The global Polyvinylidene Fluoride (PVDF) market is estimated to be valued at USD 1,437.2 million in 2025 and is expected to surpass USD 3,369.3 million by 2035, expanding at a compound annual growth rate (CAGR) of 8.8% during the forecast period.

-market-industry-value-analysis.webp)

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,437.2 Million |

| Projected Market Size in 2035 | USD 3,369.3 Million |

| CAGR (2025 to 2035) | 8.8% |

Growth is supported by increasing deployment of PVDF in high-performance applications across electrical, chemical, automotive, and renewable energy sectors.

PVDF is being adopted for its favorable combination of thermal stability, chemical resistance, and mechanical strength, which supports its use in aggressive industrial environments. In chemical processing industries, PVDF is being utilized in piping, pumps, and valves where resistance to corrosive media is critical. Its long service life and ease of fabrication are aligning well with operational reliability standards in chemical plants and semiconductor facilities.

In the electrical and electronics sector, PVDF is being used in wire insulation, lithium-ion battery binders, and piezoelectric films. Battery manufacturers are increasingly incorporating PVDF as a binder in cathodes and separators to improve energy density, mechanical integrity, and safety in electric vehicle batteries. Companies across Asia, Europe, and North America are scaling production to meet rising demand from EV platforms, supported by regulatory policies and electrification targets.

The material’s piezoelectric and dielectric properties are enabling its use in sensors and actuators across aerospace and industrial automation. In solar photovoltaic applications, PVDF coatings are being applied to backsheet films to provide UV resistance and environmental durability, particularly in harsh climates. With the rise in solar installations and energy storage systems, this application is expected to gain further traction.

Innovation is being directed toward the development of lower-emission and recycled PVDF variants, especially as scrutiny intensifies around fluoropolymer waste and emissions. Manufacturers are investing in closed-loop processing and advanced compounding techniques to minimize environmental footprint and align with global compliance frameworks such as REACH and EPA fluoropolymer guidance.

-market-analysis-by-product-type.webp)

Pelletized PVDF is projected to hold approximately 39.8% of the global PVDF market share in 2025 and is expected to grow at a CAGR of 8.6% through 2035. This form is widely used in injection molding, extrusion, and compounding processes across applications such as wire insulation, membrane fabrication, and pipe production. Its uniformity, low moisture content, and handling convenience make it preferred in mass-scale manufacturing environments. As demand for corrosion-resistant and high-performance polymers increases in sectors like electronics, chemicals, and infrastructure, pelletized PVDF remains the primary format chosen by processors.

-market-analysis-by-type.webp)

Beta phase PVDF is estimated to account for approximately 42.6% of the global PVDF market share in 2025 and is forecast to grow at a CAGR of 9.0% through 2035. Known for its strong ferroelectric, dielectric, and piezoelectric characteristics, beta-phase PVDF is widely used in sensors, actuators, energy harvesting devices, and lithium-ion battery separators. The alignment of polymer chains in this phase enhances electrical performance, making it highly suitable for next-generation electronic and medical devices. With the increasing demand for wearable electronics, smart sensors, and solid-state batteries, the beta phase is gaining momentum in precision-driven and high-performance applications.

High Production Costs and Raw Material Prices

Production of PVDF needs a volume large quantities of raw material and energy, so it's relatively expensive as a type polymers. The ups down prices resulting from such factors as fluctuating costs on fluorine categories also affect the profitability of all manufacturers involved in these products

Environmental Regulations and Disposal Issues

PVDF, a fluoropolymer is subject to strict environmental standards both through production and disposal for the simple reason that emissions/disposal are tough problems. Compliance with these regulations adds cost to the production of goods.

Growing Demand in Renewable Energy and Electronics

The increased acceptance of PVDF in solar energy panels, lithium ion batteries, antifouling of electrical coatings, directly leads to market growth. Its fine chemical inertness, heat stability and electrical insulation properties left make it the best material for these uses.

Advancements in Sustainable and Recyclable PVDF

The development of more dog-friendly and recyclable formulations than traditional PVDF offers room for market growth. Companies that focus on green alternatives are likely to earn themselves a competitive advantage by being able to sell those points over their business rivals.

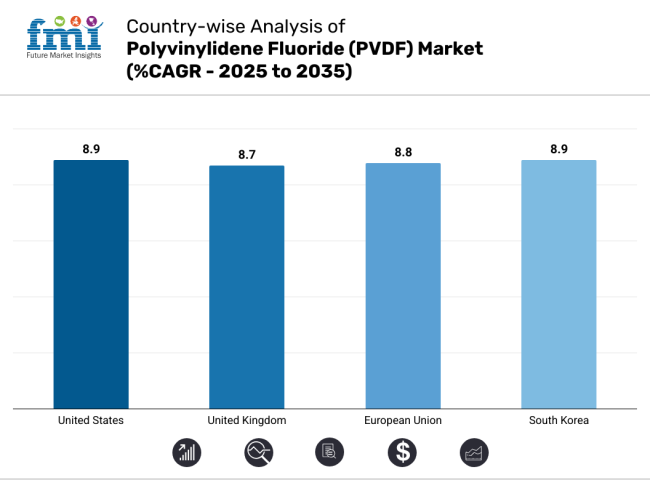

In the United States market for PVDF thePolyvinylidene Fluoride (PVDF) is gaining favour because it has been combined into or incorporated into various industries particularly those seen before as difficult to contend with: aerospace, electronics, renewable energy, etc. The search for high-end materials, including high-end polymer materials offering superb chemical resistance and structural strength. Government policies encouraging clean power generation and electric vehicles are also driving up the demand for PVDF in power-operated applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.9% |

The United Kingdom's PVDF Market has been expanding as industries turn to advanced polymeric materials for high-tech applications. An increased emphasis on sustainability and high-performance coatings in both construction and automobile industries is driving the market for it. Advances in PVDF-based water purification membranes and energy storage solutions have also promoted the growth of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.7% |

Fluoropolymer regulations promoting renewables and recycling are also benefiting the market for her materials in the European Union. Examples include Germany and France who are prominent leaders in innovation today; PVDF is widely used for their lithium-ion battery product lines, as well as coatings and medical supplies. The growing demand for high-performance plastics in 3D printing and semiconductor manufacturing is further promoting market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.8% |

South Korea’s PVDF Market is on the rise thanks to the country’s strong electronics and battery-making sectors. An expanding electric car market as well as the demand for advanced separator materials in lithium-ion batteries are major factors fuelling its growth. More investment in research and development for high-performance polymers is also boosting the market’s smooth progress.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.9% |

The PVDF market is set for significant growth, driven by rising demand in battery technology, semiconductors, and corrosion-resistant infrastructure. Leading producers are expanding capacity, particularly in Asia and Europe, to secure long-term supply chains and leverage downstream integration opportunities. This strategic expansion is aimed at meeting the growing demand from key industries and enhancing competitiveness. As the market continues to evolve, companies that invest in scaling production and securing reliable supply chains are positioned to capture substantial market share.

The overall market size for Polyvinylidene Fluoride market was USD 1,437.2 Million in 2025.

The Polyvinylidene Fluoride market is expected to reach USD 3,369.3 Million in 2035.

The polyvinylidene fluoride (PVDF) market will grow due to rising demand in batteries, coatings, electronics, and aerospace, driven by its exceptional chemical resistance, thermal stability, and increasing use in renewable energy and high-performance applications.

The top 5 countries which drives the development of Polyvinylidene Fluoride market are USA, European Union, Japan, South Korea and UK.

β Phase PVDF demand supplier to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluoride Materials Market

Barium Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Benzotrifluoride Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Fluoride Market Size & Outlook 2025 to 2035

Boron Trifluoride and Complexes Market 2025 to 2035

Potassium Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Sulphur Hexafluoride Market Growth 2025 to 2035

Competitive Overview of Tributyl Tin Fluoride Market Share

2-Fluorobenzotrifluoride Market Forecast and Outlook 2025 to 2035

Anhydrous Hydrogen Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Potassium Hydrogen Fluoride Market Growth - Trends & Forecast 2025 to 2035

Potassium Zirconium Fluoride Market

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA