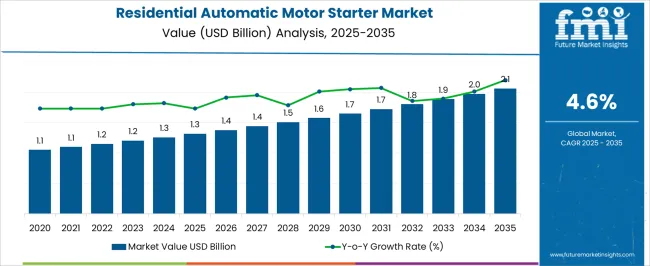

The residential automatic motor starter market is projected to reach USD 1.3 billion by 2025, growing to USD 2.1 billion by 2035, with a CAGR of 4.6%. During the early adoption phase of 2020–2024, gradual deployment was observed, as users became familiar with automation in residential electrical systems. Market confidence was established as safety and operational reliability were emphasized. By 2025, steady uptake was achieved, with adoption being influenced by growing awareness of reduced manual intervention.

The scaling stage of 2025–2030 is defined by stronger integration into household setups, with consistent annual increments from USD 1.3 billion to USD 1.7 billion. By 2030–2035, consolidation is expected to occur, with the market expanding from USD 1.7 billion to USD 2.1 billion. This stage will be characterized by reinforced consumer trust, wider availability, and standardized applications across residential infrastructure. Broader acceptance will be ensured as maintenance, affordability, and performance consistency are highlighted. Industry suppliers are anticipated to focus on strengthening their service networks to support long-term usage. The transition through these phases illustrates a clear pathway in which early experimentation gave way to broader scaling, eventually reaching a stable and mature adoption framework across residential markets.

| Metric | Value |

|---|---|

| Residential Automatic Motor Starter Market Estimated Value in (2025 E) | USD 1.3 billion |

| Residential Automatic Motor Starter Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The global industrial machinery market has been valued as the largest contributor, holding nearly 28% share, as widespread use in manufacturing has been emphasized. The electrical equipment sector has been assessed at around 17%, supported by steady demand from both commercial and residential applications. Within the electronics and semiconductors market, nearly 14% of the share has been captured, as production efficiency and precision tools are being relied upon. The construction equipment industry has been placed at 12%, where growing adoption across infrastructure projects has been recorded. The automotive components sector has been assigned a share of 10%, since integration of automation tools has been widely practiced. The aerospace and defense equipment market has been estimated at 8%, reinforced by government contracts and consistent procurement. Around 6% has been contributed by the energy and utilities sector, as equipment has been used for power distribution and system management. Finally, the healthcare equipment market has been noted with nearly 5% share, as specialized tools and devices have been incorporated across hospitals and diagnostic centers.

The Residential Automatic Motor Starter market is witnessing steady growth as residential infrastructure increasingly adopts energy-efficient and automated electrical solutions. The market expansion is being driven by rising demand for reliable motor control systems in residential applications such as water pumps, HVAC systems, and home automation setups.

Technological advancements in smart home integration, remote monitoring, and energy management have encouraged adoption by homeowners seeking convenience, safety, and cost efficiency. The market is also benefiting from growing awareness of electrical safety standards, which require motor starters with built-in protection against overloads, short circuits, and voltage fluctuations.

Increasing construction activity in urban and suburban areas, coupled with the rise in smart residential projects, is further facilitating the deployment of automatic motor starters. As homeowners prioritize energy optimization and automated control, the Residential Automatic Motor Starter market is expected to sustain its growth trajectory, driven by innovation, safety compliance, and the demand for efficient, long-lasting motor operation.

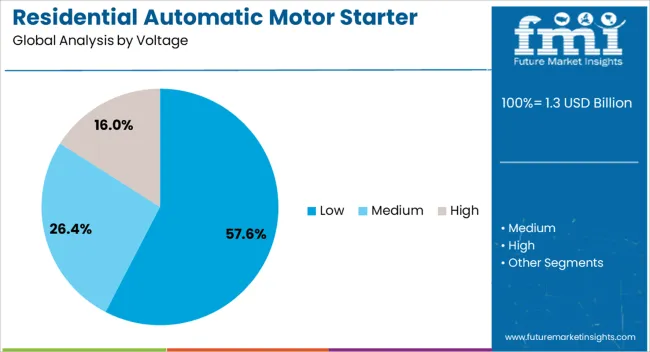

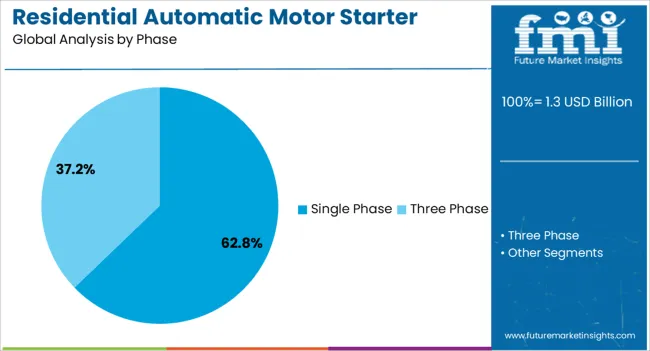

The residential automatic motor starter market is segmented by voltage, phase, and geographic regions. By voltage, residential automatic motor starter market is divided into Low, Medium, and High. In terms of phase, residential automatic motor starter market is classified into Single Phase and Three Phase. Regionally, the residential automatic motor starter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Low Voltage segment is projected to hold 57.6% of the Residential Automatic Motor Starter market revenue share in 2025, positioning it as the leading voltage category. This dominance is being attributed to its suitability for typical residential electrical systems, which operate at lower voltage levels, offering safe and efficient motor operation. Adoption has been enhanced by the segment’s ability to support frequent start-stop cycles without compromising equipment reliability or increasing energy consumption.

Low voltage starters are preferred in residential applications due to simplified installation, compatibility with common household wiring, and reduced maintenance requirements. The growth of this segment has also been driven by rising consumer awareness regarding electrical safety and adherence to regulatory standards that favor low-voltage solutions.

Additionally, the widespread availability of cost-effective components and scalable designs has made low-voltage motor starters a practical choice for homeowners and residential contractors alike. As residential automation continues to expand, the low-voltage segment is expected to maintain its leadership by delivering reliable and safe motor control solutions that meet household demands.

The Single Phase segment is expected to capture 62.8% of the Residential Automatic Motor Starter market revenue share in 2025, making it the most significant phase type in residential applications. This leadership is being influenced by the prevalence of single-phase power supply in most households, which simplifies integration with existing wiring infrastructure and reduces installation complexity.

Single phase motor starters are being favored for their cost efficiency, ease of maintenance, and compatibility with common residential appliances such as water pumps, small HVAC units, and home automation motors. The growth of this segment is further supported by the increasing construction of urban and suburban homes that rely on single-phase electricity distribution.

Additionally, single-phase starters are well-suited for automated control systems, allowing homeowners to benefit from remote operation and energy optimization. As residential automation trends continue to accelerate, the single-phase segment is expected to maintain its market leadership by providing accessible, safe, and efficient motor control solutions for a wide range of household applications.

The residential automatic motor starter market is expanding due to rising urbanization, growing adoption of home water pumps, HVAC systems, and increased focus on safety and energy efficiency. North America and Europe lead with advanced starters designed for smart homes and energy-conscious households, while Asia-Pacific shows strong growth fueled by population density, residential construction, and demand for affordable motor protection. Manufacturers differentiate through compact designs, overload protection, remote monitoring, and integration with smart electrical systems, with regional regulations and infrastructure shaping adoption globally.

Motor protection and energy savings are critical factors driving starter adoption. North America and Europe emphasize advanced designs offering overload protection, short-circuit safety, and energy-efficient operation to align with residential building codes. Asia-Pacific markets prioritize cost-effective motor starters that balance safety with affordability for large-scale use in water pumps and air conditioners. Differences in protection sophistication affect motor longevity, maintenance costs, and energy bills. Leading suppliers provide advanced starters with auto-reset functions and thermal protection, while regional producers deliver practical, low-cost alternatives. Motor protection and efficiency contrasts shape adoption, household reliability, and competitiveness across global residential motor starter markets.

The rise of connected households and IoT-enabled devices influences starter adoption. North America and Europe lead with smart starters that integrate with home energy management systems, enabling remote monitoring and automatic fault detection. Asia-Pacific adoption is growing in urban centers where connected appliances and smart meters are gaining traction, though affordability limits advanced adoption in rural areas. Differences in smart integration impact convenience, safety, and energy optimization. Suppliers offering Wi-Fi-enabled, app-controlled motor starters gain higher adoption, while regional players focus on functional, standalone solutions. Smart integration contrasts shape adoption, household modernization, and competitive positioning in residential starter markets worldwide.

Starter design and installation simplicity are vital for residential applications. North America and Europe prioritize compact, modular starters suitable for space-constrained electrical panels, ensuring quick and safe installation. Asia-Pacific markets emphasize durable, easy-to-install solutions for high-demand appliances such as pumps and refrigerators, with cost efficiency as a core requirement. Differences in design compactness and ease of use affect installation time, maintenance, and homeowner adoption. Suppliers offering plug-and-play starters with clear labeling and user-friendly interfaces gain premium traction, while regional manufacturers focus on robust, simplified alternatives. Design and installation contrasts drive adoption and competitiveness across global residential motor starter markets.

Compliance with electrical codes, energy efficiency rules, and household safety standards strongly influences market adoption. North America and Europe enforce strict residential regulations regarding thermal protection, fire resistance, and electrical insulation, driving demand for certified products. Asia-Pacific regulations vary; advanced regions align with global norms, while emerging markets adopt practical standards emphasizing affordability. Differences in compliance rigor affect product approval, installation costs, and consumer trust. Suppliers providing globally certified, regulation-compliant starters gain market credibility, while local manufacturers focus on cost-effective compliance with domestic norms. Safety and regulatory contrasts shape adoption, household reliability, and market competitiveness in global residential starter markets.

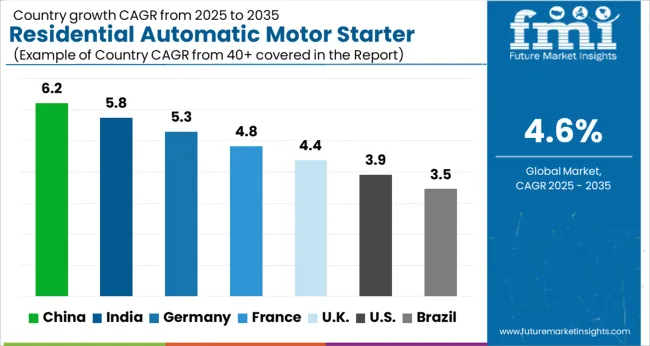

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

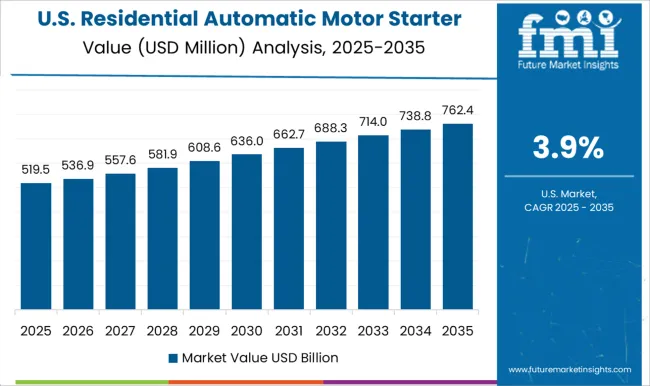

| USA | 3.9% |

| Brazil | 3.5% |

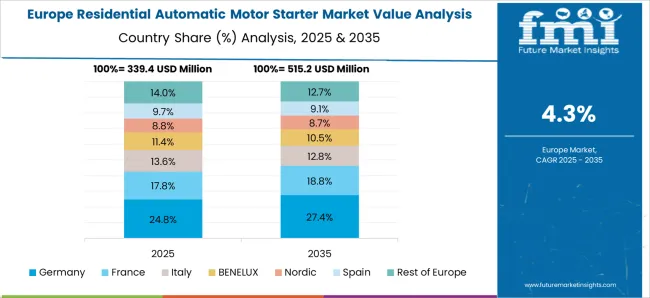

The residential automatic motor starter market is projected to grow at a 4.6% CAGR through 2035, driven by increasing household automation, energy efficiency needs, and electrical safety standards. Among BRICS nations, China dominates with a 6.2% growth rate, supported by large-scale residential construction and government energy-efficiency initiatives, while India, expanding at 5.8%, sees demand fueled by rapid electrification and urban housing developments. In OECD economies, Germany is advancing at 5.3%, benefiting from strong engineering expertise and compliance with strict EU safety norms. The UK follows with a 4.4% CAGR, where residential retrofitting and smart home solutions encourage adoption, while the USA, growing at 3.9%, reflects steady integration of starters into residential HVAC and water pumping systems. This report covers developments across 40+ countries, spotlighting the five leading growth markets shaping the industry outlook.

The residential automatic motor starter market in China is being driven at a CAGR of 6.2% with increasing household adoption of automated electrical systems. Starters designed to protect motors from overload and voltage fluctuations are being adopted widely in urban and semi-urban housing projects. Manufacturers are being encouraged to deliver compact, cost-efficient, and durable devices. Distribution through electrical wholesalers, retail outlets, and e-commerce platforms is being maintained. Government policies supporting modern residential infrastructure and the integration of safety-focused devices are being followed. Research and development in smart starters with advanced monitoring and energy-saving features is being conducted. Rising demand for household appliances, water pumps, and automated systems is being considered a key factor behind market growth in China.

Residential automatic motor starter market in India is being expanded at a CAGR of 5.8% as urbanization and modern housing projects continue to grow. Motor starters offering overload protection, automatic restart, and improved voltage management are being adopted across households. Manufacturers are being focused on producing cost-effective, reliable, and compact devices. Distribution through electrical retailers, authorized suppliers, and online platforms is being ensured. Awareness programs on safe electrical installations and household efficiency improvements are being conducted. Rising demand for water pumps, domestic appliances, and home automation is being considered a primary factor supporting market growth in India.

Residential automatic motor starter market in Germany is being driven at a CAGR of 5.3% with growing adoption of residential safety-focused electrical devices. Automatic motor starters are being adopted to improve motor protection, energy efficiency, and reliability in household systems. Manufacturers are being encouraged to provide technologically advanced, durable, and space-efficient devices. Distribution through authorized distributors, electrical contractors, and online suppliers is being maintained. Research and development in smart starters with monitoring, diagnostics, and energy management features is being conducted. Germany’s strong focus on energy-efficient households and safety regulations is being considered a key driver of adoption.

The United Kingdom residential automatic motor starter market is being expanded at a CAGR of 4.4% due to increasing installation of residential automation and energy-efficient systems. Automatic starters are being adopted in households to protect motors and enhance reliability of domestic appliances. Manufacturers are being focused on delivering compact, reliable, and cost-efficient devices. Distribution through wholesalers, contractors, and online suppliers is being ensured. Training sessions and awareness programs on safe installation are being conducted. Rising use of home automation technologies, water pumps, and electrical appliances is being considered a key factor driving market demand in the United Kingdom.

The United States residential automatic motor starter market is being driven at a CAGR of 3.9% as households increasingly adopt automatic starters for electrical safety and energy efficiency. Starters designed to handle overloads, voltage drops, and automatic restarts are being adopted in residential settings. Manufacturers are being encouraged to supply durable, technologically advanced, and compact devices. Distribution through retailers, electrical contractors, and e-commerce platforms is being maintained. Research and development in smart starters with energy monitoring and remote-control features is being conducted. Expanding adoption of domestic appliances, water pumping systems, and home automation is being considered a major factor supporting growth of the residential automatic motor starter market in the United States.

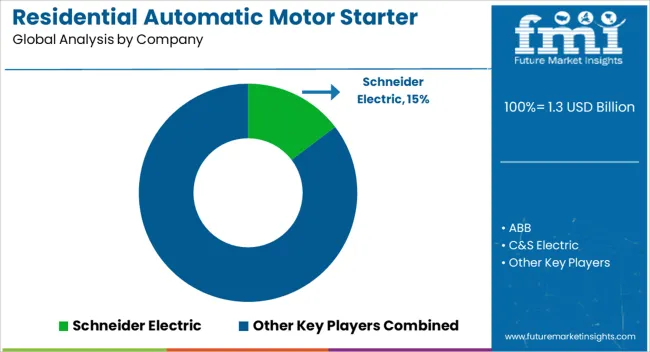

The residential automatic motor starter market is witnessing steady growth, supported by rising electricity demand, increasing adoption of household appliances, and the need for efficient motor protection systems. Automatic motor starters are widely used in residential setups to provide overload and short-circuit protection while ensuring smooth motor operations. The growing focus on energy efficiency, home automation, and safety standards is further boosting demand for advanced starters integrated with digital monitoring and smart control features. Prominent players in this market include Schneider Electric, ABB, C&S Electric, CHINT Group, Danfoss, Eaton, Emerson Electric, Fuji Electric, Havells India, L&T Electrical and Automation, Lovato Electric, Mitsubishi Electric, Rockwell Automation, Siemens, SKN-Bentex Group, and WEG. These companies are investing heavily in innovative solutions that meet the growing residential demand for compact, reliable, and intelligent starters. Schneider Electric, ABB, and Siemens are among the global leaders, known for offering technologically advanced solutions with high efficiency and connectivity features. Eaton, Rockwell Automation, and Mitsubishi Electric provide robust and reliable products that cater to both residential and light commercial applications. Meanwhile, regional players like Havells India, C&S Electric, and SKN-Bentex Group hold strong positions in emerging markets, offering cost-effective solutions tailored to local consumer needs. Companies such as Fuji Electric, Danfoss, and WEG are expanding their portfolios with energy-efficient designs and smart starters that integrate seamlessly with modern electrical infrastructure. Additionally, L&T Electrical and Automation and Lovato Electric are focusing on affordability and durability, ensuring wider accessibility in price-sensitive markets. Market growth is being driven by rapid urbanization, rising middle-class populations, and the expansion of residential construction activities. With increasing awareness of energy savings and the adoption of IoT-enabled devices, demand for smart motor starters is expected to rise further. Continuous R&D investments, partnerships, and regional expansions are being emphasized by leading players to strengthen their presence in this competitive sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Voltage | Low, Medium, and High |

| Phase | Single Phase and Three Phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, C&S Electric, CHINT Group, Danfoss, Eaton, Emerson Electric, Fuji Electric, Havells India, L&T Electrical and Automation, Lovato Electric, Mitsubishi Electric, Rockwell Automation, Siemens, SKN-Bentex Group, and WEG |

| Additional Attributes | Dollar sales vary by product type, including direct-on-line (DOL), star-delta, and soft starters; by motor capacity, spanning fractional horsepower to medium-capacity motors; by application, such as HVAC systems, pumps, and household appliances; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising residential automation, energy efficiency needs, and increasing use of smart motor control solutions. |

The global residential automatic motor starter market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the residential automatic motor starter market is projected to reach USD 2.1 billion by 2035.

The residential automatic motor starter market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in residential automatic motor starter market are low, medium and high.

In terms of phase, single phase segment to command 62.8% share in the residential automatic motor starter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA