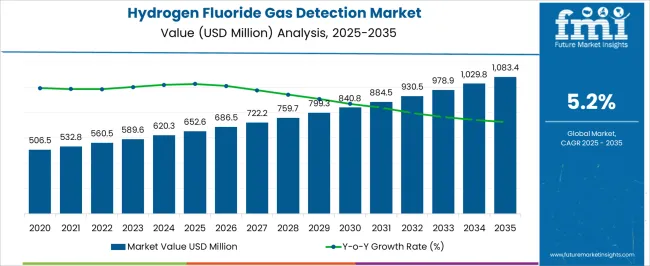

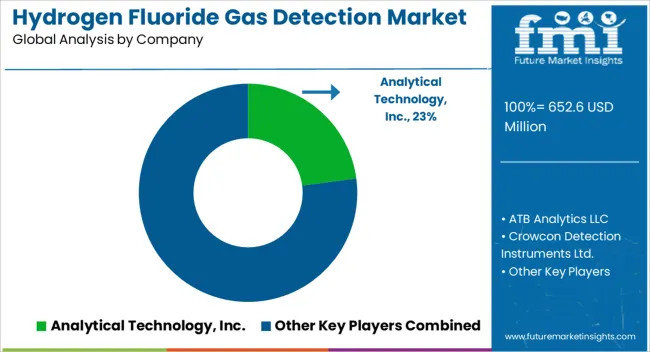

The hydrogen fluoride gas detection market is estimated to be valued at USD 652.6 million in 2025 and is projected to reach USD 1083.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The hydrogen fluoride gas detection market is projected to experience steady expansion, with its value anticipated to rise from USD 652.6 million in 2025 to USD 1,083.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.2%. Revenue progression is being influenced by increasing demand for safety monitoring in chemical plants, semiconductor manufacturing units, and industrial facilities handling corrosive gases. Year-on-year growth indicates a consistent upward trajectory, with market value expected to reach approximately USD 799.3 million by 2029 and USD 930.5 million by 2032.

Emphasis on precise detection, rapid alert systems, and integration with industrial control frameworks is being considered pivotal for market expansion. Throughout the forecast period, the hydrogen fluoride gas detection market is being shaped by stricter compliance mandates, operational risk mitigation, and the need for reliable gas monitoring solutions. Adoption across process industries, research laboratories, and hazardous material handling facilities is being steadily reinforced, supporting overall market capitalization.

Enhanced sensor accuracy, remote monitoring capabilities, and system interoperability are being recognized as key differentiators for competitive positioning. By 2035, the market is expected to achieve a strong foothold as a crucial component for occupational safety, regulatory adherence, and operational assurance, reflecting consistent demand and long-term value accumulation.

| Metric | Value |

|---|---|

| Hydrogen Fluoride Gas Detection Market Estimated Value in (2025 E) | USD 652.6 million |

| Hydrogen Fluoride Gas Detection Market Forecast Value in (2035 F) | USD 1083.4 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

The hydrogen fluoride gas detection market is estimated to hold a notable proportion within its parent markets, representing approximately 10-12% of the gas detection and monitoring market, around 8-9% of the industrial safety equipment market, close to 6-7% of the chemical process safety market, about 4-5% of the environmental monitoring market, and roughly 3-4% of the occupational health and safety market. Collectively, the cumulative share across these parent segments is observed in the range of 31-37%, reflecting a significant presence of hydrogen fluoride-specific detection solutions across industrial, chemical, and safety applications.

The market has been influenced by the need for precise and rapid detection of hydrogen fluoride, which is highly corrosive and hazardous even at low concentrations, where operational accuracy, real-time monitoring, and reliability are prioritized. Adoption is often guided by procurement patterns emphasizing compliance with safety standards, integration with existing safety and monitoring systems, and responsiveness in high-risk environments. Market participants have focused on sensor sensitivity, long-term durability, and ease of deployment to ensure reliable detection across critical industrial processes.

As a result, the hydrogen fluoride gas detection market has not only captured a substantial share within the core gas detection and industrial safety segments but has also impacted chemical process safety, environmental monitoring, and occupational health sectors, underscoring its strategic role in safeguarding personnel, assets, and operational continuity across multiple domains.

The hydrogen fluoride gas detection market is witnessing steady growth due to increasing safety regulations, heightened awareness of occupational hazards, and the expansion of industries handling hazardous chemicals. The toxic and corrosive nature of hydrogen fluoride requires advanced monitoring systems to ensure workplace safety and regulatory compliance.

Growing adoption of continuous monitoring technologies and integration with industrial IoT platforms have enhanced detection accuracy, response speed, and maintenance efficiency. Industries such as chemicals, electronics, and metallurgy are investing in fixed and portable detection solutions to mitigate exposure risks and prevent operational disruptions.

The market outlook remains strong, supported by rising global emphasis on employee safety, environmental protection, and advanced hazard detection infrastructure across industrial operations.

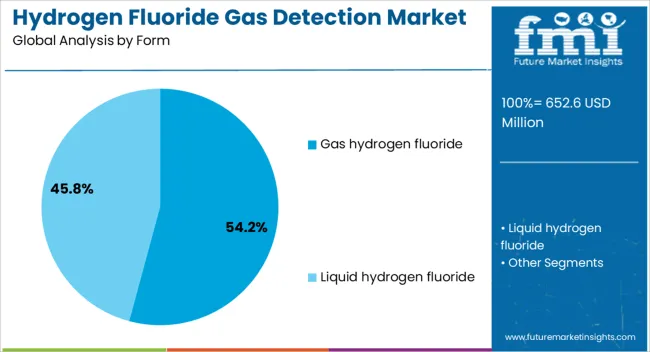

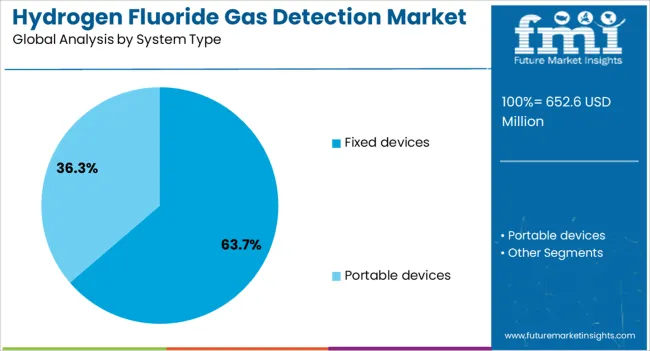

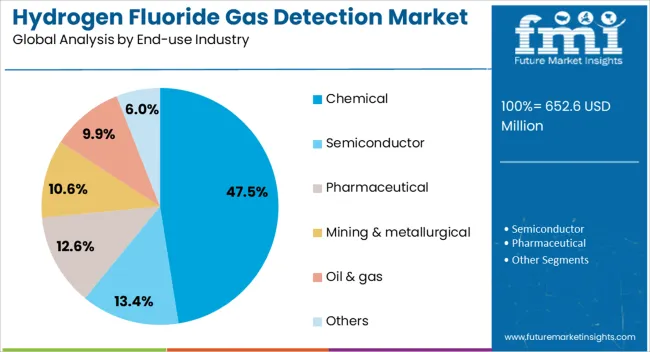

The hydrogen fluoride gas detection market is segmented by form, system type, end-use industry, and geographic regions. By form, hydrogen fluoride gas detection market is divided into gas hydrogen fluoride and liquid hydrogen fluoride. In terms of system type, hydrogen fluoride gas detection market is classified into fixed devices and portable devices. Based on end-use industry, hydrogen fluoride gas detection market is segmented into chemical, semiconductor, pharmaceutical, mining & metallurgical, oil & gas, and others. Regionally, the hydrogen fluoride gas detection industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gas hydrogen fluoride form segment is projected to account for 54.2% of the total market revenue by 2025, making it the leading form category. Its dominance is driven by the high prevalence of hydrogen fluoride in gaseous form across industrial processes, particularly in chemical production and metal processing applications.

Continuous emission risks and the necessity for real time monitoring in manufacturing environments have increased the demand for specialized detection equipment for this form.

The segment’s growth is further supported by advancements in sensor sensitivity, enabling early leak detection and minimizing potential hazards.

The fixed devices system type segment is expected to hold 63.7% of market revenue by 2025, positioning it as the most widely adopted system type. This is attributed to the critical need for uninterrupted monitoring in high risk industrial zones where hydrogen fluoride exposure can occur unexpectedly.

Fixed detection systems provide constant surveillance, automated alerts, and integration with plant safety systems, ensuring rapid response to leaks.

Their reliability, low maintenance requirements, and compatibility with centralized monitoring networks have strengthened their adoption in large scale facilities.

The chemical end use industry segment is set to capture 47.5% of the total market revenue by 2025, making it the leading industrial application. This growth is fueled by extensive use of hydrogen fluoride in chemical manufacturing processes and the associated safety risks.

Stringent workplace safety regulations, coupled with the high toxicity of the gas, have compelled chemical companies to invest heavily in robust detection systems.

The need to protect workforce health, avoid production downtime, and maintain regulatory compliance continues to reinforce the chemical sector’s leadership in this market.

The hydrogen fluoride gas detection market is driven by the need to safeguard industrial and chemical processing facilities, emphasizing compliance and employee safety. Opportunities arise from expanding industrial applications and stringent safety regulations, while trends focus on smart, connected, and real-time monitoring systems. Challenges persist due to corrosive environments, maintenance needs, and equipment costs. Overall, HF gas detection solutions are being increasingly adopted to prevent hazards, ensure operational reliability, and provide continuous monitoring in high-risk chemical and industrial sectors worldwide, supporting steady market growth.

The demand for hydrogen fluoride (HF) gas detection systems has been driven by the necessity to monitor and safeguard industrial plants, chemical processing units, and semiconductor manufacturing facilities. HF gas is highly corrosive and toxic, making early detection critical to preventing operational hazards and protecting personnel. Industries are deploying fixed and portable detectors, electrochemical sensors, and real-time monitoring solutions to comply with safety regulations and minimize workplace exposure. Increased focus on regulatory adherence and employee safety is compelling chemical manufacturers and metal processing facilities to integrate continuous gas detection systems. This heightened vigilance and regulatory pressure have accelerated adoption, emphasizing the importance of precise, rapid-response HF gas monitoring technologies across industrial operations globally.

Significant opportunities are emerging from industrial sectors that rely on HF gas, including aluminum smelting, petroleum refining, and semiconductor fabrication. Companies are seeking reliable detection solutions to mitigate chemical hazards and enhance workplace safety programs. Market participants are introducing advanced sensors, IoT-enabled detectors, and remote monitoring systems that allow for rapid response and minimal operational interruption. Emerging economies investing in chemical and aluminum production infrastructure are anticipated to adopt HF gas detection systems aggressively. Regulatory mandates for emissions control and worker protection further amplify market potential. As a result, new business models, including sensor-as-a-service and modular installations, are positioning HF gas detection as an indispensable component of industrial safety and operational continuity.

Market trends reveal a shift toward smart, connected, and multi-sensor HF gas detection systems. Real-time monitoring, automated alarms, and wireless integration with plant control systems are being prioritized to enhance rapid hazard identification. Multi-sensor setups that combine electrochemical, infrared, and photoionization detection are gaining traction for improved accuracy. Cloud-enabled analytics platforms are being used to provide predictive insights and streamline maintenance schedules. This integration of connectivity and automation has influenced purchasing decisions, with industrial operators favoring systems that deliver actionable data and operational efficiency. The trend of remote monitoring and automated reporting is reinforcing the adoption of HF gas detection solutions in high-risk industrial environments worldwide.

Challenges in the HF gas detection market are posed by the corrosive nature of hydrogen fluoride and the demanding environments in which detection systems operate. Equipment durability is affected by temperature extremes, humidity, and chemical exposure, necessitating frequent maintenance and calibration. High initial costs of advanced sensors, coupled with the need for specialized installation and training, restrict adoption in smaller industrial units. False alarms and sensor drift can compromise reliability and operational confidence. Manufacturers are addressing these obstacles by offering robust, corrosion-resistant sensors, automated calibration routines, and comprehensive service packages. Despite these measures, deployment complexity and maintenance requirements continue to influence market penetration in certain industrial segments.

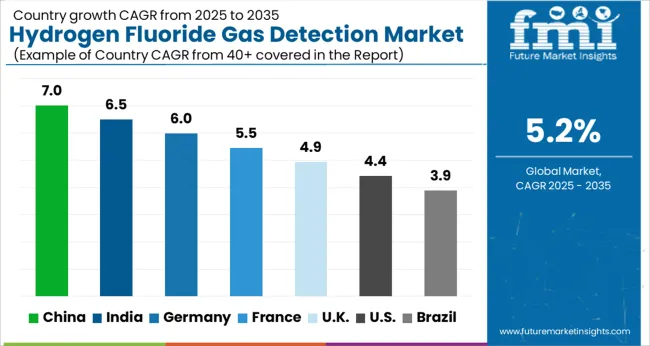

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global hydrogen fluoride gas detection market is projected to grow at a CAGR of 5.2% from 2025 to 2035. China leads with a growth rate of 7%, followed by India at 6.5%, and Germany at 6%. The United Kingdom records a growth rate of 4.9%, while the United States shows the slowest growth at 4.4%. Market expansion is driven by increasing industrial applications, chemical manufacturing, and rising concerns for worker safety and environmental compliance. Emerging economies such as China and India experience faster growth due to industrial expansion, infrastructure development, and stricter safety regulations. Mature markets like the UK, USA, and Germany focus on technology adoption, predictive monitoring, and regulatory adherence to prevent hazardous exposure. This report includes insights on 40+ countries, with the top markets highlighted here.

Health concerns associated with particulate matter have been driving market expansion across diverse regions. Scientific studies have linked prolonged exposure to fine particles with asthma, lung disease, and cardiovascular complications. As a result, hospitals, schools, and public spaces have witnessed installations of monitoring devices to ensure safer environments. Growing involvement of non-governmental organizations, research institutions, and local communities in air quality projects has supported widespread adoption. Publicly accessible air quality data has encouraged informed decision making by individuals and policy makers. This increasing awareness has created a favorable environment for sustained investments in particulate matter monitoring solutions across industrial and residential landscapes.

The hydrogen fluoride gas detection market in China is projected to grow at a CAGR of 7%. Rapid industrialization, expansion of chemical manufacturing plants, and increasing adoption of hazardous gas monitoring systems drive strong demand. Industrial sectors including pharmaceuticals, petrochemicals, and electronics increasingly implement detection technologies to prevent worker exposure and comply with stringent safety standards. Smart monitoring systems integrating IoT, sensors, and real-time alerts are gaining traction to ensure operational safety. Regulatory support, industrial safety awareness, and infrastructure development further accelerate market growth. China continues to strengthen its position by investing in advanced gas detection technologies and solutions to address complex industrial challenges.

The hydrogen fluoride gas detection market in India is projected to grow at a CAGR of 6.5%. Industrial growth, chemical plant expansion, and stricter occupational safety regulations drive significant adoption. Companies are increasingly deploying real-time detection systems for hazardous gases to improve worker safety, prevent environmental contamination, and comply with legal requirements. Investments in smart monitoring solutions, predictive maintenance, and automated alert systems further accelerate market penetration. Growing awareness of industrial safety standards and rising chemical production contribute to steady expansion. India’s market benefits from supportive government policies, increasing industrial capacity, and technological adoption for reliable gas detection solutions across multiple sectors.

The hydrogen fluoride gas detection market in Germany is projected to grow at a CAGR of 6%. Increasing chemical manufacturing, energy production, and industrial operations drive adoption. German industries implement advanced gas detection technologies to maintain compliance with strict environmental and occupational safety regulations. Real-time monitoring, sensor integration, and automated alert systems are widely adopted to mitigate hazardous exposure risks. Investments in industrial safety infrastructure, smart monitoring technologies, and predictive analytics contribute to steady growth. Germany’s strong regulatory framework, focus on worker safety, and advanced industrial practices continue to support the hydrogen fluoride gas detection market.

The hydrogen fluoride gas detection market in the United Kingdom is projected to grow at a CAGR of 4.9%. Growth is driven by chemical manufacturing, energy production, and industrial safety requirements. Companies implement detection systems for hazardous gases to prevent accidents, ensure compliance, and protect worker health. Advanced monitoring technologies, predictive alerts, and sensor-based systems are increasingly adopted to maintain operational safety. Government policies promoting workplace safety and environmental protection support market expansion. Steady industrial growth, modernization of chemical plants, and emphasis on regulatory adherence contribute to the adoption of hydrogen fluoride gas detection solutions in the UK

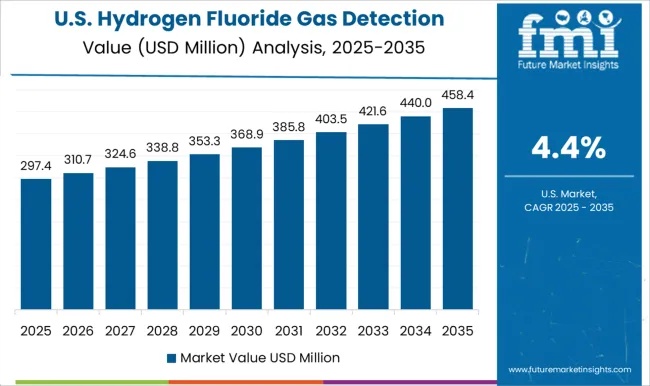

The hydrogen fluoride gas detection market in the United States is projected to grow at a CAGR of 4.4%. Industrial, chemical, and energy sectors implement gas detection technologies to ensure safety, regulatory compliance, and environmental protection. Adoption of IoT-enabled sensors, automated alerts, and real-time monitoring systems enhances operational efficiency and hazard prevention.

Investments in industrial safety infrastructure and predictive maintenance further strengthen market growth. Mature industries focus on technology upgrades, compliance with occupational safety standards, and reducing potential risks from hazardous gas exposure. The combination of regulatory enforcement, technological deployment, and industrial safety awareness maintains stable demand for hydrogen fluoride gas detection solutions in the USA

The hydrogen fluoride gas detection market is shaped by leading global instrumentation providers and specialized sensor manufacturers offering solutions for chemical plants, industrial facilities, and environmental monitoring. Companies such as Honeywell International Inc., Drägerwerk AG & Co. KGaA, and MSA Safety Incorporated lead the market with advanced detection systems emphasizing high sensitivity, reliability, and compliance with international safety standards.

Product brochures highlight rapid detection, real-time monitoring, and integration with alarm systems to prevent exposure and ensure worker safety. Crowcon Detection Instruments Ltd. and Analytical Technology, Inc. differentiate through portable and fixed monitoring solutions tailored for harsh industrial environments. ATB Analytics LLC and GFG Instrumentation, Inc. focus on scalable systems suitable for continuous monitoring in high-risk zones.

Marketing materials emphasize sensor durability, operational accuracy, and low maintenance requirements, presenting hydrogen fluoride gas detectors as essential tools for process safety and regulatory compliance. Emerging and regional players such as RKI Instruments, Gao Tek Inc., Gasera Ltd., International Gas Detectors, New Cosmos Electric Co., Ltd., R.C. Systems, Inc., Sensidyne, LP, and Teledyne Technologies Incorporated compete on cost-efficiency, ease of installation, and customization for specific industrial needs. Brochures frequently highlight real-time data logging, wireless connectivity, and early warning capabilities.

Market competition is driven by detection sensitivity, response time, reliability under extreme conditions, and integration with broader safety and process control systems. Companies are increasingly emphasizing modular designs, predictive maintenance features, and compatibility with IoT platforms. The strategic focus remains on safeguarding personnel, minimizing operational disruptions, and ensuring compliance with safety regulations, solidifying hydrogen fluoride gas detectors as indispensable in chemical and industrial safety frameworks.

| Item | Value |

|---|---|

| Quantitative Units | USD 652.6 million |

| Form | Gas hydrogen fluoride and Liquid hydrogen fluoride |

| System Type | Fixed devices and Portable devices |

| End-use Industry | Chemical, Semiconductor, Pharmaceutical, Mining & metallurgical, Oil & gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Analytical Technology, Inc., ATB Analytics LLC, Crowcon Detection Instruments Ltd., Drägerwerk AG & Co. KGaA, Gao Tek Inc., Gasera Ltd., GFG Instrumentation, Inc., Honeywell International Inc., International Gas Detectors, MSA Safety Incorporated, New Cosmos Electric Co., Ltd., R.C. Systems, Inc, RKI Instruments, Sensidyne, LP, and Teledyne Technologies Incorporated |

| Additional Attributes | Dollar sales by detector type (electrochemical, infrared, semiconductor) and application (chemical plants, refineries, pharmaceuticals, laboratories) are key metrics. Trends include rising demand for safety monitoring in industrial processes, growth in hydrogen fluoride usage, and adoption of real-time detection systems. Regional deployment, technological advancements, and regulatory compliance are driving market growth. |

The global hydrogen fluoride gas detection market is estimated to be valued at USD 652.6 million in 2025.

The market size for the hydrogen fluoride gas detection market is projected to reach USD 1,083.4 million by 2035.

The hydrogen fluoride gas detection market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in hydrogen fluoride gas detection market are gas hydrogen fluoride and liquid hydrogen fluoride.

In terms of system type, fixed devices segment to command 63.7% share in the hydrogen fluoride gas detection market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenated Palm Oil Market

Hydrogenerators Market

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA