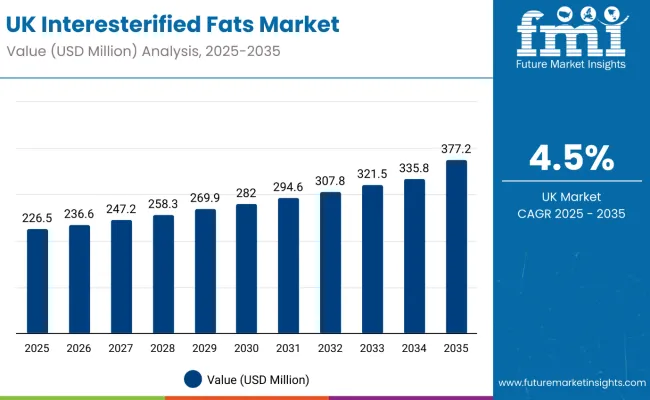

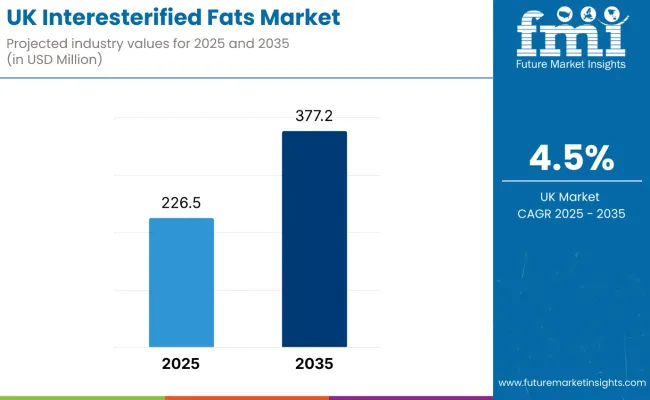

Sales of interesterified fats in the UK are estimated at USD 226.5 million in 2025, with projections indicating a rise to USD 377.2 million by 2035, reflecting a CAGR of 4.5% over the forecast period. This growth is driven by rising demand in processed food manufacturing, increasing adoption of healthier fat alternatives, and expanding industrial usage in pharmaceuticals and personal care products.

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 226.5 million |

| Projected Value (2035F) | USD 377.2 million |

| CAGR (2025 to 2035) | 4.5% |

Per capita consumption is expected to steadily increase as food manufacturers continue to reformulate products to improve texture, shelf life, and nutritional profile.

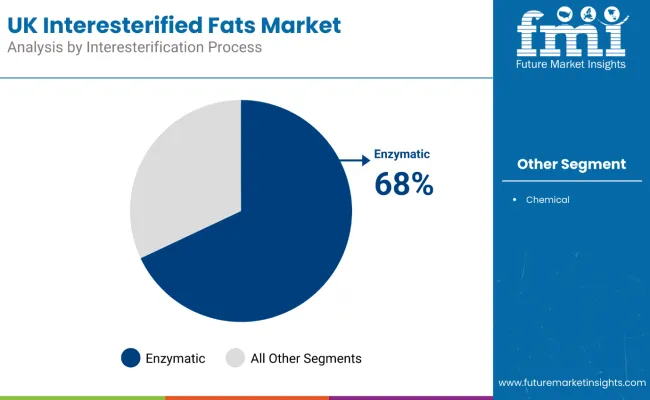

Enzymatic interesterification is poised to remain the leading process segment with a 68.0% share in 2025, owing to superior operational efficiency, lower trans-fat content, and customization flexibility for industrial applications. Chemical interesterification, while still significant, is gradually being replaced in applications where health-conscious formulations and regulatory compliance are critical.

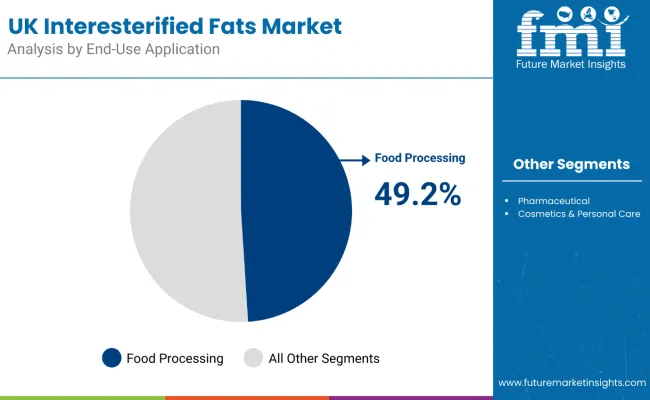

By end-use application, food processing will continue to drive the highest demand, with a 49.2% share in 2025, supported by applications in bakery, confectionery, and dairy product manufacturing. Pharmaceuticals and cosmetics & personal care products are also expanding, driven by functional ingredient applications and formulation innovations.

Consumer adoption is concentrated among manufacturers seeking functional and customizable fats, while regulatory scrutiny of trans fats and rising demand for clean-label formulations further support the trend. Cost optimization, technological improvements in enzymatic processing, and partnerships between suppliers and industrial clients are expected to accelerate adoption.

The interesterified fats segment in UK is classified into process, source, and end-use application. By process, the key segments include enzymatic and chemical interesterification. By source, it is segmented into palm oil, soybean oil, groundnut oil, walnut oil, coconut oil, rapeseed oil, sunflower oil, cottonseed oil, and other oils. By end-use application, the category spans food processing, pharmaceuticals, and cosmetics & personal care products.

Enzymatic interesterified fats are projected to dominate with a 68.0% value share in 2025, driven by precise control over fat composition, health compliance, and reduced trans-fat content. Chemical interesterification remains relevant in cost-sensitive applications but is gradually being replaced where regulatory compliance and functional performance are prioritized.

Food processing applications are projected to account for the largest share at 49.2% in 2025, driven by bakery, confectionery, and dairy products that require improved texture, spreadability, and shelf life. Pharmaceutical applications are growing due to use in formulations requiring specific fat structures, while cosmetics and personal care products are expanding as ingredient functionalities evolve.

The interesterified fats category in the UK attracts a range of industrial and health-focused manufacturers seeking functional, compliant, and innovative fat solutions. While motivations range from regulatory compliance to product performance enhancement to clean-label formulation, demand is concentrated among several key consumer segments. Each segment demonstrates distinct adoption behaviors, application priorities, and purchasing considerations.

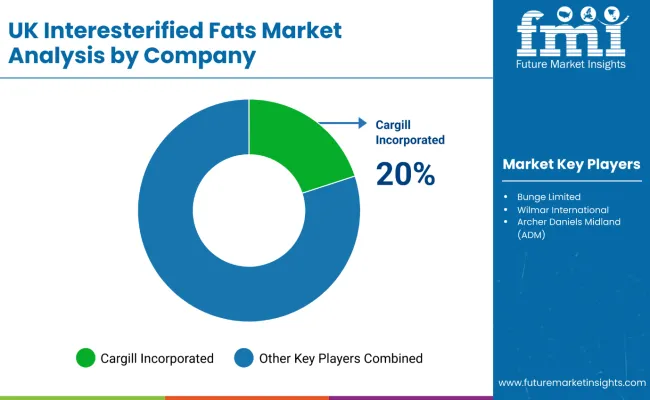

The competitive environment in the UK interesterified fats sector is characterized by a mix of domestic and international fat suppliers. Technical expertise in enzymatic and chemical processing, rather than sheer production scale, remains the decisive success factor: the top suppliers collectively serve hundreds of food, pharmaceutical, and personal care manufacturers nationwide and account for the majority of industrial distribution.

Cargill Incorporated is a leading player, estimated to hold around 20% share. The company leverages advanced enzymatic processing capabilities, extensive industrial partnerships, and a broad portfolio of functional fat solutions for food, pharmaceutical, and cosmetic applications. Its strong focus on regulatory compliance and clean-label formulations ensures deep penetration across major industrial segments in the UK.

Bunge Limited and Wilmar International Limited provide complementary fat solutions with robust supply chain integration and customizable products. Their strategies emphasize collaborative R&D with food manufacturers, technology licensing, and targeted expansion into high-value applications in pharmaceuticals and personal care formulations.

Archer Daniels Midland (ADM) leverages global production scale alongside tailored industrial solutions, focusing on functional fat applications that meet trans-fat reduction and texture optimization requirements. Recent expansions have strengthened ADM’s positioning in bakery, confectionery, and dairy processing applications.

The next tier includes Intercontinental Specialty Fats Sdn, 3F Industries Limited, Oleo Fats Inc., IOI Corporation Berhad, Liberity Oil Mills Ltd., Fuji Oil Holdings, Mewah International Inc., Novozymes, Oleofinos, AAK Kamani Pvt. Ltd., and Willowton Group. These companies focus on niche and specialized fat solutions, often offering targeted enzymatic or chemical interesterification services, functional customization, and innovation for specific end-use applications.

Consolidation and strategic partnerships are expected to continue, as expertise in enzymatic processing, product customization, and regulatory compliance becomes increasingly critical for sustaining industrial partnerships and expanding presence across food, pharmaceutical, and personal care sectors in the UK.

Key Developments

In May 2025, Wilmar International published its 2024 Sustainability Report, highlighting Science Based Targets initiative validation of its emissions reduction goals. The company aims to significantly cut greenhouse gas and FLAG emissions by 2032 and achieve ambitious net-zero targets by 2050, reinforcing its commitment to climate action and sustainability.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 226.5 Million |

| Interesterification Process | Enzymatic, Chemical |

| Source | Palm Oil, Soybean Oil, Groundnut Oil, Walnut Oil, Coconut Oil, Rapeseed Oil, Sunflower Oil, Cottonseed Oil, Other Oils |

| End-Use Application | Food Processing, Pharmaceutical, Cosmetics & Personal Care Products |

| Key Companies Profiled | Bunge, Archer Daniels Midland Company, Cargill Incorporated, Wilmar International Limited, Intercontinental Specialty Fats Sdn, 3F Industries Limited, Oleo Fats Inc., IOI Corporation Berhad, Liberity Oil Mills Ltd., Fuji Oil Holdings, Mewah International Inc., Novozymes, Oleofinos, AAK Kamani Pvt. Ltd., Willowton Group |

| Additional Attributes | Dollar sales by product type and form, regional demand trends, competitive landscape, consumer preferences for natural versus conventional fats, integration with sustainable sourcing practices, innovations in extraction and processing technologies, clean-label and allergy-free product developments, and market adoption across dietary and functional applications |

The global United Kingdom interesterified fats market is estimated to be valued at USD 226.5 billion in 2025.

The market size for the United Kingdom interesterified fats market is projected to reach USD 351.7 billion by 2035.

The United Kingdom interesterified fats market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in United Kingdom interesterified fats market are chemical and enzymatic.

In terms of source, palm oil segment to command 48.9% share in the United Kingdom interesterified fats market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Collation Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Aluminum Tubes Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Child Resistant Bottles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA