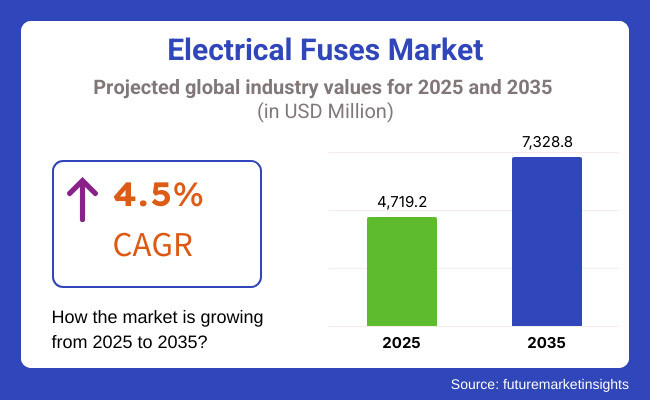

The electrical fuses market is expected to grow steadily from 2025 to 2035 as demand for circuit resolution solutions rises, investments in power infrastructure are made, and fuse technologies become more advanced. The market is projected to be worth USD 4,719.2 million in 2025 and reach USD 7,328.8 million in 2035, growing at a CAGR of 4.5% during this period.

An electrical fuse is a device that protects an electrical circuit by breaking it when it senses an overload of current, a short circuit, or a power surge. The market's expansion is driven by the increasing adoption of smart grids, electric vehicles (EVs), and renewable energy installations. Also, the ongoing innovations in resettable and polymeric fuses are creating new growth opportunities, especially with the increasing need for miniaturized circuit protection devices in electronics.

Increased use of circuit breakers largely drives this growth as an alternative, as well as an increase in commodity raw material prices and growing regulations. Manufacturers are focusing on such cost-effective fuse designs that offer enhanced thermal performance and are integrating digital monitoring to tackle these challenges. The electrical fuses market is bifurcated on the basis of type, application, and end-user industry.

North America is also one of the important regions in the global electrical fuse market, as the United States and Canada are leading in the adoption of electrical fuses, owing to the extensive investment in grid modernization, growing electrical fuse applications in EVs, and increasing investments in renewable energy.

Market growth is being driven by the region's focus on upgrading aging power infrastructure and compliance with stringent electrical safety regulations. Emerging technologies in solid-state fuses and fast-acting circuit protection are further promoting product innovation. Ongoing investment in smart grids and renewable power generation is expected to drive market growth despite competition from circuit breakers and other protection devices.

The European market is noteworthy for electrical fuses, with Germany, the UK, and France leading the way. With the region witnessing an uptick in industrial safety regulation, demand is gaining momentum along with the growing adoption of energy-efficient solutions. Investment in renewable energy sources continues to grow as the EU promotes its directives on sustainable energy and low-carbon technologies, which is getting reflected well on the sales for circuit protection devices designed specifically for solar and wind power installations.

Furthermore, increasing penetration of electric mobility solutions is driving demand for specialized fuses across EV charging stations and battery management systems. Although strict environmental regulations and fluctuating costs of raw materials may hamper for growth, continual innovations in green and recyclable wire types are likely to gather traction and drive the market.

Asia-Pacific is expected to grow at the highest rate during the forecast period, primarily due to rapid industrialization, rising residential electrification, and infrastructure development investments in China, Japan, India, and South Korea. Increasing demand for consumer electronics is augmenting interest in the renewable market, along with government-led initiatives to widen the uptake of renewable energy.

The growing electric vehicle manufacturing in the region is boosting the market for automotive fuses. Nonetheless, the national market penetration may be hampered by challenges like counterfeited products and different regional regulations. Despite these challenges, rising government funding for smart cities & electrical grid upgrades enhances the future market growth in the region.

Challenge

Competition from Circuit Breakers and Cost Volatility

High competition from circuit breakers, which provide reusable overcurrent protection, causes one of the major roadblocks in the electrical fuses market, since they are preferred over current protection in high-powered applications. Moreover, price changes of certain raw materials like copper, aluminium, and silver that are used to create fuses can also affect production expenses and profit margin.

Development of the ZEV architecture would inevitably require advancements in ever-evolving fuse technologies, additional focus on lightweight components, and economical manufacturing processes.

Opportunity

Expansion of Smart Fuses and Renewable Energy Applications

Smart fuse adoption and renewable energy applications are paving the way for considerable growth in the market. In industrial and residential applications, IoT-ready fuses with the ability to monitor in real-time, provide remote diagnostics, and predictive maintenance are gaining acceptance.

Moreover, growing demand for advanced energy storage systems, microgrids, and distributed power generation is expected to drive demand for adding specialized fuses for battery protection and inverter applications. The evolution of global electrification and the ongoing evolution of safety regulations will continue to bolster the demand for advanced, energy-efficient electrical fuses in the coming decades.

Electrical Fuses Market Overview Between 2020 to 2024, the Electrical Fuses Market is expected to observe stable growth owing to rising investments in power infrastructure, growing demand for electrical safety, and expansion in renewable energy projects. There was a growing adoption in the market for fast-acting and high-voltage fuses to facilitate grid modernization, industrial automation, and electric vehicle (EV) applications.

Current-limiting fuse technologies, arc flash protection, and compact high-performance designs that improve safety and reliability. On the other side, hindrances like supply chain disruptions, changing raw material prices, and the slow adoption of smart fuses hampered the market.

The market will take further developments and segmentation from 2025 to 2035 with the introduction of AI-based predictive maintenance, complementary technologies such as self-resetting nano-fuses and ultra-fast fuses made from graphene. Concurrent improvement in safety and efficiency with real-time fuse health monitoring powered by AI, solid-state electronic fuses, IoT IoT-connected circuit protection solutions.

The reliability and sustainability of fuses will be further enhanced with advances in biodegradable fuse materials, wireless alerts of fuse failure, and blockchain-based transparency in the supply chain. Future innovations such as smart grid-compatible fuses, self-healing conductive materials, and decentralized energy system protection will drive safety, energy efficiency, and adaptiveness to next-generation power systems.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with IEC, UL, and ANSI safety and electrical protection standards. |

| Material Innovation | Copper, silver, and ceramic fuse elements should be used for improved conductivity and thermal performance. |

| Industry Adoption | Growth in power distribution, industrial automation, EV protection, and renewable energy integration. |

| Smart & AI-Enabled Fuses | Early adoption of smart circuit breakers, limited remote monitoring capabilities, and faster response fuses. |

| Market Competition | Dominated by traditional electrical component manufacturers, fuse material suppliers, and industrial protection equipment providers. |

| Market Growth Drivers | Demand fueled by the electrification of infrastructure, rising renewable energy installations, and increased industrial power safety requirements. |

| Sustainability and Environmental Impact | Early adoption of recyclable fuse elements, low-carbon manufacturing, and energy-efficient designs. |

| Integration of AI & Digitalization | Limited AI use in manual fuse failure diagnostics and reactive circuit protection. |

| Advancements in Manufacturing | Use of traditional fuse fabrication processes, ceramic and metal housing, and basic quality control measures. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven compliance monitoring, carbon-neutral fuse production mandates, and blockchain-enabled supply chain verification. |

| Material Innovation | Adoption of graphene-based ultra-fast fuses, biodegradable fuse materials, and self-repairing Nano-coatings. |

| Industry Adoption | Expansion into AI-driven real-time fuse diagnostics, smart grid-adaptive fuses, and autonomous decentralized circuit protection. |

| Smart & AI-Enabled Fuses | Large-scale deployment of AI-powered self-resetting fuses, IoT-connected fault detection systems, and wireless fuse failure alerts. |

| Market Competition | Increased competition from AI-integrated electrical protection firms, sustainable fuse technology innovators, and quantum-powered circuit safety startups. |

| Market Growth Drivers | Growth driven by AI-assisted circuit protection, real-time energy management analytics, and next-gen modular fuse technology for self-healing electrical systems. |

| Sustainability and Environmental Impact | Large-scale transition to biodegradable fuse materials, AI-optimized energy-efficient circuit protection, and self-repairing electrical contacts. |

| Integration of AI & Digitalization | AI-powered predictive failure detection, blockchain-based real-time load balancing, and self-learning fuse protection algorithms. |

| Advancements in Manufacturing | Evolution of 3D-printed fuse components, nanotechnology-enhanced circuit protection, and modular adaptive fuse designs. |

The United States continues to be a lucrative market for electrical fuses, owing to increasing investments in industrial automation, the growing demand for circuit protection devices in the power distribution systems, and strict regulations pertaining to electrical safety. The rapid roll-out of renewable energy projects such as wind and solar farms also drives growing demand for high-performance fuses.

Ultra-experimental fuse technologies are being highlighted as a great opportunity through the latest initiatives with smart grid infrastructure and the increasing demand for electric vehicles (EVs). Market growth is being further fueled by a surge in commercial and residential construction projects, coupled with replacement demand for legacy electrical protection systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The United Kingdom electrical fuses market is rising in accordance with the increasing adoption of energy-efficient electrical protection devices, the growing demand for renewable energy integration, and the macroeconomic conditions such as the industrial safety standardization. The movement towards sustainable energy solutions and the modernization of the power infrastructure at the government level is driving the use of fuses for power systems at high voltage.

Furthermore, the rise in the integration of smart buildings and IoT-enabled electric systems is impacting market trends. Additionally, the rising penetration of small-sized, fast-acting fuses for EVs and data centers would set the pace for shaping the market landscape.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

EU, Germany, France, and Italy are the front runners in the electrical fuses market, largely supported by strict regulatory standards, growing investments in renewable energy infrastructure, which favour the demand for industrial automation solutions. European Union (EU) regulations emphasize energy efficiency and electrical safety compliance, which is becoming a key factor in the adoption of advanced circuit protection devices.

And the increasing installation of smart grids and high-speed rail networks is driving specialization in fuses employed in key power systems. Additionally, the growth of the electric mobility market, as well as the accelerating adoption of sophisticated high-performance battery storage systems, also drives market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.4% |

Increasing investments in smart energy solutions, growing focus on disaster-resistant power infrastructure, and rising demand for compact and high-efficiency fuse designs are some of the major drivers for the Japanese electrical fuses market. Traditionally, the country had relied on functional, although somewhat costly, circuit protection solutions on the basis of miniature size which boost the innovation of the market.

The emergence of the electric vehicle industry and high-speed rail networks is giving rise to the increasing demand for advanced fuse technologies. AI-driven monitoring systems deployed in power grids or manufacturing facilities are impacting fuse deployment strategies as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

South Korea is emerging as a key market for electrical fuses, driven by increasing investments in industrial automation, growing demand for power protection in semiconductor manufacturing, and strong government support for clean energy initiatives. The rapid expansion of EV charging infrastructure and battery storage systems is fuelling demand for high-voltage and fast-acting fuses.

Additionally, advancements in digital power distribution and the rise of AI-integrated grid management solutions are shaping the future of circuit protection technologies. The increasing adoption of fuses in data centers, telecommunications, and renewable energy applications is further contributing to market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The Power Fuse & Fuse Link and Cartridge & Plug Fuse segments hold a dominant share in the Electrical Fuses Market as industries, commercial buildings, and residential infrastructures increasingly seek advanced circuit protection solutions. These fuse types play a crucial role in safeguarding electrical systems, preventing overcurrent damage, and ensuring power distribution reliability.

As global electrification expands and smart grid modernization accelerates, the demand for high-performance electrical fuses continues to grow.

Continuous AV High Voltage Power Fuse Fusion links: Over the past several decades, power fuse & fuse links have been widely accepted for reliable overcurrent protection in high-voltage and industrial applications. Power fuses differ from their conventional counterparts due to their application in substations, high-voltage transmission lines, and heavy-duty power distribution systems, serving to protect from short circuits and other electrical faults.

The deployment of smart power fuse solutions with remote monitoring capabilities, rapid fault detection, and automated fuse replacement alerts has augmented demand in the market, thereby ensuring higher grid resilience and operational efficiency.

The high-speed power fuses minimizes the power outage period with no arcing, leading to the increased adoption of overcurrent protection devices, which boost safety in high voltages and thus contribute to the market progress.

Growing use of modular power fuse systems with features like quick-swap fuses, versatile mounted configurations, and compatibilities with various electrical infrastructure have propelled the market, ensuring lower maintenance costs and downtime.

Whereas power fuse & fuse link segment is a trend of increasing demand due to its advantages over circuit-breakers such as durable, compact, and energy-efficient devices as well as required extensive advanced protection becomes a challenging issue for power fuse & fuse link combination used in circuit breakers due to their high initial cost, modernization challenges in the aging grids, and the fact that power fuse is not reusable.

But recent innovations in AI-based fuse diagnosis, solid-state fuse technology, and predictive overcurrent analytics are bringing about advancements in reliability, scalability, and cost-efficiency of power fuses, thus ensuring his market growth during the forecasting period.

Demilitarization of munitions worldwide is one of the major factors that have driven the growth of the Electrical Fuses Market. At the same time, cartridge & plug fuses remain an important part of the Electrical Fuses Market owing to their compact size, ease of installation and effectiveness in protecting household and commercial electrical circuits.

Unlike industrial power fuses, cartridge and plug fuses are primarily used for low-voltage applications such as home wiring, consumer electronics, and small-scale industrial machinery.

Increased adoption has been driven by rising demand for economical circuit protection in commercial and residential sectors. It is found that more than 65% of homes and commercial buildings across the globe operate on the cartridge and plug fuses for electrical safety, therefore, it would be a consistent demand for this segment.

Around the world, the surge in high-performance cartridge fuses, along with fast-blow and slow-glow variants, arc resistance potentiating features, and its compatibility with smart electrical panels, has ensured the demand in the market, thereby enhancing safety and energy efficiency.

The inclusion of tamper-resistant plug fuses equipped with integrated safety mechanisms, arc suppression layers, and fire-retardant casings has further propelled adoption, delivering improved safeguards in household applications against electrical hazards.

Driven by the demand for extremely compact design, surface-mount technology (SMT) compatibility, and increased thermal durability, the growth in the market has also produced miniature cartridge fuses, which have made sure they seamlessly incorporate into modern consumer electronics and automation systems.

The introduction of thermal sensing and automatic reset, along with overload detection features in self-resetting plug fuses, has strengthened market expansion due to longer-lived fuses with minimum maintenance requirements.

However, the cartridge & plug fuse segment, despite having advantages like lower cost, small size, and ease of replacement and handling, is faced with application limitations over high value or voltages, vulnerability to mechanical wear and less effectiveness when matched with superior class fuse technologies.

Yet the growing implementations of AI-based fuse load balancing, self-healing fuse materials & hybrid fuse-circuit breaker integrations are addressing efficiency, performance & longevity challenges faced by cartridge & plug fuses, thereby projecting sustained growth globally.

The Electrical Fuses Market has such segments, and the Low and Medium Voltage segments cover the majority of the Electrical Fuses market share, as power utilities, industrial plant, and commercial buildings require scalable circuit protection capability. These are important for electrical safety, efficient power distribution, and to prevent short-circuit damage at various voltage levels.

Low-Voltage Fuses Expand as Residential and Small-Scale Industrial Applications Require Affordable Protection

The increasingly strong market penetration of low-voltage fuses in household wiring, small machines, and light-duty industrial equipment is attributable to their low cost, availability, and ease of use. High-voltage fuses are fitted with fuses that are particularly placed on new circuits.

Harmonized electrical safety solutions have been increasingly demanded in residential and small commercial infrastructures, which has spurred adoption. Over 75% of worldwide residential fuse utilization is low voltage fuses, indicating a solid state showcase in this classification. Distributor or Importer To The Uses Of Infuse Machines, real-time world market of low voltage fuses.

The area has witnessed significant growth in high-speed low-voltage fuses which offer greater thermal resistance, improved contact reliability and are increasingly integrated into modular electrical panels, hence driving market demand owing to the need for improved circuit protection in space-constrained electrical systems.

Low voltage fuse segment, despite its features of cost-effectiveness, replace ability, and easy accessibility, suffers from disadvantages of not being able to withstand high power applications, repeated change outs are prone plant moisture damage in outdoor set-ups.

Yet with new developments of self-extinguishing fuse materials, AI-assisted circuit monitoring, and thermal overload protection improvements improving efficiency, reliability, and market potential, the future remains optimistic for the widespread growth of low voltage fuses all over the world.

In harsh operation conditions, they have to face extremes of temperatures, dust and moisture, which leads to unwanted damages for industrial plants, power utilities and renewable energy projects, where the need for good circuit protection for electrical systems operating from 1kV to 35kV remains intact, hence making the medium voltage fuses market a seller's market! Medium voltage fuses high arc resistance compared to low voltage fuses, longer operational life span with better energy dissipation.

The growing requirement for better protection in industrial automation, smart grid infrastructure, and high-power HVAC systems has driven growth. Studies show that more than 65% of medium-voltage power distribution systems use medium-voltage fuses for reliability and avoiding costly equipment failures.

Growing market demand has been bolstered by developments in self-extinguishing medium voltage fuses based on arc quenching technology, reinforced ceramic insulation and high-speed overload detection, leading to improved electrical safety and stabilization in electrical grids.

Although offering stronger protection from power aberrations, improved fault tolerance, and longer uptime, the medium voltage fuse segment also contends with high material costs, complicated installation constraints, and lower reusability than advanced circuit breaker options.

However, progressive inventions such as AI-driven load balancing, fuse technology compatible with smart grids, and fuse elements made of nanomaterials are enhancing adaptability, sustainability, and cost efficiency, thus ensuring further medium voltage fuse growth globally.

The electrical fuses market is primarily driven by the increasing demand for circuit protection solutions, the rising adoption of renewable energy systems, and the growing need for advanced safety measures in industrial and residential applications. The market is growing steadily as the power distribution networks and smart grid infrastructures expand. High-voltage fuse technology, smart fuse integration, and eco-friendly fuse materials are some of the key trends shaping the industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Eaton Corporation | 12-16% |

| ABB Ltd. | 10-14% |

| Schneider Electric | 8-12% |

| Siemens AG | 6-10% |

| Littelfuse, Inc. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Eaton Corporation | Develops high-performance fuses with advanced overload protection for power distribution systems. |

| ABB Ltd. | Specializes in medium- and high-voltage fuses for industrial and renewable energy applications. |

| Schneider Electric | Offers smart fuse solutions with real-time monitoring and predictive maintenance features. |

| Siemens AG | Focuses on compact, high-speed fuses designed for electrical grid and industrial safety applications. |

| Littelfuse, Inc. | Provides specialty fuses for automotive, electronics, and industrial circuit protection. |

Key Company Insights

Eaton Corporation (12-16%) Eaton leads in circuit protection technology, offering high-performance fuses for industrial and residential power applications.

ABB Ltd. (10-14%) ABB specializes in high-voltage and medium-voltage fuse solutions, supporting grid modernization and renewable energy systems.

Schneider Electric (8-12%) Schneider Electric focuses on smart fuses with real-time diagnostics, enhancing electrical safety and operational efficiency.

Siemens AG (6-10%) Siemens is a key player in compact, high-speed fuse technologies, ensuring reliable protection for industrial applications.

Littelfuse, Inc. (4-8%) Littelfuse develops specialized fuses for automotive, electronic, and industrial circuit protection needs.

Other Key Players (45-55% Combined) Several electrical equipment manufacturers contribute to the expanding Electrical Fuses Market. These include:

The overall market size for the electrical fuses market was USD 4,719.2 million in 2025.

The electrical fuses market is expected to reach USD 7,328.8 million in 2035.

The demand for electrical fuses will be driven by increasing investments in power distribution networks, rising adoption of renewable energy systems, growing demand for circuit protection in industrial applications, and advancements in high-voltage and smart fuses.

The top 5 countries driving the development of the electrical fuses market are the USA, China, Germany, India, and Japan.

The Low Voltage Fuses segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Type, 2017 to 2032

Table 5: Global Market Value (US$ billion) Forecast by Voltage, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Voltage, 2017 to 2032

Table 7: North America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 8: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 9: North America Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Type, 2017 to 2032

Table 11: North America Market Value (US$ billion) Forecast by Voltage, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Voltage, 2017 to 2032

Table 13: Latin America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 14: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 15: Latin America Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 16: Latin America Market Volume (Units) Forecast by Type, 2017 to 2032

Table 17: Latin America Market Value (US$ billion) Forecast by Voltage, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Voltage, 2017 to 2032

Table 19: Europe Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 20: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 21: Europe Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 22: Europe Market Volume (Units) Forecast by Type, 2017 to 2032

Table 23: Europe Market Value (US$ billion) Forecast by Voltage, 2017 to 2032

Table 24: Europe Market Volume (Units) Forecast by Voltage, 2017 to 2032

Table 25: Asia Pacific Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Asia Pacific Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 28: Asia Pacific Market Volume (Units) Forecast by Type, 2017 to 2032

Table 29: Asia Pacific Market Value (US$ billion) Forecast by Voltage, 2017 to 2032

Table 30: Asia Pacific Market Volume (Units) Forecast by Voltage, 2017 to 2032

Table 31: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 32: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2032

Table 33: Middle East and Africa Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 34: Middle East and Africa Market Volume (Units) Forecast by Type, 2017 to 2032

Table 35: Middle East and Africa Market Value (US$ billion) Forecast by Voltage, 2017 to 2032

Table 36: Middle East and Africa Market Volume (Units) Forecast by Voltage, 2017 to 2032

Figure 1: Global Market Value (US$ billion) by Type, 2022 to 2032

Figure 2: Global Market Value (US$ billion) by Voltage, 2022 to 2032

Figure 3: Global Market Value (US$ billion) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ billion) Analysis by Region, 2017 to 2032

Figure 5: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 9: Global Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 12: Global Market Value (US$ billion) Analysis by Voltage, 2017 to 2032

Figure 13: Global Market Volume (Units) Analysis by Voltage, 2017 to 2032

Figure 14: Global Market Value Share (%) and BPS Analysis by Voltage, 2022 to 2032

Figure 15: Global Market Y-o-Y Growth (%) Projections by Voltage, 2022 to 2032

Figure 16: Global Market Attractiveness by Type, 2022 to 2032

Figure 17: Global Market Attractiveness by Voltage, 2022 to 2032

Figure 18: Global Market Attractiveness by Region, 2022 to 2032

Figure 19: North America Market Value (US$ billion) by Type, 2022 to 2032

Figure 20: North America Market Value (US$ billion) by Voltage, 2022 to 2032

Figure 21: North America Market Value (US$ billion) by Country, 2022 to 2032

Figure 22: North America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 23: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 27: North America Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 30: North America Market Value (US$ billion) Analysis by Voltage, 2017 to 2032

Figure 31: North America Market Volume (Units) Analysis by Voltage, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Voltage, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Voltage, 2022 to 2032

Figure 34: North America Market Attractiveness by Type, 2022 to 2032

Figure 35: North America Market Attractiveness by Voltage, 2022 to 2032

Figure 36: North America Market Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ billion) by Type, 2022 to 2032

Figure 38: Latin America Market Value (US$ billion) by Voltage, 2022 to 2032

Figure 39: Latin America Market Value (US$ billion) by Country, 2022 to 2032

Figure 40: Latin America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 48: Latin America Market Value (US$ billion) Analysis by Voltage, 2017 to 2032

Figure 49: Latin America Market Volume (Units) Analysis by Voltage, 2017 to 2032

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Voltage, 2022 to 2032

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Voltage, 2022 to 2032

Figure 52: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 53: Latin America Market Attractiveness by Voltage, 2022 to 2032

Figure 54: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 55: Europe Market Value (US$ billion) by Type, 2022 to 2032

Figure 56: Europe Market Value (US$ billion) by Voltage, 2022 to 2032

Figure 57: Europe Market Value (US$ billion) by Country, 2022 to 2032

Figure 58: Europe Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 59: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 63: Europe Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 66: Europe Market Value (US$ billion) Analysis by Voltage, 2017 to 2032

Figure 67: Europe Market Volume (Units) Analysis by Voltage, 2017 to 2032

Figure 68: Europe Market Value Share (%) and BPS Analysis by Voltage, 2022 to 2032

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Voltage, 2022 to 2032

Figure 70: Europe Market Attractiveness by Type, 2022 to 2032

Figure 71: Europe Market Attractiveness by Voltage, 2022 to 2032

Figure 72: Europe Market Attractiveness by Country, 2022 to 2032

Figure 73: Asia Pacific Market Value (US$ billion) by Type, 2022 to 2032

Figure 74: Asia Pacific Market Value (US$ billion) by Voltage, 2022 to 2032

Figure 75: Asia Pacific Market Value (US$ billion) by Country, 2022 to 2032

Figure 76: Asia Pacific Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: Asia Pacific Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 81: Asia Pacific Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 84: Asia Pacific Market Value (US$ billion) Analysis by Voltage, 2017 to 2032

Figure 85: Asia Pacific Market Volume (Units) Analysis by Voltage, 2017 to 2032

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Voltage, 2022 to 2032

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Voltage, 2022 to 2032

Figure 88: Asia Pacific Market Attractiveness by Type, 2022 to 2032

Figure 89: Asia Pacific Market Attractiveness by Voltage, 2022 to 2032

Figure 90: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 91: Middle East and Africa Market Value (US$ billion) by Type, 2022 to 2032

Figure 92: Middle East and Africa Market Value (US$ billion) by Voltage, 2022 to 2032

Figure 93: Middle East and Africa Market Value (US$ billion) by Country, 2022 to 2032

Figure 94: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 95: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 96: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: Middle East and Africa Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 99: Middle East and Africa Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 100: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 101: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 102: Middle East and Africa Market Value (US$ billion) Analysis by Voltage, 2017 to 2032

Figure 103: Middle East and Africa Market Volume (Units) Analysis by Voltage, 2017 to 2032

Figure 104: Middle East and Africa Market Value Share (%) and BPS Analysis by Voltage, 2022 to 2032

Figure 105: Middle East and Africa Market Y-o-Y Growth (%) Projections by Voltage, 2022 to 2032

Figure 106: Middle East and Africa Market Attractiveness by Type, 2022 to 2032

Figure 107: Middle East and Africa Market Attractiveness by Voltage, 2022 to 2032

Figure 108: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Electrical Conduit Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Safety Personal Protection Equipment (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steering Column Lock Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steel Market Growth - Trends & Forecast 2025 to 2035.

Electrical Coil Tester Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Digital Twin Market Growth – Trends & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Electrical Steel Coatings Market 2025-2035

Electrical Insulation Materials Market Trends 2024 to 2034

Electrical Label Market Demand & Industry Applications 2024 to 2034

Electrical Service Market Growth – Trends & Forecast 2024-2034

Electrical Safety Analyzers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA