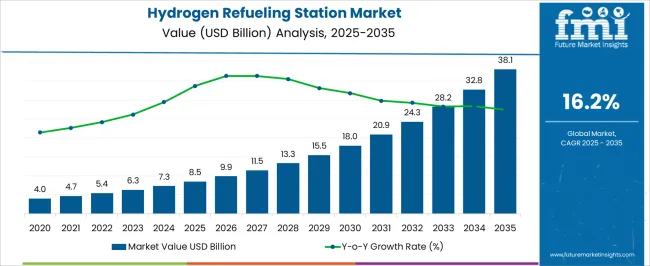

In 2025, the hydrogen refueling station market is valued at USD 8.5 billion and is expected to reach USD 38.1 billion by 2035, growing at a CAGR of 16.2%. The absolute dollar opportunity over this period is USD 29.6 billion, representing the incremental revenue potential from 2025 to 2035. This substantial growth indicates increasing investments and infrastructure expansion in the sector.

Companies can capitalize on this market by strategically planning capacity additions, expanding service networks, and meeting the growing demand for hydrogen refueling solutions, ensuring they capture a meaningful share of the projected market expansion over the decade.

From a business perspective, the absolute dollar opportunity of USD 29.6 billion offers significant financial incentives for both new entrants and established players. With annual market growth from USD 8.5 billion in 2025 to USD 38.1 billion in 2035, the sector presents consistent revenue-generating potential. The CAGR of 16.2% emphasizes rapid growth, allowing companies to plan investments in phases while optimizing operational and distribution strategies. By analyzing market trends and targeting key regions, stakeholders can leverage this opportunity to maximize returns, improve service coverage, and establish a strong competitive position throughout the ten-year growth trajectory.

| Metric | Value |

|---|---|

| Hydrogen Refueling Station Market Estimated Value in (2025 E) | USD 8.5 billion |

| Hydrogen Refueling Station Market Forecast Value in (2035 F) | USD 38.1 billion |

| Forecast CAGR (2025 to 2035) | 16.2% |

A breakpoint analysis for the hydrogen refueling station market identifies key thresholds where growth accelerates or strategic adjustments become necessary. With the market at USD 8.5 billion in 2025 and expected to reach USD 38.1 billion by 2035 at a CAGR of 16.2%, initial breakpoints occur around USD 15.5–18.0 billion. These points represent early momentum in market adoption and infrastructure expansion, signaling opportunities for companies to increase investments in station construction, supply chain capacity, and regional coverage.

Recognizing these breakpoints allows stakeholders to prioritize resource allocation and optimize timing for maximum revenue capture during periods of high growth. Later-stage breakpoints in the range of USD 28.2–32.8 billion reflect approaching market maturity and intensified competition. Surpassing these thresholds may require companies to refine operational efficiency, scale networks strategically, and differentiate offerings to maintain growth. Monitoring these breakpoints ensures that businesses can anticipate shifts in demand and make informed investment decisions, balancing expansion with risk management.

The current landscape reflects significant investments in both technology development and station deployment, driven by the global push towards decarbonization and sustainable transport solutions.

Growth opportunities are reinforced by advancements in hydrogen production and storage technologies, as well as growing collaborations between public and private sectors to build comprehensive refueling networks. As hydrogen-powered commercial fleets and passenger vehicles gain traction, the demand for reliable, efficient, and scalable refueling infrastructure continues to rise.

The market outlook is promising, with ongoing efforts to standardize refueling protocols and improve station efficiency shaping future expansion. Increasing environmental regulations and commitments to reduce greenhouse gas emissions are expected to further accelerate the development and adoption of hydrogen refueling stations worldwide.

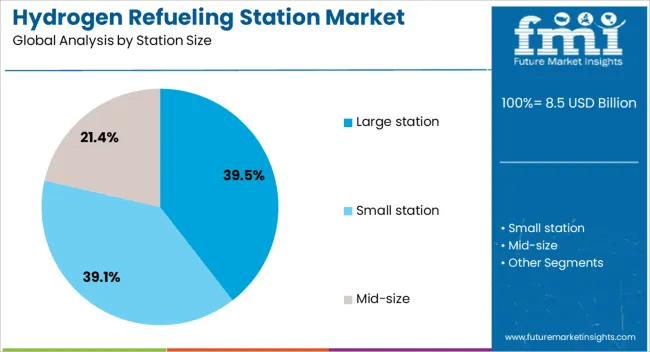

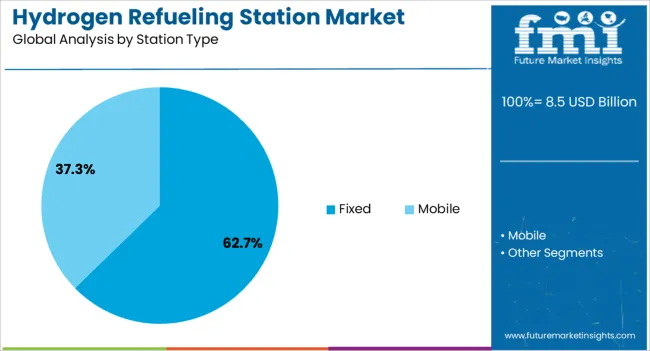

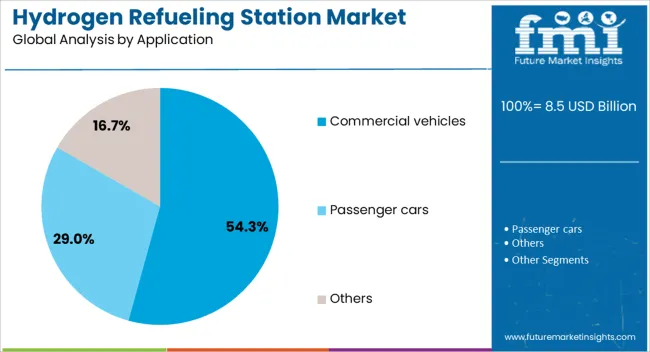

The hydrogen refueling station market is segmented by station size, station type, application, and geographic regions. By station size, hydrogen refueling station market is divided into Large station, Small station, and Mid-size. In terms of station type, hydrogen refueling station market is classified into Fixed and Mobile. Based on application, hydrogen refueling station market is segmented into Commercial vehicles, Passenger cars, and Others.

Regionally, the hydrogen refueling station industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The large station segment is projected to hold 39.5% of the Hydrogen Refueling Station market revenue share in 2025, representing a leading position in terms of station size. This segment’s growth is attributed to the increasing demand for high-capacity refueling points capable of servicing multiple vehicles simultaneously.

Large stations are preferred in regions with growing hydrogen vehicle adoption, particularly where fleet operations require fast and frequent refueling. The scalability of these stations allows for better accommodation of future demand surges without significant infrastructure overhaul.

Moreover, the integration of advanced compression and storage systems in large stations enhances operational efficiency and refueling speed. These factors collectively contribute to the segment’s prominence as the backbone of expanding hydrogen mobility ecosystems.

The fixed station segment is expected to capture 62.7% of the market revenue share in 2025, making it the dominant station type within the Hydrogen Refueling Station market. This preference is largely due to the operational reliability and robustness of fixed infrastructure, which supports continuous, high-volume hydrogen dispensing.

Fixed stations are typically located at strategic urban and highway sites, enabling consistent service to commercial and passenger vehicles alike. Their capacity to house complex storage and compression equipment facilitates adherence to stringent safety and performance standards.

The long-term investment appeal of fixed stations is strengthened by their ability to integrate with renewable hydrogen production facilities and grid systems, supporting the wider hydrogen ecosystem. As hydrogen adoption grows, fixed stations are expected to remain the primary choice for large-scale refueling infrastructure.

The commercial vehicles application segment is anticipated to hold 54.3% of the Hydrogen Refueling Station market revenue share in 2025, positioning it as the leading application area. This segment’s growth is driven by the expanding deployment of hydrogen fuel cell trucks, buses, and delivery vehicles aimed at reducing emissions in freight and public transport sectors.

Commercial fleets benefit from the extended range and quick refueling capabilities offered by hydrogen technology, making it a viable alternative to battery electric vehicles for heavy-duty applications. Investments in dedicated hydrogen refueling infrastructure for commercial vehicles are being prioritized to meet operational requirements such as high throughput and frequent usage.

Additionally, regulatory incentives and sustainability goals across logistics and transit companies are accelerating the adoption of hydrogen fuel cell vehicles, thereby boosting demand for corresponding refueling stations. The emphasis on decarbonizing commercial transport will continue to underpin this segment’s market leadership.

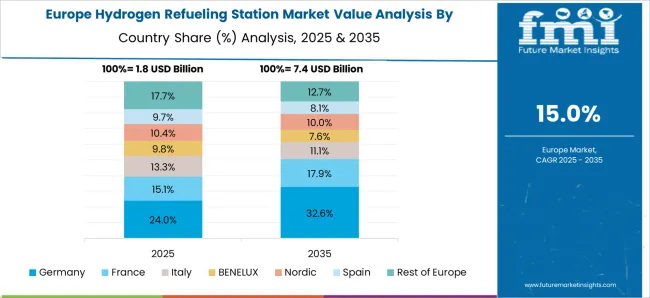

The hydrogen refueling station market is growing due to the global push toward clean mobility, rising fuel cell vehicle adoption, and government initiatives supporting hydrogen infrastructure. Europe and North America lead with advanced, high-capacity stations integrated into national hydrogen mobility strategies. Asia-Pacific shows rapid growth driven by China, Japan, and South Korea, which are investing heavily in urban hydrogen networks and commercial fleets.

Key manufacturers differentiate through dispensing technology, safety systems, compression and storage solutions, and station uptime reliability. Regulatory support, subsidies, and growing demand for zero-emission transportation solutions fuel market growth. Companies offering scalable, modular, and high-throughput refueling stations gain competitive advantage, while smaller regional suppliers focus on pilot or localized projects. Regional deployment strategies, cost optimization, and integration with renewable hydrogen supply chains significantly influence adoption and long-term market expansion.

Hydrogen refueling stations differ in dispensing capacity, pressure levels, and storage technology. Europe and North America prioritize high-capacity, fast-fill stations capable of serving multiple fuel cell vehicle fleets daily, with integrated safety and monitoring systems. Asia-Pacific markets, while expanding quickly, often deploy smaller-scale or modular stations for fleet or urban pilot projects. Differences in capacity and technology affect throughput, service reliability, and operational costs. Leading global suppliers provide advanced, high-pressure storage and compression systems, while regional producers focus on cost-effective, scalable solutions. These contrasts shape adoption rates, regional fleet planning, and supplier competitiveness, with mature markets emphasizing reliability and emerging markets prioritizing rapid infrastructure expansion and affordability.

Regulatory and policy environments significantly influence hydrogen refueling adoption. Europe and North America provide structured subsidies, tax credits, and long-term infrastructure strategies to support zero-emission vehicles. Asia-Pacific countries, including Japan, China, and South Korea, have introduced incentives for commercial fleets and urban deployment, but policies vary by region. Differences in government support affect station deployment speed, technology selection, and private-sector investment. Suppliers aligning with local policy frameworks can secure high-value projects and public-private partnerships, while those ignoring regulations face limited adoption opportunities. Policy contrasts determine market access, station distribution density, and the pace of hydrogen mobility adoption across diverse geographies.

Hydrogen station viability depends on feedstock sourcing, production methods, and logistics. Europe focuses on green hydrogen produced from renewable electricity to meet climate targets, whereas North America integrates a mix of green and blue hydrogen. Asia-Pacific relies on a combination of grey and green hydrogen, balancing cost and availability. Differences in production methods influence pricing, carbon footprint, and long-term sustainability. Suppliers investing in efficient, modular production and storage systems gain an edge in competitive markets, while regional producers with limited supply chains may face challenges in scaling stations. Supply chain reliability and hydrogen availability directly impact operational uptime, adoption rates, and market confidence.

Hydrogen refueling station deployment is influenced by vehicle type and fleet size. Europe and North America emphasize commercial fleets, taxis, and passenger fuel cell vehicles requiring standardized, high-throughput stations. Asia-Pacific adoption includes urban buses, delivery fleets, and pilot programs for private vehicles, emphasizing modular and cost-effective infrastructure. Differences in end-user demand affect station capacity, location planning, and technology requirements. Leading suppliers develop flexible station designs catering to high-volume and small-scale deployments, while regional producers target localized urban or fleet-specific applications. These contrasts determine adoption patterns, capital allocation, and long-term infrastructure development strategies, influencing market growth across regions.

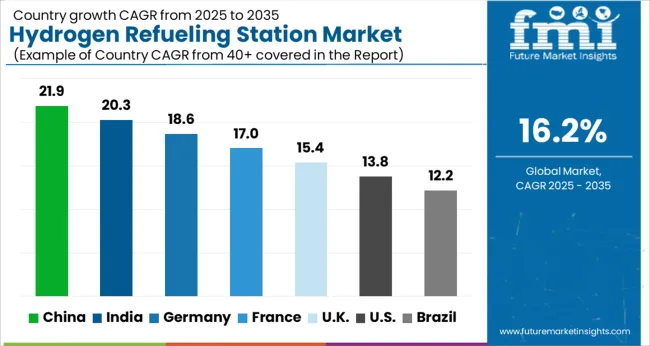

| Country | CAGR |

|---|---|

| China | 21.9% |

| India | 20.3% |

| Germany | 18.6% |

| France | 17.0% |

| UK | 15.4% |

| USA | 13.8% |

| Brazil | 12.2% |

The global hydrogen refueling station market was projected to grow at a 16.2% CAGR through 2035, driven by demand in fuel cell vehicles, public transportation, and industrial applications. Among BRICS nations, China recorded 21.9% growth as large-scale refueling infrastructure was commissioned and compliance with energy and safety standards was enforced, while India at 20.3% growth saw expansion of production and installation facilities to support rising regional adoption of hydrogen mobility. In the OECD region, Germany at 18.6% maintained substantial output under strict industrial and energy regulations, while the United Kingdom at 15.4% relied on moderate-scale operations for public and commercial hydrogen refueling. The USA, expanding at 13.8%, remained a mature market with steady demand across automotive and industrial segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Hydrogen refueling station market in China is growing at a CAGR of 21.9%. Between 2020 and 2024, growth was driven by government incentives, expanding fuel cell vehicle adoption, and increasing public and commercial hydrogen vehicle fleets. Manufacturers focused on building high-capacity, safe, and reliable stations in urban centers and along major transport corridors. Investments in infrastructure and partnerships with automotive OEMs supported market expansion. In the forecast period 2025 to 2035, growth is expected to accelerate with deployment of smart, automated, and scalable refueling stations, integration with renewable hydrogen production, and expansion to smaller cities. China remains a global leader due to supportive policies, large vehicle market, and strong commitment to decarbonization.

Hydrogen refueling station market in India is growing at a CAGR of 20.3%. Historical period 2020 to 2024 saw growth supported by rising interest in hydrogen fuel vehicles, pilot projects, and government support for clean transportation. Manufacturers focused on cost-effective, safe, and modular refueling solutions in metro areas and industrial hubs. Collaboration with automotive and energy companies strengthened infrastructure deployment. In the forecast period 2025 to 2035, market growth is expected to continue with expansion of nationwide hydrogen networks, smart monitoring, and renewable hydrogen integration. Growing urban mobility, environmental policies, and fleet electrification programs will further drive adoption. India is projected to maintain rapid growth due to large population, urban vehicle density, and increasing investment in green energy.

Hydrogen refueling station market in Germany is growing at a CAGR of 18.6%. Between 2020 and 2024, growth was supported by strong government backing, automotive industry adoption of fuel cell vehicles, and expanding regional hydrogen infrastructure. Manufacturers focused on high safety, efficiency, and reliability standards. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption of automated refueling, integration with renewable hydrogen, and deployment of regional and highway networks. Environmental regulations, technological innovation, and public-private partnerships will further support adoption. Germany remains a key European market due to its automotive leadership, hydrogen technology expertise, and strong climate initiatives.

Hydrogen refueling station market in the United Kingdom is growing at a CAGR of 15.4%. During 2020 to 2024, adoption was driven by public and commercial hydrogen vehicle pilot programs, government funding, and focus on decarbonization. Manufacturers focused on modular, safe, and reliable stations suitable for urban and regional deployment. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption of renewable hydrogen, automated monitoring systems, and network expansion along major transport routes. Fleet electrification initiatives, government incentives, and public awareness of green mobility will further support growth. The United Kingdom market demonstrates steady expansion with emphasis on safety, efficiency, and environmental sustainability.

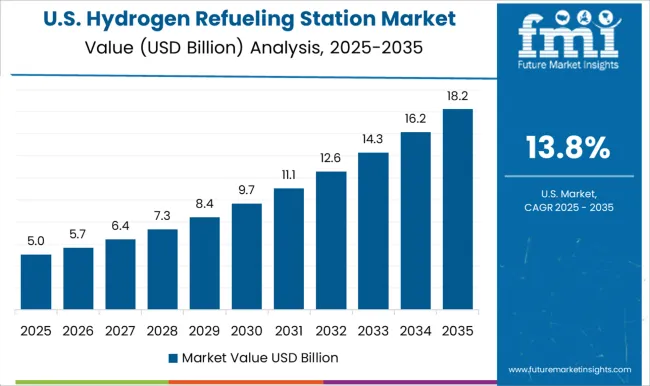

Hydrogen refueling station market in the United States is growing at a CAGR of 13.8%. Historical period 2020 to 2024 saw growth fueled by adoption of fuel cell vehicles, federal and state incentives, and regional refueling networks. Manufacturers focused on high-capacity, reliable, and safe stations in key urban and corridor areas. In the forecast period 2025 to 2035, growth is expected to continue steadily with deployment of automated, renewable-integrated stations, expansion to secondary cities, and public-private partnerships. Environmental regulations, fleet electrification, and technological innovation will further support market adoption. The United States market demonstrates consistent growth with emphasis on safety, efficiency, and nationwide network development.

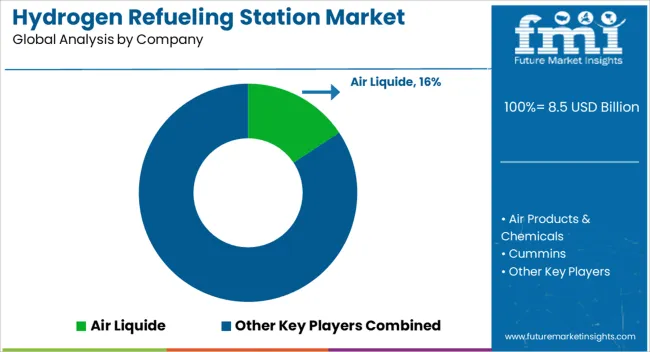

The hydrogen refueling station market is supplied by Air Liquide, Air Products & Chemicals, Cummins, China Petrochemical Corporation, Calvera, Deutsche Bahn, ENGIE, Hydrogen Refueling Solutions, Hyundai Hydrogen Mobility, ITM Power, Iwatani Corporation, Linde, McPhy Energy, Nel ASA, Plug Power, Norwegian Hydrogen, and Shell. Competition is defined by refueling capacity, dispensing pressure, station footprint, and integration with renewable hydrogen production. Air Liquide and Linde brochures highlight high-capacity stations with multiple dispensers and fast-fill capabilities for commercial fleets. ITM Power and McPhy Energy emphasize modular electrolysis-based refueling units with on-site hydrogen production.

Cummins and Nel ASA datasheets specify compressor and storage systems, flow rates, and safety redundancies. Observed market trends show growing adoption of compact and automated stations for urban mobility solutions and fleet applications. Strategies among suppliers focus on deployment networks, scalability, and operational efficiency. Air Products & Chemicals and Shell prioritize highway and urban corridor installations with standardized interface protocols for vehicles. ENGIE and Calvera invest in integrating renewable hydrogen sources with refueling infrastructure. Plug Power and Hyundai Hydrogen Mobility highlight fleet-centric solutions with high daily throughput and reduced refueling times.

ITM Power and McPhy Energy focus on modular design for rapid expansion, while Norwegian Hydrogen and Hydrogen Refueling Solutions emphasize service reliability and predictive maintenance. Observed approaches include partnerships with automotive OEMs, compliance with international safety standards, and alignment with government incentive programs to accelerate hydrogen adoption. Product brochures specify station capacity in kilograms per day, maximum dispensing pressures, compressor types, storage pressures, fueling protocols, and operational cycle times. Air Liquide and Linde provide detailed schematics of integrated supply, storage, and dispensing systems. ITM Power and McPhy Energy datasheets describe electrolysis rates, modular add-on units, and maintenance schedules.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.5 Billion |

| Station Size | Large station, Small station, and Mid-size |

| Station Type | Fixed and Mobile |

| Application | Commercial vehicles, Passenger cars, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Air Products & Chemicals, Cummins, China Petrochemical Corporation, Calvera, Deutsche Bahn, ENGIE, Hydrogen Refueling Solutions, HyundaiHydrogenMobility, ITM Power, Iwatani Corporation, Linde, McPhy Energy, Nel ASA, Plug Power, Norwegian Hydrogen, and Shell |

| Additional Attributes | Dollar sales vary by station type, including gaseous, liquid, and hybrid refueling stations; by application, such as passenger vehicles, buses, and commercial fleets; by end-use industry, spanning automotive, logistics, and public transportation; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by rising hydrogen vehicle adoption, government incentives, and expansion of hydrogen infrastructure. |

The global hydrogen refueling station market is estimated to be valued at USD 8.5 billion in 2025.

The market size for the hydrogen refueling station market is projected to reach USD 38.1 billion by 2035.

The hydrogen refueling station market is expected to grow at a 16.2% CAGR between 2025 and 2035.

The key product types in hydrogen refueling station market are large station, small station and mid-size.

In terms of station type, fixed segment to command 62.7% share in the hydrogen refueling station market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogenated Palm Oil Market

Hydrogenerators Market

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA