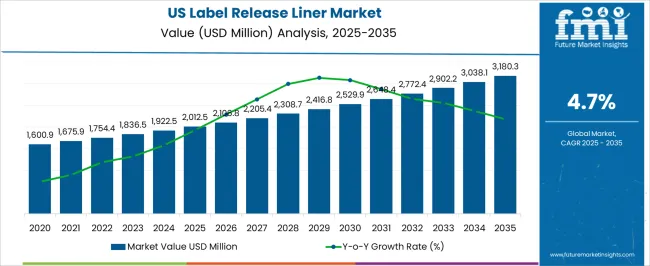

The United States Label Release Liner Market is estimated to be valued at USD 2012.5 million in 2025 and is projected to reach USD 3180.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| United States Label Release Liner Market Estimated Value in (2025 E) | USD 2012.5 million |

| United States Label Release Liner Market Forecast Value in (2035 F) | USD 3180.3 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

The United States label release liner market is expanding steadily as a result of increasing demand for packaged consumer goods, pharmaceuticals, and logistics solutions. Growth in e commerce and retail has accelerated the use of pressure sensitive labels, particularly in barcode and QR code formats, which support inventory tracking, authentication, and digital integration.

Sustainability initiatives are prompting manufacturers to innovate with recyclable substrates and reduced material usage without compromising performance. Advances in liner coating technologies have improved release characteristics, enhancing efficiency in high speed labeling operations.

Regulatory compliance in food and pharmaceutical sectors is reinforcing the adoption of reliable and tamper evident labeling solutions. The overall outlook remains positive as industries continue to prioritize efficiency, product security, and consumer convenience while transitioning toward sustainable packaging practices.

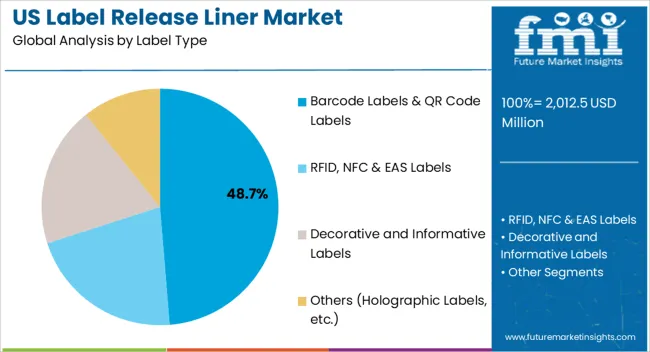

The barcode labels and QR code labels segment is projected to represent 48.70% of total revenue by 2025 within the label type category, positioning it as the leading segment. This growth is being driven by rising demand for digital traceability, supply chain transparency, and secure product identification.

Increased adoption of smart labeling technologies in retail, logistics, and healthcare has further strengthened this segment.

The ability of barcode and QR code labels to enhance operational efficiency and consumer engagement has reinforced their dominance in the label type category.

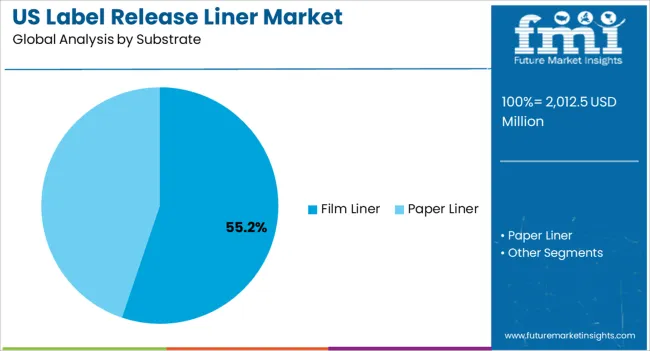

The film liner segment is expected to account for 55.20% of the total market revenue by 2025 within the substrate category, making it the dominant sub segment. This performance is attributed to the superior strength, durability, and resistance of film liners, which provide consistent performance in demanding labeling applications.

Film liners support higher converting speeds and reduce label waste, offering operational efficiency advantages.

Their ability to perform reliably under variable environmental conditions has ensured widespread adoption, particularly in food and beverage and pharmaceutical sectors.

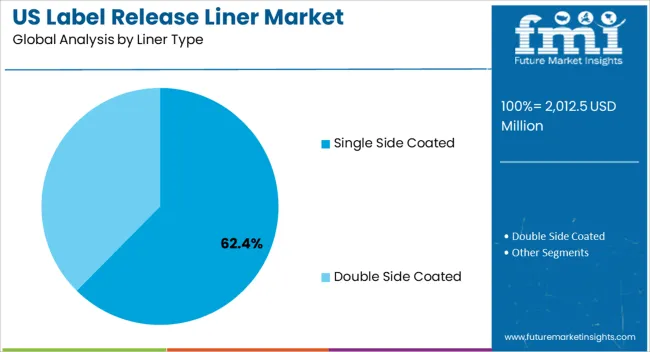

The single side coated liner type is projected to contribute 62.40% of the market share by 2025 within the liner type category, positioning it as the most significant sub segment. This is being driven by its cost effectiveness, compatibility with a wide range of adhesives, and ease of processing in automated labeling systems.

Single side coated liners deliver reliable release properties while maintaining production efficiency.

Their widespread usage across multiple end use industries has reinforced their market leadership, making them the preferred choice within the liner type category.

As per Future Market Insights, sales of label release liners in the United States market grew at around 3.0% CAGR during the historic period (2020 to 2025). Total market value increased from USD 1,414.1 million in 2020 to USD 1,744.2 million in 2025.

Looking ahead, the United States label release industry is expected to thrive at a steady CAGR of 4.9% from 2025 to 2035. The market is likely to total a valuation of USD 2,681.7 million by 2035.

Rising usage of labels across a wide range of sectors is expected to boost the United States market for label release liners during the assessment period.

Pressure-sensitive labels are becoming more and more in demand across a variety of sectors, including food & beverage, healthcare, and consumer products. These labels are backed with release liners, which offer a smooth, uniform surface for printing and application.

A significant development in the market is the rising need for environmentally friendly and sustainable release liners. To develop sustainable release liners that are biodegradable, compostable, or constructed from recycled materials, businesses are spending money on research and development.

The industry is expanding as a result of printing technology improvements like digital printing. Label printing is frequently done digitally since it offers quicker turnaround times and personalization.

The label release liner market in the United States will expand steadily due to rising need for pressure-sensitive labels across numerous sectors. Future market growth is anticipated to be fueled by a concern for sustainability and the environment.

The focus has been on sustainable packaging. Growing presence of key retail chains, and rising customer demand for ready-to-eat (packaged foods) have increased the petition for release liners in label applications. This in turn is fostering market development.

Key Factors Driving the United States Label Release Liner Industry:

The label-release liner industry is expanding as a result of the growing environmental consciousness in the United States. The need for sustainable and eco-friendly products as customers become more ecologically aware is having a big impact on the market for label release liners.

The rising need for environmentally friendly packaging is one of the key forces behind this trend. Customers are searching for goods that utilize less plastic and other environmentally hazardous components. Thus, there is an increasing need for labels and release liners that are recyclable, biodegradable, compostable, or reusable.

The market is experiencing innovation as a result of the mounting demand for sustainable goods. Businesses are investing in cutting-edge technology such as digital printing and water-based coatings to produce more sustainable products that nevertheless exceed customer performance expectations.

Logistics and inventory management are a vital part of any sector. They help manage crucial aspects such as storage, tracking, and movement of all kinds of goods from manufacturers to consumers.

Technology-oriented labels such as RFID, NFC, barcode, etc., have gained immense popularity in the United States packaging sector. These labels are frequently used for asset tracking and inventory management.

Several manufacturers and brand owners are using technology-oriented labels to enhance their supply chain mechanisms and control over logistics. These labels also have specific applications in warehouses.

For instance, in warehouses, they are used to keep tabs on the inventory, check the details of the products, and intimate the relevant party regarding the status of packages. Paper and plastic-based release liners are efficiently used as substrate layers for these labels.

The demand for technology-oriented labels is touching new heights in the United States because they reduce human errors by automating the data collection process.

Astonishing demand generation for these kinds of labels across all industrial and non-industrial sectors is expected to boost the United States label release liner market.

Barcode Labels & QR Code Labels to Generate Lucrative Opportunities for Companies

Based on label types, decorative and informative labels segment dominate the United States market. On the other hand, RFID, NFC & EAS labels and barcode & QR code labels will witness higher demand.

Barcode & QR code labels segment is expected to thrive at 5.7% CAGR while the RFID, NFC & EAS labels segment is likely to expand at 5.0% CAGR.

Barcode and QR-code labels are being increasingly used across various sectors, including retail, healthcare, logistics, and manufacturing. This in turn will continue to create high demand for label release liners during the next ten years.

Barcode & barcode labels are used to identify products, maintain inventories, and give consumers information. They are witnessing high adoption across a wide range of sectors. This in turn will continue to create demand for label release liners.

High-quality release liners that can resist the printing and application procedures and guarantee that the labels adhere properly are necessary for the usage of barcode and QR-code labels. Due to rising e-commerce usage and the necessity for track and trace systems in the healthcare sector, demand for these labels is predicted to keep rising.

The United States label release liner market is anticipated to witness steady growth because of the growing demand for barcode and QR-code labels. High usage of these labels is expected to open up new business prospects for label release liner suppliers and manufacturers in the United States.

Single-Side Coated Liners to Dominate the United States Industry

As per Future Market Insights (FMI), single side coated segment is expected to retain its dominance in the United States market. The target segment is set to attain a valuation of USD 1,606.3 million by 2035.

High adoption of single-sided liners is due to their distinct characteristics and advantages over other liner types. This includes better convenience and cost-effectiveness.

In the pressure-sensitive label sector, single-side coated liners are frequently utilized since they are coated on just one side, typically with silicone.

Single-side coated liners' affordability is one of their key benefits. These liners have lower production costs since they require less coating material and processing time.

Single-side coated liners are also more environmentally beneficial because less trash is produced during production. In comparison to other liner varieties, single-side coated liners also provide better print quality.

The liner's uniformly smooth surface makes it possible to print with excellent quality and guarantees that the labels will stick. This is crucial for barcode and QR-code labels since they require precise printing and scanning.

Key manufacturers of label release liners in the United States market are focusing on developing innovative products to expand their customer bases. They are also investing vigorously in research and development and adopting strategies such as mergers, acquisitions, and partnerships.

Recent developments:

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 2012.5 million |

| Projected Market Value (2035) | USD 3180.3 million |

| Anticipated Growth Rate (2025 to 2035) | 4.7% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in million Sq., and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Label Type, Substrate, Liner Type |

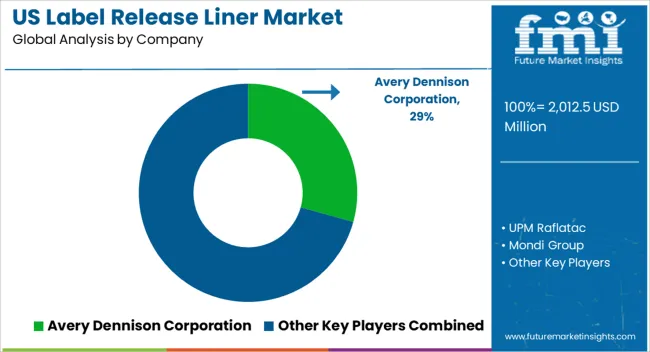

| Key Companies Profiled | Avery Dennison Corporation; UPM Raflatac; Mondi Group; Elkem Silicones USA Corp.; Mitsubishi Chemical America, Inc.; Gascogne Flexible; 3M Company; Loparex LLC; Toray Plastics (America), Inc.; Polyplex Corporation Ltd.; LINTEC Corporation; Twin Rivers Paper Company. |

The global United States label release liner market is estimated to be valued at USD 2,012.5 million in 2025.

The market size for the United States label release liner market is projected to reach USD 3,180.3 million by 2035.

The United States label release liner market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in United States label release liner market are barcode labels & qr code labels, rfid, nfc & eas labels, decorative and informative labels and others (holographic labels, etc.).

In terms of substrate, film liner segment to command 55.2% share in the United States label release liner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Collation Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Aluminum Tubes Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Child Resistant Bottles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA