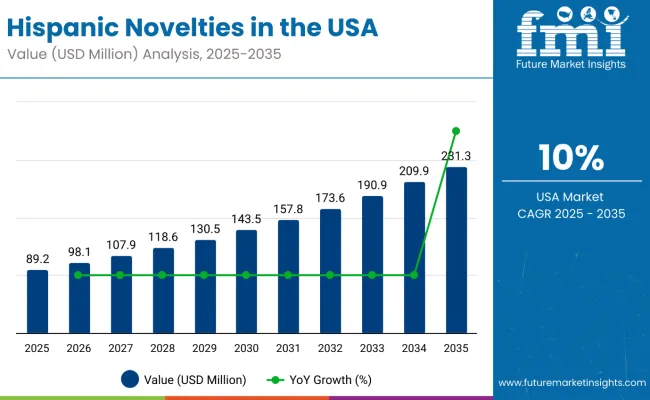

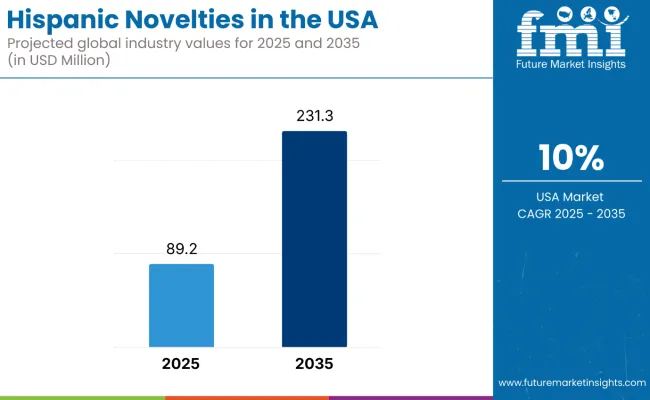

Sales of Hispanic novelties in the USA are estimated at USD 89.2 million in 2025 and projected to reach USD 231.3 million by 2035, reflecting a CAGR of 10% over the forecast period.

| Metric | Value |

| Estimated Size (2025E) | USD 89.2 million |

| Projected Value (2035F) | USD 231.3 million |

| CAGR (2025 to 2035) | 10% |

This growth is driven by rising demand for culturally authentic products, increasing Hispanic population demographics, expanding availability through modern retail and e-commerce platforms, and growing interest in traditional fruit-based frozen treats. The clean-label movement and consumer preference for authentic, heritage-inspired products are expected to accelerate market adoption across key urban markets further.

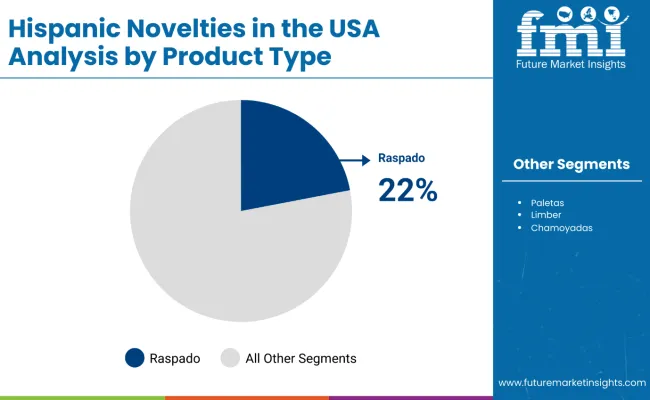

Raspados are poised to remain the leading product segment with a 22% share in 2025, owing to their traditional appeal, refreshing nature, and widespread cultural recognition among Hispanic consumers. Other conventional products, including paletas, chamoyadas, limber, Nieve de garrafa, cremoladas, and granizados, continue to gain traction as consumers seek authentic taste experiences that connect them to their cultural heritage.

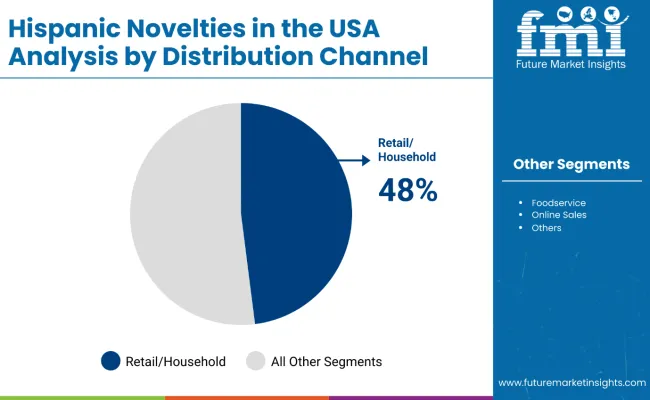

By distribution channel, retail/household will continue to drive the highest demand, with a 48% share in 2025, supported by increased mainstream retail adoption, growing Hispanic household purchasing power, and expanded product availability in grocery chains. Foodservice, ice-cream parlours, travel retail, and online sales channels are also experiencing robust growth, driven by increased cultural awareness and product accessibility.

Adoption is concentrated among Hispanic communities seeking cultural authenticity, health-conscious individuals preferring fruit-based options, and mainstream consumers exploring diverse flavors. The expansion of specialized retailers, growing presence in mainstream grocery chains, and increased e-commerce availability are expected to broaden market reach and accelerate adoption across diverse consumer segments.

The USA Hispanic novelties are analyzed across several major segments such as product type, flavor, and distribution channel. By product type, the categories include paletas, chamoyadas, limber, raspados, nieve de garrafa, cremoladas, granizados, and other products (cholados). By flavor, it is segmented into fruits (berry, banana, orange, coconut, others), herbs & spices (cinnamon, mint, peppermint, and others), dry fruits & nuts (cashew, almond, hazelnut, and others), beans (chocolate, coffee, and others), and flower (lavender, rose, hibiscus). By distribution channel, key segments include foodservice, travel retail, ice-cream parlour, retail/household (via hypermarket/supermarket, convenience store, grocery store, specialty store, discount store, departmental store), and online sales (mass merchandiser, company website).

Raspados are projected to dominate with a 22% value share by 2025, driven by their cultural significance, affordability, and high customization potential. These traditional shaved ice desserts resonate strongly with Hispanic consumers while attracting mainstream audiences seeking authentic and refreshing treats.

Retail/household channels are projected to account for the largest share of 48% by 2035, driven by improved product accessibility, impulse purchasing behavior, and expanding shelf space in mainstream grocery chains. This segment benefits from higher foot traffic and promotional opportunities that boost visibility among both Hispanic and non-Hispanic consumers.

The Hispanic novelties category in the USA attracts a diverse range of culturally connected, health-conscious, and adventurous consumers seeking authentic frozen treats that deliver traditional flavors and cultural experiences. While motivations range from nostalgic connections to health benefits to artistic exploration, demand is concentrated among several key consumer segments. Each segment demonstrates distinct adoption behaviors, product preferences, and purchasing considerations.

Collectively, these segments drive demand for Hispanic novelties in the USA, with adoption patterns shaped by cultural authenticity, health considerations, flavor exploration, and family bonding experiences.

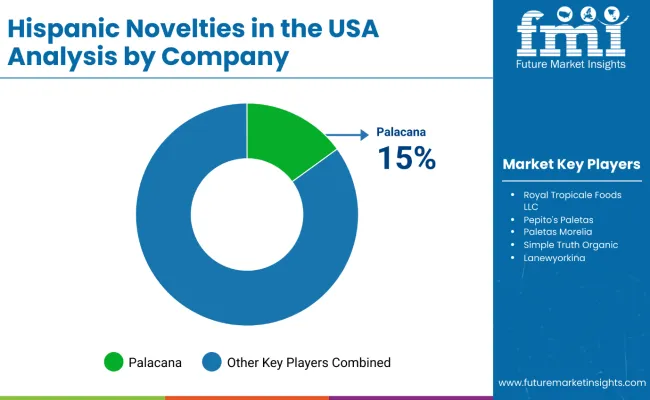

The competitive environment in the USA Hispanic novelties sector is characterized by a mix of established frozen dessert manufacturers expanding into authentic ethnic products and specialized Hispanic-focused brands. Success depends more on innovation in authentic flavors, cultural connection, and distribution accessibility than on conventional frozen dessert expertise such as the top suppliers collectively serve millions of Hispanic and mainstream consumers across retail and foodservice channels nationwide and account for the majority of market distribution.

Innovation and strategic partnerships are expected to continue, as expertise in authentic flavor development, cultural marketing, and eco-friendly distribution becomes increasingly critical for sustaining consumer loyalty and expanding presence across retail and foodservice sectors, targeting both Hispanic heritage consumers and mainstream audiences seeking authentic cultural experiences.

| Items | Values |

|---|---|

| Quantitative Units | USD 89.2 Million |

| Product Type | Paletas, Chamoyadas, Limber, Raspados, Nieve de Garrafa, Cremoladas, Granizados, Otros Productos (Cholados) |

| Flavor | Fruits (Berry, Banana, Orange, Coconut, Others), Herbs & Spices (Cinnamon, Mint, Peppermint and Others), Dry Fruits & Nuts (Cashew, Almond, Hazelnuts and Others), Beans (Chocolate, Coffee and Others), Flowers (Lavender, Rose, Hibiscus) |

| Distribution Channels | Foodservice (Cafes, Quick-service Restaurants, Full-service Restaurants, Bakeries & Patisseries), Travel Retail, Ice-cream Parlour, Retail/Household (Hypermarket/Supermarket, Convenience Store, Grocery Store, Specialty Store, Discount Store, Departmental Store), Online Sales (Mass Merchandiser, Company Website) |

| Regions Covered | North America |

| Country Covered | United States |

| Key Companies Profiled | Palacana, Royal Tropicale Foods LLC, Pepito's Paletas, Masterpaletas, La Brisa Ice Cream Operating Company, Paletas Morelia, Raspados Loly's, Simple Truth Organic™ (Kroger), Lanewyorkina |

| Additional Attributes | Dollar sales by product type and flavor, regional consumption trends, competitive landscape, consumer preferences for traditional versus innovative flavors, integration with health and wellness positioning, innovations in reduced-sugar and fortified formulations, and quality standardization across diverse distribution channels |

The global United States hispanic novelties market is estimated to be valued at USD 89.2 million in 2025.

The market size for the United States hispanic novelties market is projected to reach USD 222.2 million by 2035.

The United States hispanic novelties market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in United States hispanic novelties market are paletas, chamoyadas, limber, raspados, nieve de garrafa, cremoladas, granizados and other products (cholados, etc.).

In terms of flavor, fruits segment to command 39.6% share in the United States hispanic novelties market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Collation Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Aluminum Tubes Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Child Resistant Bottles Market Size and Share Forecast Outlook 2025 to 2035

United States Executive Education Program Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA