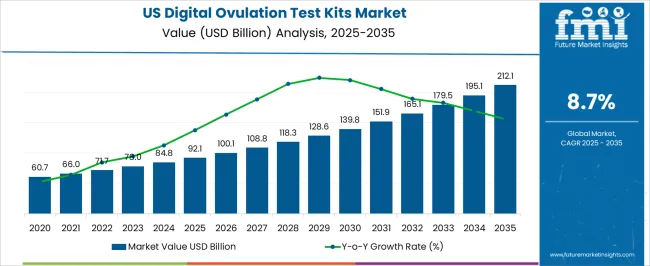

The United States Digital Ovulation Test Kits Market is estimated to be valued at USD 92.1 billion in 2025 and is projected to reach USD 212.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period.

| Metric | Value |

|---|---|

| United States Digital Ovulation Test Kits Market Estimated Value in (2025 E) | USD 92.1 billion |

| United States Digital Ovulation Test Kits Market Forecast Value in (2035 F) | USD 212.1 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The United States digital ovulation test kits market is experiencing robust growth fueled by rising awareness of fertility management, delayed family planning trends, and increasing reliance on home based diagnostic solutions. Enhanced accuracy and convenience of digital kits compared to traditional strip based alternatives have made them the preferred choice among consumers.

Technological innovations such as Bluetooth connectivity, app integration, and cycle tracking features are further supporting adoption. Growing investment in women’s health and expanding distribution networks across retail and e commerce channels are reinforcing accessibility.

Additionally, the emphasis on personalized healthcare and consumer empowerment in reproductive planning is driving steady market demand. The outlook remains positive as healthcare providers and consumers continue to recognize the value of digital ovulation kits in improving fertility outcomes and supporting informed family planning decisions.

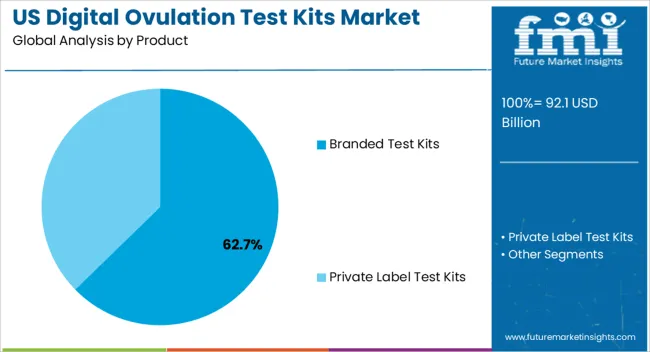

The branded test kits segment is projected to account for 62.70% of the total market revenue by 2025, positioning it as the dominant product type. This leadership is supported by consumer trust in established brands, higher accuracy rates, and the availability of advanced digital features that improve usability and reliability.

Marketing initiatives and strong retail presence have further expanded brand visibility, while premium positioning has reinforced consumer confidence.

Continuous innovation and FDA approvals have ensured product credibility, making branded test kits the preferred choice over generic alternatives.

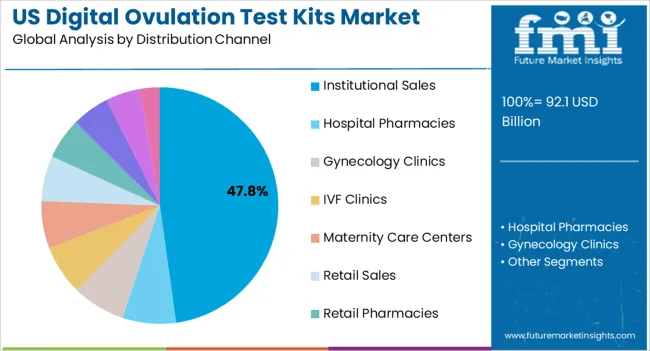

The institutional sales segment is expected to hold 47.80% of the overall market revenue by 2025, making it the leading distribution channel. This dominance is driven by bulk purchasing by hospitals, clinics, and fertility centers, which rely on high accuracy digital kits to support patient diagnostics and reproductive care programs.

Institutional procurement ensures consistent supply and quality assurance, thereby strengthening adoption. Partnerships between manufacturers and healthcare providers have also played a key role in expanding institutional sales.

As fertility care and reproductive health programs expand across the United States, the segment continues to demonstrate strong growth momentum.

Driven by a higher average age for pregnancy and a declining fertility rate worldwide, the digital ovulation test kits market rose at a 4.1% CAGR registered from 2020 to 2025. Decreasing rates of fertility are a growing concern across the globe, specifically in the United States

According to the report by Future Market Insights, the United States market for digital ovulation test kits is likely to rise at 9.1% CAGR between 2025 and 2035.

Branded test kits remain the top-selling product in the digital ovulation test kits market, accounting for over 83% of the revenue generated by 2035. This is due to increasing e-commerce availability, which has resulted in the increasing demand for branded test kits.

Institutional sales are expected to lead the market over the forecast period, generating a revenue of USD 212.1 million by 2035 due to increasing fertility awareness and rising demand for ovulation testing in hospitals.

Key manufacturers in the United States have initiated various awareness programs. Including campaigns, medication maintenance, and online education programs for the public to create awareness about women's health, particularly in terms of PCOS and PCOD. Healthcare providers and organizations are teaming up to improve fertility rates across the United States

For instance, in February 2024, Swiss Precision Diagnostics GmbH launched a campaign named ‘Conceiving Hood,' which is designed to de-stigmatize the pre-pregnancy phase by putting control back in women's hands. With this campaign, the company wants to promote the importance of healthcare care before conception by sharing facts and facilities.

Women often find difficulty in interpreting test results in the case of line indicator ovulation test kits and digital ovulation test kits. However, these issues are primarily solved through digital offerings, providing direct results easily readable on digital displays.

The results of a feasibility study conducted by Clearblue revealed that using digital devices reduced the chances of errors and misinterpretation by around 70%. Also, Bio-AMD, Inc. introduced the PixoTest technology to make use of the image and lighting sensing module of the mobile device or smartphone to identify the color change reactions on biochemical test strips.

This enables users to monitor fertility disorders. The rapid adoption of digital strip readers for ovulation tests creates a conducive environment for growth. Digital ovulation test kits have rapidly replaced conventional ovulation test kits with line indicators or analog alternatives in the last decade.

Some leading manufacturers are introducing new features to detect two leading fertility hormones using urine samples. For instance, in October 2020, Procter & Gamble launched the Clearblue Connected Ovulation Test System, the first and only ovulation test system to track two unique fertility hormones with connectivity to a smartphone.

It is the only ovulation test kit that accurately detects both the luteinizing hormone and estrogen to determine an extended fertility period. Growing demand for an advanced digital ovulation test is expected to aid long-term growth.

Advancements in fertility monitoring parameters have resulted in the introduction of alternatives to digital ovulation tests, predicting peak fertility periods. For instance, in February 2024, the United States FDA approved the AVA fertility tracking wearable device.

Wearable devices are proven as clinically effective as LH tests in predicting fertilization and ovulation, with additional days of fertility being identified. Thus, the growing scope of adoption for such alternatives is restraining market growth.

Similarly, the high prices of digital ovulation test kits and incidences of product recalls are expected to deter the growth of the United States digital ovulation test kits market.

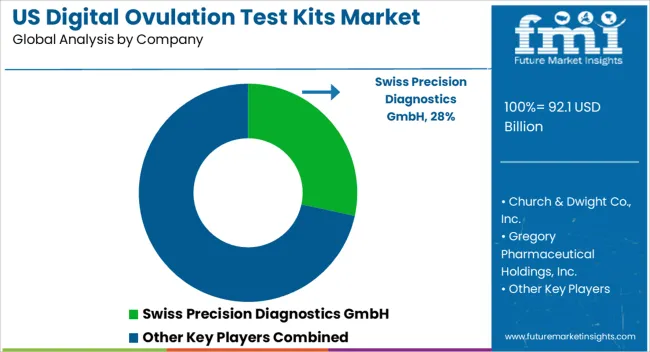

The launch of technologically advanced products from companies such as Swiss Precision Diagnostics GmbH, Church & Dwight Co, Inc., and Sugentec Inc. has increased the demand for digital ovulation test kits in the United States market. These products have advanced features such as easy Bluetooth connectivity, improved fertility days tracking, and digital strip reader features.

These smart features have made ovulation monitoring easier by using home ovulation test kits. However, these digital devices with advanced features are relatively inexpensive. If local manufacturers successfully launch digital ovulation test kits at a low price, the demand for digital kits may increase again in the United States market.

Based on product type, branded test kits hold the lead, accounting for nearly 85.20% of the market in 2025. The leading players are promoting and marketing their products through various e-commerce sites to bolster demand in the country.

Direct marketing through e-commerce sites thus supports the growth of branded test kits compared to private label test kits. Similarly, key players promote their products in professional, scientific meetings and conferences. This promotional strategy is expected to greatly increase the sale of branded test kits in the coming decade.

The institutional sales segment is expected to contribute a maximum revenue share of more than 54.21% in the United States digital ovulation test kits market in 2025 owing to the ease of availability of digital ovulation test kits in hospital pharmacies and fertility centers.

Its accessibility to consumers and relatively higher chances of available quality products are significant factors driving market growth through the end of 2035.

The competitive landscape in the United States digital ovulation test kits market is characterized by intense competition among key players. Leading market players are investing in research and development activities to develop advanced and technologically innovative products.

The United States digital ovulation test kits market is highly regulated, and companies are required to comply with stringent quality standards and obtain necessary certifications. This regulatory environment creates barriers to entry for new players and provides an advantage to established companies with a strong reputation and compliance track record.

For example, in November 2024, Samplytics Technologies Private Limited announced the Inito Fertility Monitor, a smartphone-connected device that helps to identify up to 6 fertile days and measures two primary fertility hormones - estrogen and luteinizing hormone (LH).

A few of the leading companies operating in the market are Church & Dwight Co., Inc., Swiss Precision Diagnostics GmbH, Sugentech, Inc., Gregory Pharmaceutical Holdings, Inc., iXensor Co., Ltd, Samplytics Technologies Private Limited, Bio-AMD, and others.

As per FMI, over 72% of the market share is currently covered by the top 2 players in the United States

Recent Development

NFI Consumer Healthcare, a manufacturer and distributor of pharmaceutical ointments expanded the agreement with Callitas Health in February 2020. Through this agreement, the company can distribute co-branded products in the United States, such as the over-the-counter ovulation test kit.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Country Covered | The United States |

| Key Segments Covered | Product, Distribution Channel |

| Key Companies Profiled | Swiss Precision Diagnostics GmbH; Church & Dwight Co., Inc.; Gregory Pharmaceutical Holdings, Inc.; Sugentech, Inc.; iXensor Co. Ltd; Samplytics Technologies Private Limited; Bio-AMD |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global United States digital ovulation test kits market is estimated to be valued at USD 92.1 billion in 2025.

The market size for the United States digital ovulation test kits market is projected to reach USD 212.1 billion by 2035.

The United States digital ovulation test kits market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in United States digital ovulation test kits market are branded test kits and private label test kits.

In terms of distribution channel, institutional sales segment to command 47.8% share in the United States digital ovulation test kits market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA