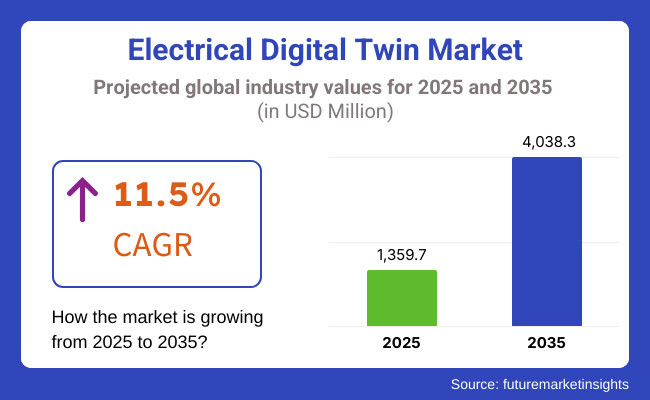

Innovative solutions are being developed for maintaining electrical equipment which are expected to create growth opportunities for the electrical digital twin market. The market is projected to have a market value of USD 1,359.7 million in 2025 and is expected to reach USD 4,038.3 million by 2035, at a substantial compound annual growth rate (CAGR) of 11.5% during the forecast period.

Electrical digital twins allow you to monitor, analyse, and optimise electrical infrastructure in real time, empowering utilities and industrial operators to improve operational efficiency and mitigate operational risks. Market growth is being driven by the growing penetration of renewable energy sources, along with the rapid growth of smart grids and digital substations.

Also, ongoing advancements in cloud computing and IoT-based asset management continue to drive the capabilities of the digital twin platforms.

Market growth may be hampered by the high costs of implementing edge AI systems, cybersecurity risks, and the complexities of data integration. So, To tackle these issues, organisations are investing in AI-based automation, secure cloud-based solutions, and advanced data analytics to support digital twin to Excel Converter.

Based on deployment model, application, and end-user industry, the electrical digital twin market is segmented as - End user industries include utilities, industrial manufacturing industries, renewable energy, and data centers, with demand growing for real-time digital modelling and predictive analytics.

The United States and Canada are the frontrunners in North America in the adoption of electrical digital twins due to high investments in grid modernization and digital transformation initiatives. The market is being driven by the focus of the region on smart grid deployment, the rising demand for predictive maintenance, and the presence of key technology companies.

Furthermore, and direct from your own government initiatives that encourage energy efficiency and resilient infrastructure help facilitate the implementation of digital twin solutions. Market growth is anticipated to continue due to ongoing advancements in AI-driven grid analytics and digital asset management, despite hindering factors including cybersecurity threats and high implementation costs.

Germany, the UK, and France are significant contributors to the wider European electrical digital twin market. The region’s emphasis on integrating renewable, rigorous regulatory frameworks and smart infrastructure investments are driving demand. The European Union's emphasis on sustainable energy management and data-driven grid optimization is also adding to market potential.

Particularly, collaborations between the utilities and technology enterprises are catalysing the advancement of digital twin solutions across power plants and substations. Although the worry over data privacy and issues on standardization might restrict adoption but also research and development in digital simulation, predictive modelling will probably lead to expansion in the market.

The Asia-Pacific region is projected to witness the highest growth in the electrical digital twin market due to increasing industrialization, urbanization, and energy infrastructure investments. Digital twin solutions are being increasingly adopted in countries like China, Japan, India, and South Korea to improve power distribution efficiency while cutting down on energy losses.

The proliferation of renewable energy projects and government-led smart city initiatives are also driving demand. Nevertheless, obstacles including digital infrastructure deficiencies and policy ambiguities could impede market penetration in these regions. Nonetheless, growing investment in AI-enabled asset monitoring and an increase in domestic technology providers are expected to drive market growth in the region.

Challenge

Cybersecurity Risks and Data Integration Complexities

A significant challenge in the electrical digital twin market is incorporating cybersecurity and effectively integrating data from different power systems. Digital twin platforms which depend on the real-time data sharing from several IoT sensors, cloud networks and AI-based analytics are also vulnerable to cyber threats as well as data breaching.

Moreover, integrating legacy infrastructure with modern digital twin solutions can be both complex and costly. To combat these hurdles, we may see investment into secure cloud frameworks, AI-based anomaly detection, and the establishment of standardized interoperability protocols.

Opportunity

Expansion of AI-Powered and Cloud-Based Digital Twin Solutions

The growing adoption of AI-embedded predictive analytical tools and cloud-based digital twin platforms offers lucrative growth prospects for the market. Asset reliability and operational efficiency are being improved through plant monitoring in real-time, fault detection, and predictive maintenance capabilities.

The emergence of edge computing and 5G connectivity are also allowing for increased and faster data processing and improved digital twin simulations. As industries increasingly emphasize energy efficiency, automation, and digital resilience, the advanced electrical digital twin market is likely to grow significantly over the next decade.

The rising investments in smart grid infrastructure, increasing adoption for IoT-enabled asset monitoring, and demand for predictive maintenance of electrical networks are driving the growth of the electrical digital twin market from 2020 to 2024. Moving towards real-time virtual models of power grids, substations, and industrial electrical systems was underway as utilities and industrial operators demanded greater visibility, operational efficiency, and cost savings.

Cloud-based digital twin platforms, AI analytics, and edge computing were integrated for better performance monitoring and improved grid resilience. Despite these advantages, the widespread adoption of digital twin technology was impeded by challenges such as data security concerns, integration complexities, and high implementation costs.

Between 2025 to 2035, we can witness maturing AI-powered autonomous grid management and where simulations, built on quantum computing principles and block chain, will create a new decentralized power world. Technologies like self-learning AI-based digital twins, real-time predictive failure analysis of the grid and immersive (VR based) virtual substations will ameliorate grid vibration and facilitate grid integrity.

Further industry transformations will come from advances in digital twin interoperability, nanosecond-scale electrical event simulations and decentralized AI-powered energy trading. Moreover, the continuous trend of innovation brought about by 5G-enabled digital twin networking, AI-powered cybersecurity for Grid Data, and digital-twin-based carbon footprint optimization will thrive as we will have the ability to offer energy-efficient, resilient, and sustainable services.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FERC, IEEE, and IEC standards for smart grid digitalization and data security. |

| Technology & Infrastructure | Use of cloud-based digital twin models, AI-driven asset monitoring, and edge computing for grid analytics. |

| Industry Adoption | Growth in power utilities, renewable energy monitoring, and industrial electrical system optimization. |

| Smart & AI-Enabled Digital Twins | Early adoption of predictive maintenance models, IoT-enabled real-time asset tracking, and sensor-based digital grid replicas. |

| Market Competition | Dominated by traditional electrical infrastructure providers, cloud computing firms, and industrial automation companies. |

| Market Growth Drivers | Demand fuelled by grid modernization, energy efficiency mandates, and rising adoption of renewable energy. |

| Sustainability and Environmental Impact | Early adoption of digital twin-powered energy efficiency tracking, reduced downtime analytics, and real-time carbon footprint monitoring. |

| Integration of AI & Digitalization | Limited AI use in basic predictive analytics and remote condition monitoring. |

| Advancements in Simulation & Modelling | Use of basic electrical load flow simulations, thermal efficiency monitoring, and cloud-based remote asset modelling. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven grid stability regulations, blockchain-based compliance verification, and quantum-secure data encryption for digital twins. |

| Technology & Infrastructure | Transition to autonomous AI-driven grid self-healing systems, real-time nanosecond-scale electrical event simulations, and quantum computing-based network optimizations. |

| Industry Adoption | Expansion into AI-powered self-adaptive electrical networks, smart city grid integration, and decentralized energy trading platforms. |

| Smart & AI-Enabled Digital Twins | Large-scale deployment of self-learning AI digital twins, immersive VR-based virtual substations, and blockchain-powered automated energy settlements. |

| Market Competition | Increased competition from AI-driven grid optimization start-ups, decentralized energy trading platforms, and quantum-powered predictive analytics providers. |

| Market Growth Drivers | Growth driven by AI-driven predictive outage prevention, decentralized energy ecosystem integration, and next-gen cybersecurity for electrical grid twins. |

| Sustainability and Environmental Impact | Large-scale transition to AI-powered energy waste reduction, decentralized low-carbon power distribution networks, and net-zero carbon grid optimizations. |

| Integration of AI & Digitalization | AI-powered real-time power flow optimization, digital twin-based AI-driven energy forecasting, and automated fault mitigation algorithms. |

| Advancements in Simulation & Modelling | Evolution of nanosecond-scale grid event simulations, digital twin interoperability across global smart grids, and AI-driven self-optimizing power networks. |

While North America is a significant market for electrical digital twins, the USA exchanges a large share of the demand for electrical digital twins, mostly due to increasing investments in smart grid infrastructure, rapid adoption of AI-driven predictive analytics, and demand for real-time energy monitoring solutions.

Market growth is driven by the proliferation of renewable energy projects and the growing demand for digital transformation in power utilities. Furthermore, government initiatives to support grid modernization and the incorporation of such IoT-enabled solutions into power distribution networks further drive the adoption.

Industry trends are also being driven by the growing importance of cloud-based platforms and digital twin applications in asset performance management and operational efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 11.9% |

There is a steady growth in the UK electrical digital twin market driven by factors such as the transition towards smart energy infrastructure, increasing focus towards predictive maintenance capabilities and rising investments in AI-enabled grid optimization technologies. Increasingly, the government’s drive for digitalization in the power sector, as well as its commitment to decarbonisation, are encouraging investments in digital twin technology for energy networks.

The growth of offshore wind and distributed energy resources (DERs) is also driving demand for advanced simulation and analytics platforms. Thus, the utilization of digital twins in power plants and the electric vehicle (EV) charging infrastructure, along with the increasing acceptance of cloud-based solutions, is impacting the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 11.1% |

Germany, France and Italy are driving the EU electrical digital twin market due to favourable regulatory frameworks, growing smart grid technology penetration, and increasing capital investments towards digital transformation across power utilities. Across Europe, ambitious European Union (EU) climate and energy policies will drive adoption of solutions such as digital twins in power distribution, asset management, and renewable energy forecasting.

Similarly, trends in the market such as the increasing implementation of AI-enabled digital twins for power network predictive maintenance and cybersecurity will be the driving forces on the markets. There is already a growing interest in the fusion of block chain and digital twins for energy trading and grid decentralization.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 11.4% |

Soaring demand for smart energy systems, robust government support for digital transformation in the energy sector, and growing adoption of AI-based asset performance management solutions are fuelling growth of the electrical digital twin market in Japan. With a focus on integrating digital twin technology in nuclear and renewable energy sectors, innovation is driving its growth.

The use of more cyber-physical systems for grid security and digital simulation technologies for disaster management is further driving adoption. Growing applications of digital twins in industrial automation and smart city infrastructure are also influencing the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.9% |

The market drivers include rising investments in smart grid modernization, the growth in AI-enabled energy management solutions, and strong government initiatives supporting digital transformation within utilities. Industry expertise in semiconductor and IoT-based services has positioned the country at the helm of developing advanced digital twin platforms for use in real-time grid monitoring and fault detection.

The market share analysis based on the components types, applications, and verticals are covered for both global and regional scenarios. With the increase in operational efficiency of digital twin applications, the integration of 5G and edge computing are contributing to it.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.6% |

As industries, utilities, and renewable energy providers are increasingly adopting real-time simulation and predictive analytics to optimize operations, The Digital Grid and Digital Wind Farm segments account for the maximum share in the Electrical Digital Twin Market.

These two types are vital to enhancing grid resilience, improving energy efficiency, and facilitating predictive maintenance across power generation and distribution networks. The demand for electrical digital twin solutions is increasing, driven by the rapid digital transformation of the energy sector.

Unlike conventional methods of monitoring the grids, digital twins are virtual replicas of the physical electrical network, contributing to predictive analysis, remote diagnostics, and automation for fault detection. Smart grid modernization adoption market has picked up pace owing to rising demand of smart grid in urban and industrial areas.

Over 70% of power utilities across the globe are investing to develop digital grid technologies that allow energy distribution to be as efficient as possible with minimum downtime.

And this market demand has been bolstered by growth in AI-based digital grid management solutions that leverage machine learning for fault prediction, automated outage recovery, and on-the-fly energy flow optimization all ensuring greater operational efficiency and sustainability.

The key to the spread of power-efficient block chain-based energy transaction platforms featuring decentralised peer-to-peer energy trading, transparent grid dynamics, and automatic demand-response mechanisms is to enhance security and compliance in power transactions.

This advanced technology includes features, such as AI-based self-healing grids through automatic fault isolation, predictive load balancing, and natural grid restoration, which have driven the self-healing grids market to higher reliability within electric power grids sector, resultantly providing lesser service interruptions.

The uptake of digitised grid solutions in the integration of renewables such as real-time wind and solar energy forecasting, dynamic balancing of power in grids and battery storage boosters to smooth the transition in energy flows has supplemented favourable policies for a critical market expansion and the new solutions promise greater reliability and efficiency in energy transition strategies.

While the digital grid segment enjoys several advantages such as efficiency, sustainability, predictive grid management, etc., it also confronts challenges like cybersecurity risks, high initial implementation costs, and complexity involved in integration with legacy infrastructure.

But, innovations like quantum computing for grid simulation, AI decision making for cyber hygiene protocols, and 5G powered phenomena in ultra-fast grid communication are enhancing scalability, resilience & performance to assure deeper penetration of Digital Grid Solution in markets all over the globe.

As the wind industry widely embraces digital wind farm solutions to improve energy efficiency, optimize turbine performance, and facilitate maintenance operations, Digital wind farm solution continues to dominate over 35% share in Electrical Digital Twin Market during the forecast period. In contrast to traditional monitoring and predictive maintenance systems, digital twins offer a real-time digital representation of wind farms allowing for continuous, condition-based maintenance and optimized energy generation.

Growing need for renewable energy optimization, especially at offshore and onshore wind farms, continues to drive adoption. More than 65% of global wind energy operators are working on digital twin solutions to improve turbine efficiency and predict maintenance needs, according to studies.

Rising trend of AI-integrated wind farm data analytics which expected to bolster demand for machine learning-based performance predictions, real-time blades condition monitoring, predictive failure avoidance has strengthened market demand for the same thereby boost wind energy generation.

Integration of digital twin-assisted offshore wind farm management with real-time weather impact analysis, adaptive blade positioning algorithms, and automated maintenance scheduling has further boosted adoption and ensured optimized power generation in situational environment extremes.

Real-time computational fluid dynamics (CFD) analysis, turbine yaw optimization, and adaptive pitch control systems can maximize wind energy harvest in such solutions for turbine yaw and pitch control, leading to market growth as they provide superior power extraction efficiency and longer life of wind turbine components.

The digital wind farm solutions, as part of hybrid energy resource system, integrating battery storage, active power management grid and grid-supportive demand response into the system will drive market growth by offering grid stability and efficiency optimization for worldwide wind energy projects.

While offering substantial benefits in sustainability, predictive maintenance, and efficiency optimization, the digital wind farm segment also comes with its unique set of challenges, such as data complexity from large-scale wind farms, limited connectivity in remote installations, and the associated storage requirements on the data itself.

While the path to digital wind farms may be arduous, new innovations such as edge computing-based wind farm monitoring, AI-powered data compression for analytics, and block chain-based submission and validation of energy output, create scalable, reliable, and high-performance solutions with increasingly practical use cases for energy producers worldwide.

The electrical digital twin market is segmented by type into production digital twin, system digital twin, human digital twin and asset digital twin; As manufacturers, utilities, and energy providers have started virtually modelling, the segments that hold the larger share are Production digital twin as well as system digital twin such types of use cases play a central part in allowing real-time decision making, minimizing downtime, and maximizing operational efficiency across a wide range of use cases.

Production digital twin solutions have seen strong market adoption owing to their ability to increase technical and manufacturing efficiency, optimize production workflows, and reduce downtime. Production digital twins, unlike static simulation models, offer real-time visibility into operational performance, allowing firms to anticipate maintenance needs and reduce disruptions.

Demand for predictive maintenance and process automation especially in the context of large-scale manufacturing and energy production has propelled adoption. Research suggests that 60% of industrial enterprises implementing Industry 4.0 technologies use production digital twins to enhance manufacturing and energy efficiency.

The emergence of AI-adjacent production digital twins powered by machine learning-augmented process optimization, on-the-fly predictive analytics, and real time operational simulations helped propel market demand far more, optimizing productivity and resource usage.

Adoption has also been accelerated by the availability of IoT-connected production digital twins that utilize sensor-based data collection, cloud-integrated monitoring, and real-time anomaly detection to increase process efficiency and minimize downtime.

Moreover, the advancements in energy-efficient production simulations, such as automated process reconfiguration, AI-based defect detection, and adaptive resource allocation have led to optimal market growth with reduced operation costs and enhanced sustainability.

While the production digital twin segment is growing due to its benefits in process optimization, predictive maintenance, and efficiency enhancement, high implementation costs and the complexity of data integration, along with workforce skill gaps in digital adoption, pose challenges.

However, because of advancements in AI capabilities for real-time process simulation, the management of production data secured by the blockchain, and operational modelling based on quantum computing, performance, scalability, and long-term cost-effectiveness are improved, assuring an ongoing growth in production digital twins all over the world.

System digital twin solutions are seeing robust market growth across energy providers, utilities & smart city use cases, as reducing the cost of ultra-large-scale physical hardware, maintenance downtime and finding optimal operating points are done by applying comprehensive simulation models to massive electrical infrastructure.

While production digital twins tend to be isolated, system digital twins can capture real-time monitoring and coordination of interrelated power assets, transmission grids, and industrial systems.

Adoption has been driven by the growing need for energy-efficient smart infrastructure, particularly in urban planning, power distribution and renewable energy integration. According to studies, more than 65% of the utilities & power generation companies are leveraging the system digital twin to improve operational efficiency and reliability.

The increasing prevalence of AI-driven system digital twins with predictive capacity demand analytics, real-time load balancing algorithms, and autonomic fault prevention mechanisms, has further strengthened market demand, which has ensured better stability of grids and the efficiency of energy distribution.

While offering benefits in large-scale system optimization, predictive analytics, and operational efficiency, the system digital twin segment faces challenges that include high computational power demand, cybersecurity threats in cloud-based implementations and complexity in legacy infrastructure integration.

Fortunately, new developments in areas like 5G-compatible real-time system simulations, blockchain-based grid modelling security and AI-improved multi-variable optimization are strengthening scalability, reliability, and cost-efficiency, paving way for the digital twin of systems take over worldwide.

The Electrical Digital Twin Market is driven by increasing adoption of smart grid technology, advancements in AI-driven predictive maintenance, and the need for enhanced operational efficiency in power infrastructure. With the growing integration of IoT and cloud-based solutions, the market is experiencing steady growth. Key trends shaping the industry include real-time asset monitoring, AI-powered simulations, and cybersecurity-focused digital twin solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| General Electric (GE) | 12-16% |

| Siemens AG | 10-14% |

| Schneider Electric | 8-12% |

| ABB Ltd. | 6-10% |

| Hitachi Energy | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| General Electric (GE) | Develops AI-powered electrical digital twin solutions for power grid optimization. |

| Siemens AG | Specializes in predictive maintenance and asset performance management using digital twin technology. |

| Schneider Electric | Offers real-time energy management and simulation-based digital twin solutions. |

| ABB Ltd. | Focuses on cloud-integrated digital twin platforms for smart grid and industrial automation. |

| Hitachi Energy | Provides digital twin solutions with cybersecurity-enhanced monitoring for electrical networks. |

Key Company Insights

General Electric (GE) (12-16%) GE leads in AI-driven digital twin technology, providing real-time predictive analytics for power infrastructure.

Siemens AG (10-14%) Siemens specializes in advanced asset performance management, integrating AI and IoT into electrical digital twins.

Schneider Electric (8-12%) Schneider focuses on real-time energy management solutions using simulation-based digital twin technology.

ABB Ltd. (6-10%) ABB is a key player in cloud-based digital twin platforms, enhancing smart grid and industrial power systems.

Hitachi Energy (4-8%) Hitachi Energy provides cybersecurity-enhanced digital twin solutions, ensuring secure and efficient electrical operations.

Other Key Players (45-55% Combined) Several technology and energy management companies contribute to the expanding Electrical Digital Twin Market. These include:

The overall market size for the electrical digital twin market was USD 1,359.7 million in 2025.

The electrical digital twin market is expected to reach USD 4,038.3 million in 2035.

The demand for electrical digital twin technology will be driven by increasing adoption of smart grids, rising investments in power infrastructure modernization, growing focus on predictive maintenance, and advancements in artificial intelligence and machine learning for real-time asset monitoring.

The top 5 countries driving the development of the electrical digital twin market are the USA, China, Germany, Japan, and India.

The System Digital Twin segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Twin Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Usage Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Twin Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Usage Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Twin Type, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Usage Type, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Twin Type, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Usage Type, 2018 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: South Asia Market Value (US$ Million) Forecast by Twin Type, 2018 to 2033

Table 27: South Asia Market Value (US$ Million) Forecast by Usage Type, 2018 to 2033

Table 28: South Asia Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 29: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Twin Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Usage Type, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Value (US$ Million) Forecast by Twin Type, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Usage Type, 2018 to 2033

Table 40: Oceania Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 42: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Value (US$ Million) Forecast by Twin Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Usage Type, 2018 to 2033

Table 46: MEA Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Twin Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Usage Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Twin Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Twin Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Twin Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Usage Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 25: Global Market Attractiveness by Twin Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Usage Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Deployment Type, 2023 to 2033

Figure 28: Global Market Attractiveness by End User, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Twin Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Usage Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Twin Type, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Twin Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Twin Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Usage Type, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 55: North America Market Attractiveness by Twin Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Usage Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Deployment Type, 2023 to 2033

Figure 58: North America Market Attractiveness by End User, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Twin Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Usage Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Twin Type, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Twin Type, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Twin Type, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Usage Type, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Twin Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Usage Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Deployment Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Twin Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Usage Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Twin Type, 2018 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Twin Type, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Twin Type, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Usage Type, 2018 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 115: Europe Market Attractiveness by Twin Type, 2023 to 2033

Figure 116: Europe Market Attractiveness by Usage Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Deployment Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by End User, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Twin Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Usage Type, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Twin Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Twin Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Twin Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Usage Type, 2018 to 2033

Figure 134: South Asia Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 135: South Asia Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 136: South Asia Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 137: South Asia Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 138: South Asia Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 139: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 144: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Twin Type, 2023 to 2033

Figure 146: South Asia Market Attractiveness by Usage Type, 2023 to 2033

Figure 147: South Asia Market Attractiveness by Deployment Type, 2023 to 2033

Figure 148: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 149: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 150: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Twin Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Usage Type, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Twin Type, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Twin Type, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Twin Type, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Usage Type, 2018 to 2033

Figure 164: East Asia Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 165: East Asia Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 166: East Asia Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 167: East Asia Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 168: East Asia Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 169: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Twin Type, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Usage Type, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Deployment Type, 2023 to 2033

Figure 178: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Twin Type, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Usage Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Twin Type, 2018 to 2033

Figure 191: Oceania Market Value Share (%) and BPS Analysis by Twin Type, 2023 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections by Twin Type, 2023 to 2033

Figure 193: Oceania Market Value (US$ Million) Analysis by Usage Type, 2018 to 2033

Figure 194: Oceania Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 195: Oceania Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 196: Oceania Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 197: Oceania Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 198: Oceania Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 199: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 204: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 205: Oceania Market Attractiveness by Twin Type, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Usage Type, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Deployment Type, 2023 to 2033

Figure 208: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Twin Type, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Usage Type, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Twin Type, 2018 to 2033

Figure 221: MEA Market Value Share (%) and BPS Analysis by Twin Type, 2023 to 2033

Figure 222: MEA Market Y-o-Y Growth (%) Projections by Twin Type, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) Analysis by Usage Type, 2018 to 2033

Figure 224: MEA Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 225: MEA Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 227: MEA Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 228: MEA Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 229: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 234: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 235: MEA Market Attractiveness by Twin Type, 2023 to 2033

Figure 236: MEA Market Attractiveness by Usage Type, 2023 to 2033

Figure 237: MEA Market Attractiveness by Deployment Type, 2023 to 2033

Figure 238: MEA Market Attractiveness by End User, 2023 to 2033

Figure 239: MEA Market Attractiveness by Application, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Electrical Conduit Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Safety Personal Protection Equipment (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steering Column Lock Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steel Market Growth - Trends & Forecast 2025 to 2035.

Electrical Coil Tester Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Fuses Market Analysis – Growth & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Electrical Steel Coatings Market 2025-2035

Electrical Insulation Materials Market Trends 2024 to 2034

Electrical Label Market Demand & Industry Applications 2024 to 2034

Electrical Service Market Growth – Trends & Forecast 2024-2034

Electrical Safety Analyzers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA