cost efficiency further strengthen their adoption worldwide.

The use of non-metal electrical conduits in residential construction is expanding due to their lightweight nature, corrosion resistance, and ease of installation. Homebuilders increasingly prefer PVC, CPVC, and HDPE conduits for wiring protection in apartments, villas, and housing complexes. Lower labor costs and faster installation cycles drive adoption, especially in large-scale residential developments. Growing awareness of electrical safety and compliance with building codes further incentivizes the use of non-metal conduits over traditional metal alternatives. Retrofit projects in older homes also contribute to demand, as these conduits provide flexibility for upgrades. Market players are focusing on supplying pre-cut and customizable conduit solutions to meet varying residential specifications efficiently

Non-metal conduits are witnessing strong demand in commercial infrastructure, including office complexes, retail centers, and hospitality projects. Architects and facility managers favor these conduits for their durability, fire-retardant properties, and chemical resistance. In addition, non-metal conduits simplify electrical system design by reducing the need for heavy support structures, allowing easier routing of complex cable networks. Adoption is further supported by local regulations mandating safer electrical installations in high-occupancy commercial buildings. Electrical contractors value the flexibility and lower handling costs of non-metal conduits, which improve project timelines. Suppliers are introducing conduit varieties compatible with advanced cable management systems to cater to growing commercial infrastructure requirements.

In industrial and process environments, non-metal electrical conduits are used extensively for wiring protection in corrosive and high-moisture conditions. Facilities in chemical, pharmaceutical, and water treatment sectors require conduits resistant to chemicals, UV exposure, and temperature variations. CPVC and HDPE conduits dominate these applications due to their mechanical and chemical stability. The demand is driven by compliance with industrial electrical safety standards and the need for low-maintenance solutions. Manufacturers are investing in robust conduit systems designed for high-pressure and heavy-duty industrial setups. Flexible installation options and the ability to withstand harsh environmental conditions make non-metal conduits increasingly preferred in expanding industrial landscapes.

Non-metal conduits are increasingly applied in public infrastructure, including utilities, transportation, and urban service networks. They provide corrosion resistance for underground and outdoor installations and reduce maintenance costs compared to metal alternatives. Governments and municipalities favor non-metal conduits for electrical grid expansion, street lighting, and water pump stations. Regulatory frameworks emphasizing electrical safety and fire protection support their adoption. The market is witnessing growth as suppliers develop UV-stabilized, high-durability conduits suitable for outdoor exposure. Long-term planning for utility networks also encourages the use of non-metal conduits to ensure reliable performance, low operational costs, and extended service life in public infrastructure projects.

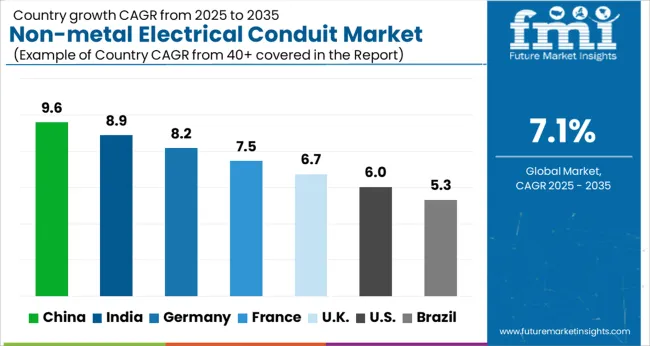

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

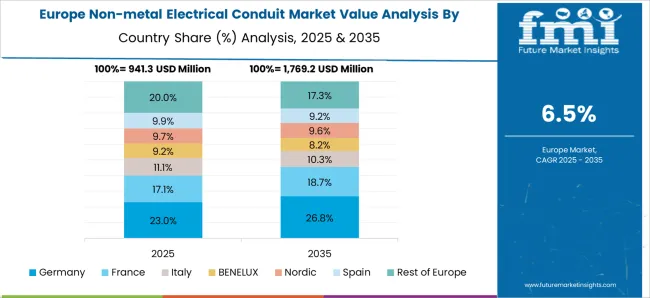

The non-metal electrical conduit market is projected to grow globally at a CAGR of 7.1% from 2025 to 2035, driven by rising demand across residential, commercial, industrial, and utility infrastructure applications. China leads with a CAGR of 9.6%, supported by large-scale urban and industrial electrification projects, increased construction of housing and commercial complexes, and adoption of corrosion-resistant conduit systems. India follows at 8.9%, benefiting from government-backed infrastructure programs, expanding industrial parks, and growing retrofitting of electrical networks in urban and semi-urban regions. France posts 7.5%, influenced by public and private sector investments in electrical safety, building code compliance, and replacement of aging metal conduits. The United Kingdom achieves 6.7%, with growth driven by commercial construction, modernization of office and retail electrical systems, and utility network upgrades. The United States records 6.0%, reflecting steady industrial and residential demand, stringent electrical safety regulations, and gradual replacement of conventional metallic conduits. These country-level trends indicate Asia-Pacific as a high-growth region, Europe maintaining stable incremental growth, and North America sustaining consistent demand, positioning non-metal conduits as a preferred choice across multiple applications worldwide.

China’s CAGR for the non-metal electrical conduit market was 7.8% during 2020–2024 and increased to 9.6% across 2025–2035, indicating a marked acceleration. Initial growth was supported by ongoing residential and commercial construction, early adoption of corrosion-resistant conduit systems, and retrofitting of industrial electrical networks. The stronger phase reflects massive infrastructure investments, expansion of industrial parks, and growing demand for fire- and corrosion-safe electrical installations. Domestic manufacturers have scaled production, targeting both urban and semi-urban projects, while government-backed electrification initiatives in transportation, utilities, and manufacturing continue to expand market volume. By 2035, China is projected to remain the dominant market globally.

India’s CAGR for the non-metal electrical conduit market stood at 7.1% during 2020–2024 and rose to 8.9% across 2025–2035, reflecting steady growth acceleration. Earlier adoption was influenced by pilot infrastructure projects, initial industrial park electrification, and gradual replacement of aging metal conduits. The subsequent increase is driven by government-backed smart city programs, expansion of manufacturing zones, and wider deployment of electrical safety-compliant conduits in commercial and residential developments. Local manufacturers expanded production to meet rising demand from urban centers and semi-urban industrial clusters. India’s focus on reliable, cost-efficient electrical infrastructure is expected to sustain high market momentum in the next few years.

France’s CAGR for the non-metal electrical conduit market recorded 6.3% between 2020–2024 and increased to 7.5% during 2025–2035, reflecting moderate expansion. Initial growth was driven by electrical safety compliance, gradual replacement of metal conduits, and ongoing investments in public building retrofitting. Strengthened expansion in the latter period is linked to large-scale commercial construction, modernization of industrial facilities, and increased awareness of corrosion-resistant conduit benefits. Manufacturers focused on high-quality, code-compliant products while government incentives for safer electrical installations contributed to higher adoption rates. France remains a stable market in Europe, sustaining incremental growth with steady demand across multiple applications.

The United Kingdom’s CAGR for non-metal electrical conduit was 5.6% during 2020–2024 and is projected to reach 6.7% between 2025–2035, highlighting measured growth. Early-stage adoption was shaped by steady commercial construction, incremental infrastructure upgrades, and limited replacement of traditional metallic conduits. Growth in the next decade is expected to be stronger due to modernization of office buildings, retail complexes, and utility networks emphasizing fire- and corrosion-resistant solutions. Increasing awareness of conduit safety, compliance with British standards, and targeted adoption in industrial facilities support sustained demand. The UK continues to offer a mature but steadily expanding market for non-metal conduit solutions.

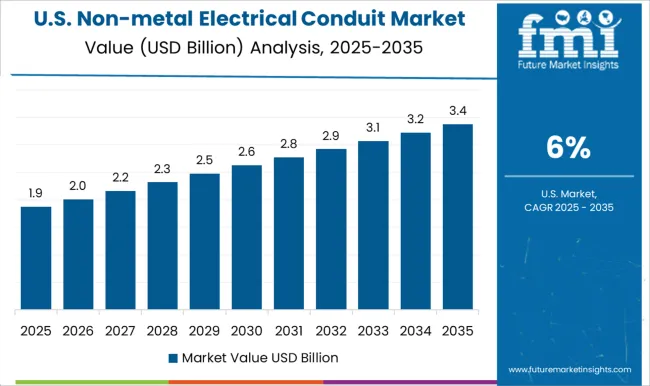

The United States’ CAGR for non-metal electrical conduit market was 5.0% between 2020–2024 and improved to 6.0% for 2025–2035, reflecting steady expansion. Early growth resulted from ongoing retrofitting of aging electrical systems, incremental construction, and initial adoption in industrial and commercial projects. The later acceleration is driven by broader replacement programs, safety-focused building codes, and growing awareness of non-metal conduit benefits, including corrosion resistance and fire safety. Manufacturers expanded production capacities to serve industrial, commercial, and residential sectors. The USA remains a mature market with steady replacement-driven growth and incremental demand from modernization programs across multiple infrastructure sectors.

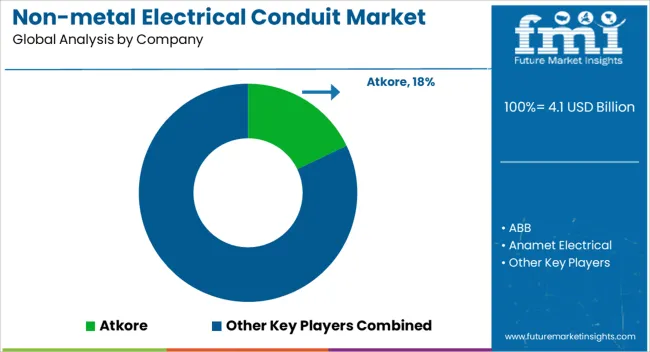

The non-metal electrical conduit market is characterized by participation from leading electrical infrastructure suppliers, industrial equipment manufacturers, and specialty conduit producers catering to commercial, residential, and industrial installations. Atkore has established a strong presence through a wide range of corrosion-resistant and flexible conduit solutions, targeting industrial and commercial projects. ABB strengthens its position by offering integrated electrical systems and conduit solutions optimized for safety and compliance across multiple sectors. Anamet Electrical focuses on modular and scalable conduit systems for industrial and infrastructure applications, while Astral leverages lightweight, high-durability conduits for residential and commercial construction projects. Cantex has gained recognition in North America for innovative PVC and flexible conduit offerings, serving electrical contractors and utilities.

Champion Fiberglass emphasizes corrosion- and chemical-resistant conduits suitable for industrial, marine, and infrastructure environments. Electri-Flex supports adoption with flexible metallic and non-metallic conduit solutions, addressing safety and installation efficiency. Guangdong Ctube Industry drives competitiveness through large-scale production capabilities and cost-efficient conduits in Asia. HellermannTyton focuses on cable management integration and modular conduit systems across industrial and commercial sectors. Hubbell delivers complete electrical infrastructure packages with non-metal conduits and fittings, supporting construction and industrial projects. Legrand strengthens its footprint through standardized, code-compliant conduit solutions in commercial and residential projects.

Schneider Electric emphasizes integrated electrical safety solutions, including non-metallic conduits, in industrial and infrastructure applications. Wienerberger provides innovative, durable conduit systems for civil, residential, and industrial electrical installations. Competition in this market is defined by product reliability, code compliance, material innovation, and distribution networks. Strategic differentiation is achieved through R&D investment, regional manufacturing scale, partnerships with electrical contractors, and expanded portfolio offerings to serve multiple end-use sectors, positioning these companies as central players in global non-metal electrical conduit deployment.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Classification | Polyvinyl Chloride (PVC), Reinforced Thermosetting Resin (RTRC/FRE), Rigid Non-Metallic (RNC), and Electrical Non-Metallic Tubing (ENT) |

| End Use | Residential, Commercial, Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atkore, ABB, Anamet Electrical, Astral, Cantex, Champion Fiberglass, Electri-Flex, Guangdong Ctube Industry, HellermannTyton, Hubbell, Legrand, Schneider Electric, and Wienerberger |

| Additional Attributes | Dollar sales, share by material type (PVC, fiberglass, flexible), regional adoption trends, regulatory compliance, construction vs industrial demand, competitive landscape, pricing benchmarks, and end-use segment penetration. |

The global non-metal electrical conduit market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the non-metal electrical conduit market is projected to reach USD 8.1 billion by 2035.

The non-metal electrical conduit market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in non-metal electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of classification, polyvinyl chloride (pvc) segment to command 48.7% share in the non-metal electrical conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Electrical Safety Personal Protection Equipment (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steering Column Lock Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steel Market Growth - Trends & Forecast 2025 to 2035.

Electrical Coil Tester Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Fuses Market Analysis – Growth & Forecast 2025 to 2035

Electrical Digital Twin Market Growth – Trends & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Electrical Steel Coatings Market 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA