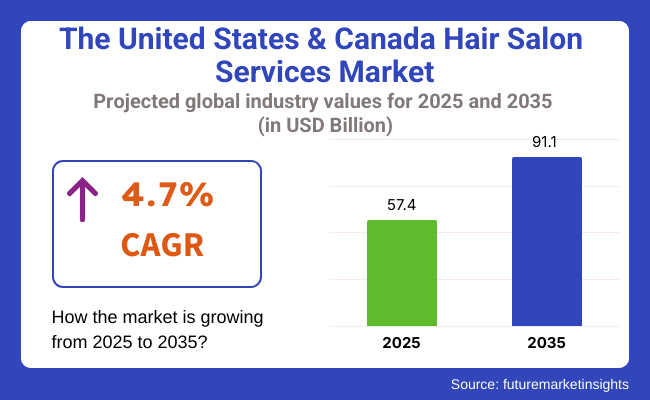

The United States & Canada hair salon market size was USD 57.4 billion in 2025 and is expected to progress at a 4.7% CAGR from 2025 to 2035. The industry valuation will be USD 91.1 billion in 2035. Among the major drivers for the same is the growing consumer demand for premium, personalized grooming that goes beyond the traditional haircut to encompass wellness, scalp care, and lifestyle satisfaction.

As urban populations increase and self-care becomes more integral to daily routines, hair salons are evolving into full-service facilities offering color treatment, hair spa treatments, extensions, and customized styling for different hair types. The rise in multicultural beauty awareness has also prompted salons to adopt inclusive services appropriate to different hair textures, ethnicities, and styling needs.

Digital transformation is taking deep root in the industry. With artificial intelligence-powered consultation software and appointment scheduling through applications to customer data insights and digital loyalty programs, the salons are streamlining operations and retaining clients.

Social media trends, influencer marketing, and word-of-mouth recommendations through social media are creating the center of consumer decision-making, which compels salons to invest in brand management, experience creation, and service offerings.

Professionalization of the business is also gaining momentum. Chains and franchises are gaining ground by offering standardized hygiene, clear pricing and certified stylists. Boutique salons are thriving at the same time by creating niche positioning clean beauty, luxury experience, or community space. This dual trend is increasing diversity and allowing new business models to emerge.

Along with that, the aging population has increased disposable incomes and growing male customer bases are expanding. Anti-aging hair therapies, scalp revival, and chemical-free therapy are being added to core services. In Canada and the United States, where healthcare and wellness spending are high, holistic value proposition salons are increasingly replacing low-cost models.

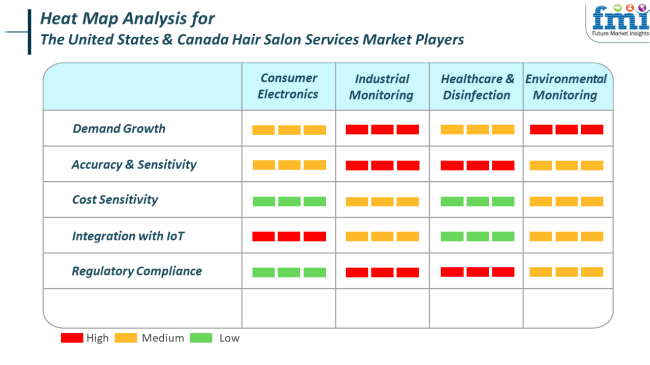

In consumer buying in the salon services sector, buying behavior is more comparable to that of healthcare and lifestyle businesses in that quality, customization, and sanitation are of utmost importance. Clients expect the services to be tailored to hair type, scalp condition, and lifestyle needs and are placing more emphasis on ingredient safety and technician expertise.

Demand momentum is fueled by digital interaction and shifting beauty standards. Clients are booking services based on trends in beauty, online education, and brand awareness. Merging intelligent scheduling, stylist recommendations, and immediate service feedback enhances transparency and responsiveness, supporting client happiness and loyalty.

Cost tolerance, in this case, is demographically varied, greater for premium prices in urban and health-oriented industries. Regulatory compliance, including sanitation standards, licensing, and chemical use protocols, is essential to shaping both consumer confidence and operational qualification, particularly for chains and multi-unit operators.

The North American hair salon services market, in expansion, faces various systemic challenges. Among these is the issue of labor availability and retention. Skilled stylists, colorists, and barbers are highly sought after, but talent shortages perpetually plague the industry due to uneven training standards, wage pressures, and pandemic-related exits from the workforce.

Economic recessions also pose a threat, especially to discretionary service segments such as premium styling, luxury treatments, and non-essential add-ons. Consumers will reduce or shift to low-cost alternatives during economic recessions, affecting mid-to-premium salons more significantly. Flexibility in service offerings and pricing strategies will be the most critical aspect in weathering such cycles.

Health and regulatory compliance create an additional layer of operating risk. Unforeseen changes in licensing, restrictions on chemical use, and sanitation protocols can create compliance risks.

From 2020 to 2024, the United States & Canada hair salon services industry saw significant growth driven by the increasing demand for professional grooming and hair care services. The boom in self-care and grooming trends, especially with the pandemic fueling the need for home-based services, helped drive demand.

The sector also saw technology adoption, including online scheduling systems, digital consultations, and social media-driven beauty trends. Additionally, as consumers grew more aware of sustainability and eco-friendly offerings, salons included natural and cruelty-free products to keep pace with consumer attitudes. Additionally, demand for added-value services such as hair coloring, treatments, and styling also grew in the two regions.

During the future 2025 to 2035 years, growth is expected to be more with the emergence of advanced technologies such as AI-powered consultations, tailored haircare services, and virtual try-on features. Social media influence, with the increasing disposable income, will spur further growth.

Sustainability will increasingly become a consideration in purchasing decisions, nudging salons toward greening themselves. In 2035, the sector is likely to be impacted by tech-savvy experiences and environmentally sound products offered with customized, made-for-individual, tailored packages targeted toward an increasingly technology-literate customer base.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Rising interest in self-care, professional grooming, and hair treatments. | Increasing use of digital and AI-driven personalized services, growing disposable incomes. |

| Adoption of online booking, digital consultations, and social media influence. | Use of AI for virtual try-ons, advanced hair care analytics, and online consultations. |

| Increased focus on eco-friendly products and sustainable services. | Rising demand for sustainable, personalized , and tech-enabled hair services. |

| Growth of hair coloring, treatments, and styling services. | Tech-enhanced experiences, personalized consultations, and eco-conscious offerings. |

| Adoption of safety measures due to the pandemic and hygiene awareness. | Stricter sustainability and eco-friendly product regulations in salon services. |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.4% |

| Canada | 5.7% |

The USA will be expanding at 6.4% CAGR during the forecast period. The USA hair salon services industry is witnessing tremendous change with increasing consumer focus on beauty, self-care, and personalized grooming experiences. High disposable incomes and heightened demand for upscale beauty and wellness services are fueling demand.

There is an increasing trend among consumers to choose salons that offer holistic beauty care, such as hair styling, coloring, scalp treatment, and therapy services. Furthermore, celebrity culture and social media continue to shape hairstyle fashion trends, with consumers seeking professional salon services regularly to remain fashionable.

Salon chains and independent professionals also increasingly invest in state-of-the-art technologies, such as online appointment bookings, artificial intelligence-driven style suggestions and personalized consultations, which increase customer satisfaction and convenience.

A new generation of male customers is also driving business expansion, as barbershop treatments are included in full-service salons. In addition to this, organic and environmentally friendly hair care products are becoming increasingly prominent as part of salon services, consistent with trends in sustainable consumption.

Strategic partnerships between the product and salon brands have helped to improve service quality and consumer engagement. Together, these trends are reinforcing the USA as a growing industry for hair salon services through 2035.

Canada will expand at a 5.7% CAGR over the years to come. Canada's hair salon services market is gradually gaining momentum, fueled by urbanization, increasing living standards, and increasing consumer willingness to spend on grooming and wellness services. In major urban areas such as Toronto, Vancouver, and Montreal, there is an increasing number of full-service salons and boutique studios offering bespoke experiences.

Demand is being fueled by growing multicultural influences, leading to varied hair care requirements as well as the adoption of various global styling techniques. Consumer preferences are shifting towards salons that provide not just haircuts but also complete care, including color services, damaged hair repair, and scalp health.

Canadian salons are also experiencing a digital transformation, with many companies adopting booking apps, mobile payments, and reward programs to retain and grow clients. Increasing awareness regarding product ingredients and sustainability has brought forth greater demand for cruelty-free and plant-based salon products.

Furthermore, government support for small businesses and entrepreneurs is driving the growth of innovative salon startups. As customers continue to look for high-quality and specialized services, the Canadian hair salon services market will see steady and uniform growth throughout the forecast period.

In 2025, the hair salon services market is projected to be primarily driven by hair styling services, accounting for 40% of the share, while haircutting services hold 30%.

Increased focus on personal image has also driven demand for hair styling services, including blowouts, updos, and special looks. Urban areas are seeing this demand trend more so, with clients wanting in-depth styling more often. Drybar, famous for blowout services, and Toni & Guy, which is into high-end styling and color treatments, are the key players in this segment.

Drybar has stamped its own identity in the exclusive hairstyling niche, ideally serving customers looking for professional, quick hairstyles without a cut. Besides, the social media boom, especially on Instagram, has heightened the yearning for Instagrammable looks, thus further expanding the styling service industry. The demand for hairstyling is booming, especially for weddings, parties, and business events, which has contributed to the growth of this segment.

Conversely, haircutting services remain a classically important aspect of the salon business, although they represent a small revenue share. Maintaining regular haircuts and trims is essential to keeping hair healthy and manageable. Great Clips and Supercuts, companies well-known for inexpensive haircuts performed with speed and convenience, would be prime examples.

Great Clips, cutting-edge and catering to customers who may just need a quick trim, made it easy to schedule appointments or walk right in, being the go-to place for someone in need of regular cuts and not necessarily fancy hairstyles. Cutting hair is very crucial, but the demand is steadier and more predictable than the demand for hairstyling, which has fluctuations.

The Hair Salon Services Market forecast for 2025 states that it will be completely driven through franchise outlets with an industry share of about 45%. Brand-owned outlets will be at 35% even though they will hold additional shares.

Franchise outlets are now an overwhelming power in the industry, given their capacity to provide uniformity in services and cost across a number of branches. The success of an example of franchise-salon bases is seen in chains such as Supercuts, Fantastic Sams, and Cost Cutters.

They offer affordable services covering haircuts, styling, and even coloring at numerous locations within an area, thus appealing to many customers who find convenience and reliability appealing. The true scalability of franchises would allow them to reach an even wider audience while still offering services that are cost-effective but of good quality. Franchise salons tend to offer only speed and affordability; hence, they perfectly fit the needs of the targeted convenience seekers in their busy lives.

Though contributing a portion to the smaller share, hair salon services are gaining traction in the premium industry. These outlets include Toni & Guy, Aveda, and Frederic Fekkai, which are high-end and life-personalized. Brand-owned salons invest in pricier services, luxury haircuts, color treatments, and exclusive products.

Aveda counts on organic and eco-friendly ingredients to attract those who opt for a greener and more eco-friendly lifestyle. Frederic Fekkai offers high-end services that include super-premium products dedicated to high-net individuals, especially in very affluent urban areas. Salons generally owned under a particular brand usually come with a more luxurious atmosphere where clients can unwind and get personalized service.

The United States & Canada Hair Salon Services Market is highly fragmented. While such key players like Regis Corporation, Great Clips, Ulta Beauty Inc., Hair Cuttery Family of Brands (HCFB), and Blo Blow Dry Bar have secured strong brand equity by coining franchising, premium servicing, and technology, there are other ways in which they have gained dominance by establishing a sizable number of salons, by differentiating their service, and by implementing a digital appointment system to streamline client experience.

Regis Corporation, with franchises such as Smart Style and Supercuts, has ownership of thousands of stores. It currently continues to push forward, optimizing its franchising model and restructuring internally, concentrating on regaining market agility. Great Clips, known for its value-based and widespread franchise base, holds steady growth because of the aggressive eastern region expansion, plus the check-in through app-based systems, which displays benefits in tighter customer retention.

Ulta Beauty Inc. is a retail beauty chain that has integrated salon service across nearly all its locations, thus providing a hybrid beauty destination model that boosts customer loyalty and service up-sell opportunities. Therefore, the Hair Cuttery Family of Brands has emerged from bankruptcy with a leaner portfolio and a renewed focus on stylist training and operational efficiency. Blo Blow Dry Bar is in the premium express styling segment and is capitalizing on the blowout trend with sleek aesthetics while expanding in urban metros and affluent suburbs.

Market competition is getting severe with the introduction of small, specialized salons and specialized service providers like Drybar, Toni & Guy, and Seva Beauty, creating niche offerings, treatment personalization, and branding strategies for lifestyles.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Regis Corporation | 12-16% |

| Great Clips | 10-14% |

| Ulta Beauty Inc. | 8-12% |

| Hair Cuttery Family of Brands | 6-9% |

| Blo Blow Dry Bar | 5-8% |

| Other Key Players (Combined) | 41-49% |

| Company Name | Offerings & Activities |

|---|---|

| Regis Corporation | Operating multiple salon brands, investing in franchise optimization and salon digitization. |

| Great Clips | Low-cost haircutting chain with over 4,000 locations; strong digital check-in integration. |

| Ulta Beauty Inc. | Beauty retail-salon hybrid model; salon services offered in ~90% of locations across North America. |

| Hair Cuttery Family of Brands | Mid-tier salon group focusing on stylist development, loyalty programs, and local customization. |

| Blo Blow Dry Bar | It specializes in blowouts and express styling and is growing via a franchise network in upscale locations. |

Key Company Insights

Regis Corporation (12-16%)

Holds one of the largest salon footprints in North America with a multi-brand approach and renewed investment in tech and franchise agility.

Great Clips (10-14%)

Continues to scale via franchising, offering reliable, quick services across thousands of stores with digital innovations like online check-in.

Ulta Beauty Inc. (8-12%)

Leverages its retail footprint to cross-sell salon services, driving traffic through integrated loyalty programs and in-store experiences.

Hair Cuttery Family of Brands (6-9%)

Rebuilding with operational discipline post-restructuring, now emphasizing stylist education and customer-first service delivery.

Blo Blow Dry Bar (5-8%)

Gaining ground in urban and suburban markets by targeting the express beauty segment with clean branding and upscale interiors.

The market is segmented into hair cutting, hair styling, and hair treatment.

The market is categorized into franchise outlets, brand-owned outlets, and individual outlets.

The market is divided into large, medium, and small establishments.

The industry is slated to reach USD 57.4 billion in 2025.

The industry is predicted to reach a size of USD 91.1 billion by 2035.

Key companies include Regis Corporation, Blo Blow Dry Bar, Ulta Beauty Inc., Hair Cuttery Family of Brands (HCFB), Great Clips, Toni & Guy, Seva Beauty, Drybar, Saco Hair, Rush Hair & Beauty, Franck Provost, Jean Louis David, and The Lounge Hair Salon.

The USA, slated to grow at 6.4% CAGR during the forecast period, is poised for the fastest growth.

Hair styling services are being widely used.

Table 1: The Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 2: The Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 3: The Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 4: The Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 5: The Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 6: The Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 7: The Market Value (The USA$ Million) Analysis By Region, 2018 to 2033

Table 8: The Market Value (The USA$ Million) Analysis By Region, 2018 to 2033

Table 9: The USA Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 10: The USA Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 11: The USA Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 12: The USA Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 13: The USA Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 14: The USA Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 15: The USA Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 16: The USA Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 17: West Region Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 18: West Region Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 19: West Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 20: West Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 21: West Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 22: West Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 23: West Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 24: West Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 25: South East Region Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 26: South East Region Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 27: South East Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 28: South East Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 29: South East Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 30: South East Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 31: South East Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 32: South East Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 33: South West Region Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 34: South West Region Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 35: South West Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 36: South West Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 37: South West Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 38: South West Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 39: South West Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 40: South West Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 41: Mid-West Region Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 42: Mid-West Region Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 43: Mid-West Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 44: Mid-West Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 45: Mid-West Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 46: Mid-West Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 47: Mid-West Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 48: Mid-West Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 49: North East Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 50: North East Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 51: North East Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 52: North East Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 53: North East Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 54: North East Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 55: North East Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 56: North East Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 57: Canada Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 58: Canada Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Table 59: Canada Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 60: Canada Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Table 61: Canada Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 62: Canada Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Table 63: Canada Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Table 64: Canada Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Figure 01: The Market Value (The USA$ Million) and Volume (Units) Analysis, 2018 to 2022

Figure 02: The Market Value (The USA$ Million) and Volume (Units) Forecast, 2023 to 2033

Figure 03: The Market Value (The USA$ Million) Analysis, 2018 to 2022

Figure 04: The Market Value (The USA$ Million) Forecast, 2023 to 2033

Figure 05: The Market Absolute $ Opportunity Value (The USA$ Million), 2023 to 2033

Figure 06: The Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Figure 07: The Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 08: The Market Attractiveness By Service Type, 2023 to 2033

Figure 09: The Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Figure 10: The Market Y-o-Y Growth (%) Projections, By Type, 2023 to 2033

Figure 11: The Market Attractiveness By Type, 2023 to 2033

Figure 12: The Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Figure 13: The Market Y-o-Y Growth (%) Projections, By Size, 2023 to 2033

Figure 14: The Market Attractiveness By Size, 2023 to 2033

Figure 15: The Market Value (The USA$ Million) Analysis By Country, 2018 to 2033

Figure 16: The Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 17: The Market Attractiveness By Country, 2023 to 2033

Figure 18: The USA Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Figure 19: The USA Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 20: The USA Market Attractiveness By Service Type, 2023 to 2033

Figure 21: The USA Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Figure 22: The USA Market Y-o-Y Growth (%) Projections, By Type, 2023 to 2033

Figure 23: The USA Market Attractiveness By Type, 2023 to 2033

Figure 24: The USA Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Figure 25: The USA Market Y-o-Y Growth (%) Projections, By Size, 2023 to 2033

Figure 26: The USA Market Attractiveness By Size, 2023 to 2033

Figure 27: The USA Market Value (The USA$ Million) Analysis By Region, 2018 to 2033

Figure 28: The USA Market Y-o-Y Growth (%) Projections, By Region, 2023 to 2033

Figure 29: The USA Market Attractiveness By Region, 2023 to 2033

Figure 30: West Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Figure 31: West Region Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 32: West Region Market Attractiveness By Service Type, 2023 to 2033

Figure 33: West Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Figure 34: West Region Market Y-o-Y Growth (%) Projections, By Type, 2023 to 2033

Figure 35: West Region Market Attractiveness By Type, 2023 to 2033

Figure 36: West Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Figure 37: West Region Market Y-o-Y Growth (%) Projections, By Size, 2023 to 2033

Figure 38: West Region Market Attractiveness By Size, 2023 to 2033

Figure 39: South East Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Figure 40: South East Region Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 41: South East Region Market Attractiveness By Service Type, 2023 to 2033

Figure 42: South East Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Figure 43: South East Region Market Y-o-Y Growth (%) Projections, By Type, 2023 to 2033

Figure 44: South East Region Market Attractiveness By Type, 2023 to 2033

Figure 45: South East Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Figure 46: South East Region Market Y-o-Y Growth (%) Projections, By Size, 2023 to 2033

Figure 47: South East Region Market Attractiveness By Size, 2023 to 2033

Figure 48: South West Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Figure 49: South West Region Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 50: South West Region Market Attractiveness By Service Type, 2023 to 2033

Figure 51: South West Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Figure 52: South West Region Market Y-o-Y Growth (%) Projections, By Type, 2023 to 2033

Figure 53: South West Region Market Attractiveness By Type, 2023 to 2033

Figure 54: South West Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Figure 55: South West Region Market Y-o-Y Growth (%) Projections, By Size, 2023 to 2033

Figure 56: South West Region Market Attractiveness By Size, 2023 to 2033

Figure 57: Mid-West Region Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Figure 58: Mid-West Region Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 59: Mid-West Region Market Attractiveness By Service Type, 2023 to 2033

Figure 60: Mid-West Region Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Figure 61: Mid-West Region Market Y-o-Y Growth (%) Projections, By Type, 2023 to 2033

Figure 62: Mid-West Region Market Attractiveness By Type, 2023 to 2033

Figure 63: Mid-West Region Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Figure 64: Mid-West Region Market Y-o-Y Growth (%) Projections, By Size, 2023 to 2033

Figure 65: Mid-West Region Market Attractiveness By Size, 2023 to 2033

Figure 66: North East Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Figure 67: North East Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 68: North East Market Attractiveness By Service Type, 2023 to 2033

Figure 69: North East Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Figure 70: North East Market Y-o-Y Growth (%) Projections, By Type, 2023 to 2033

Figure 71: North East Market Attractiveness By Type, 2023 to 2033

Figure 72: North East Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Figure 73: North East Market Y-o-Y Growth (%) Projections, By Size, 2023 to 2033

Figure 74: North East Market Attractiveness By Size, 2023 to 2033

Figure 75: Canada Market Value (The USA$ Million) Analysis By Service Type, 2018 to 2033

Figure 76: Canada Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 77: Canada Market Attractiveness By Service Type, 2023 to 2033

Figure 78: Canada Market Value (The USA$ Million) Analysis By Type, 2018 to 2033

Figure 79: Canada Market Y-o-Y Growth (%) Projections, By Type, 2023 to 2033

Figure 80: Canada Market Attractiveness By Type, 2023 to 2033

Figure 81: Canada Market Value (The USA$ Million) Analysis By Size, 2018 to 2033

Figure 82: Canada Market Y-o-Y Growth (%) Projections, By Size, 2023 to 2033

Figure 83: Canada Market Attractiveness By Size, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA