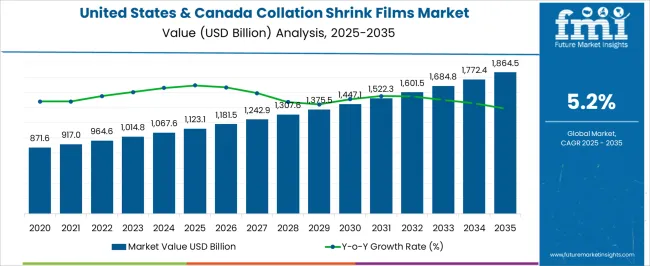

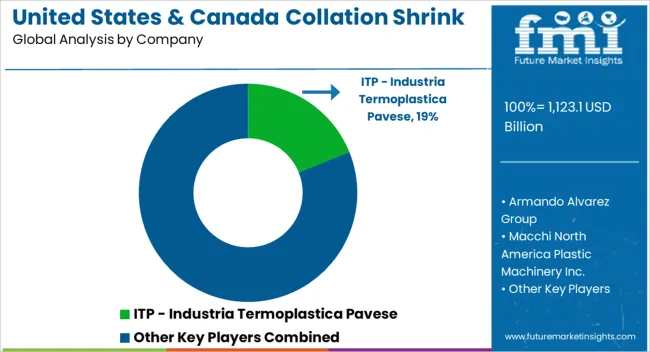

The United States & Canada Collation Shrink Films Market is estimated to be valued at USD 1123.1 billion in 2025 and is projected to reach USD 1864.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| United States & Canada Collation Shrink Films Market Estimated Value in (2025 E) | USD 1123.1 billion |

| United States & Canada Collation Shrink Films Market Forecast Value in (2035 F) | USD 1864.5 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The United States and Canada collation shrink films market is expanding steadily, supported by strong demand from the food, beverage, and consumer goods industries. Sustainability concerns and the push for lightweight yet durable packaging solutions are influencing adoption of advanced shrink films.

Manufacturers are focusing on developing recyclable and downgauged film variants to meet regulatory compliance and brand sustainability targets. Growth in bottled beverages, household consumables, and e commerce shipments has significantly boosted usage due to the films’ ability to provide product protection, cost efficiency, and high shelf appeal.

Continuous investments in advanced extrusion technologies and multilayer film structures are enhancing strength, clarity, and performance across a range of applications. With increasing emphasis on product differentiation and reduced environmental impact, the outlook for collation shrink films remains positive in both premium and mass market packaging.

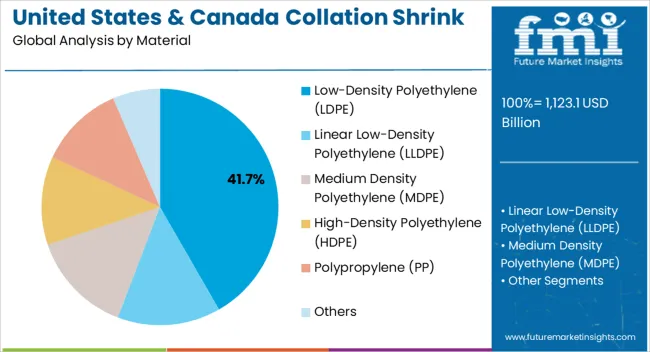

The low density polyethylene material segment is expected to account for 41.70% of total market revenue by 2025, making it the leading material type. Its dominance is attributed to high flexibility, superior strength to weight ratio, and cost efficiency.

LDPE films provide excellent shrink performance and adaptability across automated packaging lines, which is essential for high volume beverage and consumer goods industries. Their recyclability and compatibility with downgauged structures have further strengthened adoption.

As sustainability commitments intensify, LDPE continues to be favored due to its balance of performance, affordability, and environmental compliance.

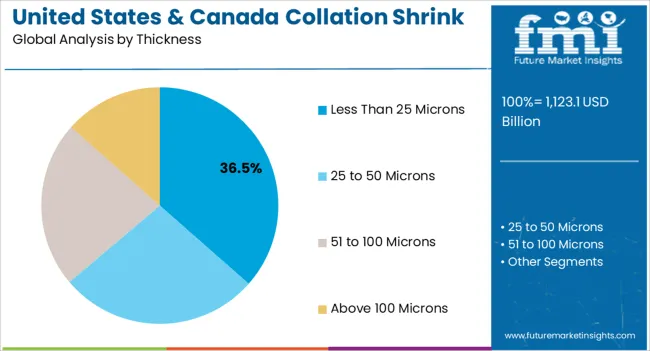

The less than 25 microns thickness segment is projected to capture 36.50% of the total market revenue by 2025. Demand in this segment is driven by the trend toward downgauging, which enables material savings and reduced environmental impact without compromising performance.

Thinner films provide cost advantages while maintaining strength and durability for lightweight product bundling. Technological advancements in extrusion have improved the consistency and reliability of thinner films, supporting adoption in high speed packaging operations.

This balance of reduced material usage and functional integrity has positioned thinner films as the preferred choice for manufacturers.

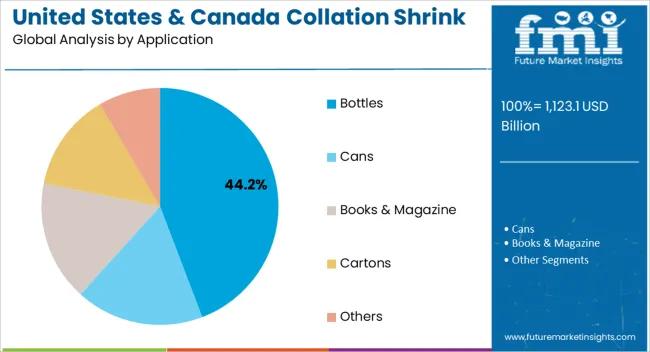

The bottles application segment is anticipated to hold 44.20% of the overall market share by 2025, reflecting its position as the leading application. Growth in bottled water, carbonated drinks, and alcoholic beverages has driven widespread use of shrink films for secure bundling and transportation.

The ability of shrink films to deliver product stability, tamper resistance, and brand visibility has made them integral to beverage packaging. Additionally, compatibility with recyclable and downgauged film formats has further supported their appeal in this segment.

With beverage consumption continuing to rise, bottles remain the largest and most resilient driver of shrink film adoption across North America.

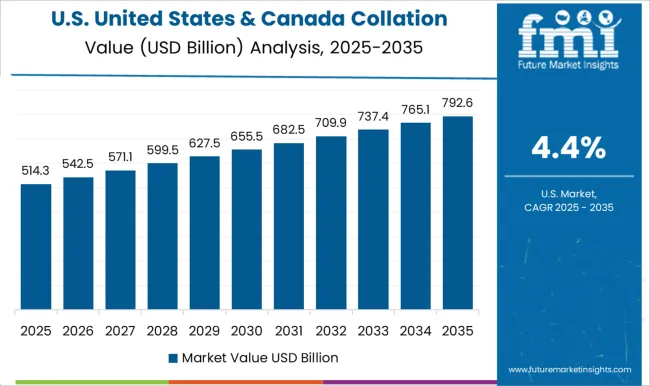

The United States & Canada collation shrink films market witnessed a CAGR of 2.7% during the historic period from 2020 to 2025. Total market valuation at the end of 2025 reached USD 984.1 million.

For the projection period (2025 to 2035), Future Market Insights (FMI) predicts collation shrink film demand in the United States & Canada market to rise at 5.2% CAGR.

Collation shrink films are becoming a preferred flexible packaging solution. This is because they are very thin, heat-treated, and stretched-out plastic films which snuggly and tightly wrap products to maximize the protection of goods and prevent slippage.

Several end users such as food & beverage, pharmaceuticals, and cosmetics industries are considering collation shrink films as a first choice for secondary packaging. This is because such type of packaging results in a clear, lightweight, and durable barrier of protection around the product.

These films are used by placing them on products or pallets and applying heat of around 150° C to them, preferably with a heat gun. This causes them to shrink and conform to the shape of the product. This allows for packaging with a stiff and tight holding force that does not take up any space for storage.

Collation shrink films are naturally transparent which offers clear visibility of the packed goods. They can also be printed to facilitate branding or advertising.

The availability of collation shrink films in several thicknesses as well as lengths and breadth provides the benefit of increased utility as they can be used for packaging items of widely different sizes and shapes.

Increasing Demand from Logistics and Booming E-commerce Business Fueling Sales

Globalization led to a sharp increase in imports and exports across the continents. This paved the way for vast delivery chains and thus increased the demand for logistics.

Manufacturing businesses and suppliers are making use of flexible packaging to enhance the packaging systems for efficient and smooth delivery, avoiding any potential damages from mishaps. This is positively impacting collation shrink film sales.

The economical, lightweight, and tamper-proof features of collation shrink films are making the ideal packaging products in the transport industry across the United States and Canada.

Further, the dawn of the e-commerce business has led to the growth of the plastic packaging industry by leaps and bounds. This is attributed to the fact that single-use, light-in-weight packaging is one of the most feasible ways for facilitating delivery to the end users.

Leading e-commerce players are preferring to use shrink-wrap films & hoods owing to their various benefits. This in turn will continue to create opportunities for collation shrink film manufacturers.

Ability to Extend the Shelf Life of Processed Food to Elevate Collation Shrink Film Demand

Food products are vulnerable to degradation and molding, rendering them unfit to consume when exposed to undesired biological, atmospheric, and chemical factors. As a result, processed food manufacturers are actively seeking solutions to protect food quality for longer periods.

Collation shrink films with exceptional barrier performance are favored for superior packaging solutions which aid in the extended shelf life of food products and preserve their quality.

The United States & Canada collation shrink film market is witnessing innovations owing to continuous product developments in the materials, design, and chemical properties of packaging material.

The physical and functional attributes of collation shrink films are resultant features of the capabilities of materials used in the production of collation shrink films.

| Country | United States |

|---|---|

| Market Share (2025) | 69.4% |

| Market Share (2035) | 66.6% |

| BPS Analysis | -280 |

| Country | Canada |

|---|---|

| Market Share (2025) | 30.6% |

| Market Share (2035) | 33.4% |

| BPS Analysis | 280 |

Booming Food & Beverages Industry Driving Collation Shrink Film Demand in Canada

Canada collation shrink films market value reached USD 1123.1 million in 2025. Over the next ten years, demand for collation shrink films across Canada is expected to increase at a steady pace. This is due to the rising usage of these films across the thriving food & beverages industry.

According to Agriculture and Agri-Food Canada (AAFC), the food and beverage processing sector in Canada is the second leading manufacturing industry. It exports processed food & beverage products to 192 countries, of which the United States is the leading importer.

The products manufactured by the food and beverage industry are generally packed in either bottles, cans, or cartons. These packages require optimum protection while transporting and storing as they can go bad fairly quickly. Even a slight blow could prove harmful to the food item and may cause the package to leak.

To prevent such mishaps, collation shrink films are used to deliver food products safely over wide distances. These films ensure a high level of protection and do not consume any space.

The rapid expansion of the food & beverage industry in Canada along with the increasing export of processed food and beverages products will therefore continue to fuel collation shrink film demand.

High Requirement of Collation Shrink Films in the United States Pharmaceutical Sector Boosting Sales

The United States is expected to remain at the epicenter of North America's collation shrink films market during the assessment period. It is estimated to account for more than 1/3rd of the market value share in 2035.

The increasing need for protective packaging across the booming pharmaceutical sector is a prominent factor driving the United States collation shrink films industry.

The United States accounts for around 45% of the global pharmaceutical market which makes use of collation shrinks films as a protective measure for packaging bottles of syrups, pills, tablets, etc.

Further, changing lifestyles and readily available food and retail outlets are boosting the food and beverages sector in the country. This in turn will further trigger collation shrink film sales in the country.

Manufacturers Prefer Low-Density Polyethylene for Making Collation Shrink Films

According to Future Market Insights, low-density polyethylene (LDPE) is likely to remain the most preferred material for making collation shrink films. This is due to the various advantages of low-density polyethylene.

Low-density polyethylene offers benefits such as high chemical resistance, flexibility, impact resistance, moisture resistance, etc. as a result, it has become an ideal material for making collation shrink films across the United States and Canada.

The rising popularity of LDPE collation shrink films across the United States and Canada will play a key role in boosting the market.

The low-density polyethylene segment is anticipated to expand by more than 1.6x of the current market value by the end of 2035. Together, low-density polyethylene (LDPE) and linear low-density polyethylene (LLDPE) segments are expected to hold more than half of the market share during the forecast period.

Bottles to Remain the Most Profitable Application of Collation Shrink Films

As per Future Market Insights, the bottles segment is expected to remain the most lucrative application in the United States & Canada markets. This is due to the rising usage of collation shrink films for packing a wide variety of bottles.

Being the prevalent consumer of bottled water globally, the United States is becoming a lucrative market for collation shrink films. This is because these films are being widely used as protective packaging for bottled water.

Shrink wrap bundling films allow food & beverage companies to easily pack, transport, and protect various products. These films also reduce overall transportation costs.

Rising consumption of beverages and liquid supplements in both the United States & Canada is expected to boost sales of collation shrink films during the assessment period. The sales of the collation shrink films used for packaging bottles alone are expected to reach over USD 1864.5 million by 2035.

Collation shrink films are mostly preferred for bulk packaging of water, sauce, and several bottles used for packaging medicines. Therefore, this segment holds a prominent share of the United States & Canada markets.

Key collation shrinks film manufacturers operating in the United States & Canada markets are focusing on increasing their revenues by expanding their presence and enhancing production capabilities.

Companies are also adopting merger & acquisition strategies and developing new products to meet customer needs. Recent developments:

| Attribute | Details |

|---|---|

| Market Value in 2025 | USD 1123.1 billion |

| Projected Market Valuation (2035) | USD 1864.5 billion |

| Growth Rate | 5.2% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million, Revenue in USD million, Volume in Tonnes, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segment Covered | Material, Thickness, Application, End Use, Country |

| Key Countries Profiled | The United States, Canada |

| Key Companies Profiled | ITP - Industria Termoplastica Pavese; Armando Alvarez Group; Macchi North America Plastic Machinery Inc.; Accredo Packaging, Inc.; Transcontinental Packaging; Dow Inc.; Berry Global Inc.; Pyramid Shrink Film; Plastixx FFS Technologies; Sealed Air Corporation; NOVA Chemicals Corporate; Packman Packaging Pvt. Ltd.; Impackt Packaging Solutions; Brentwood Plastics, Inc.; Intertape Polymer Group; Clysar, LLC; iSell Packaging; Bonset America Corporation; International Plastics Inc. |

The global united states & Canada collation shrink films market is estimated to be valued at USD 1,123.1 billion in 2025.

The market size for the united states & Canada collation shrink films market is projected to reach USD 1,864.5 billion by 2035.

The united states & Canada collation shrink films market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in united states & Canada collation shrink films market are low-density polyethylene (ldpe), linear low-density polyethylene (lldpe), medium density polyethylene (mdpe), high-density polyethylene (hdpe), polypropylene (pp) and others.

In terms of thickness, less than 25 microns segment to command 36.5% share in the united states & Canada collation shrink films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA