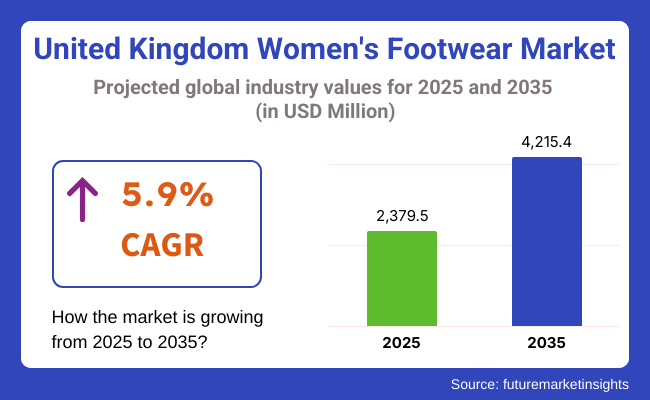

The industry is expected to register steady growth during the next decade due to fashion trends changing, rising disposable incomes, and the growing influence of e-commerce. The valuation is expected to reach approximately USD 2,379.5 million by 2025 and approximately USD 4,215.4 million by 2035, and the industry is expected to expand at a compound annual growth rate (CAGR) of 5.9% during the forecast period.

The female footwear industry in the UK is experiencing a complete overhaul. Some of the motivating forces behind the transformation are growing interest in personal expression through fashion, increased awareness of comfort and well-being from footwear, and niche fashion footwear styles (i.e., green, vegan, and athleisure shoes) rising in popularity.

Consequently, both established older heritage brands and newer ones are broadening product lines to meet various lifestyle requirements, ranging from formal and casual to performance shoes. Maybe the most powerful industry growth driver is the ongoing e-commerce phenomenon.

With mobile-first shopping behavior and omnichannel retailing now common, online channels are myth-busting luxury and boutique shoes to bring it more mainstream across age groups. Retailers are also leveraging AI-driven recommendations, virtual try-ons, and one-to-one marketing in order to create more customer experiences and brand loyalty.

Sustainability has become a defining phenomenon, with environmentally conscious consumers calling upon brands to green up. From recycled material to biodegradable soles and transparent supply chains, sustainable innovation not only meets environmental needs but is also employed as an effective brand-building tool. Many UK footwear businesses are now setting themselves towards ESG objectives, where fashion and purpose must intersect.

Additionally, celebrity endorsement and social media visibility, influencer collaborations, and designer collabs have also had a decisive impact on driving new launches and capsule collections into the mainstream. Exposure such as that of Gen Z and millennial consumers is generating swift changes in consumer behavior and condensing fashion cycles.

However, the industry faces certain challenges. Rising inflation, import uncertainty, and post-Brexit trade regulations can influence the level of production cost and pricing models. Further, as fashion is always going to be cyclical, inventory issues and the pressure of fast supply chain responsiveness continue to be major operational concerns.

With continued investment in innovation, marketing, and customer engagement, the footwear industry for women is poised for healthy, sustainable growth. Given that brands are focusing on a mix of style, comfort, and eco-responsibility, the category will likely see a fascinating decade ahead, led by innovation and responsible consumption.

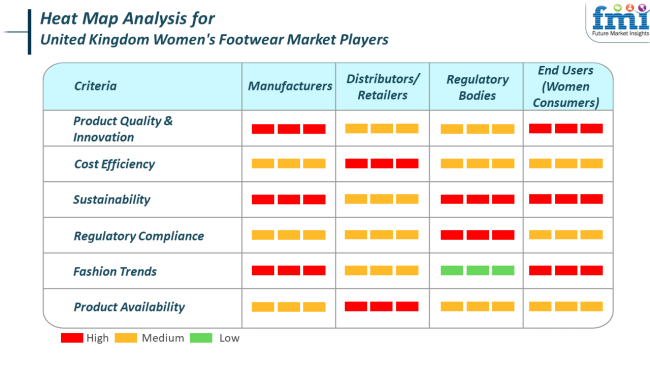

The United Kingdom is growing strongly, led by changing consumer preferences, fashion, and sustainability initiatives. The company's focus is on providing comfortable, versatile footwear, with a clear shift away from conventional high heels towards flats, trainers, and platformed sandals.

Retailers have driven the offering of affordability and luxury as a service, with businesses like Kurt Geiger able to adapt their product lines to accommodate this.

Sustainability is also gaining prominence, with businesses like Hotter Shoes expanding home manufacturing and using eco-friendly production.

End users women first are seeking more comfort, durability, and style in their buying decisions, with increasing demand for fashion- and eco-friendly shoes. This segment is also driven by the resurgence of early 2000s styles, driving demand for lower heels, ballerinas, and loafers.

There was a growth in the industry between 2020 and 2024 due to shifting consumer trends. The demand for comfort footwear, including flats, trainers, and low-heeled footwear, was a prevalent trend. The pandemic brought about a lifestyle change, with more consumers opting for versatile and comfortable shoes for work-from-home setups and daily excursions.

Besides, green options and the demand for eco-friendly materials in footwear products grew as consumers became more environmentally conscious. Expansion through e-commerce contributed significantly, providing convenience and ample options to consumers.

Online selling channels became essential, especially among young generations, as it was easy for them to buy shoes online. During the forecast period, the industry will likely continue to change, with increased emphasis on eco-friendly fashion and innovation in footwear technology.

Some of the main drivers will be greater acceptance of athleisure and multifunctional shoes and a transition towards inclusive sizing and customization. Further, influencer fashion and luxury collaborations will keep influencing the industrywith fashionable, high-quality, and comfortable shoes.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Comfort-driven footwear, e-commerce growth, eco-consciousness, pandemic impact | Rise of athleisure, sustainable materials, influencer-driven trends, inclusive sizing, customization |

| Increased digital shopping, e-commerce platforms, virtual try-on | Advancements in smart footwear, 3D printing for custom designs, and augmented reality shopping experiences |

| Demand for comfort and versatility, rise in online shopping, sustainability | Sustained demand for multifunctional, sustainable shoes, customization and inclusivity at center stage |

| Transition towards flats, trainers, low heels, demand for sustainable shoes | Development of luxury partnerships, intelligent and responsive shoes, consolidation of sustainable production meth ods |

| Rise in online shopping and direct-to-consumer routes | Sustained predominance of e-commerce, consolidation of AI-powered personalized shopping, sustainable retailing practices |

The United Kingdom shows steady growth fueled by changing fashion trends, rising disposable income, and the impact of e-commerce. There are a number of risks that may affect its future course.

One of the key threats is economic sensitivity. Shoes, especially women's fashion shoes, tend to be a discretionary buy. Accordingly, in economically uncertain or declining economic times, consumers tend to reduce expenditure on non-essential categories such as fashion. This can lead to lower volumes of sales and declining growth.

The high level of competition also acts as a hurdle. A host of new and established brands are competing for their share, promoting price wars as well as squeezing profit margins. Small-scale producers, in most cases, would struggle to establish differentiation for their products since buyers have ample variety to pick from. Direct-to-consumer platforms through online retailers have further created stiff competition.

In order to counteract these risks, the United Kingdom must emphasize diversification in product ranges to appeal to various consumer segments. Investment in sustainability is also important to support the increasing popularity of eco-friendly and ethically sourced products.

The UK depicts an active trajectory of product sales stimulated by evolving lifestyle trends among consumers, increasing awareness of fashion, and the mounting influence of virtual shopping environments. Footwear demand across different footwear segments, including casual, formal, and sports footwear, continues to be subject to evolving seasonal trends as well as growing demand for comfort and appearance.

The convergence of fashion with functionality is more common, and females seek versatile shoes to be used for work as well as for casual settings. This consumer pattern is encouraging business firms to design multipurpose products and expand their product lines. Greater use of the Internet for shopping, particularly among young consumers, is reshaping business models and broadening accessibility in urban and suburban markets.

Shoe companies are surfing e-commerce and influencer marketing tides to increase brand exposure and traffic. Sustainability remains a key trend, with a strong push towards vegan materials, the recycling of fabrics, and the open-sourcing of materials. Local UK and international manufacturers are seeking to invest in innovation and manufacturing ethics as a means of meeting regulatory standards and consumer ethos.

Furthermore, designer-shoe company collaborations are increasingly common, facilitating differentiation in a competitive market. Overall, the UK market continues to be a strong and opportunity-rich market for premium, mid-range, and value-based segment growth.

By product type,sneakers would account for 42% of the total market share in 2025, followed by a 39% share by boots.

Sneakers are the go-to footwear today, especially for millions of people, because they perfectly cut across lifestyle habits of comfort, athleisure, and some versatility. Having been made so popular through casually sporty dressing in the office and everyday activities among the younger ones, millennials and Gen Z are a big contributor to this increasing demand.

The likes of Nike, Adidas, and New Balance have made their claim for the marketplace by launching collections that bring women-specific ranges to women's performance and related styles. Adidas has "Ultraboost"; Nike has "Air Max" lines of shoes become specifically style favorites, appealing to those living sporty lives with some fashion. Tied in with the growing phenomenon of online sneaker culture, scarcity drops, and influencer-promoted strategies, this has set trendlines for the sneaker market.

Boots, while slightly trailing, hold a substantial share at 39%, driven by seasonal demand and fashion appeal. Ankle boots, knee-highs, and combat boots are always among the favorites in the UK, especially in autumn and winter.

Fast fashion brands like Zara and ASOS, as well as iconic heritage brands such as Dr. Martens and Clarks, are cashing in on the current fad and producing a continual line of boots for work, casual, and formal occasions. In fact, Dr. Martens keeps sending resonant signs about young people with special collaborations and its idiosyncratically utilitarian style.

At the same time, a new eco-friendly boot line has recently been established by brands like Allbirds and Timberland as a part of sustainable fashion.

Both segments are experiencing digital retail expansion, custom marketing, and sustainable materials. While sneakers are the mainstay for use at any time, boots still have a clear advantage with stylistic expression as well as seasonality, therefore being essential items in the complex wardrobes of UK women.

By material,leather is projected to lead with an estimated share of 28%, while rubber-based footwear follows at 21%.

The most important fact associated with leather is its quality, durability, and premium appeal. Leather furniture is used for both topside and bottom surface identity by-products, such as boots, loafers, and formals. For example, companies such as Clarks, Kurt Geiger, and Dune London always base their long-term marketing strategies on leather as part of their core categories.

The offer promoted high cost and durability coupled with the classic connectivity between each side of the business and casual wear. Also, there are other expensive brands like Galuchat and Prada, which advertise their luxury leather segments.

Like cardboard, rubber is catching the eye of many people because, besides that, it can also serve them well in a practical, economical, and household manner. There is a considerable demand for the above products, such as rain boots (wellies), slip-on shoes, and hybrid rubber sneakers. Brands like Hunter and Crocs have witnessed continuous demand in this category.

Hunter has also become a location where customers can get the newly stylish yet practical rain boots, as these are generally known for rural yet urban consumers. They provide coverage against the weather while not compromising on style. Moreover, the same trend of recycled or bio-based rubber in manufacturing appeals to eco-conscious consumers, a niche that brands such as Native Shoes have only started exploring.

So, while leather has long been synonymous with premium and formal segments, it is quickly establishing a niche for itself in casual, all-weather, and sustainability-focused categories. With the continued advancement of fashion, function, and innovation, both materials will continue to have a strong foothold in the UK's women's footwear market.

The UK Women’s Footwear Market showcases a vibrant mix of performance-driven global giants, legacy British brands, and niche lifestyle players. Nike, Inc. has high brand visibility, rapid product innovation concerning sustainability and limited custom sneaker options tailored via digital platforms, retaining a revenue share.

Adidas AG, on the other hand, continues to explore the blend of athletic performance and streetwear aesthetics; its sustainable image backed by the "Primegreen" initiative resonates with the younger demographic.

The Dr. Martens Group combines British punk heritage with modern design cues to maintain its UK stronghold as well as leverage collaboration and DTC expansion. The growth of Skechers is a result of an emphasis on affordability and ergonomics, mainly appealing to the aging but style-conscious. Clarks is a traditional brand that has begun storytelling anew with a contemporary eye on design, comfort consumers, and reinvention in casual fashion.

Emerging competition is from ergonomic brands like BIRKENSTOCK and Geox, which are known to be comfortable and breathable. Fashion-aware luxury brands like Fairfax Fav and Grenson Shoes are developing a niche through limited collections and craftsmanship. Success in the market and beyond will depend on heritage balanced with fashion agility and digital outreach as omnichannel access, localized design appeal, and demand shift toward sustainability.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Nike Inc. | 18-22% |

| Adidas AG | 14-18% |

| Dr. Martens Group | 10-13% |

| Skechers USA, Inc. | 8-11% |

| C. & J. Clark International Ltd | 7-10% |

| Other Key Players (Combined) | 26-32% |

| Company Name | Offerings & Activities |

|---|---|

| Nike Inc. | Sportswear and fashion sneakers with digital customization, sustainable product lines, and influencer campaigns. |

| Adidas AG | Athletic and streetwear footwear using recycled materials and celebrity/fashion collaborations. |

| Dr. Martens Group | Fashion partnerships and a strong DTC presence support durable leather boots and shoes. |

| Skechers USA, Inc. | Comfortable, affordable casual and performance shoes with wide demographic appeal. |

| Clarks | Classic comfort footwear with a renewed design focus, expanding into stylish, versatile collections. |

Key Company Insights

Nike Inc. (18-22%)

The dominant force in UK women's footwear, Nike's data-driven designs, digital customization tools, and sustainability programs continue to drive growth. Localized campaigns resonate with younger, trend-aware audiences.

Adidas AG (14-18%)

Combines sports credibility with fashion influence, supported by partnerships (e.g., Stella McCartney) and sustainability platforms like “End Plastic Waste.”

Dr. Martens Group (10-13%)

Leverages British identity and cultural relevance to maintain loyal followings while modernizing styles for new generations. A robust online strategy strengthens its DTC reach.

Skechers USA, Inc. (8-11%)

Emphasizes comfort, affordability, and lifestyle versatility, helping it gain ground in both everyday and active footwear categories across UK retail networks.

Clarks (7-10%)

Undergoing brand rejuvenation through style updates and targeted marketing, appealing to both legacy customers and younger women seeking casual comfort.

The segmentation is into two main categories: Sneakers and Boots. Within the sneakers category, there are various subtypes, including plimsoll sneakers, high-top sneakers, slip-on sneakers, athletic sneakers, hiking & running sneakers, and other types. The boots category includes ankle boots, mid-calf boots, knee-high boots, over-the-knee boots, Chelsea boots, riding boots, and winter boots.

The segmentation is intorubber, leather, polyester, velvet, canvas, textile, and other materials, with each material offering distinct features and benefits for different footwear types.

By sales channel, the segmentation is into direct sales/exclusive stores, modern trade stores, department stores, specialty stores, off-price stores, and other sales channels. Online platforms, particularly company websites and e-commerce platforms.

The industry is slated to reach USD 2,379.5 million in 2025.

The industry is predicted to reach a size of USD 4,215.4 million by 2035.

Key companies include Nike Inc., Adidas AG, Puma SE, Skechers U.S.A., Inc., Converse Inc., Vans (VF Corporation), Reebok International Limited, Under Armour, Inc., BIRKENSTOCK DIGITAL GMBH, C. & J. Clark International Ltd (Clarks), Dr. Martens Group, Timberland LLC, Blundstone Australia Pty Ltd, PALLADIUM EU, Red Wing Brands of America, Inc., Bata Brands SA, Grenson Shoes, Fairfax and Favor® Ltd., Wolverine World Wide, Inc. (Hush Puppies), and Geox S.p.A.

The United Kingdom, slated to grow at a steady pace, is poised for strong growth.

Sneakers are being widely used.

Table 01: Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 02: Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 03: Market Value (US$ million) Analysis By Material, 2018 to 2033

Table 04: Market Volume (Units) Analysis By Material, 2018 to 2033

Table 05: Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 06: Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 01: Market Value (US$ million) and Volume (Units) Analysis, 2018 to 2022

Figure 02: Market Value (US$ million) and Volume (Units) Forecast, 2023 to 2033

Figure 03: Market Value (US$ million) Analysis, 2018 to 2022

Figure 04: Market Value (US$ million) Forecast, 2023 to 2033

Figure 05: Market Absolute $ Opportunity Value (US$ million), 2023 to 2033

Figure 06: Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 07: Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 08: Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 09: Market Attractiveness By Product Type, 2023 to 2033

Figure 10: Market Value (US$ million) Analysis By Material, 2018 to 2033

Figure 11: Market Volume (Units) Analysis By Material, 2018 to 2033

Figure 12: Market Y-o-Y Growth (%) Projections, By Material, 2023 to 2033

Figure 13: Market Attractiveness By Material, 2023 to 2033

Figure 14: Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 15: Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 16: Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 17: Market Attractiveness By Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Collation Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Aluminum Tubes Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Child Resistant Bottles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA