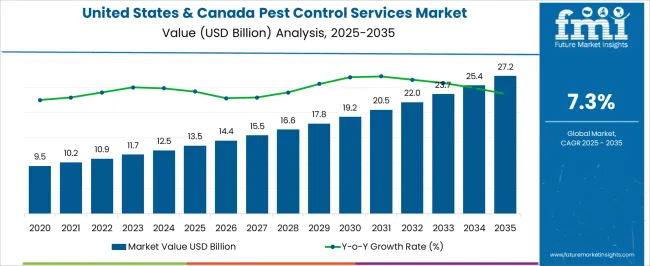

The United States & Canada Pest Control Services Market is estimated to be valued at USD 13.5 billion in 2025 and is projected to reach USD 27.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

| Metric | Value |

|---|---|

| United States & Canada Pest Control Services Market Estimated Value in (2025 E) | USD 13.5 billion |

| United States & Canada Pest Control Services Market Forecast Value in (2035 F) | USD 27.2 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The pest control services market in the United States and Canada is expanding steadily, supported by rising urbanization, stricter health regulations, and increasing consumer awareness regarding hygiene and safety. Demand has been reinforced by the growth of residential, commercial, and industrial infrastructure, where pest-related concerns directly impact operational continuity and health standards.

Advances in environmentally sustainable pest management practices, integrated pest management solutions, and digital monitoring technologies are further shaping service adoption. Regulatory guidelines aimed at minimizing risks associated with chemical exposure are pushing service providers to balance effectiveness with safety.

As climate variability influences pest activity across seasons, the outlook remains positive for service innovation and diversified control methods that cater to both urban and rural markets.

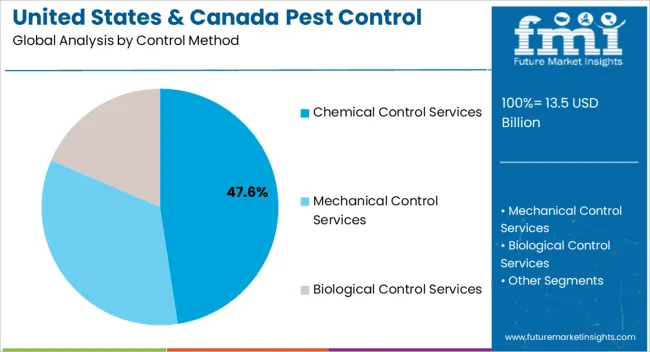

The chemical control services segment is projected to account for 47.60% of total revenue by 2025, making it the leading control method. Its dominance is attributed to its proven effectiveness, broad spectrum applicability, and immediate action against a wide range of pests.

Widespread acceptance across residential and commercial sectors has been supported by availability of advanced formulations that comply with evolving safety standards. Furthermore, the ability of chemical solutions to deliver predictable results has reinforced their position as a reliable option.

While eco-friendly alternatives are growing, chemical control services continue to dominate due to their scalability, cost-effectiveness, and adaptability to different pest challenges.

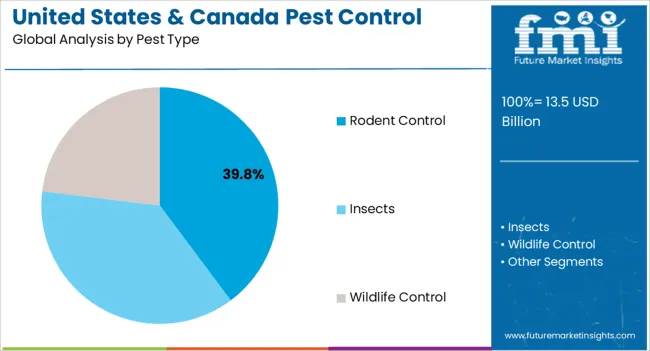

The rodent control segment is anticipated to represent 39.80% of the total market share by 2025, positioning it as the leading pest type category. Rising concerns about food safety, disease transmission, and infrastructure damage have intensified demand for effective rodent control measures across urban and industrial areas.

Regulatory compliance within food processing and storage facilities has further boosted reliance on professional rodent management. Additionally, increasing awareness of health risks associated with rodent infestations has made prevention and elimination a top priority.

The continued expansion of urban environments and waste management challenges are also fueling consistent growth in this segment.

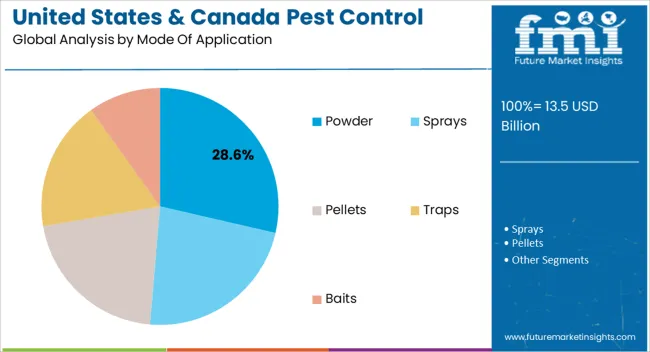

The powder application segment is expected to contribute 28.60% of market revenue by 2025, making it the most significant mode of application. This preference is driven by the ease of use, longer residual effect, and cost-effectiveness of powdered formulations.

Powder applications are valued for their ability to target entry points, cracks, and hidden nesting sites effectively. Their wide acceptance in both indoor and outdoor pest control operations has strengthened their position as a preferred choice.

In addition, the compatibility of powder with both chemical and natural formulations has allowed for broader usage across diverse pest management strategies, thereby maintaining its leadership in the application segment.

As per Future Market Insights (FMI), pest control services sales revenue in the United States & Canada markets grew at 6.5% CAGR from 2020 to 2025. For the next ten years, the market is projected to thrive at around 7.3% CAGR.

The pest control services market is driven by factors such as the increasing adoption of digital applications and technology.

Pest control is crucial for ensuring food safety in the worldwide food supply chain. Automation and a sustainable approach have become prominent within the supply chain, and the increasing demand for pest control services has resulted in a significant rise in the number of service providers in the market.

With the use of digital technologies such as motion sensors and automated traps, operating companies have expanded their scope of offerings to include monitoring and suppression.

For instance, to effectively monitor food-processing facilities, Rentokil Initial PLC provides digital pest management technologies, like the PestConnect line of IoT-enabled devices.

These few factors are expected to boost development and alter current patterns in pest control services throughout the projection period.

Growing Awareness of Harmful Effects of Pests Boosting Pest Control Services Demand

One of the key dynamics driving the demand for pest control services is the increasing awareness of the harmful effects of pests on human health and the environment.

Consumers are becoming more aware of the risks associated with pests and are demanding pest control services to ensure the safety and well-being of people and their surroundings. This will continue to expand the United States & Canada pest control services market size.

Adoption of Integrated Pest Management (IPM) Practices to Foster Market Development

Another significant dynamic is the adoption of integrated pest management practices. IPM involves the use of multiple techniques such as biological and mechanical control methods, to manage pest problems in a sustainable and environmentally responsible way.

IPM approach is gaining popularity due to its effectiveness and the growing awareness of environmental sustainability.

Growing Demand for Eco-friendly and Sustainable Solutions to Create Opportunities for Companies

The pest control services industry is also being driven by the growing demand for eco-friendly and sustainable solutions. Consumers are becoming more conscious of the environmental impact of pest control chemicals and are seeking safer and more sustainable alternatives. This is leading to the development of non-toxic and biodegradable pest control products and services.

Rapid shift towards eco-friendly and sustainable solutions will open new growth opportunities for companies.

Increasing Adoption of Digital Applications and Technology to Fuel Market Expansion

The adoption of digital applications and technology is also a key dynamic in the pest control services market.

Pest control service providers are leveraging digital technologies such as loT-enabled pest-control devices, motion sensors, and automated traps to improve the efficiency and effectiveness of their services. This trend is driven by the need for more accurate and precise pest control, especially in commercial and industrial applications.

Insects Category to Create Lucrative Growth Opportunities

Based on pest type, insects segment will continue to generate lucrative opportunities for the United States & Canada pest control service providers. The target segment held a significant market share of around 62.2% in 2025. This is due to rising need for preventing crop loss triggered by increasing insect activity.

Similarly, rising need for eradicating insects from hospitals, hotels, industries, airports, etc. to minimize risk of diseases will boost growth of the target segment.

According to a 2020 study by the National Pest Management Association (NPMA), over 95% of pest management professionals have dealt with bed bugs, and more than 70% of them believe the bed bug treatment overall was successful.

Similarly, about 65% of experts said that there is a rising demand for pest control & management services. The study also found that 90% of pest control experts had seen bed bugs in apartments or condominiums, over 65% had seen them in hotels or motels, and so on. This in turn is creating high demand for insect control services.

Powder Category to Witness Rising Demand

By mode of application, the powder segment holds a significant share in terms of revenue. It is primarily used to get rid of ants and cockroaches.

In powder formulations, common active substances such as cypermethrin and hydramethylnon are utilized. Although it is effective, powder formulations are also highly regulated.

While hydramethylnon poses no risk to people, the United States Environmental Protection Agency (EPA) has identified it as a potential carcinogen. To lessen or get rid of insect infestations, powder formulations can be used in residential, commercial, and transportation facilities.

Commercial Sector to Remain a Key Revenue-generation Segment

Application in the commercial category held a significant share of 35.6% in 2025. Further, it is expected to generate lucrative revenue-generation opportunities for pest control service companies through 2035. This is due to rising need for controlling pests in commercial buildings.

Increasing intolerance for pests in commercial spaces, such as offices, healthcare, food and beverage, and hospitality is expected to boost pest control services sales revenue.

The growing infrastructure in the commercial space and strict regulations for hygiene maintenance are also contributing to this growth.

The commercial business sector typically enters into multi-year contracts with pest control service providers, which helps in generating a secure revenue stream. This is a key factor driving demand for pest control services in the commercial segment.

Prominent players in the pest control services market are employing various business strategies. This includes the launch of new pest control services, mergers, acquisitions, and geographical expansions.

To deliver effective products and services, major firms compete to combine cutting-edge technologies. These innovations are intended to meet the growing demand for pest control services in commercial areas and big organizations that must maintain hygienic workplaces.

For instance:

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 13.5 billion |

| Projected Market Value (2035) | USD 27.2 billion |

| Anticipated Growth Rate (2025 to 2035) | 7.3% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million/billion for Value |

| Key Segments Covered | Control Method, Pest Type, Mode of Application, Application, Country |

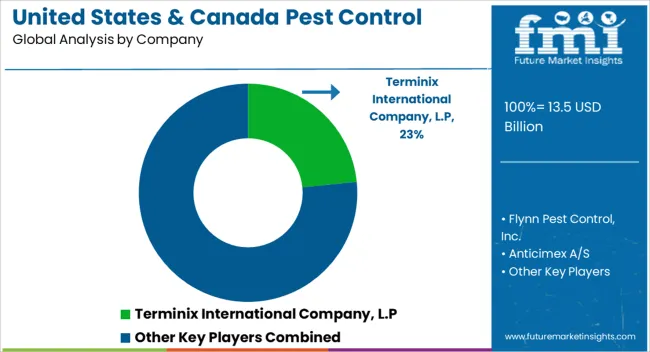

| Key Companies Profiled | Terminix International Company, L.P; Flynn Pest Control, Inc.; Anticimex A/S; Rollins Inc.; Rentokil Initial Plc; Team Pest USA Exterminating Co.; Ecolab, Inc.; Eco-Friendly Pest Control; Green Pest Solutions; Massey Services Inc.; Southern Pest Control Inc.; Bulwark Exterminating Inc.; Primax Pest Control; Great Lakes Pest Control Co., Inc.; ABC Home & Commercial Services; Gecko Pest Control; Arrow Exterminators Inc.; Ehrlich Pest Control; Accurate Pest Control Inc.; Crystal Pest Control; Green Earth Pest Control Inc.; BHB Pest Elimination LLC; Others (As per Request) |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global united states & Canada pest control services market is estimated to be valued at USD 13.5 billion in 2025.

The market size for the united states & Canada pest control services market is projected to reach USD 27.2 billion by 2035.

The united states & Canada pest control services market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in united states & Canada pest control services market are chemical control services, _insecticides, _rodenticides, _others (pheromones and repellents), mechanical control services, _trapping, _light traps, _adhesive traps, _malaise traps, biological control services, _microbial, _plant-extracts and _predatory insect.

In terms of pest type, rodent control segment to command 39.8% share in the united states & Canada pest control services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA