The United States & Canada foundation repair services market size was USD 11.8 billion in 2025 and is expected to grow at a 5.4% CAGR from 2025 to 2035. The industry is projected to reach USD 20 billion by 2035. The rising incidence of structural deterioration in aging residential and commercial structures, along with climatic shifts that enhance soil movement and compromise foundational integrity in North America, is one of the major growth drivers.

Subsidence, frost heave, poor construction techniques and hydrostatic pressure induce foundation issues in extensive types of terrain throughout Canada and the United States. In response to the demand, special services such as slab jacking, pier systems, wall anchoring, and soil stabilization are in increasing demand. Homeowners, property owners, and municipalities are requiring non-destructive, long-lasting repair solutions that fully restore structural integrity without extreme demolition.

Technological innovation is revolutionizing business with the use of polymer injection, advanced geotechnical mapping, and real-time moisture monitoring. These technologies enhance diagnostic precision and enable tailored repair solutions, reducing labor intensity and long-term results. Furthermore, digitalization of customer engagement from appointment scheduling to post-service tracking is enhancing transparency and operational efficiency among service providers.

The sector is further fueled by homeowner awareness and concerns about property value. As long as house prices remain high, preventative and repair structural maintenance has become a strategic investment, particularly in regions that have experienced histories of drought, heavy rain, or earthquakes. Insurance policy limits for foundation issues also provide a further incentive to act early and correct professionally.

Building codes and safety regulations in both countries are increasingly centered on foundation performance, particularly retrofitting current buildings to comply with the requirements of today's safety needs. This is driving the demand for certified professionals and accelerating the rolling up of services under nationally branded services with comprehensive warranties and technical expertise.

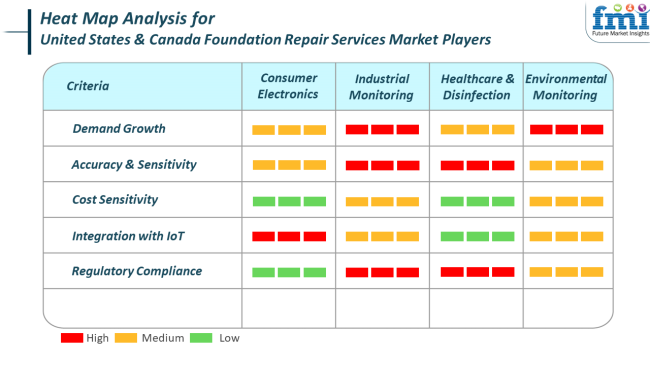

The most relevant overlap in foundation repair work is with industrial and environmental monitoring due to the requirement for reliable subsurface diagnosis, site-specific design, and compliance with municipal building codes. Customers for residential, commercial, and institutional settings need long-term structural performance, safety, and minimal disruption.

The demand for foundation repair is heavily reliant on environmental stressors such as moisture fluctuation, ground movement, and seismically active regions. Consumers need to have high diagnostic accuracy and delivery of repair, and they prefer service providers who utilize sophisticated equipment such as LIDAR, ground-penetrating radar, and IoT-enabled foundation sensors.

Though cost sensitivity may differ with project size, long-term ROI is a primary decision driver, particularly when resale value or occupancy safety is involved. Compliance with regulations is of prime importance, especially in commercial and public projects, where compliance with geotechnical, seismic, and zoning codes is mandatorily required.

The industries are exposed to a series of structural as well as operating risks. A key among such risks is the heterogeneity of geographic soil behavior as well as climatic patterns, which is problematic in the standardization of the service. Problems concerning foundations in the clay-rich soils of Texas are extremely different from the frost scenario of Canada, thus requiring local know-how that could be challenging in uniform service across large geographical distances.

A second challenge is the patchy nature of the service provider industry. While larger homegrown players are expanding, much of the industry remains served by local contractors who lack the technical capability or qualification to perform advanced repairs. This imbalance generates quality control risks and can ultimately decrease consumer confidence in certain areas.

In addition, rising construction material costs, labor shortages, and insurance limits create financial threats to providers and customers alike. Permits, inspection backlog, and equipment availability problems can also affect project timelines and profitability. Organizations with scalable technologies, local adaptability, and customer-centric business models will be in the best position to mitigate these threats and sustain steady growth up to 2035.

The industry increased substantially between 2020 and 2024, primarily fueled by rising urbanization, aging infrastructure, and shifting climate conditions. Foundation repair services demand accelerated owing to the reasons such as soil movement due to freeze-thaw cycles, moisture-related issues, and effects of severe weather.

Improvement in diagnostic techniques and repair techniques also fueled expansion in service delivery. Real estate residential and commercial experienced increasing demand for repair and maintenance between 2020 and 2024, especially in regions prone to natural calamities and climatic pressure.

For the years 2025 to 2035, the industry will expand further with increased use of intelligent technologies like sensors and monitoring systems to identify early signs of foundation defects. Conversely, sustainability needs in construction and repair work will also propel innovations towards green practices and materials.

The business will also see greater automation and AI-driven solutions in repair activity and foundation testing, which will enable greater efficiency and cost advantages. In addition, stricter building codes will result in increased foundation repair demand due to the owners' need to meet new safety codes.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Aging infrastructure, intense weather, and urbanization. | Urbanization, smart technology integration, and rising awareness of climatic threats. |

| Use of advanced diagnostic tools for foundation issues. | Use of AI, automation, and IoT sensors to monitor in real time and predict maintenance. |

| Increased demand for commercial and residential repair. | Focus on preventative maintenance and green repair methods, focusing on long-term sustainability. |

| Increased repair services from moisture, soil movement, and cracks in foundations. | Increased smart foundation solutions, AI-driven analysis, and sustainable material usage. |

| Enhanced regional laws promoting better foundation maintenance standards. | Stricter building codes and environmentally focused legislation will lead to more repair work. |

In 2025, the industry is projected to be dominated by wall repair services, which are expected to hold an industry share of 35%. Settlement repair services will follow, accounting for 25% of the industry.

A large number of issues remain under this service because of the problems related to foundation wall cracks, bowing, and shifting. These problems could frequently be found in older homes or buildings in places with expansive soils or moisture change-prone areas.

Foundation Repair Contractors (FRC) and Basement Systems are well known for their advanced wall repair techniques using carbon fiber reinforcement and steel wall anchors, designed ultimately to prevent further movement and stabilize foundations. This is growing, thanks to the increased awareness of the need for early detection and subsequent repair of wall complaints in residential and commercial properties.

Settlement repair is relatively small in terms of revenue but still worth something, given that settlement of the foundation is prevalent in older and non-reliable buildings. Usually, these kinds of repairs involve helical piers, push piers, and slab jack techniques to raise and level the foundation.

Typical companies that provide these services include Ram Jack and Atlas Foundation Repair. With time, it is expected that the demand for these services will increase because homeowners and businesses want to keep their properties in shape, especially in areas affected by soil movement, earthquakes, or variations in moisture.

Both are going to be very much essential in the future: wall repair mainly because of their scope of wider applicability in residential and commercial structures.

In 2025, the industry is expected to be predominantly driven by repairs for buildings, which are projected to capture an industry share of 60%. Roads will follow with a smaller industry share of 8%.

The application building is dominant in the industry because there are many residential, commercial, and industrial buildings requiring foundation repairs. Foundational issues such as settling, cracks, moisture damage, and soil movement usually plague buildings, and that is where most foundation repair services are focused.

Companies like Basement Systems and Foundation Support works provide solutions such as slab jacking, pier installation, and foundation stabilization. Demand for foundation repair works in buildings continues to be strong because homeowners are concerned with keeping their houses and commercial spaces structurally sound.

The road segment, however, is small in the industry for foundation repairs. Roads and highways need foundation repair mainly due to erosion, water damage, and shifting soil. Most of the time, repairs done under this segment have been less numerous than building-related repairs because, typically, the infrastructure is submitted for regular maintenance-renewal programs, including foundation repair, as part of the broad reconstruction program.

Most of these areas are taken care of by contractors such as Geo Stabilization International and CCI (Cement Contractors, Inc.), whose focus is on soil stabilization and foundation repairs in relation to roads and highways, considering the durability and safety of public transport systems.

In summary, the building establishment will still lead the recovery industry in foundation applications as the need for structural maintenance continues in residential and commercial buildings. Nevertheless, the road segment will still be important in providing stability and safety of the infrastructure across the regions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

| Canada | 4.7% |

The USA industry is on a smooth ride, driven by older residential and commercial structures, shifting soil conditions, and increased climate-induced structural vulnerabilities. A high percentage of homes in the majority of areas were built several decades ago, and the majority of them are now experiencing foundation issues as a result of natural degradation, extreme weather conditions, and expansive soil settlement.

This has raised the need for specialty services such as foundation leveling, pier installation, and structural reinforcement. Higher instances of natural disasters such as floods, hurricanes, and droughts are also playing a crucial role in driving the demand for preventive and repair foundation solutions. In addition, greater awareness among homeowners regarding early detection of structural failure is driving early repairs and consistent demand for services.

Asset value preservation has also become a significant spur, with homeowners insisting on foundation repair to save asset value. Technological advances, such as the use of polyurethane foam injection and computerized structural monitoring systems, are further easing service provision and improving contractor productivity.

Industry professionalization, increased contractor networks, and access to financing options for homeowners are supporting broader industry expansion. Urbanization, infrastructure renovation plans, and energy-saving retrofitting plans are poised to drive the industry further ahead during the forecast period.

Canada's foundation repair services industry is gathering pace due to a synergy of environmental, demographic, and structural factors. Temperature changes in climatic conditions seasonally, freeze-thaw situations and the prevalence of clay-bearing soil types in most locations have made properties specifically susceptible to foundation issues.

This has resulted in a steady increase in residential and commercial repair services aimed at mitigating structural risks and extending building lives.

Expanding urban residential development, especially in high-density provinces such as Ontario, British Columbia, and Alberta, has also contributed to increased demand for corrective and preventative foundation services. The Canadian industry is also fueled by growing homeowner anxiety regarding long-term property upkeep, supported by greater access to technical data and specialized service professionals.

New construction codes and building regulations are pushing innovation in foundation engineering and repair techniques. Companies are investing in non-invasive and environmentally friendly repair methods, which appeal to a consumer base that cares about both sustainability and durability.

Additionally, insurance providers are increasingly grasping the need for proactive care of foundations towards the avoidance of risk, driving early interventions. As public and private investment in the renewal of homes and making infrastructure resilient will keep growing in the future, the industry for foundation repair services in Canada will grow steadily through the forecast years.

The industry is steadily consolidating as some of these major regional players are increasing their industry share while also forming their competitive technologies, which will make them stand out in the industry. Olshan Foundation Repair and Ram Jack are still considered cornerstones of national scope because of their expansive service coverage and strong brand equity, along with systemized repair solutions.

Transferable warranties and a national presence make Olshan the number one option for residential and light commercial jobs. At the same time, Ram Jack takes advantage of patented steel pier systems and a certified contractor network throughout North America.

Helitech is tangentially dominant in the Midwest through its hybrid model of in-house service teams that expand into dealerships, wherein structural repair is bundled with waterproofing and concrete leveling. Master Services Company is growing aggressively in the Southeast due to its responsive teams and competitive warranties.

Arizona Foundation Services remains the leading force in arid zone engineering solutions with a strong focus on geotechnical innovations engineered for the specifics of desert and dry soil conditions.

Other smaller players like Windler Foundation Repair System and Longview Foundation Repair are presently rising in their local areas through localized marketing, service bundling, and customer-centric financing programs.

The drive of competition is increasingly being applied through the adoption of digital diagnostics, twisted preventative maintenance contracts and regional expertise in soils. As climate-related ground shifts force demand for repairs, players are diversifying out into proactive soil stabilizing and long-term structural health monitoring.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Olshan Foundation Repair | 14-18% |

| Ram Jack | 12-16% |

| Helitech | 10-13% |

| Master Services Company | 8-11% |

| Arizona Foundation Services | 7-10% |

| Other Key Players (Combined) | 33-38% |

| Company Name | Offerings & Activities |

|---|---|

| Olshan Foundation Repair | Full-service national operator offering waterproofing, structural correction, and drainage systems with lifetime warranties. |

| Ram Jack | Technologically advanced steel pier solutions with a certified contractor network in both the USA and Canada. |

| Helitech | Midwest specialist with bundled offerings for waterproofing, foundation leveling, and structural reinforcements. |

| Master Services Company | Southeastern-focused provider of basement waterproofing and foundation repair with fast response and localized diagnostics. |

| Arizona Foundation Services | Tech-enabled solutions tailored to desert soils, including digital mapping and foundation stabilization systems. |

Key Company Insights

Olshan Foundation Repair (14-18%)

An industry icon in the USA, Olshan leverages national reach, multi-decade warranties, and custom repair solutions to maintain top-tier brand recognition across residential and light commercial sectors.

Ram Jack (12-16%)

Known for engineering rigor and patented technology, Ram Jack serves a broad client base via a franchise system with deep regional penetration in both countries.

Helitech (10-13%)

Helitech uses dealerships and acquisitions to widen its Midwest footprint, excelling in bundled structural and moisture control services.

Master Services Company (8-11%)

A nimble regional player scaling in the southeastern USA through responsive service, geographically tailored solutions, and strong warranty support.

Arizona Foundation Services (7-10%)

A leader in desert-geared diagnostics, this firm is notable for using foundation mapping and soil simulation tech to engineer stability in challenging environments.

By service type, the industry is segmented into settlement repair, wall repair, chimney repair, flood slab repair, and other types.

By application, the industry is categorized into buildings, roads, pavements, tunnels, railways, dams, and other applications.

By end user, the industry is segmented into residential and commercial.

The industry is slated to reach USD 11.8 billion in 2025.

The industry is predicted to reach a size of USD 20 billion by 2035.

Key companies include Worldwide Inc., Kent Foundation Repair, Master Services Company, Olshan Foundation Repair, Helitech, Ram Jack, Arizona Foundation Services, Windler Foundation Repair System, Advanced Foundation Repair, The Dwyer Company Inc., Acculift Foundation Repair, Longview Foundation Repair, DFW Foundation Repair Services, Huntsville Foundation Repair, Grapevine Foundation Repair, Alfa Foundation, Tyler Foundation Repair, and Basic Foundation Repair.

The USA, slated to grow at 5.4% CAGR during the forecast period, is poised for the fastest growth.

Wall repair services are being widely used.

Table 1: Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Table 2: Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Table 3: Market Value (US$ Million) Analysis By Application, 2018 to 2033

Table 4: Market Value (US$ Million) Analysis By Application, 2018 to 2033

Table 5: Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 6: Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 7: Market Value (US$ Million) Analysis By Sales Channel, 2018 to 2033

Table 8: Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Table 9: Market Value (US$ Million) Analysis By Region, 2018 to 2033

Table 10: Market Value (US$ Million) Analysis By Region, 2018 to 2033

Table 11: Market Value (US$ Million) Analysis By Country, 2018 to 2033

Table 12: Market Value (US$ Million) Analysis By Country, 2018 to 2033

Table 13: Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Table 14: Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Table 15: Market Value (US$ Million) Analysis By Application, 2018 to 2033

Table 16: Market Value (US$ Million) Analysis By Application, 2018 to 2033

Table 17: Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 18: Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 19: Market Value (US$ Million) Analysis By Sales Channel, 2018 to 2033

Table 20: Market Value (US$ Million) Analysis By Sales Channel, 2018 to 2033

Table 21: West Region Market Value (US$ Million) Analysis By Country, 2018 to 2033

Table 22: West Region Market Value (US$ Million) Analysis By Country, 2018 to 2033

Table 23: West Region Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Table 24: West Region Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Table 25: West Region Market Value (US$ Million) Analysis By Application, 2018 to 2033

Table 26: West Region Market Value (US$ Million) Analysis By Application, 2018 to 2033

Table 27: West Region Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 28: West Region Market Value (US$ Million) Analysis By End User, 2018 to 2033

Table 29: West Region Market Value (US$ Million) Analysis By Sales Channel, 2018 to 2033

Table 30: West Region Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Table 31: South East Region Market Value (United States$ Million) Analysis By Country, 2018 to 2033

Table 32: South East Region Market Value (United States$ Million) Analysis By Country, 2018 to 2033

Table 33: South East Region Market Value (United States$ Million) Analysis By Service Type, 2018 to 2033

Table 34: South East Region Market Value (United States$ Million) Analysis By Service Type, 2018 to 2033

Table 35: South East Region Market Value (United States$ Million) Analysis By Application, 2018 to 2033

Table 36: South East Region Market Value (United States$ Million) Analysis By Application, 2018 to 2033

Table 37: South East Region Market Value (United States$ Million) Analysis By End User, 2018 to 2033

Table 38: South East Region Market Value (United States$ Million) Analysis By End User, 2018 to 2033

Table 39: South East Region Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Table 40: South East Region Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Table 41: South West Region Market Value (United States$ Million) Analysis By Country, 2018 to 2033

Table 42: South West Region Market Value (United States$ Million) Analysis By Country, 2018 to 2033

Table 43: South West Region Market Value (United States$ Million) Analysis By Service Type, 2018 to 2033

Table 44: South West Region Foundation Repair Service Market Value (United States$ Million) Analysis By Service Type, 2018 to 2033

Table 45: South West Region Market Value (United States$ Million) Analysis By Application, 2018 to 2033

Table 46: South West Region Foundation Repair Service Market Value (United States$ Million) Analysis By Application, 2018 to 2033

Table 47: South West Region Market Value (United States$ Million) Analysis By End User, 2018 to 2033

Table 48: South West Region Market Value (United States$ Million) Analysis By End User, 2018 to 2033

Table 49: South West Region Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Table 50: South West Region Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Table 51: Mid-West Region Market Value (United States$ Million) Analysis By Country, 2018 to 2033

Table 52: Mid-West Region Foundation Repair Service Market Value (United States$ Million) Analysis By Country, 2018 to 2033

Table 53: Mid-West Region Market Value (United States$ Million) Analysis By Service Type, 2018 to 2033

Table 54: Mid-West Region Market Value (United States$ Million) Analysis By Service Type, 2018 to 2033

Table 55: Mid-West Region Market Value (United States$ Million) Analysis By Application, 2018 to 2033

Table 56: Mid-West Region Market Value (United States$ Million) Analysis By Application, 2018 to 2033

Table 57: Mid-West Region Market Value (United States$ Million) Analysis By End User, 2018 to 2033

Table 58: Mid-West Region Market Value (United States$ Million) Analysis By End User, 2018 to 2033

Table 59: Mid-West Region Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Table 60: Mid-West Region Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Table 61: North East Market Value (United States$ Million) Analysis By Country, 2018 to 2033

Table 62: North East Market Value (United States$ Million) Analysis By Country, 2018 to 2033

Table 63: North East Market Value (United States$ Million) Analysis By Service Type, 2018 to 2033

Table 64: North East Market Value (United States$ Million) Analysis By Service Type, 2018 to 2033

Table 65: North East Market Value (United States$ Million) Analysis By Application, 2018 to 2033

Table 66: North East Market Value (United States$ Million) Analysis By Application, 2018 to 2033

Table 67: North East Market Value (United States$ Million) Analysis By End User, 2018 to 2033

Table 68: North East Market Value (United States$ Million) Analysis By End User, 2018 to 2033

Table 69: North East Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Table 70: North East Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Table 71: Market Value (United States$ Million) Analysis By Country, 2018 to 2033

Table 72: Market Value (United States$ Million) Analysis By Country, 2018 to 2033

Table 73: Market Value (United States$ Million) Analysis By Service Type, 2018 to 2033

Table 74: Market Value (United States$ Million) Analysis By Service Type, 2018 to 2033

Table 75: Market Value (United States$ Million) Analysis By Application, 2018 to 2033

Table 76: Market Value (United States$ Million) Analysis By Application, 2018 to 2033

Table 77: Market Value (United States$ Million) Analysis By End User, 2018 to 2033

Table 78: Market Value (United States$ Million) Analysis By End User, 2018 to 2033

Table 79: Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Table 80: Market Value (United States$ Million) Analysis By Sales Channel, 2018 to 2033

Figure 01: Market Value (US$ Million) and Volume (Units) Analysis, 2018 to 2022

Figure 02: Market Value (US$ Million) and Volume (Units) Forecast, 2023 to 2033

Figure 03: Market Value (US$ Million) Analysis, 2018 to 2022

Figure 04: Market Value (US$ Million) Forecast, 2023 to 2033

Figure 05: Market Absolute $ Opportunity Value (US$ Million), 2023 to 2033

Figure 06: Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Figure 07: Market Volume (Units) Analysis By Service Type, 2018 to 2033

Figure 08: Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 09: Market Attractiveness By Service Type, 2023 to 2033

Figure 10: Market Value (US$ Million) Analysis By Application, 2018 to 2033

Figure 11: Market Volume (Units) Analysis By Application, 2018 to 2033

Figure 12: Market Y-o-Y Growth (%) Projections, By Application, 2023 to 2033

Figure 13: Market Attractiveness By Application, 2023 to 2033

Figure 14: Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 15: Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 16: Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 17: Market Attractiveness By End User, 2023 to 2033

Figure 18: Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 19: Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 20: Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 21: Market Attractiveness By Country, 2023 to 2033

Figure 22: Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Figure 23: Market Volume (Units) Analysis By Service Type, 2018 to 2033

Figure 24: Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 25: Market Attractiveness By Service Type, 2023 to 2033

Figure 26: Market Value (US$ Million) Analysis By Application, 2018 to 2033

Figure 27: Market Volume (Units) Analysis By Application, 2018 to 2033

Figure 28: Market Y-o-Y Growth (%) Projections, By Application, 2023 to 2033

Figure 29: Market Attractiveness By Application, 2023 to 2033

Figure 30: Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 31: Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 32: Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 33: Market Attractiveness By End User, 2023 to 2033

Figure 34: Market Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 35: Market Volume (Units) Analysis By Region, 2018 to 2033

Figure 36: Market Y-o-Y Growth (%) Projections, By Region, 2023 to 2033

Figure 37: Market Attractiveness By Region, 2023 to 2033

Figure 38: West Region Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Figure 39: West Region Market Volume (Units) Analysis By Service Type, 2018 to 2033

Figure 40: West Region Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 41: West Region Market Attractiveness By Service Type, 2023 to 2033

Figure 42: West Region Market Value (US$ Million) Analysis By Application, 2018 to 2033

Figure 43: West Region Market Volume (Units) Analysis By Application, 2018 to 2033

Figure 44: West Region Market Y-o-Y Growth (%) Projections, By Application, 2023 to 2033

Figure 45: West Region Market Attractiveness By Application, 2023 to 2033

Figure 46: West Region Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 47: West Region Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 48: West Region Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 49: West Region Market Attractiveness By End User, 2023 to 2033

Figure 50: South East Region Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Figure 51: South East Region Market Volume (Units) Analysis By Service Type, 2018 to 2033

Figure 52: South East Region Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 53: South East Region Market Attractiveness By Service Type, 2023 to 2033

Figure 54: South East Region Market Value (US$ Million) Analysis By Application, 2018 to 2033

Figure 55: South East Region Market Volume (Units) Analysis By Application, 2018 to 2033

Figure 56: South East Region Market Y-o-Y Growth (%) Projections, By Application, 2023 to 2033

Figure 57: South East Region Market Attractiveness By Application, 2023 to 2033

Figure 58: South East Region Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 59: South East Region Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 60: South East Region Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 61: South East Region Market Attractiveness By End User, 2023 to 2033

Figure 62: South West Region Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Figure 63: South West Region Market Volume (Units) Analysis By Service Type, 2018 to 2033

Figure 64: South West Region Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 65: South West Region Market Attractiveness By Service Type, 2023 to 2033

Figure 66: South West Region Market Value (US$ Million) Analysis By Application, 2018 to 2033

Figure 67: South West Region Market Volume (Units) Analysis By Application, 2018 to 2033

Figure 68: South West Region Market Y-o-Y Growth (%) Projections, By Application, 2023 to 2033

Figure 69: South West Region Market Attractiveness By Application, 2023 to 2033

Figure 70: South West Region Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 71: South West Region Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 72: South West Region Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 73: South West Region Market Attractiveness By End User, 2023 to 2033

Figure 74: Mid-West Region Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Figure 75: Mid-West Region Market Volume (Units) Analysis By Service Type, 2018 to 2033

Figure 76: Mid-West Region Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 77: Mid-West Region Market Attractiveness By Service Type, 2023 to 2033

Figure 78: Mid-West Region Market Value (US$ Million) Analysis By Application, 2018 to 2033

Figure 79: Mid-West Region Market Volume (Units) Analysis By Application, 2018 to 2033

Figure 80: Mid-West Region Market Y-o-Y Growth (%) Projections, By Application, 2023 to 2033

Figure 81: Mid-West Region Market Attractiveness By Application, 2023 to 2033

Figure 82: Mid-West Region Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 83: Mid-West Region Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 84: Mid-West Region Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 85: Mid-West Region Market Attractiveness By End User, 2023 to 2033

Figure 86: North East Market Value (US$ Million) Analysis By Service Type, 2018 to 2033

Figure 87: North East Market Volume (Units) Analysis By Service Type, 2018 to 2033

Figure 88: North East Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 89: North East Market Attractiveness By Service Type, 2023 to 2033

Figure 90: North East Market Value (US$ Million) Analysis By Application, 2018 to 2033

Figure 91: North East Market Volume (Units) Analysis By Application, 2018 to 2033

Figure 92: North East Market Y-o-Y Growth (%) Projections, By Application, 2023 to 2033

Figure 93: North East Market Attractiveness By Application, 2023 to 2033

Figure 94: North East Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 95: North East Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 96: North East Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 97: North East Market Attractiveness By End User, 2023 to 2033

Figure 98: Market Value (United States$ Million) Analysis By Service Type, 2018 to 2033

Figure 99: Market Volume (Units) Analysis By Service Type, 2018 to 2033

Figure 100: Market Y-o-Y Growth (%) Projections, By Service Type, 2023 to 2033

Figure 101: Market Attractiveness By Service Type, 2023 to 2033

Figure 102: Market Value (US$ Million) Analysis By Application, 2018 to 2033

Figure 103: Market Volume (Units) Analysis By Application, 2018 to 2033

Figure 104: Market Y-o-Y Growth (%) Projections, By Application, 2023 to 2033

Figure 105: Market Attractiveness By Application, 2023 to 2033

Figure 106: Market Value (United States$ Million) Analysis By End User, 2018 to 2033

Figure 107: Market Volume (Units) Analysis By End User, 2018 to 2033

Figure 108: Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 109: Market Attractiveness By End User, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA