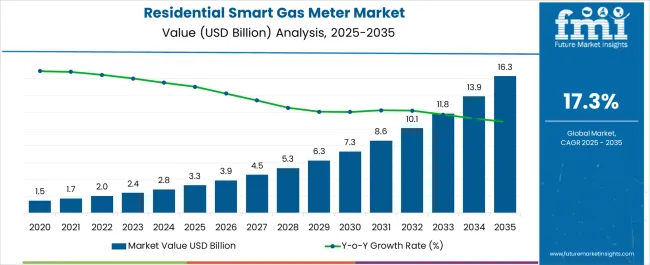

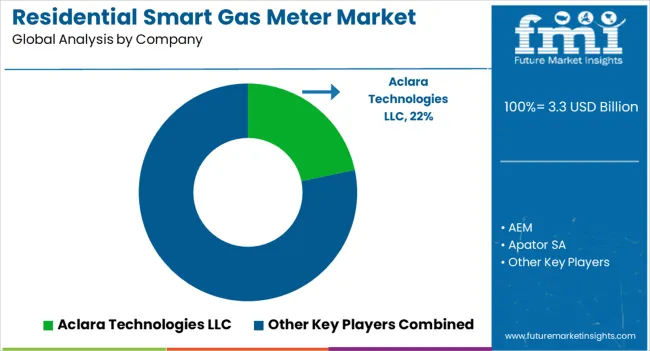

The Residential Smart Gas Meter Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 16.3 billion by 2035, registering a compound annual growth rate (CAGR) of 17.3% over the forecast period. Regulatory frameworks and government mandates play a pivotal role in shaping market dynamics, influencing both adoption rates and technological innovation within the sector. Policies promoting energy efficiency, carbon emission reductions, and smart grid integration are central to market growth, driving utilities and residential consumers to upgrade traditional gas meters to smart systems.

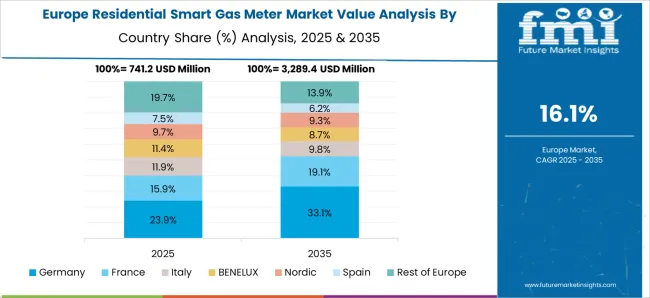

In regions such as Europe and North America, stricter regulatory compliance on energy metering and utility reporting standards accelerates smart gas meter deployment. Mandates requiring real-time consumption monitoring, automated billing, and integration with demand response programs compel utility providers to invest in smart metering infrastructure. From 2025 to 2030, the market value rises from USD 3.3 billion to USD 7.3 billion, reflecting regulatory-driven adoption as pilot projects mature into full-scale rollouts. Incentives for energy savings and penalties for non-compliance further motivate stakeholders to implement advanced metering solutions.

By 2030 to 2035, the market is expected to reach USD 16.3 billion, as compliance deadlines, government subsidies, and mandatory replacement policies converge. Regulatory oversight ensures standardization, interoperability, and cybersecurity measures, while also encouraging continuous product innovation. The regulatory influence is a primary driver, enabling widespread adoption of smart gas meters, optimizing energy consumption, and supporting national sustainability and digitalization goals.

| Metric | Value |

|---|---|

| Residential Smart Gas Meter Market Estimated Value in (2025 E) | USD 3.3 billion |

| Residential Smart Gas Meter Market Forecast Value in (2035 F) | USD 16.3 billion |

| Forecast CAGR (2025 to 2035) | 17.3% |

The residential smart gas meter market is experiencing notable growth due to increasing adoption of intelligent utility infrastructure, energy efficiency mandates, and consumer demand for real-time consumption insights. The shift toward digital metering is being propelled by national smart grid programs, which aim to improve operational transparency and reduce energy losses in residential gas distribution.

Smart gas meters are enabling households to monitor usage patterns, detect leaks, and receive remote billing updates, all of which contribute to enhanced safety and cost management. Technological advancements in wireless communication and IoT integration are supporting widespread deployment across both developed and emerging economies.

As regulatory bodies and utility providers aim to modernize legacy systems and reduce manual intervention, the market for residential smart gas meters continues to expand with strong future potential.

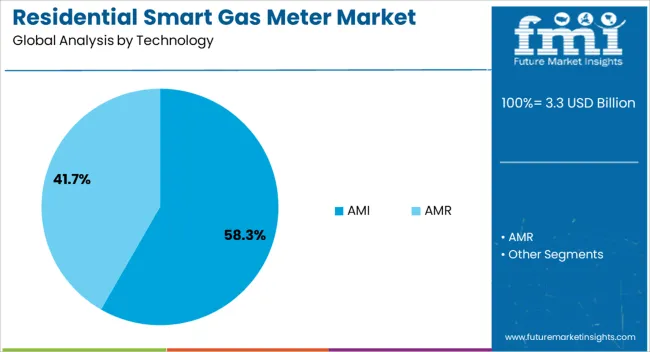

The residential smart gas meter market is segmented by technology and geographic regions. By technology, the residential smart gas meter market is divided into AMI and AMR. Regionally, the residential smart gas meter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The AMI segment is projected to represent 58.30% of the total market revenue by 2025 within the technology category, positioning it as the leading segment. Growth in this segment is being driven by the ability of advanced metering infrastructure to provide two-way communication between utilities and end users.

AMI systems enable real-time data transmission, remote disconnection and reconnection, and detailed consumption analytics that help improve energy efficiency and service reliability. Utilities benefit from streamlined operations, enhanced demand forecasting, and reduced operational costs, while consumers gain better visibility into their usage patterns. The increasing integration of AMI with cloud platforms and IoT frameworks is further accelerating its adoption. As smart grids evolve and utilities invest in digital transformation, AMI remains the preferred technology due to its scalability, accuracy, and compatibility with modern energy management requirements.

The market has expanded due to increasing adoption of intelligent metering systems in households and multi-family units. Smart meters allow real-time monitoring, accurate billing, leak detection, and integration with home energy management platforms. Growth has been driven by energy efficiency initiatives, regulatory mandates for automated metering, and the transition toward digital utilities. Technological innovations in IoT connectivity, wireless communication, and data analytics have reinforced adoption. Rising consumer demand for energy management, safety, and cost optimization has positioned smart gas meters as a critical component in modern residential energy infrastructure globally.

Technological advancements have strengthened the market by improving accuracy, connectivity, and functionality. Advanced sensors and ultrasonic measurement techniques have been integrated to provide precise consumption data and detect leaks in real time. IoT-enabled meters transmit data wirelessly to utility providers and home energy management systems, allowing automated billing, usage tracking, and energy optimization. Integration with mobile applications and cloud-based platforms enables consumers to monitor consumption patterns, set alerts, and manage costs efficiently. The secure communication protocols and encryption measures have been implemented to ensure data integrity and prevent unauthorized access. These technological enhancements have improved operational efficiency, safety, and consumer engagement, making smart gas meters an essential solution in digitally connected households.

Energy efficiency programs and regulatory frameworks have driven adoption of residential smart gas meters. Governments and utility authorities have promoted automated metering infrastructure to optimize gas consumption, reduce wastage, and support national energy conservation targets. Standards and guidelines for meter accuracy, remote reading capabilities, and safety monitoring have ensured consistent performance. Incentive schemes and subsidies for smart meter installation have encouraged residential uptake. Utilities have leveraged real-time monitoring to forecast demand, detect anomalies, and implement dynamic pricing strategies. These regulatory and efficiency-driven initiatives have reinforced the market by enhancing accountability, promoting consumer participation in energy savings, and accelerating the replacement of conventional meters with advanced digital solutions globally.

Operational reliability and safety have significantly influenced the residential smart gas meter market. Smart meters are designed to withstand temperature variations, pressure fluctuations, and environmental exposure while maintaining accurate measurement and reporting. Leak detection, fault alerts, and automated shutoff mechanisms have enhanced household safety and reduced risks of accidents. Remote diagnostics and predictive maintenance features allow utilities to address issues promptly, minimizing downtime and service interruptions. The durability and dependability of smart gas meters have been critical for gaining consumer trust and ensuring uninterrupted gas supply. These reliability and safety features have reinforced market growth by making smart meters a preferred solution for modern residential energy monitoring and management.

The integration of residential smart gas meters with smart home ecosystems and digital energy platforms has expanded market potential. Meters are increasingly connected to energy management systems, mobile applications, and cloud-based dashboards for real-time monitoring and automated control. Data analytics enable insights into consumption trends, cost optimization, and energy efficiency improvements. Integration with home automation devices, such as smart thermostats and utility management systems, allows coordinated energy use and predictive maintenance. Consumers benefit from remote monitoring, alerts, and tailored energy-saving recommendations. This convergence of smart metering and digital home solutions has enhanced convenience, efficiency, and user engagement, positioning residential smart gas meters as a core component of intelligent, connected household energy infrastructure worldwide.

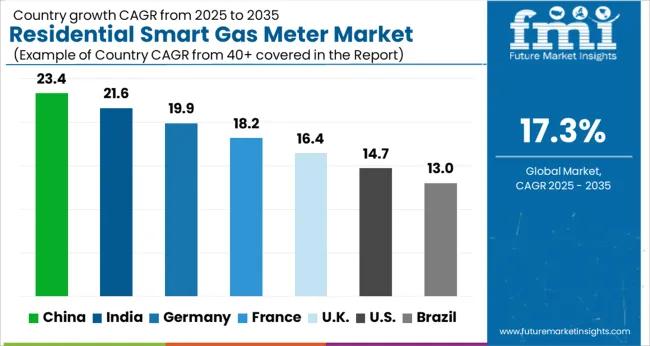

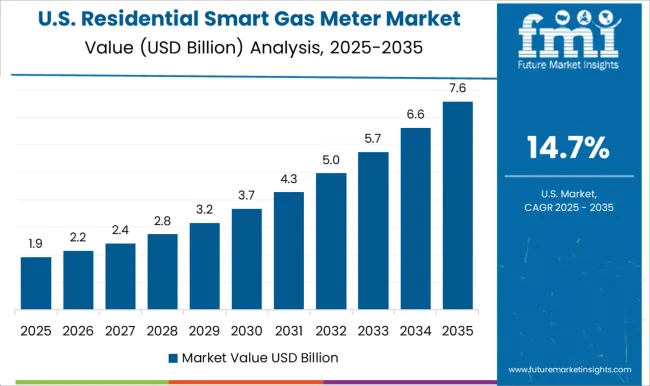

The market is set to expand at a CAGR of 17.3% between 2025 and 2035, driven by the shift toward digital metering, energy efficiency initiatives, and smart grid integration. China leads with a 23.4% CAGR, supported by large-scale deployments and government-backed smart city programs. India follows at 21.6%, fueled by modernization of urban energy infrastructure and utility digitization. Germany, at 19.9%, benefits from strong regulatory frameworks and advanced metering infrastructure. The UK, growing at 16.4%, focuses on energy monitoring and sustainable consumption. The USA, at 14.7%, sees steady adoption through utility modernization and smart home integration. This report covers 40+ countries, with the top markets highlighted here for reference.

The industry in China is expected to expand at a CAGR of 23.4% from 2025 to 2035, driven by nationwide smart utility initiatives and government-backed energy monitoring programs. Widespread deployment in urban and suburban areas is accelerating adoption, while integration with IoT-enabled home automation systems is improving efficiency. Leading manufacturers are investing in digital metering technologies and secure communication protocols to enhance reliability and data accuracy. Pilot programs in high-density residential communities are testing advanced analytics and predictive maintenance features, supporting long-term scalability.

India is anticipated to grow at a CAGR of 21.6% during 2025 to 2035, driven by government programs promoting smart metering and energy efficiency in urban and peri-urban areas. Utility companies are deploying advanced communication-enabled meters to optimize billing and reduce leakage. Technological collaborations with international providers are enhancing accuracy, security, and remote monitoring capabilities. Rapid urban expansion and increasing consumer awareness of energy management are supporting market adoption.

Germany is forecast to expand at a CAGR of 19.9% over 2025 to 2035, driven by government regulations promoting energy efficiency and intelligent utility management. Integration with smart grids and energy management platforms is enhancing operational efficiency. Local manufacturers are focusing on high-precision sensors and secure data transmission protocols. Residential energy cooperatives and utility-led programs are fostering adoption, while retrofitting older installations is creating additional demand.

The United Kingdom is expected to grow at a CAGR of 16.4% from 2025 to 2035, supported by government initiatives and utility-led smart metering programs. Advanced digital meters are being deployed to enhance billing accuracy, energy efficiency, and household monitoring. Manufacturers are investing in robust communication networks and cybersecurity measures. Regional projects in densely populated areas are piloting predictive analytics for maintenance and energy usage optimization.

The United States market is forecast to grow at a CAGR of 14.7% between 2025 and 2035, driven by federal and state initiatives promoting smart utility deployment and energy efficiency. Off-grid residential communities and metropolitan areas are increasingly adopting connected gas meters for automated billing and usage monitoring. Advanced metering infrastructure and analytics platforms are being implemented to optimize operations. Manufacturers are focusing on reliability, interoperability, and secure data transmission to meet regulatory and consumer requirements.

The increasing need for accurate energy measurement, remote monitoring, and efficient billing systems drives the market. Leading players such as Honeywell International, Inc., Itron, Inc., and Landis+Gyr dominate the market with technologically advanced smart meters that offer real-time data analytics, automated leak detection, and integration with smart home systems. Aclara Technologies LLC and Neptune Technology Group, Inc. focus on delivering scalable solutions suitable for large utility networks, emphasizing interoperability and reliability. Companies like Schneider Electric SE and Sensus leverage global service networks to provide end-to-end solutions, including meter deployment, data management, and maintenance services. Azbil Kimmon Co., Ltd., Osaki Electric Co., Ltd., and Zenner International GmbH & Co., KG offer region-specific products optimized for varying regulatory standards and customer needs. Chint Group, Wasion Group, AEM, Apator SA, and Raychem RPG Private Limited focus on cost-effective and modular smart meter designs for residential and small commercial applications, supporting grid modernization initiatives.

Market strategies revolve around product launches, R&D in digital metering technologies, and strategic collaborations to expand geographic reach. Entry barriers include compliance with stringent safety and accuracy standards, high initial infrastructure costs, and integration complexities with existing utility networks, which favor experienced providers while presenting challenges for new entrants aiming to capture market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Technology | AMI and AMR |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aclara Technologies LLC, AEM, Apator SA, Azbil Kimmon Co., Ltd., Honeywell International, Inc., Itron, Inc., Landis+Gyr, Sensus, Wasion Group, Zenner International GmbH & Co., KG |

| Additional Attributes | Dollar sales by meter type and connectivity solution, demand dynamics across single-family homes, multi-unit residential complexes, and utility-managed installations, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in IoT integration, remote reading capabilities, and real-time consumption analytics, environmental impact of reduced gas wastage, energy efficiency, and electronic component lifecycle, and emerging use cases in automated billing, smart home energy management, and leak detection systems. |

The global residential smart gas meter market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the residential smart gas meter market is projected to reach USD 16.3 billion by 2035.

The residential smart gas meter market is expected to grow at a 17.3% CAGR between 2025 and 2035.

The key product types in residential smart gas meter market are AMI and AMR.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Generator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA