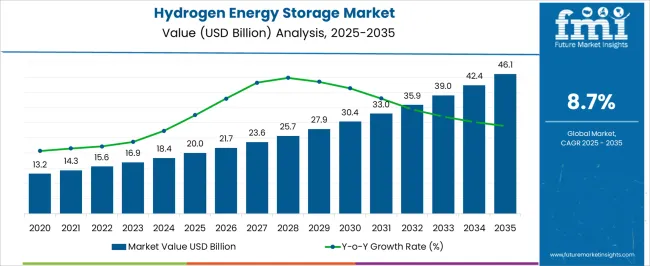

The Hydrogen Energy Storage Market is estimated to be valued at USD 20.0 billion in 2025 and is projected to reach USD 46.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period. This reflects a robust Compound Annual Growth Rate (CAGR) of 8.7% over the forecast period. The market demonstrates a consistent upward trajectory, with absolute value increments increasing steadily year over year. In the initial years, the market value rises by approximately USD 1.7 billion from 2025 to 2026, moving from USD 20.0 billion to USD 21.7 billion.

This upward momentum gains strength as the annual absolute growth progressively increases to about USD 3.7 billion by 2034-2035. The steady growth indicates a compounding effect where the market is not only expanding but also accelerating its value addition annually. Year-on-year absolute growth expands gradually, reflecting expanding investments and adoption of hydrogen storage technologies driven by energy transition trends and increasing emphasis on clean energy solutions. The market’s expansion is supported by technological advancements and government incentives, contributing to stronger absolute dollar growth, especially in the latter half of the forecast period.

The Hydrogen Energy Storage Market’s growth curve shows a consistent acceleration in absolute dollar terms. This trend signals increasing market maturity with expanding demand and infrastructure, making it an attractive opportunity for investors seeking sustained long-term growth with compound value appreciation.

| Metric | Value |

|---|---|

| Hydrogen Energy Storage Market Estimated Value in (2025 E) | USD 20.0 billion |

| Hydrogen Energy Storage Market Forecast Value in (2035 F) | USD 46.1 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The hydrogen energy storage market is gaining traction as global decarbonization goals, renewable energy integration, and grid flexibility needs continue to shape energy infrastructure investments. With the intermittent nature of solar and wind energy, hydrogen has emerged as a scalable solution to store surplus electricity and balance supply-demand gaps across industrial and utility sectors.

Government-backed hydrogen roadmaps, public-private partnerships, and funding for green hydrogen pilot projects have bolstered technology maturity and deployment. Advancements in electrolysis efficiency, storage system design, and safety protocols are accelerating adoption, particularly in regions targeting net-zero emissions.

Strategic focus on localized energy resilience, coupled with declining costs of renewable generation and electrolyzers, is paving the way for large-scale hydrogen storage infrastructure. Looking forward, market growth is expected to be supported by cross-sector collaboration among energy, transport, and industrial players as hydrogen moves from pilot stages to integrated systems.

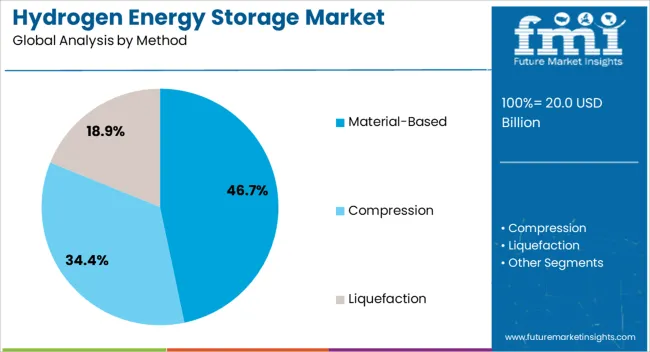

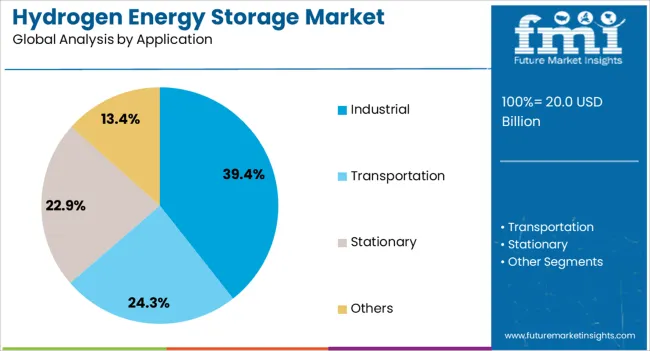

The hydrogen energy storage market is segmented by method, application, and geographic regions. By method of the hydrogen energy storage market is divided into Material-Based, Compression, and Liquefaction. In terms of application of the hydrogen energy storage market is classified into Industrial, Transportation, Stationary, and Others.

Regionally, the hydrogen energy storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Material-based hydrogen storage is projected to hold 46.7% of the overall market share in 2025, establishing it as the leading storage method. This dominance is being driven by advancements in metal hydrides, chemical hydrogen storage, and nanomaterials that offer compact and high-density storage solutions.

The ability to store hydrogen safely under moderate temperature and pressure conditions has improved operational feasibility, particularly for stationary and mobile applications. Material-based methods have been favored for their enhanced volumetric energy density and reduced risk of leakage or explosion compared to gaseous storage.

Research institutions and industrial stakeholders have increasingly collaborated on next-generation hydrogen carriers, which has accelerated commercialization potential. As demand rises for storage systems that integrate seamlessly with fuel cells and distributed energy applications, material-based methods are expected to remain at the forefront of innovation.

Industrial applications are expected to contribute 39.4% of the total revenue in the hydrogen energy storage market by 2025, marking them as the leading use case segment. This leadership is being shaped by the increasing use of hydrogen in ammonia production, petrochemical refining, metal processing, and combined heat and power (CHP) systems.

Industries are adopting hydrogen energy storage to mitigate power volatility, ensure energy security, and decarbonize high-emission processes. Regulatory pressure to reduce carbon intensity and energy-related emissions has prompted large industrial players to integrate on-site renewable generation with hydrogen storage systems.

The ability to store surplus electricity and convert it into hydrogen for immediate or later industrial use has proven both economical and reliable in energy-intensive environments. As green hydrogen costs decline and industrial energy transition roadmaps mature, adoption in the industrial sector is expected to intensify further.

The market has been expanding rapidly as the global shift toward clean and renewable energy sources intensifies. Hydrogen storage solutions offer a promising method for managing energy generated from intermittent renewable sources such as wind and solar, enabling energy to be stored and dispatched when needed. The market growth is supported by increasing investments in green hydrogen production, government policies promoting decarbonization, and advancements in storage technologies including compressed gas, liquefaction, and solid-state storage. Challenges such as high infrastructure costs, safety concerns, and limited storage capacity continue to influence market dynamics.

The rising penetration of renewable energy sources with variable outputs, including wind and solar power, has created a pressing need for effective energy storage solutions to balance supply and demand. Hydrogen storage technologies are increasingly utilized to store excess energy generated during peak production periods, which can later be converted back into electricity or used as fuel. This capability enhances grid stability, reduces curtailment of renewable energy, and supports energy security. Large-scale projects and pilot programs integrating hydrogen storage with renewable plants have demonstrated technical feasibility and economic benefits. The ability to store energy over long durations distinguishes hydrogen from other storage forms, positioning it as a key enabler of renewable energy integration.

Significant progress in hydrogen storage technologies has enhanced storage density, operational safety, and cost-efficiency. Compressed hydrogen storage using advanced high-pressure tanks has been optimized to improve volumetric density and reduce weight. Liquefied hydrogen storage offers higher energy density but requires cryogenic temperatures, demanding sophisticated insulation and safety systems. Emerging solid-state storage methods using metal hydrides or chemical carriers provide safer and more compact alternatives, although commercialization is still in progress. Innovations in materials science and system design focus on minimizing leakage risks and improving thermal management. These technological improvements increase the viability of hydrogen storage for diverse applications including transportation, grid support, and industrial use.

Government initiatives and regulatory frameworks aimed at reducing carbon emissions have been pivotal in accelerating the hydrogen energy storage market. Many countries have introduced ambitious hydrogen roadmaps, subsidies, and research funding to support infrastructure development and commercialization of storage technologies. Public-private partnerships and strategic investments by energy companies, technology providers, and venture capitalists are driving large-scale demonstration projects and supply chain expansion. The alignment of hydrogen storage with national clean energy targets enhances investor confidence and market momentum. Additionally, international collaborations facilitate knowledge sharing and standardization efforts, which are critical for overcoming technical and regulatory challenges.

Despite the promising outlook, the hydrogen energy storage market faces significant challenges related to high capital expenditures, complex infrastructure requirements, and safety concerns. The development of storage facilities, transport pipelines, and refueling stations involves substantial upfront investment and long project lead times. Handling and storing hydrogen safely demands strict adherence to protocols and advanced safety technologies, which can increase operational costs. Moreover, the lack of widespread hydrogen infrastructure limits market scalability and consumer confidence. Efforts to reduce costs through economies of scale, modular system designs, and technological innovation are ongoing. Addressing these barriers is essential to unlocking the full potential of hydrogen storage in the global energy transition.

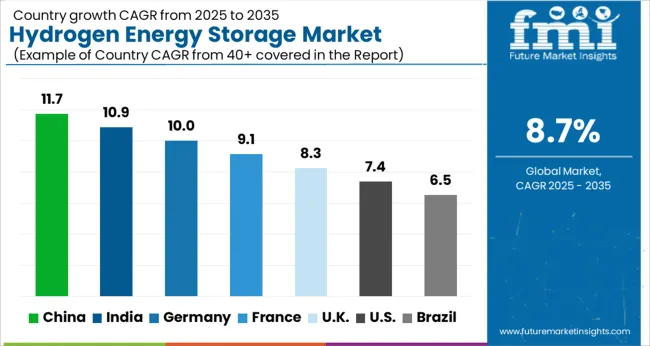

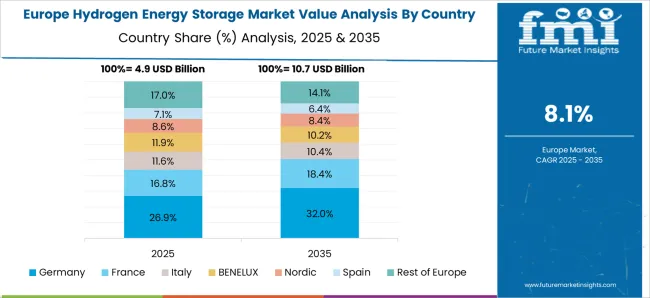

The market is forecasted to grow at a CAGR of 8.7% between 2025 and 2035, driven by increasing focus on renewable energy integration, decarbonization goals, and advancements in storage technologies. China leads with an 11.7% CAGR, supported by substantial investments in hydrogen infrastructure and clean energy policies. India follows at 10.9%, fueled by rising energy demand and government initiatives for green hydrogen.

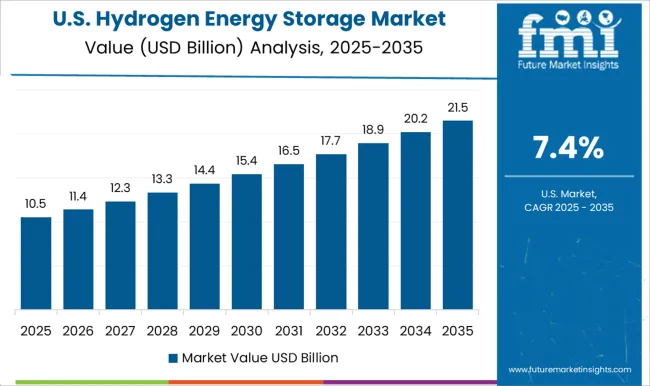

Germany, growing at 10.0%, benefits from advanced research and strong commitments to energy transition. The UK, at 8.3%, is expanding hydrogen storage projects aligned with net-zero targets. The USA, with a 7.4% CAGR, reflects growth from innovation in fuel cell technologies and hydrogen applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to witness a compound annual growth rate of 11.7% from 2025 to 2035 in the hydrogen energy storage industry. The growth is propelled by significant investments in green hydrogen projects and expanding renewable energy capacity. Domestic companies such as SinoHy and State Power Investment Corporation are focusing on developing advanced storage technologies including metal hydrides and liquid organic hydrogen carriers. Strategic collaborations between energy firms and technology startups have accelerated commercialization. Government incentives supporting carbon neutrality goals and hydrogen infrastructure expansion further boost demand. Integration of hydrogen storage in transportation and industrial applications is a key driver.

The hydrogen energy storage market in India is projected to grow at a CAGR of 10.9% through 2035, fueled by rising renewable energy installations and government initiatives promoting hydrogen economy development. Companies such as Reliance Industries and Adani Group invest in electrolyzer manufacturing and storage system development. The push for clean energy in industrial sectors and transportation encourages adoption. Pilot projects integrating hydrogen storage with solar and wind power farms have demonstrated improved grid stability. Policy support and increasing R&D expenditure strengthen market prospects.

Germany’s hydrogen energy storage industry is forecasted to expand at a CAGR of 10.0%, backed by strong commitment to decarbonize energy systems and promote renewable integration. Key players such as Siemens Energy and Linde are innovating storage solutions focusing on efficiency and safety. Industrial applications including steel manufacturing and chemical production are primary end users. Government funding programs incentivize research in solid-state and liquid hydrogen storage technologies. Integration of hydrogen storage with offshore wind energy projects is gaining traction.

The hydrogen energy storage market in the United Kingdom is anticipated to grow at a CAGR of 8.3% from 2025 to 2035, supported by national hydrogen strategy implementation and renewable capacity growth. Companies like ITM Power and Johnson Matthey are advancing electrolyzer and storage system technologies. The transport sector’s hydrogen fuel cell adoption drives demand for mobile and stationary storage solutions. Pilot projects demonstrate benefits in grid balancing and energy security. Collaboration with European hydrogen initiatives enhances technological exchange.

Sales of hydrogen energy storage solutions in the United States are expected to grow at a CAGR of 7.4% between 2025 and 2035, driven by expanding renewable power generation and decarbonization targets. Leading firms including Plug Power and Bloom Energy focus on improving storage efficiency and scaling electrolyzer production. Demand from industrial, commercial, and transportation sectors is growing steadily. Federal and state incentives for clean energy storage systems accelerate market growth. Research into novel storage materials and safety improvements continues.

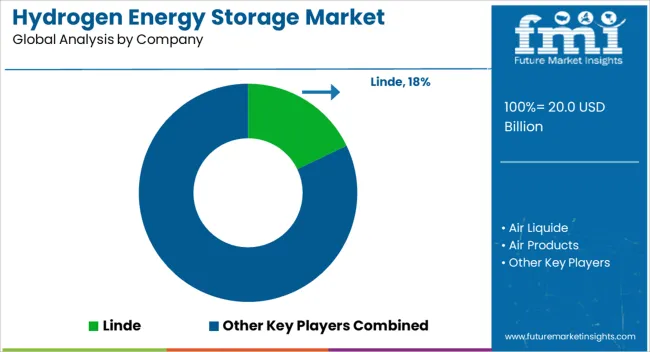

The market includes prominent industrial gas suppliers, technology innovators, and specialized energy companies delivering solutions for efficient hydrogen production, storage, and distribution. Linde, Air Liquide, and Air Products stand out as industry leaders, leveraging extensive experience in gas processing and infrastructure to supply large-scale hydrogen storage systems supporting industrial and energy sectors.

Cockerill Jingli Hydrogen and Engie focus on integrating hydrogen storage with renewable energy projects, enhancing grid stability and energy flexibility. FuelCell Energy and ITM Power develop advanced electrolyzer and storage technologies designed to increase efficiency and reduce costs in hydrogen production and containment. GKN Hydrogen and McPhy Energy offer modular storage solutions aimed at diverse applications ranging from transportation to power generation.

Gravitricity and Hydrogen in Motion explore innovative storage concepts, including mechanical and hybrid systems, to complement traditional hydrogen tanks. Nel and SSE contribute with end-to-end hydrogen infrastructure solutions, combining storage with fueling and energy management services. Market growth is fueled by increasing demand for clean energy storage alternatives and government initiatives promoting hydrogen as a key energy vector.

Entry barriers include high capital investment, complex engineering challenges, and regulatory compliance related to safety and environmental standards. Leading providers capitalize on technical expertise, strategic partnerships, and global service capabilities to maintain competitive advantages in this emerging sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.0 Billion |

| Method | Material-Based, Compression, and Liquefaction |

| Application | Industrial, Transportation, Stationary, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Linde, Air Liquide, Air Products, Cockerill Jingli Hydrogen, Engie, FuelCell Energy, GKN Hydrogen, Gravitricity, Hydrogen in Motion, ITM Power, McPhy Energy, Nel, and SSE |

| Additional Attributes | Dollar sales by storage type and end-use sector, demand dynamics across transportation, power generation, and industrial applications, regional trends in deployment across Asia-Pacific, North America, and Europe, innovation in solid-state storage, metal hydrides, and compressed hydrogen tanks, environmental impact of production emissions, material lifecycle, and storage safety, and emerging use cases in grid-scale energy balancing, hydrogen fueling stations, and backup power systems for critical infrastructure. |

The global hydrogen energy storage market is estimated to be valued at USD 20.0 billion in 2025.

The market size for the hydrogen energy storage market is projected to reach USD 46.1 billion by 2035.

The hydrogen energy storage market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in hydrogen energy storage market are material-based, compression and liquefaction.

In terms of application, industrial segment to command 39.4% share in the hydrogen energy storage market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stationary Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Material-Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Transportation Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Energy Storage Devices Market

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Flywheel Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Automotive Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Data Center Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Energy-saving Constant Humidity Storage Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Underground Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Compressed Air Energy Storage (CAES) Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA