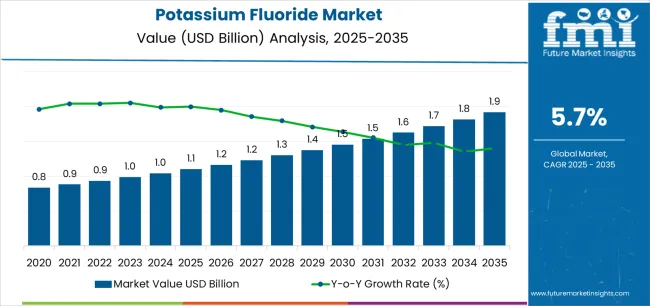

The potassium fluoride market is projected to grow from USD 1.1 billion in 2025 to USD 1.9 billion in 2035, reflecting a CAGR of 5.7%. A 10-year growth comparison shows a steady and balanced expansion driven by industrial, metallurgical, and chemical applications. Between 2025 and 2030, the market is expected to experience moderate growth as demand strengthens from aluminum production, glass etching, and the synthesis of fluorine compounds. Rising industrial activity and advancements in chemical manufacturing will support consistent gains during this period, with moderate price stability across major regional markets.

As outlined in FMI’s verified materials science research, supporting innovation in industrial and consumer applications, from 2030 to 2035, the growth rate is likely to show a slight acceleration as new applications in electronics, specialty chemicals, and metal surface treatment expand the product’s end-use base. Improved production methods and supply chain efficiency will also contribute to stronger output and stable pricing. Compared to the first half of the decade, the latter period will likely deliver higher value addition due to technological improvements and increased focus on quality and purity standards. The overall 10-year comparison reflects a predictable upward trend, supported by stable demand, technological progress, and incremental diversification of applications, ensuring sustained market expansion and consistent profitability for key producers across the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.1 billion |

| Forecast Value in (2035F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The potassium fluoride market is expected to reach USD 1.1 billion in 2025 and grow to approximately USD 1.9 billion by 2035, reflecting a forecast CAGR of 5.7%. Over this ten-year period, market expansion is attributed to rising adoption of potassium fluoride in chemical manufacturing, metallurgy, and surface treatment applications. Demand from the aluminum and glass processing industries, which together represent around 55% of total consumption, continues to strengthen as these sectors scale up production efficiency and corrosion protection processes. The pharmaceutical and electronics industries are expected to account for nearly 25% of market growth during this period, driven by its increasing use as a catalyst and etching agent.

Between 2025 and 2035, Asia-Pacific is anticipated to remain the leading region, contributing close to 50% of total demand growth due to industrial expansion in China, Japan, and India. North America and Europe will see steady progress, supported by ongoing advancements in chemical synthesis and materials engineering. The shift toward high-purity grades of potassium fluoride for electronics and specialty chemical production highlights the industry’s focus on quality, performance, and controlled application environments. Continuous R&D efforts and increased investment in refining technologies are expected to strengthen overall market growth over the next decade.

Market expansion is being supported by the increasing global demand for pharmaceutical intermediates and active pharmaceutical ingredient synthesis requiring versatile fluorinating agents that can introduce fluorine atoms into organic molecules, enable nucleophilic substitution reactions, and support diverse pharmaceutical chemistry applications across drug development and commercial manufacturing. Modern pharmaceutical synthesizers and fine chemical manufacturers are increasingly focused on implementing high-purity reagents that can ensure reaction efficiency, minimize impurities, and provide consistent performance while meeting stringent pharmaceutical quality specifications. Potassium fluoride's proven ability to serve as an effective fluorinating agent, catalyst, and phase-transfer reagent makes it an essential chemical for contemporary pharmaceutical and specialty chemical manufacturing.

The growing emphasis on semiconductor manufacturing and electronics applications is driving demand for ultra-high purity potassium fluoride grades that can support etching processes, surface treatment, and specialized chemical vapor deposition applications requiring exceptional purity and controlled moisture content. Electronics manufacturers' preference for reliable fluorine sources that combine chemical reactivity with stringent quality specifications is creating opportunities for innovative potassium fluoride applications. The rising influence of battery technology advancement and lithium-ion battery production is also contributing to increased adoption of battery-grade potassium fluoride serving as electrolyte components and fluorination reagents in electrode material synthesis supporting the global electrification transition.

The market is segmented by purity, application, end-use industry, form, and region. By purity, the market is divided into above 99% (including electronic/semiconductor grade, pharma/biotech synthesis, fine chemicals & catalysts, and other high-spec uses) and below 99%. Based on application, the market is categorized into organic chemicals (including fluorination for specialties, pharma intermediates/API steps, battery & advanced materials, and other organics), inorganic fluorides, electroplating, glass etching, and others. By end-use industry, the market covers pharmaceuticals (including API synthesis, advanced intermediates, and excipients/specialty), electronics & semiconductors, chemicals, agriculture, and others. By form, the market is divided into powder (including moisture-controlled packaged and standard powder) and solution/liquid. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

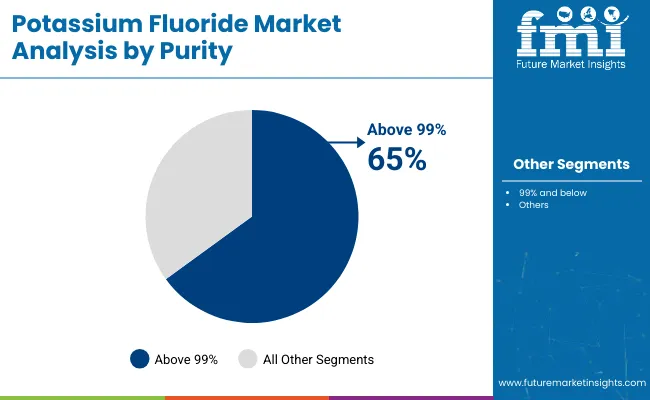

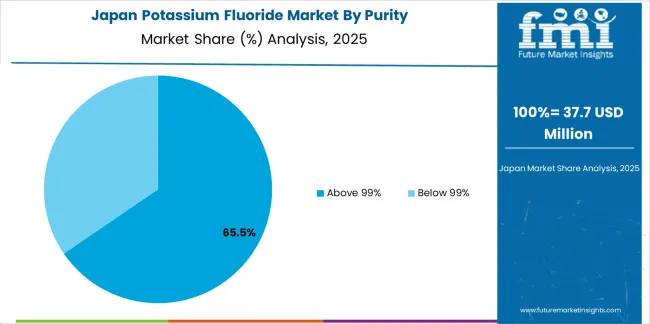

The above 99% purity segment is projected to maintain its leading position in the potassium fluoride market in 2025 with a commanding 65.0% market share, reaffirming its role as the preferred quality specification for demanding applications requiring exceptional purity, minimal impurities, and controlled moisture content. Within this high-purity segment, pharma and biotech synthesis applications command 38.0% of the high-purity market, representing pharmaceutical intermediate production and active pharmaceutical ingredient manufacturing requiring stringent quality control. Electronic and semiconductor grade accounts for 34.0% of high-purity potassium fluoride, serving semiconductor fabrication, display manufacturing, and electronics applications demanding ultra-low metal contamination. Fine chemicals and catalysts hold 20.0%, addressing specialty synthesis and catalytic applications. Other high-specification uses represent 8.0%, encompassing optical coatings and advanced materials.

Pharmaceutical manufacturers and electronics producers increasingly utilize above 99% purity potassium fluoride for its reliable performance, comprehensive analytical documentation, and ability to meet stringent regulatory and quality specifications. This purity segment forms the foundation of premium potassium fluoride applications, representing specifications with the greatest quality assurance and regulatory acceptance across pharmaceutical synthesis and semiconductor manufacturing. With manufacturing processes requiring materials that ensure product quality and regulatory compliance, above 99% purity potassium fluoride aligns with both performance objectives and quality assurance requirements.

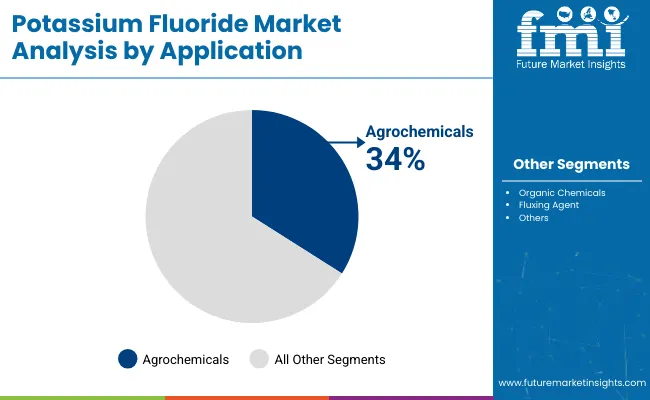

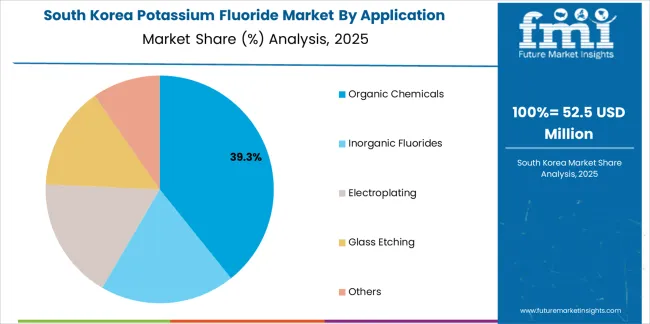

The organic chemicals application segment is projected to represent the largest share of potassium fluoride demand in 2025 with 39.0% market share, underscoring its critical role as the primary driver for potassium fluoride adoption across fluorination reactions, pharmaceutical intermediate synthesis, and specialty chemical production. Within the organic chemicals segment, fluorination for specialty chemicals commands 46.0% of organic applications, representing nucleophilic fluorination reactions and specialty fluorinated compound synthesis. Pharma intermediates and API synthesis steps account for 31.0%, addressing pharmaceutical manufacturing requiring fluorine incorporation. Battery and advanced materials hold 13.0%, serving emerging applications in energy storage and functional materials. Other organic uses represent 10.0%, encompassing diverse synthetic applications.

Chemical synthesizers prefer potassium fluoride for its strong nucleophilicity enabling effective fluorination, compatibility with diverse organic substrates, and ability to operate under mild conditions compared to alternative fluorinating agents. Positioned as an essential reagent for fluorine chemistry, potassium fluoride offers both synthetic utility advantages and safety benefits compared to more hazardous fluorinating agents. The segment is supported by continuous pharmaceutical innovation and growing availability of high-purity grades meeting stringent synthesis requirements. As pharmaceutical manufacturing capacity expands globally and fluorinated drug development increases, the organic chemicals application will continue to dominate the market.

The powder form segment commands 58.0% market share in 2025, reflecting the dominant physical form for potassium fluoride distribution and utilization across pharmaceutical, electronics, and chemical applications. Within the powder segment, moisture-controlled packaged powder represents 44.0% of powder sales, addressing applications requiring minimized moisture exposure and hydrolysis prevention through specialized packaging including moisture-barrier containers and inert atmosphere protection. Standard powder accounts for 56.0% of powder sales, serving general industrial applications with conventional packaging and handling.

The powder form's dominance stems from ease of handling, accurate dosing capabilities, compatibility with standard chemical processing equipment, and effective moisture management through appropriate packaging systems. Solution and liquid forms serve specialized applications requiring pre-dissolved potassium fluoride or continuous dosing systems but represent smaller market share due to handling challenges and concentration limitations. The powder segment's leadership is reinforced by established distribution infrastructure, compatibility with batch processing operations common in pharmaceutical and specialty chemical synthesis, and customer preference for solid reagents enabling flexible formulation and precise stoichiometric control across diverse reaction conditions.

The potassium fluoride market is advancing steadily due to increasing pharmaceutical intermediate demand supporting fluorinated drug synthesis and growing adoption of specialty fluorinating reagents that provide selective reactivity and predictable performance across diverse pharmaceutical, agrochemical, and electronics applications. The market faces challenges, including handling and safety concerns related to fluoride toxicity and corrosiveness requiring specialized equipment and trained personnel, regulatory restrictions on fluoride compound use and disposal affecting market access in certain regions, and competition from alternative fluorinating agents including tetrabutylammonium fluoride and cesium fluoride offering specialized advantages in specific reaction conditions. Innovation in ultra-high purity grades and sustainable production technologies continues to influence product development and market expansion patterns.

The growing adoption of advanced semiconductor fabrication technologies and electronics manufacturing is enabling increased potassium fluoride utilization in etching processes, cleaning applications, and surface treatment operations requiring ultra-high purity fluoride sources with minimal metallic contamination and controlled particle size distributions. Semiconductor-grade potassium fluoride provides essential fluoride ions for silicon etching, oxide removal, and surface passivation while meeting stringent electronic-grade specifications including low sodium, low chloride, and comprehensive trace metal control. Electronics manufacturers are increasingly recognizing the critical importance of high-purity fluoride reagents for process control, yield optimization, and device reliability supporting advanced chip manufacturing and display production.

Modern battery manufacturers and materials developers are incorporating potassium fluoride in lithium-ion battery electrolyte formulations, electrode material synthesis, and solid electrolyte development to enhance electrochemical performance, improve cycling stability, and support next-generation energy storage technologies through fluorine-containing battery components and fluorination processes. Battery-grade potassium fluoride enables electrolyte optimization and cathode material processing while providing essential fluoride sources for emerging solid-state battery technologies. Advanced energy storage applications also allow chemical manufacturers to serve comprehensive electrification objectives and differentiate products beyond traditional pharmaceutical and electronics markets, creating competitive advantages in sustainable technology segments and supporting long-term strategic positioning as battery production expands globally.

The emergence of fluoride waste recovery systems, industrial waste stream valorization, and circular fluorine chemistry is creating opportunities for sustainable potassium fluoride production utilizing recovered fluoride from semiconductor wastewater, pharmaceutical waste streams, and electroplating operations while reducing environmental impact and supporting circular economy implementation. These innovations enable chemical producers to develop sustainable feedstock sources, reduce raw material costs, and address environmental concerns regarding fluoride waste disposal through technology-driven recovery and purification systems. Leading chemical companies are investing in fluoride recovery programs that reduce dependency on primary fluoride sources, support environmental sustainability objectives, and create competitive advantages in cost structure while addressing regulatory pressures and corporate responsibility expectations across global chemical markets.

| Country | CAGR (2025-2035) |

|---|---|

| India | 6.0% |

| South Korea | 5.6% |

| China | 5.7% |

| Japan | 4.9% |

| USA | 4.8% |

| UK | 4.7% |

| Germany | 4.6% |

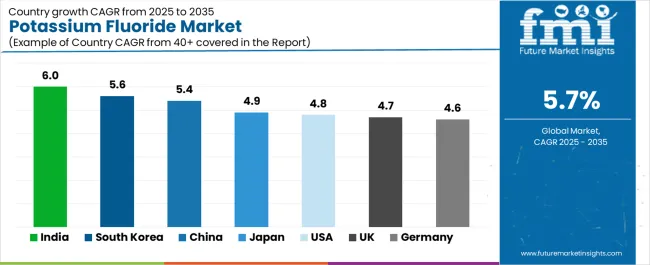

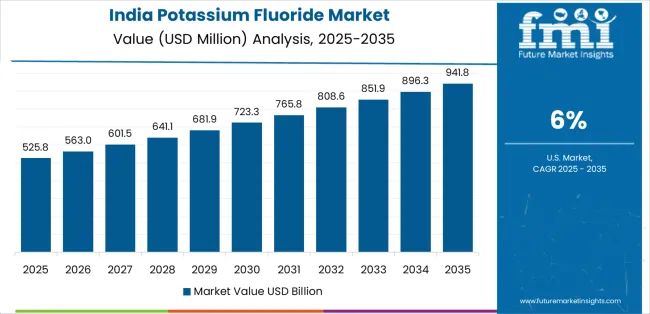

The potassium fluoride market is experiencing solid growth globally, with India leading at a 6.0% CAGR through 2035, driven by expansion of fluorination capacity for pharmaceutical and agrochemical intermediates, growing domestic specialty chemical manufacturing, and import substitution strategies in high-purity fluoride salts supporting self-reliance initiatives. South Korea follows at 5.6%, supported by semiconductor and display etching applications, lithium-ion battery materials production growth, and advanced electronics manufacturing requiring ultra-high purity fluoride reagents. China shows growth at 5.7%, emphasizing scale in specialty chemicals manufacturing and export of high-purity potassium fluoride grades serving global pharmaceutical and electronics markets.

Japan records 4.9%, focusing on precision manufacturing applications, optical coating production, and semiconductor chemical supply with stringent quality specifications. The United States demonstrates 4.8% growth, supported by pharmaceutical synthesis expansion and electronics applications with investments in battery supply chain chemicals. The United Kingdom exhibits 4.7% growth, emphasizing specialty pharma synthesis and stricter purity specifications in regulated pharmaceutical production. Germany shows 4.6% growth, supported by specialty chemicals manufacturing and electroplating applications under tight environmental controls.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

Revenue from potassium fluoride in India is projected to exhibit exceptional growth with a CAGR of 6.0% through 2035, driven by expansion of fluorination capacity for pharmaceutical intermediate production and agrochemical synthesis supporting domestic active pharmaceutical ingredient manufacturing, growing specialty chemical production infrastructure reducing import dependency, and import substitution strategies in high-purity fluoride salts supporting government self-reliance initiatives and reducing trade deficits.

The country's position as a major pharmaceutical manufacturing hub and expanding fine chemical capabilities are creating substantial demand for high-purity potassium fluoride across pharmaceutical and agrochemical applications. Major international chemical suppliers and domestic fluoride manufacturers are establishing comprehensive production and distribution capabilities to serve Indian pharmaceutical markets.

Revenue from potassium fluoride in South Korea is expanding at a CAGR of 5.6%, supported by the country's advanced semiconductor fabrication requiring ultra-high purity etching chemicals and surface treatment reagents, display manufacturing utilizing potassium fluoride in glass etching and panel production, and lithium-ion battery materials production growth driving demand for battery-grade fluoride compounds. The country's technology-driven industrial base and quality-focused manufacturing are driving specialized potassium fluoride demand. Korean semiconductor companies and battery manufacturers are establishing comprehensive sourcing strategies for pharmaceutical and electronic-grade potassium fluoride.

Revenue from potassium fluoride in the United States is expanding at a CAGR of 4.8%, supported by the country's robust pharmaceutical research and synthesis activity requiring high-purity fluorinating reagents, electronics manufacturing serving semiconductor and specialty applications, and investments in domestic battery supply chain chemicals supporting electrification initiatives and strategic supply security. The nation's innovation-driven pharmaceutical sector and electronics industry are driving demand for specialized potassium fluoride grades. Leading pharmaceutical companies and chemical manufacturers are investing in comprehensive potassium fluoride supply chains.

Revenue from potassium fluoride in Japan is expanding at a CAGR of 4.9%, supported by the country's precision manufacturing culture emphasizing ultra-high purity chemical reagents, optical coating production requiring specialized fluoride compounds, and semiconductor chemical supply serving domestic and export markets with stringent quality specifications and comprehensive analytical documentation. Japan's quality-focused chemical industry and advanced manufacturing sectors are driving demand for premium potassium fluoride grades. Japanese chemical companies and pharmaceutical manufacturers are investing in ultra-high purity potassium fluoride capabilities.

Revenue from potassium fluoride in China is growing at a CAGR of 5.7%, driven by the country's large-scale specialty chemicals manufacturing infrastructure, expanding pharmaceutical intermediate production serving domestic drug synthesis, and export of high-purity potassium fluoride grades to international pharmaceutical and electronics markets. The country's established chemical manufacturing capabilities and cost-competitive production are supporting global potassium fluoride supply. Chinese fluoride manufacturers and pharmaceutical intermediate producers are establishing comprehensive production capabilities.

Revenue from potassium fluoride in the United Kingdom is expanding at a CAGR of 4.7%, supported by the country's specialty pharmaceutical synthesis expertise requiring high-purity fluorinating reagents, stricter purity specifications in regulated pharmaceutical production supporting comprehensive quality control, and fine chemical manufacturing serving pharmaceutical and specialty chemical sectors. The UK's quality-focused pharmaceutical industry and regulatory emphasis are driving demand for premium potassium fluoride grades. British pharmaceutical companies and contract development organizations are establishing comprehensive fluorine chemistry capabilities.

Revenue from potassium fluoride in Germany is growing at a CAGR of 4.6%, driven by the country's specialty chemicals manufacturing requiring fluorination reagents and fluoride compounds, electroplating applications serving automotive and industrial metal finishing, and comprehensive environmental controls driving adoption of sustainable production practices and waste fluoride recovery systems. Germany's advanced chemical industry and environmental standards are supporting demand for certified potassium fluoride. German chemical companies and pharmaceutical manufacturers are investing in sustainable fluoride sourcing.

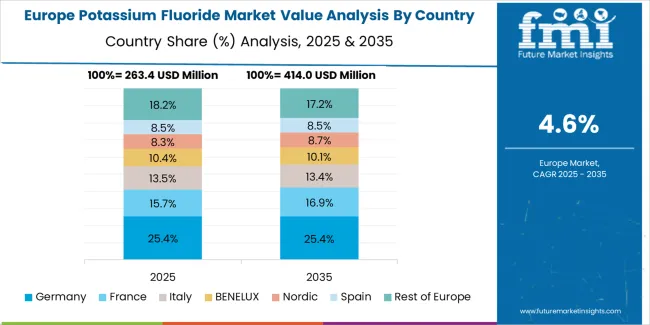

The potassium fluoride market in Europe is projected to grow from USD 0.4 billion in 2025 to USD 0.6 billion by 2035, registering a CAGR of 4.7% over the forecast period. Germany is expected to maintain its leadership position with a 24.0% market share in 2025, moderating slightly to 23.8% by 2035, supported by its specialty chemicals manufacturing base, pharmaceutical intermediate production, and electroplating applications with comprehensive environmental controls and quality standards.

The United Kingdom follows with 18.0% in 2025, projected to reach 18.2% by 2035, driven by specialty pharmaceutical synthesis expertise and stricter purity specifications in regulated production. France holds 16.0% in 2025, rising to 16.1% by 2035, supported by pharmaceutical manufacturing and specialty chemical applications. Italy commands 12.0% in 2025, projected to reach 12.2% by 2035, driven by pharmaceutical production and fine chemical manufacturing. Spain accounts for 10.0% in 2025, expected to reach 10.1% by 2035, supported by growing pharmaceutical and chemical industries. Benelux & Nordics maintain 12.0% in 2025, growing to 12.2% by 2035, driven by specialty chemical production and pharmaceutical applications. Central & Eastern Europe holds 8.0% in 2025, moderating to 7.4% by 2035, attributed to pharmaceutical manufacturing expansion and chemical production supporting diverse industrial applications across emerging markets implementing advanced fluorine chemistry and pharmaceutical synthesis capabilities meeting European quality and regulatory standards.

The potassium fluoride market is characterized by competition among established fluorine chemical manufacturers, specialty inorganic producers, and pharmaceutical intermediate suppliers. Companies are investing in advanced purification technology research, moisture control systems, quality assurance excellence, and comprehensive product portfolios to deliver high-purity, consistent, and certified potassium fluoride solutions. Innovation in ultra-high purity grades, sustainable production routes, and application-specific packaging is central to strengthening market position and competitive advantage.

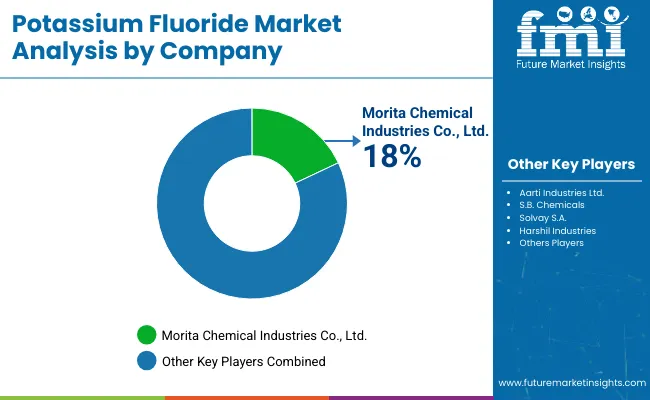

Morita Chemical Industries Co., Ltd. leads the market with a commanding 19.0% market share, offering comprehensive fluorine chemical solutions with advanced potassium fluoride production capabilities, emphasizing pharmaceutical and electronic-grade products with stringent purity control and technical support across pharmaceutical synthesis, semiconductor, and specialty chemical applications.

The company introduced upgraded >99.5% potassium fluoride grades in 2025 targeted at semiconductor and pharmaceutical synthesis, with tighter moisture specifications and enhanced packaging to reduce HF-related corrosion at end-use sites. Aarti Industries Ltd. provides comprehensive fluoride salts production from Indian operations, having debottlenecked fluoride-salts capacity in Gujarat during 2024 to support pharma and agrochemical intermediates with process controls for consistent high-purity supply.

Solvay S.A. specializes in fluorinated specialties production, expanding European fluorinated chemicals capability and implementing fluoride recovery and recycling at selected plants in 2024 to lower product carbon intensity and waste. S.B. Chemicals focuses on high-purity inorganic fluorides serving the pharmaceutical and electronics markets. Tanfac Industries Ltd. offers Indian fluoride production with pharmaceutical-grade specifications.

Harshil Industries provides specialty fluorides for Indian pharmaceutical sector. Honeywell International Inc. delivers advanced fluorine chemicals with global distribution. American Elements specializes in high-purity inorganic chemicals including electronic-grade potassium fluoride. Fluorochem Ltd. focuses on specialty fluorine compounds for pharmaceutical research. Shanghai Yixin Chemical Co., Ltd. provides Chinese potassium fluoride production serving domestic and export markets.

Potassium fluoride represents a specialized fluorine chemistry segment within pharmaceutical intermediates and specialty inorganics, projected to grow from USD 1.1 billion in 2025 to USD 2.2 billion by 2035 at a 5.7% CAGR. This alkali metal fluoride, primarily above 99% purity grades for demanding applications, is produced through reaction of potassium hydroxide or potassium carbonate with hydrofluoric acid to serve as a versatile fluorinating agent in pharmaceutical synthesis, a nucleophilic reagent in organic chemistry, an etching chemical in semiconductor manufacturing, and a specialized component in battery electrolytes and optical coatings. Market expansion is driven by increasing pharmaceutical fluorination demand, growing semiconductor manufacturing, expanding battery technology development, and rising emphasis on high-purity specialty chemicals across pharmaceutical, electronics, and advanced materials sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.1 billion |

| Purity | Above 99% (Electronic/Semiconductor Grade, Pharma/Biotech Synthesis, Fine Chemicals & Catalysts, Other High-spec Uses), Below 99% |

| Application | Organic Chemicals (Fluorination for Specialties, Pharma Intermediates/API Steps, Battery & Advanced Materials, Other Organics), Inorganic Fluorides, Electroplating, Glass Etching, Others |

| End-Use Industry | Pharmaceuticals (API Synthesis, Advanced Intermediates, Excipients/Specialty), Electronics & Semiconductors, Chemicals, Agriculture, Others |

| Form | Powder (Moisture-controlled Packaged, Standard Powder), Solution/Liquid |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | India, South Korea, China, Japan, United States, United Kingdom, Germany, and 40+ countries |

| Key Companies Profiled | Morita Chemical Industries, Aarti Industries, Solvay, S.B. Chemicals, Tanfac Industries, Harshil Industries |

| Additional Attributes | Dollar sales by purity, application, end-use industry, and form categories, regional demand trends, competitive landscape, technological advancements in purification systems, sustainable production development, pharmaceutical quality optimization, and semiconductor application expansion |

The global potassium fluoride market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the potassium fluoride market is projected to reach USD 1.9 billion by 2035.

The potassium fluoride market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in potassium fluoride market are above 99% and below 99%.

In terms of application, organic chemicals segment to command 39.0% share in the potassium fluoride market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Potassium Hydrogen Fluoride Market Growth - Trends & Forecast 2025 to 2035

Potassium Zirconium Fluoride Market

Potassium Formate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Tetrafluoroborate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Fluoborate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Propionate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Acetate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Citrate Market Growth - Trends & Forecast 2025 to 2035

Potassium Formate Industry Analysis in North America - Size, Share & Forecast 2025 to 2035

Potassium Carbonate Market Growth – Trends & Forecast 2025 to 2035

Potassium Sorbate Market Analysis by Product Type, Application and Region from 2025 to 2035

Potassium Chloride Market Growth – Trends & Forecast 2025 to 2035

Potassium Humate Market Growth – Trends & Forecast 2025 to 2035

Potassium Cryolite Market

Potassium Alum Market

Potassium Hydrogen Sulphite Market

Dipotassium Guanylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium, Potassium and Calcium Salts Market Analysis by Agriculture, Pharmaceuticals and Personal Care Through 2035

Demand for Potassium Sulfate in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA