Global potassium chloride market will continue to grow as it is widely used as fertilizer. Potash is most often found as potassium chloride, which is essential for plant benefits as potassium is necessary for better crop yield and quality. Beyond agriculture, potassium chloride finds broad application in water treatment, food processing, and drug manufacturing, where it is used in electrolyte solutions and potassium deficiency medications.

With the exploding food demand to sustain the growing global population, it’s potassium chloride based fertilizers, among others, that are increasingly arming the most efficient forms of agriculture ever seen on Earth. Additionally, Increasing application across industrial and pharmaceutical is another factor of market growth.

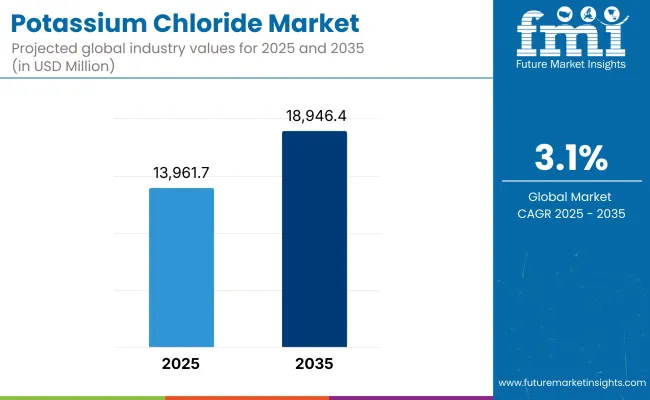

The Market was valued at USD 13,961.7 Million in 2025 and expected to reach USD 18,946.4 Million by 2035, at a CAGR of 3.1% throughout the forecast period. In addition, the market is expected to exhibit growth during the forecast year due to key aspects such as the evolving sustainable methods of potash extraction and the steadily growing investments in precision agriculture.

North America held a significant share of the potassium chloride market owing to growing adoption of novel farming practices and relatively advanced agriculture sector. In the United States, there is a high demand for potash fertilizers that increase crop yield substantially to satiate the food demands of its growing population.

In addition, the area is not lacking in some of the biggest producers of potash available on the planet, ensuring a steady source of potassium chloride, suitable for a wide range of commercial uses. Another reason for the uptake of potassium-based fertilizers is the rising trend of adopting organic farming and precision agriculture technologies.

Agriculture sector and food security still remain a strong watchword in Europe as potential contributors to the potassium chloride market remains witnessing a steady growth rate over the forecast period. Need for more fertilizer use efficiency Countries like Germany, France, and UK are prioritizing efficient fertilizer use to enhance soil health and maximize crop productivity.

Meeting environmental regulations in the region promote the use of efficient and environmentally friendly potash fertilizers. Moreover, rising adoption of potassium chloride in food processing industry as salt alternative is powering the growth of the market.

The potassium chloride market will be led by the Asia-Pacific region which is expected to grow at the highest rate due to rapid increase in population and urbanization along with rising demand for food. There are huge strides in potash fertilizer consumption as people in countries such as China and India invest heavily to cash in on agriculture and to ensure food security.

Moreover, the increasing demand for potassium chloride in this region is also driven by governmental efforts to modernize farming practices and increase crop yield. Increasing demand for potassium chloride from the expanding pharmaceutical and water treatment industries is also driving market expansion.

Challenges

Supply Chain Disruptions, Price Volatility, and Environmental Concerns

Regions that import large amounts of potash have started eyeing the potassium chloride market with an eye to maintain supply chains in politically and trade-constrained environments. Market uncertainty due to relatively higher prices which are volatile is impacted by demand from agriculture, industrial and pharmaceutical. Moreover, environmental issues: potash mining and waste disposal has prompted stringent regulations that force companies to spend on eco-friendly mining and waste management practices.

Opportunities

Growth in Fertilizer Demand, Expanding Pharmaceutical Applications, and Technological Advancements in Mining

Key factors driving the market growth include increased demand for potassium chloride-based fertilizers, strong activities in the Asia-Pacific and Latin America region, and as agricultural productivity feed priority. There is also a significant demand for potassium chloride in pharmaceutical applications both in IV solutions and dietary supplements that contributes to the market growth.

Moreover, innovations in potash extraction and processing technologies, such as automated mining and eco-friendly extraction methods, are enhancing efficiency and sustainability within the sector.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with fertilizer safety standards and mining regulations. |

| Consumer Trends | Demand for potassium chloride in fertilizers, pharmaceuticals, and industrial uses. |

| Industry Adoption | Used primarily in agriculture, chemical processing, and healthcare. |

| Supply Chain and Sourcing | Dependence on potash mining in Canada, Russia, and Belarus. |

| Market Competition | Dominated by potash fertilizer producers and chemical suppliers. |

| Market Growth Drivers | Increased demand for high-yield fertilizers, medical-grade potassium, and industrial applications. |

| Sustainability and Environmental Impact | Early adoption of low-impact mining techniques and potash recovery systems. |

| Integration of Smart Technologies | Introduction of automated fertilizer blending and precision agriculture solutions. |

| Advancements in Potash Processing | Pharmaceutical grade high purity potassium chloride. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates, eco-friendly potash mining requirements, and waste management laws. |

| Consumer Trends | Growth in organic fertilizers, high-purity pharmaceutical-grade potassium chloride, and water treatment applications. |

| Industry Adoption | Expansion into eco-friendly fertilizers, biotech solutions, and alternative potash extraction methods. |

| Supply Chain and Sourcing | Shift toward automated mining, AI-driven resource optimization, and new potassium reserves exploration. |

| Market Competition | Entry of sustainable potash mining firms, biotech-based potassium suppliers, and AI-powered supply chain management firms. |

| Market Growth Drivers | Accelerated by sustainable potash extraction, potassium chloride alternatives, and smart farming innovations. |

| Sustainability and Environmental Impact | Large-scale shift toward zero-waste mining, carbon-neutral fertilizer production, and biodegradable potassium chloride formulations. |

| Integration of Smart Technologies | Diversifying into AI-powered soil analysis, remote fertilizer application monitoring and block chain technology-based potash traceability |

| Advancements in Potash Processing | The evolution towards Bio-Technology enabled potassium synthesis, and alternative sources and sustainable formulations of this nutrient. |

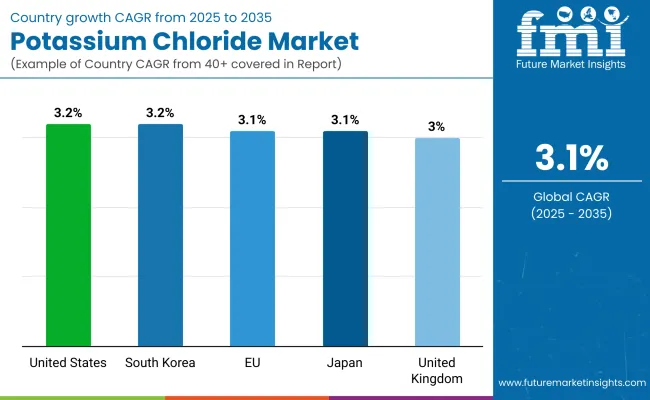

Growing demand for agricultural fertilizers, rise in pharmaceutical applications, and investments in sustainable potash extraction technologies drives the growth of the USA potassium chloride market. The adoption of precision farming and soil nutrient management solutions is also spurring the market growth of potassium-based fertilizers. Furthermore, policies encouraging green potash mining and water-efficient farming are influencing the sector's outlook.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

The UK market is growing at a good pace due to growing emphasis on sustainable agriculture, an uptick in demand for organic fertilizers, and expansion of pharmaceutical-grade potassium chloride production. Market growth is driven by the adoption of AI-driven precision agriculture and the government implementation of eco-friendly fertilizers. Also, potassium chloride recycling and alternative extraction technologies are opening up growth opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.0% |

The potash mining has stringently environmental regulations; the demand for organic and bio-based fertilizers is rising, along with increasing investment in sustainable agricultural practices drives the market for potassium chloride in Europe. Germany, France, and Spain is leading sector such as precision farming, potassium chloride-based soil enhancers, and controlled-release fertilizers.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.1% |

Increased demand for precision agriculture solutions, growing pharmaceutical utilization, and strong investment in biotechnology driven potassium chloride formulations are driving the growth of potassium chloride market in Japan. Smart and sustainable approaches such as high-efficiency crop nutrition and urban farming solutions are accompanied by a growing need for potassium-based fertilizers in the market. Moreover, including developments in alternative sources of potash and smart irrigation systems are changing the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

This can be attributed to favorable government initiatives to promote sustainable agriculture, rising pharmaceutical-grade potassium chloride consumption, ongoing technology digression towards smart farming in South Korea. The adoption of hydroponic farming and soil health monitoring system with the use of AI for nutrients application accelerate the market growth. Moreover, the investigation of bioengineered potassium chloride alternatives is opening doors for market players.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.2% |

As industries and agricultural producers turn to potassium chloride for soil fertility, industrial processing, and chemical formulations, the agricultural grade and chemical/industrial grade segments lead the potassium chloride market. Such segments are vital in improving crop yield, facilitating production of manufactured goods, and boosting overall demand in the market.

The market has been ruled by agricultural-grade potassium chloride, as it is an effective, great efficiency, and inexpensive quick potassium fertilizer. Potassium chloride is also the preferred potassium-based fertilizers which offers high nutrients availability typically required for large scale farming operations unlike any other potassium-based fertilizers.

The emerging need for high-efficiency fertilizers that include potassium chloride to enhance root growth, moisture retention, and plant disease resistance, has raised market acceptance. Agricultural applications make up over 60% of global potassium chloride consumption which is vital for plant growth.

The rapid expansion of precision agriculture landing optimized potassium application techniques, soil monitoring technologies, and AI-assisted nutrient management systems has further propelled the market growth for potassium fertilizers ensuring better efficiency of fertilizer and reduced nutrient runoff.

Moreover, sustainable farming practices involving controlled potassium chloride release fertilizers, potassium formulations compatible with organic production, and soil conditioning practices are designed to be more friendly with the surrounding environment, and consequently, have augmented adoption of potassium chloride fertilizers.

The expansion of potassium chloride-based specialty fertilizer types based on, including but not limited to crop-specific nutrient mixtures, formulations for liquid application, and low-chloride fertilizer types suitable for useful plant life sensitive to chloride have fueled the growth of the market, as they promise to restore agricultural productivity and soil overall health.

Despite its ability to offer value by satisfying the nutrient needs of crops at a low cost, which is more accessible to farmers and fertilizer manufacturers worldwide, agricultural grade potassium chloride currently also suffers from several significant issues, including, soil salinization potential, growing limitations imposed by environmental regulations, and its reliance on international potash value chains susceptible to market dynamics.

Yet new economic developments in controlled-release fertilizers and chloride-free potassium alternatives and the way artificial intelligence can optimize soil nutrients are pushing agricultural sustainability that will bode well for future growth in potassium chloride-based fertilizers.

Chemical and industrial-grade potassium chloride has achieved widespread market penetration, especially in the chemical processing, pharmaceutical, and water treatment sectors, as companies look to high-purity sources of potassium for niche applications. Industrial grade unlike agricultural grade potassium chlorides which may have significant levels of impurities, chemical and industrial grades are highly purified in complex and expensive processes to yield a product that is of the highest quality for industrial use.

Market adoption was accelerated by the increasing use of potassium chloride in industrial applications, as it is widely used as a major electrolyte in chemical synthesis, an important ingredient in pharmaceutical preparations, and as a necessary ingredient in water softening and treatment systems.

Over 40% of the potassium chloride consumed in industrial applications supports the chemical manufacturing and processing industries, according to various studies.The growth of high purity potassium chloride applications including pharmaceutical-grade electrolyte solutions, laboratory reagents, and food-grade potassium chloride as a salt substitute has bolstered this market growth confirming higher industrial requirement.

AI-empowered chemical processing that also involves the real-time analysis of purity levels, auto investigation and improvement of crystallization leads to predictive batch quality control, has ensured that adoption levels continue to rise as precise production is assured alongside enhanced compliance for the new quality standards.

The evolution of sustainable and eco-friendly potassium chloride processing techniques including low energy extractive, waste reduction initiatives and renewable potassium sourcing would help optimize market growth and better align with industrial sustainability goals.While the segment benefits from being able to produce it with relatively low cost and high compatibility in the chemical and pharmaceutical industry, it is also plagued with factors like expensive manufacturing processes and strong regulatory barriers along with the limited availability of ultra-pure potassium chloride sources.

But breakthroughs in AI-based chemical synthesis, next-generation purification processes and bio-sourced potassium extraction technologies are enhancing market economics, enabling ongoing growth in chemical and industrial potassium chloride end-use.

The cereals and oilseeds segments are significant contributors to market growth driven by the increasing global food demand, sustainable farming practices, and farming productivity improvements.

Potassium is an important nutrient that improves metabolism in plants, regulates water, and increases tolerance to environmental stress, making cereal crops a large consumer of potassium chloride-based fertilizers. Unlike nitrogen and phosphorus fertilizers, potassium chloride also increases plants' tolerance to stress, leading to more stable yields across variable environmental conditions.

Rising demand for potassium-fortified fertilizers in cereal farming during cereal growers and improved potassium application methods across wheat, rice, and corn production have driven market adoption. The emerging high-efficiency fertilization techniques, including the use of precision potassium, fertigation systems, and soil nutrient balancing on the basis of AI have furthered market expansion to ensure maximal nutrient uptake and a decrease in potassium losses.

As a result, the strong adoption of climate-resilient agricultural practices, inspiring potassium-rich drought-resistant crop varieties, smart irrigation management, and potassium-based stress mitigation strategies, in addition to these technologies, to address the issue of food security and sustainable farming.

Potassium chloride-based formulations of micronutrients containing secondary elements and trace elements will drive market growth. The use of enriched mixtures of potassium developed for use with cereal crops can help to enhance quality, shelf life, and nutrient density.

Granulated, which has advantages with the ability to increase cereal crop yields while at the same time increasing soil fertility and optimizing plant health, the cereals segment faces populous concerns like potassium leaching as well as the risk of excess chloride being accumulated in heavy soils, prompting the need for balanced nutrient management. But improvements in AI-based nutrient application systems, controlled-release potassium fertilizers, and eco-friendly potassium chloride extraction methods are driving crop productivity and will sustain the growth of potassium chloride for cereal crops for many years.

From seed development, oil synthesis to plant health, potassium chloride is essential for all, and it has made substantial market penetration in oilseed crops, primarily with soybean, sunflower and canola producers. While cereals can tolerate it, potassium must be applied in balance with oilseeds to ensure maximum return in terms of seed production and oil yield.

Market adoption has been driven by the growing demand for potassium-based fertilizers in oilseed agriculture, with potassium chloride applications improving root development, plant vigor, and oil content. More than 45% of potassium chloride derived fertilizers used in oilseed production because of its affect on seed and oil quality.

Market growth has been further strengthened with the increasing adoption of specific climate potassium fertilization strategies, such as targeted foliar potassium applications or utilizing potassium-sulfur mixed fertilizers and potassium chloride fertigation techniques to maximize oilseed yield per harvest, and its respective nutritional value.

Advances in precision farming such as artificial intelligence-based potassium monitoring, real-time plant nutrient tracking, and satellite-assisted soil potassium mapping have also led to the adoption of oilseed crops, allowing enhanced management of oilseed crops with decreased input costs.

Specialized potassium formulations, including chloride-free potassium variants, are available for sensitive oilseed crops, while water-soluble potassium blends and bioavailable potassium compounds are also introduced, and this further enhances the market growth, as it ensures that the potassium forms will be adaptable in the complex and diverse soil conditions.

The oilseeds segment, despite its benefits in increasing the production of oilseeds along with enhancing the stress tolerance of plants and increasing their oil content, still faces drawbacks like fluctuating potassium availability, over-fertilization and prohibitory laws for chloride-based fertilizers in certain regions.

However, the increasing efficiency of crop yield through innovations in AI-oriented potassium nutrient optimization, sustainable potassium chloride extraction techniques (related) and the onset of climate-adaptive potassium fertilizer blends shows continued expansion in potassium chloride uses for oilseeds.

Increasing demand in agriculture as a primary component of potash fertilizers, rising applications of potassium chloride in industrial and chemical processes, and technological advancements in AI-powered extraction and refining techniques are driving the potassium chloride market. Industry trends are defined by soaring demand in the expansion of food production, the resultant depletion of soil nutrients, and the general prevalence of a move toward thee adoption of sustainable fertilizer solutions.

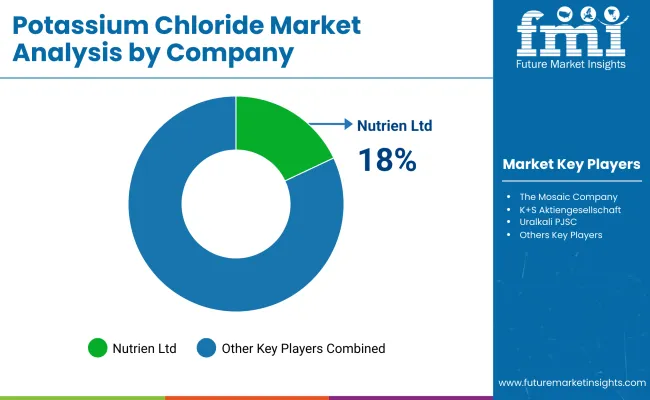

Major market players strategic objectives with regards to AI-integrated production efficiency, sustainable potash mining, and customized potassium chloride materials. This is attributed to the contribution of the major industry players such as chemical manufacturers, fertilizer producers, and industrial solution providers who focus on developing sustainable solutions for potassium chloride which are cost-effective, high-purity, and application-specific.

Market Share Analysis by Key Players & Potassium Chloride Suppliers

| Company Name | Estimated Market Share (%) |

|---|---|

| Nutrien Ltd. | 18-22% |

| The Mosaic Company | 14-18% |

| K+S Aktiengesellschaft | 12-16% |

| Uralkali PJSC | 8-12% |

| Israel Chemicals Ltd. (ICL) | 6-10% |

| Other Potassium Chloride Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Nutrien Ltd. | AI-driven processes for potassium chloride extraction, high purity potash fertilizer and personalised soil fertility solutions |

| The Mosaic Company | Experts for AI-driven precision agriculture, crop-specific potassium chloride formulations, and sustainable extraction of potash. |

| K+S Aktiengesellschaft | AI optimized KCl refining, industrial-scale chemical-grade KCl, and sustainable fertilizer production. |

| Uralkali PJSC | Provides high-efficiency potassium chloride for fertilizers, AI-assisted nutrient management, and large-scale potash extraction technologies. |

| Israel Chemicals Ltd. (ICL) | Offers AI-enhanced potassium chloride production for agricultural and industrial applications, emphasizing eco-friendly and specialty fertilizers. |

Key Market Insights

Nutrien Ltd. (18-22%)

Nutrien leads in AI-driven potassium chloride extraction and fertilizer production, offering high-performance potash formulations tailored for soil nutrient optimization.

The Mosaic Company (14-18%)

Mosaic specializes in AI-enhanced agricultural potassium chloride solutions, integrating sustainable mining techniques and crop-specific nutrient formulations.

K+S Aktiengesellschaft (12-16%)

K+S focuses on AI-powered potassium chloride processing, providing high-purity KCl for industrial, agricultural, and chemical applications.

Uralkali PJSC (8-12%)

Uralkali provides large-scale potash extraction, AI-assisted precision fertilizer solutions, and potassium chloride formulations optimized for enhanced soil productivity.

Israel Chemicals Ltd. (ICL) (6-10%)

ICL integrates AI-driven potassium chloride production with eco-friendly practices, delivering high-performance fertilizers for sustainable agriculture and industrial applications.

Other Key Players (30-40% Combined)

Several fertilizer manufacturers, chemical producers, and specialty potassium chloride solution providers contribute to next-generation innovations, AI-driven production efficiency, and sustainable potash processing. Key contributors include:

The overall market size for the potassium chloride market was USD 13,961.7 Million in 2025.

The potassium chloride market is expected to reach USD 18,946.4 Million in 2035.

The demand for potassium chloride is rising due to its increasing use in agriculture as a key fertilizer component and its expanding applications in the chemical and pharmaceutical industries. The rising global food demand and advancements in potash extraction technologies are further driving market growth.

The top 5 countries driving the development of the potassium chloride market are the USA, China, Canada, Russia, and India.

Agricultural and Chemical/Industrial Grades are expected to command a significant share over the assessment period.

Table 01: Global Market Size (US$ million) and Volume (Kilo Tons) Forecast by Crop, 2018 to 2033

Table 02: Global Market Size (US$ million) and Volume (Kilo Tons) Forecast by Grade, 2018 to 2033

Table 03: Global Market Size (US$ million) and Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 04: Global Market Size (US$ million) and Volume (Kilo Tons) Forecast by Region, 2018 to 2033

Table 05: North America Market Size (US$ million) and Volume (Kilo Tons) Forecast by Crop, 2018 to 2033

Table 06: North America Market Size (US$ million) and Volume (Kilo Tons) Forecast by Grade, 2018 to 2033

Table 07: North America Market Size (US$ million) and Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 08: North America Market Size (US$ million) and Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 09: Latin America Market Size (US$ million) and Volume (Kilo Tons) Forecast by Crop, 2018 to 2033

Table 10: Latin America Market Size (US$ million) and Volume (Kilo Tons) Forecast by Grade, 2018 to 2033

Table 11: Latin America Market Size (US$ million) and Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Size (US$ million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: Europe Market Size (US$ million) and Volume (Kilo Tons) Forecast by Crop, 2018 to 2033

Table 14: Europe Market Size (US$ million) and Volume (Kilo Tons) Forecast by Grade, 2018 to 2033

Table 15: Europe Market Size (US$ million) and Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 16: Europe Market Size (US$ million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Size (US$ million) and Volume (Kilo Tons) Forecast by Crop, 2018 to 2033

Table 18: East Asia Market Size (US$ million) and Volume (Kilo Tons) Forecast by Grade, 2018 to 2033

Table 19: East Asia Market Size (US$ million) and Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 20: East Asia Market Size (US$ million) and Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 21: South Asia Market Size (US$ million) and Volume (Kilo Tons) Forecast by Crop, 2018 to 2033

Table 22: South Asia Market Size (US$ million) and Volume (Kilo Tons) Forecast by Grade, 2018 to 2033

Table 23: South Asia Market Size (US$ million) and Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 24: South Asia Market Size (US$ million) and Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 25: Oceania Market Size (US$ million) and Volume (Kilo Tons) Forecast by Crop, 2018 to 2033

Table 26: Oceania Market Size (US$ million) and Volume (Kilo Tons) Forecast by Grade, 2018 to 2033

Table 27: Oceania Market Size (US$ million) and Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 28: Oceania Market Size (US$ million) and Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 29: Middle East & Africa Market Size (US$ million) and Volume (Kilo Tons) Forecast by Crop, 2018 to 2033

Table 30: Middle East & Africa Market Size (US$ million) and Volume (Kilo Tons) Forecast by Grade, 2018 to 2033

Table 31: Middle East & Africa Market Size (US$ million) and Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 32: Middle East & Africa Market Size (US$ million) and Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Figure 01: Global Market Value (US$ million) Historical Data and Forecast 2018 to 2033

Figure 02: Global Market Absolute $ Opportunity Analysis, 2018 to 2033

Figure 03: Global Market Historical Volume (KT), 2017 to 2022

Figure 04: Global Market Volume (KT) Forecast, 2023 to 2033

Figure 05: Global Demand-Supply Analysis (KT)

Figure 06: Global Market Share and BPS Analysis by Crop, 2023 to 2033

Figure 07: Global Market Y-o-Y Growth by Crop, 2023 to 2033

Figure 08: Global Market Absolute $ Opportunity by Cereals Segment, 2018 to 2033

Figure 09: Global Market Absolute $ Opportunity by Oilseeds Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity by Fiber and Sugar Segment, 2018 to 2033

Figure 11: Global Market Absolute $ Opportunity by Fruits & Vegetables Segment, 2018 to 2033

Figure 12: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 13: Global Market Attractiveness Analysis by Crop, 2023 to 2033

Figure 14: Global Market Share and BPS Analysis by Grade, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth by Grade, 2023 to 2033

Figure 16: Global Market Absolute $ Opportunity by Agriculture Segment, 2018 to 2033

Figure 17: Global Market Absolute $ Opportunity by Chemical/Industrial Segment, 2018 to 2033

Figure 18: Global Market Attractiveness Analysis by Grade, 2023 to 2033

Figure 19: Global Market Share and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth by Application, 2023 to 2033

Figure 21: Global Market Absolute $ Opportunity by Agriculture Segment, 2018 to 2033

Figure 22: Global Market Absolute $ Opportunity by Deicer Segment, 2018 to 2033

Figure 23: Global Market Absolute $ Opportunity by Water Softeners Segment, 2018 to 2033

Figure 24: Global Market Absolute $ Opportunity by Industrial Segment, 2018 to 2033

Figure 25: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 26: Global Market Attractiveness Analysis by Application, 2023 to 2033

Figure 27: Global Market Share and BPS Analysis by Region, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth by Region, 2023 to 2033

Figure 29: North America Market Absolute $ Opportunity, 2018 to 2033

Figure 30: Latin America Market Absolute $ Opportunity, 2018 to 2033

Figure 31: Europe Market Absolute $ Opportunity, 2018 to 2033

Figure 32: East Asia Market Absolute $ Opportunity, 2018 to 2033

Figure 33: South Asia Market Absolute $ Opportunity, 2018 to 2033

Figure 34: Oceania Market Absolute $ Opportunity, 2018 to 2033

Figure 35: Middle East & Africa Market Absolute $ Opportunity, 2018 to 2033

Figure 36: Global Market Attractiveness Analysis by Region, 2023 to 2033

Figure 37: North America Market Share and BPS Analysis by Crop, 2023 to 2033

Figure 38: North America Market Y-o-Y Growth by Crop, 2023 to 2033

Figure 39: North America Market Attractiveness Analysis by Crop, 2023 to 2033

Figure 40: North America Market Share and BPS Analysis by Grade, 2023 to 2033

Figure 41: North America Market Y-o-Y Growth by Grade, 2023 to 2033

Figure 42: North America Market Attractiveness Analysis by Grade, 2023 to 2033

Figure 43: North America Market Share and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth by Application, 2023 to 2033

Figure 45: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 46: North America Market Share and BPS Analysis by Country, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth by Country, 2023 to 2033

Figure 48: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 49: Latin America Market Share and BPS Analysis by Crop, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth by Crop, 2023 to 2033

Figure 51: Latin America Market Attractiveness Analysis by Crop, 2023 to 2033

Figure 52: Latin America Market Share and BPS Analysis by Grade, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth by Grade, 2023 to 2033

Figure 54: Latin America Market Attractiveness Analysis by Grade, 2023 to 2033

Figure 55: Latin America Market Share and BPS Analysis by Application, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth by Application, 2023 to 2033

Figure 57: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 58: Latin America Market Share and BPS Analysis by Country, 2023 to 2033

Figure 59: Latin America Market Y-o-Y Growth by Country, 2023 to 2033

Figure 60: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 61: Europe Market Share and BPS Analysis by Crop, 2023 to 2033

Figure 62: Europe Market Y-o-Y Growth by Crop, 2023 to 2033

Figure 63: Europe Market Attractiveness Analysis by Crop, 2023 to 2033

Figure 64: Europe Market Share and BPS Analysis by Grade, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth by Grade, 2023 to 2033

Figure 66: Europe Market Attractiveness Analysis by Grade, 2023 to 2033

Figure 67: Europe Market Share and BPS Analysis by Application, 2023 to 2033

Figure 68: Europe Market Y-o-Y Growth by Application, 2023 to 2033

Figure 69: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 70: Europe Market Share and BPS Analysis by Country, 2023 to 2033

Figure 71: Europe Market Y-o-Y Growth by Country, 2023 to 2033

Figure 72: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 73: East Asia Market Share and BPS Analysis by Crop, 2023 to 2033

Figure 74: East Asia Market Y-o-Y Growth by Crop, 2023 to 2033

Figure 75: East Asia Market Attractiveness Analysis by Crop, 2023 to 2033

Figure 76: East Asia Market Share and BPS Analysis by Grade, 2023 to 2033

Figure 77: East Asia Market Y-o-Y Growth by Grade, 2023 to 2033

Figure 78: East Asia Market Attractiveness Analysis by Grade, 2023 to 2033

Figure 79: East Asia Market Share and BPS Analysis by Application, 2023 to 2033

Figure 80: East Asia Market Y-o-Y Growth by Application, 2023 to 2033

Figure 81: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 82: East Asia Market Share and BPS Analysis by Country, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth by Country, 2023 to 2033

Figure 84: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 85: South Asia Market Share and BPS Analysis by Crop, 2023 to 2033

Figure 86: South Asia Market Y-o-Y Growth by Crop, 2023 to 2033

Figure 87: South Asia Market Attractiveness Analysis by Crop, 2023 to 2033

Figure 88: South Asia Market Share and BPS Analysis by Grade, 2023 to 2033

Figure 89: South Asia Market Y-o-Y Growth by Grade, 2023 to 2033

Figure 90: South Asia Market Attractiveness Analysis by Grade, 2023 to 2033

Figure 91: South Asia Market Share and BPS Analysis by Application, 2023 to 2033

Figure 92: South Asia Market Y-o-Y Growth by Application, 2023 to 2033

Figure 93: South Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 94: South Asia Market Share and BPS Analysis by Country, 2023 to 2033

Figure 95: South Asia Market Y-o-Y Growth by Country, 2023 to 2033

Figure 96: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 97: Oceania Market Share and BPS Analysis by Crop, 2023 to 2033

Figure 98: Oceania Market Y-o-Y Growth by Crop, 2023 to 2033

Figure 99: Oceania Market Attractiveness Analysis by Crop, 2023 to 2033

Figure 100: Oceania Market Share and BPS Analysis by Grade, 2023 to 2033

Figure 101: Oceania Market Y-o-Y Growth by Grade, 2023 to 2033

Figure 102: Oceania Market Attractiveness Analysis by Grade, 2023 to 2033

Figure 103: Oceania Market Share and BPS Analysis by Application, 2023 to 2033

Figure 104: Oceania Market Y-o-Y Growth by Application, 2023 to 2033

Figure 105: Oceania Market Attractiveness Analysis by Application, 2023 to 2033

Figure 106: Oceania Market Share and BPS Analysis by Country, 2023 to 2033

Figure 107: Oceania Market Y-o-Y Growth by Country, 2023 to 2033

Figure 108: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 109: Middle East & Africa Market Share and BPS Analysis by Crop, 2023 to 2033

Figure 110: Middle East & Africa Market Y-o-Y Growth by Crop, 2023 to 2033

Figure 111: Middle East & Africa Market Attractiveness Analysis by Crop, 2023 to 2033

Figure 112: Middle East & Africa Market Share and BPS Analysis by Grade, 2023 to 2033

Figure 113: Middle East & Africa Market Y-o-Y Growth by Grade, 2023 to 2033

Figure 114: Middle East & Africa Market Attractiveness Analysis by Grade, 2023 to 2033

Figure 115: Middle East & Africa Market Share and BPS Analysis by Application, 2023 to 2033

Figure 116: Middle East & Africa Market Y-o-Y Growth by Application, 2023 to 2033

Figure 117: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 118: Middle East & Africa Market Share and BPS Analysis by Country, 2023 to 2033

Figure 119: Middle East & Africa Market Y-o-Y Growth by Country, 2023 to 2033

Figure 120: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Potassium Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Potassium Formate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Tetrafluoroborate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Fluoborate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Propionate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Acetate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Citrate Market Growth - Trends & Forecast 2025 to 2035

Potassium Formate Industry Analysis in North America - Size, Share & Forecast 2025 to 2035

Potassium Carbonate Market Growth – Trends & Forecast 2025 to 2035

Potassium Sorbate Market Analysis by Product Type, Application and Region from 2025 to 2035

Potassium Hydrogen Fluoride Market Growth - Trends & Forecast 2025 to 2035

Potassium Humate Market Growth – Trends & Forecast 2025 to 2035

Potassium Zirconium Fluoride Market

Potassium Cryolite Market

Potassium Alum Market

Potassium Hydrogen Sulphite Market

Dipotassium Guanylate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA