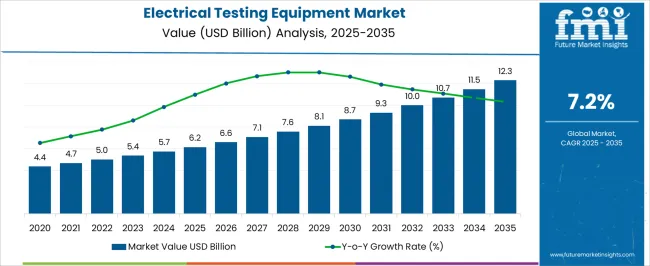

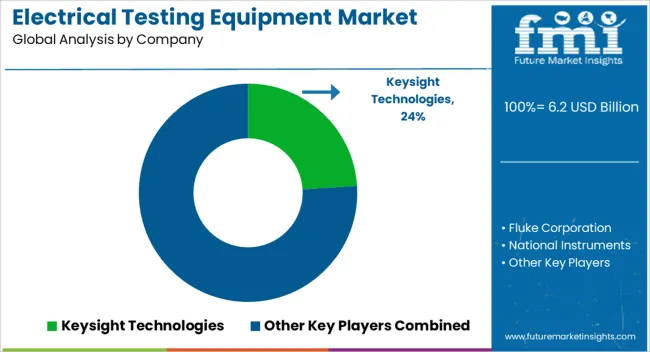

The Electrical Testing Equipment Market is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 12.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Electrical Testing Equipment Market Estimated Value in (2025 E) | USD 6.2 billion |

| Electrical Testing Equipment Market Forecast Value in (2035 F) | USD 12.3 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The Electrical Testing Equipment market is experiencing consistent growth due to increasing investments in industrial automation, infrastructure development, and the need for reliable electrical system validation across industries. The market is being influenced by the demand for high-accuracy testing tools, compliance with evolving safety and quality standards, and the rising adoption of automated and connected testing solutions. Growth is further supported by the expansion of renewable energy projects, smart grids, and electrification initiatives across commercial, industrial, and defense sectors.

The integration of advanced software features in electrical testing equipment has enhanced real-time monitoring, fault diagnostics, and predictive maintenance capabilities. Increasing awareness of operational safety, coupled with stricter regulatory frameworks, is compelling organizations to adopt high-performance electrical testing systems.

Additionally, growing focus on minimizing downtime and ensuring uninterrupted power distribution is expected to provide significant opportunities for innovation and expansion within the market The future outlook is strongly positive, as the demand for versatile, precise, and software-enabled testing solutions continues to rise across diverse end-use industries.

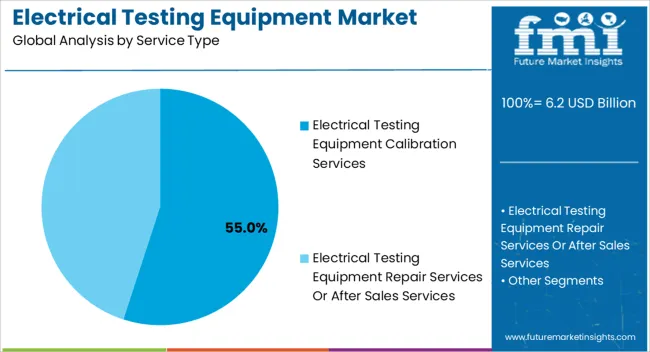

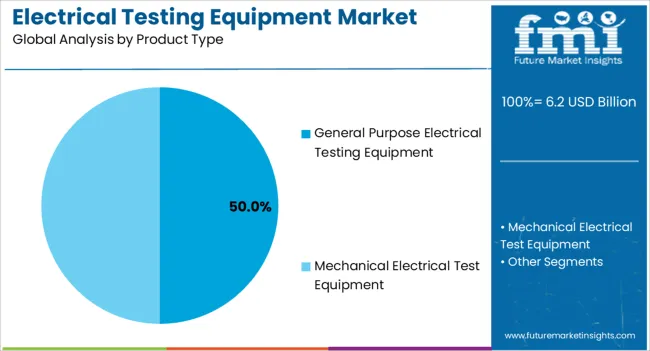

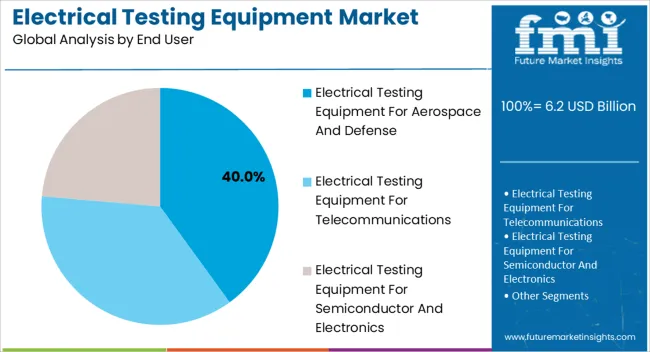

The electrical testing equipment market is segmented by service type, product type, end user, and geographic regions. By service type, electrical testing equipment market is divided into Electrical Testing Equipment Calibration Services and Electrical Testing Equipment Repair Services Or After Sales Services. In terms of product type, electrical testing equipment market is classified into General Purpose Electrical Testing Equipment and Mechanical Electrical Test Equipment. Based on end user, electrical testing equipment market is segmented into Electrical Testing Equipment For Aerospace And Defense, Electrical Testing Equipment For Telecommunications, and Electrical Testing Equipment For Semiconductor And Electronics. Regionally, the electrical testing equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Electrical Testing Equipment Calibration Services segment is projected to hold 55.0% of the overall market revenue in 2025, making it the leading service type. This prominence is attributed to the growing emphasis on accuracy, reliability, and compliance with international standards in electrical systems. Calibration services ensure that testing equipment performs at optimal precision, which is critical in industries such as aerospace, defense, and energy where safety and operational integrity are paramount.

The demand has been accelerated by regulatory requirements for periodic validation of electrical devices and equipment. Organizations increasingly prefer outsourced calibration services due to cost efficiency, reduced downtime, and access to specialized expertise and advanced calibration infrastructure.

As electrical systems become more complex and testing protocols more rigorous, the segment benefits from the need for high-quality service that supports precise measurement, traceability, and certification This trend is expected to continue as industrial growth, technological complexity, and regulatory compliance requirements expand globally.

The General Purpose Electrical Testing Equipment segment is anticipated to account for 50.0% of the market revenue in 2025, making it the dominant product type. This leadership is attributed to its versatility and ability to meet a broad range of testing requirements across industries, including manufacturing, construction, and maintenance. The equipment allows measurement of key electrical parameters such as voltage, current, resistance, and insulation, which is essential for ensuring system safety, reliability, and performance.

The segment’s growth has been accelerated by increasing industrial electrification, rising demand for preventive maintenance, and expanding adoption of smart factory initiatives. Cost efficiency, ease of use, and compatibility with various applications have further reinforced the preference for general purpose testing tools.

The ability to upgrade or integrate these instruments with software-driven data acquisition and analytics enhances their utility, making them suitable for long-term operational deployment The segment is expected to maintain its leading position due to the ongoing need for reliable, adaptable, and widely applicable testing solutions.

The Electrical Testing Equipment for Aerospace and Defense segment is projected to hold 40.0% of the market revenue in 2025, making it the largest end-use industry segment. This dominance is being driven by the stringent safety, quality, and performance standards inherent to aerospace and defense applications. Testing equipment in this sector is required to meet rigorous certification and compliance criteria, supporting reliability in mission-critical systems.

The growth of this segment is further influenced by increasing global defense budgets, modernization programs, and the adoption of advanced avionics and electronic systems. High precision, repeatability, and robustness in extreme environmental conditions have made these specialized testing solutions indispensable.

The need for continuous monitoring, predictive maintenance, and assurance of operational integrity has accelerated the deployment of advanced testing equipment The segment is expected to sustain its leadership as aerospace and defense industries prioritize safety, operational efficiency, and adherence to strict regulatory frameworks across all electrical and electronic systems.

Over the last decade, there has been a significant increase in demand for consumer goods, industrial machinery, and manufacturing. Manufacturers in a variety of industries must ensure that electromagnetic disturbances do not interfere with the function of their products in order to comply with market requirements and avoid costly recalls.

Circuit breaker test equipment, cable fault test equipment, insulation testing, motor, generator, and transformer testing, resistance, battery, and power quality testing, and relay and protection testing are all part of the electrical test equipment.

Electrical testing equipment boosts productivity and quality. Electrical testing equipment is important in detecting faults and producing electronic equipment. Electrical testing equipment is significantly less expensive than other types of testing equipment. Electrical testing equipment is also useful in laboratories that serve multiple purposes, such as repairing services and workmanship. This electrical testing equipment reduces technical errors and saves labor time. Electrical testing equipment is a powerful tool for determining the intensity of electricity. Electrical testing equipment can perform tests on a wide range of electronic instruments, including high voltage tests, impulse winding tests, and many others.

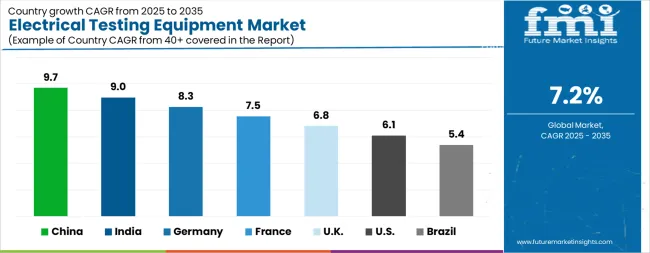

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.5% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The Electrical Testing Equipment Market is expected to register a CAGR of 7.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.7%, followed by India at 9.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.4%, yet still underscores a broadly positive trajectory for the global Electrical Testing Equipment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.3%. The USA Electrical Testing Equipment Market is estimated to be valued at USD 2.2 billion in 2025 and is anticipated to reach a valuation of USD 4.0 billion by 2035. Sales are projected to rise at a CAGR of 6.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 327.6 million and USD 182.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.2 Billion |

| Service Type | Electrical Testing Equipment Calibration Services and Electrical Testing Equipment Repair Services Or After Sales Services |

| Product Type | General Purpose Electrical Testing Equipment and Mechanical Electrical Test Equipment |

| End User | Electrical Testing Equipment For Aerospace And Defense, Electrical Testing Equipment For Telecommunications, and Electrical Testing Equipment For Semiconductor And Electronics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Keysight Technologies, Fluke Corporation, National Instruments, Tektronix (a subsidiary of Fortive), Anritsu Corporation, Yokogawa Electric Corporation, Rohde & Schwarz, and Megger Group |

The global electrical testing equipment market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the electrical testing equipment market is projected to reach USD 12.3 billion by 2035.

The electrical testing equipment market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in electrical testing equipment market are electrical testing equipment calibration services and electrical testing equipment repair services or after sales services.

In terms of product type, general purpose electrical testing equipment segment to command 50.0% share in the electrical testing equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Electrical Conduit Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Steering Column Lock Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steel Market Growth - Trends & Forecast 2025 to 2035.

Electrical Coil Tester Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Fuses Market Analysis – Growth & Forecast 2025 to 2035

Electrical Digital Twin Market Growth – Trends & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Electrical Steel Coatings Market 2025-2035

Electrical Service Market Growth – Trends & Forecast 2024-2034

Electrical Safety Analyzers Market

Electrical Shielding Tape Market

Electrical Generators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA