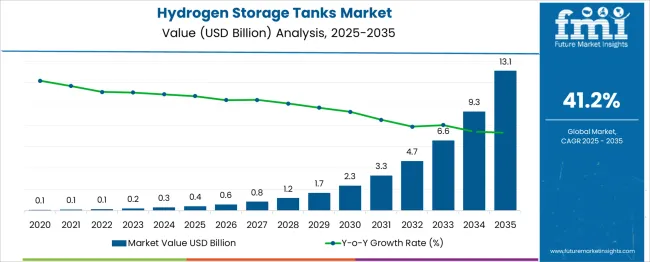

The Hydrogen Storage Tanks Market is estimated to be valued at USD 0.4 billion in 2025 and is projected to reach USD 13.1 billion by 2035, registering a compound annual growth rate (CAGR) of 41.2% over the forecast period.

The growth reflects a foundational shift in global energy systems as hydrogen transitions from niche pilot projects to mainstream energy and mobility solutions. By 2030, the market is expected to reach USD 2.3 billion, representing a five-year absolute gain of USD 1.9 billion.

This early-stage expansion more than fivefold from the 2025 baseline is largely driven by increasing demand for high-pressure tanks in fuel cell electric vehicles, especially in freight and public transport fleets. Type III and Type IV composite tanks, which offer a superior strength-to-weight ratio, are expected to account for the majority of this value growth due to their efficiency and compatibility with emerging mobility standards.

Regions such as Europe, South Korea, Japan, and parts of North America are accelerating hydrogen investments, creating strong downstream demand for safe, lightweight storage solutions. As hydrogen becomes critical for decarbonizing industrial, transport, and power sectors, storage tank technologies will see consistent upgrades, making this market one of the highest-yielding segments in clean energy infrastructure.

| Metric | Value |

|---|---|

| Hydrogen Storage Tanks Market Estimated Value in (2025 E) | USD 0.4 billion |

| Hydrogen Storage Tanks Market Forecast Value in (2035 F) | USD 13.1 billion |

| Forecast CAGR (2025 to 2035) | 41.2% |

The global hydrogen storage tank market is led by transportation applications, representing over 55% of total demand in 2026. This dominance reflects widespread deployment of fuel cell electric vehicles, particularly in regions pushing hard on clean transportation infrastructure. High-pressure compressed hydrogen tanks especially Type III and IV composite tanks are rapidly becoming standard in passenger cars, buses, and heavy-duty trucks due to their strength-to-weight ratio and fast-fill capabilities. The stationary power generation segment, handling grid-level energy storage and hydrogen plants, occupies around 22% of the market. This sector uses larger, often metal or metal–composite storage systems to enable backup power, surplus renewable energy storage, or decarbonized industrial heat generation. Industrial hydrogen use, including chemical processing, refining, and steel production, makes up about 13%, with tanks chosen for corrosion resistance and safety in high-temperature environments. Lastly, portable power applications, such as off-grid units, military power systems, and remote installations, account for roughly 10% of demand, using compact metal hydride or low-pressure tanks where mobility and safety are crucial. With composite materials forecast to exceed 55% of tank material share by 2037 and high-pressure (200–500 bar) dominance, the market reflects a structured segmentation driven by application-specific requirements.

The hydrogen storage tanks market is gaining strong momentum as global initiatives push toward decarbonization and the wider deployment of hydrogen-powered systems. A growing need for efficient, safe, and lightweight storage solutions has encouraged the shift from conventional metallic tanks to composite-based structures. Increasing investment in hydrogen-powered vehicles, including buses, trucks, and trains, has driven the demand for tanks that can support higher pressures without adding substantial weight.

The integration of tanks into fuel cell systems across mobility and stationary energy applications is being supported by advancements in material science, pressure vessel engineering, and regulatory certifications. Partnerships among automakers, energy conglomerates, and composite tank manufacturers have accelerated product development cycles and commercial readiness.

Policies promoting hydrogen infrastructure deployment and green hydrogen production are expected to stimulate demand for advanced tanks across distribution, storage, and transport. The industry outlook remains positive as stakeholders prioritize durability, weight reduction, and operational safety, paving the way for scalable adoption across both on-road and off-road use cases.

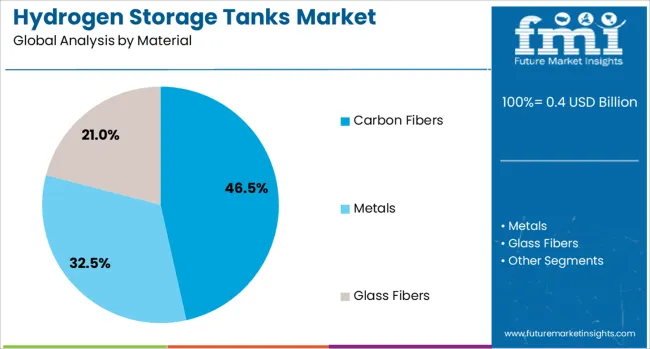

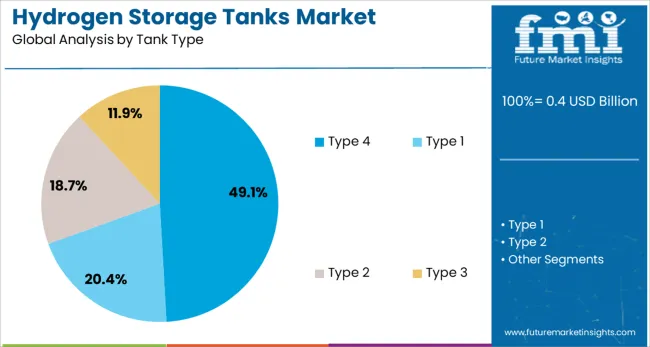

The hydrogen storage tanks market is segmented by material, tank type, pressure range, storage form, application, and geographic regions. The market for hydrogen storage tanks is divided into Carbon Fibers, Metals, and Glass Fibers. The hydrogen storage tanks market is classified into Type 4, Type 1, Type 2, and Type 3.

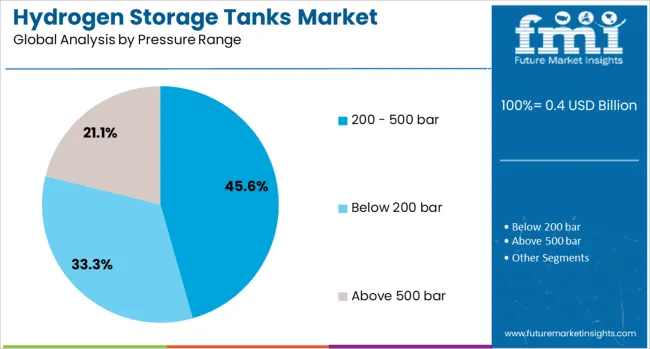

Based on the pressure range of the hydrogen storage tanks, the market is segmented into 200 - 500 bar, below 200 bar, and above 500 bar. The storage form of the hydrogen storage tanks market is segmented into Physical-Based and Material-Based. By application of the hydrogen storage tanks market is segmented into Transportation, Industrial, and Others. Regionally, the hydrogen storage tanks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Carbon fibers are projected to hold 46.5% of the material-based revenue share in the hydrogen storage tanks market in 2025, making it the dominant material segment. This leadership position is being reinforced by the increasing requirement for high-strength, lightweight composites that can endure high-pressure storage environments without structural degradation. Carbon fibers have been preferred for their superior tensile strength-to-weight ratio, which directly supports the development of fuel-efficient hydrogen mobility systems.

Their compatibility with advanced epoxy and polymer linings has enabled better performance under cyclical loading and extreme temperature conditions. The reduced mass of carbon fiber tanks contributes significantly to vehicle range optimization, especially in long-haul and commercial transport fleets.

The material’s growing adoption is also supported by declining production costs due to scaling efforts by major fiber manufacturers and supply chain localization. As automotive, aerospace, and industrial hydrogen applications demand more agile and efficient storage options, carbon fiber-based tanks are positioned as the material of choice in forward-looking hydrogen infrastructure programs.

Type 4 tanks are expected to account for 49.1% of the tank type revenue share in the hydrogen storage tanks market by 2025, reflecting their growing prominence in advanced hydrogen storage systems. The rise of Type 4 tanks has been influenced by their all-composite construction with polymer liners, which ensures substantial weight savings and corrosion resistance compared to metallic or hybrid counterparts.

These tanks have gained widespread deployment in mobility applications such as hydrogen-powered buses, trucks, and refueling stations due to their ability to sustain high-pressure loads while offering flexibility in shape and integration. Their enhanced fatigue life, lower maintenance requirements, and compliance with stringent global safety standards have positioned them as the preferred choice for OEMs and fleet operators.

The capacity to handle pressure cycles with minimal performance degradation has strengthened their use in continuous-duty operations. As hydrogen distribution networks expand and fuel cell vehicle platforms evolve, Type 4 tanks are likely to see sustained demand owing to their superior performance characteristics and evolving production capabilities.

The 200 to 500 bar pressure range is anticipated to command 45.6% of the hydrogen storage tanks market revenue share in 2025, making it the leading segment in terms of operating pressure. The dominance of this pressure range is being driven by its suitability across a broad spectrum of hydrogen mobility and refueling applications where moderate pressure is required to ensure storage efficiency and safety.

Tanks in this range offer an optimal balance between energy density and structural stability, enabling secure storage during transport and use in medium- to long-range vehicles. The segment’s growth is being supported by regulatory acceptance across key markets, as well as standardization efforts in vehicle platforms and fueling protocols.

Additionally, system integrators and fuel cell solution providers have increasingly favored this range for infrastructure compatibility, reduced compression energy needs, and manageable engineering complexities. As adoption widens across logistics, public transport, and light commercial vehicle categories, the 200 to 500 bar segment is expected to maintain its lead in supporting the transition to hydrogen-based energy systems.

Growing demand for clean energy infrastructure and hydrogen fuel applications is boosting the hydrogen storage tanks sector. Adoption spans commercial vehicles, industrial gas, and grid-scale energy storage without the need for physical hydrogen pipelines.

Hydrogen refueling station operators and fuel cell vehicle OEMs are choosing high-pressure composite storage tanks and advanced solid-state tank designs for onsite infrastructure. These tanks enable safe hydrogen containment up to 700 bar while meeting weight, space and regulatory safety specifications. Demand is increasing in sectors such as transportation, logistics fleets, and mobile refueling trailers. Operators prioritize durability under pressure cycling, temperature swings, and transport. Certified container designs and standardized assemblies simplify installation timing across regions. With expanding hydrogen mobility adoption, the need for reliable, refuellable storage infrastructure supports predictable demand for engineered tank systems that meet performance and safety thresholds in demanding service paces.

Opportunities lie in providing modular tank skids that integrate with compressors, fuel dispensers, and safety controls ideal for phased deployment at fueling or industrial gas facilities. Tank access-as-a-service models let smaller operators reduce upfront infrastructure costs by subscribing to equipment use and regular maintenance support. Regional fabrication hubs near industrial or transport clusters help shorten lead times and adapt tanks to local codes. Partnerships with energy integrators, OEM vehicle fleets, or green hydrogen producers enable bundled installations of storage, fueling and vehicle systems. Pilots offering standardized tank modules tailored for hydrogen hubs or farm-based electrolysis systems support scalable rollout. These approaches help reduce barriers to entry and enhance acceptance across hydrogen deployment use cases.

Manufacturers of hydrogen storage tanks must manage high production costs driven by advanced materials and precision fabrication. Composite tanks particularly Types III, IV, and emerging Type V require carbon fiber and polymer liners, inflating material costs. Supply of carbon fiber and other composite feedstocks remains constrained, creating potential bottlenecks. The complexity of manufacturing these pressure-rated vessels demands specialized skills and cleanroom conditions, further raising production overhead. Small-scale producers face capital barriers during scale-up. Logistics for fragile composite cylinders increase transport challenges. Customers deploying heavy-duty vehicles or industrial gas systems may be deterred by premium pricing unless long-term cost savings from lightweight designs are demonstrated. Without improved economies of scale or alternative materials, tank manufacturers remain exposed to supply volatility and price sensitivity in competitive procurement environments

Hydrogen-powered mobility and industrial sectors offer significant opportunity for tank adoption, especially demand for high-pressure storage above 500 bars. This segment holds the largest volume share due to heavy-duty transport use and fuel cell vehicle deployment enabling longer range per vehicle. Industrial users such as refineries, chemical plants, and hydrogen fueling stations also require modular tank arrays for compressed or liquid hydrogen delivery. Growing national hydrogen strategies and corridor development support multi-application deployment across logistics, stationary power support, and mobility infrastructure. Manufacturers offering certified, high-pressure composite tanks optimized for refueling stations and vehicle use gain market preference. Integration of lightweight, robust storage units supports modular fleet operations in remote areas and heavy-vehicle fleets seeking fast refueling with minimal onboard weight

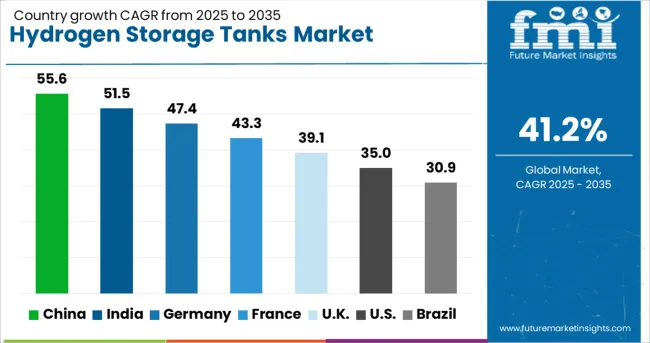

| Country | CAGR |

|---|---|

| China | 55.6% |

| India | 51.5% |

| Germany | 47.4% |

| France | 43.3% |

| UK | 39.1% |

| USA | 35.0% |

| Brazil | 30.9% |

China, part of the BRICS group, is projected to grow at a 55.6% CAGR from 2025 to 2035, supported by a national rollout of hydrogen fuel cell infrastructure and extensive investment in Type IV composite tank manufacturing. India, also in BRICS, follows at 51.5%, where government-led mobility programs and public–private partnerships are accelerating the development of on-board and stationary hydrogen storage systems. Within the OECD, Germany is expanding at 47.4%, with consistent integration of hydrogen tanks into freight transport solutions and industrial decarbonization zones. France, recording 43.3% growth, continues to scale storage systems for green hydrogen hubs focused on long-haul transport and distributed power applications. The United Kingdom, at 39.1%, is deploying storage units in marine pilot projects, hydrogen refueling stations, and backup power systems for grid resiliency. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The hydrogen storage tanks market in China is expanding rapidly at a growth rate of 55.6% due to increasing usage across energy, transport, and industrial sectors. Widespread deployment in hydrogen-powered mobility and stationary power systems is propelling market momentum. Domestic manufacturers are increasing output of Type III and Type IV composite tanks to serve electric vehicles and fixed installations. Cylinders rated for high pressure are being built to meet international standards. Demand is rising for lightweight and high-capacity storage options using advanced materials. Innovations in resin technology and filament winding methods are improving strength and performance.

India is seeing strong demand for hydrogen storage tanks, growing at 51.5% annually, supported by developments in clean energy transport and industrial applications. Composite tank adoption is increasing in demonstration and pilot fuel cell vehicle programs. Domestic production is scaling with government and private collaboration. Use in onboard vehicle storage, energy buffers, and mobile supply systems is creating new opportunities. Manufacturers are improving tank linings and materials to meet thermal and mechanical durability needs. Interest is also growing in medium-size tanks for city transit and logistics use cases.

Germanys hydrogen storage tanks market is growing at 47.4% per year as demand increases across mobility, industrial gas, and backup power applications. Domestic engineering companies are developing precision testing and production capabilities for Type IV composite tanks. Automotive and energy sectors are requesting modular, lightweight tanks that meet European standards. Utility-scale projects and transport initiatives are placing consistent orders. Structural testing for burst protection and leak control is guiding design improvements. Carbon fiber tanks are leading usage in high-pressure scenarios for vehicles and distributed systems.

Hydrogen tank demand in France is rising at a rate of 43.3% per year, driven by investment in hydrogen-powered mobility and energy systems. Composite tank manufacturing is increasing to meet needs in vehicles and fixed infrastructure. Modular tanks with flexible form factors are being created to simplify integration. Manufacturers are ensuring quality through automated testing aligned with EU safety protocols. Design is focused on reducing weight while maintaining strength for large-scale vehicle conversions. Orders for preconfigured tank sets are increasing among municipal service providers and industrial buyers.

In the United Kingdom, market is seeing growth in hydrogen storage tank use at 39.1% annually as clean energy projects expand into public transport, marine, and hybrid energy systems. Domestic production of high-pressure tanks is being strengthened with improved materials and testing methods. Projects involving ferries, trains, and utility vehicles are adopting pressure-rated tanks built for confined spaces. Design partnerships with automakers and marine firms are improving mounting and safety performance. Tank systems are gaining popularity in modular infrastructure where compact energy storage is needed.

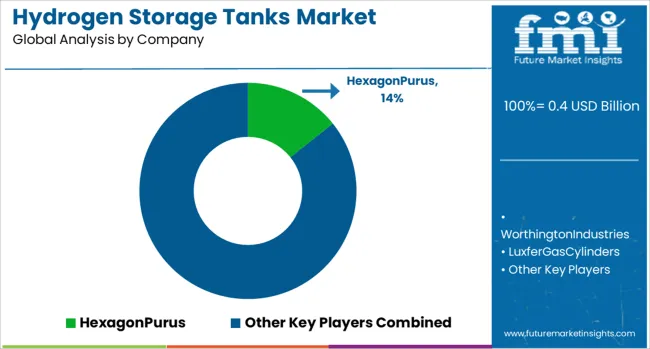

The hydrogen storage tanks market is evolving rapidly, driven by increasing demand for clean energy applications in transport, industry, and energy storage. Suppliers are segmented into Tier 1, Tier 2, and Tier 3 categories based on scale, innovation, and application specialization. In the Tier 1 segment, Hexagon Purus leads with advanced Type IV composite tanks engineered for lightweight and high-pressure hydrogen storage. These tanks are widely deployed in fuel cell electric vehicles, buses, and heavy-duty transport.

Worthington Industries, Luxfer Gas Cylinders, and Quantum Fuel Systems also hold key Tier 1 positions, bringing decades of experience in high-pressure gas containment and system integration for hydrogen mobility and stationary applications. Tier 2 manufacturers, including Plastic Omnium, NPROXX, and Doosan Mobility Innovation, specialize in modular and compact tank systems designed for next-generation applications such as drones, small fuel cell vehicles, and portable backup energy units. These companies focus on balancing performance, cost-efficiency, and adaptability across emerging hydrogen sectors.

Tier 3 players like Mahytec, Steelhead Composites, Umoe Advanced Composites, and ECS cater to niche requirements in marine transport, industrial hydrogen storage, and decentralized hydrogen networks. Their offerings emphasize flexibility, rugged construction, and compliance with diverse regulatory standards. Emerging firms such as BayoTech, Weldship, Pragma Industries, and Hensoldt are pushing the boundaries of innovation by developing customized pressure vessels, localized manufacturing capabilities, and integrated hydrogen logistics solutions. Together, these suppliers are shaping a dynamic market ecosystem focused on enabling hydrogen as a viable, scalable energy carrier across global economies.

On April 17, 2025, Hylium Industries Inc. officially confirmed it signed an agreement to supply high-capacity liquefied hydrogen storage tanks to AirFirst Co. in South Korea. These advanced tanks are engineered to minimize boil off and maintain pressure and thermal stability during transportation and prolonged storage

| Item | Value |

|---|---|

| Quantitative Units | USD 0.4 Billion |

| Material | Carbon Fibers, Metals, and Glass Fibers |

| Tank Type | Type 4, Type 1, Type 2, and Type 3 |

| Pressure Range | 200 - 500 bar, Below 200 bar, and Above 500 bar |

| Storage Form | Physical Based and Material Based |

| Application | Transportation, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | HexagonPurus, WorthingtonIndustries, LuxferGasCylinders, QuantumFuelSystems, PlasticOmnium, NPROXX, DoosanMobilityInnovation, SteelheadComposites, Mahytec, BayoTech, UmoeAdvancedComposites, ECS, Weldship, PragmaIndustries, and Hensoldt |

| Additional Attributes | Dollar sales by tank type such as metal, composite, hydride or cryogenic, pressure rating from low to above 500 bar, and application including stationary storage, transport fueling, and industrial use; demand driven by fuel cell vehicle rollout, renewable energy integration, and energy transition policies; innovation in lightweight composite and hybrid materials; cost shaped by raw-materials and pressure ratings; and rising use in mobility, backup power, and seasonal storage. |

The global hydrogen storage tanks market is estimated to be valued at USD 0.4 billion in 2025.

The market size for the hydrogen storage tanks market is projected to reach USD 13.1 billion by 2035.

The hydrogen storage tanks market is expected to grow at a 41.2% CAGR between 2025 and 2035.

The key product types in hydrogen storage tanks market are carbon fibers, metals and glass fibers.

In terms of tank type, type 4 segment to command 49.1% share in the hydrogen storage tanks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenated Palm Oil Market

Hydrogenerators Market

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA