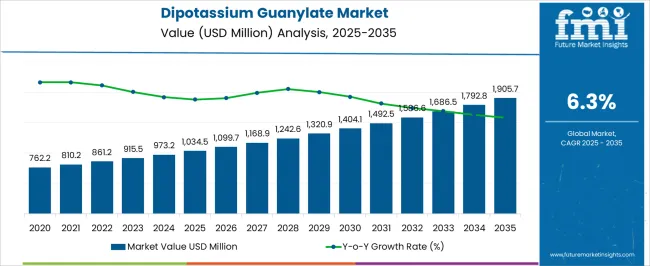

The Dipotassium Guanylate Market is estimated to be valued at USD 1034.5 million in 2025 and is projected to reach USD 1905.7 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Dipotassium Guanylate Market Estimated Value in (2025 E) | USD 1034.5 million |

| Dipotassium Guanylate Market Forecast Value in (2035 F) | USD 1905.7 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The Dipotassium Guanylate market is witnessing stable growth, supported by its increasing adoption as a flavor enhancer in a variety of food applications. The current landscape is defined by the rising consumer demand for umami-rich taste profiles, especially in processed and convenience foods. Industry sources, including food ingredient publications and corporate announcements, indicate that manufacturers are actively integrating Dipotassium Guanylate into flavor formulations to reduce sodium content while maintaining taste intensity.

The future outlook is strengthened by growing awareness regarding clean-label ingredients and expanding global consumption of instant and ready-to-eat meals. Additionally, production efficiencies and improvements in fermentation-based synthesis methods have lowered costs, making the ingredient more accessible to mid-tier food manufacturers.

The market is also benefiting from regulatory support in major economies that recognize Dipotassium Guanylate as a safe additive, allowing for broader usage With evolving consumer preferences and ongoing product innovation in the food sector, the market is expected to expand steadily across diverse applications.

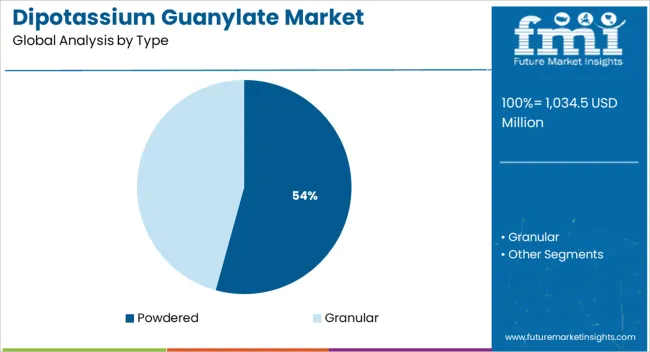

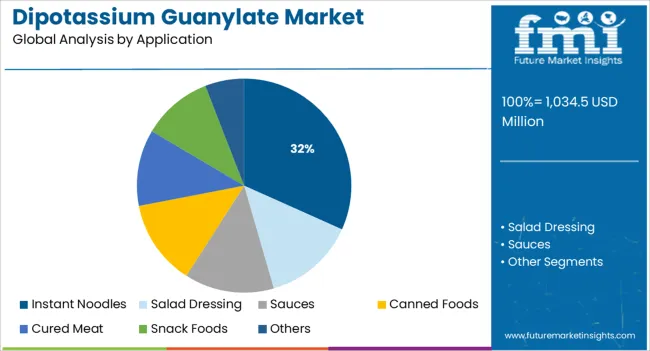

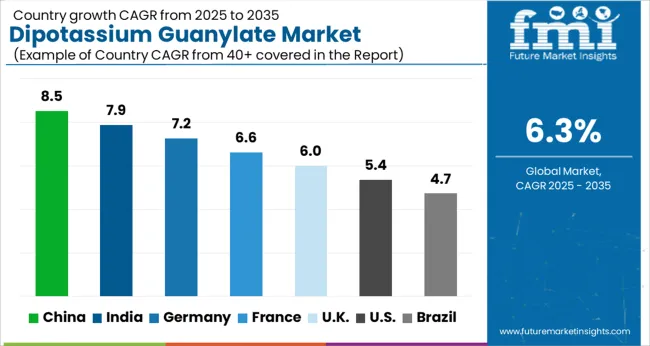

The market is segmented by Type and Application and region. By Type, the market is divided into Powdered and Granular. In terms of Application, the market is classified into Instant Noodles, Salad Dressing, Sauces, Canned Foods, Cured Meat, Snack Foods, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powdered type segment is projected to account for 54.3% of the Dipotassium Guanylate market revenue share in 2025, establishing it as the dominant form in the industry. This segment's leading position is being driven by its superior handling characteristics, longer shelf life, and compatibility with various food manufacturing processes.

Food ingredient bulletins and supplier technical sheets have highlighted that the powdered form offers greater solubility and ease of blending, making it suitable for bulk production in sauces, broths, and seasoning mixes. Additionally, its extended storage stability without degradation of flavor-enhancing properties has made it a preferred choice among food manufacturers.

Product development teams have favored powdered Dipotassium Guanylate for its adaptability in both dry and liquid formulations, providing flexibility across multiple product lines These attributes have contributed significantly to the segment’s prominence, ensuring consistent demand from large-scale food processors and enabling cost-efficient logistics in global markets.

The instant noodles application segment is expected to contribute 31.7% of the Dipotassium Guanylate market revenue share in 2025, marking it as the leading application area. This growth is being driven by rising global consumption of instant noodles, particularly in Asia Pacific and emerging markets, where flavor differentiation remains a key competitive factor.

Food industry reports and corporate product updates have indicated that manufacturers are increasingly incorporating Dipotassium Guanylate to boost umami flavor and enhance palatability without excessive salt content. The segment’s leadership has also been reinforced by the scalability of Dipotassium Guanylate usage in seasoning packets and broth formulations, where its concentrated taste effect allows for reduced dosage while maintaining flavor intensity.

Instant noodle producers have continued to prioritize consistency and sensory appeal, both of which are effectively supported by this flavor enhancer These drivers have ensured that instant noodles remain a primary application for Dipotassium Guanylate in the global food additives market.

The value of the global market for Disodium Guanylate expanded from USD 734.7 to USD 876.1 between 2020 and 2025, growing at a CAGR of 4.5%.

The Disodium Guanylate market is a rapidly evolving sector that has seen substantial growth in the last few years. This article will provide a comprehensive overview of the historical outlook and future projections for this product. It will analyze various aspects such as production capacity, pricing trends, competitive landscape, major players, and recent developments in the industry.

The global Disodium Guanylate Market is forecast to grow at a solid CAGR of 6.3% from USD 1034.5 Billion in 2025 to USD 1,686.6 Billion by 2035.

The US accounted for 33.3% of the North American market with a value of USD 1034.5 Million in 2025. The United States of America holds a dominant position in the global market for Disodium Guanylate. This food additive is used to enhance the flavor of many dishes, and its use has become increasingly popular around the world due to its unique taste. The US’s strong foothold as a leading producer and exporter of Disodium Guanylate can be attributed to several factors.

The China Brewing Boiler Market will grow at 4.0% CAGR between 2025 and 2035. The Disodium Guanylate market in China is rapidly growing. With the increasing demand for quality ingredients in Chinese cooking, the Disodium Guanylate market is gaining momentum. The product is not only being used to enhance the flavor profile of dishes but has also become an important ingredient in various food products throughout China.

The India Brewing Boiler Market will grow at 4.6% CAGR between 2025 and 2035. India is a major manufacturer and exporter of Disodium Guanylate, a flavor enhancer used in the food industry. Disodium Guanylate is derived from natural sources like seaweed, yeast extract, and mushrooms. India's position in the global Disodium Guanylate market has been steadily increasing over the years due to its competitive pricing and quality product offerings. In recent years, India has emerged as one of the leading suppliers of Disodium Guanylate.

Disodium Guanylate is a food additive used to enhance the flavor and aroma of processed foods. It’s made from yeast extract, which is then processed and converted into a powder form. This powder form has become increasingly popular for use in modern food production due to its high solubility, low cost, and ease of use. The main benefit of using Disodium Guanylate in powder form is that it can be easily absorbed by the body.

Disodium Guanylate, also known as E627 or GMS, is a food additive used in the food and beverage industry to enhance flavor. It is an organic salt derived from dried fish or fermented vegetables. This ingredient has been used in many countries for centuries as a preservative and flavoring agent.

Disodium Guanylate is a natural flavor enhancer used in many food products. It is an ingredient commonly found in salad dressings, sauces, instant noodles, and canned foods. Its primary purpose is to boost the umami flavor of food items and make them more attractive to consumers. Disodium Guanylate is found in a variety of different foods, including cured meats, snack foods, and other processed items.

The global Disodium Guanylate market is experiencing significant growth in recent years. This has led to intense competition among the key players in this industry. With the increasing demand for Disodium Guanylate, companies are investing heavily in research and development activities and trying to capture a larger share of the market.

In order to gain a competitive advantage over their rivals, companies are expanding their product portfolio, introducing new products with various features and benefits, as well as implementing strategies such as collaborations, mergers & acquisitions, partnerships, etc.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East & Africa (MEA) |

| Key Countries Covered | The US, Mexico, Canada, Germany, The UK, France, Italy, Spain, India, Japan, China, South Korea, Australia, Argentina, Brazil, South Africa, UAE |

| Key Segments Covered | Form, Application, Region |

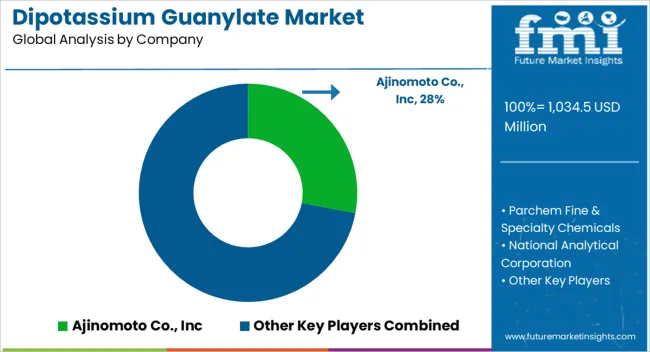

| Key Companies Profiled | Ajinomoto Co., Inc; Parchem Fine & Specialty Chemicals; National Analytical Corporation; Pastene Co. ltd; Sigma-Aldrich Co. LLC; Zhengzhou Sigma Chemical Co Ltd; Xi’an Leader Leader biochemical engineering company limited; Wuxi Accobio Biotech Inc; Shaanxi Dideu Medichem Co Ltd |

| Report Coverage | Company Share Analysis, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives, Market Forecast, Competitive Landscape |

| Customization & Pricing | Available upon Request |

The global dipotassium guanylate market is estimated to be valued at USD 1,034.5 million in 2025.

The market size for the dipotassium guanylate market is projected to reach USD 1,905.7 million by 2035.

The dipotassium guanylate market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in dipotassium guanylate market are powdered and granular.

In terms of application, instant noodles segment to command 31.7% share in the dipotassium guanylate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Dipotassium Phosphate Market Analysis by Dipotassium Phosphate Anhydrous, Dipotassium Hydrogen Phosphate Trihydrate, Dipotassium Phosphate Used in Coffee Mate, Potassium Phosphate dibasic and Dipotassium Hydrogen Phosphate Through 2035

Disodium Guanylate Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA