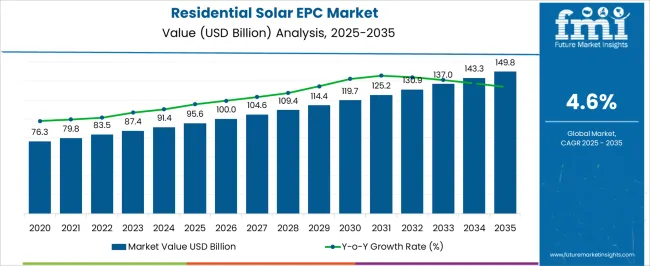

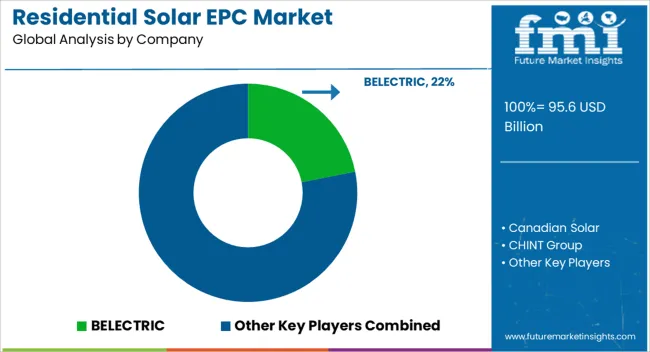

The Residential Solar EPC Market is estimated to be valued at USD 95.6 billion in 2025 and is projected to reach USD 149.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

This steady expansion reflects the rising adoption of rooftop solar installations supported by declining photovoltaic module costs, favorable financing models, and increasing household participation in renewable energy generation. From 2025 to 2030, growth will likely be shaped by government incentives, tax credits, and net metering schemes that encourage individual homeowners to invest in solar EPC services.

During the period from 2030 to 2035, the market is expected to transition toward consolidation, where large EPC providers will leverage economies of scale, standardized installation practices, and digital design tools to reduce costs and expand their reach. The incremental increase of USD 54.2 billion over the ten years signals consistent but moderate expansion compared with utility-scale projects.

Key opportunities will lie in emerging economies with growing residential energy needs and limited grid reliability, where rooftop systems can deliver both energy savings and independence. Service differentiation through maintenance packages, monitoring systems, and integration with residential energy storage will become critical in shaping competitiveness across regional markets.

| Metric | Value |

|---|---|

| Residential Solar EPC Market Estimated Value in (2025 E) | USD 95.6 billion |

| Residential Solar EPC Market Forecast Value in (2035 F) | USD 149.8 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The residential solar EPC market is experiencing sustained growth driven by rising electricity costs, supportive policy frameworks, and increasing awareness of clean energy solutions among homeowners. The shift toward decentralized power generation has been further accelerated by improvements in photovoltaic efficiency, smart metering systems, and energy storage integration.

Incentives such as net metering, tax credits, and low interest financing options are enabling residential consumers to invest in solar systems with greater confidence. Additionally, advancements in digital project design, remote monitoring, and predictive maintenance are optimizing system performance while reducing lifecycle costs.

With growing environmental consciousness and regulatory emphasis on emission reduction targets, the adoption of residential solar continues to expand. The market outlook remains strong as technology providers, contractors, and investors align to make rooftop solar more accessible and economically viable across both urban and semi urban households.

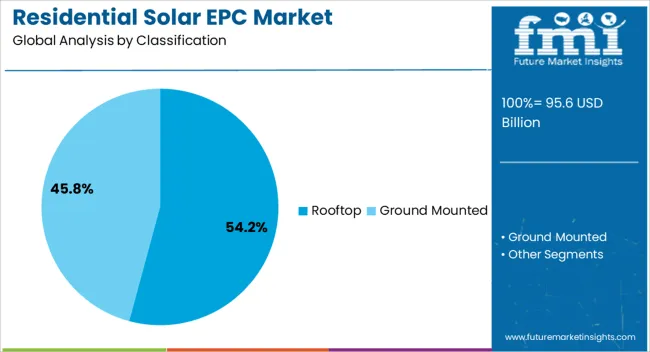

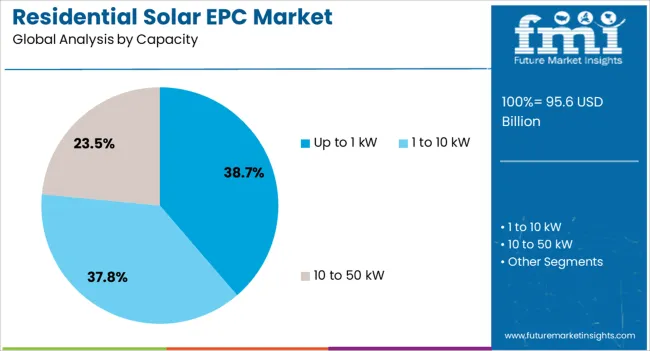

The residential solar EPC market is segmented by classification, capacity, and geographic regions. By classification, the residential solar EPC market is divided into Rooftop and Ground Mounted. In terms of capacity, the residential solar EPC market is classified into Up to 1 kW, 1 to 10 kW, and 10 to 50 kW. Regionally, the residential solar EPC industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rooftop segment is projected to contribute 54.20% of total revenue by 2025 under the classification category, establishing it as the dominant segment. This prominence is due to increased residential rooftop availability, favorable government mandates for distributed solar, and declining installation costs.

Homeowners are increasingly opting for rooftop solar as it utilizes existing space without additional land requirements and enhances property value. The ability to integrate systems seamlessly with home architecture and energy storage units further supports its widespread adoption.

Enhanced design flexibility and support from regional EPC providers are strengthening the position of rooftop systems, making this segment the cornerstone of residential solar deployment.

The up to 1 kW segment is expected to hold 38.70% of total market revenue by 2025 within the capacity category, positioning it as the leading capacity range. This segment is favored in urban households with limited roof space or lower power needs, where compact and cost effective solar solutions are ideal.

Its affordability and ease of installation make it highly attractive for first time adopters and low income residential consumers. Government subsidy schemes and simplified grid connectivity processes have also contributed to its rising adoption.

As energy efficiency standards evolve and smaller households seek independence from grid volatility, the up to 1 kW segment continues to lead due to its practical, scalable, and financially accessible features.

The residential solar EPC market is experiencing growth driven by increasing adoption, supportive government policies, and competitive pricing. Financing solutions are crucial for driving further market expansion as more homeowners seek solar solutions to lower energy costs.

The residential solar EPC market is seeing increased growth as more homeowners look for alternative energy sources to reduce their electricity costs. Government incentives, rebates, and tax credits continue to encourage residential solar adoption. As energy prices rise, the demand for solar solutions is intensifying. This is further supported by rising consumer awareness of the long-term savings and environmental benefits of solar energy. Residential solar EPC companies are benefitting from the growing interest in energy independence, with customers seeking to offset energy costs through solar panel installations. The rising costs of conventional energy sources make solar an increasingly attractive option for homeowners.

Government policies and regulations are significant drivers of growth in the residential solar EPC market. As more countries implement net metering, feed-in tariffs, and renewable energy targets, residential solar installations are gaining traction. Policies designed to encourage clean energy use directly impact the adoption rate of residential solar systems, with many nations introducing incentives such as tax credits and grants to reduce the upfront cost. These supportive measures allow homeowners to overcome financial barriers and make solar a more attractive investment. As such policies evolve, the residential solar EPC market is expected to expand in both developed and emerging economies.

The residential solar EPC market is becoming increasingly competitive, with several key players providing a wide range of services, from installation to system maintenance. Companies such as SunPower, First Solar, and Vivint Solar dominate the market, with a focus on streamlining solar energy systems for homeowners. Smaller regional players also contribute to the market by offering tailored solutions based on local energy needs and incentives. This competitive environment is pushing companies to offer better pricing, superior customer service, and enhanced financing options, as they strive to meet the growing demand for solar installations in residential areas.

Cost remains a critical factor influencing the adoption of residential solar systems, with upfront expenses often being a barrier for many homeowners. To overcome this, EPC providers are increasingly offering innovative financing solutions such as solar leases, power purchase agreements (PPAs), and low-interest loans, allowing customers to pay for their systems over time. These financing models make solar power more accessible and financially viable, even for those who might not be able to afford the upfront costs. As these financial options become more widespread, the market is seeing a growing number of homeowners making the switch to solar energy.

| Countries | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

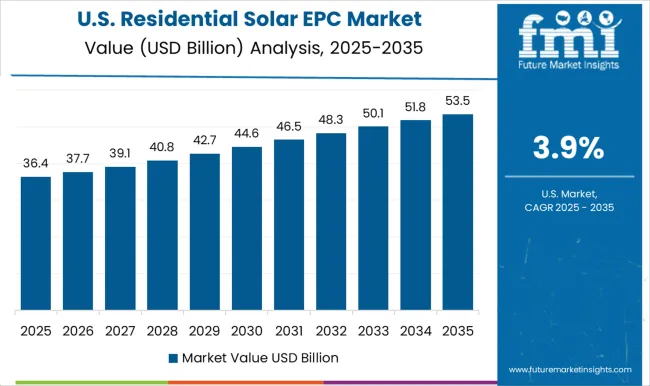

| USA | 3.9% |

| Brazil | 3.5% |

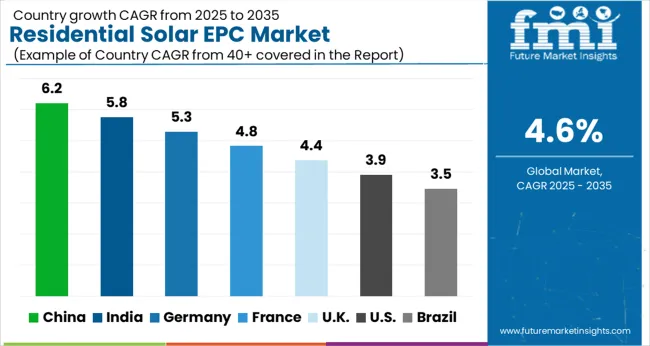

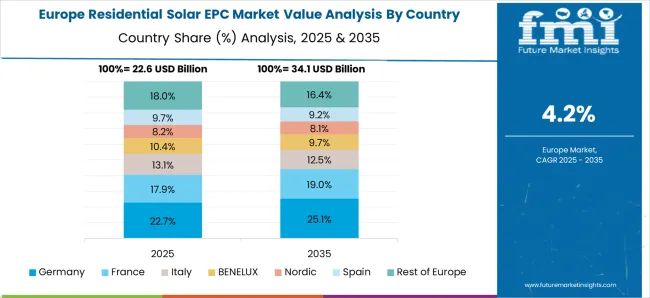

The residential solar EPC market is projected to grow globally at a CAGR of 4.6% from 2025 to 2035, driven by increasing demand for residential solar solutions. China leads with a CAGR of 6.2%, fueled by rapid solar adoption driven by strong government incentives and growing demand for energy independence. India follows with a 5.8% CAGR, supported by expanding residential solar programs and a focus on renewable energy to address power shortages. France records a 4.8% CAGR, driven by government policies promoting solar energy and subsidies for homeowners. The UK sees a 4.4% CAGR, aided by continued investments in solar adoption and green energy initiatives. The USA maintains a 3.9% CAGR, with growth supported by rising awareness and solar incentives, especially in states with high energy costs. This growth outlook underscores the increasing adoption of residential solar solutions globally, with Asia-Pacific and Europe leading the way in solar adoption and regulatory support.

The CAGR for the UK residential solar EPC market was approximately 3.8% during 2020–2024 and is projected to rise to 4.4% for the 2025–2035 period. The slower growth during 2020–2024 can be attributed to challenges such as high initial costs, limited public awareness, and slower adoption in some regions. However, from 2025 onward, the market is expected to experience a stronger growth trajectory as increasing government incentives, the rise in electricity prices, and growing demand for energy independence push more homeowners to adopt solar power solutions. Technological advancements, along with improved financing options, will make solar energy more accessible, driving market expansion. The UK’s focus on green energy and the expansion of residential solar adoption is expected to fuel consistent growth in the coming decade.

China’s residential solar EPC market is expected to grow at a CAGR of 6.2% from 2025 to 2035. The market growth rate during 2020–2024 was around 5.8%, driven by aggressive government incentives, a strong push for renewable energy, and increasing investments in residential solar. With a rapidly expanding middle class and increasing energy needs in urban areas, demand for residential solar solutions has been growing steadily. As the cost of solar technologies continues to decrease and energy efficiency improves, more homeowners are adopting solar energy systems. In the coming years, the market is expected to accelerate, driven by continued government support, advancements in solar technology, and the expansion of the residential solar sector in rural areas.

India’s residential solar EPC market is projected to grow at a CAGR of 5.8% from 2025 to 2035. The market experienced a 5.0% CAGR during 2020–2024, with growth driven by government incentives, the focus on reducing energy deficits, and a rise in residential solar installations. The Indian government has introduced various initiatives, such as subsidies and tax rebates, to promote renewable energy, which has significantly driven market growth. During the 2025–2035 period, the residential solar EPC market in India is expected to accelerate further, driven by increased energy costs, enhanced financing options, and growing consumer awareness about the benefits of solar energy. The rise of energy independence and the shift towards clean energy solutions will continue to support the expansion of solar energy in residential homes.

France’s residential solar EPC market is projected to grow at a CAGR of 4.8% from 2025 to 2035, up from 4.5% during 2020–2024. The market saw gradual growth due to supportive government policies and incentives designed to encourage solar adoption. During the 2020–2024 period, the adoption rate was slower as compared to other European countries, primarily due to the high upfront costs of solar installations. However, with increasing energy prices and growing interest in reducing carbon footprints, residential solar adoption is expected to rise. From 2025 onwards, market growth will be driven by enhanced financing options, advancements in solar technologies, and an increasing focus on sustainability.

The residential solar EPC market in the USA grew at a CAGR of 4.2% during 2020–2024, with an expected rise to 3.9% for 2025–2035. The slower growth during 2020–2024 was driven by varying state-level incentives, high initial costs, and market saturation in some regions. However, the market is projected to experience more growth in the 2025–2035 period as solar adoption becomes more mainstream, with additional incentives and programs being introduced. Increased energy demand, declining costs of solar technologies, and a focus on energy independence are expected to drive solar adoption in residential homes. The growth rate will also be influenced by evolving policy frameworks, especially in states with strong solar initiatives.

The residential solar EPC market is shaped by a combination of global solar companies and specialized providers delivering comprehensive solutions for residential solar installations. Canadian Solar stands as a dominant player, offering high-performance solar panels and inverters, providing complete EPC solutions for residential and commercial applications.

CHINT Group maintains a strong presence with cost-effective, reliable solar solutions and a broad range of EPC services, supporting residential solar adoption. Mahindra Susten, backed by its strong engineering expertise, focuses on sustainable solar projects and smart grid solutions for residential energy needs.

TATA Power Solar, one of India’s leading solar energy companies, combines manufacturing excellence with EPC services, offering high-efficiency solar systems for residential applications. VIKRAM SOLAR LTD. is another major player, providing innovative solar panel solutions and complete EPC services, while Waaree Energies Ltd. is renowned for its high-quality solar equipment and services in the residential sector.

Companies like BELECTRIC, CJR Renewables, Eternia Solar, and Goldi Solar, Inc. are driving innovation with advanced technologies and tailored solutions for residential solar installations. Key competitive strategies in this market include technological innovation, emphasis on energy efficiency, and expanding market presence through strong dealer networks.

Manufacturers and EPC providers are focusing on offering integrated solar solutions that cater to the increasing demand for renewable energy in residential areas. There is a growing emphasis on providing cost-effective solar energy solutions with long-term reliability, which is expected to further accelerate the adoption of residential solar energy systems globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 95.6 Billion |

| Classification | Rooftop and Ground Mounted |

| Capacity | Up to 1 kW, 1 to 10 kW, and 10 to 50 kW |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BELECTRIC, Canadian Solar, CHINT Group, CJR Renewables, Eternia Solar, Goldi Solar, Inc., Jakson, JUWI, Mahindra Susten, TATA POWER SOLAR, VIKRAM SOLAR LTD., and Waaree Energies Ltd. |

| Additional Attributes | Dollar sales projections, market share across regions, competitive landscape, growth drivers like government incentives in solar systems, and consumer adoption trends. |

The global residential solar EPC market is estimated to be valued at USD 95.6 billion in 2025.

The market size for the residential solar EPC market is projected to reach USD 149.8 billion by 2035.

The residential solar EPC market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in residential solar EPC market are rooftop and ground mounted.

In terms of capacity, up to 1 kw segment to command 38.7% share in the residential solar EPC market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA