The residential generator market is advancing steadily, driven by rising instances of power outages, increasing reliance on electrical appliances, and growing preference for backup power solutions in urban and rural households. Weather-related disruptions and aging power infrastructure have elevated demand for reliable, home-based generation systems.

Technological improvements in inverter and control systems are enhancing operational efficiency, noise reduction, and fuel economy. The market also benefits from increased awareness of energy security and comfort, particularly in regions prone to grid instability.

Expanding real estate developments, coupled with the availability of portable and stationary configurations, are further supporting adoption. Future growth will be reinforced by hybrid systems integrating renewable energy storage and smart home compatibility..

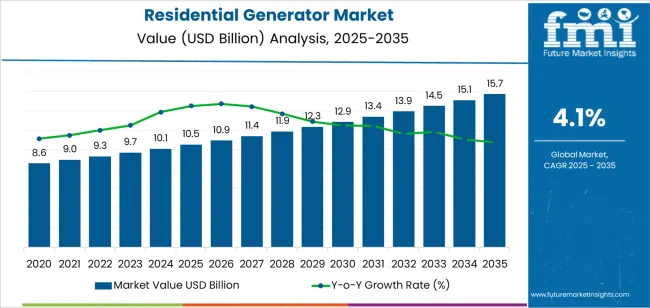

| Metric | Value |

|---|---|

| Residential Generator Market Estimated Value in (2025 E) | USD 10.5 billion |

| Residential Generator Market Forecast Value in (2035 F) | USD 15.7 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

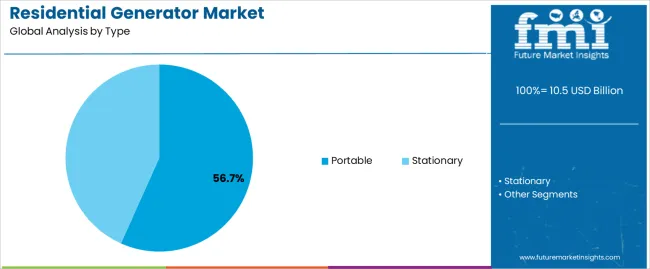

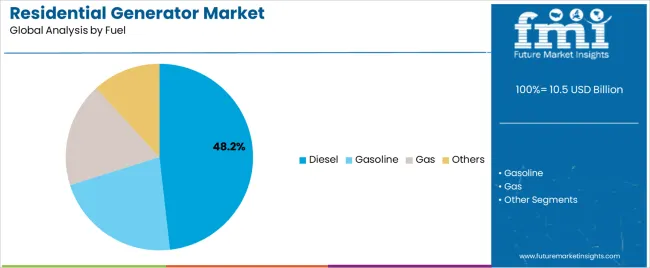

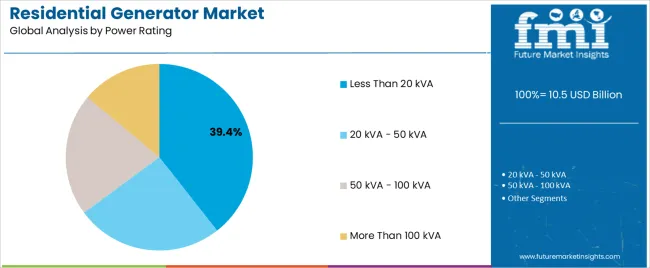

The market is segmented by Type, Fuel, and Power Rating and region. By Type, the market is divided into Portable and Stationary. In terms of Fuel, the market is classified into Diesel, Gasoline, Gas, and Others. Based on Power Rating, the market is segmented into Less Than 20 kVA, 20 kVA - 50 kVA, 50 kVA - 100 kVA, and More Than 100 kVA. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

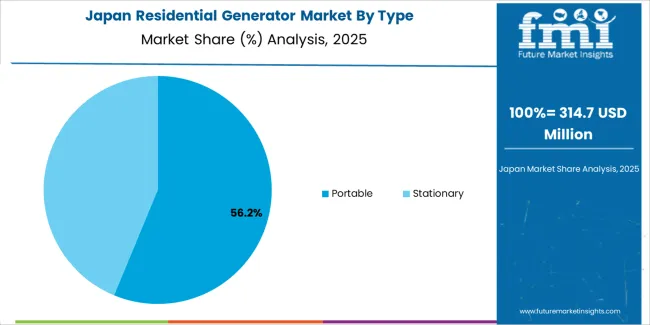

The portable segment holds approximately 56.70% share in the type category, reflecting its widespread use due to mobility, ease of installation, and affordability. Portable generators are preferred for temporary backup during outages, outdoor activities, and emergency use.

Their compact design and ability to operate multiple household appliances make them a practical choice for diverse consumers. The segment’s expansion is supported by advancements in inverter technology that provide cleaner power output compatible with sensitive electronics.

Rental availability and rising demand in disaster-prone areas have also strengthened its market share. With continued innovation in lightweight and low-noise designs, the portable generator segment is expected to sustain its leadership position..

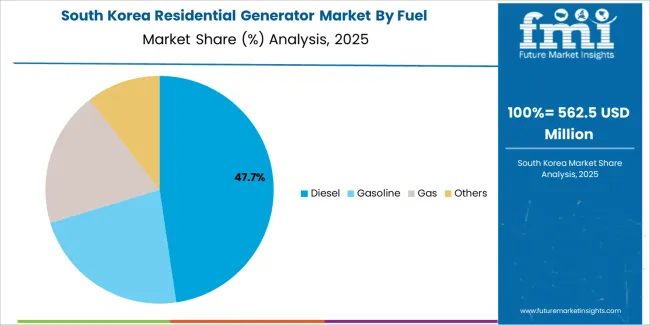

The diesel segment dominates the fuel category, accounting for approximately 48.20% share. This segment’s prominence is based on its superior fuel efficiency, durability, and ability to deliver sustained power over long durations.

Diesel generators are favored in regions with unreliable power grids due to their reliability and low operating costs per kilowatt-hour. Manufacturers are focusing on emission control technologies and hybrid integration to comply with environmental standards.

The segment continues to attract demand from large households and estates requiring extended power backup. With ongoing infrastructure challenges and consumer preference for dependable performance, the diesel generator segment is poised to maintain its strong presence..

The less than 20 kVA segment leads the power rating category, representing approximately 39.40% share. This capacity range is well-suited for typical residential loads, including lighting, refrigeration, and basic appliances.

Its compact size, affordability, and efficiency make it ideal for individual homes and small residential complexes. The segment benefits from increasing urban housing density and growing interest in personal backup systems.

Technological advancements in micro-inverter and noise-reduction mechanisms have enhanced user comfort and convenience. With the global shift toward energy reliability and the rising adoption of small-capacity power systems, this segment is expected to retain its dominant position throughout the forecast period..

The residential generator market is anticipated to surpass a global valuation of USD 15.7.0 billion by 2035, with a growth rate of 4.1% CAGR.

While the residential generator market is experiencing growth, several restraining factors can adversely affect its development and expansion.

| Attributes | Details |

|---|---|

| Top Type | Portable |

| CAGR (2025 to 2035) | 4.0% |

Based on the type, the portable segment dominates the residential generator market, expanding at a CAGR of 4.0% through 2035. The segment’s popularity is rising due to the following factors:

| Attributes | Details |

|---|---|

| Top Fuel | Diesel |

| CAGR (2025 to 2035) | 3.8% |

Based on fuel, sales of diesel generators are rising at a 3.8% CAGR. This rising popularity is attributed to:

The section analyzes the global residential generator market by country, including the United States, the United Kingdom, China, Japan, and South Korea. The table presents the CAGR for each country, indicating the expected market growth in that country through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.4% |

| United Kingdom | 5.1% |

| China | 4.8% |

| Japan | 5.5% |

| South Korea | 6.7% |

The United States dominates the residential generator market in the North American region. It is expected to exhibit an annual growth rate of 4.4% until 2035.

The United Kingdom is the leading European country in the global residential generator market, and its market is predicted to register an annual growth rate of 5.1%.

China is another Asian country leading in the global residential generator market. The Chinese market is anticipated to register a CAGR of 4.8% through 2035.

Japan is another leading Asian country in the global residential generator market. The Japanese market is anticipated to register a CAGR of 5.5% through 2035.

Japan is the leading Asian country in the residential generator market. The Chinese market is anticipated to register a CAGR of 6.7% through 2035.

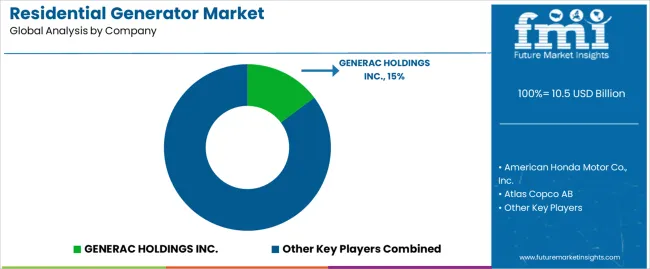

Major companies are implementing multiple strategies to drive growth in the residential generator market. These include investing heavily in research and development to innovate and develop generators with better efficiency, reliability, and ease of use.

They are also expanding their distribution networks and strengthening partnerships with dealers and home improvement retailers to increase their market reach.

Manufacturers are investing in marketing and promotional activities to raise awareness about the benefits of residential generators and educate consumers about the importance of backup power solutions.

By doing so, these companies aim to establish themselves as trusted brands in the market and capitalize on growing consumer demand for residential generators.

Recent Developments

The global residential generator market is estimated to be valued at USD 10.5 billion in 2025.

The market size for the residential generator market is projected to reach USD 15.7 billion by 2035.

The residential generator market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in residential generator market are portable and stationary.

In terms of fuel, diesel segment to command 48.2% share in the residential generator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Solar Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA