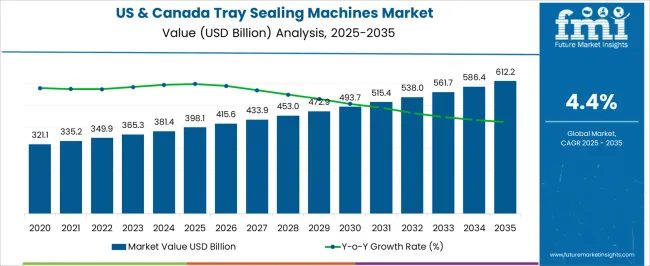

The United States and Canada Tray Sealing Machines Market is estimated to be valued at USD 398.1 billion in 2025 and is projected to reach USD 612.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| United States and Canada Tray Sealing Machines Market Estimated Value in (2025 E) | USD 398.1 billion |

| United States and Canada Tray Sealing Machines Market Forecast Value in (2035 F) | USD 612.2 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The United States and Canada tray sealing machines market is experiencing steady growth driven by the rising demand for convenience foods, ready to eat meals, and sustainable packaging solutions. Increasing consumer preference for extended shelf life and freshness assurance has encouraged widespread use of tray sealing technologies, particularly in meat, poultry, seafood, and ready meal applications.

Food safety regulations and compliance requirements in both countries are accelerating the adoption of advanced sealing machines capable of ensuring airtight, contamination free packaging. Technological innovations such as integration of modified atmospheric packaging, energy efficient sealing systems, and automated features are enhancing operational efficiency and cost effectiveness for food processors.

The market outlook remains promising as manufacturers continue to invest in automation, sustainability, and high performance machinery to meet evolving consumer and regulatory expectations in North America.

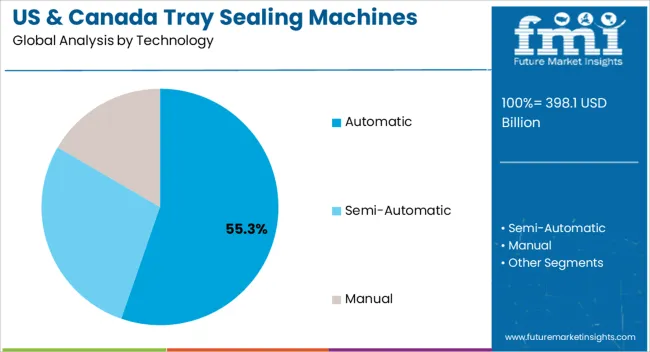

The automatic segment is projected to hold 55.30% of total revenue by 2025 within the technology category, positioning it as the dominant segment. This leadership is attributed to the ability of automatic machines to deliver consistent sealing quality, reduce manual intervention, and optimize production throughput.

Their scalability across medium to large food processing facilities has made them the preferred choice for enterprises seeking operational efficiency. Additionally, automation enhances worker safety, reduces labor dependency, and ensures compliance with stringent hygiene standards.

Continuous advancements in machine intelligence and remote monitoring capabilities are further supporting adoption. As a result, automatic machines are widely recognized as the leading technology in the tray sealing machines market across the United States and Canada.

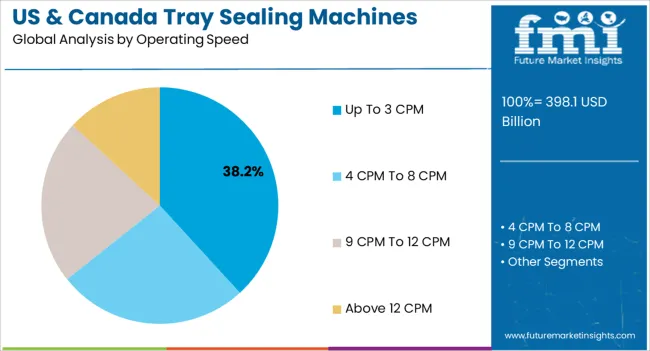

The up to 3 CPM segment is expected to account for 38.20% of market revenue by 2025 within the operating speed category, making it the most significant subsegment. Its prominence is supported by demand from small and medium scale processors who require reliable yet cost effective sealing solutions.

Machines operating at this speed offer flexibility for diverse packaging formats while maintaining ease of use and low maintenance requirements. They are particularly suitable for businesses with moderate production volumes where efficiency and affordability are both critical.

Growing adoption among specialty food producers and regional suppliers has reinforced the market presence of this subsegment, ensuring its steady contribution to overall revenue share.

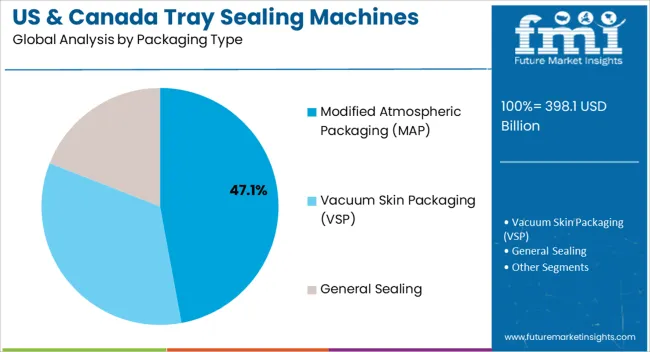

The modified atmospheric packaging segment is forecasted to contribute 47.10% of the total revenue by 2025 within the packaging type category, emerging as the leading subsegment. This is driven by its effectiveness in extending product shelf life, maintaining nutritional value, and preserving flavor integrity without reliance on chemical preservatives.

Its application in packaging perishable products such as fresh produce, meat, seafood, and baked goods has reinforced adoption across food sectors in the United States and Canada. Consumer demand for natural freshness and waste reduction has further accelerated use.

Investments by manufacturers in sealing machines that can seamlessly integrate MAP functionality have strengthened the leadership of this packaging type, making it a cornerstone in modern food packaging strategies.

| Attribute | Key Insights |

|---|---|

| Market Size (2025) | USD 363.9 million |

| Estimated Market Size (2035) | USD 521.9 million |

| Value-based CAGR (2025 to 2035) | 4.6% |

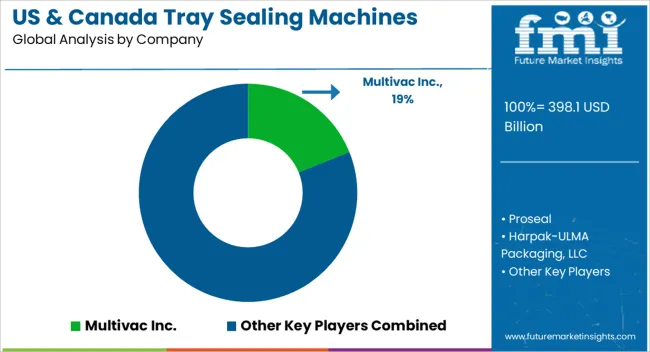

| Collective Value Share: Top 5 Companies (2025A) | 25 to 30% |

The demand for tray-sealing machines has increased significantly over recent years. This is primarily due to the growth of businesses around food packaging and solutions. Increasing demand for packaged food products and the need for attractive packaging is also set to enhance the product appeal.

Developments in packaging solutions have pushed vendors to adopt fast processing units and improve machine capabilities. The United States & Canada tray sealing machines market is projected to generate an incremental growth opportunity of USD 174.4 million over the given time. It is predicted to expand 1.5x the current market value during the forecast period.

The United States & Canada tray sealing machines market registered a CAGR of 3.7% during the historic period 2020 to 2025. It is likely to reach a market value of USD 398.1 million in 2025 from USD 321.1 million in 2020.

The rise of e-commerce and online grocery shopping has brought about significant changes in the food and beverage industry. With the convenience of e-commerce, more consumers are opting to purchase their groceries and food products online. This trend has created a high demand for packaged food products. These items can be easily shipped and delivered to consumers' homes.

Tray sealing machines are essential equipment for food manufacturers and packaging companies catering to the e-commerce market. These machines can quickly and efficiently seal food products in trays.

Tray sealing machines ensure that they are securely packaged and ready for shipping. They can also accommodate a wide range of tray sizes and shapes. These factors make them a versatile option for packaging different types of food products.

Tray sealing machines are widely used in the food industry to seal food trays and containers with a protective film or lid. It ensures the safety and freshness of the contents inside. These machines are particularly important for take-out and delivery services. They ensure that the food remains fresh and hygienic during transportation.

Restaurants and food outlets are investing rigorously in high-quality tray sealing machines to keep up with the demand for delivery orders. These machines not only ensure the quality of the food but also help to reduce waste. They provide an airtight seal that preserves food for long periods.

The increasing demand for tray sealing machines has primarily been due to the rise in popularity of online food delivery platforms. With more people ordering food online than ever before, restaurants and food service providers are under increasing pressure to meet demand while maintaining quality and freshness.

Tray sealing machines provide an efficient and cost-effective way to package pre-made meals and keep them fresh during transportation.

With more consumers looking for quick and easy ways to eat healthily, pre-made meals have become a highly popular option. Tray sealing machines allow food service providers to package pre-made meals for such purposes. These machines help in preserving the freshness and nutritional value of food. This makes them an attractive option to package food for health-conscious consumers.

For several restaurants and food service providers that offer take-out and delivery services, tray sealing machines have become a lifeline. Tray sealing machines have played an important role in enabling these businesses to quickly and efficiently package meals for delivery or pickup. It helps them to stay afloat during times of high demand.

Airtight tray sealed packages achieved through tray sealing machines also help reduce food waste by preserving the quality of the food for longer periods. Upon being exposed to air and moisture, food starts to spoil, lose its taste and texture, and eventually become inedible. Tray sealing machines prevent this by keeping the food fresh. It also reduces the likelihood of it being dumped due to spoilage.

With the high involvement of man force in production and packaging facilities, the probability of variations in the final output is high. This is not desirable for packaged food products as they need to maintain consistent standards.

Food processing companies are actively adopting technological advancements to tackle this issue. Automated food processing and packaging machines deliver minimal or no variations in the final output. They also ensure minimal wastage and enhanced productivity.

For instance, tray sealing machines are now capable of operating at 20 cycles per minute. They can deliver an output of 120 sealed trays per minute (i.e. 6 trays per cycle).

Several other integrated systems, such as seal inspection systems and leakage inspection systems, have attracted a large share of end-users. Food-processing companies are readily adopting tray sealing machines or upgrading their existing tray sealing machines to meet evolving preferences. This is likely to continue propelling the tray sealing machines market in the region.

High Usage of Sensors and Control Systems Driving Popularity of Automatic Tray Sealing Machines

Automatic tray sealing machines segment is likely to expand at a CAGR of 6.3% during the forecast period. The demand for automatic tray sealing machines in the market is expected to reach a valuation of USD 612.2 million by 2035 in the United States & Canada.

When a tray is manually sealed, the quality of the seal can vary depending on the worker sealing the tray. Human error such as uneven pressure or misalignment of the tray and sealing film can result in an inadequate seal. Even if the tray looks like it has been sealed properly, it might not be airtight, which can lead to contamination or spoilage.

Automatic tray sealing machines provide a consistent and reliable seal for each tray. It reduces the chances of human error and ensures that the product inside is properly sealed. This is particularly important for food products that are sensitive to temperature and air exposure. Improper sealing can result in a shortened shelf life or loss of quality.

Automated machines use advanced technology to create a reliable and consistent seal. The tray sealing machine applies the same amount of pressure to each tray and ensures that the seal is uniform and airtight. Automatic tray sealing machines also extensively use sensors and control systems. They are used to monitor and adjust the temperature and pressure during the sealing process.

Meat, Poultry, & Seafood Packaging to Hold a Significant Market Share by 2035

By application, meat, poultry, & seafood packaging provides prominent usage of tray sealing machine. This segment is estimated to capture around 27.8% share in the total United States & Canada market by 2035. Tray sealing machines are increasingly used to package meat and poultry products, which include chicken breasts, beefsteaks, and pork chops.

These machines work by placing the meat or poultry product in a tray made of plastic or other suitable material. It is followed by sealing the product with a thin film or lid that is also made of plastic. Suppliers and retailers prefer such packaging since meat and poultry products are highly perishable and can spoil quickly if not stored properly.

The seal packaged by the tray sealing machine helps keep the product fresh by preventing the entry of air and other contaminants that can cause spoilage. Several machines are also equipped with advanced features such as vacuum sealing and modified atmosphere packaging. These features can further extend the shelf life of products by removing oxygen from the packaging and replacing it with a controlled atmosphere.

| Country | United States |

|---|---|

| Market Share (2025) | 83.8% |

| Market Share (2035) | 82.0% |

| BPS Analysis | -180 |

| Country | Canada |

|---|---|

| Market Share (2025) | 16.3% |

| Market Share (2035) | 18.0% |

| BPS Analysis | 180 |

Increasing Popularity of Ready-to-Eat Meals Fueling Demand for Tray Sealing Machines in United States

According to the United States Department of Agriculture, ready-to-eat meals are becoming more popular due to the fast-paced lifestyles of modern consumers. People are looking for convenient and healthy food options that can be consumed on the go. Several food manufacturers are producing pre-packaged meals that can be easily consumed without the need for any additional preparation.

To ensure the quality and safety of ready-to-eat meals, it is essential to have an efficient packaging process in place. This is where tray sealing machines come into play. Tray sealing machines are used to seal pre-formed trays or containers with a plastic film.

It helps in creating an airtight seal that preserves the freshness and quality of the food inside. These machines are capable of sealing trays made out of a variety of materials, including polypropylene, polyethylene, and polyester, among others.

The demand for tray sealing machines is increasing because they offer several benefits to food manufacturers and retailers. They allow for efficient packaging processes, reducing the time and labor required to seal each individual tray. This can lead to increased productivity and cost savings for manufacturers.

Tray sealing machines provide a consistent and reliable seal, which is essential for maintaining the quality and safety of the food inside. This is especially important for perishable foods that can spoil quickly if not properly sealed. The United States is anticipated to register a CAGR of 4.4% during the forecast period 2025 to 2035.

Rising Meat Consumption Within Canada Generating Lucrative Demand for Tray Sealing Machines

According to the Government of Canada, retail sales of fresh meat were valued at USD 381.4 billion in 2024, with 2.5% CAGR over USD 321.1 billion in 2020.

Tray sealing machines are versatile packaging machines used to package a wide range of meat products. They package fresh, frozen, or cooked meat products. They are also useful in packaging processed meat products such as sausages, patties, and meatballs.

The demand for tray sealing machines in Canada is driven by the increasing consumption of convenient foods such as pre-packaged meals and meal kits. These products often contain frozen meat produce, which require reliable and efficient packaging solutions to ensure their quality and freshness.

Tray sealing machines are an ideal solution for packaging these products as they can create efficient airtight seals. This helps maintain the freshness of the meat product while also providing an attractive and convenient packaging solution.

Key companies are concentrating on developing innovations and technology which can support market growth for tray sealing machines. To strengthen their resources, renowned players are increasing their research & development of technological advancements.

They are also prioritizing the use of durable materials, precision engineering, and rigorous quality control processes. They are offering excellent customer support and services to attract customers.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.4% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Technology Type, Operatinf Speed, Packaging Type, Application, Country |

| Key Countries Covered | United States, Canada |

| Key Companies Profiled | Multivac Inc.; Proseal; Harpak-ULMA Packaging, LLC; ILPRA SPA; ProMach, Inc. (Ossid LLC); ORICS Industries, Inc.; Point Five Packaging; APEX Packaging Corporation; John Bean Technologies Corporation (JBT); Starview Packaging Machinery Inc.; Atlas Vas Machine LLC; Standard-Knapp Inc.; Reiser Canada |

The global United States and Canada tray sealing machines market is estimated to be valued at USD 398.1 billion in 2025.

The market size for the United States and Canada tray sealing machines market is projected to reach USD 612.2 billion by 2035.

The United States and Canada tray sealing machines market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in United States and Canada tray sealing machines market are automatic, semi-automatic and manual.

In terms of operating speed, up to 3 cpm segment to command 38.2% share in the United States and Canada tray sealing machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Collation Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Aluminum Tubes Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Cold Chain Packaging Market Insights- Demand and Growth Forecast 2025 to 2035

United States & Canada Hair Salon Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

United States & Canada Foundation Repair Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Child Resistant Bottles Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Educational Tourism Market Growth, Trends and Forecast from 2025 to 2035

United States and Canada Residential Lighting Fixture Market Growth, Trends and Forecast from 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Degassing Valves Industry Analysis in United States & Canada - Size, Share, and Forecast 2025 to 2035

Protective Packaging Industry Analysis in United States and Canada - Size, Share, and Forecast 2025 to 2035

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA