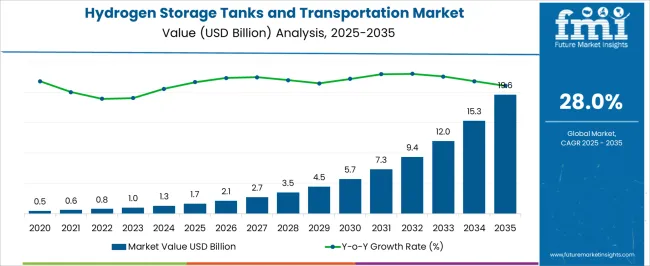

In 2025, the hydrogen storage tanks and transportation market is valued at USD 1.7 billion and is projected to reach USD 19.6 billion by 2035, growing at a CAGR of 28.0%. The absolute dollar opportunity over this period is USD 17.9 billion, highlighting the vast additional market potential from 2025 to 2035. This steep rise reflects the expanding role of hydrogen as an energy carrier and the need for efficient storage and logistics solutions.

Companies can leverage this opportunity by scaling manufacturing, building reliable supply networks, and focusing on high-demand regions to capture long-term revenue streams. From a commercial standpoint, the USD 17.9 billion absolute dollar opportunity offers significant potential for both emerging and established players. With the market increasing from USD 1.7 billion in 2025 to USD 19.6 billion in 2035 at a CAGR of 28.0%, the expansion provides room for investments across infrastructure, partnerships, and service models.

Firms can secure advantages by ensuring cost-efficient production, advancing capacity for large-scale projects, and expanding customer engagement. This predictable trajectory allows stakeholders to build strong positioning, diversify their client base, and achieve sustainable profitability within a decade of accelerated industry growth.

| Metric | Value |

|---|---|

| Hydrogen Storage Tanks and Transportation Market Estimated Value in (2025 E) | USD 1.7 billion |

| Hydrogen Storage Tanks and Transportation Market Forecast Value in (2035 F) | USD 19.6 billion |

| Forecast CAGR (2025 to 2035) | 28.0% |

A breakpoint analysis for the hydrogen storage tanks and transportation market identifies critical thresholds where the industry experiences accelerated momentum. With the market valued at USD 1.7 billion in 2025 and projected to reach USD 19.6 billion by 2035 at a CAGR of 28.0%, early breakpoints occur between USD 2.7–4.5 billion. This phase signals the transition from small-scale adoption to broader deployment, as demand for hydrogen logistics infrastructure gains traction. Companies reaching this stage can optimize production efficiency, expand delivery networks, and position themselves ahead of competitors to capture the surge in demand during this rapid scale-up period. Later-stage breakpoints appear between USD 9.4–15.3 billion, reflecting a decisive shift into large-scale commercial adoption before reaching USD 19.6 billion in 2035. This stage requires businesses to refine strategies around cost competitiveness, ensure reliability in large-capacity storage, and strengthen collaborations across the supply chain. Crossing these breakpoints indicates intensified competition and a need for strategic partnerships to handle volume growth. Firms aligning their operations with these thresholds will be better equipped to sustain market share, maximize returns, and navigate the expansion as the market evolves into a core segment of hydrogen-related industries.

The current market landscape reflects growing investments in hydrogen infrastructure, government-backed decarbonization policies, and advancements in storage technology that enhance safety and efficiency.

Demand is being influenced by the rising need for efficient long-distance hydrogen transportation and scalable storage solutions for both stationary and mobile applications. The ability to integrate storage systems with renewable energy projects and fuel cell technologies is creating new pathways for adoption.

Future growth is expected to be driven by the continuous improvement in lightweight tank designs, higher pressure capabilities, and cost-effective manufacturing techniques. As hydrogen-powered mobility and industrial usage expand, the market is set to benefit from robust policy support, increasing private investments, and technological innovations that align with global net-zero ambitions.

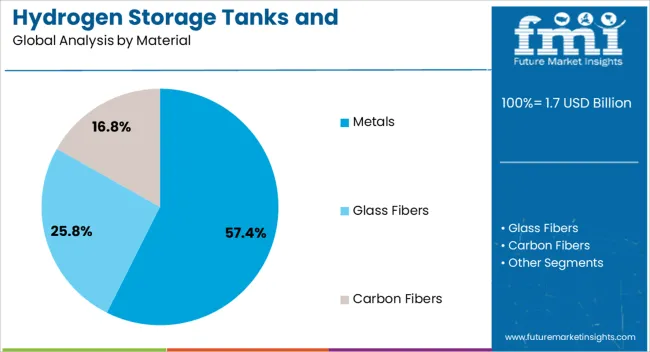

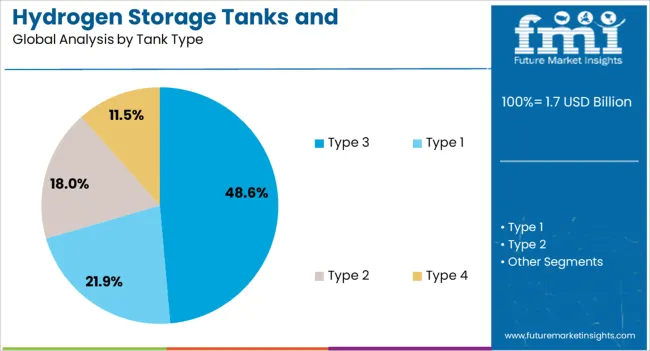

The hydrogen storage tanks and transportation market is segmented by material, tank type, pressure, application, and geographic regions. By material, hydrogen storage tanks and transportation market is divided into Metals, Glass Fibers, and Carbon Fibers. In terms of tank type, hydrogen storage tanks and transportation market is classified into Type 3, Type 1, Type 2, and Type 4.

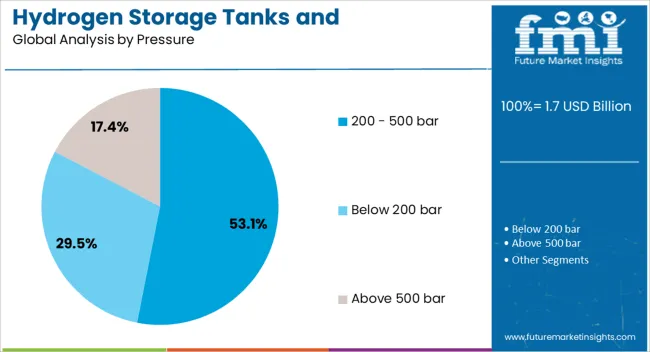

Based on pressure, hydrogen storage tanks and transportation market is segmented into 200 - 500 bar, Below 200 bar, and Above 500 bar. By application, hydrogen storage tanks and transportation market is segmented into Vehicles, Railways, Marine, and Industrial. Regionally, the hydrogen storage tanks and transportation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Metals material segment is projected to hold 57.4% of the hydrogen storage tanks & transportation market revenue in 2025, making it the leading material category. This dominance is being driven by the high structural strength, durability, and proven safety performance of metal-based tanks in hydrogen storage applications. The use of metals allows tanks to withstand extreme operating pressures while maintaining integrity over long service lives, making them highly suitable for both stationary and transportation purposes.

Manufacturing processes for metal tanks are well-established, enabling large-scale production with consistent quality. Furthermore, the recyclability and availability of metals support sustainability objectives, which is a growing priority in clean energy infrastructure.

The segment’s growth is also being supported by its compatibility with established inspection and maintenance protocols, ensuring reliable performance in high-demand applications. As demand for hydrogen transport solutions scales up, the metals segment is expected to maintain its leadership due to its reliability, safety credentials, and lifecycle cost efficiency.

The Type 3 tank category is expected to account for 48.6% of the Hydrogen Storage Tanks & Transportation market revenue in 2025, making it the most prominent tank type. This leadership is being attributed to the combination of a metal liner with a full composite wrap, which delivers both high pressure resistance and reduced weight.

Type 3 tanks offer an optimal balance between performance, durability, and cost-effectiveness, making them suitable for a wide range of applications from automotive fuel storage to stationary energy systems. The segment has benefited from advancements in composite materials that enhance tensile strength and improve hydrogen permeation resistance.

The ability to operate at higher pressures while maintaining structural integrity has made Type 3 tanks a preferred choice for mobility solutions where weight and fuel efficiency are critical. As hydrogen fueling infrastructure expands globally, demand for Type 3 tanks is anticipated to grow, supported by their adaptability and proven safety standards.

The 200 to 500 bar pressure range is projected to capture 53.1% of the Hydrogen Storage Tanks & Transportation market revenue in 2025, establishing it as the leading pressure category. This dominance is being driven by the suitability of this range for a wide variety of stationary and mobile applications where balanced storage capacity, cost, and safety considerations are important.

Operating within this pressure range allows for efficient hydrogen storage while avoiding the higher infrastructure costs and technical complexities associated with ultra-high-pressure systems. The segment’s growth is being reinforced by its alignment with industry standards for medium-pressure hydrogen applications, facilitating interoperability across production, storage, and distribution networks.

Additionally, advancements in tank manufacturing and sealing technologies have improved the safety and efficiency of storage within this range. As hydrogen utilization expands in sectors such as public transport, industrial energy, and distributed power generation, the 200 to 500 bar segment is expected to remain a preferred and widely adopted standard.

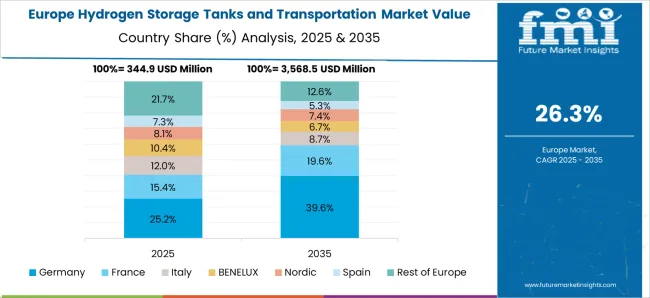

The hydrogen storage tanks and transportation market is expanding as governments, industries, and mobility sectors accelerate hydrogen adoption for clean energy. Europe and North America lead with investments in advanced composite tanks, liquid hydrogen logistics, and safety-compliant infrastructure. Asia Pacific demonstrates strong growth through government-backed hydrogen mobility projects and industrial integration. Manufacturers differentiate by tank type, material strength, safety standards, and storage capacity. Regional differences in regulations, infrastructure maturity, and cost sensitivity shape adoption, partnerships, and competitive positioning globally.

Hydrogen storage tanks differ by pressure level, phase (compressed gas or liquid), and material composition, such as steel, aluminum, or carbon fiber composites. Europe and North America emphasize lightweight composite tanks for mobility and industrial applications due to efficiency and safety regulations. Asia-Pacific markets balance affordability and performance, relying more on metal-based tanks for large-scale industrial use. Differences in tank design affect weight, energy density, and safety ratings. Global suppliers target advanced, premium tanks, while regional producers focus on durable, cost-effective solutions. These contrasts determine adoption rates, application suitability, and market competitiveness across regions.

Hydrogen transportation depends on pipelines, trailers, and cryogenic tankers, requiring significant infrastructure investment. North America and Europe prioritize high-capacity logistics systems integrated with refueling networks, enabling large-scale adoption in mobility and energy sectors. Asia-Pacific emphasizes modular, cost-efficient logistics solutions for industrial hydrogen supply chains and emerging fuel cell vehicle fleets. Differences in infrastructure maturity impact transportation efficiency, delivery costs, and regional project scalability. Companies with integrated logistics networks and refueling infrastructure partnerships gain advantages, while local providers focus on affordability and accessibility. Infrastructure contrasts strongly influence adoption, long-term growth, and global hydrogen competitiveness.

Strict safety regulations and certification requirements shape hydrogen storage and transportation systems. Europe and North America mandate advanced safety standards covering tank design, leak prevention, and transport approvals. Asia-Pacific markets vary, with developed economies pushing for harmonized standards while emerging markets adopt phased compliance. Differences in regulation affect time-to-market, investment needs, and cross-border compatibility. Manufacturers meeting global certification frameworks gain credibility and wider access, while regional producers focus on domestic regulations. Regulatory contrasts drive adoption speed, brand positioning, and global competitiveness in hydrogen logistics solutions.

Hydrogen storage and transportation demand differ across mobility, power generation, and industrial sectors. Europe and North America emphasize fuel cell mobility and energy storage applications requiring lightweight, high-capacity tanks. Asia-Pacific’s adoption is driven by industrial demand, steelmaking decarbonization, and government-supported fuel cell vehicle projects. Differences in end-use focus affect technology preference, supply chain requirements, and investment flows. Suppliers addressing diverse end-use sectors gain broader opportunities, while regional providers specialize in cost-sensitive industrial applications. End-use demand contrasts guide adoption patterns, revenue streams, and long-term strategic positioning globally.

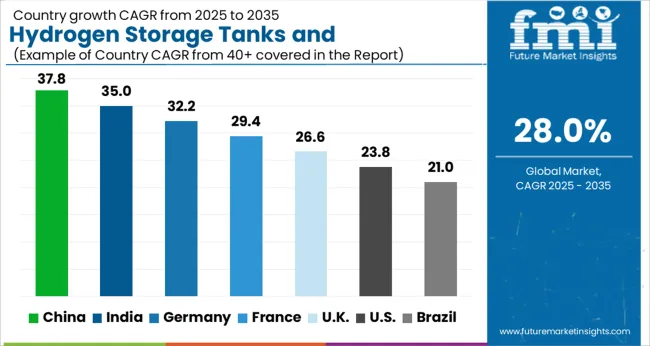

| Country | CAGR |

|---|---|

| China | 37.8% |

| India | 35.0% |

| Germany | 32.2% |

| France | 29.4% |

| UK | 26.6% |

| USA | 23.8% |

| Brazil | 21.0% |

The global hydrogen storage tanks and transportation market was projected to expand at a 28.0% CAGR through 2035, supported by rapid developments in clean energy infrastructure. In BRICS, China registered 37.8% growth as large-scale tank manufacturing facilities were established and standards for hydrogen safety and transport were enforced. India followed at 35.0%, with capacity expansions initiated to address rising energy transition requirements. In the OECD region, Germany at 32.2% demonstrated strong adoption as industrial demand was supported by stringent handling and storage protocols. The United Kingdom, advancing at 26.6%, focused on regulated distribution frameworks to serve regional fuel cell deployments. The USA, at 23.8%, maintained consistent progress with federal guidelines ensuring operational safety and reliability in hydrogen storage and logistics. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Hydrogen storage tanks and transportation market in China is growing at a CAGR of 37.8%. Between 2020 and 2024, growth was driven by national hydrogen strategies, rapid deployment of fuel cell vehicles, and expansion of hydrogen refueling infrastructure. Manufacturers focused on high-pressure, durable, and lightweight storage tanks suitable for mobility and industrial applications. In the forecast period 2025 to 2035, growth is expected to accelerate with adoption of advanced composite tanks, cryogenic storage, and large-scale hydrogen logistics solutions. Expansion of green hydrogen projects, government-backed clean energy policies, and increasing industrial hydrogen demand will further boost adoption. China is set to remain a global leader due to large-scale investments, manufacturing capacity, and strong government initiatives supporting hydrogen economy.

Hydrogen storage tanks and transportation market in India is growing at a CAGR of 35.0%. Historical period 2020 to 2024 saw growth supported by government hydrogen roadmaps, industrial pilot projects, and renewable energy integration. Manufacturers focused on cost-effective, high-pressure, and durable storage tanks for small-scale mobility and industrial applications. In the forecast period 2025 to 2035, market growth is expected to continue with adoption of advanced composite tanks, cryogenic storage systems, and dedicated hydrogen transportation networks. Expansion of renewable-powered hydrogen projects, government policies promoting decarbonization, and industrial demand for clean hydrogen will further drive adoption. India is projected to remain a fast-growing market due to strong policy support, renewable energy expansion, and rising focus on sustainable industrial development.

Hydrogen storage tanks and transportation market in Germany is growing at a CAGR of 32.2%. Between 2020 and 2024, growth was supported by clean energy policies, hydrogen mobility initiatives, and renewable integration. Manufacturers focused on safe, durable, and high-efficiency storage tanks for industrial and transport applications. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of advanced composite, cryogenic, and large-scale hydrogen logistics systems. Expansion of hydrogen infrastructure, EU decarbonization goals, and industrial demand for green hydrogen will further boost adoption. Germany remains a leading European market due to strong regulatory frameworks, renewable integration, and advanced engineering capacity.

Hydrogen storage tanks and transportation market in the United Kingdom is growing at a CAGR of 26.6%. During 2020 to 2024, adoption was driven by government hydrogen strategies, pilot projects for hydrogen mobility, and renewable integration. Manufacturers focused on durable, lightweight, and safe hydrogen storage systems for mobility and energy applications. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption of advanced composite tanks, cryogenic storage, and hydrogen logistics networks supporting large-scale deployment. Expansion of hydrogen refueling stations, government-backed infrastructure projects, and industrial decarbonization initiatives will further support market development. The United Kingdom demonstrates stable growth with focus on safety, efficiency, and renewable hydrogen adoption.

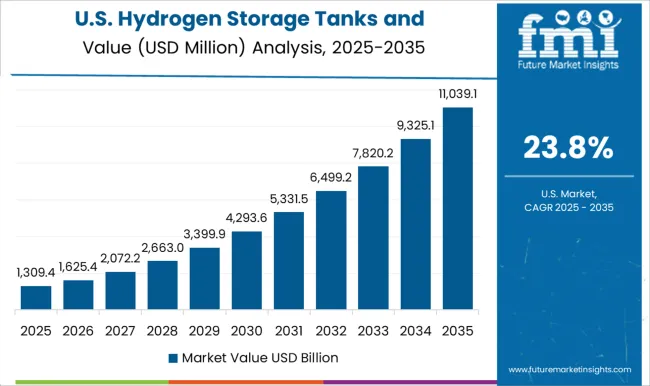

Hydrogen storage tanks and transportation market in the United States is growing at a CAGR of 23.8%. Historical period 2020 to 2024 saw growth fueled by renewable energy integration, fuel cell vehicle adoption, and federal clean energy programs. Manufacturers focused on durable, efficient, and lightweight tanks for mobility, industrial, and energy storage applications. In the forecast period 2025 to 2035, growth is expected to continue with adoption of advanced composite and cryogenic storage systems, along with dedicated hydrogen logistics infrastructure. Expansion of green hydrogen projects, government funding, and industrial demand for sustainable energy solutions will further drive adoption. The United States market demonstrates consistent growth with emphasis on efficiency, reliability, and large-scale hydrogen infrastructure.

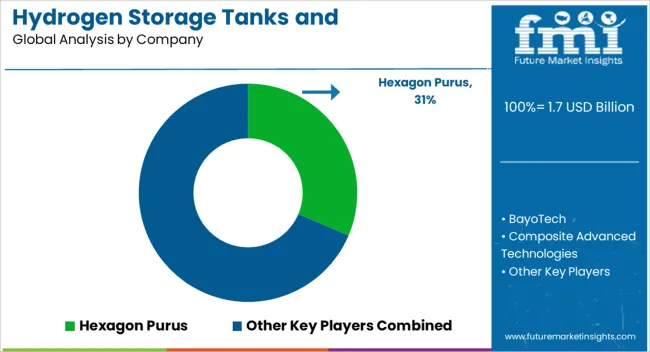

The hydrogen storage tanks and transportation market is supplied by Hexagon Purus, BayoTech, Composite Advanced Technologies, Doosan Mobility Innovation, ECS GmbH & Co. KG, Hensoldt, Luxfer Gas Cylinders, Mahytec, Marine Service Noord, NPROXX, Plastic Omnium, Pragma Industries, Quantum Fuel Systems, Steelhead Composites, Tenaris, Umoe Advanced Composites, Weldship Corporation, and Worthington Industries. These companies provide critical solutions for hydrogen supply chains, including Type III and Type IV composite pressure vessels, cryogenic tanks, and transportation trailers designed to meet global safety standards. Brochures typically emphasize lightweight carbon-fiber designs, extended lifecycle durability, and compliance with international certifications such as ISO, EC79, and ASME.

Market strategies revolve around innovation, partnerships, and scaling production capacity to meet rising demand from fuel cell vehicles, renewable energy storage, and industrial hydrogen applications. Hexagon Purus, NPROXX, and Luxfer lead in lightweight composite cylinders designed for mobility and stationary systems. Companies like Plastic Omnium and Quantum Fuel Systems integrate storage systems into automotive platforms, while Worthington Industries and Weldship Corporation specialize in large-scale tube trailers and bulk transport systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Material | Metals, Glass Fibers, and Carbon Fibers |

| Tank Type | Type 3, Type 1, Type 2, and Type 4 |

| Pressure | 200 - 500 bar, Below 200 bar, and Above 500 bar |

| Application | Vehicles, Railways, Marine, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hexagon Purus, BayoTech, Composite Advanced Technologies, Doosan Mobility Innovation, ECS GmbH & Co. KG, Hensoldt, Luxfer Gas Cylinders, Mahytec, Marine Service Noord, NPROXX, Plastic Omnium, Pragma Industries, Quantum Fuel Systems, Steelhead Composites, Tenaris, Umoe Advanced Composites, Weldship Corporation, and Worthington Industries |

| Additional Attributes | Dollar sales vary by tank type, including Type I, Type II, Type III, and Type IV composite tanks; by storage form, spanning compressed gas, liquid hydrogen, and solid-state; by application, such as mobility, industrial use, power generation, and refueling infrastructure; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by hydrogen economy expansion, renewable integration, and investments in clean mobility. |

The global hydrogen storage tanks and transportation market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the hydrogen storage tanks and transportation market is projected to reach USD 19.6 billion by 2035.

The hydrogen storage tanks and transportation market is expected to grow at a 28.0% CAGR between 2025 and 2035.

The key product types in hydrogen storage tanks and transportation market are metals, glass fibers and carbon fibers.

In terms of tank type, type 3 segment to command 48.6% share in the hydrogen storage tanks and transportation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenated Palm Oil Market

Hydrogenerators Market

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA