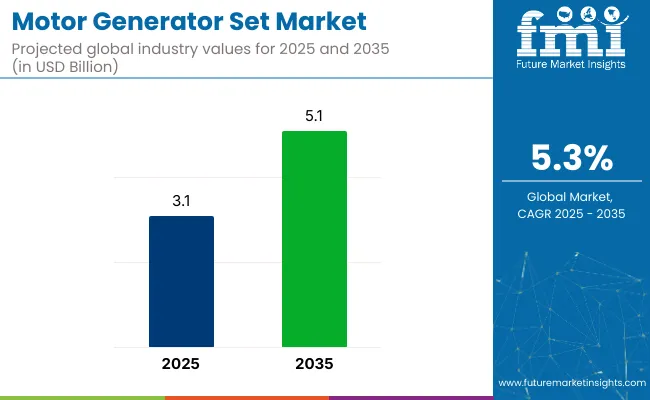

The global motor generator set market is valued at USD 3.1 billion in 2025 and is slated to be worth USD 5.1 billion by 2035, reflecting a CAGR of 5.3%. Market expansion will be driven by increasing demand for stable and uninterrupted power supply across industrial sector, healthcare industry, and data centers.

The increasing adoption of hybrid energy solutions, regulatory pressure to reduce emissions, and the need for backup power in renewable energy integrations are shaping the market. DC to AC motor generator sets will play a critical role in voltage stabilization, especially in precision manufacturing and data processing sectors. Smart grid expansion and microgrid development are expected to support continued adoption globally.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 3.1 billion |

| Projected Value (2035) | USD 5.1 billion |

| CAGR (2025 to 2035) | 5.3% |

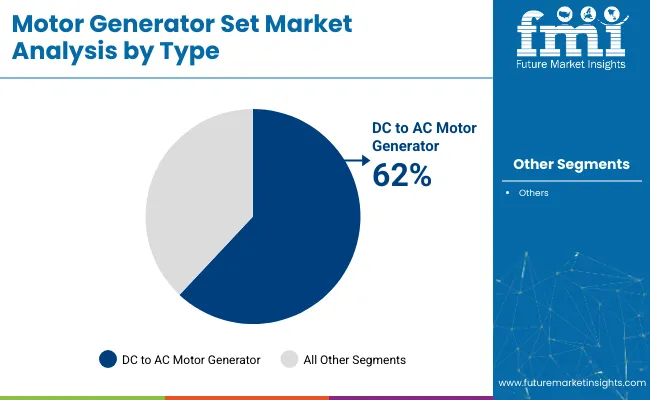

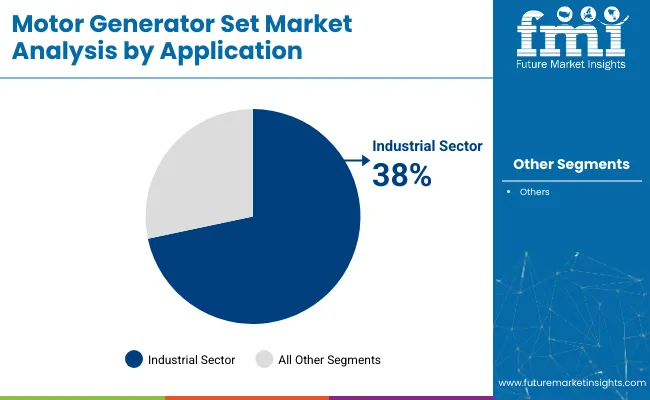

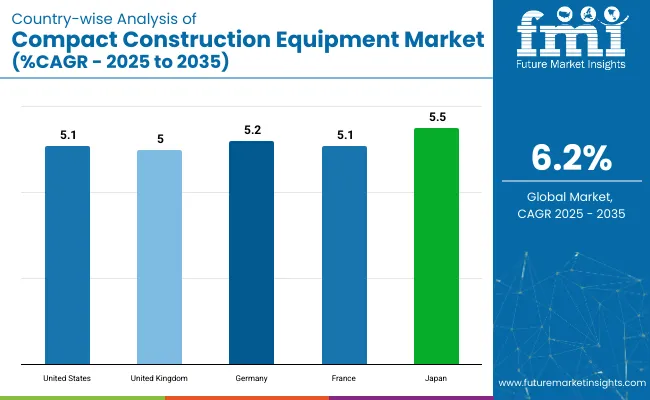

The USA is projected to retain the largest market share through 2035, driven by expanding demand in data centers, healthcare, and smart infrastructure. A CAGR of 5.5% is estimated to be registered by Japan, driven by the demand for backup power solutions for high-tech industrial operations. DC to AC systems account for the highest segment share of 62%, while the industrial sector by application segment holds 38% of the market share in 2025.

Profitability is being experienced by Caterpillar and Mitsubishi Electric due to increasing demand for hybrid and fuel-efficient generators. These companies benefit from their focus on digital monitoring and compact designs. Challenges may be faced by companies reliant solely on traditional AC to DC generators due to declining adoption in conventional industries and growing regulatory hurdles. European manufacturers face pressure to comply with stringent emission norms, leading to higher operational costs.

Looking forward, investments in hybrid motor generator systems that combine solar, wind, and diesel backup will shape the next wave of innovations. Integration with IoT and AI for predictive maintenance and efficiency monitoring is expected to gain traction. Emerging markets in Africa and Southeast Asia will offer new growth opportunities due to unreliable grids and ongoing industrialization. Manufacturers who focus on modular, low-emission systems are poised to succeed over the forecast period.

The global motor generator set market is segmented by type into DC to AC motor generator set and AC to DC motor generator set. It is segmented by application into industrial, automotive industry, electrical and electronic industry, energy/oil/power industries, metal & mineral industry, and by region (North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa).

DC to AC motor generator sets are expected to dominate the global market due to their essential role in renewable energy integration, industrial automation, and backup systems. These sets efficiently convert DC power, often generated by solar and wind sources, into usable AC power for grid and facility use. Their compatibility with modern smart grid systems and critical infrastructure applications like data centers and telecom networks is projected to drive their share to 62% by 2035.

The industrial sector is projected to lead all applications in the motor generator set market, accounting for 38% of the market share by 2035. This dominance is attributed to the sector's dependence on stable and continuous power supply for operations such as mining, manufacturing, and heavy-duty automation. A crucial role in mitigating voltage fluctuations is played by generator sets, ensuring equipment safety, minimizing downtime, and making them indispensable in sectors focused on operational efficiency and precision manufacturing.

Recent Trends in the Motor Generator Set Market

Key Challenges Facing the Motor Generator Set Market

The motor generator set market in the USA is expected to expand at a CAGR of 5.1% from 2025 to 2035. Growth is being fueled by the rising demand for stable power in data centers, healthcare facilities, and advanced manufacturing units. Adoption is being further boosted by strong federal support for energy resilience and disaster preparedness. Hybrid technologies are gaining popularity to ensure compliance with emission regulations and operational efficiency goals.

The motor generator set market in the UK is anticipated to grow at a CAGR of 5.0% between 2025 and 2035. Increased investments in digital infrastructure, particularly data centers and smart buildings, are raising demand for stable power solutions. Environmental regulations are pushing the adoption of hybrid and low-emission generator sets. The UK’s transition to renewables has also created demand for grid stabilization tools like motor generator sets.

The motor generator set market in Germany is projected to witness a CAGR of 5.2% during the forecast period of 2025 to 2035. The country’s strong manufacturing base and leadership in industrial automation support generator set deployment. Adoption is being reinforced by technological innovation, especially through the integration of smart monitoring and fuel efficiency. Government-driven energy transition policies are also increasing hybrid and renewable-compatible generator demand.

The motor generator set industry in France is forecast to grow at a CAGR of 5.1% between 2025 and 2035. The country’s focus on energy diversification and infrastructure modernization supports steady demand. The transport and telecommunication sectors are key adopters of backup generator sets. Hybrid generators are also gaining preference in sectors affected by energy transition policies.

The Japanese motor generator set market is set to grow at 5.5% CAGR from 2025 to 2035. Frequent natural disasters and high-tech industrial operations necessitate resilient backup power solutions. The country is also advancing hybrid and low-emission technologies aligned with its carbon neutrality goals. Investment in smart factories and disaster-resilient infrastructure is further supporting market expansion.

The motor generator set market is moderately consolidated, with a mix of global leaders and regional players shaping the competitive landscape. Prominent companies such as Caterpillar Inc., Cummins Inc., Mitsubishi Heavy Industries, ABB Ltd., and General Electric collectively hold a significant share.

These firms compete aggressively based on technology innovation, hybrid system integration, fuel efficiency, emissions compliance, and smart monitoring solutions. The market edge is being maintained through strategic expansions into emerging markets and continuous investment in R&D.

Companies focus on developing hybrid and low-emission generator sets, aligning with global carbon reduction goals. They integrate IoT-based predictive maintenance, making digitalization a major theme and AI-driven diagnostics into their generator systems.

Firms like Cummins and Mitsubishi are expanding manufacturing footprints in Asia Pacific, while Caterpillar is pushing localized service networks to strengthen aftermarket support. The aim is to reduce operational costs and provide resilience in power supply for critical sectors like data centers, oil & gas, and healthcare.

Recent Motor Generator Set Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.1 billion |

| Projected Market Size (2035) | USD 5.1 billion |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions /Volume in units |

| By Type | DC to AC Motor Generator Set, AC to DC Motor Generator Set |

| By Application | Industrial, Automotive Industry, Electrical and Electronic Industry, Energy/Oil/Power Industries, Metal & Mineral Industry |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kohler Co., Mitsubishi Heavy Industries, ABB Ltd., Siemens AG, General Electric, Toshiba Corporation, Kirloskar Electric Company |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

In terms of Type, the industry is divided into DC to AC Motor Generator Set, AC to DC Motor Generator Set

In terms of Application, the industry is divided into Industrial, Automotive Industry, Electrical and Electronic Industry, Energy/Oil/Power Industries, Metal & Mineral Industry

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global market is valued at USD 3.1 billion in 2025.

By 2035, the motor generator set market is projected to reach USD 5.1 billion.

The market is anticipated to grow at a CAGR of 5.3% during the forecast period.

DC to AC motor generator sets are expected to lead the market with a projected 62% share by 2035.

Top players include Caterpillar Inc., Cummins Inc., ABB Ltd., General Electric, and Mitsubishi Heavy Industries.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Motorhome Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorized Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Motorized Pool Tube Market Size and Share Forecast Outlook 2025 to 2035

Motorized Decoiler Machine Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Chain Market Analysis - Size, Share, and Forecast 2025 to 2035

Motor Protector Market Size, Growth, and Forecast for 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motor Control IC Market by Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Motor Testing Equipment Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA