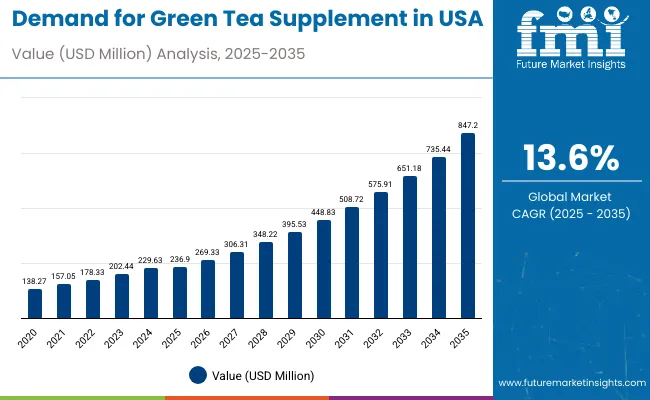

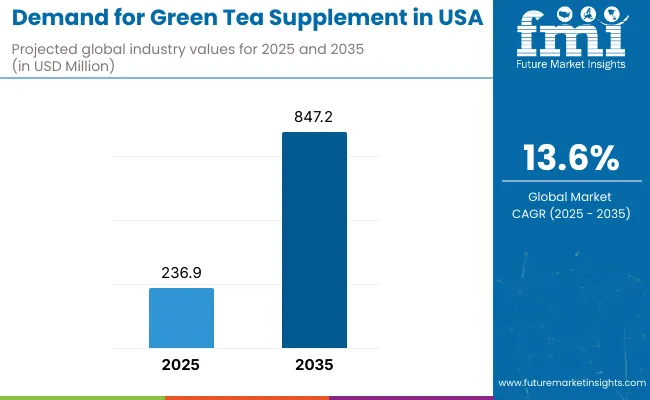

Sales of green tea supplements in the USA are estimated at USD 236.9 million in 2025, with projections indicating a rise to USD 847.2 million by 2035, reflecting a CAGR of 13.6% over the forecast period. This growth is driven by increasing awareness of preventive healthcare, growing consumer preference for plant-based and clean-label supplements, rising obesity rates in the United States, and expanding scientific research around green tea's therapeutic benefits. Per capita consumption is expected to steadily increase as consumers continue to seek natural wellness solutions that offer antioxidant properties and metabolic health support.

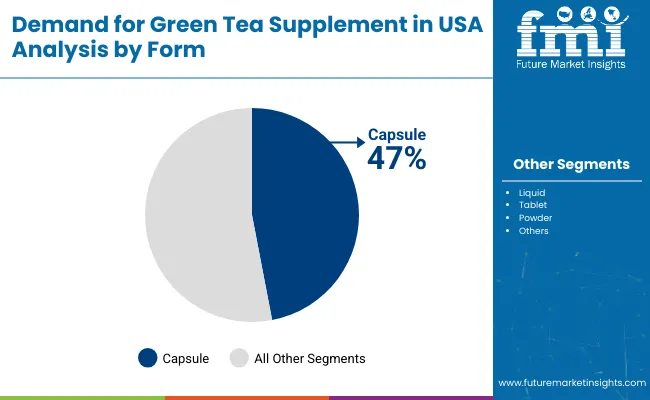

Capsule green tea supplements are poised to remain the leading form segment with a 47% share in 2025, owing to superior convenience, precise dosage control, and widespread consumer familiarity with this delivery format. Powder alternatives, while still significant, cater to specific applications where versatility in consumption methods and custom dosing are prioritized.

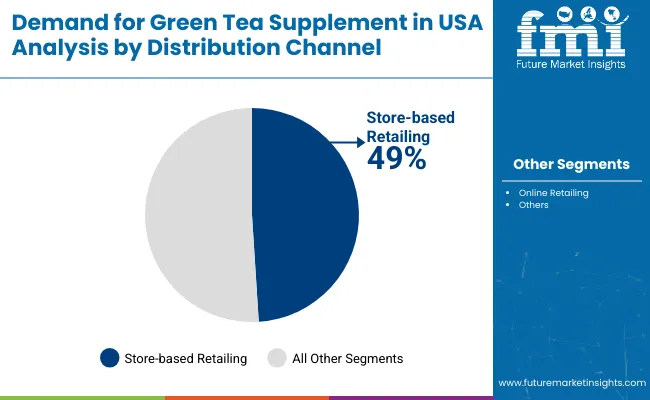

By distribution channel, store-based retail will continue to drive the highest demand, with a 49% share in 2025, supported by established consumer shopping habits, product visibility and accessibility, and the ability for consumers to examine products before purchase physically. Online retail channels are also experiencing robust growth, driven by convenience shopping trends and expanding e-commerce penetration in the supplement category.

Consumer adoption is particularly concentrated among health-conscious individuals, fitness enthusiasts, and those seeking natural weight management solutions, with increased availability of premium and standardized extract formulations further supporting market expansion. Product innovation, format diversification, and strategic partnerships between manufacturers and retail chains are expected to accelerate adoption.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 236.9 million |

| Projected Value (2035F) | USD 847.2 million |

| CAGR (2025 to 2035) | 13.6% |

The green tea supplement in the USA is classified into multiple categories. By form, it includes capsule, liquid, tablet, and powder. Based on distribution channel, it comprises store-based retailing (grocery stores, mass merchandise and supercenters, club stores, convenience stores, health and wellness stores, drug stores and pharmacies, and other retailers (dollar stores, forecourt retailers) and online retailing (company website and gross merchandise value platforms).

Capsule green tea supplements are projected to dominate with a 47% value share in 2025, driven by consumer preference for convenience, precise dosage control, and neutral taste profile. Other forms, including tablets, powders, and liquids, serve specific consumer needs but represent smaller market shares.

Store-based retailing is projected to account for the largest share at 49% in 2025, driven by consumer preference for product authenticity verification, in-person expert consultation, and physical product inspection before purchase. Online retail represents a growing segment, while specialty health stores continue to serve dedicated wellness consumers.

The green tea supplement category in the USA attracts a diverse range of health-conscious, wellness-focused, and preventive healthcare consumers seeking natural alternatives that support metabolic health, antioxidant protection, and weight management goals. While motivations range from fitness enhancement to disease prevention to natural wellness support, demand is concentrated among several key consumer segments. Each segment demonstrates distinct adoption behaviors, product preferences, and purchasing considerations.

Health-conscious millennials and Gen Z consumers represent the largest consumer base, prioritizing natural ingredients, standardized extracts, and scientifically-backed formulations. These consumers actively seek plant-based supplements to support wellness goals, boost antioxidant intake, and align with perceived health benefits of natural preventive healthcare approaches.

Fitness enthusiasts and weight management seekers show consistent demand for reliable, effective supplements that provide metabolic support and energy enhancement. Their purchasing decisions are influenced by ingredient potency, third-party testing certifications, and proven efficacy in supporting fitness and weight management goals.

Aging adults and preventive healthcare consumers increasingly choose green tea supplements to support cardiovascular health, cognitive function, and antioxidant protection. Their adoption is driven by scientific research awareness, doctor recommendations, and proactive approaches to maintaining long-term health and vitality.

Busy professionals and lifestyle-focused consumers, including those seeking convenient wellness solutions, adopt standardized green tea supplements that fit seamlessly into daily routines without requiring tea preparation time. These consumers often prioritize convenience, consistent dosing, and portable formats that support active lifestyles.

Collectively, these segments drive demand for green tea supplements in the USA, with adoption patterns shaped by health considerations, scientific validation, convenience preferences, and wellness lifestyle integration.

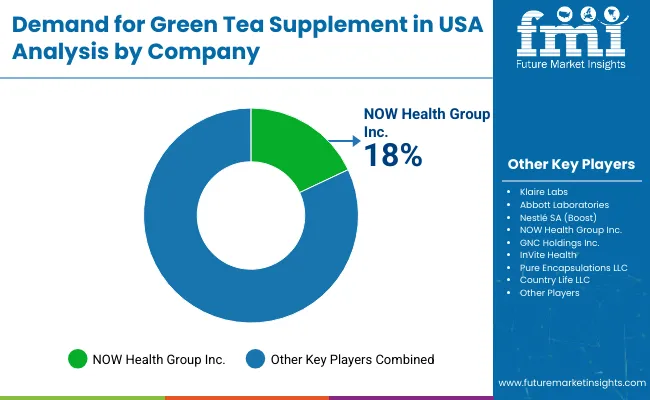

The competitive environment in the USA green tea supplement sector is characterized by a mix of established nutraceutical companies and specialized wellness brands. Innovation in standardized extracts, bioavailability, and formulation purity, rather than traditional supplement manufacturing alone, remains the decisive success factor: the top suppliers collectively serve millions of health-conscious consumers across retail and online channels nationwide and account for the majority of market distribution.

InVite Health is among the most prominent players, leveraging its clinical-grade formulations and extensive healthcare practitioner network. The company focuses on potency standardization, third-party testing, and strategic positioning to capture both fitness enthusiasts and preventive healthcare consumers seeking high-quality green tea extract supplements.

Pure Encapsulations, LLC and NOW Health Group provide comprehensive supplement portfolios with strong quality positioning and research-backed product offerings. Their strategies emphasize clean-label formulations, hypoallergenic options, and targeted expansion into both retail pharmacy and specialty health channels through standardized EGCG content and functional benefits.

Country Life, LLC leverages its natural supplement expertise alongside targeted marketing to wellness-focused and organic consumers, focusing on certified organic products and strategic partnerships with health food stores and naturopathic practitioners.

The next tier includes Source Naturals, Nature's Way, Jarrow Formulas, Life Extension, Swanson Health, Solgar, Garden of Life, and Nature Made. These companies focus on specialized formulations, competitive positioning, and diverse market segments, often offering standardized extracts, combination formulas, or value-oriented green tea supplement solutions.

Innovation and strategic partnerships are expected to continue, as expertise in extract standardization, bioavailability enhancement, and sustainable sourcing becomes increasingly critical for sustaining consumer trust and expanding presence across pharmacy, health store, and e-commerce sectors in the USA.

| Items | Value |

| Quantitative Units (2025) | USD 236.9 million |

| Form | Capsule, Liquid, Tablet, Powder |

| Distribution Channel | Store-based Retailing (Grocery Store, Supercenters, Club Store, Convenience Store, Health & Wellness Stores, Drug Stores, Other Retailers), Online Retailing (Company Website, Gross Merchandiser) |

| Count ry Covered | United States |

| Key Companies Profiled | Klaire Labs, Abbott Laboratories, Nestlé SA (Boost), NOW Health Group Inc., GNC Holdings Inc., InVite Health, Pure Encapsulations LLC, Country Life LLC, Organika Health Products, Nature’s Bounty, Evlution Nutrition, NutraBio Labs Inc., Nutraceutical International Corporation, Life Extension, Threshold® Enterprises Ltd. (Source Naturals), Puritan's Pride, DaVinci Laboratories of Vermont |

| Additional Attributes | Dollar sales by form and distribution channel; regional demand trends; competitive landscape; consumer preference for natural versus synthetic supplements; sustainable sourcing integration; innovations in extraction and formulation technologies; and regulatory quality standardization |

The global United States green tea supplement market is estimated to be valued at USD 236.9 billion in 2025.

The market size for the United States green tea supplement market is projected to reach USD 803.9 billion by 2035.

The United States green tea supplement market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in United States green tea supplement market are capsule, liquid, tablet and powder.

In terms of distribution channel, store-based retailing segment to command 42.7% share in the United States green tea supplement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

United States Green and Bio-based Polyol Market Report – Trends, Demand & Industry Forecast 2025–2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Extracts Market Analysis – Size, Share & Forecast 2025 to 2035

Analysis and Growth Projections for Green Supplement Business

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA