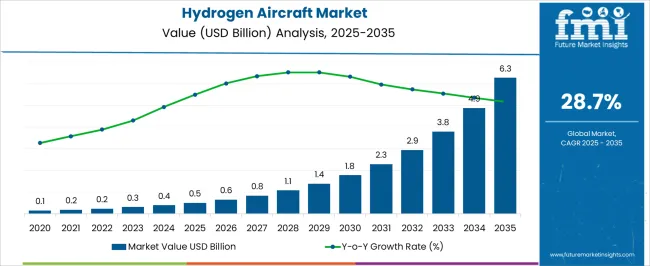

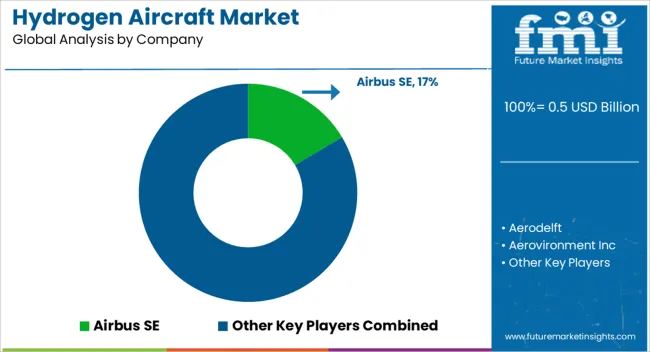

The hydrogen aircraft market is estimated to be valued at USD 0.5 billion in 2025 and is projected to reach USD 6.3 billion by 2035, registering a compound annual growth rate (CAGR) of 28.7% over the forecast period.

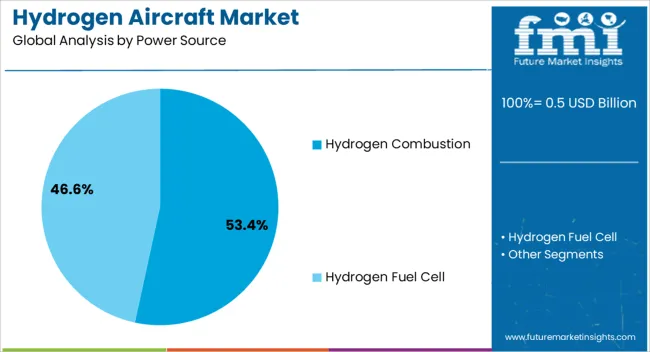

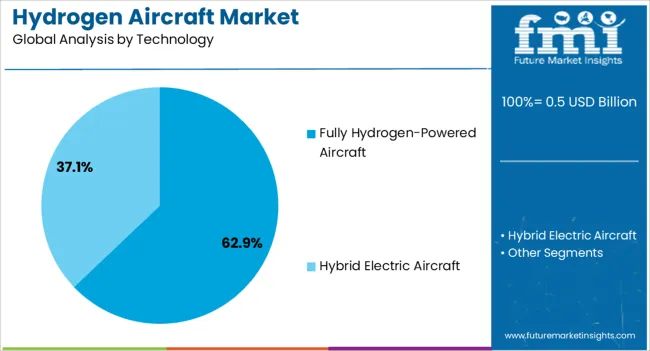

This sharp growth trajectory emphasizes the disruptive role of hydrogen-based aviation solutions in reshaping propulsion technologies. The contribution analysis by technology reveals that hydrogen fuel cells and hydrogen combustion engines are the two dominant approaches shaping adoption. Fuel cells are increasingly viewed as the more scalable pathway for regional and short-haul aircraft, offering high efficiency, lower emissions, and silent operations.

Their contribution is expected to accelerate rapidly from the early years, aligning with advancements in lightweight storage tanks and infrastructure. Hydrogen combustion engines, on the other hand, are expected to maintain a vital role during the forecast period, particularly as transitional technology. Their ability to leverage modified turbine systems while utilizing hydrogen fuel provides a bridge for aircraft manufacturers seeking to adapt existing fleets. Over time, their contribution may decline relative to fuel cells, but they remain crucial for larger aircraft where energy density requirements are higher. Hybrid hydrogen-electric configurations also emerge as complementary contributors, especially after 2030, as battery integration with fuel cells improves. These technological contributions underpin the markets exponential scaling while balancing near-term feasibility with long-term sustainability in aviation propulsion.

| Metric | Value |

|---|---|

| Hydrogen Aircraft Market Estimated Value in (2025 E) | USD 0.5 billion |

| Hydrogen Aircraft Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 28.7% |

The hydrogen aircraft market represents an emerging segment within the aerospace and clean aviation industry, emphasizing zero emission propulsion and alternative fuel adoption. Within the overall aircraft propulsion systems market, it accounts for about 2.6%, reflecting its early stage but growing relevance. In the sustainable aviation fuel and alternative energy sector, it holds nearly 3.1%, highlighting its role as a long term solution beyond biofuels. Across the commercial aircraft innovation market, the segment captures 1.9%, supported by pilot projects and prototype testing. Within the regional and short haul aviation sector, it represents 2.2%, showcasing early adoption potential. In the aerospace research and development category, it secures 3.7%, emphasizing rising investment in hydrogen combustion and fuel cell technologies. Recent developments in this market have centered on propulsion innovation, infrastructure development, and strategic alliances.

Advances include hydrogen powered fuel cell systems integrated into small scale aircraft and test flights of hydrogen combustion engines. Key players are collaborating with aerospace OEMs, energy companies, and airport operators to develop hydrogen storage, refueling, and distribution networks. Lightweight composite tanks and cryogenic storage systems are being engineered to address fuel density challenges. Hybrid architectures combining batteries and hydrogen are gaining momentum to extend flight ranges. Governments and aviation regulators are funding demonstration projects and offering incentives for zero emission aviation. These advancements demonstrate how innovation, collaboration, and infrastructure readiness are shaping the market.

The hydrogen aircraft market is gaining momentum, driven by the global aviation industry’s transition toward sustainable propulsion systems and the push for carbon-neutral air travel. Government-backed initiatives, technological advancements in hydrogen storage and fuel systems, and collaborations between aerospace manufacturers and energy providers are accelerating development timelines. Demonstration projects and prototype launches have increased investor confidence, while regulatory bodies are providing frameworks to support certification and commercialization.

Rising environmental concerns and the need to comply with stricter emission targets are prompting airlines and aircraft manufacturers to explore hydrogen as a viable alternative to fossil fuels. The market outlook is further supported by investments in hydrogen production infrastructure, including green hydrogen facilities, which will be crucial for long-term operational scalability.

Advancements in hydrogen combustion technology and fully hydrogen-powered aircraft designs are expected to shape the competitive landscape, with significant adoption anticipated in short to medium-haul flight ranges.

The hydrogen aircraft market is segmented by power source, technology, range, passenger capacity, application, and geographic regions. By power source, hydrogen aircraft market is divided into hydrogen combustion and hydrogen fuel cell. In terms of technology, hydrogen aircraft market is classified into fully hydrogen-powered aircraft and hybrid electric aircraft. Based on range, hydrogen aircraft market is segmented into up to 1000 km, 1000 km to 2000 km, and over 2000 km. By passenger capacity, hydrogen aircraft market is segmented into up to 4 passengers, 5 to 10 passengers, and more than 10 passengers. By application, hydrogen aircraft market is segmented into commercial and military & defense. Regionally, the hydrogen aircraft industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hydrogen combustion segment is projected to account for 53.4% of the hydrogen aircraft market revenue in 2025, positioning it as the leading power source. This dominance is supported by its technical compatibility with modified turbine engines, which allows for faster integration into existing aircraft designs compared to fuel cell systems. Industry testing has demonstrated that hydrogen combustion can deliver high thrust performance while significantly reducing CO₂ emissions. Additionally, the relative familiarity of combustion engine technology to aerospace engineers reduces the complexity of pilot training and maintenance adaptation. The scalability of hydrogen combustion for various aircraft classes, from small regional jets to larger commercial models, has also contributed to its wider acceptance. As research continues to improve combustion efficiency and address challenges such as NOx emissions, the Hydrogen Combustion segment is expected to remain a preferred choice for manufacturers seeking near-term deployment solutions.

The fully hydrogen-powered aircraft segment is projected to hold 62.9% of the hydrogen aircraft market revenue in 2025, making it the leading technology category. This segment benefits from its potential to achieve zero in-flight carbon emissions, positioning it as a central solution to aviation’s decarbonization goals. Developments in hydrogen storage, lightweight composite materials, and propulsion integration are enabling manufacturers to design aircraft optimized for hydrogen from the ground up, rather than adapting existing fossil fuel-based designs. The segment’s momentum is further supported by demonstration programs from leading aerospace firms, which are showcasing operational feasibility for commercial passenger services. Additionally, international policy frameworks and green aviation funding programs are providing the financial and regulatory support needed for large-scale adoption. The Fully Hydrogen-Powered Aircraft segment is expected to be instrumental in redefining future aircraft design standards and operational models.

The up to 1000 km segment is projected to represent 39.7% of the hydrogen aircraft market revenue in 2025, leading in terms of operational range. This segment’s growth is driven by the suitability of hydrogen propulsion for short to medium-haul flights, where infrastructure limitations and refueling logistics are more manageable. Aircraft in this range category are ideal for regional connectivity, providing airlines with an opportunity to offer sustainable services on high-frequency routes. The segment also aligns with the initial deployment strategies of hydrogen aircraft manufacturers, who are prioritizing shorter ranges to optimize weight, storage volume, and energy efficiency. Market adoption in this category is further supported by regional airports and government-backed pilot projects, which can implement hydrogen refueling facilities with lower capital investment compared to long-haul hubs. As the technology matures and fueling networks expand, the Up to 1000 km range segment is expected to remain the foundation for early commercial operations.

The market has been gaining momentum as the aviation industry seeks viable pathways to reduce carbon emissions and address fuel efficiency challenges. Hydrogen is being explored as both a direct combustion fuel and a feedstock for fuel cells that can power electric propulsion systems. Compared with conventional jet fuel, hydrogen offers higher energy density by weight and produces only water vapor as its main emission. Aircraft manufacturers, airlines, and governments are investing in pilot projects and prototype developments to evaluate the feasibility of hydrogen-powered aviation.

Global aviation faces mounting pressure to address its contribution to greenhouse gas emissions, which has fueled interest in hydrogen-based propulsion technologies. Regulatory frameworks and international climate agreements are pushing airlines and aircraft manufacturers to reduce dependency on fossil-based jet fuels. Hydrogen offers a pathway for achieving carbon-neutral or near-zero emission flights, especially for regional and medium-range operations. Several leading aerospace companies are conducting flight demonstrations and engineering studies on hydrogen-powered aircraft concepts. The ability of hydrogen to deliver significant reductions in carbon intensity compared with synthetic aviation fuels has positioned it as a leading candidate for decarbonization. This shift is being supported by government subsidies and research funding aimed at accelerating innovation in green aviation technologies.

Advancements in hydrogen storage, fuel cell technologies, and propulsion integration are playing a vital role in the progress of hydrogen aircraft development. Modern cryogenic storage methods are enabling the safe handling of liquid hydrogen at extremely low temperatures, while lightweight composite tanks are improving efficiency. Fuel cell systems are being engineered to deliver reliable power to electric propulsion units, supporting quieter and more efficient flight operations. Hybrid propulsion models combining fuel cells with hydrogen combustion turbines are also under exploration. The ongoing refinement of these technologies is expected to overcome technical barriers and improve performance. Continuous innovation has therefore become central to achieving the scalability and reliability required for commercial deployment of hydrogen-powered aircraft.

Despite its promise, the hydrogen aircraft market is constrained by the lack of adequate refueling and distribution infrastructure. Establishing hydrogen production facilities, liquefaction plants, and airport refueling stations requires significant investment and cross-industry collaboration. Airlines and airport authorities must address logistical challenges related to transporting, storing, and handling hydrogen safely at scale. The development of hydrogen supply chains must align with renewable energy production to ensure that aviation hydrogen is produced sustainably. Without such infrastructure, the widespread deployment of hydrogen aircraft remains limited to demonstration projects and regional test flights. These constraints are expected to shape the pace and extent of hydrogen adoption in global aviation markets.

Cost competitiveness continues to be a major factor affecting the market readiness of hydrogen aircraft. Producing green hydrogen through electrolysis remains more expensive than conventional jet fuels, raising concerns about the economic feasibility of large-scale adoption. Airlines must balance sustainability objectives with operational profitability, creating pressure on developers to deliver cost-effective solutions. Government incentives, carbon pricing mechanisms, and long-term fuel cost savings could improve adoption prospects. The high upfront investment required for aircraft redesign, infrastructure development, and certification processes adds complexity. Economic viability will therefore depend on a combination of technological breakthroughs, supportive policies, and gradual scaling of production to reduce costs across the hydrogen aviation ecosystem.

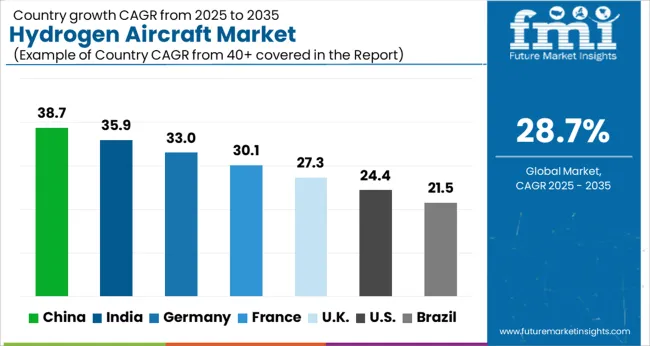

| Country | CAGR |

|---|---|

| China | 38.7% |

| India | 35.9% |

| Germany | 33.0% |

| France | 30.1% |

| U.K. | 27.3% |

| U.S. | 24.4% |

| Brazil | 21.5% |

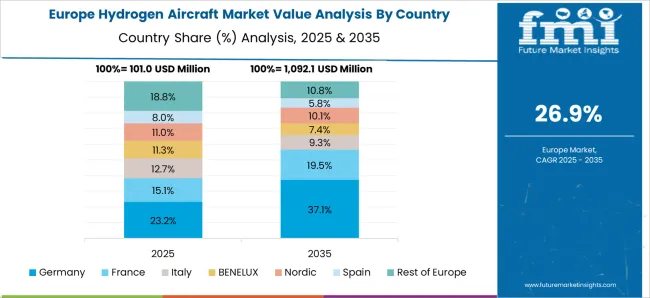

The market is anticipated to record exceptional expansion with significant emphasis on decarbonizing aviation and introducing next generation propulsion systems. China stands at the forefront with 38.7% growth, supported by large scale investments in hydrogen infrastructure and domestic aerospace manufacturing. India follows with 35.9%, driven by government backed clean aviation initiatives and a rising aerospace ecosystem. Germany achieves 33.0%, where technological innovation and partnerships with leading aircraft manufacturers enhance adoption. The United Kingdom secures 27.3%, propelled by strong R&D programs and commercial pilot projects. The United States registers 24.4%, reflecting progress in fuel cell technology and collaborations between aerospace and energy industries. Together, these markets demonstrate a transformative shift in aviation, positioning hydrogen powered aircraft as a cornerstone of future mobility strategies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to advance at a CAGR of 38.7%, showcasing the country’s strong push toward decarbonizing aviation. Investments in hydrogen propulsion systems and the development of supporting infrastructure are accelerating adoption. Leading domestic manufacturers are actively collaborating with research institutes and international firms to advance fuel cell technology and ensure compatibility with next-generation aircraft. Airports in China are gradually preparing to adapt refueling systems and ground operations for hydrogen-powered aviation. Government initiatives promoting clean energy adoption in transportation further strengthen the business case for hydrogen-based aviation. The transition toward sustainable aviation is being viewed as a national priority, with hydrogen aircraft emerging as a viable pathway to reducing carbon emissions.

In India, the market is anticipated to grow at a CAGR of 35.9%, reflecting the government’s focus on clean energy aviation. Efforts to reduce dependency on fossil fuels and growing environmental concerns are shaping new investment patterns. Aviation authorities are evaluating hydrogen as an alternative propulsion source, while domestic carriers are showing interest in pilot projects for future adoption. Research and development initiatives are being strengthened through collaborations with global aerospace companies. The need to meet international climate commitments and support sustainable aviation practices is creating momentum for hydrogen-powered aircraft. Infrastructure planning for hydrogen supply chains and airport readiness is also gaining attention. This transition positions hydrogen aviation as a potential solution to India’s long-term carbon neutrality goals.

The market in Germany is forecast to expand at a CAGR of 33.0%, supported by strong investments in sustainable aviation technologies. The country is positioning itself as a leader in hydrogen innovation, with national aerospace programs integrating hydrogen propulsion into long-term strategies. Collaborations between aerospace manufacturers, research centers, and government agencies are shaping the development of hydrogen-based flight solutions. German airports are also preparing for hydrogen refueling and operational adjustments to accommodate new technologies. A strong regulatory framework and emphasis on reducing carbon emissions in aviation are driving momentum. The long-standing expertise of German engineering firms in fuel cell technologies provides a foundation for advancing this market. Market players are expected to focus on both domestic adoption and export opportunities.

The market in the United Kingdom is projected to grow at a CAGR of 27.3%, reflecting government initiatives to accelerate aviation decarbonization. National programs are being launched to support hydrogen propulsion research, with aerospace companies and universities collaborating on prototypes. Airports are examining the integration of hydrogen infrastructure to ensure long-term readiness for commercial adoption. The market is benefiting from targeted funding programs aimed at reducing aviation’s carbon footprint. International partnerships with European and North American firms are also enabling technology transfer and knowledge sharing. Public and private stakeholders are aligning their strategies to ensure that hydrogen aircraft becomes a viable pathway for clean aviation. This long-term direction enhances the United Kingdom’s role in global sustainable aerospace developments.

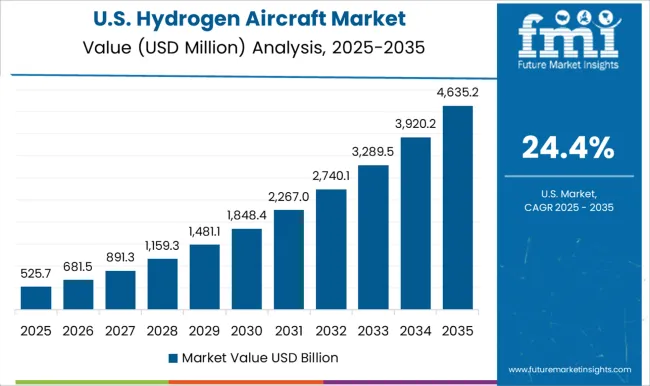

The market in the United States is expected to register a CAGR of 24.4%, driven by rising interest in sustainable aviation and decarbonization targets. Federal initiatives and aerospace innovation programs are encouraging the adoption of hydrogen technologies. Leading American aerospace firms are investing heavily in developing prototypes and exploring fuel cell integration for future aircraft models. Universities and research labs are playing a crucial role in advancing hydrogen propulsion systems. The U.S. aviation sector is also exploring partnerships with international stakeholders to accelerate technology adoption. Infrastructure readiness, including hydrogen fueling systems at airports, is beginning to gain consideration. The growing focus on reducing the aviation sector’s carbon emissions underpins the long-term potential of hydrogen aircraft in the U.S.

The market is gaining momentum as aerospace manufacturers and innovators explore sustainable propulsion technologies to reduce carbon emissions and dependence on fossil fuels. Airbus SE leads the market with significant investments in hydrogen-powered aviation concepts, including its ZEROe program, targeting commercial adoption in the coming decades. Aerodelft and Aerovironment Inc. represent pioneers in experimental and unmanned hydrogen aircraft development, focusing on advancing fuel cell integration and lightweight structures. Apus Group and Flyka are emerging players concentrating on regional and urban mobility applications powered by hydrogen systems. GKN Aerospace, under Melrose Industries Plc., plays a vital role in component development, leveraging expertise in propulsion systems and composite materials to support hydrogen aviation.

Hes Energy Systems has been advancing hydrogen fuel cell technologies for aerial applications, while Pipistrel D.O.O has contributed with electric and hybrid solutions and is exploring hydrogen-powered aircraft integration. Skai, under Alaka’i Technologies, and Urban Aeronautics Ltd. focus on hydrogen-driven vertical take-off and landing aircraft that cater to air taxi and urban air mobility markets. ZeroAvia Inc. has established itself as a front-runner in hydrogen-electric propulsion, conducting successful test flights and building partnerships with global airlines. Together, these companies highlight a competitive yet collaborative ecosystem where hydrogen propulsion is expected to play a transformative role in the future of aviation.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.5 billion |

| Power Source | Hydrogen Combustion and Hydrogen Fuel Cell |

| Technology | Fully Hydrogen-Powered Aircraft and Hybrid Electric Aircraft |

| Range | Up to 1000 km, 1000 km to 2000 km, and Over 2000 km |

| Passenger Capacity | Up to 4 Passengers, 5 to 10 Passengers, and More than 10 Passengers |

| Application | Commercial and Military & Defense |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airbus SE, Aerodelft, Aerovironment Inc, Apus Group, Flyka, GKN Aerospace (Under Melrose Industries Plc.), Hes Energy Systems, Pipistrel D.O.O, Skai (Under Alaka’i Technologies), Urban Aeronautics Ltd., and ZeroAvia Inc. |

| Additional Attributes | Dollar sales by aircraft type and propulsion system, demand dynamics across commercial, cargo, and defense aviation sectors, regional trends in hydrogen fuel adoption, innovation in storage systems, fuel cell efficiency, and lightweight materials, environmental impact of reduced carbon emissions and fuel infrastructure challenges, and emerging use cases in zero-emission air travel, regional connectivity, and next-generation sustainable aviation. |

The global hydrogen aircraft market is estimated to be valued at USD 0.5 billion in 2025.

The market size for the hydrogen aircraft market is projected to reach USD 6.3 billion by 2035.

The hydrogen aircraft market is expected to grow at a 28.7% CAGR between 2025 and 2035.

The key product types in hydrogen aircraft market are hydrogen combustion and hydrogen fuel cell.

In terms of technology, fully hydrogen-powered aircraft segment to command 62.9% share in the hydrogen aircraft market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenated Palm Oil Market

Hydrogenerators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA