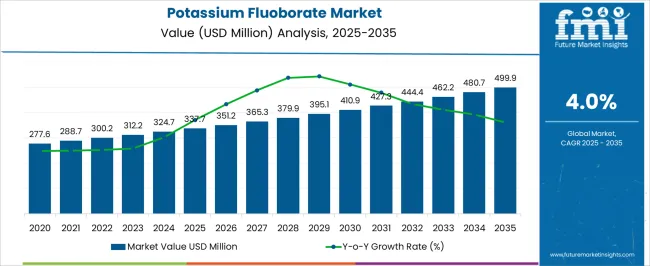

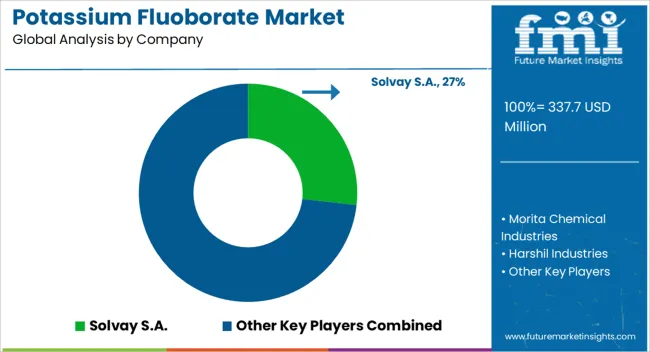

The Potassium Fluoborate Market is estimated to be valued at USD 337.7 million in 2025 and is projected to reach USD 499.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Potassium Fluoborate Market Estimated Value in (2025 E) | USD 337.7 million |

| Potassium Fluoborate Market Forecast Value in (2035 F) | USD 499.9 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The potassium fluoborate market is experiencing consistent demand driven by its extensive use in metal processing, aluminum refining, and flux applications. Increasing industrialization, particularly in Asia Pacific and the Middle East, has amplified demand for high-performance fluxing agents used in aluminum brazing and soldering.

Advancements in metallurgical processes, along with growing applications in aluminum alloys, have enhanced the importance of potassium fluoborate as a critical compound in the manufacturing value chain. The market is also benefiting from the rise in electric vehicle production and lightweight material development, where aluminum processing plays a central role.

Regulatory compliance regarding purity specifications and sustainable handling of fluorine compounds is shaping innovation in material refinement and packaging practices. The outlook remains stable with demand sustained by downstream applications in metallurgy and electronics, especially where reliability, conductivity, and material stability are essential.

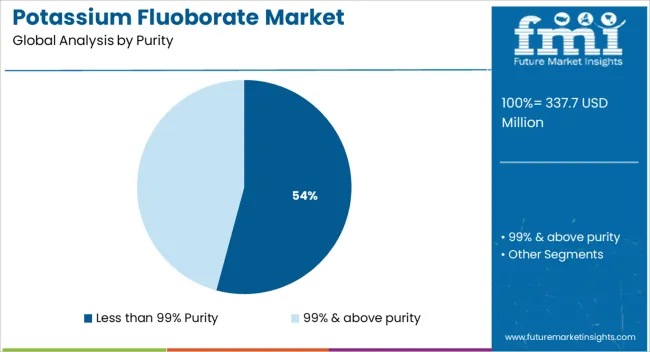

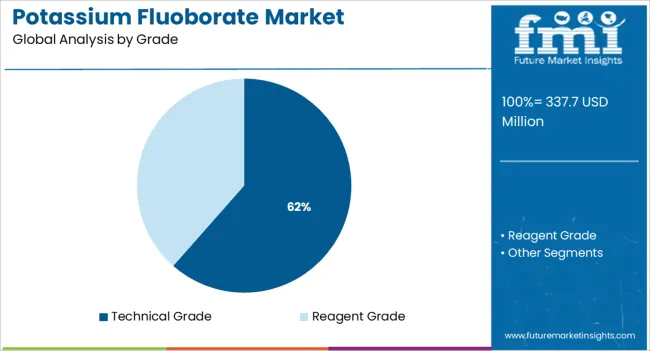

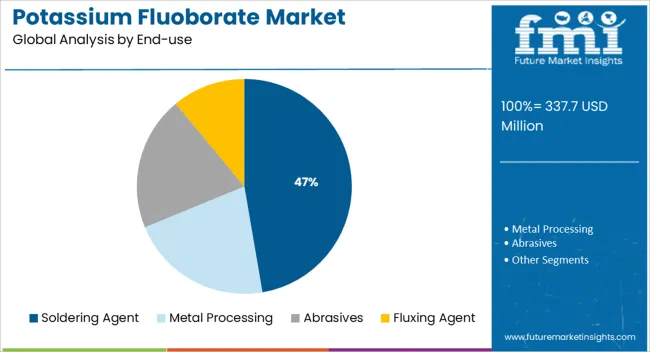

The market is segmented by Purity, Grade, and End-use and region. By Purity, the market is divided into Less than 99% Purity and 99% & above purity. In terms of Grade, the market is classified into Technical Grade and Reagent Grade. Based on End-use, the market is segmented into Soldering Agent, Metal Processing, Abrasives, and Fluxing Agent. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 99% purity segment is projected to account for 54.20% of total revenue by 2025 within the purity category, establishing it as the leading segment. This is attributed to its wide suitability for industrial uses where ultra high purity is not mandatory.

Cost effectiveness and sufficient chemical performance in fluxing, brazing, and chemical synthesis applications have supported its preference among manufacturers. In industrial environments that prioritize throughput and functional output over ultrapure chemical precision, the less than 99% variant delivers an optimal balance of affordability and effectiveness.

Its dominance is further reinforced by stable supply availability and reduced purification costs compared to higher purity grades.

Technical grade potassium fluoborate is expected to hold 61.50% of the total market revenue by 2025 under the grade category, making it the most significant grade in use. This growth is supported by its extensive application in aluminum processing, welding fluxes, and general industrial chemical synthesis.

The chemical composition of technical grade material meets the performance requirements of large scale manufacturing processes without incurring the costs associated with high purity grades. Its compatibility with additive blends and efficiency in metallurgical reactions have reinforced its widespread usage.

Furthermore, the balance between performance reliability and cost efficiency makes technical grade material the standard choice across multiple heavy industry segments.

The soldering agent segment is projected to contribute 47.30% of overall market revenue by 2025 in the end use category, positioning it as the dominant application. This prominence is driven by increasing demand from the electronics, automotive, and aerospace sectors where efficient joining of metal parts is crucial.

Potassium fluoborate’s role in enhancing solder flow, reducing oxidation, and ensuring strong metal bonding has made it an essential ingredient in flux formulations. As manufacturers seek reliable, low residue, and temperature stable soldering agents for precision applications, the utility of potassium fluoborate continues to rise.

Growth in electrical components production and lightweight structural assembly has further reinforced its application in soldering, securing its leadership in end use preference.

The potassium fluoborate market witnessed a CAGR of 3.5% over the historical period of 2020 to 2024. The market shrank as a result of the 2024 pandemic crisis, which was reflected in material pricing, varying needs for chemicals and specialty materials, altered consumer expectations for chemical products, and increased logistical expenses. Each of these variables had a negative impact on the market during the initial quarters.

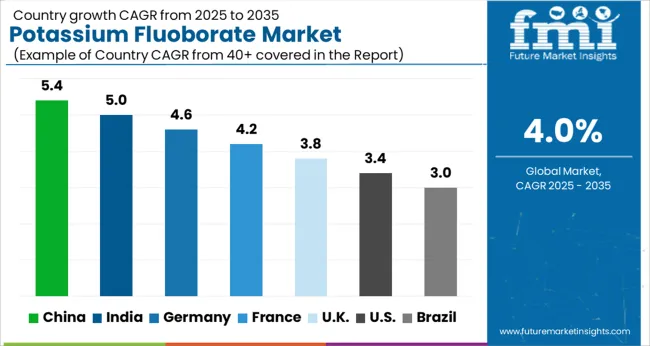

As per the current estimate, the potassium fluoborate market is poised to grow at around a CAGR of 4.0% for the period between 2025 and 2035. The growing demand for potassium fluoborate & fluoride compounds in industries for different functions is expected to boost the market.

Metallurgy, automotive, and oil & gas are some of the key industries for potassium fluoborate, hence the growth of these industries has a direct impact on the market. On the back of these factors, the demand in the market is projected to surge by 1.5x between 2025 and 2035.

Increasing Application as Soldering Agent to Spur the Sales in the USA

On the back of increasing application in diverse industries, the availability of raw resources, and a superior industrial environment, the USA is anticipated to dominate the North American region.

The USA is anticipated to have a significant share owing to its extensive and diverse industrial base and continuous petrochemical and gas & oil infrastructure development. The growth of the country is being influenced by the application of fluxing agents, soldering agents, and abrasives are used up to large extent.

Potassium fluoborate is employed as an active filler in the formation of resin-bonded abrasives, and as a component in the manufacture of grinding wheels. Also, abrasive discs to lower operating temperatures, and it provides a variety of sharp cutting tools, all of which contribute to the expansion of the domestic industry.

China to be the Manufacturing Hub for Potassium Fluoborate Companies

China is knowns as a manufacturing hub as it has a strong manufacturing base and the presence of numerous manufacturers. Increasing demand for the metal from industries & metal processing is primarily driving the market.

China also has a strong automobile industry, which is a key industry for the potassium fluoborate. The growing use of aluminum metal bodies in automobiles, which are safer to use than steel equivalents and make up half the weight of the average car, may promote the expansion of the potassium fluoborate. Aluminum is being used in automotive parts, railways, and planes in their components. Potassium fluoborate is used as an agent in the refining of aluminum.

Additionally, China has an evident chemical industry and it supplies various chemicals to other regions. Potassium fluoborate finds application in the chemical industry as it is used in the production of agrochemicals such as ammonium fluoride, sodium fluoride & others. It is also used as a precursor in producing electrolytes, which are a crucial part of lithium-ion batteries.

99% Purity Potassium Fluoborate is the Most Preferred among Manufacturers

Potassium fluoborate is majorly available in 2 purities, such as one is less than 99% and another is more than 99% purity. Oxygen-sensitive applications such as metal alloy production like titanium, boron & aluminum, require potassium fluoborate. In oxygen-sensitive applications, less than 99% purity potassium fluoborate is used. It is a potassium source and partially soluble in water. It is used as a fluxing agent in the production of boron alloys using magnesium & aluminum casting as it is not soluble in water.

Growing demand for electronics, heating, and air conditioning to establish a long-lasting connection between electrical components may increase the demand. This is utilized as a fluxing agent for soldering, which enhances the mechanical strength and electrical contact in solder joints.

Application in Metal Fabrication and Automobile to Generate Maximum Revenue

Due to its widespread use in several applications across numerous industries, the global market for potassium fluoroborate is expected to grow. Fluoride compounds are frequently employed in alloying metal and optical deposition applications, both of which contribute to the expansion of the worldwide potassium fluoroborate market.

The global potassium fluoroborate market is gaining traction as a result of the rising demand for abrasives in various grinding and polishing applications for sectors like electronic & electrical equipment, metal fabrication, automobile, and machinery. The market for abrasives is growing quickly, and this growth is strongly correlated with the demand for potassium fluoroborate.

The market is expected to be consolidated with the presence of several dominant key players. These players are expected to hold more than 50% of the market share. Some of the prominent key trends are an expansion of production capacities and the adoption of new & modified manufacturing techniques.

Manufacturers are focusing on the launch of a new product line in purity form, as well as continued research and development to expand their product portfolio. Furthermore, industrial participants are focusing on developing manufacturing units in order to increase the core business.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025E) | USD 337.7 million |

| Projected Market Value (2035F) | USD 499.9 million |

| Value CAGR (2025 to 2035) | 4.0% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value and Kilo Tons for Volume |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, BENELUX, Russia, China, Japan, South Korea, India, ASEAN, Australia and New Zealand, GCC Countries, Turkey, Northern Africa, South Africa |

| Key Segments Covered | Purity, Grade, Application, and Region |

| Key Companies Profiled | Solvay S.A.; Morita Chemical Industries; Harshil Industries; Honeywell Fine Chemicals; AMG Aluminum; Madras Fluorine Ltd.; Stella Chemifa Corporation; Triveni Chemicals; Skyline Chemicals; Foshan Nanhai Fluoride Chemical Co. Ltd; Derivados Del Flúor (DDF); Hunan Merits New Materials Co. Ltd.; American Elements; PARTH INDUSTRIES; AWISHKAR CHEMICALS INDUSTRIES; S. B. CHEMICALS; FENGYUAN INDIA PRIVATE LIMITED. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global potassium fluoborate market is estimated to be valued at USD 337.7 million in 2025.

The market size for the potassium fluoborate market is projected to reach USD 499.9 million by 2035.

The potassium fluoborate market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in potassium fluoborate market are less than 99% purity and 99% & above purity.

In terms of grade, technical grade segment to command 61.5% share in the potassium fluoborate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Potassium Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Potassium Formate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Tetrafluoroborate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Propionate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Acetate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Citrate Market Growth - Trends & Forecast 2025 to 2035

Potassium Formate Industry Analysis in North America - Size, Share & Forecast 2025 to 2035

Potassium Carbonate Market Growth – Trends & Forecast 2025 to 2035

Potassium Sorbate Market Analysis by Product Type, Application and Region from 2025 to 2035

Potassium Hydrogen Fluoride Market Growth - Trends & Forecast 2025 to 2035

Potassium Chloride Market Growth - Trends & Forecast 2025 to 2035

Potassium Humate Market Growth – Trends & Forecast 2025 to 2035

Potassium Zirconium Fluoride Market

Potassium Cryolite Market

Potassium Alum Market

Potassium Hydrogen Sulphite Market

Dipotassium Guanylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium, Potassium and Calcium Salts Market Analysis by Agriculture, Pharmaceuticals and Personal Care Through 2035

Demand for Potassium Sulfate in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA