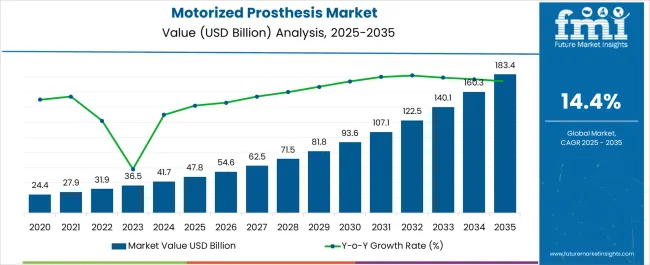

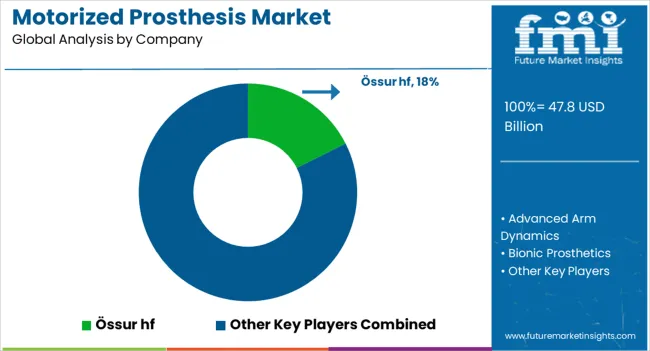

The Motorized Prosthesis Market is estimated to be valued at USD 47.8 billion in 2025 and is projected to reach USD 183.4 billion by 2035, registering a compound annual growth rate (CAGR) of 14.4% over the forecast period.

| Metric | Value |

|---|---|

| Motorized Prosthesis Market Estimated Value in (2025E) | USD 47.8 billion |

| Motorized Prosthesis Market Forecast Value in (2035F) | USD 183.4 billion |

| Forecast CAGR (2025 to 2035) | 14.4% |

The motorized prosthesis market is expanding steadily, driven by technological breakthroughs in bionics, growing rehabilitation needs among aging and amputee populations, and rising investment in personalized healthcare. Greater awareness and diagnosis of limb loss, particularly among adults, has accelerated the demand for advanced prosthetic solutions that restore functional mobility and improve quality of life.

Innovations in electromyography (EMG) sensors, AI-assisted limb control, and integration with smart wearable ecosystems are enhancing patient outcomes and adoption rates. Public health systems and private insurers are increasingly covering high-performance prosthetics, further improving access.

Simultaneously, partnerships between medtech firms and orthopedic networks are reshaping service models to deliver specialized fitting and post-prosthesis care. In the coming years, the market is expected to benefit from increasing digitization in orthopedic workflows, improved material durability, and broader global access through localized manufacturing and assistive healthcare initiatives.

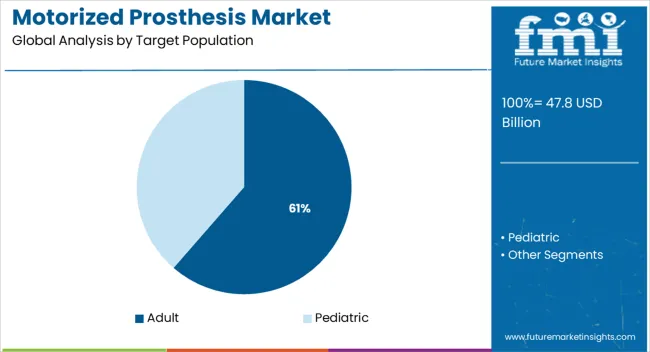

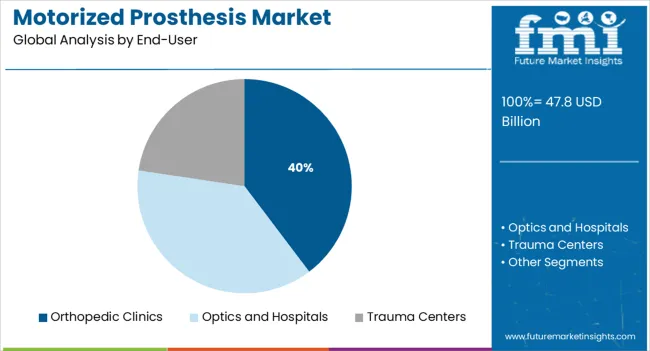

The market is segmented by Target Population and End-User and region. By Target Population, the market is divided into Adult and Pediatric. In terms of End-User, the market is classified into Orthopedic Clinics, Optics and Hospitals, and Trauma Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Adults are expected to account for 61.4% of the total market revenue in 2025, making them the dominant target population in the motorized prosthesis sector. This lead is being driven by higher incidence rates of limb loss in adult populations due to trauma, vascular diseases, and occupational hazards.

As adult patients often require devices tailored to more intensive daily activity and mobility demands, they are more likely to benefit from the enhanced strength, precision, and responsiveness offered by motorized prosthetics. The availability of more advanced fitting protocols and customizable prosthesis programs targeted at adults has further expanded adoption.

Additionally, rehabilitation professionals and clinicians are focusing on adult-centric mobility restoration as part of broader return-to-work and lifestyle reactivation strategies, reinforcing sustained demand in this segment.

Orthopedic clinics are projected to hold 39.7% of the overall market share in 2025, emerging as the leading end-user category. This segment’s leadership is being reinforced by its direct role in prosthesis evaluation, customization, and patient training.

Clinics are increasingly integrating advanced diagnostic systems and digital modeling software to enhance the precision of prosthetic fitting and improve post-operative care. The concentration of skilled prosthetists and therapists in specialized orthopedic facilities has further driven patient trust and preference.

As motorized prostheses become more technically sophisticated, the need for clinical guidance and iterative adjustments has increased, positioning orthopedic clinics as critical hubs for comprehensive prosthetic rehabilitation. The shift toward value-based care and long-term patient engagement continues to support their role as the primary channel for motorized prosthesis delivery.

Drivers:

A global study on motorized prosthesis suggests that a rising healthcare budget along with a higher number of research and development programs regarding prosthesis parts, deployment, and their development have fuelled the sales of motorized prosthesis objects. Another factor driving the motorized prosthesis market is the government's investment and interest in building a strong healthcare system that can help people with disabilities.

Restraints:

Due to batteries and motors, motorized prosthetics are likely to be heavier when compared with a body-powered prosthesis and therefore restrain the growth of the motorized prosthetics market. Moreover, the presence of batteries and motors makes them heavier than a body-powered prosthesis, further hampering the motorized prosthesis market growth.

The light bod-based prosthesis systems are only suitable for people who have strength in their core muscles. Motorized systems are designed for people whose muscle strength is low and who are recovering slowly.

Dominating the market space, North America is likely to hold the largest share of 49.5% in 2025. There are several factors driving the growth of the motorized prosthesis market. Factors such as technological advancements and rising research and development expenditures to support affected patients are driving the growth of the motorized prosthesis market.

NGOs working for the betterment of differently-abled people also consume a good amount of the global motorized prosthesis market. Increasing healthcare infrastructure, along with the growth in IT infrastructure, is also driving motorized prosthesis market growth.

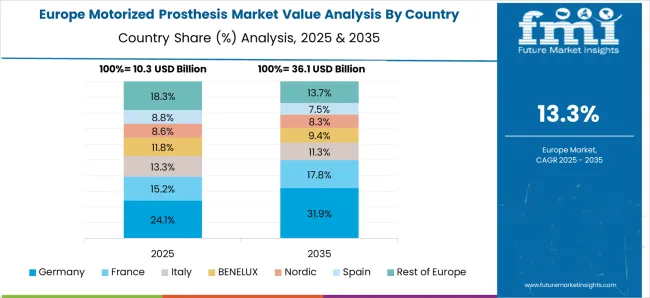

In Western Europe, healthcare infrastructure and access to advanced technology are more developed, contributing to a market share of 29.7% in 2025. Furthermore, government support, favorable reimbursement policies, and a high disposable income are driving the motorized prosthesis market. New healthcare policies covering prosthesis equipment and their fulfillment in the state healthcare units have fueled the sales of motorized prosthesis systems.

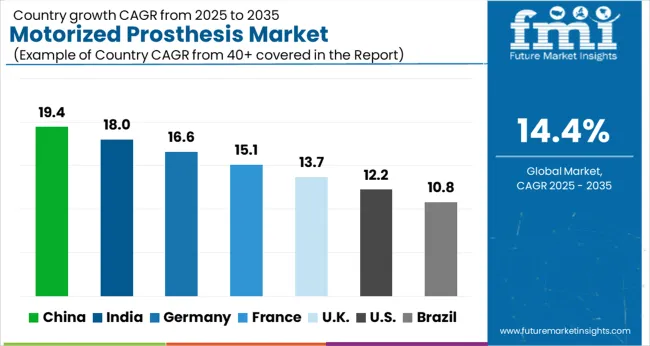

The market in Asia-Pacific is forecast to grow at the fastest rate due to consistent technological advancements and increased Research and Development investment by both private and public organizations.

The motorized prosthesis market survey explains that with large companies in the industry and ongoing Research and Development, the prosthetic limb market has become highly competitive. Various companies make both upper and lower-extremity prosthetics. An amputee can hold objects much more efficiently with Steeper's thermoelectric system, which includes an easy-to-use Myo Kinisi hand along with an auto grip function:

Due to the higher number of big healthcare giants trying their luck in the prosthetics market, the motorized prosthesis market share is highly competitive. Key manufacturers are coming up with multiple solutions for differently abled people. From electric prostheses to body-powered prosthetics and electric arm prostheses are the latest by-products of innovation-driven Research and Development programs.

Key Market Developments:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 14.4% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments Covered | Target Population, End-User, and Region. |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East Africa; ASEAN; South Asia; Rest of Asia; Australia; and New Zealand. |

| Country scope | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, United Arab Emirates(UAE), Iran, South Africa. |

| Key companies profiled | Advanced Arm Dynamics; Bionic Prosthetics and Orthotics; BionX Medical Technologies, Inc.; Faulhaber Group; Freedom Innovations; LLC; Mobius Bionics LLC; Össur hf.; Otto Bock HealthCare GmbH; Sensars Neuroprosthteics,; Touch Bionics Inc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global motorized prosthesis market is estimated to be valued at USD 47.8 billion in 2025.

The market size for the motorized prosthesis market is projected to reach USD 183.4 billion by 2035.

The motorized prosthesis market is expected to grow at a 14.4% CAGR between 2025 and 2035.

The key product types in motorized prosthesis market are adult and pediatric.

In terms of end-user, orthopedic clinics segment to command 39.7% share in the motorized prosthesis market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Motorized Pool Tube Market Size and Share Forecast Outlook 2025 to 2035

Motorized Decoiler Machine Market Growth - Trends & Forecast 2025 to 2035

Non-Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Endoprosthesis Market Analysis – Growth & Forecast 2025 to 2035

Penile Prosthesis Market

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

ePTFE Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Transcatheter Bioprosthesis Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA