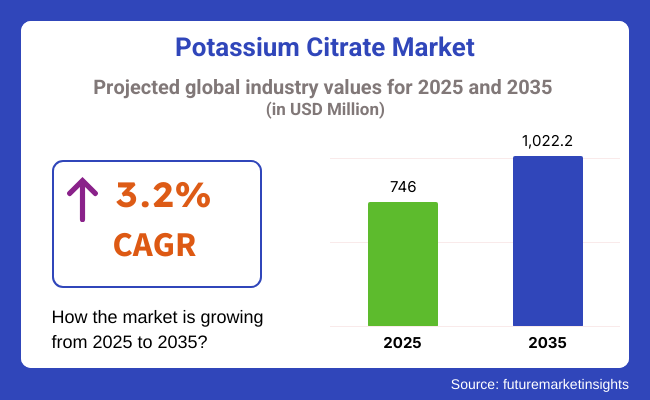

The global potassium citrate market is anticipated to reach USD 746 million in 2025 and expand to USD 1,022.2 million by 2035, reflecting a CAGR of 3.2% over the assessment period. Market expansion is being driven by its increasing adoption in pharmaceutical, food processing, and industrial applications, where buffering, alkalizing, and stabilizing functions are required.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 746 million |

| Market Value (2035F) | USD 1,022.2 million |

| CAGR (2025 to 2035) | 3.2% |

Potassium citrate is being utilized in pharmaceutical formulations to treat renal tubular acidosis, prevent kidney stones, and support electrolyte balance. Its safety profile and regulatory approval across global healthcare systems are supporting consistent usage in urinary alkalinization and metabolic acidosis management. As reported by the National Kidney Foundation, kidney stone incidence has increased over the past decade, particularly in the United States and parts of Asia, reinforcing demand for therapeutic compounds like potassium citrate (NKF, 2024).

In the food and beverage sector, potassium citrate is being applied as a pH regulator, emulsifier, and preservative. It is incorporated into processed foods, nutritional beverages, and supplements due to its ability to maintain product stability and extend shelf life. Growing consumer demand for clean-label and additive-free food products has led to the preference for multifunctional and GRAS-certified ingredients such as potassium citrate.

The compound is available in food-grade, pharmaceutical-grade, and industrial-grade variants, with purity and compliance benchmarks influencing its suitability for different sectors. Industrial-grade potassium citrate is being used in formulations for personal care products, detergents, and electroplating processes.

Despite volatility in raw material availability and logistics constraints, manufacturers are investing in sustainable production technologies and expanding regional distribution channels. Production efficiencies and capacity enhancements are being implemented to meet demand across North America, Europe, and Asia-Pacific.

The increasing use of potassium citrate as a multifunctional and naturally derived compound is expected to support its integration into wellness-focused formulations and industrial solutions. Its compliance with global safety standards, multifunctionality, and adaptability across diverse end-use applications are expected to sustain market growth through 2035.

Pharmaceutical-grade potassium citrate is projected to account for 44% of global demand in 2025, growing at a CAGR of 5.7% through 2035. This grade is essential for treating kidney stones, acidosis, and preventing gout. With increasing incidence of chronic kidney disease (CKD), lifestyle disorders, and aging population across the USA, Japan, and Europe, medical use is rising steadily.

Prescription and OTC sales of potassium citrate tablets are supported by favorable health reimbursements and strong R&D pipelines focused on urological wellness. Furthermore, clean-label trends are driving demand for high-purity, allergen-free formulations among supplement manufacturers.

The food-grade segment is expected to hold 31% market share in 2025 and grow at a CAGR of 5.3%. Used as an acidity regulator, stabilizer, and potassium fortifier, potassium citrate is gaining attention from beverage, dairy, and bakery producers seeking alternatives to sodium-based additives. Health-conscious consumers increasingly prefer products with lower sodium content and functional benefits.

The ingredient’s compatibility with vegan and gluten-free labels has also expanded its adoption across clean-label foods. In regions like Western Europe and Australia, regulatory support for potassium enrichment in foods is helping drive growth.

Raw Material Sourcing and Compliance Barriers in Pharma and Food Applications

The potassium citrate market struggles with availability of raw materials and strict regulations on potassium citrate in food and pharmaceuticals. In regions with limited chemical infrastructure where high-purity citric acid and potassium sources have to be sourced from outside causing supply fluctuations.

Additionally, the need for product consistency across applications in dietary supplements, food additives, and renal medications necessitates adherence to a variety of international standards, such as USP, FCC, and E-number standards.

To meet growing safety expectations, small-scale producers often lack the certifications or traceability to capture these lucrative markets, turning the segment into a highly competitive environment for mid-tier manufacturers.

Health Supplement Boom and Clean-Label Formulation Demand

The market is flourishing thanks to increasing demand for functional health supplements, renal care products and acid-neutralizing food additives. The importance of potassium citrate to kidney stone prevention, gout management, and electrolyte balance makes it a key component of clinical nutrition and OTC wellness lines.

Its clean-label attractiveness is also driving use in low-sodium foods and beverages. As more consumers look for transparent, no synthetic ingredients, potassium citrate aligns nicely with “natural additive” formulations. Advancements in granulation, coating, and controlled-release delivery format technology are paving new pathways for pharmaceutical and nutraceutical applications around the world.

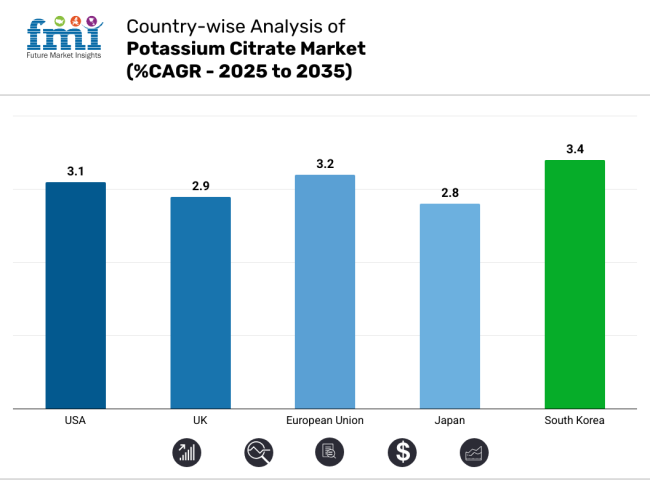

The American potassium citrate market is witnessing a modest increment owing to its significant applications in the pharmaceutical industry for the alleviation of kidney stones, urinary alkalinisation, and treatment of particular cardiovascular ailments. The rising incidence of urinary disorders and aging populations are the two factors driving this upward trend in prescription volumes.

Moreover, rising utilization of food-grade potassium citrate for its buffering and stabilizing properties in the USA food and beverage industry is likely to bring in demand. Leading domestic producers are emphasizing on producing USP-grade quality as per regulatory compliance for pharma and overall food premises.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.1% |

The United Kingdom potassium citrate market is growing steadily, which can be attributed to the increasing demand for low-sodium food items among consumers. Potassium citrate is a food additive increasingly used as a salt substitute and acidity regulator in processed foods, beverages, and dairy products.

Increased focus on renal health and nutrient dietary supplements is further acting as a driver for market growth, alongside pharmaceutical-based applications. As consumer expectations and regulatory standards evolve, local manufacturers play to their strengths in the arena of clean-label, food-safe production.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.9% |

Potassium citrate is widely utilized across the spectrum of industries including pharmaceuticals, nutraceuticals, and applications in food preservation, leading to the consistent growth of the potassium citrate market in the European Union. Germany, France, and Italy are leading consumers, owing to an ageing population and changing dietary habits, as well as health-oriented product formulations.

Well, EU clean labelling and functional food additive regulations are further establishing potassium citrate as a multifunctional food ingredient. The pharmaceutical industry is also continuing to tap this compound for safer, potassium-based alternatives to cope with mineral imbalances.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.2% |

Potassium Citrate Market in Japan is growing at a moderate pace with substantial shifts in the respective developments wherever it is used in functional beverages and dietary supplements targeting the bone health and blood pressure regulation. A mature pharmaceutical industry in the country also utilizes potassium citrate in some metabolic therapies.

Manufacturers are subject to strict regulatory requirements, so they must meet high safety and purity standards. Granule and tablet formulations are still innovating at Japanese firms, with products specifically aimed at an aging and health-conscious populace.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.8% |

Potassium Citrate Market in South Korea to Grow Steadily as Demand in the Beverage and Health Food Segments Increase Its role as a flavor enhancer and pH stabilizer makes it well suited for use in carbonated beverages and powdered supplements.

The pharmaceutical industry is also incorporating potassium citrate in formulations targeting kidney health and muscle cramping ailments. A new style of formulation tailor-made blends and soluble formats to capture changing consumer and clinical demands is a South Korean company’s response.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.4% |

The potassium citrate market is becoming more competitive as key producers expand their capacities and diversify grade portfolios. Manufacturers are focusing on sustainability, offering non-GMO, halal, and kosher-certified variants to meet growing global demand. Strategic partnerships with nutraceutical and pharma brands are helping companies innovate in areas such as effervescent tablets and chewable supplements.

Pricing remains moderately stable, though cost pressures from citric acid supply chains could influence margins. Market players are also investing in traceability and regulatory compliance systems to align with tightening food and pharma safety norms across North America and the EU.

The overall market size for the potassium citrate market was USD 746 million in 2025.

The potassium citrate market is expected to reach USD 1,022.2 million in 2035.

The increasing use of potassium citrate in treating kidney-related disorders, rising demand from the pharmaceutical sector, and growing preference for anhydrous grades in medical and nutritional formulations fuel the potassium citrate market during the forecast period.

The top 5 countries driving the development of the potassium citrate market are the USA, UK, European Union, Japan, and South Korea.

Pharmaceuticals and anhydrous grades lead market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Potassium Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Potassium Formate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Tetrafluoroborate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Fluoborate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Propionate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Acetate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Formate Industry Analysis in North America - Size, Share & Forecast 2025 to 2035

Potassium Carbonate Market Growth – Trends & Forecast 2025 to 2035

Potassium Sorbate Market Analysis by Product Type, Application and Region from 2025 to 2035

Potassium Hydrogen Fluoride Market Growth - Trends & Forecast 2025 to 2035

Potassium Chloride Market Growth – Trends & Forecast 2025 to 2035

Potassium Humate Market Growth – Trends & Forecast 2025 to 2035

Potassium Zirconium Fluoride Market

Potassium Cryolite Market

Potassium Alum Market

Potassium Hydrogen Sulphite Market

Dipotassium Guanylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium, Potassium and Calcium Salts Market Analysis by Agriculture, Pharmaceuticals and Personal Care Through 2035

Demand for Potassium Sulfate in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA