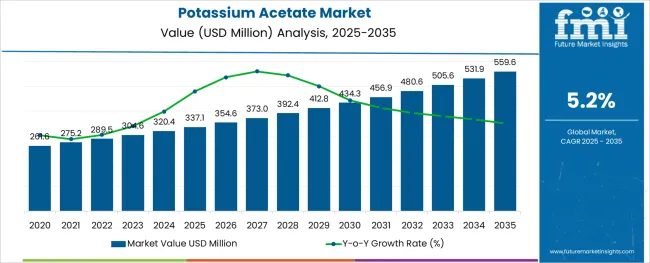

The Potassium Acetate Market is estimated to be valued at USD 337.1 million in 2025 and is projected to reach USD 559.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The potassium acetate market is gaining steady traction, supported by rising demand across pharmaceutical, food, and industrial sectors for highly soluble and environmentally safe compounds. As sustainability and safety regulations intensify, potassium acetate is being increasingly favored as an alternative to conventional salts in applications ranging from deicing to medical formulations.

The compound’s role as a buffering agent, stabilizer, and electrolyte enhancer is contributing to its widespread adoption across industries where performance consistency and compliance are critical. The market is also witnessing increasing investment in high-purity formulations and scalable production capabilities, particularly in regions with robust pharmaceutical and food manufacturing infrastructure.

Advancements in process technology and regional supply chain localization are further enabling cost efficiency and reliable delivery. With growing environmental scrutiny over chlorides and demand for safe multifunctional additives, potassium acetate is expected to maintain its position as a versatile compound with expanding industrial relevance.

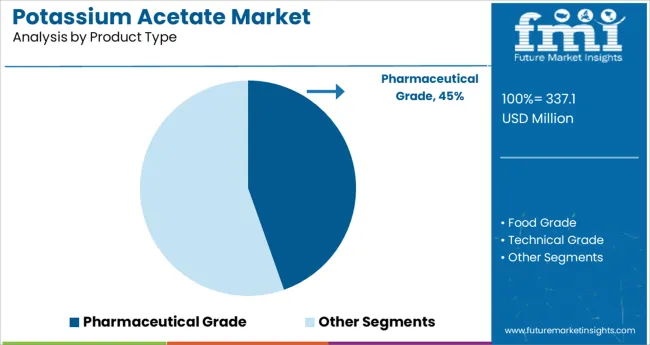

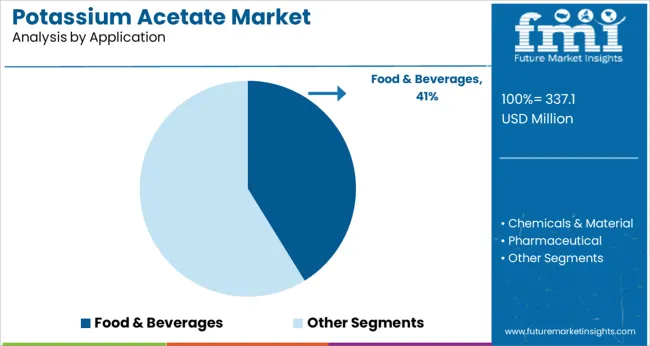

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Pharmaceutical Grade, Food Grade, and Technical Grade. In terms of Application, the market is classified into Food & Beverages, Chemicals & Material, and Pharmaceutical. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Pharmaceutical Grade, Food Grade, and Technical Grade. In terms of Application, the market is classified into Food & Beverages, Chemicals & Material, and Pharmaceutical. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Pharmaceutical grade potassium acetate is projected to command 44.6% of the total market revenue share in 2025, making it the leading product type. This dominance has been attributed to its stringent purity levels, consistent solubility profile, and compliance with pharmacopeial standards required for medical and intravenous applications.

The compound’s buffering and electrolyte-balancing properties have made it a staple in parenteral nutrition solutions and dialysis formulations. Regulatory alignment with agencies such as the US Food and Drug Administration and the European Medicines Agency has supported its widespread acceptance in pharmaceutical production.

Additionally, increasing demand for intravenous fluids, injectable formulations, and critical care solutions is elevating consumption of pharmaceutical grade variants. Manufacturers have been scaling up GMP-compliant production facilities and quality assurance processes to meet rising demand, reinforcing this segment’s leadership in the potassium acetate market.

The food and beverages segment is expected to account for 41.2% of the potassium acetate market revenue in 2025, making it the dominant application category. This leadership is supported by potassium acetate’s recognized status as a safe food additive under international food safety standards.

Its multifunctional role as a pH regulator, preservative, and flavor stabilizer has driven its integration into packaged food products and beverages requiring shelf-life extension and acidity control. Regulatory approvals from global food safety bodies have ensured consistent use across a wide range of food processing environments.

Growing consumer preference for clean-label, potassium-enriched alternatives to sodium-based additives has also contributed to segmental expansion. The ability to deliver functional performance while aligning with sodium-reduction goals and food safety mandates has solidified potassium acetate’s position as a go-to ingredient in the global food and beverage industry.

The major factor driving the global potassium acetate market is that the compound is being used as an alternative to potassium chloride. This is owing to the environmental restrictions on the application of potassium chloride.

Potassium acetate functionality properties are identical to the latter. In high-density brines potassium acetate has a higher potential for use than potassium chloride due to its time-solubility. Additionally, the fluid is chloride-free, making it ideal for environmentally sensitive areas. Moreover, it provides shale hydration and swelling inhibition through cation exchange and electrolysis.

Market growth for potassium acetate is driven by the growing use of potassium chloride as an alternative. The potassium acetate market is driven by applications that require solubilized minerals, which is likely to create high demand and support market growth.

Processed food products and changing lifestyles are also expected to increase demand for potassium acetate and boost its market growth. The use of potassium acetate in the pharmaceuticals, chemical, food, and agriculture sectors is further aiding the market growth of potassium acetate.

Though the potassium acetate market has an average growth pace and is anticipated to keep up with the momentum, certain impediments could slow down the healthy growth of the market.

The major factor that hampers the growth of the market is the side effects of the potassium acetate compound if it is used in an inadequate composition. Some of the symptoms of potassium intoxication include burning sensations and tingling in the hands and feet, which can also lead to near-death symptoms.

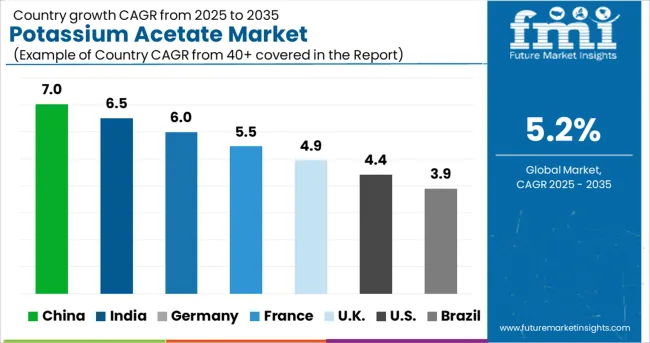

The demand for potassium acetate has increased in the North American region. North America is anticipated to control a potassium acetate market share of 30.1% in 2025 with increasing demand from the food and beverage industry as a preservative and flavor enhancer.

In the last decade, North America has held the largest revenue share in the global potassium acetate market due to the presence of numerous pharmaceutical companies involved in Research and Development activities related to the drug discovery process. In addition, these companies used potassium acetate derivatives as key reagents, thus positively influencing market growth over the projected period.

The Europe potassium acetate market is predicted to experience significant growth and hold a market share of 27.5% in 2025. The increasing trend of packed food products, in turn, leads to demand for food additives such as potassium acetate and the increasing adoption of potassium acetate for a wide range of applications such as diabetic treatment in the pharmaceutical industry and as the deicing agent in several other industries.

The start-up ecosystem in the potassium acetate market is clouded by several companies because of the growing awareness about the benefits of potassium acetate among consumers as a non-toxic and environmentally friendly alternative to other preservatives.

To ensure product differentiation and to acquire a considerable share of the market, major vendors are adopting creative strategies and are constantly developing innovative products. Most of the major potassium acetate manufacturers concentrate on capitalizing their funds to maintain applications and technical marketing groups are appointed to serve the ever-changing needs of clients.

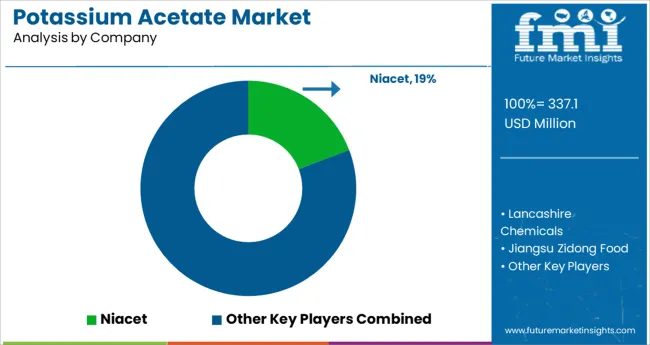

The potassium acetate market is consolidated with a presence of a few strong players from around the globe. A few of the prominent players in the global potassium acetate market are Niacet, Lancashire Chemicals, Jiangsu Zidong Food, Anhui Hongyang Chemical, Wuxi Yangshan Biochemical, Lianyungang Tongyuan Chemical, Jiangsu Kolod Food, and Shanxi Zhaoyi Chemical.

Emerging trends in the potassium acetate market are brought about by strategies adopted by the key players in the market are partnership and collaboration with other operators, expansion into the untapped market, and joint ventures with organizations in emerging countries to gain a strong foothold in the market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.2% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Class, Application, Region |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, The Asia Pacific excluding Japan, Japan, The Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia &, New Zealand, China, India, GCC Countries, South Africa |

| Key Companies Profiled | Niacet, Lancashire Chemicals, Jiangsu Zidong Food, Anhui Hongyang Chemical, Wuxi Yangshan Biochemical, Lianyungang Tongyuan Chemical, Jiangsu Kolod Food, Shanxi Zhaoyi Chemical |

| Customization | Available Upon Request |

The global potassium acetate market is estimated to be valued at USD 337.1 million in 2025.

It is projected to reach USD 559.6 million by 2035.

The market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types are pharmaceutical grade, food grade and technical grade.

food & beverages segment is expected to dominate with a 41.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Potassium Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Potassium Formate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Acetate Salt Market Size and Share Forecast Outlook 2025 to 2035

Acetate Cloth Tape Market Size and Share Forecast Outlook 2025 to 2035

Potassium Tetrafluoroborate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Fluoborate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Propionate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Citrate Market Growth - Trends & Forecast 2025 to 2035

Potassium Formate Industry Analysis in North America - Size, Share & Forecast 2025 to 2035

Potassium Carbonate Market Growth – Trends & Forecast 2025 to 2035

Potassium Sorbate Market Analysis by Product Type, Application and Region from 2025 to 2035

Potassium Hydrogen Fluoride Market Growth - Trends & Forecast 2025 to 2035

Potassium Chloride Market Growth - Trends & Forecast 2025 to 2035

Potassium Humate Market Growth – Trends & Forecast 2025 to 2035

Potassium Zirconium Fluoride Market

Potassium Cryolite Market

Potassium Alum Market

Potassium Hydrogen Sulphite Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA