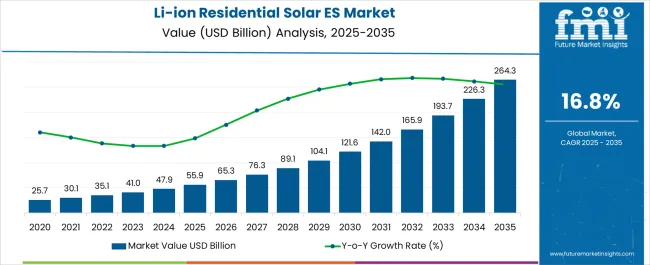

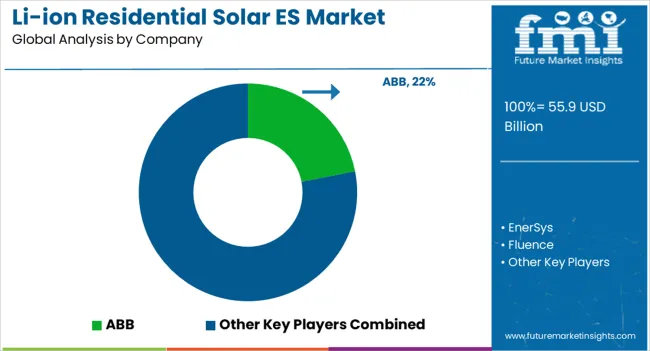

The Lithium Ion Residential Solar Energy Storage Market is estimated to be valued at USD 55.9 billion in 2025 and is projected to reach USD 264.3 billion by 2035, registering a compound annual growth rate (CAGR) of 16.8% over the forecast period. The market is currently positioned in the early growth stage of the adoption lifecycle, characterized by early adopters investing in lithium-ion battery storage systems to complement rooftop solar installations, mitigate grid dependency, and optimize energy management.

During the initial years, growth is primarily influenced by technology cost reductions, government incentives, and the deployment of smart energy management solutions. As production scales and manufacturing efficiencies improve, the market enters the early majority phase around the mid-forecast period, where broader consumer segments adopt lithium-ion storage solutions for residential applications. Price declines, performance enhancements, and expanded financing models further accelerate penetration, promoting widespread acceptance across diverse geographies.

Toward the latter part of the forecast period, the market approaches a late majority phase, as lithium-ion storage systems become a mainstream choice for residential energy storage. Market maturity is expected to be supported by standardization, ecosystem integration with home energy management systems, and regulatory frameworks promoting clean energy adoption.

The adoption lifecycle underscores a structured progression from niche early adoption to broad mainstream integration, with key players needing to invest strategically in technology, distribution, and customer education to capture sustained growth opportunities.

| Metric | Value |

|---|---|

| Lithium Ion Residential Solar Energy Storage Market Estimated Value in (2025 E) | USD 55.9 billion |

| Lithium Ion Residential Solar Energy Storage Market Forecast Value in (2035 F) | USD 264.3 billion |

| Forecast CAGR (2025 to 2035) | 16.8% |

The lithium ion residential solar energy storage market is expanding steadily as households seek greater energy independence, improved power reliability, and reduced electricity costs. Rising concerns over grid instability, increasing electricity tariffs, and the shift toward decentralized energy systems are driving adoption.

Lithium ion storage systems are being preferred due to their high energy density, long cycle life, and compatibility with rooftop solar photovoltaic installations. Policy incentives, tax credits, and net metering programs are further accelerating installations across residential areas.

Additionally, advancements in battery management systems and safety protocols are making lithium ion solutions more accessible and user friendly for residential use. As the transition to low carbon energy systems intensifies, the market is poised for sustained growth driven by technology improvements, favorable regulations, and growing consumer interest in sustainable energy autonomy.

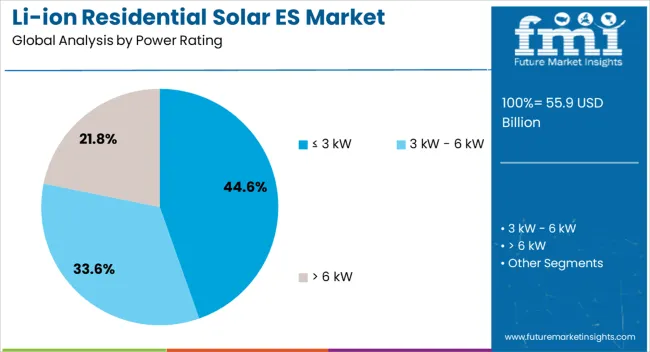

The lithium-ion residential solar energy storage market is segmented by power rating and geographic regions. By power rating, the lithium ion residential solar energy storage market is divided into ≤ 3 kW, 3 kW - 6 kW, and > 6 kW. Regionally, the lithium ion residential solar energy storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The power rating segment of 3 kW and below is projected to account for 44.6% of the total market revenue by 2025, making it the leading sub segment within the power rating category. This dominance is due to the suitability of lower capacity systems for small to medium-sized households that prioritize cost-effective and space-efficient solutions.

These systems are often selected for daily residential energy balancing, backup during outages, and optimized self-consumption from rooftop solar panels. Lower capital investment and easier installation requirements further increase their appeal to homeowners.

Additionally, integration with modular solar systems and compatibility with smart home energy management tools have enhanced their adoption. As urban residential areas continue to embrace solar energy for both environmental and economic reasons, the demand for ≤ 3 kW systems remains strong, firmly positioning this sub-segment at the forefront of residential solar storage deployment.

The market has been growing due to increasing adoption of rooftop solar systems and rising consumer interest in energy independence. Lithium ion batteries have been preferred for their high energy density, longer life cycles, and low maintenance requirements. Market expansion has been supported by government incentives, falling battery prices, and the integration of smart home energy management systems. Rising electricity costs, reliability concerns, and growing environmental awareness have further reinforced adoption, making lithium ion storage solutions an essential component of residential solar energy systems globally.

The market for lithium ion residential solar energy storage has been primarily influenced by the increasing installation of rooftop solar panels in residential settings. Homeowners have adopted energy storage solutions to maximize self-consumption of solar energy, reduce dependence on the grid, and manage peak electricity costs. Integration with smart meters and home energy management systems has enabled optimized charging and discharging cycles, ensuring efficiency and reliability. The expansion of net-metering policies and financial incentives in various regions has encouraged adoption by lowering initial investment barriers. Additionally, awareness campaigns regarding energy independence, resilience during outages, and sustainability have strengthened the appeal of lithium ion battery storage for residential consumers, making residential solar energy storage a critical driver for market growth.

Technological innovations have reinforced the market by enhancing battery efficiency, safety, and performance. Lithium ion chemistries, including lithium iron phosphate (LFP) and nickel manganese cobalt (NMC), have been optimized for higher energy density, longer cycle life, and thermal stability. Battery management systems (BMS) have been integrated to monitor state of charge, prevent overcharging, and improve lifespan. Modular and compact designs have allowed seamless installation in residential spaces, while improved inverter compatibility has enabled smooth integration with solar systems. Research in solid-state and next-generation lithium ion batteries has aimed to further improve safety, reduce costs, and enhance storage capacity, thereby supporting broader adoption of residential solar energy storage solutions across global markets.

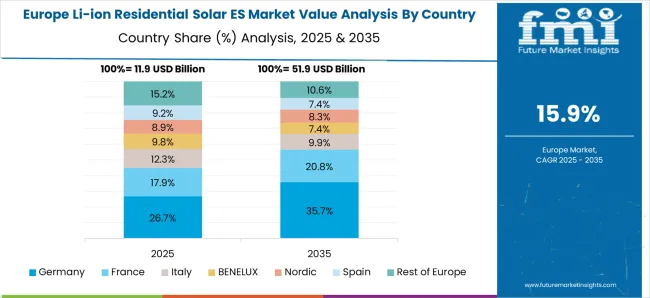

The market has been shaped by regulatory measures, subsidies, and incentive programs designed to promote renewable energy adoption. Governments in Europe, North America, and Asia-Pacific have introduced tax credits, rebates, and feed-in tariff programs to encourage installation of solar panels and paired energy storage systems. Building codes and energy efficiency mandates have further incentivized the integration of residential storage systems. Environmental standards emphasizing carbon reduction and grid decarbonization have reinforced demand for clean energy storage solutions. These regulations have driven collaborations between battery manufacturers, solar developers, and utilities, ensuring wider deployment of lithium ion storage solutions while promoting sustainability and energy efficiency in residential energy management.

Despite strong demand, the market has faced challenges related to high initial investment, raw material price volatility, and competition from alternative storage technologies. Prices of lithium, cobalt, and nickel have fluctuated, impacting manufacturing costs. Emerging technologies, such as flow batteries and advanced lead-acid solutions, have provided alternatives, particularly in cost-sensitive markets. Installation complexity, consumer awareness gaps, and concerns over battery safety during thermal events have also influenced adoption. Manufacturers and service providers have responded by offering financing options, extended warranties, and installation support. Continuous innovation in cost reduction, efficiency, and reliability has remained critical to sustaining market growth while addressing competitive and economic challenges.

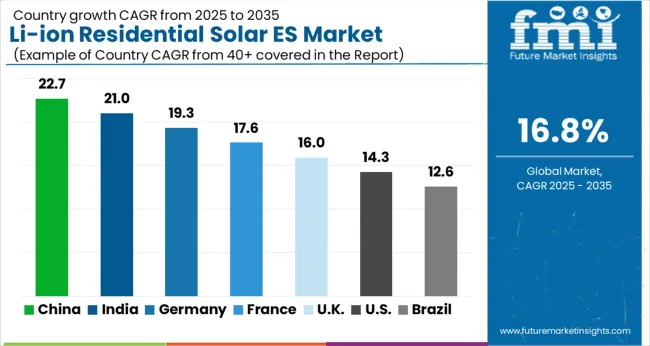

| Countries | CAGR |

|---|---|

| China | 22.7% |

| India | 21.0% |

| Germany | 19.3% |

| France | 17.6% |

| UK | 16.0% |

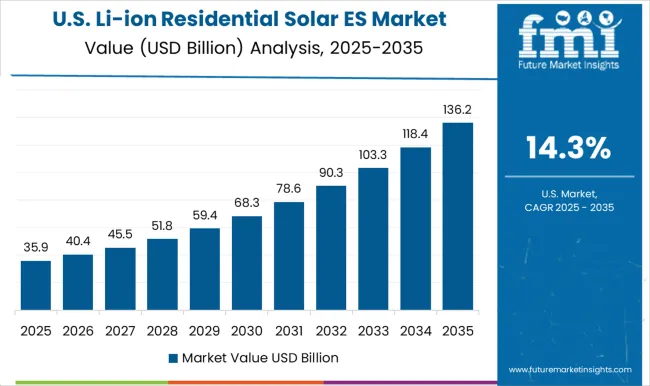

| USA | 14.3% |

| Brazil | 12.6% |

The market is anticipated to expand at a CAGR of 16.8% from 2025 to 2035, driven by rising adoption of residential solar systems, technological improvements in battery storage, and government incentives for clean energy. China leads with a 22.7% CAGR, supported by large-scale residential solar projects and domestic battery manufacturing. India follows at 21.0%, fueled by growing rooftop solar installations and electrification programs. Germany, at 19.3%, benefits from strong renewable energy policies and advanced energy storage integration. The UK, growing at 16.0%, focuses on energy-efficient homes and pilot solar storage projects, while the USA, at 14.3%, experiences steady adoption due to state-level incentives and smart grid integration. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is witnessing robust growth in the market with a CAGR of 22.7%. The expansion is fueled by widespread adoption of residential solar systems, government incentives for clean energy storage, and growing awareness of energy independence. Manufacturers are focusing on improving battery efficiency, life cycle, and safety features while scaling production capacity. Strategic partnerships with global technology providers enhance technological capabilities. Investments in smart storage solutions and pilot projects contribute to market expansion, while rising residential electricity demand and integration with distributed solar networks support rapid adoption.

India is projected to grow at a CAGR of 21%, driven by rising solar rooftop installations and residential energy storage adoption. Government programs promoting energy self-sufficiency and renewable energy targets are encouraging market expansion. Companies are investing in R&D to improve lithium-ion battery efficiency, safety, and affordability. Partnerships with international technology providers and financing solutions for residential users are accelerating adoption. Demand is further supported by increased awareness of energy cost savings and reliability, particularly in regions with unstable grid supply.

Germany is forecasted to grow at a CAGR of 19.3% due to strong policies promoting residential renewable energy and energy storage solutions. Manufacturers are emphasizing high-efficiency lithium-ion cells, smart energy management, and long-life battery systems.

The market is supported by government subsidies for solar-plus-storage installations and energy-efficient home programs. Collaboration with European technology providers enhances innovation in storage solutions, while pilot projects in residential districts are driving adoption. Consumer preference for energy independence and reduced electricity costs is increasing demand for residential storage solutions.

The United Kingdom is projected to expand at a CAGR of 16%, influenced by renewable energy policies and increasing adoption of home solar energy systems. Residential energy storage is gaining traction to manage peak electricity demand and improve energy reliability. Companies are investing in modular storage systems, battery management technologies, and safety features. Strategic collaborations with European and global technology firms are enhancing local manufacturing capabilities. Market growth is supported by government incentives, smart energy initiatives, and rising awareness among homeowners regarding cost savings and sustainable energy usage.

The United States is expected to grow at a CAGR of 14.3%, driven by residential solar adoption, federal clean energy incentives, and growing consumer preference for energy independence. Companies are focusing on scaling lithium-ion battery production, improving charge efficiency, and integrating energy storage with smart home solutions.

Strategic partnerships with technology providers enhance capabilities and reduce cost per unit. Market growth is further accelerated by increasing electricity rates, rising awareness of energy cost savings, and installation of solar-plus-storage systems across suburban and urban homes.

The market has experienced significant growth due to the increasing adoption of renewable energy solutions and the rising need for energy independence at the household level. Leading companies such as Tesla, LG Electronics, and Samsung SDI have established themselves as key players, offering high-efficiency lithium-ion battery systems with advanced energy management features for residential applications. These providers focus on enhancing battery lifespan, safety, and performance while integrating seamlessly with solar PV systems.

Schneider Electric, Siemens Energy, and SolarEdge Technologies contribute through innovative inverter-coupled storage solutions that optimize energy utilization and enable smart home energy management. ABB, Honeywell International, and Johnson Controls focus on scalable and reliable storage technologies, addressing grid stability and backup power requirements. EnerSys, Fluence, Leclanche, Maxwell Technologies, Primus Power, and Saft provide technologically advanced batteries and energy management systems tailored for residential and small-scale commercial installations.

Companies such as Huawei Technologies, Toshiba Corporation, and Uniper are expanding global operations, emphasizing energy efficiency, modularity, and long-term sustainability. The market is shaped by continuous technological innovation, strategic partnerships, and investments in R&D to improve energy density, reduce costs, and enhance safety standards. As residential solar adoption grows worldwide, these providers are positioned to drive market expansion, offering reliable, efficient, and environmentally friendly lithium-ion energy storage solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 55.9 Billion |

| Power Rating | ≤ 3 kW, 3 kW - 6 kW, and > 6 kW |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, EnerSys, Fluence, Honeywell International, Huawei Technologies, Johnson Controls, Leclanche, LG Electronics, Maxwell Technologies, Primus Power, Saft, SAMSUNG SDI, Schneider Electric, Siemens Energy, SolarEdge Technologies, Tesla, Toshiba Corporation, and Uniper |

| Additional Attributes | Dollar sales by battery type and capacity, demand dynamics across residential and commercial solar installations, regional trends in renewable energy adoption, innovation in energy density and charge-discharge efficiency, environmental impact of battery production and recycling, and emerging use cases in off-grid and smart home energy management. |

The global lithium ion residential solar energy storage market is estimated to be valued at USD 55.9 billion in 2025.

The market size for the lithium ion residential solar energy storage market is projected to reach USD 264.3 billion by 2035.

The lithium ion residential solar energy storage market is expected to grow at a 16.8% CAGR between 2025 and 2035.

The key product types in lithium ion residential solar energy storage market are ≤ 3 kw, 3 kw - 6 kw and > 6 kw.

In terms of , segment to command 0.0% share in the lithium ion residential solar energy storage market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lithium-Ion Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Transportation Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium-Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Battery Separator Market Growth & Trends 2025 to 2035

Lithium Ion Battery Dispersant Market Growth – Trends & Forecast 2024-2034

Lithium Ion Battery Material Market Growth – Trends & Forecast 2024-2034

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Lithium Extraction From Brine Technology Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA