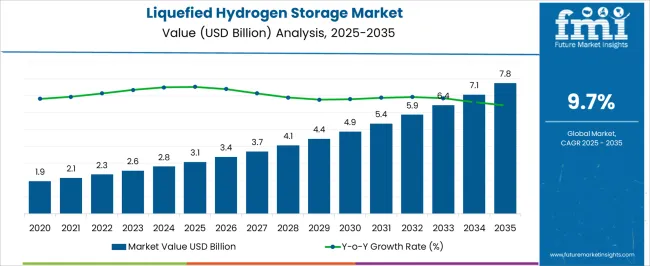

The Liquefied Hydrogen Storage Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 7.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

The trajectory highlights consistent expansion, supported by the growing role of hydrogen in energy diversification and long-distance trade. In the initial stage between 2025 and 2028, the curve reflects moderate gains as adoption remains focused on pilot-scale projects, aerospace applications, and industrial hydrogen hubs, bringing the market closer to USD 4.2 billion.

The middle phase from 2029 to 2032 marks a stronger upward slope, where accelerating investments in cross-border hydrogen corridors, liquefaction plants, and advanced cryogenic technologies push valuations past USD 5.8 billion. This stage represents the most dynamic acceleration of the curve, reflecting the rapid development of infrastructure.

Toward the final phase, 2033 to 2035, growth remains positive but begins to show moderation, with the market reaching USD 7.8 billion as competition, technology standardization, and infrastructure saturation balance expansion.

| Metric | Value |

|---|---|

| Liquefied Hydrogen Storage Market Estimated Value in (2025 E) | USD 3.1 billion |

| Liquefied Hydrogen Storage Market Forecast Value in (2035 F) | USD 7.8 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The liquefied hydrogen storage market is gaining momentum as global industries accelerate their transition toward low carbon energy systems. With hydrogen emerging as a critical enabler of decarbonization strategies, demand for efficient large scale storage solutions has intensified.

Liquefaction allows hydrogen to be stored and transported at higher energy densities compared to compressed forms, making it suitable for long distance distribution and industrial integration. Advancements in cryogenic tank design, insulation technologies, and safety mechanisms have supported scalability and operational feasibility.

Policy incentives, green hydrogen production initiatives, and strategic investments in hydrogen infrastructure are reinforcing long term market prospects. As energy intensive sectors seek alternatives to fossil fuels, liquefied hydrogen storage is positioned as a foundational component of the emerging hydrogen economy.

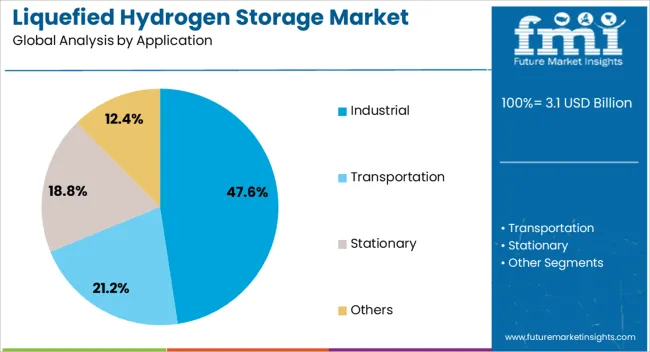

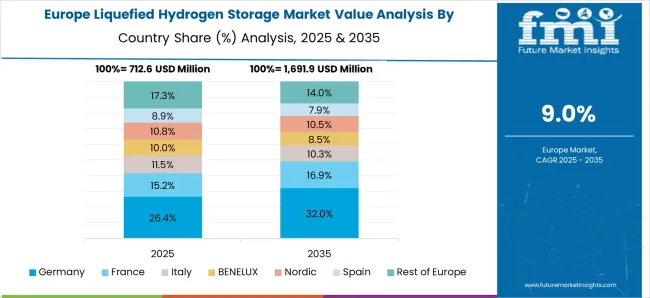

The liquefied hydrogen storage market is segmented by application, and geographic regions. By application of the liquefied hydrogen storage market is divided into Industrial, Transportation, Stationary, and Others. Regionally, the liquefied hydrogen storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industrial application segment is expected to contribute 47.60% of the total market revenue by 2025, establishing it as the dominant end use category. This leadership is attributed to the rising use of hydrogen across refineries, chemical manufacturing, steel production, and electronics sectors, where consistent supply and storage are mission-critical.

The capability of liquefied hydrogen to serve as a clean feedstock and energy source has led to its broader integration in industrial decarbonization efforts. Large-scale operations demand high-volume storage systems that offer stability, efficiency, and safety under cryogenic conditions, making liquefied hydrogen the preferred format.

Additionally, industry-driven hydrogen adoption is being supported by regulatory frameworks, public-private partnerships, and carbon neutrality commitments. These factors combined are strengthening the industrial sector’s position as the primary growth driver within the liquefied hydrogen storage market.

The liquefied hydrogen storage market is expanding due to increasing hydrogen demand, infrastructure development, and advances in cryogenic technologies. Investment and regulatory support are key factors driving this growth.

The growing demand for hydrogen as a clean energy alternative is a key driver in the liquefied hydrogen storage market. Hydrogen is increasingly being used as a fuel source in various sectors, including transportation, industrial processes, and energy generation. As governments and industries invest in hydrogen infrastructure, the demand for efficient and cost-effective storage solutions is rising. Liquefied hydrogen storage is favored due to its high energy density and ease of transport, enabling hydrogen to be stored and moved over long distances. The adoption of hydrogen fuel cell vehicles and the need for low-emission alternatives in industries contribute significantly to the market’s expansion.

The development of advanced cryogenic storage systems is a key dynamic propelling the liquefied hydrogen storage market. Cryogenic tanks designed for liquefied hydrogen allow for high-density storage at low temperatures, which is essential for maximizing storage efficiency. As hydrogen fuel use increases across various industries, the need for safer, more reliable storage systems is growing. Manufacturers are focusing on improving tank designs, increasing capacity, and reducing costs associated with storage systems. These innovations are expected to improve the overall performance and economics of liquefied hydrogen storage, driving adoption in commercial applications and long-distance transport.

Significant investments in hydrogen infrastructure are a major factor in driving the liquefied hydrogen storage market. Governments and private entities are increasing their commitment to developing hydrogen fueling stations, storage facilities, and transportation networks to support the growing hydrogen economy. The establishment of infrastructure such as liquefied hydrogen storage plants, pipelines, and fueling stations is essential for enabling large-scale hydrogen adoption, particularly in transportation. With expanding networks, the efficiency and convenience of using liquefied hydrogen as a fuel will improve, thus enhancing its market appeal. Strategic investments in these infrastructures are crucial for meeting growing hydrogen demand.

Government policies and regulations are playing a critical role in the growth of the liquefied hydrogen storage market. Policies that promote hydrogen use, such as clean energy mandates and low-carbon transportation incentives, are creating a favorable environment for liquefied hydrogen adoption. These regulations are pushing industries to transition to hydrogen-based technologies, further boosting demand for efficient storage solutions. As countries implement stricter environmental regulations and set ambitious emission reduction targets, the demand for hydrogen storage solutions is expected to rise. Regulatory frameworks focused on the safety and standardization of storage systems are crucial for ensuring widespread acceptance and use.

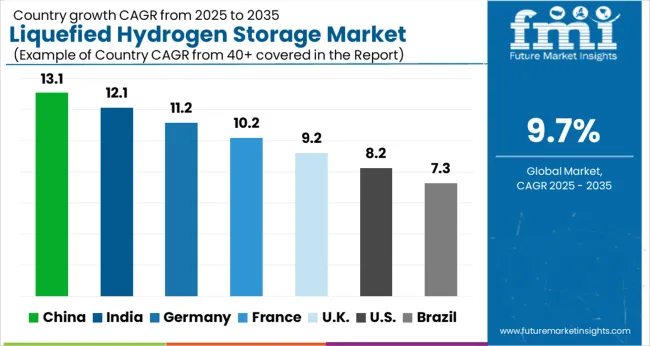

| Countries | CAGR |

|---|---|

| China | 13.1% |

| India | 12.1% |

| Germany | 11.2% |

| France | 10.2% |

| UK | 9.2% |

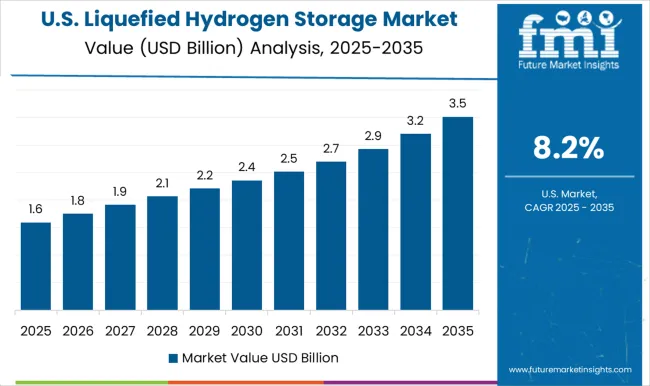

| USA | 8.2% |

| Brazil | 7.3% |

The liquefied hydrogen storage market is projected to grow globally at a CAGR of 9.7% from 2025 to 2035, supported by the increasing demand for hydrogen as an alternative energy source across industries like transportation and industrial processes. China leads with a CAGR of 13.1%, driven by rapid industrialization, the expansion of hydrogen infrastructure, and government support for clean energy solutions. India follows closely at 12.1%, with strong government incentives for hydrogen adoption and significant investments in renewable energy. France grows at 10.2%, driven by the country's ongoing transition to cleaner energy sources, alongside growing hydrogen adoption in transportation and industry. The UK achieves 9.2%, with a focus on developing a hydrogen economy and integration into national energy strategies. The USA grows at 8.2%, reflecting steady market growth in both energy and mobility sectors. This analysis shows strong growth in the Asia-Pacific region, particularly in China and India, with steady expansion in Europe and North America.

China is projected to post a CAGR of 13.1% during 2025–2035, surpassing the global 9.7%. This growth is driven by China’s rapid industrialization, increased government investments in hydrogen infrastructure, and strong demand for hydrogen in transportation and industrial applications. The adoption of liquefied hydrogen storage is accelerating as hydrogen plays a key role in the country’s energy transition strategy. Significant investments in infrastructure and the growing focus on clean energy solutions are further supporting this growth. As China continues to lead in the development of hydrogen technologies, liquefied hydrogen storage will be pivotal in meeting the country’s energy and emission reduction goals.

India is forecasted to post a CAGR of 12.1% for 2025–2035, surpassing the global 9.7%. Growth is supported by increased government incentives for hydrogen adoption and the rising need for clean energy solutions in transportation and industry. As India expands its renewable energy projects, liquefied hydrogen will become a critical component for energy storage and distribution. The country's growing hydrogen infrastructure, along with rising investments in hydrogen fuel cells for mobility and industry, is expected to propel market growth. India’s push for carbon-neutral goals and expanding clean energy markets further supports the increasing demand for liquefied hydrogen storage.

France is projected to grow at a CAGR of 10.2% during 2025–2035, exceeding the global 9.7%. The growth is driven by France’s focus on reducing carbon emissions and the country’s ongoing commitment to hydrogen as part of its clean energy transition. Government-backed hydrogen projects, especially in transportation and industrial sectors, are accelerating the demand for liquefied hydrogen storage solutions. Additionally, the establishment of hydrogen infrastructure and partnerships across the European Union are expected to fuel the adoption of liquefied hydrogen storage. France’s energy transition strategy, which includes leveraging hydrogen to meet low-carbon objectives, ensures long-term growth for the storage market.

The UK is projected to grow at a CAGR of 9.2% during 2025–2035, slightly below the global 9.7%. This growth is driven by increasing government focus on hydrogen technologies and the country’s commitment to achieving carbon-neutral goals by 2050. Hydrogen's role in transportation and industry is becoming more prominent, leading to greater demand for liquefied hydrogen storage solutions. Investments in hydrogen infrastructure, including fuel cell technology and storage systems, are contributing to the market’s expansion. The UK is strengthening its hydrogen infrastructure and focusing on integrating it into energy systems, providing a solid foundation for the storage market.

The USA is projected to grow at a CAGR of 8.2% during 2025–2035, slightly below the global 9.7%. This growth is supported by a strong focus on clean energy solutions, especially within the transportation sector. The USA has seen steady progress in hydrogen adoption across commercial vehicles and industrial applications, pushing demand for liquefied hydrogen storage. Federal incentives for renewable energy and green hydrogen solutions are expected to drive further adoption. Despite competition from other clean technologies, the continued expansion of hydrogen infrastructure, including storage and distribution networks, is critical for the USA market’s long-term growth.

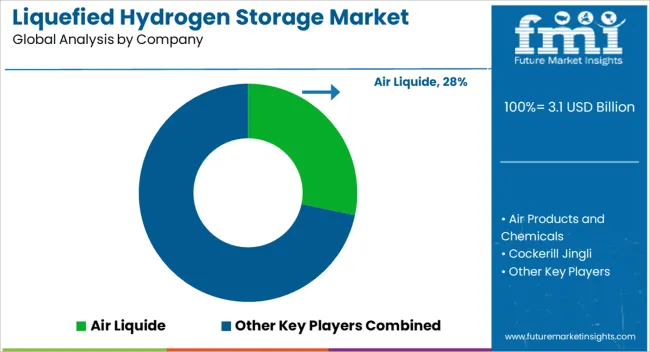

The liquefied hydrogen storage market is highly competitive, with several key players involved in the development and distribution of hydrogen storage technologies. Companies such as Air Liquide and Linde are leaders in the global hydrogen infrastructure market, offering a wide range of storage solutions, including cryogenic tanks and liquefied hydrogen storage systems.

Air Products and Chemicals is a prominent player, known for its comprehensive hydrogen production and storage solutions, and its ongoing investments in clean energy technologies. ENGIE focuses on the development of green hydrogen production and storage systems, supporting the transition to cleaner energy sources across various industries. Cockerill Jingli, a significant competitor in the market, provides specialized cryogenic technology for efficient liquefied hydrogen storage and is heavily involved in large-scale hydrogen projects in Asia and Europe.

FuelCell Energy contributes to the hydrogen economy by offering innovative fuel cell technologies that support the storage and utilization of liquefied hydrogen in power generation. ITM Power is advancing in the field of electrolysis-based hydrogen production and storage solutions, positioning itself as a key player in the integration of liquefied hydrogen storage systems.

McPhy Energy is a leader in the development of hydrogen storage and distribution technologies, with a focus on sustainable energy solutions for the industrial and transportation sectors. Nel is involved in the production of hydrogen electrolysis equipment, which plays a vital role in supporting liquefied hydrogen storage technologies. GKN and Gravitricity focus on innovative storage solutions, including energy storage systems that complement liquefied hydrogen storage.

SSE is expanding its hydrogen infrastructure and is committed to developing clean energy solutions, further supporting the growth of hydrogen storage markets. The competitive dynamics in the liquefied hydrogen storage market are shaped by continuous innovation, growing investments in infrastructure, and a strategic focus on sustainable and efficient hydrogen storage solutions. Key players are working on expanding their product portfolios and increasing market presence to meet the rising demand for hydrogen as a clean energy alternative.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Application | Industrial, Transportation, Stationary, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Air Products and Chemicals, Cockerill Jingli, ENGIE, FuelCell Energy, GKN, Gravitricity, ITM Power, Linde, McPhy Energy, Nel, and SSE |

| Additional Attributes | Dollar sales, and regional market share, along with growth projections for the coming years, they would also seek information on the competitive landscape, identifying key players and their market share, as well as technological advancements in storage solutions. |

The global liquefied hydrogen storage market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the liquefied hydrogen storage market is projected to reach USD 7.8 billion by 2035.

The liquefied hydrogen storage market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in liquefied hydrogen storage market are industrial, transportation, stationary and others.

In terms of , segment to command 0.0% share in the liquefied hydrogen storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquefied Petroleum Gas Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenated Palm Oil Market

Hydrogenerators Market

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA