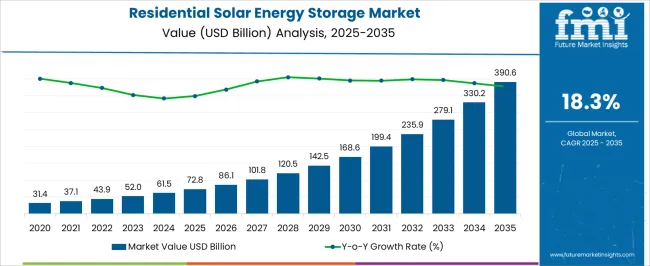

The residential solar energy storage market is set to grow from USD 72.8 billion in 2025 to USD 390.6 billion in 2035, with a CAGR of 18.3%. The long-term value accumulation curve shows rapid expansion, with values increasing from 72.8 billion in 2025 to 120.5 billion by 2028 and 168.6 billion by 2030. This trajectory reflects the increasing adoption of residential solar systems paired with energy storage solutions, driven by the need for reliable, cost-effective energy solutions.

By 2031, the industry value is expected to reach 199.4 billion, climbing to 235.9 billion in 2033 and 330.2 billion by 2034. The value accumulation curve points to accelerated demand in key markets, supported by rising consumer awareness and greater availability of energy storage products. The curve indicates an undeniable shift toward residential energy storage systems as integral components of smart home energy management. The curve highlights a strong, upward trajectory, making this market one of the most dynamic within the energy sector. By 2035, the market is expected to mature into a multi-billion-dollar sector with sustainable growth prospects.

| Metric | Value |

|---|---|

| Residential Solar Energy Storage Market Estimated Value in (2025 E) | USD 72.8 billion |

| Residential Solar Energy Storage Market Forecast Value in (2035 F) | USD 390.6 billion |

| Forecast CAGR (2025 to 2035) | 18.3% |

The residential solar energy storage segment is estimated to contribute nearly 25% of the solar energy market, about 18% of the energy storage market, close to 14% of the residential energy solutions market, nearly 10% of the renewable energy equipment market, and around 8% of the home appliances market. Collectively, this represents an aggregated share of approximately 75% across its parent categories. This proportion emphasizes the growing reliance on solar energy storage as an integral component of residential energy systems, enabling households to optimize solar power generation for later use. Their role has been cemented by the increasing adoption of solar panels and the need for reliable, sustainable energy solutions to reduce dependency on grid power. Industry analysts consider solar energy storage solutions not just as backup systems but as strategic enablers that enhance the value of solar energy in residential settings.

Demand has been supported by rising electricity costs, the push for off-grid solutions, and the desire for greater energy independence. Residential solar energy storage is also seen as critical in maximizing the efficiency and performance of solar energy systems, ensuring that excess energy produced during the day is stored for use during nighttime or cloudy periods. As a result, the residential solar energy storage market is viewed as a pivotal sector, shaping the future of home energy solutions and reinforcing its position as a key enabler in the broader renewable energy landscape.

The market is experiencing strong growth, supported by the rapid expansion of distributed solar generation and the rising need for reliable backup power in households. The current market landscape is characterized by increasing adoption of energy storage systems that complement rooftop solar installations, enabling homeowners to optimize energy usage and reduce dependence on grid supply.

Advances in battery technology, declining component costs, and favorable policy frameworks have further strengthened market expansion. Growing concerns over energy security and the push for renewable integration into residential power systems are accelerating installations.

The future outlook is shaped by continued technological innovation, improved battery lifespan, and intelligent energy management solutions that allow seamless integration with smart home infrastructure. With heightened focus on energy independence and sustainability, residential solar storage is poised to remain a key enabler of decentralized energy ecosystems.

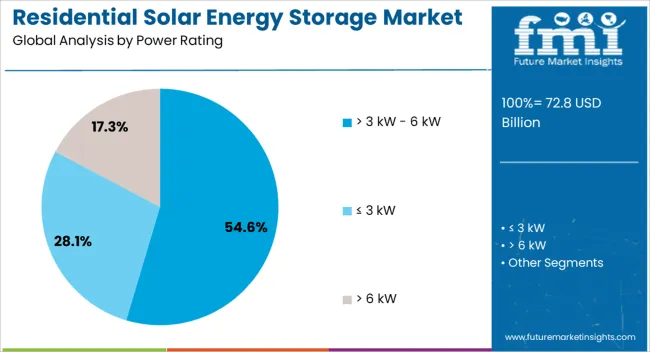

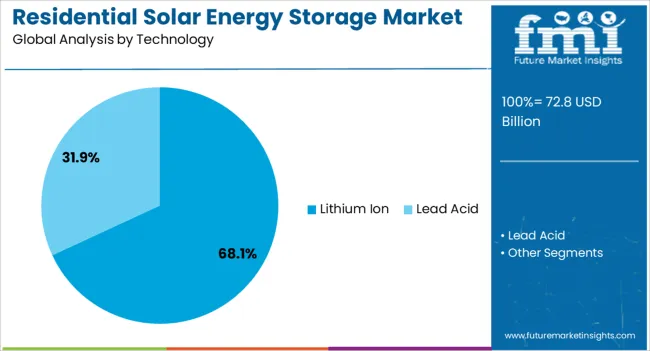

The residential solar energy storage market is segmented by power rating, technology, and geographic regions. By power rating, residential solar energy storage market is divided into > 3 kW - 6 kW, ≤ 3 kW, and > 6 kW. In terms of technology, residential solar energy storage market is classified into lithium ion and lead acid. Regionally, the residential solar energy storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 3 kW - 6 kW power rating segment is projected to hold 54.6% of the residential solar energy storage market revenue in 2025, making it the leading capacity range. This dominance is being driven by its suitability for meeting the typical daily energy requirements of medium to large residential households while offering a balance between cost and performance.

Installations in this range provide adequate storage capacity for self-consumption optimization, peak shaving, and reliable backup during outages. The segment’s growth is being supported by the rising number of residential solar systems designed to match average household consumption patterns, along with incentives that encourage installations capable of maximizing solar utilization.

The ability of this capacity range to integrate with both single-phase and three-phase home electrical systems has further encouraged its adoption. As homeowners increasingly prioritize systems that ensure energy resilience while delivering long-term value, the > 3 kW - 6 kW segment is expected to retain its leadership.

The lithium ion technology segment is expected to account for 68.1% of the market revenue in 2025, maintaining its dominant position. This leadership is being attributed to the superior energy density, longer cycle life, and higher efficiency offered by lithium ion batteries compared to alternative storage technologies.

The segment’s growth has been reinforced by significant cost reductions achieved through large-scale manufacturing and advancements in cell chemistry, which have improved performance and safety. Lithium ion systems also support compact designs and modular configurations, making them ideal for residential installations with space constraints.

The technology’s compatibility with advanced energy management systems enables real-time monitoring and intelligent charging and discharging, enhancing the overall value proposition for homeowners. As demand for high-performance, low-maintenance, and long-lasting storage solutions continues to rise, lithium-ion technology is set to remain the preferred choice for residential solar energy storage applications.

The residential solar energy storage market is expected to expand as more homeowners seek energy independence, cost savings, and resilience through solar-plus-storage systems. Demand is driven by falling battery prices, favorable government incentives, and rising electricity costs. Opportunities are emerging in energy storage-as-a-service models, integration with smart home systems, and expanding grid connection services. Trends focus on longer battery life, faster charging, and compact storage units. However, challenges such as high upfront costs, limited battery capacity, and regulatory complexity continue to influence broader adoption.

Demand for residential solar energy storage has been reinforced by the growing need for energy independence and lower electricity costs. Homeowners are increasingly adopting solar-plus-storage solutions to offset high electricity prices and reduce reliance on the grid. Solar battery systems, especially those designed to store excess power for nighttime use, are becoming more attractive as electricity prices continue to rise. Government incentives and rebates have further stimulated demand, making storage solutions more accessible. As more households seek energy resilience, the market for residential solar energy storage is positioned to expand, particularly in regions with high energy costs or frequent grid disruptions.

Opportunities in the residential solar energy storage market are emerging through storage-as-a-service models, smart home integration, and grid-connected storage solutions. Homeowners are increasingly interested in subscription-based services that eliminate high upfront costs, offering battery storage solutions without long-term commitments. Integrating storage systems with smart home platforms allows homeowners to optimize energy use based on real-time data, enhancing efficiency and control. Expanding grid connection services also present opportunities, as some regions offer compensation for energy fed back into the grid. These developments point to a future where energy storage is more accessible and adaptable, driving adoption in the residential sector.

Trends in the residential solar energy storage market are focused on enhancing battery life, reducing space requirements, and improving overall system efficiency. Manufacturers are working toward longer-lasting lithium-ion batteries with warranties extending beyond 10 years, responding to consumer demand for long-term solutions. Compact and aesthetically pleasing designs are gaining traction as homeowners seek systems that integrate seamlessly into their homes. Faster charging capabilities are also becoming a trend, making energy storage systems more efficient. As consumer interest in energy autonomy grows, these trends reflect the market’s focus on delivering high-performance, low-maintenance, and user-friendly storage systems for residential applications.

Challenges in the residential solar energy storage market revolve around high upfront costs, limited battery capacity, and regulatory complexity. While prices for solar batteries have decreased, the initial investment remains a significant barrier for many homeowners, particularly in cost-sensitive regions. Battery capacity, though improving, is still limited, requiring multiple units for larger homes or high energy demands. Regulatory hurdles, such as zoning restrictions and utility connection requirements, add complexity to installations, delaying adoption. These challenges suggest that, while the market is growing, widespread adoption will depend on reducing costs, improving capacity, and streamlining regulatory processes to make residential solar energy storage more accessible.

| Country | CAGR |

|---|---|

| China | 24.7% |

| India | 22.9% |

| Germany | 21.0% |

| France | 19.2% |

| UK | 17.4% |

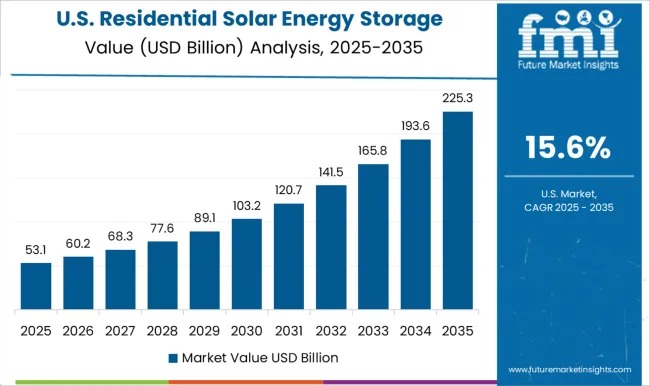

| USA | 15.6% |

| Brazil | 13.7% |

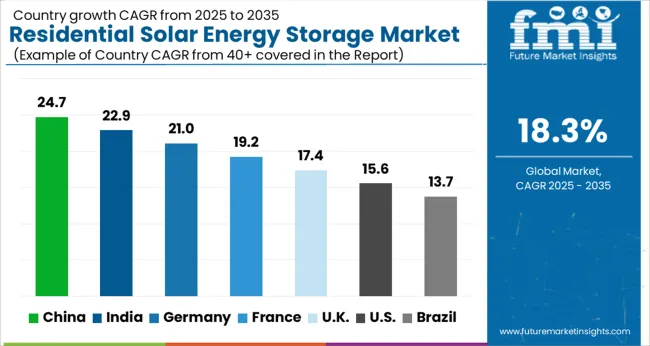

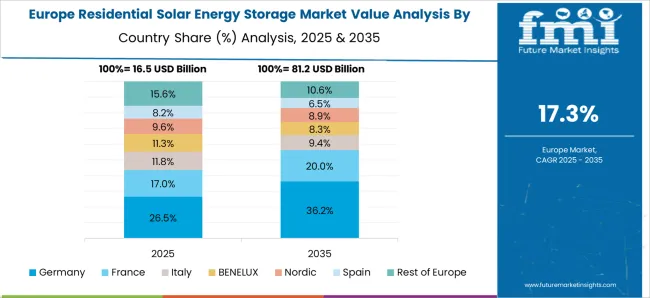

The global residential solar energy storage market is projected to grow at a CAGR of 18.3% between 2025 and 2035. China leads with 24.7%, followed by India at 22.9% and France at 19.2%. The United Kingdom is forecast at 17.4%, while the United States records 15.6%. Growth is driven by rising residential solar adoption, demand for energy independence, and government incentives for clean energy solutions. Asian markets experience faster growth due to large scale solar deployment and expanding energy storage infrastructure. European countries emphasize quality, integration with renewable energy systems, and policy frameworks. The USA reflects steady growth, supported by grid modernization, federal incentives, and increased consumer interest in energy autonomy. This report includes insights on 40+ countries; the top markets are shown here for reference.

The residential solar energy storage market in China is projected to grow at a CAGR of 24.7%. Growth is driven by strong government backing for renewable energy adoption, energy security initiatives, and rising household solar installations. Solar energy storage systems are increasingly integrated with home solar panels to provide consumers with backup power, reduce electricity costs, and enhance energy efficiency. Domestic manufacturers play a significant role in scaling production and driving cost reductions, making residential energy storage systems more accessible. With a large residential base and widespread policy support, China continues to lead in both adoption and production of residential solar energy storage solutions.

The residential solar energy storage market in India is forecast to grow at a CAGR of 22.9%. Expansion is fueled by increasing power shortages, rising electricity tariffs, and government support for renewable energy solutions. As solar installations grow in urban and rural areas, demand for energy storage systems to enhance solar energy utilization during non-sunlight hours rises. Residential consumers are increasingly opting for energy storage solutions to ensure reliability, especially in remote and off-grid areas. Incentives such as subsidies for rooftop solar and storage systems further accelerate adoption. India’s growing energy needs and cost-effective storage options make it one of the most dynamic markets for residential solar energy storage globally.

The residential solar energy storage market in France is projected to expand at a CAGR of 19.2%. Growth is supported by strong demand for residential solar installations, increasing consumer awareness of energy independence, and government policies promoting renewable energy. French consumers are increasingly adopting solar energy storage systems to optimize their energy consumption and reduce reliance on the grid. Storage solutions are also gaining traction in rural and suburban areas where grid reliability is lower. With strict EU environmental standards and incentives for solar adoption, France continues to be one of the leading European markets for residential solar storage systems.

The residential solar energy storage market in the UK is forecast to grow at a CAGR of 17.4%. Growth is influenced by increasing demand for energy independence, rising electricity prices, and government-backed green energy programs. The integration of storage systems with residential solar panels is gaining traction in both new builds and retrofits, supported by subsidies and feed-in tariffs. The UK government’s commitment to reaching net zero emissions by 2050 drives continued adoption of renewable technologies, including solar storage. While growth is slower than in Asia, steady consumer interest in green energy solutions and long-term savings sustains the market.

The residential solar energy storage market in the US is expected to expand at a CAGR of 15.6%. Growth is supported by federal and state-level incentives for solar adoption, increasing consumer demand for energy autonomy, and technological advancements in battery storage systems. Rising concerns over grid reliability, particularly during extreme weather events, drive the need for home energy storage solutions. Additionally, the growing adoption of electric vehicles and smart home systems further enhances the appeal of solar storage integration. Despite slower growth compared to Asia, the USA remains a key market due to its large residential base, technological innovation, and government backing.

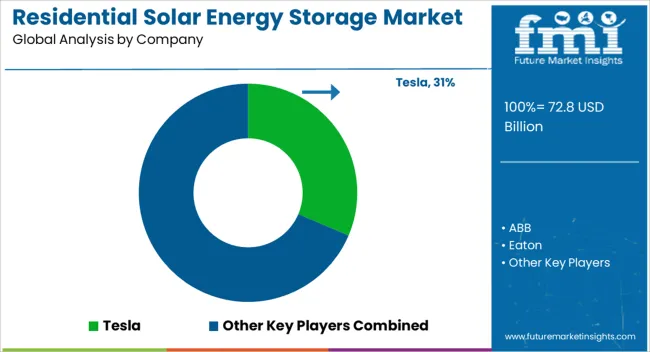

The residential solar energy storage market is highly competitive, driven by increasing adoption of solar photovoltaic systems, rising energy costs, and growing consumer awareness of energy independence. Market rivalry is shaped by storage capacity, battery chemistry (lithium-ion, lead-acid, or flow batteries), efficiency, pricing, warranty terms, and integration with smart home energy management systems. Companies differentiate themselves through advanced energy management software, modular and scalable storage solutions, and long-lasting battery performance.

Key players such as Tesla, LG Energy Solution, Sonnen GmbH, Enphase Energy, Panasonic, BYD, SimpliPhi Power, VARTA AG, Pylontech, and E3/DC lead the market by offering innovative, reliable, and user-friendly residential storage systems. Strategic collaborations, partnerships with solar panel manufacturers, and regional distribution expansion are common approaches to enhance market presence. Emerging players focus on cost-effective and compact solutions to capture growing residential demand, especially in regions with favorable solar policies and incentives. The market remains moderately fragmented, with top players emphasizing technology differentiation, regulatory compliance, and customer service to secure long-term contracts and strengthen market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 72.8 Billion |

| Power Rating | > 3 kW - 6 kW, ≤ 3 kW, and > 6 kW |

| Technology | Lithium Ion and Lead Acid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tesla, ABB, Eaton, Enphase Energy, EnerSys, Fluence, Honeywell, Huawei, Johnson Controls, Leclanche, LG Electronics, Maxwell Technologies, Primus Power, Saft, SAMSUNG SDI, Schneider Electric, Siemens Energy, SolarEdge Technologies, Toshiba, and Uniper |

| Additional Attributes | Dollar sales by storage type (lithium-ion, lead-acid, flow batteries), Dollar sales by application (residential, off-grid, backup power), Trends in energy independence and grid optimization, Role in enhancing solar system efficiency and reducing energy costs, Growth driven by renewable energy adoption, Regional demand across North America, Europe, Asia Pacific. |

The global residential solar energy storage market is estimated to be valued at USD 72.8 billion in 2025.

The market size for the residential solar energy storage market is projected to reach USD 390.6 billion by 2035.

The residential solar energy storage market is expected to grow at a 18.3% CAGR between 2025 and 2035.

The key product types in residential solar energy storage market are > 3 kw - 6 kw, ≤ 3 kw and > 6 kw.

In terms of technology, lithium ion segment to command 68.1% share in the residential solar energy storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lithium Ion Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA