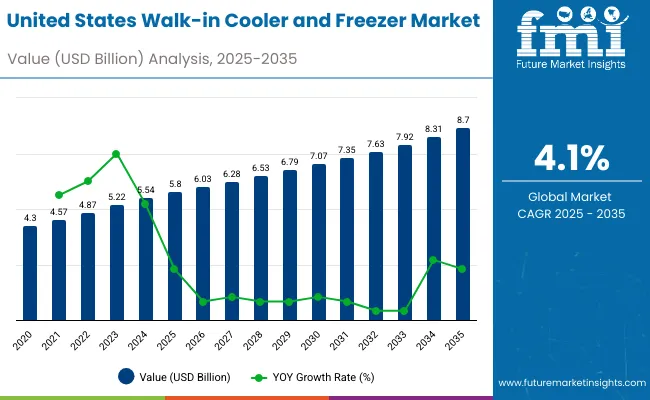

The United States walk-in cooler & freezer market is projected to grow from USD 5.8 billion in 2025 to approximately USD 8.7 billion by 2035, recording an absolute increase of USD 2.9 billion over the forecast period. This translates into total growth of 50.0%, with demand forecast to expand at a compound annual growth rate (CAGR) of 4.1% between 2025 and 2035. Overall sales are expected to grow by nearly 1.50X during the same period, supported by rising United States foodservice activities, increasing cold-chain infrastructure development, and growing demand for temperature-controlled storage across food retail and healthcare operations. The United States, led by Texas, Florida, and California, continues to demonstrate strong growth potential driven by chain restaurant expansion, hurricane-resilient installations, and energy-code compliance initiatives.

Between 2025 and 2030, United States walk-in cooler & freezer market is projected to expand from USD 5.8 billion to USD 7.1 billion, resulting in a value increase of USD 1.3 billion, which represents 44.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising United States foodservice operations, particularly across Texas and Florida where chain restaurant growth and hospitality rebound are accelerating refrigeration installations. Increasing adoption of prefabricated panelized systems and growing utilization of outdoor pad-mount configurations continue to drive demand. Equipment suppliers are expanding their production capabilities to address the growing complexity of modern United States cold-chain operations and energy-efficiency requirements, with American foodservice operations leading investments in advanced refrigeration technologies.

From 2030 to 2035, demand is forecast to grow from USD 7.1 billion to USD 8.7 billion, adding another USD 1.6 billion, which constitutes 55.2% of the overall ten-year expansion. This period is expected to be characterized by expansion of low-GWP refrigeration systems, integration of advanced remote monitoring and controls technologies, and development of standardized installation protocols across different foodservice and retail operations. The growing adoption of sustainable refrigeration practices and electrification initiatives, particularly in California and northeastern states, will drive demand for more sophisticated walk-in systems and specialized technical capabilities.

Between 2020 and 2025, United States walk-in cooler & freezer demand experienced steady expansion, driven by increasing United States foodservice activities in quick-service restaurants and institutional kitchens and growing awareness of energy-efficiency benefits for operational cost reduction. The sector developed as foodservice operations, especially in Texas and California, recognized the need for specialized refrigeration equipment and advanced insulation technologies to improve temperature stability while meeting stringent energy codes and food safety regulations. Chain operators and independent establishments began emphasizing proper equipment specification and installation quality to maintain operational efficiency and regulatory compliance.

| Metric | Value |

|---|---|

| United States Walk-in Cooler & Freezer Sales Value (2025) | USD 5.8 billion |

| United States Walk-in Cooler & Freezer Forecast Value (2035) | USD 8.7 billion |

| United States Walk-in Cooler & Freezer Forecast CAGR (2025-2035) | 4.1% |

Demand expansion is being supported by the rapid increase in United States foodservice operations nationwide, with Texas maintaining its position as a chain restaurant growth leadership region, and the corresponding need for specialized refrigeration equipment for food storage, beverage cooling, and ingredient preservation. Modern foodservice operations rely on advanced walk-in systems to ensure food safety compliance, temperature consistency, and optimal inventory management. United States foodservice requires comprehensive refrigeration infrastructure including coolers for produce and beverages, freezers for protein and frozen goods, and specialized units for pharmaceutical cold-chain applications to maintain operational excellence and regulatory adherence.

The growing complexity of United States cold-chain operations and increasing energy regulations, particularly stringent requirements in California and northeastern states, are driving demand for advanced walk-in systems from certified manufacturers with appropriate insulation performance and refrigeration expertise. Foodservice companies are increasingly investing in prefabricated panelized systems and remote monitoring technologies to improve energy efficiency, reduce operational costs, and enhance temperature control in challenging United States climate environments. Regulatory requirements and food safety specifications are establishing standardized refrigeration procedures that require specialized capabilities and trained installation teams, with American foodservice operations often setting benchmark standards for global cold-chain practices.

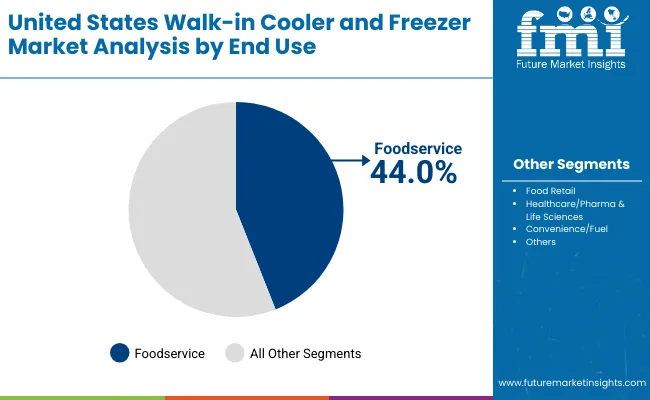

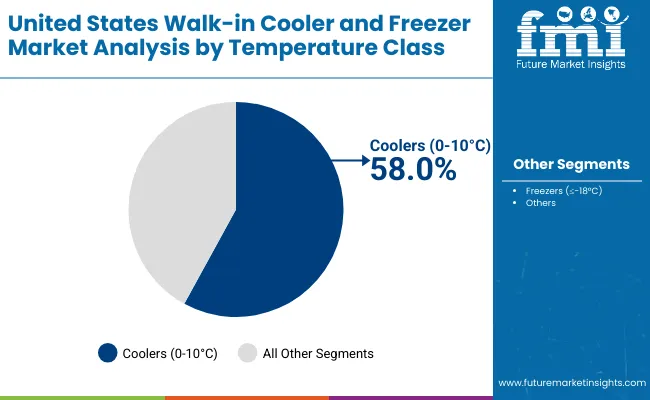

Demand is segmented by end use, temperature class, and construction & location. By end use, sales are divided into foodservice (QSR & fast-casual, full-service restaurants, institutional kitchens, catering/ghost kitchens), food retail, healthcare/pharma & life sciences, and convenience/fuel & others. Based on temperature class, demand is categorized into coolers 0-10°C (beverage/produce, back-of-house prep, floral/deli) and freezers ≤-18°C (reach-in attached rooms, deep-freeze & blast). In terms of construction & location, sales are segmented into prefabricated panelized systems (indoor back-of-house, outdoor pad-mount with penthouse/remote condensing) and site-built rooms (retrofit/expansion, new build custom). Regionally, demand is divided across the United States, with Texas, Florida, California, New York, Georgia, Illinois, and Arizona representing key growth states for United States walk-in cooler & freezer technologies.

Foodservice is projected to account for 44.0% of United States walk-in cooler & freezer demand in 2025, making it the leading end-use segment across the sector. This dominance reflects the critical importance of temperature-controlled storage and food safety compliance in restaurant operations, where even minor temperature excursions can result in significant food waste and regulatory violations. Within the foodservice segment, QSR & fast-casual operations command the largest share at 18.0%, driven by aggressive chain expansion programs and standardized equipment specifications across national franchises throughout Texas, Florida, and California. Full-service restaurants represent 14.0% of demand, particularly valued for their diverse storage requirements spanning fresh produce, proteins, and prepared ingredients, while institutional kitchens account for 8.0%, reflecting steady investments in school nutrition programs and healthcare foodservice modernization. Catering and ghost kitchen operations contribute 4.0%, serving the rapidly growing off-premise dining and delivery segments.

Coolers operating in the 0-10°C range are expected to represent 58.0% of United States walk-in cooler & freezer demand in 2025, highlighting their critical role as the dominant temperature segment. Large-scale foodservice and retail operations, particularly across Texas, California, and Florida, require extensive cooler capacity to maintain fresh produce quality, beverage inventory, and prepared food safety. Within coolers, beverage/produce applications lead with 24.0% share, driven by grocery store remodels and convenience store expansion programs requiring high-volume refrigerated display support. Back-of-house prep coolers account for 19.0%, primarily concentrated in restaurant kitchens and institutional foodservice facilities where ingredient staging and order assembly demand rapid access to temperature-controlled storage, while floral/deli applications represent 15.0% of demand, serving specialty retail and supermarket service departments. The segment is fueled by increasing food safety regulations and energy code requirements, with operators prioritizing high-R insulation systems that reduce compressor runtime while maintaining tight temperature control.

United States walk-in cooler & freezer demand is advancing steadily due to increasing United States foodservice activities and growing recognition of energy-efficiency benefits, with Texas and California serving as key drivers of technological innovation and regulatory standards. However, the sector faces challenges including high capital costs, need for continuous maintenance and refrigerant management, and varying equipment requirements across different climate zones and installation configurations. Low-GWP refrigerant transitions and remote monitoring programs, particularly advanced in California and northeastern operations, continue to influence equipment specifications and operational patterns.

The growing pipeline of QSR and fast-casual expansion programs across Texas, Florida, and Georgia, combined with food retail remodel initiatives in California and New York, is creating sustained walk-in demand across new construction and retrofit applications. Major restaurant brands are investing in standardized equipment specifications, prefabricated panel systems, and rapid installation protocols that enable accelerated site deployment while maintaining brand consistency across franchise networks. Cold-chain distribution facilities and last-mile delivery hubs present specialized refrigeration requirements including high-capacity freezers, multi-temperature configurations, and dock-accessible layouts adapted for material handling equipment. These foodservice-driven expansion programs are generating multi-year equipment procurement cycles that support sustained demand growth across the forecast period. Imperial Brown's addition of an automated foaming line and expanded door fabrication capacity in 2025 demonstrates manufacturer response to shortened lead-time requirements for multi-site grocery remodels.

Modern equipment manufacturers, led by KPS Global, Bally Refrigerated Boxes, and Polar King, are incorporating advanced insulation systems and low-GWP refrigerant options that improve energy performance, reduce environmental impact, and enhance operational cost structures. Integration of remote monitoring capabilities, automated defrost controls, and variable-speed refrigeration systems enables more precise temperature management and comprehensive performance tracking. Advanced walk-in systems also support next-generation foodservice operations including energy-code compliant installations and zero-emission refrigeration that maximize efficiency while minimizing utility expenses, with California foodservice operations increasingly adopting these technologies through electrification pilots and utility incentive programs. Polar King's launch of factory-assembled outdoor walk-ins with low-GWP condensing options and integrated controls for remote monitoring in 2024 demonstrates accelerating technology commercialization that positions manufacturers as sustainability partners addressing operator cost reduction and regulatory compliance objectives.

| State | CAGR (2025-2035) |

|---|---|

| Texas | 4.6% |

| Florida | 4.5% |

| California | 4.3% |

| New York | 4.1% |

| Georgia | 4.0% |

| Illinois | 3.9% |

| Arizona | 3.8% |

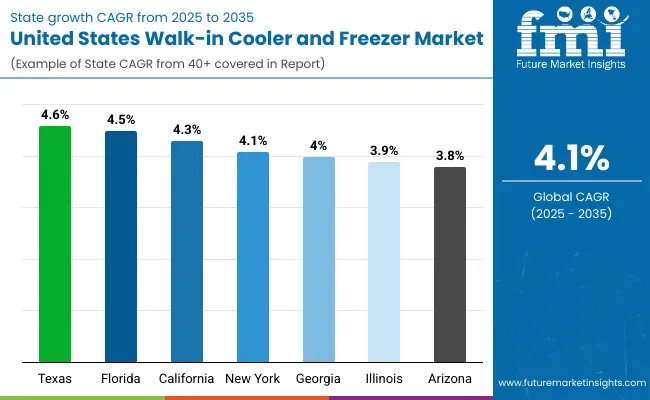

The United States walk-in cooler & freezer industry is witnessing steady growth, supported by rising foodservice activity, cold-chain expansion, and the integration of energy-efficient refrigeration systems across operations. Texas leads the nation with a 4.6% CAGR, reflecting chain restaurant growth, cold-chain hubs, and high new-build permits driving refrigeration installations. Florida follows with a 4.5% CAGR, supported by hospitality rebound and hurricane-resilient outdoor installations. California grows at 4.3%, driven by food retail remodels, energy-code upgrades, and electrification pilots across the state.

Demand for United States walk-in coolers & freezers in Texas is projected to exhibit strong growth with a CAGR of 4.6% through 2035, driven by ongoing chain restaurant expansion programs, development of cold-chain distribution corridors, and increasing new-build construction permits across metropolitan areas. As the dominant United States foodservice growth state, Texas' emphasis on business-friendly regulations and population growth is creating significant demand for refrigeration equipment with rapid installation capabilities and climate-resilient performance. Major equipment manufacturers and foodservice operators are establishing comprehensive specification strategies to support multi-site rollouts and supply chain efficiency across Texas operations.

Demand for United States walk-in coolers & freezers in Florida is expanding at a CAGR of 4.5%, supported by extensive hospitality sector recovery, hurricane-resilient outdoor installation requirements, and tourism-driven foodservice activity across coastal regions. The state's foodservice sector, representing a crucial component of United States restaurant operations, is increasingly adopting advanced refrigeration systems including reinforced panels, wind-rated outdoor units, and corrosion-resistant components. Equipment suppliers and foodservice operations are gradually implementing comprehensive specification programs to serve expanding United States foodservice activities throughout Florida and broader southeastern territories.

Demand for United States walk-in coolers & freezers in California is growing at a CAGR of 4.3%, driven by established food retail remodel programs, stringent energy-code compliance requirements, and electrification pilot initiatives across major metropolitan areas. The state's foodservice and retail sectors, integral components of United States commercial refrigeration adoption, are gradually integrating modern equipment technologies to improve energy performance and regulatory compliance. Foodservice operations and equipment distributors are investing in high-R insulation systems and low-GWP refrigerant solutions to address growing energy-efficiency requirements and align with California environmental standards.

Demand for United States walk-in coolers & freezers in New York is growing at a CAGR of 4.1%, supported by urban back-of-house retrofit projects, last-mile grocery operations, and space-efficient refrigeration requirements across New York City and metropolitan areas. The state's dense urban foodservice environment is driving demand for compact walk-in configurations adapted for constrained back-of-house spaces and multi-story building installations. Equipment suppliers are developing technical expertise to support New York's unique installation challenges including basement installations, rooftop units, and vertical integration solutions. Urban retrofit and renovation projects are supporting refrigeration demand in existing restaurant spaces, food halls, and institutional kitchens requiring equipment replacement within tight dimensional constraints throughout New York metropolitan territories.

Demand for United States walk-in coolers & freezers in Georgia is expanding at a CAGR of 4.0%, driven by distribution corridor development, QSR expansion programs, and OEM manufacturing presence across the Atlanta metropolitan area and surrounding regions. The state's strategic logistics position and business-friendly environment are establishing refrigeration requirements across foodservice and cold-chain applications. Major food distributors and regional chains are implementing comprehensive refrigeration infrastructure to support southeastern territory expansion and supply chain optimization initiatives. Distribution infrastructure development is driving refrigeration demand in warehouse facilities, cross-dock operations, and regional distribution centers supporting food retail and foodservice supply chains throughout Georgia territories.

Demand for United States walk-in coolers & freezers in Illinois is growing at a CAGR of 3.9%, supported by grocery store modernization programs, institutional kitchen investments, and foodservice activity across Chicago and metropolitan regions. The state's established food retail sector is adopting modern refrigeration to improve energy performance and customer experience through comprehensive equipment upgrade programs. Commercial operators and institutional buyers are implementing advanced refrigeration systems to address operational efficiency requirements and regulatory compliance standards. Grocery modernization and remodel programs are facilitating refrigeration demand in supermarket renovations, format conversions, and equipment replacement projects improving energy efficiency throughout Illinois retail territories.

Demand for United States walk-in coolers & freezers in Arizona is expanding at a CAGR of 3.8%, driven by population inflows, outdoor-rated installation requirements, and foodservice expansion across Phoenix and metropolitan areas. The state's extreme climate conditions are establishing specialized refrigeration requirements adapted for high ambient temperatures and outdoor installations. Equipment manufacturers and contractors are developing enhanced cooling capabilities and specialized installation techniques to address Arizona's challenging operational environment. Population growth and residential development are supporting foodservice expansion and refrigeration demand in new restaurant construction, grocery store development, and convenience retail projects throughout Arizona growth corridors.

United States walk-in cooler & freezer demand is defined by competition among specialized refrigeration manufacturers, panel system suppliers, and installation service providers, with domestic manufacturers maintaining significant national influence. Manufacturers are investing in advanced insulation technologies, prefabricated panel systems, installation efficiency capabilities, and comprehensive distribution networks to deliver reliable, energy-efficient, and compliant refrigeration solutions across United States and global operations.

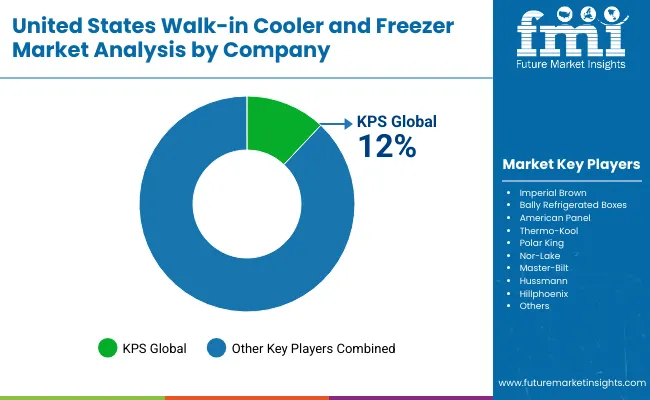

KPS Global, United States-based and holding 12% share, offers comprehensive United States walk-in refrigeration solutions including prefabricated panels, refrigeration systems, and installation services with focus on energy efficiency, installation speed, and chain operator requirements across United States and global operations. The company introduced higher-R insulated panel lines and quicker-install panel joints in 2024 aimed at reducing on-site labor for national QSR rollouts. Imperial Brown, with extensive United States manufacturing presence, provides prefabricated refrigeration systems and added an automated foaming line with expanded door fabrication capacity in 2025 to shorten lead times for multi-site grocery remodels.

Bally Refrigerated Boxes delivers specialized walk-in solutions with emphasis on custom configurations and retrofit applications. American Panel provides prefabricated panel systems focusing on commercial foodservice and retail installations. Thermo-Kool emphasizes energy-efficient refrigeration solutions for chain operators and independent establishments. Polar King offers factory-assembled outdoor walk-in units and launched systems with low-GWP condensing options and integrated controls for remote monitoring in 2024. Nor-Lake specializes in foodservice refrigeration with comprehensive product ranges.

Walk-in coolers and freezers represent critical infrastructure for safe, efficient storage of perishable foods, beverages, and temperature-sensitive products across foodservice, retail, and healthcare operations. With the United States industry projected to reach USD 8.7 billion by 2035, driven by chain restaurant expansion, cold-chain development, and energy-efficiency imperatives, the sector stands at the intersection of food safety compliance, operational cost management, and environmental sustainability. The refrigeration ecosystem-spanning prefabricated panels, refrigeration systems, installation services, and remote monitoring technologies-requires coordinated action across equipment manufacturers, foodservice operators, food retailers, consulting engineers, regulatory bodies, and technical training organizations to unlock its full value potential while addressing the complexity of climate adaptation and energy code compliance across diverse geographic regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.7 billion |

| End Use | Foodservice (QSR & fast-casual, full-service restaurants, institutional kitchens, catering/ghost kitchens), food retail, healthcare/pharma & life sciences, convenience/fuel & others |

| Temperature Class | Coolers 0-10°C (beverage/produce, back-of-house prep, floral/deli), freezers ≤-18°C (reach-in attached rooms, deep-freeze & blast) |

| Construction & Location | Prefabricated panelized systems (indoor back-of-house, outdoor pad-mount with penthouse/remote condensing), site-built rooms (retrofit/expansion, new build custom) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| States/Countries Covered | Texas, Florida, California, New York, Georgia, Illinois, Arizona (United States), Canada, Mexico, Germany, United Kingdom, France, China, India, Japan |

| Key Companies Profiled | KPS Global, Imperial Brown, Bally Refrigerated Boxes, American Panel, Thermo-Kool, Polar King, Nor-Lake, Master-Bilt, Hussmann, Hillphoenix |

| Additional Attributes | Dollar sales by end use, temperature class, and construction & location segment, state-level demand trends across United States, competitive landscape with established domestic walk-in manufacturers and refrigeration innovators, operator preferences for prefabricated versus site-built construction models, integration with remote monitoring technologies and energy management systems particularly advanced in California, innovations in higher-R insulation panel systems, low-GWP refrigeration solutions, and factory-assembled outdoor configurations, and adoption of automated installation systems, predictive maintenance platforms, and comprehensive food safety integration capabilities for enhanced operational efficiency and regulatory compliance across United States and global foodservice operations |

The U.S. walk-in cooler and freezer market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the united states walk-in cooler and freezer market is projected to reach USD 8.7 billion by 2035.

The united states walk-in cooler and freezer market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in united states walk-in cooler and freezer market are .

In terms of temperature class, coolers (0-10°c) segment to command 58.0% share in the united states walk-in cooler and freezer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

United Kingdom Absorbable Tissue Spacer Market Outlook – Share, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA