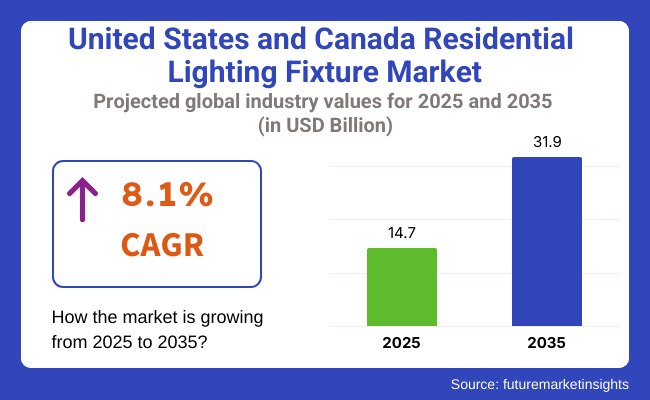

The industry size of the United States and Canada residential lighting fixture market is projected to be USD 14.7 billion in 2025 and will achieve an 8.1% CAGR between 2025 and 2035. The industry size of these two countries is predicted to reach USD 31.9 billion by 2035.

One of the key drivers for this growth is the increasing uptake of smart lighting systems as part of the overall trend toward interconnected home ecosystems and energy efficiency. In the United States and Canada, increased usage of LED lighting fixtures is transforming homes. They offer greater energy savings and longer life than conventional lighting, so they're gaining popularity for new construction as well as remodels.

Versatility in design, adjustable intensity, and the growing array of styles available from manufacturers, from modern minimalism to historically styled fixtures, also win over homeowners.

Demand is also spurred by government policy in both countries that encourage energy-efficient upgrades. Rebates and incentive programs provided by utilities, as well as new building codes mandating efficiency levels, are fueling greater adoption. Green building certifications such as LEED also continue to encourage the use of efficient lighting products in residential buildings.

Technological integration is a major differentiator in this industry. App-controlled, voice-controlled, and sensor-controlled fixtures are going mainstream for luxury as well as mid-range homes. The trend aligns with increasing consumer demand for convenience, security, and sustainability.

The residential lighting fixture industry in the USA and Canada will continue to expand owing to robust building activity, transformation of urban lifestyle, and significant emphasis on living climate-responsibly. Industry growth will be sustained steadily over the forecast period due to innovation focusing on modularity, energy conservation, and Internet of Things-enabled products.

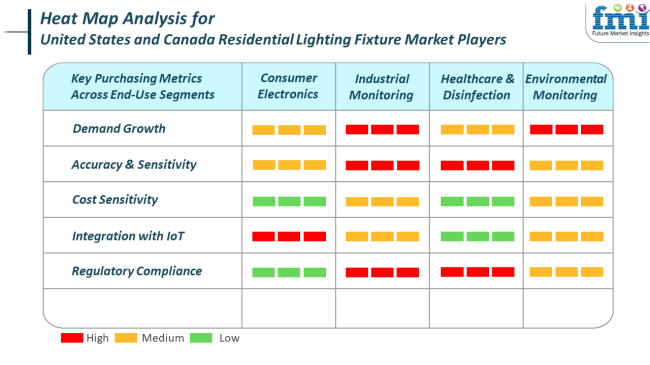

In the USA and Canadian residential sector, lighting fixtures tailored to smart consumer electronics are in high demand, with homeowners increasingly prioritizing compatibility with digital assistants and wireless control platforms. This segment sees balanced interest in efficiency and visual appeal, especially in metropolitan and suburban housing markets.

Industrial and environmental sectors are expanding due to rising awareness of energy audits and the need for optimized resource use. In these areas, lighting products must meet stringent reliability and performance standards, especially where system monitoring and automation are critical. The demand for regulatory compliance is especially high in Canada, where sustainability regulations are advancing rapidly.

Healthcare-related applications in residential spaces, including antimicrobial lighting and UV-based disinfection systems, have grown in relevance post-pandemic. This industry segment emphasizes performance, safety, and compliance with emerging health standards, particularly in multigenerational and senior living environments gaining popularity in North America.

In the United States and Canada, the residential lighting fixture market faces several notable risks despite its strong growth outlook. One of the primary risks is rising material and transportation costs, which can reduce margins and push retail prices higher. Disruptions in international supply chains also affect the availability of electronic components critical for smart lighting features, which may delay delivery timelines or limit product variety.

Regulatory divergence between USA federal energy mandates and Canadian provincial energy codes can create operational complexity for manufacturers. Compliance costs may increase as firms must navigate differing documentation and certification processes, particularly for LED and IoT-integrated fixtures. Smaller manufacturers could find it difficult to scale while maintaining cross-border compatibility.

Technological obsolescence poses another challenge in this fast-evolving industry. Consumers expect lighting products to integrate seamlessly with the latest smart home platforms, and companies that fail to keep pace risk falling behind. Rapid changes in connectivity standards and cybersecurity expectations demand continual product updates, placing a burden on R&D teams and increasing lifecycle costs

During the period from 2020 to 2024, the United States and Canadian residential lighting fixture market saw a dramatic shift owing to increased home improvement activity and increasing demand for energy-efficient products. Due to extended home stays during and after the pandemic, consumers focused on ambiance lighting and functionality and chose LED-based products and smart lighting systems.

Aesthetic appeal and customization also figured in more, with homeowners preferring fixtures that kept up with shifting interior design fashion. Additionally, a growing sense of environmental responsibility contributed to using energy-efficient lights and fixtures made of recyclable or sustainable resources.

Soon, between 2025 and 2035, the industry will likewise shift with mounting adoption of smart home technologies. Lighting fixtures will increasingly incorporate voice control and IoT-based technologies for residents to have greater control over mood, color temperature, and energy consumption.

Sustainability will continue to be at the core, while innovation takes the shape of low-impact material, extended-life cycle products through modularity, and solar-integrated choices. Personalization will be more sophisticated, with lighting solutions tailored to fit lifestyle and circadian rhythms using data-driven platforms and app-based ecosystems.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing focus on energy-efficient, tastefully consistent illumination | Requirement of intelligent, personal, and wellness-oriented lighting |

| Emergence of LED lighting and early adoption of smart home functions | Full adoption of IoT, voice control, and circadian lighting solutions |

| Integration of recyclable material and energy-efficient innovations | Shift toward solar-powered, modular, and low-impact material innovation |

| Shift toward minimalism and fixture personalization | Personalized, adaptive lighting suited to lifestyle and well-being goals |

| Home improvement trends and lifestyle post-pandemic shifts | Integration of smart homes, green policies, and artificial intelligence-based solutions |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.4% |

| Canada | 5.8% |

The USA industry will grow at 6.4% CAGR over the study period. With high urbanization rates, smart home penetration and sustainability-oriented regulatory policies, the USA residential lighting fixture industry is set to witness strong growth.

Consumers are increasingly shifting towards energy-efficient LED lighting systems that are frequently augmented with smart features. Government incentives to conserve energy have also helped to drive this momentum, specifically in the form of incentives and rebates for upgrading residential lighting systems to environmentally friendly systems.

Surprising leaps in IoT and home automation technologies have also transformed customer expectations, stimulating the integration of lighting with AI-driven systems, voice control, and sensor work. Trends in interior design have also spurred demand for decorative and personalized fixtures.

The USA industry is fueled by a robust domestic manufacturing base and tech-driven retail environment, enabling innovation in aesthetics and energy efficiency. Internet portals have also been instrumental in broadening product availability and price competitiveness.

Further, rising disposable income and demand for home improvement after the pandemic have also stimulated industry activity. The future will also see a surge in wireless, app-based lighting systems and the use of sustainable materials, further cementing the nation's leadership position in the residential lighting fixture industry.

The Canadian industry will be growing at 5.8% CAGR throughout the study. Although proportionally smaller in population size than the USA, Canada's home lighting equipment industry is being propelled by rapid growth because of favorable government policy, increasing environmental awareness and an increasing concern for energy-saving solutions throughout urban and suburban regions.

Much of the demand results from the replacement of traditional lighting systems with smart and LED lighting technologies with longer lifespans and lower ownership costs. The adoption of smart lighting technologies in homes is gaining pace in Canadian cities, driven by advances in wireless infrastructure and rising smartphone penetration.

Canadian residential homes demand for contemporary style and straightforward interior design is also promoting innovation in the styling of fixtures, cleanness, simplicity of lines, sustainability and efficient compactness. In addition, building codes requiring low-energy lighting products have promoted homeowners and developers to use advanced lighting.

Climatic regional conditions, such as severe winters and restricted natural light in parts of the country, are contributing to the demand for efficient and superior residential lighting. The renovation segment is also driving growth, with lighting taking a focal role in home renovation activity. The Canadian industry is set to continue to derive benefits from growing digitalization and environmental performance concerns.

Pendants will retain the highest industry share among domestic lighting fittings in the USA and Canada between 2025 and 2035. Their attraction stems from a combination of decorative purpose and focused illumination, making them perfect for dining rooms, kitchen islands, and entranceways.

As open-plan living gains popularity, pendants create a statement while keeping the space functional. Industry leaders like Signify (Philips), Acuity Brands, and Kichler Lighting are growing their pendant lines with intelligent, dimmable LED products that reflect energy efficiency and style trends. Based on current adoption rates and renovation trends, pendants are expected to capture 33-36% of product-type industry share by 2030. Flush mount ceiling lights account for the second-largest category because they are well-suited for low-ceilinged rooms with minimal space, like bedrooms, hallways, and laundry rooms.

These lights are used extensively in both single-family and multi-unit residences because they are convenient and relatively inexpensive. Manufacturers like Lithonia Lighting, Progress Lighting, and Hampton Bay continue to introduce flush mount models that focus on ease of installation and LED compatibility.

Though design enhancements have enhanced their attractiveness, conservative growth within this segment is linked to affordability and replacement cycles and not to design creativity. Industry share is anticipated to stabilize at 22-24% by 2035 on the back of continuous demand within small residential applications.

Hardwired lighting dominates the residential lighting fixture industry within the USA and Canada, constituting the norm for permanent installations. These products are integrated into the home's electrical infrastructure, providing durability, safety, and compatibility with contemporary lighting control systems.

Widely used in new construction and large-scale remodels, hardwired products are at the core of functional and architectural lighting designs. Major providers like Hubbell Incorporated, Eaton Corporation, and Leviton fuel this segment with smart-ready and energy-efficient solutions.

As a result of their important function in primary lighting throughout the home, hardwired lighting fixtures are expected to hold more than 60% of the power source industry share through 2035, increasing with new home building and smart home take-up.

Battery-powered lighting fixtures have a smaller but expanding share of the residential industry. Their fundamental advantage is flexibility, simplicity of installation, and adaptability to temporary or otherwise hard-to-wire spaces like closets, under-cabinet, or outdoor patios.

They are in demand by renters and shoppers looking for DIY-friendly lighting. Companies like Mr. Beams and Brilliant Evolution are introducing motion-sensing capability and rechargeable options into their product lines. Albeit constituting under 10% of the industry, battery-powered lighting is also set to rise steadily projected CAGR of 8-10% driven by ongoing gains in battery longevity, LED performance, and the need for convenient, portable illumination.

The residential lighting fixture industry in North America is highly competitive among the key players, which are always innovating to satisfy the consumers' qualities of energy efficiency, smart lighting solutions, and aesthetic appeal.

Philips remains the leading industry player on the back of its extensive product portfolio, which consists of LED and smart lighting solutions, and has built strategic partnerships in the smart home space. This has given the company a strong focus on sustainability and cutting carbon emissions, along with providing eco-friendly solutions across home applications.

Acuity Brands Lighting, Inc. holds its strong second position since its coverage is very wide in that extensive range of lighting fixtures and controls for both the residential and commercial sectors. Acuity is also known for its advancements in energy-efficient products as it continues to branch out into smart lighting, thus positioning itself as one of the leaders in innovation for both design and functionality.

Likewise, Eaton Corporation has built itself into one of the most popular companies with its varied portfolio, which includes lighting control systems and energy-efficient solutions. This has put Eaton solidly in front for its foray into the intelligent home and IoT integration sectors.

Other major competitors like Lutron Electronics Co., Inc., Leviton Manufacturing Co., Inc., and Legrand have largely retained their edge in the industry with their high-performance residential lighting solutions and controls. These companies focus more on quality, design, and energy-efficient technologies.

On the other hand, RAB Lighting, Osram Licht AG, and Cree, Inc. are using the advantages created by advancing LED and energy-efficient technologies to generate economically feasible, long-lasting lighting products for residences. These players, however, are seeking diversification by venturing into outdoor and industrial lighting markets.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Philips | 24-28% |

| Acuity Brands Lighting, Inc. | 18-22% |

| Eaton Corporation | 12-16% |

| Leviton Manufacturing Co., Inc. | 8-12% |

| Legrand | 6-10% |

| Other Players | 18-24% |

| Company Name | Offerings & Activities |

|---|---|

| Philips | Leader in LED and smart lighting solutions; commitment to sustainability. |

| Acuity Brands Lighting, Inc. | Wide range of energy-efficient lighting fixtures and smart controls. |

| Eaton Corporation | Diversified portfolio in lighting control systems and energy-efficient products. |

| Lutron Electronics Co., Inc. | Known for lighting controls and dimming systems, expanding into smart home solutions. |

| Leviton Manufacturing Co., Inc. | Lighting controls, dimmers, and smart lighting solutions. |

Key Company Insights

Philips continues to command a leading industry share of approximately 24-28%, with a strong focus on sustainability and innovation. The company’s wide-ranging portfolio in LED and smart lighting technologies, along with its strategic partnerships in the smart home sector, ensures its leadership in both residential and commercial lighting solutions.

Acuity Brands Lighting, Inc., with an industry share of 18-22%, remains a formidable competitor through its emphasis on energy-efficient products and smart home integration. Acuity continues to innovate in the design and functionality of lighting fixtures, aiming to enhance user experience while delivering energy savings.

Eaton Corporation holds a significant 12-16% share and is focusing on expanding its smart lighting capabilities and IoT-enabled products for residential use. By offering a diverse range of energy-efficient solutions, Eaton has positioned itself as a leader in providing advanced and integrated lighting solutions.

Lutron Electronics Co., Inc., with an 8-12% share, is capitalizing on the growing demand for advanced lighting control systems and smart home solutions. Lutron’s products emphasize quality, reliability, and user-friendly interfaces, keeping the company competitive in the residential market. Leviton Manufacturing Co., Inc. (6-10%) focuses on providing premium lighting controls and dimmers, also expanding its presence in the smart home industry through integrated lighting solutions.

By product type, the industry is segmented into chandeliers, flush mount ceiling lights, pendants, semi-flush mount ceiling lights, and other types.

By power source, the industry is divided by power source into battery-powered, corded-electric, and hardwired.

By technology, the industry is categorized by technology into incandescent, fluorescent, and LED.

By usage, the industry is divided by usage into indoor and outdoor.

By sales channel, the industry is segmented by sales channel into direct sales, modern trade, departmental stores, specialty stores, online retailers (direct to consumer and third-party to consumer), and other sales channels.

By country, the industry is segmented by country, including the United States (with further subdivisions into West Region, South West Region, Mid-West Region, North East Region, and South East Region) and Canada.

The industry is expected to reach USD 14.7 billion in 2025.

The industry is projected to grow to USD 31.9 billion by 2035.

The industry is expected to grow at a CAGR of 6.4% during the forecast period.

Pendants are a key segment within the residential lighting fixture industry.

Key players include Philips, Acuity Brands Lighting, Inc., Eaton Corporation, Lutron Electronics Co., Inc., Leviton Manufacturing Co., Inc., Legrand, Ideal Industries, Inc., RAB Lighting, Osram Licht AG, Cree, Inc., Osram Sylvania, Hubbell Lighting, Cooper Lighting, Zumtobel Group, and Panasonic.

Table1: Value (US$ million) Analysis By Product Type, 2019 to 2034

Table2: Value (US$ million) Analysis By Product Type, 2019 to 2034

Table3: Value (US$ million) Analysis By Power Source, 2019 to 2034

Table4: Value (US$ million) Analysis By Power Source, 2019 to 2034

Table5: Value (US$ million) Analysis By Technology, 2019 to 2034

Table6: Value (US$ million) Analysis By Technology, 2019 to 2034

Table7: Value (US$ million) Analysis By Usage, 2019 to 2034

Table8: Value (US$ million) Analysis By Usage, 2019 to 2034

Table9: Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table10: Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table11: West Value (US$ million) Analysis By Product Type, 2019 to 2034

Table12: West Value (US$ million) Analysis By Product Type, 2019 to 2034

Table13: West Value (US$ million) Analysis By Power Source, 2019 to 2034

Table14: West Value (US$ million) Analysis By Power Source, 2019 to 2034

Table15: West Value (US$ million) Analysis By Technology, 2019 to 2034

Table16: West Value (US$ million) Analysis By Technology, 2019 to 2034

Table17: West Value (US$ million) Analysis By Usage, 2019 to 2034

Table18: West Value (US$ million) Analysis By Usage, 2019 to 2034

Table19: West Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table20: West Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table21: South West Value (US$ million) Analysis By Product Type, 2019 to 2034

Table22: South West Value (US$ million) Analysis By Product Type, 2019 to 2034

Table23: South West Value (US$ million) Analysis By Power Source, 2019 to 2034

Table24: South West Value (US$ million) Analysis By Power Source, 2019 to 2034

Table25: South West Value (US$ million) Analysis By Technology, 2019 to 2034

Table26: South West Value (US$ million) Analysis By Technology, 2019 to 2034

Table27: South West Value (US$ million) Analysis By Usage, 2019 to 2034

Table28: South West Value (US$ million) Analysis By Usage, 2019 to 2034

Table29: South West Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table30: South West Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table31: Mid-West Value (US$ million) Analysis By Product Type, 2019 to 2034

Table32: Mid-West Value (US$ million) Analysis By Product Type, 2019 to 2034

Table33: Mid-West Value (US$ million) Analysis By Power Source, 2019 to 2034

Table34: Mid-West Value (US$ million) Analysis By Power Source, 2019 to 2034

Table35: Mid-West Value (US$ million) Analysis By Technology, 2019 to 2034

Table36: Mid-West Value (US$ million) Analysis By Technology, 2019 to 2034

Table37: Mid-West Value (US$ million) Analysis By Usage, 2019 to 2034

Table38: Mid-West Value (US$ million) Analysis By Usage, 2019 to 2034

Table39: Mid-West Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table40: Mid-West Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table41: North East Value (US$ million) Analysis By Product Type, 2019 to 2034

Table42: North East Value (US$ million) Analysis By Product Type, 2019 to 2034

Table43: North East Value (US$ million) Analysis By Power Source, 2019 to 2034

Table44: North East Value (US$ million) Analysis By Power Source, 2019 to 2034

Table45: North East Value (US$ million) Analysis By Technology, 2019 to 2034

Table46: North East Value (US$ million) Analysis By Technology, 2019 to 2034

Table47: North East Value (US$ million) Analysis By Usage, 2019 to 2034

Table48: North East Value (US$ million) Analysis By Usage, 2019 to 2034

Table49: North East Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table50: North East Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table51: South East Value (US$ million) Analysis By Product Type, 2019 to 2034

Table52: South East Value (US$ million) Analysis By Product Type, 2019 to 2034

Table53: South East Value (US$ million) Analysis By Power Source, 2019 to 2034

Table54: South East Value (US$ million) Analysis By Power Source, 2019 to 2034

Table55: South East Value (US$ million) Analysis By Technology, 2019 to 2034

Table56: South East Value (US$ million) Analysis By Technology, 2019 to 2034

Table57: South East Value (US$ million) Analysis By Usage, 2019 to 2034

Table58: South East Value (US$ million) Analysis By Usage, 2019 to 2034

Table59: South East Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table60: South East Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Table61: Sales Analysis By Product Type, 2019 to 2034

Table62: Sales Analysis By Product Type, 2019 to 2034

Table63: Sales Analysis By Power Source, 2019 to 2034

Table64: Sales Analysis By Power Source, 2019 to 2034

Table65: Sales Analysis By Technology, 2019 to 2034

Table66: Sales Analysis By Technology, 2019 to 2034

Table67: Sales Analysis By Usage, 2019 to 2034

Table68: Sales Analysis By Usage, 2019 to 2034

Table69: Sales Analysis By Sales Channel, 2019 to 2034

Table70: Sales Analysis By Sales Channel, 2019 to 2034

Figure 01: Value (US$ million) and Volume (Units) Analysis, 2019 to 2023

Figure 02: Value (US$ million) and Volume (Units) Forecast, 2024 to 2034

Figure 03: Value (US$ million) Analysis, 2019 to 2023

Figure 04: Value (US$ million) Forecast, 2024 to 2034

Figure 05: Absolute $ Opportunity Value (US$ million), 2024 to 2034

Figure 06: Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 07: Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 08: Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 09: Attractiveness By Product Type, 2024 to 2034

Figure 10: Value (US$ million) Analysis By Power Source, 2019 to 2034

Figure 11: Volume (Units) Analysis By Power Source, 2019 to 2034

Figure 12: Y-o-Y Growth (%) Projections, By Power Source, 2024 to 2034

Figure 13: Attractiveness By Power Source, 2024 to 2034

Figure 14: Value (US$ million) Analysis By Technology, 2019 to 2034

Figure 15: Volume (Units) Analysis By Technology, 2019 to 2034

Figure 16: Y-o-Y Growth (%) Projections, By Technology, 2024 to 2034

Figure 17: Attractiveness By Technology, 2024 to 2034

Figure 18: Value (US$ million) Analysis By Usage, 2019 to 2034

Figure 19: Volume (Units) Analysis By Usage, 2019 to 2034

Figure 20: Y-o-Y Growth (%) Projections, By Usage, 2024 to 2034

Figure 21: Attractiveness By Usage, 2024 to 2034

Figure 22: Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 23: Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 24: Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 25: Attractiveness By Sales Channel, 2024 to 2034

Figure 26: Value (US$ million) Analysis By Region, 2019 to 2034

Figure 27: Volume (Units) Analysis By Region, 2019 to 2034

Figure 28: Y-o-Y Growth (%) Projections, By Region, 2024 to 2034

Figure 29: Attractiveness By Region, 2024 to 2034

Figure 30: West Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 31: West Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 32: West Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 33: West Attractiveness By Product Type, 2024 to 2034

Figure 34: West Value (US$ million) Analysis By Power Source, 2019 to 2034

Figure 35: West Volume (Units) Analysis By Power Source, 2019 to 2034

Figure 36: West Y-o-Y Growth (%) Projections, By Power Source, 2024 to 2034

Figure 37: West Attractiveness By Power Source, 2024 to 2034

Figure 38: West Value (US$ million) Analysis By Technology, 2019 to 2034

Figure 39: West Volume (Units) Analysis By Technology, 2019 to 2034

Figure 40: West Y-o-Y Growth (%) Projections, By Technology, 2024 to 2034

Figure 41: West Attractiveness By Technology, 2024 to 2034

Figure 42: West Value (US$ million) Analysis By Usage, 2019 to 2034

Figure 43: West Volume (Units) Analysis By Usage, 2019 to 2034

Figure 44: West Y-o-Y Growth (%) Projections, By Usage, 2024 to 2034

Figure 45: West Attractiveness By Usage, 2024 to 2034

Figure 46: West Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 47: West Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 48: West Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 49: West Attractiveness By Sales Channel, 2024 to 2034

Figure 50: South East Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 51: South East Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 52: South West Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 53: South West Attractiveness By Product Type, 2024 to 2034

Figure 54: South West Value (US$ million) Analysis By Power Source, 2019 to 2034

Figure 55: South West Volume (Units) Analysis By Power Source, 2019 to 2034

Figure 56: South West Y-o-Y Growth (%) Projections, By Power Source, 2024 to 2034

Figure 57: South West Attractiveness By Power Source, 2024 to 2034

Figure 58: South West Value (US$ million) Analysis By Technology, 2019 to 2034

Figure 59: South West Volume (Units) Analysis By Technology, 2019 to 2034

Figure 60: South West Y-o-Y Growth (%) Projections, By Technology, 2024 to 2034

Figure 61: South West Attractiveness By Technology, 2024 to 2034

Figure 62: South West Value (US$ million) Analysis By Usage, 2019 to 2034

Figure 63: South West Volume (Units) Analysis By Usage, 2019 to 2034

Figure 64: South West Y-o-Y Growth (%) Projections, By Usage, 2024 to 2034

Figure 65: South West Attractiveness By Usage, 2024 to 2034

Figure 66: South West Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 67: South West Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 68: South West Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 69: South West Attractiveness By Sales Channel, 2024 to 2034

Figure 70: South West Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 71: South West Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 72: Mid-West Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 73: Mid-West Attractiveness By Product Type, 2024 to 2034

Figure 74: Mid-West Value (US$ million) Analysis By Power Source, 2019 to 2034

Figure 75: Mid-West Volume (Units) Analysis By Power Source, 2019 to 2034

Figure 76: Mid-West Y-o-Y Growth (%) Projections, By Power Source, 2024 to 2034

Figure 77: Mid-West Attractiveness By Power Source, 2024 to 2034

Figure 78: Mid-West Value (US$ million) Analysis By Technology, 2019 to 2034

Figure 79: Mid-West Volume (Units) Analysis By Technology, 2019 to 2034

Figure 80: Mid-West Y-o-Y Growth (%) Projections, By Technology, 2024 to 2034

Figure 81: Mid-West Attractiveness By Technology, 2024 to 2034

Figure 82: Mid-West Value (US$ million) Analysis By Usage, 2019 to 2034

Figure 83: Mid-West Volume (Units) Analysis By Usage, 2019 to 2034

Figure 84: Mid-West Y-o-Y Growth (%) Projections, By Usage, 2024 to 2034

Figure 85: Mid-West Attractiveness By Usage, 2024 to 2034

Figure 86: Mid-West Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 87: Mid-West Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 88: Mid-West Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 89: Mid-West Attractiveness By Sales Channel, 2024 to 2034

Figure 90: Mid-West Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 91: Mid-West Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 92: North East Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 93: North East Attractiveness By Product Type, 2024 to 2034

Figure 94: North East Value (US$ million) Analysis By Power Source, 2019 to 2034

Figure 95: North East Volume (Units) Analysis By Power Source, 2019 to 2034

Figure 96: North East Y-o-Y Growth (%) Projections, By Power Source, 2024 to 2034

Figure 97: North East Attractiveness By Power Source, 2024 to 2034

Figure 98: North East Value (US$ million) Analysis By Technology, 2019 to 2034

Figure 99: North East Volume (Units) Analysis By Technology, 2019 to 2034

Figure 100: North East Y-o-Y Growth (%) Projections, By Technology, 2024 to 2034

Figure 101: North East Attractiveness By Technology, 2024 to 2034

Figure 102: North East Value (US$ million) Analysis By Usage, 2019 to 2034

Figure 103: North East Volume (Units) Analysis By Usage, 2019 to 2034

Figure 104: North East Y-o-Y Growth (%) Projections, By Usage, 2024 to 2034

Figure 105: North East Attractiveness By Usage, 2024 to 2034

Figure 106: North East Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 107: North East Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 108: North East Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 109: North East Attractiveness By Sales Channel, 2024 to 2034

Figure 110: North East Value (US$ million) Analysis By Product Type, 2019 to 2034

Figure 111: North East Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 112: South East Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 113: South East Attractiveness By Product Type, 2024 to 2034

Figure 114: South East Value (US$ million) Analysis By Power Source, 2019 to 2034

Figure 115: South East Volume (Units) Analysis By Power Source, 2019 to 2034

Figure 116: South East Y-o-Y Growth (%) Projections, By Power Source, 2024 to 2034

Figure 117: South East Attractiveness By Power Source, 2024 to 2034

Figure 118: South East Value (US$ million) Analysis By Technology, 2019 to 2034

Figure 119: South East Volume (Units) Analysis By Technology, 2019 to 2034

Figure 120: South East Y-o-Y Growth (%) Projections, By Technology, 2024 to 2034

Figure 121: South East Attractiveness By Technology, 2024 to 2034

Figure 122: South East Value (US$ million) Analysis By Usage, 2019 to 2034

Figure 123: South East Volume (Units) Analysis By Usage, 2019 to 2034

Figure 124: South East Y-o-Y Growth (%) Projections, By Usage, 2024 to 2034

Figure 125: South East Attractiveness By Usage, 2024 to 2034

Figure 126: South East Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 127: South East Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 128: South East Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 129: South East Attractiveness By Sales Channel, 2024 to 2034

Figure 130: Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 131: Attractiveness By Product Type, 2024 to 2034

Figure 132: Value (US$ million) Analysis By Power Source, 2019 to 2034

Figure 133: Volume (Units) Analysis By Power Source, 2019 to 2034

Figure 134: Y-o-Y Growth (%) Projections, By Power Source, 2024 to 2034

Figure 135: Attractiveness By Power Source, 2024 to 2034

Figure 136: Value (US$ million) Analysis By Technology, 2019 to 2034

Figure 137: Volume (Units) Analysis By Technology, 2019 to 2034

Figure 138: Y-o-Y Growth (%) Projections, By Technology, 2024 to 2034

Figure 139: Attractiveness By Technology, 2024 to 2034

Figure 140: Value (US$ million) Analysis By Usage, 2019 to 2034

Figure 141: Volume (Units) Analysis By Usage, 2019 to 2034

Figure 142: Y-o-Y Growth (%) Projections, By Usage, 2024 to 2034

Figure 143: Attractiveness By Usage, 2024 to 2034

Figure 144: Value (US$ million) Analysis By Sales Channel, 2019 to 2034

Figure 145: Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 146: Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 147: Attractiveness By Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

United Kingdom Absorbable Tissue Spacer Market Outlook – Share, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA