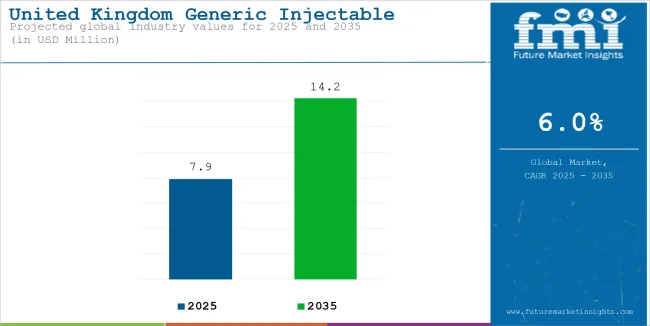

United Kingdom market, in generic injectable are significantly expanding. With rate of 6.0%, the market will reach to USD 14.2 million in 2035 from USD 7.9 million in 2025.

| Attributes | Values |

|---|---|

| Estimated United Kingdom Industry Size (2025) | USD 7.9 million |

| Projected United Kingdom Value (2035) | USD 14.2 million |

| Growth Rate from (2025 to 2035) | 6.0% |

The UK's NHS is equally influential in developing the market for generic injectables; its policies put weight on cost containment and access to affordable medicines. Therefore, with strict cost containment policies in place, patent expirations of biologics, and initiatives by various governments to boost the usage of generic drugs, the injectable generics market keeps growing.

Furthermore, the rise in prevalence of life and chronic diseases-cancer, diabetes, cardiovascular diseases, and autoimmunity disorders-have made medical treatment dependent on injectables. Growth in other areas like biosimilars, complex generics, and LAIs contributed to positive growth in the market. Innovations in drug delivery mechanisms such as prefilled syringes, self-administering devices, and nanoparticle-based injectables have driven the adoption.

In relation to this fact, the UKP is one of the most regulated pharmaceutical markets, with exceptionally high assurance of quality, safety, and efficacy for generic injectables. One would, therefore, expect continuous greasing through rapid approvals by regulatory bodies like MHRA and NICE as a way for market access for biosimilars and complex generics.

Another major driver of the generic injectables market is Brexit-induced changes in pharmaceutical supply chains. The UK has increased investments in domestic production and supply chain resilience, aiming to reduce dependency on imported generic injectables.

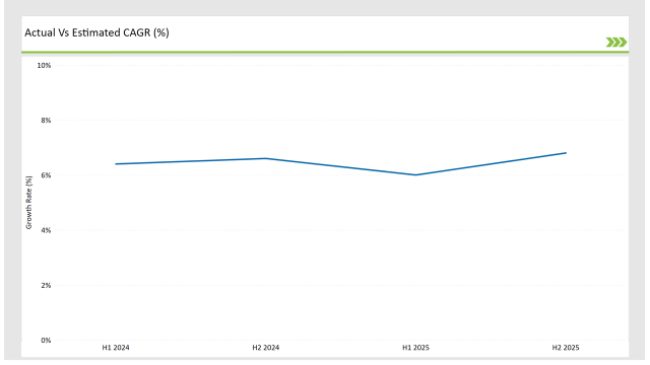

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the United Kingdom generic injectable market.

This semi-annual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The generic injectable sector for the United Kingdom market is expected to rise at 6.4% growth rate in the first half of 2024, which will increase to 6.6% in the second half of the same year. In 2025, the growth rate is expected to slightly decline to 6.0% in H1 but is expected to rise to 6.8% in H2. This pattern shows a decline of 35.0 basis points from the first half of 2023 to the first half of 2025, in the second half of 2024, it is lower by 20.0 basis points compared to the second half of 2024.

The nature of the United Kingdom generic injectable market is cyclical, with periodic shifts in government regulations, healthcare reforms, and patient needs. The performance review will, on a six-monthly basis, help any business stay competitive and correct course in changing market dynamics.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Expansion: Aurobindo Pharma Limited focuses on establishing itself as an international healthcare products and services provider. For example, the company strengthened its business position in IV drugs through an acquisition in Brazil |

| 2024 | Product Innovation: Mylan N.V., involved in the product development and innovations. It designs bioequivalent versions of branded medicines. |

| 2024 | Product Developments: Dr. Reddy's Laboratories Ltd, carries out product development, process chemistry, and manufactures complex, over-the-counter products and formulations. |

Increasing Use of Biosimilar in the Country

Major propellant factoring in overall UK generic injectables market growth is the growth in biosimilar adoptions that specially target oncology, rheumatology, and autoimmune diseases. The active promotion by NHS will ensure there are more biologic-priced analogues chosen out in healthcare purchasing decisions.

Growing Preference for Self-Administration Injectables

The increasing interest in the area of self-administered injectables seems to be oriented toward three options: prefilled syringes, auto-injectors, and wearables. All such options allow treatment at home and decrease the amount of hospital admissions, which further decreases general health costs.

Government Support and Innovation in the Market

The UK government also plays an active role in the regulation of drug pricing to ensure better access to injectables. NHS procurement policies have favored cost-effective alternatives, boosting demand for generic oncology drugs, insulin, monoclonal antibodies, and peptide hormones.

% share of Individual categories by Product Type and Distribution Channel in 2025

Monoclonal antibodies records significant surge in generic injectable market

Among product types, monoclonal antibodies (mAbs) hold the largest market share, primarily in oncology, immunology, and inflammatory diseases. Additionally, chemotherapy agents, peptide hormones, and insulin-based injectables have witnessed rising demand.

Based on the distribution channel, the dominance is by the hospital pharmacies, as most injectables need to be administered in a clinical setup by healthcare professionals. At the same time, retail and online pharmacies are increasing their market shares for insulin, pain management drugs, and hormonal therapies owing to the demand for convenience regarding medication by patients.

Note: above chart is indicative in nature

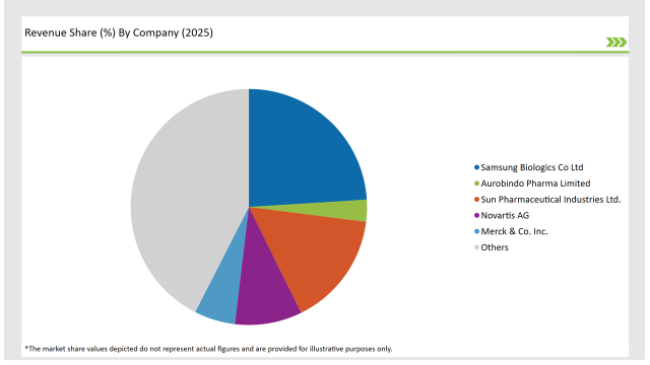

The UK generic injectables market is highly competitive, with Tier 1 companies leading the market. Tier 1 companies have dominance because they operate on a broad portfolio of generic injectables for oncology, diabetes, cardiovascular diseases, and autoimmune disorders.

Regulatory compliance, development of novel drug delivery technologies, and biosimilars under development make these Tier 1 companies strong toward continued growth.

The tier 2 companies are gaining ground by targeting high-demand injectables that are cost-effective, including monoclonal antibodies, insulin, and peptide hormones. They focus on efficient production technologies, hospital contracts, and retail pharmacy partnerships to strengthen their market position.

New entrants and mid-sized players contribute to competitive pricing, increasing domestic manufacturing, and improving distribution networks. New players are targeting niche areas of therapies and injectables based to mark their presence in the emerging market.

The industry includes various product type such as monoclonal antibodies, immunoglobulin, cytokines, insulin, peptide hormones, blood factors, peptide antibiotics, vaccines, small molecule antibiotics, chemotherapy agents, and others.

The industry includes various molecule type such as small molecule, large molecule.

The industry includes various indications such as oncology, infectious diseases, diabetes, blood disorders, hormonal disorders, musculoskeletal disorders, CNS diseases, pain management, cardiovascular diseases

Available in route of administration like intravenous (IV), intramuscular (IM) and subcutaneous (SC)

The market is expected to grow at a CAGR of 6.0% from 2025 to 2035.

Monoclonal antibodies are the leading products in the market.

Key players include Samsung Biologics Co Ltd, Aurobindo Pharma Limited , Sun Pharmaceutical, ndustries Ltd., Novartis AG, Merck & Co. Inc., Cipla Ltd, Pfizer Inc., Fresenius Kabi, Sanofi S.A, AstraZeneca Plc, Teva Pharmaceuticals., Mylan N.A, Baxter International, Dr. Reddy’s Laboratories Ltd.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States Generic Injectable Market Report – Demand, Trends & Industry Forecast 2025-2035

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA