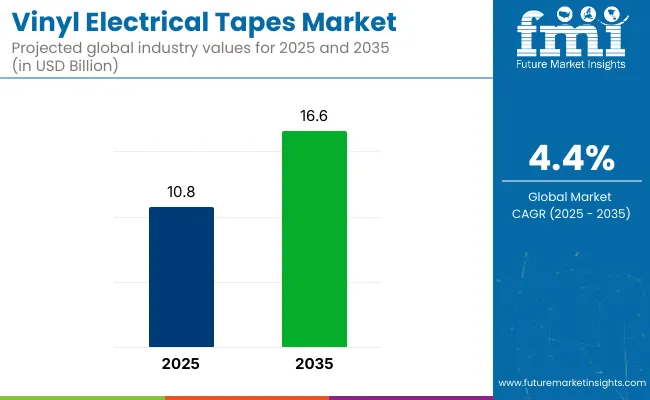

The global vinyl electrical tapes market is projected to grow from USD 10.8 billion in 2025 to USD 16.6 billion by 2035, registering a CAGR of 4.4% during the forecast period. Sales in 2024 were recorded at USD 10.3 billion.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 10.8 billion |

| Projected Market Size in 2035 | USD 16.6 billion |

| CAGR (2025 to 2035) | 4.4% |

This growth is primarily attributed to the expansion of electrical infrastructure, increasing safety regulations, and the rising adoption of durable insulation materials. Vinyl electrical tapes, known for their flexibility and resistance to moisture, corrosion, and varying temperatures, are extensively used in electrical maintenance and insulation applications across residential, commercial, and industrial sectors.

In 2023, Bron Tapes, LLC, a leading producer and distributor of pressure-sensitive tapes, announced the acquisition of GaffTech, Inc., a Seattle-based company specializing in floor tape and tape applicator technology. This strategic acquisition aims to enrich Bron Tapes' product portfolio and offer enhanced solutions to a broad customer base.

"The GaffGun™ is a natural fit for our business," stated Mike Shand, CEO of Bron Tapes. "We are excited to further develop and promote the GaffGun™ with the help of our technical sales team." This move is expected to bolster Bron Tapes' position in the vinyl electrical tapes market by integrating GaffTech's specialized technology and expanding their reach in the industry.

Recent innovations in vinyl electrical tapes have led to significant improvements in product functionality and customization. Manufacturers have focused on developing high-quality, secure, and durable tapes that cater to the specific needs of various applications.

Advancements in adhesive technologies have enabled the production of tapes with enhanced dielectric strength, flexibility, and resistance to environmental factors. Additionally, the integration of eco-friendly materials and sustainable practices has improved the environmental footprint of vinyl electrical tapes.

The vinyl electrical tapes market is expected to witness significant growth in emerging economies, particularly in the Asia-Pacific region, due to rapid urbanization and increasing consumer awareness. Applications are expanding beyond traditional sectors, with growing adoption in automotive, aerospace, and renewable energy industries. Manufacturers are anticipated to focus on developing cost-effective and versatile tape solutions to cater to diverse consumer needs and comply with evolving environmental regulations.

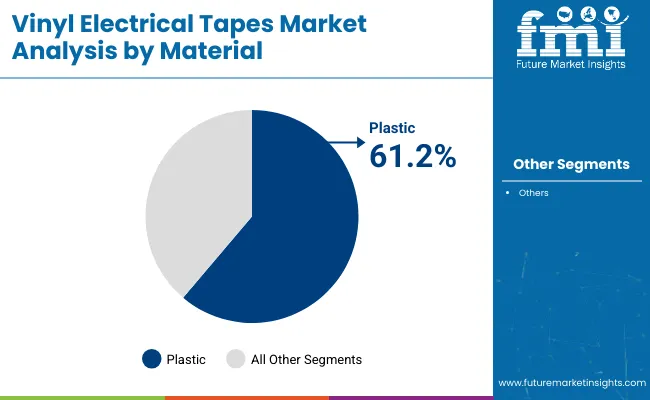

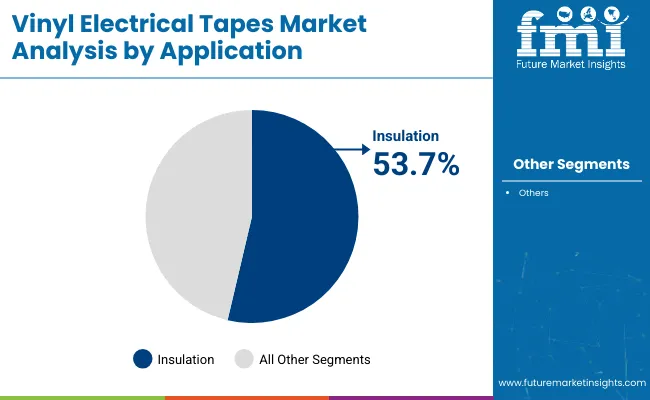

The market has been segmented based on material, thickness, application, and region. By material, plastic and rubber have been utilized to ensure flexibility, dielectric strength, and environmental resistance in various electrical applications. Thickness categories such as up to 7 mil, 8-10 mil, and above 10 mil have been defined to offer performance adaptability for insulation, bundling, and splicing.

Applications have been classified into electrical maintenance and insulation, where vinyl tapes have been employed to ensure long-term circuit protection and reliability. Regional segmentation has been carried out across North America, Latin America, Europe, the Middle East & Africa, South Asia, East Asia, and Oceania to capture diverse infrastructure development and power sector dynamics.

The plastic material segment is expected to dominate the vinyl electrical tapes market with a 61.2% share in 2025, as its usage has been supported by superior insulation properties, tensile strength, and elongation capacity. PVC-based tapes have been widely used in residential, commercial, and industrial wiring due to flame retardancy and durability. Moisture resistance and adhesion under temperature variations have been enhanced through plastic formulations. Flexibility and ease of wrapping have been favored for both temporary and permanent applications.

Plastic materials have been engineered to support a range of voltage levels and environmental conditions in electrical systems. Color-coded variants have been adopted for identification, phasing, and coding in multi-wire setups. Long-term performance and minimal edge curling have driven preference across field and factory settings. Continued growth has been projected as electrification efforts expand in infrastructure, appliances, and EV installations.

The insulation segment is projected to hold a 53.7% share of the vinyl electrical tapes market in 2025, as its dominance has been reinforced by mandatory use in electrical connections, splices, and terminations. Tapes providing dielectric strength, thermal stability, and arc resistance have been implemented across power distribution and control panel installations. Voltage integrity and short-circuit protection have been ensured through multi-layer insulation wraps. Standard compliance with UL, CSA, and IEC codes has guided product development.

Layering and tension consistency have been improved through optimized tape thickness and adhesive formulations. Field technicians and contractors have relied on insulation tapes for reliable performance in confined spaces and variable climates. Compatibility with low- and high-voltage systems has supported widespread use across utility and manufacturing networks. The insulation segment’s leadership has been sustained by safety mandates and growing energy access across emerging markets.

Fluctuating Raw Material Costs and Supply Chain Disruptions

The vinyl electrical tapes industry also struggles with the variable pricing of PVC resin, rubber-based adhesive, and stabilizer, which hinders the demand for Vinyl electrical tapes. Geopolitical, transportation and regulatory trade policies also affect the market in terms of supply chain disruptions.

Establishing strategic sourcing, creating, and restructuring investment towards alternative materials, and enhancing supply chain resilience are necessary to overcome these challenges.

Regulatory Compliance and Environmental Concerns

Vinyl electrical tapes must pass through some strict safety and environmental guidelines like the REACH, RoHS, and UL certifications. Commonly used tapes, especially those made of vinyl, are known to contain volatile organic compounds (VOCs) and non-biodegradable materials, making them less sustainable options.

Manufacturers have to invest in sustainable formulations, recyclable materials, and also become compliant to the ever-growing regulatory standards.

Growing Demand from the Electrical and Automotive Sectors

The growing integration of electrical and electronic devices and the growing automotive manufacturing are major factors for the growing demand of vinyl electrical tapes. These tapes are not just critical for wire insulation, harness protection, and moisture resistance. Businesses producing durable, flame-resistant high-performance tapes for improved temperature resistance will gain a competitive advantage in the market.

Advancements in Smart and High-Performance Tapes

The latest technologies in tape execution have resulted in high-performance, weather-resistant, flame-retardant vinyl electrical tapes. The addition of self-fusing properties, UV resistance, and enhanced adhesion capabilities allow for a wider field of application. Increased market penetration will be benefitted from industrial and specialty applications with the companies investing into research and innovations to develop advanced tape products.

The global vinyl electrical tapes market had been thriving between 2020 and 2024, driven by growth across the construction and automotive sectors and business expansions initiated by the players in the electrical industry. Marker demand was driven by rising infrastructure projects, increasing electrification, and the need for reliable insulation solutions.

That being said, fluctuating prices for raw materials and requirements for compliance with regulatory frameworks to reduce energy consumption on a European government level affected the market.

Demand for eco-friendly and high-performance tapes in the world is projected to enable high growth opportunities from 2025 to 2035. To stay away from the environmental issue, firms will concentrate on recyclable and biodegradable choices for vinyl.

Innovation is also expected through AI-powered manufacturing processes, automated tape applications, and customized adhesive processing. The actors from the market placing bets on digital transformation, sustainability, and high-tech materials will define the trends in tomorrow's industries.

Ongoing demand for insulation and electrical protection in the residential, commercial, and industrial sectors is contributing to growth in the market for vinyl electrical tapes in the United States. Ongoing implementation of modernization of power infrastructure, as well as construction of electric vehicle (EV) manufacturing plants, supports demand for high-performance insulating materials, thus driving the market.

Moreover, flame retardant & weather resistant tapes which adhere to various stringent safety regulations are seeing high demand in the USA market. The rise in do-it-yourself electrical repairs and home improvement activities are also factors in increasing demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.7% |

The candles are the best thing for distraction, as the light is the same as any and these are the things that shine in the dark. Another factor contributing to market growth is the high demand for efficient cable management systems for residential and commercial installations.

Moreover, increasing safety regulations for construction and utility maintenance is accelerating demand for high-grade electrical tapes. Increasing renovation activities and the adoption of smart home devices additionally broadens the markets for insulation solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

The vinyl electrical tapes market in the EU states is being bolstered by rapid electrification in Eastern Europe, continuing infrastructure upgrades in Western Europe, and booming automotive manufacturing in nations such as Germany. Rising adoption of electric power tools and a shift towards energy efficient electrical systems are further driving demand.

In addition, mounting pressure for sustainability and regulatory compliance is driving manufacturers to bring green and lead-free tapes. The expansion of EV charging stations and renewable power projects likewise supplements market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

Growth in consumer electronics, alongside the smart home transition and prevalence of IoT-based devices, is driving Japan's vinyl electrical tapes market. The country’s continuing emphasis on miniaturized electronics and high-voltage insulation in small devices ensures a steady demand.

Robust growth both in terms of high-quality domestic manufacturing and export demand for precision-engineered tapes are corporate growth catalysts. Increasing public infrastructure upgrades and tremor-resistant power systems also drives the demand for durable and vibration resistance vinyl tapes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

Increase in electronics, semiconductors, and industrial auto has increased the demand for vinyl electrical tapes in South Korea. PCB assembly and electrical circuit protection are in particularly high demand. The country’s booming EV and consumer electronics industries rely heavily on reliable electrical insulation, and the market is expanding for specialty vinyl tapes.

Higher installation rate for solar panels and green buildings add to the range of applications for vinyl tapes in such moisture and UV applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The increasing demand for robust insulation materials across electrical, automotive, and construction industries is accelerating growth of the Vinyl electrical tapes market. These tapes are highly preferred for their versatility, flame retardancy, moisture resistance, and dielectric strength that are essential in wire bundling, cable harnessing, and electrical insulation.

Innovations in adhesive technology and improvement of temperature resistance are providing product innovation and expanding application scope.

The increase in the skills level of tape manufacturing, urban infrastructure projects, renewable energy installations (e.g., solar panels and wind turbines), and EV manufacturers will also lead to increased tape consumption.

Regulatory standards for electrical safety and prevention of fire also have an impact on the market, leading manufacturers to develop tapes that are environmentally friendly, lead-free, and RoHS-compliant. The market is expected to grow at a global CAGR of 4.4%, driven by technological advancements, expanding partnerships with OEMs, and the demand for energy-efficient electrical components.

The overall market size for vinyl electrical tapes market was USD 10.8 billion in 2025.

The vinyl electrical tapes market expected to reach USD 16.6 billion in 2035.

Rising demand for electrical insulation, growth in construction and automotive sectors, and increased maintenance of aging electrical infrastructure will drive vinyl electrical tapes market during the forecast period.

The top 5 countries which drives the development of vinyl electrical tapes market are USA, UK, Europe Union, Japan and South Korea.

Polyvinyl chloride (PVC) segment driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vinyl Ester Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Acetate Homopolymer Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Flooring Market Growth - Trends & Forecast 2025 to 2035

Vinyl Extrusion Equipment Market Insights - Growth & Forecast 2025 to 2035

Market Positioning & Share in the Vinyl Cyclohexane Industry

Vinyl Films Market

Polyvinyl Chloride (PVC) Packaging Film Market Forecast and Outlook 2025 to 2035

Polyvinyl Butyral PVB Market Size and Share Forecast Outlook 2025 to 2035

Polyvinyl Alcohol (PVA) Films Market Size and Share Forecast Outlook 2025 to 2035

Polyvinylidene Fluoride (PVDF) Market Growth - Trends & Forecast 2025 to 2035

Polyvinyl Chloride Market Growth – Trends & Forecast 2024-2034

Polyvinyl Butyral Market Growth – Trends & Forecast 2024-2034

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Ethylene-vinyl Alcohol Copolymer (EVOH) Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Butylene-divinyl Fraction Market Growth – Trends & Forecast 2024-2034

Mass Loaded Vinyl (MLV) Market Size and Share Forecast Outlook 2025 to 2035

Calendered Polyvinyl Chloride Flexible Films Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA