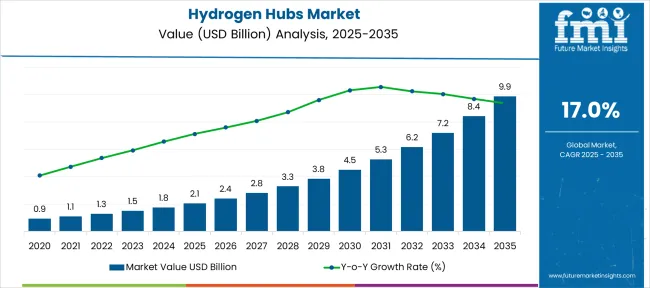

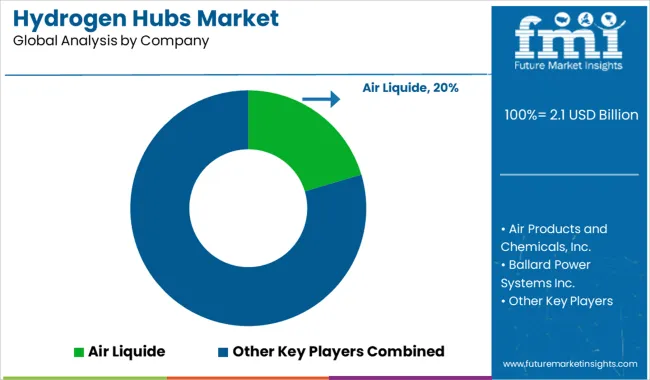

The Hydrogen Hubs Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 9.9 billion by 2035, registering a compound annual growth rate (CAGR) of 17.0% over the forecast period.

| Metric | Value |

|---|---|

| Hydrogen Hubs Market Estimated Value in (2025E) | USD 2.1 billion |

| Hydrogen Hubs Market Forecast Value in (2035F) | USD 9.9 billion |

| Forecast CAGR (2025 to 2035) | 17.0% |

The hydrogen hubs market is growing rapidly as the push for clean energy solutions intensifies worldwide. Liquid hydrogen has become a preferred form due to its high energy density and ease of storage and transportation over long distances.

Electrolysis as a supply technique is gaining traction because it produces green hydrogen using renewable electricity, aligning with global decarbonization goals. The automotive industry is a significant driver of this market as manufacturers increasingly adopt hydrogen fuel cell vehicles to reduce carbon emissions and enhance sustainability.

Infrastructure investments and government policies aimed at supporting hydrogen production and distribution have accelerated market growth. Demand for hydrogen hubs is expected to rise with the expansion of hydrogen-powered transportation and industrial applications. The growth in liquid hydrogen supply and electrolysis techniques reflects efforts to create efficient and environmentally friendly hydrogen ecosystems.

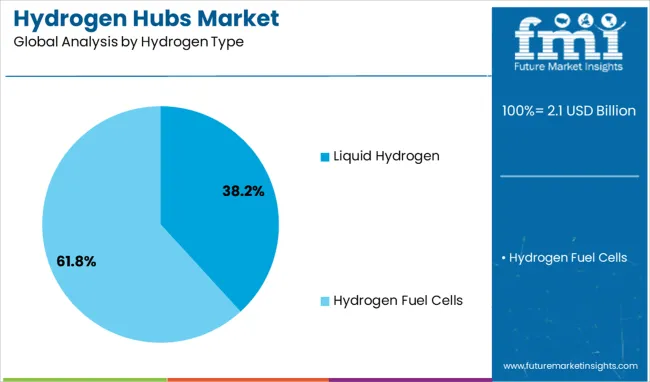

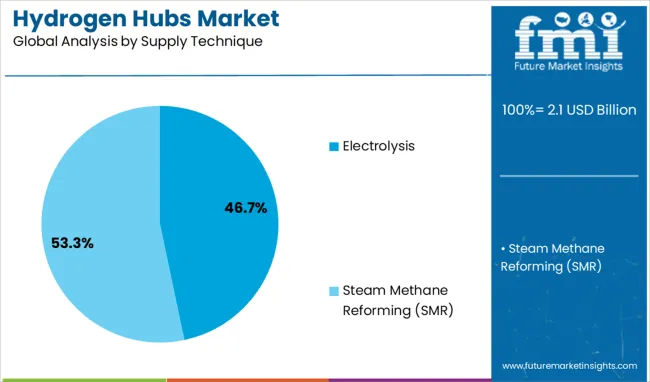

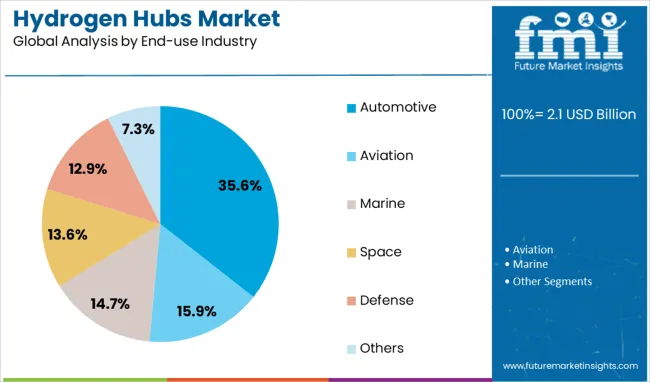

The hydrogen hubs market is segmented by hydrogen type, supply technique, end-use industry and geographic regions. The hydrogen hubs market is divided by hydrogen type into Liquid Hydrogen and Hydrogen Fuel Cells. In terms of supply technique, the hydrogen hubs market is classified into Electrolysis and Steam Methane Reforming (SMR). The hydrogen hubs market is segmented by end-use industry into Automotive, Aviation, Marine, Space, Defense, and Others. Regionally, the hydrogen hubs industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Liquid Hydrogen segment is projected to hold 38.2% of the hydrogen hubs market revenue in 2025. This growth is due to the advantages of liquid hydrogen in terms of storage and transportation efficiency compared to gaseous forms. The higher energy density of liquid hydrogen allows for easier handling and reduced volume requirements, which is critical for large-scale distribution.

It is particularly suited for applications requiring long-distance transport and large storage capacity. The infrastructure supporting liquid hydrogen is expanding, supported by technological advancements that improve liquefaction processes and safety standards. These factors have contributed to the increased adoption of liquid hydrogen in hydrogen hub development.

The Electrolysis segment is expected to generate 46.7% of the market revenue in 2025. Electrolysis produces hydrogen by splitting water molecules using electricity, often sourced from renewables, which results in low or zero carbon emissions. This green hydrogen production method has gained favor amid growing environmental regulations and sustainability commitments.

Electrolysis facilities can be located near renewable energy sources, reducing transmission losses and improving efficiency. Investments in electrolyzer technologies have improved performance and reduced costs, further accelerating adoption.

The scalability and environmental benefits of electrolysis make it the preferred supply technique within the hydrogen hubs market.

The Automotive segment is anticipated to represent 35.6% of the hydrogen hubs market revenue in 2025. Growth in this segment has been driven by the increasing use of hydrogen fuel cell vehicles as a clean alternative to internal combustion engines. Automakers have expanded their development and production of fuel cell vehicles to meet stricter emissions regulations and consumer demand for sustainable transportation.

The need for refueling infrastructure and hydrogen supply chains has boosted the demand for hydrogen hubs focused on automotive applications. Additionally, hydrogen-powered commercial vehicles and public transport are contributing to market expansion.

The automotive industry’s emphasis on reducing greenhouse gas emissions is expected to sustain demand for hydrogen hubs in the coming years.

The hydrogen hubs market is expanding due to green hydrogen infrastructure, industrial and transport sector adoption, and supportive regulatory frameworks. Strategic investments and global competition are accelerating large-scale development and integration across energy ecosystems.

The hydrogen hubs market is witnessing rapid growth due to the expansion of green hydrogen infrastructure supported by large-scale investments and policy incentives. Governments and private players are collaborating to build centralized hubs that integrate renewable energy sources with electrolysis-based hydrogen production. These facilities provide cost advantages by consolidating production, storage, and distribution processes in a single location. Major energy companies are committing to long-term projects aimed at reducing reliance on fossil fuels and supporting industrial decarbonization goals. This momentum is reinforced by government-backed financial frameworks that encourage infrastructure development, positioning hydrogen hubs as essential components in the global energy transition strategy.

Industrial and transport sectors are becoming primary demand drivers for hydrogen hubs, utilizing hydrogen as an alternative fuel for processes that require high energy density. Heavy industries like steel, cement, and chemicals are integrating hydrogen into operations to comply with emission reduction mandates. The transportation sector, particularly heavy-duty vehicles, shipping, and rail, is increasing hydrogen consumption through dedicated fueling networks linked to hubs. These applications enhance the need for well-developed hydrogen clusters capable of providing reliable and scalable supply, reducing distribution costs and addressing infrastructure gaps in regions pursuing cleaner energy alternatives.

Investments in hydrogen hubs are accelerating as public-private partnerships play a pivotal role in financing and operationalizing projects. Governments are offering subsidies, tax credits, and grants to attract energy companies and technology providers to participate in large-scale hub development. Collaborative frameworks are ensuring risk-sharing and faster deployment of infrastructure, enabling hubs to serve multiple end-users efficiently. Global energy firms are forming alliances with local players to secure renewable energy inputs and storage capabilities, ensuring cost-competitive hydrogen availability. This strategic alignment across stakeholders is critical to creating a robust hydrogen ecosystem, driving further investments and reducing capital expenditure barriers.

The growth of hydrogen hubs is strongly influenced by supportive regulatory frameworks and international competition to dominate the hydrogen economy. Policies aimed at reducing carbon emissions have mandated the development of large-scale hydrogen infrastructure in multiple countries. Regional governments are prioritizing hydrogen hubs in clean energy roadmaps, offering streamlined permitting and compliance measures. Competitive dynamics are emerging as countries like Germany, Japan, and the USA accelerate investments in hub projects to gain technological and economic leadership. This competition fosters innovation in cost optimization and operational efficiency, making hydrogen hubs a cornerstone for achieving energy diversification and industrial transformation globally.

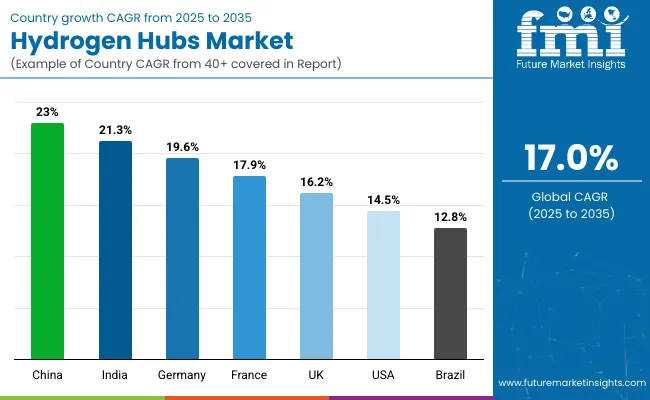

| Country | CAGR |

|---|---|

| China | 23.0% |

| India | 21.3% |

| Germany | 19.6% |

| France | 17.9% |

| UK | 16.2% |

| USA | 14.5% |

| Brazil | 12.8% |

The hydrogen hubs market, expected to grow at a global CAGR of 17.0% from 2025 to 2035, shows varying growth trajectories across major economies. China leads with an impressive 23.0% CAGR, driven by large-scale green hydrogen projects and significant government funding to integrate renewable energy sources. India follows closely at 21.3%, reflecting its aggressive clean energy transition and industrial adoption of hydrogen for steel and chemical production.

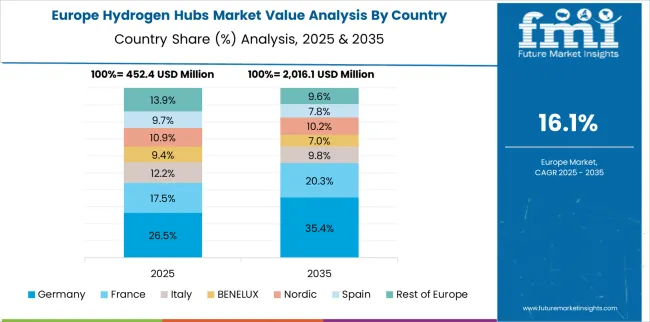

Germany posts a solid 19.6%, with strong regulatory support and expansion of hydrogen corridors linked to its mobility and manufacturing sectors. France is recording a 17.9% CAGR, supported by initiatives to decarbonize heavy transport and power generation through localized hydrogen clusters. The United Kingdom stands at 16.2%, focusing on regional hydrogen hubs tied to offshore wind energy integration and transport infrastructure.

The USA shows a steady 14.5% CAGR, benefiting from the Hydrogen Shot program and public-private partnerships aimed at large-scale deployment. While advanced economies ensure steady demand through industrial and mobility adoption, Asia-Pacific countries dominate due to accelerated infrastructure investments and competitive cost structures. The analysis encompasses detailed insights for over 40 countries, with the five highlighted above representing the most dynamic regions in hydrogen hub development globally.

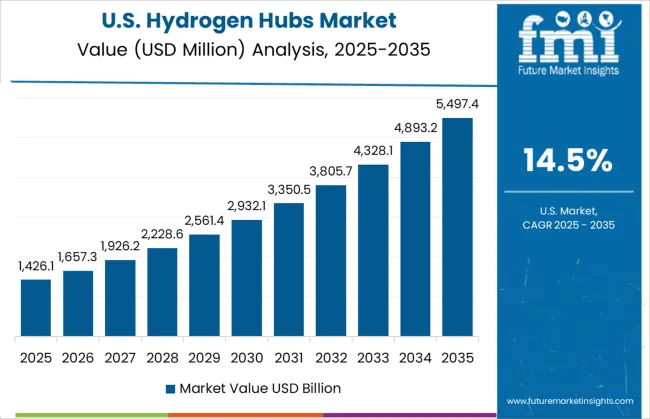

The CAGR for the USA hydrogen hubs market advanced from 10.2% during 2020–2024 to 14.5% during 2025–2035, driven by massive funding under the USA Department of Energy’s Hydrogen Energy Earthshot and Inflation Reduction Act incentives. Early adoption was modest and limited to pilot-scale hubs, but post-2025, commercial deployment surged with over USD 8 billion federal investment allocations supporting large-scale projects.

Hydrogen hubs in Texas, California, and the Midwest became strategic locations for renewable-linked hydrogen production, creating integrated supply chains for industries and mobility. The transition was largely influenced by rising demand from heavy-duty transport, chemical production, and refinery decarbonization. Infrastructure modernization, pipeline connectivity, and partnerships with leading energy companies positioned the USA to become a competitive global hydrogen hub market in the next decade.

The UK recorded a rise in CAGR from 9.8% during 2020–2024 to 16.2% during 2025–2035, supported by the UK Hydrogen Strategy and government-backed investment exceeding £1 billion for production and storage hubs. Early development was restrained due to cost barriers and regulatory uncertainty, but post-2025, offshore wind-to-hydrogen projects gained momentum in regions such as Teesside and Scotland.

Partnerships between global energy firms and technology providers strengthened the domestic supply chain, ensuring cost competitiveness for industrial and transport applications. Hydrogen adoption in heavy-duty buses and rail systems accelerated deployment of fueling infrastructure. Integration with carbon capture facilities created favorable economics for blue and green hydrogen hubs, reinforcing the UK’s ambition to lead Europe in clean energy transition.

China achieved the highest growth, with CAGR increasing from 15.4% during 2020–2024 to 23.0% between 2025–2035, anchored by government-backed hydrogen roadmaps and aggressive infrastructure expansion. Pilot projects in Beijing and Shanghai laid the foundation during early years, focusing on fuel cell bus deployment and localized hubs.

Post-2025, China launched mega hydrogen clusters integrated with renewable energy bases in Inner Mongolia and Xinjiang, supported by state-owned enterprise investments. Declining electrolyzer costs, down by 35% since 2023, ueled competitiveness, enabling large-scale green hydrogen production for industrial use in steel and ammonia. Hydrogen fueling stations surpassed 2,500 units by 2030, creating robust mobility networks. This rapid expansion positions China as the global leader in hydrogen hub capacity and technological manufacturing capabilities.

India’s hydrogen hubs market jumped from a CAGR of 13.7% during 2020–2024 to 21.3% for 2025–2035, supported by its ambitious National Green Hydrogen Mission. Early years saw demonstration hubs focusing on refining and fertilizer industries, while post-2025, large-scale deployment accelerated near renewable-rich states like Gujarat and Rajasthan.

Government-backed production-linked incentives and subsidies reduced costs for electrolyzer manufacturing, ensuring domestic supply growth. International partnerships with leading energy players strengthened technology adoption and export capability, positioning India as a key hydrogen exporter by 2030. Industrial decarbonization in steel, cement, and heavy transport sectors became primary demand drivers, while blending hydrogen into natural gas grids was introduced to broaden applications.

France’s hydrogen hubs market reported a CAGR increase from 11.5% during 2020–2024 to 17.9% in 2025–2035, supported by strategic policies under its National Hydrogen Plan. Early deployment focused on decarbonizing transport through fuel cell buses and establishing small-scale hydrogen fueling stations.

After 2025, significant investments flowed into industrial clusters for steel and chemical sectors, with additional emphasis on integrating renewable energy sources into electrolysis projects. The country’s collaboration under the EU Hydrogen Backbone initiative improved pipeline infrastructure, linking hydrogen hubs to neighboring countries. France also invested in hydrogen storage solutions, enabling seasonal energy balancing and grid stability, critical for renewable integration. These advancements established France as a competitive hydrogen hub player in Europe.

The hydrogen hubs market is being transformed by global leaders that are channeling significant investments into production, storage, and distribution frameworks to build a reliable hydrogen economy. Air Liquide and Air Products and Chemicals, Inc. are at the forefront, spearheading large-scale green hydrogen projects and setting up advanced distribution networks to enhance supply reliability.

Linde plc and Engie SA are prioritizing strategic collaborations and integrating renewable energy with electrolysis technologies, positioning themselves as key players in Europe’s decarbonization efforts. Companies like Ballard Power Systems Inc., Plug Power Inc., and Nel ASA are innovating in fuel cell and electrolyzer solutions to meet rising demand from industrial users and the transportation sector, ensuring efficiency and scalability.

Automotive leaders such as Toyota Motor Corporation and Hyundai Motor Company are reinforcing hydrogen mobility initiatives with fuel cell vehicle production and expanding hydrogen refueling networks across major economies. Siemens Energy and Mitsubishi Power are contributing by advancing large-scale electrolysis systems aimed at driving down hydrogen production costs. Shell Hydrogen continues to grow its portfolio by developing comprehensive mobility hubs and green fueling stations globally.

ITM Power plc and McPhy Energy are introducing modular electrolyzer units to enable decentralized hydrogen generation, particularly for regional and industrial applications. Collectively, these initiatives and partnerships underline a global commitment to making hydrogen hubs integral to clean energy ecosystems, supporting carbon-neutral industrial operations and sustainable transportation solutions worldwide.

In April 2025, Toyota Motor Corporation launched a public-facing "Toyota Hydrogen Solutions" portal to support commercial hydrogen applications, including trucks and stationary power

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Hydrogen Type | Liquid Hydrogen and Hydrogen Fuel Cells |

| Supply Technique | Electrolysis and Steam Methane Reforming (SMR) |

| End-use Industry | Automotive, Aviation, Marine, Space, Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Air Products and Chemicals, Inc., Ballard Power Systems Inc., Engie SA, Hydrogenics (a subsidiary of Cummins Inc.), Hyundai Motor Company, ITM Power plc, Linde plc, McPhy Energy, Mitsubishi Power, Nel ASA, Plug Power Inc., Shell Hydrogen, Siemens Energy, and Toyota Motor Corporation |

| Additional Attributes | Dollar sales, share by production method and region, cost competitiveness, policy incentives, key partnerships, infrastructure investment trends, demand drivers, and growth forecasts for industrial and mobility applications. |

The global hydrogen hubs market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the hydrogen hubs market is projected to reach USD 9.9 billion by 2035.

The hydrogen hubs market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in hydrogen hubs market are liquid hydrogen and hydrogen fuel cells.

In terms of supply technique, electrolysis segment to command 46.7% share in the hydrogen hubs market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA