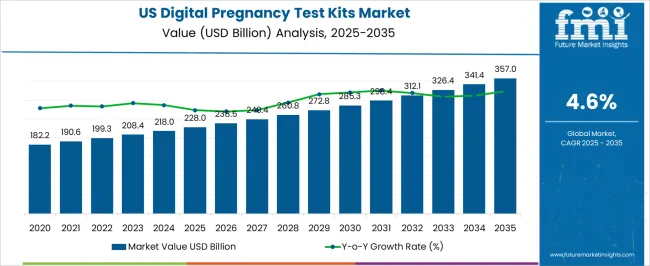

The United States of America Digital Pregnancy Test Kits Market is estimated to be valued at USD 228.0 billion in 2025 and is projected to reach USD 357.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| United States of America Digital Pregnancy Test Kits Market Estimated Value in (2025 E) | USD 228.0 billion |

| United States of America Digital Pregnancy Test Kits Market Forecast Value in (2035 F) | USD 357.0 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The United States digital pregnancy test kits market is experiencing notable growth driven by increasing consumer preference for accurate, easy to use, and digitally integrated diagnostic tools. Rising awareness of early pregnancy detection and the availability of tests with features such as digital displays, Bluetooth connectivity, and app integration have elevated demand.

Manufacturers are investing in design improvements that provide higher accuracy rates and user friendly interfaces, catering to evolving consumer expectations. Institutional and retail distribution networks are expanding, supported by aggressive promotional strategies and enhanced accessibility across both offline and online platforms.

Regulatory approvals and the high level of consumer trust in branded test kits are further reinforcing adoption trends. The outlook remains promising as the healthcare ecosystem continues to emphasize convenience, privacy, and reliability in personal health diagnostics.

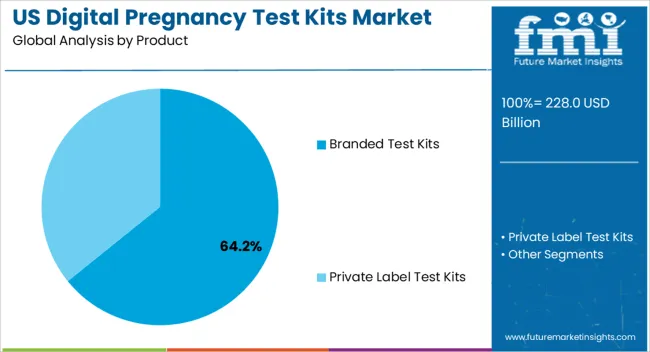

The branded test kits segment is projected to hold 64.20% of the total market revenue by 2025, making it the most dominant product category. Growth is being driven by strong brand recognition, consumer trust in accuracy, and wide product availability through retail pharmacies and e commerce channels.

Branded test kits are often associated with advanced digital features, higher sensitivity levels, and rigorous regulatory compliance, which has further strengthened their position. The ability of established brands to invest in marketing campaigns, product innovation, and extensive distribution networks has also contributed to their leadership.

With increasing demand for reliable at home diagnostics, branded test kits continue to capture the majority market share in the United States.

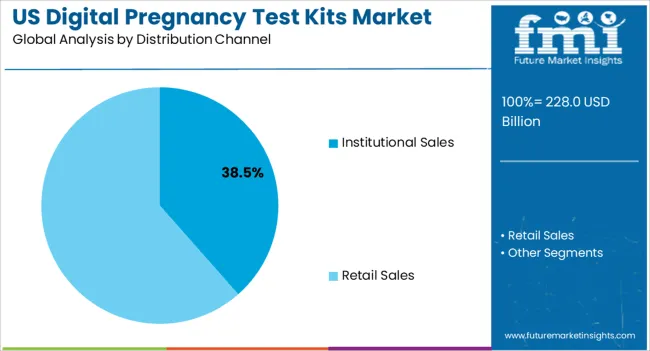

The institutional sales segment is expected to account for 38.50% of the overall market revenue by 2025, positioning it as a leading distribution channel. This growth is supported by strong procurement from hospitals, clinics, and healthcare centers, where digital pregnancy test kits are preferred for their accuracy and quick result turnaround.

Institutional buyers value the credibility of established brands, consistent supply, and cost effectiveness when purchased in bulk. The integration of digital kits in routine clinical practice has also enhanced adoption, as healthcare professionals prioritize devices that reduce interpretation errors and provide clear outcomes.

The reliance on trusted suppliers and standardized diagnostic practices ensures that institutional sales remain a significant contributor to market growth in the United States.

Rising demand for self-home pregnancy tests and the growing preference for digital pregnancy test kits over analog variants are the factors that bolstered growth in the United States of America’s digital pregnancy test kits market. The market secured a 4.7% CAGR from 2020 to 2025.

The consistent growth of demand for self-detecting pregnancy test kits adopted by working women allows for a reduced need for lab tests such as ultrasound scans, which is a key factor boosting the market growth in coming years.

Rising awareness regarding the availability of digital pregnancy test kits, and increasing preference for these products over analog options has propelled the digital pregnancy test kits market in recent years. The growing advancements in pregnancy technologies create a conducive environment for growth.

The growing incidence of inaccurate interpretation due to the visibility of lines has inclined consumer preference toward digital pregnancy test kits that are convenient while providing accurate results on digital screens. This, in turn, is widening the customer base, aiding long-term growth. Moreover, the rising teenage pregnancy rate has pushed manufacturers to conduct promotional campaigns that engage celebrities to influence and promote their products among rural populations while expanding distribution networks worldwide.

According to the FMI report, the market is expected to rise at a 4.8% CAGR from 2025 to 2035.

Branded test kits held 86.65% of the market share in 2025 and the trend is likely to continue throughout the forecast period. The growing preference toward digital pregnancy test kits over analog options offered by the leading players through hypermarkets and supermarkets rise strongly in the forthcoming years.

Increasing affordable prices have supported demand for branded test kits across various end-use settings. Local players cannot afford to invest in advanced innovations, which has slowed down the demand for private-label test kits.

Drug stores have a widespread presence across the United States, making them easily accessible to a large population. This accessibility ensures that digital pregnancy test kits are readily available to women seeking them, allowing for convenient and immediate access to the product.

Drug stores have a long-standing reputation as reliable sources for various healthcare products, including pregnancy test kits.

Consumers trust these establishments for their expertise and quality assurance, which gives them confidence in purchasing digital pregnancy test kits from drug stores and the same can be attributed to the sub-segments’ 36% value share in 2025.

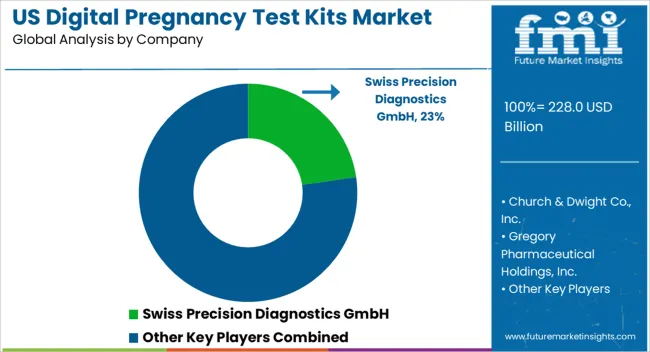

Companies operating in the United States of America’s digital pregnancy test kits market are adopting various strategies to expand their product portfolios to address the demand of an expanding patient pool in the market.

Players are implementing promotional strategies including direct marketing and online sales with a customer and distribution channel to grow their footprint across the country. The co-promotion and co-marketing strategies followed by leading manufacturers are likely to increase the popularity of digital pregnancy test kits in the market. For instance,

Product Innovation: Market players focus on continuous product innovation to enhance the performance, accuracy, and user experience of digital pregnancy test kits. This includes the development of advanced features such as Bluetooth connectivity, smartphone apps, and improved result interpretation technology.

Branding and Marketing: Companies invest in strong branding and marketing efforts to build brand recognition and increase product visibility. They utilize various channels such as social media, digital advertising, and endorsements by healthcare professionals to reach their target audience effectively.

Partnerships and Collaborations: Collaboration with healthcare professionals, clinics, and hospitals is a key strategy to promote digital pregnancy test kits. These partnerships help in establishing credibility and gaining recommendations from trusted sources in the healthcare industry.

Retail Expansion: Market players expand their retail presence by strategically partnering with pharmacies, drugstores, and online retailers. This ensures wide distribution and availability of their digital pregnancy test kits to reach a large customer base.

Consumer Education and Awareness: Companies invest in consumer education initiatives to raise awareness about the benefits and usage of digital pregnancy test kits. This includes providing informative content, FAQs, and user guides on their websites, as well as conducting awareness campaigns through various media channels.

Price Competitiveness: Competing on price is another strategy adopted by market players to attract customers. Offering competitive pricing or discounts helps in increasing market penetration and gaining a competitive edge.

By adopting these strategies, market players in the United States digital pregnancy test kits market aim to differentiate themselves, increase market share, and meet the evolving needs of their customers.

The global United States of America digital pregnancy test kits market is estimated to be valued at USD 228.0 billion in 2025.

The market size for the United States of America digital pregnancy test kits market is projected to reach USD 357.0 billion by 2035.

The United States of America digital pregnancy test kits market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in United States of America digital pregnancy test kits market are branded test kits and private label test kits.

In terms of distribution channel, institutional sales segment to command 38.5% share in the United States of America digital pregnancy test kits market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA