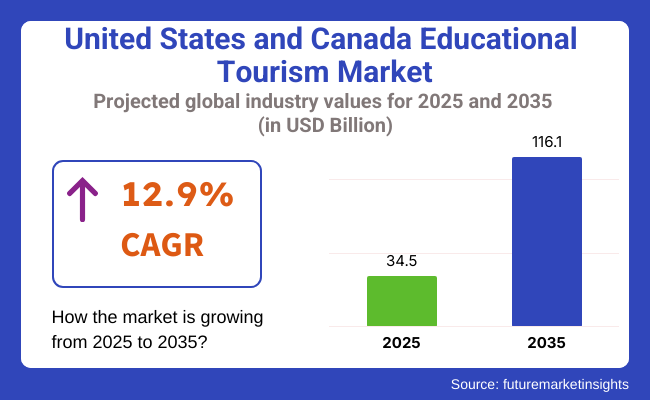

The size of the United States and Canada educational tourism market was USD 34.5 billion in 2025 and is anticipated to grow at a 12.9% CAGR during the period 2025 to 2035.

The industry is expected to reach USD 116.1 billion by 2035. One of the key drivers of this strong growth is the increase in demand for experiential, skill-enhancing and internationally accredited learning experiences among students, teachers as well as lifelong learners pursuing academic excellence in North America's top educational destinations.

Educational travel within the USA and Canada is becoming an increasingly diverse industry that encompasses educational exchanges, immersion in languages, summer schools, career-oriented programs, and pre-university sightseeing tours. The high-grade institutions, multi-cultural diversity, and English language privilege of the region draw native and foreign learners alike who require a combination of academic and cultural worth.

Technology advancement is facilitating hybrid learning models blending pre-departure virtual instruction and on-site visits with post-trip academic certification. The models improve access and allow institutions to create curriculum-aligned, scalable travel experiences. AI technologies, learning analytics and immersive media are being more widely employed to customize educational trips.

Government policies and bilateral academic arrangements also strengthen industry development by making student mobility, scholarships, and recognition of credits easier. Canada's Global Skills Strategy and USA programs enhancing STEM and humanities exchanges have made the region a top destination for organized academic travel. These frameworks provide educational legitimacy and drive cross-border alliances.

The scope of the industry is broadening from traditional university tours to encompass specialty verticals like environmental field studies in national parks, youth entrepreneurship initiatives, and global citizenship projects.

This diversification is attracting not just high school and university participants but also teachers, corporate learners, and nonprofit organizations. As educational providers and institutions become more aligned with sustainable travel behaviors, wellness trends, and DEI standards, educational tourism will be the norm in modern academic development.

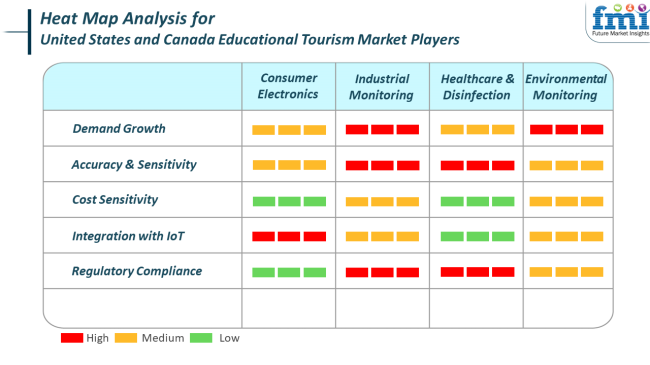

In the educational tourismindustry, end-use decision-making criteria focus on academic appropriateness, safety, and cultural fit. As experiential learning becomes more central to pedagogy, stakeholders parents and teachers, institutions and funders alike require precision in content delivery and responsiveness to varied learning needs.

Demand growth remains most vigorous in high school and undergraduate segments, where learners seek intensive international experience aligned with academic goals. Institutions are increasingly selecting providers based on their ability to offer integrated digital expertise, strong pedagogical models, and post-program certification underpinning long-term educational outcomes.

While cost sensitivity varies across income segments and institutions, overall spending patterns demonstrate a strong desire for investment in high-impact initiatives. However, safety protocols, visa sponsorship, and institutional approvals continue to be critical to trustworthiness.

Regulation adherence risk management, academic partnerships, and health protocols are the most significant promoters of program viability and industry reputation.

Despite its promising path, Canada's and the USA's educational tourism industry is marred by systemic threats that must be contained if sustainable development is to be realized. At the top of this list is excessive dependence on global mobility. Global shocks-ranging from geopolitics to health emergencies-can abruptly halt student flows, subjecting institutions as much as providers to revenue evaporation and logistical challenges.

A second threat is affordability. While high-end models are gaining traction, higher travel costs and limited access to financial aid may deter middle- and lower-income student involvement. This would concentrate benefits on a small subgroup unless school partnerships, public subsidy programs, or scholarships are expanded.

The lack of standard accreditation and regulation in certain industries may undermine education quality and program integrity. With a higher presence of private operators, inconsistencies in program delivery, safety practices, or academic applicability may undermine confidence. Formal certification, quality standards, and university association will be critical in solidifying industry structures to avoid these threats and uphold credibility in the sector.

The United States and Canada educational tourism market saw significant development from 2020 to 2024. The COVID-19 pandemic created a disruption at first in travels but, in turn, initiated an increased requirement for online as well as hybrid learning models.

With the lifting of the travel restrictions, the industry experienced a strong comeback with increased numbers of foreign students seeking means of exposure to culture, learning languages, and advancing their studies. Both Canada and America stood out as good destinations due to their quality-based education systems, diverse programs, and multicultural environments.

Popularity for exchange programs, short courses, and summer schools built up to a crescendo. In addition, education and travel enabled by virtual learning systems and course suggestions made possible by artificial intelligence helped in driving this growth forward.

Through the years 2025 to 2035, educational travel is expected to go through a transformative change in the industry. Sustainability will be a priority, with tour operators and schools adopting green policies and carbon offsetting. Virtual reality (VR) and augmented reality (AR) will transform the student learning experience abroad, providing virtual study tours and interactive learning spaces.

AI-based personalized learning paths will tailor experiences for students based on their own educational needs and interests. The experiential learning and cultural exchange trend will continue to thrive with internships, community activities, and cooperative global research. The policies of both the USand Canadian governments will also further streamline visa processes and promote educational exchange, opening doors to global access to learning opportunities.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increase in demand for online learning, hybrid programs, and short-term programs. | Increased application of VR/AR technology for experiential learning and educational visits. |

| Platforms for online courses, course suggestion aided by AI, digital booking. | AI-supported personal learning with the assistance of virtual tours, as well as augmented reality offerings. |

| Earth-friendly modes of travel began to come into prominence. | Huge emphasis upon carbon offsetting schemes, environment-friendly accommodations, and earth-friendly transportation. |

| Experiential learning, worldwide immersion, and internships on demand. | Cultural sharing and learning medium flexibility were favored by students. |

| Increased amount of experiential learning, world immersion, and internships demanded. | Growth in government scholarship schemes and exchange programs. |

| Popularity of international exchange programs, language learning, and cultural experiences. | Enhanced facilitation of visas, policy advice to international students, and bilateral educational programs. |

In 2025, the United States & Canada educational tourism industry is anticipated to be significantly influenced by student exchange programs, which will account for 30% of the industry share. Youth travel is expected to contribute 25% to the overall industry.

Due to structured immersive learning experiences where students visit foreign cultures and educational systems, student exchange programs have assumed an increasing profile. Organizations such as AFS Intercultural Programs, CIEE (Council on International Educational Exchange), and EF Education First serve as backbone institutions in cross-border learning by promoting short- and semester-long academic and cultural exchanges for high school and university students.

These programs have earned partnerships with schools and universities and work with various governmental bodies that now cater to students all around the world. This makes them tremendously credible and attractive to parents and educational institutions alike. They appeal to the personal growth side of interests, which means that both educational enhancement and personal development are also worth giving consideration.

On the other hand, youth travel is a growing sphere of educational tourism that has gained much momentum. Less structured and better known by the term "educational tourism," this segment hosts organized tours, skill-based travel camps, and abroad volunteering programs designed for school and college-age individuals.

Key players such as Rustic Pathways, G Adventures, and National Geographic Student Expeditions are offering these tailor-made school-travel experiences that combine adventure with learning-such as wildlife conservation, language immersion, or STEM workshops. Such tours are generally more like supplementary education to formal institutions, raising global awareness, independence, and soft-skill development.

Both segments are poised for growth, especially with the rising emphasis on experiential learning direction, coupled with an increasing desire for international exposure by North American students and their families in a highly charged academic and professional environment.

The higher education segment will dominate the United States & Canada educational tourism industry in 2025 with a 50% industry share. Language courses are expected to yield 22% of the total industry encapsulated.

Higher education drives educational tourism further, as international students are searching for globally recognized degrees and diverse academic experiences. The USA and Canada have world-renowned universities like Harvard University, the University of Toronto, Stanford University, and McGill University, hosting thousands of students every year for undergraduate and postgraduate studies.

These institutions partner with international education consultancy firms such as IDP Education and Shorelight, which promote international outreach programs and recruitment through academic fairs to attract prospective students. The steady movement of educational tourists penetrating North American universities for a degree is also sustained by the good reputation of universities for academic excellence, research opportunities, and post-study employment.

Language courses also significantly contribute to the industry by drawing students wishing to improve their proficiency in English. Short-term visitors and exchange students highly favor programs offered by Kaplan International, EF Language Schools, and ILAC (International Language Academy of Canada).

These language courses are typically quite flexible in scheduling, integrated into immersion activities, and serve as paths to future academic enrollment. Finally, language learning is quite attractive to tourists visiting from non-English-speaking countries in Latin America, Asia, and some parts of Europe, where quite often, the knowledge of English becomes the ticket to a better academic and career opportunity.

The industry structure is thereby representative of two sets of demand: formal degree-seeking educational tourism through higher education and short-term immersive language acquisitions. Both segments benefit from favorable visa policies, stable academic infrastructures, and the surge in international demand for North American credentials and cultural fluency.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

| Canada | 5.4% |

The USA educational tourism sector continues to grow steadily, driven by its global reputation as a worldwide leader in academic quality, cultural diversity, and institutional innovation. International students continue to flock to the USA for full-fledged learning experiences ranging from short-term study programs and summer schools to full-length university degrees.

Top-tier universities, elite language schools, and technical learning institutions accept students from all over the world, particularly from Asia, Latin America, and the Middle East. This is driven by the demand for world-class education, international networking, as well as exposure to USA professional and cultural environments.

Domestic educational tourism is also gaining momentum, with students and schools increasingly engaging in academic exchange, educational tours, and multi-disciplinary learning activities across states. Governments, science centers, museums, and heritage sites now offer packaged learning opportunities as add-ons to formal curricula.

Progress in experience-based learning approaches is facilitating more experiential and location-centric educational services that further increase industry growth. The presence of robust infrastructure, positive immigration policies for studying, and high-pressure marketing campaigns by schools and tourism boards continue to boost the country's standing in global educational tourism. Institutional partnerships, scholarship programs, and learning activities are significant in ensuring sustained demand for this sector.

Canada's education tourism sector continues to grow as a preferred and affordable destination for students from around the world seeking quality education with cultural immersion. The country's multicultural environment, safe communities, and strong education system are among the most cited factors for international student appeal.

International outreach activities by Canadian institutions involve offering study abroad opportunities, language immersion in English and French, and collaborative research programs. The initiatives have led to growing inflows of students, especially from India, China, and other African nations, where demand for internationally recognized qualifications is on the rise.

The domestic segment also plays an important contribution, with Canadian students participating in national exchange programs, school-arranged outings, and cultural exploration tours that promote experiential education. Government-funded education mobility schemes and support for indigenous and rural youth schemes are also strengthening this segment.

Institutions are adding elements of sustainability, technology, and accessibility to tours, responding to students' and teachers' evolving needs. Canada's natural scenery, bilingualism, and cultural emphasis on diversity render it a unique study destination. Ongoing collaborations between education and tourism are increasing infrastructure, accessibility, and program visibility, thereby guaranteeing continued momentum in educational tourism among Canadian provinces.

The United States and Canada educational tourism market is diversifying rapidly and strategically with increasing global demand for international academic exposure, language immersion, and experiential learning. The world of educational tourism is peopled mainly by a mixed bag of actors ranging from vertically integrated global providers to very niche consultants for tailored cultural programs and mobility facilitation.

EF Education First continues to serve as the industry benchmark with its all-inclusive model, operating everything from tour logistics and housing to schools and curriculum design. Such a scale offers quality control that underpins an advantage in standardized delivery across destinations.

IDP Education excels at digital and in-person counseling platforms, facilitating the pick-up of international students by North American institutions. It has powerfully established itself in student placement and academic testing (especially IELTS).

KILROY has created a niche for itself by combining youth travel with academic content, attracting an increasing number of high school and college students on a quest for adventurous experiential learning. Meanwhile, Cross Cultural Journeys has remained a prime option for universities and NGOs seeking to build cultural competence through customized short-term programs. Education Resources Network (ERN) has a strong focus on strategic academic partnerships and institutional mobility planning, increasingly facilitating inbound academic tourism to North America.

Using the government linkages and regional networks, small-scale actors like Intelligent Partners and Qadri International are also creating their pathways within study abroad facilitation, thereby expanding themselves. In this context, the rise of various boutique consultancy firms such as ProEd and Glinks serves to emphasize the increasing interest in highly customized educational travel options along targeted origin-destination corridors.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| EF Education First | 18-23% |

| IDP Education | 14-18% |

| KILROY | 10-14% |

| Cross Cultural Journeys | 7-10% |

| Education Resources Network | 6-9% |

| Other Key Players (Combined) | 30-35% |

| Company Name | Offerings & Activities |

|---|---|

| EF Education First | Full-service educational travel, language learning, and academic institutions are globally integrated under one brand. |

| IDP Education | Student placement services, IELTS exam providers, and digital counseling for USA and Canadian institutions. |

| KILROY | Educational and youth-focused travel combining academic learning with adventure tourism. |

| Cross Cultural Journeys | Custom-designed intercultural travel experiences for universities and nonprofit organizations. |

| Education Resources Network | Consultancy for academic institutions focused on mobility program development and international recruitment. |

Key Company Insights

EF Education First (18-23%)

Dominates through ownership of infrastructure, from schools to transport logistics, enabling superior quality control and scalability in global educational experiences.

IDP Education (14-18%)

A top student placement firm with strong relationships in the higher education sector and growing influence via IELTS testing and virtual academic counseling.

KILROY (10-14%)

A hybrid operator linking travel and learning for young adults, thriving by offering packaged educational journeys tailored to academic calendars.

Cross Cultural Journeys (7-10%)

Offers customized, mission-aligned travel for institutional clients, emphasizing cultural sensitivity and experiential global citizenship.

Education Resources Network (6-9%)

Acts as a strategic bridge between North American institutions and international students, specializing in recruitment, exchange programs, and partnerships.

By tourism type, the industry is segmented into youth travelling, student exchange program, international research program, workshop travel, language school, and others.

By education type, the industry is categorized into language courses, vocational courses, higher education, and other course types.

By age group, the industry is divided into less than 12 years, 13 to 18 years, 19 to 25 years, 26 to 40 years, and 41 to 55 years.

By consumer orientation, the industry is segmented into men and women.

By expenses, the industry is categorized into education fees, insurance fees, accommodation expenses, monthly food & grocery expenses, and other expenses.

By country, the industry is divided into the United States and Canada.

The industry is slated to reach USD 34.5 billion in 2025.

The industry is predicted to reach a size of USD 116.1 billion by 2035.

Key companies include EF Education First, KILROY, Capital Tours, Inc., Cross Cultural Journeys, Qadri International Educational Consultants, Intelligent Partners, Futures Abroad, Education Resources Network (ERN), IDP Education, Glinks International Consultancy, International Placewell Consultants, GULF, ProEd, Education Zone, and IQ Education Consultants.

The USA, slated to grow at 6.1% CAGR during the forecast period, is poised for fastest growth.

Student exchange programs are being widely used.

Table 01: Total Tourist Arrivals (billion), 2022

Table 02: Total Spending (US$ billion) and Forecast (2018 to 2033)

Table 03: Number of Tourists (billion) and Forecast (2018 to 2033)

Table 04: Spending per Traveler

Figure 01: Total Spending (US$ billion) and Forecast (2023 to 2033)

Figure 02: Total Spending Y-o-Y Growth Projections (2018 to 2033)

Figure 03: Number of Tourists (billion) and Forecast (2023 to 2033)

Figure 04: Number of Tourists Y-o-Y Growth Projections (2018 to 2033)

Figure 05: Spending per Traveler (US$ Bn) and Forecast (2023 to 2033)

Figure 06: Spending per Traveler Y-o-Y Growth Projections (2018 to 2033)

Figure 07: Current Market Analysis (% of demand), By Tourism Type, 2022

Figure 08: Current Market Analysis (% of demand), By Education Type, 2022

Figure 09: Current Market Analysis (% of demand), By Age Group, 2022

Figure 10: Current Market Analysis (% of demand), By Consumer Orientation 2022

Figure 11: Current Market Analysis (% of demand), By Expenses, 2022

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

United Kingdom Absorbable Tissue Spacer Market Outlook – Share, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA