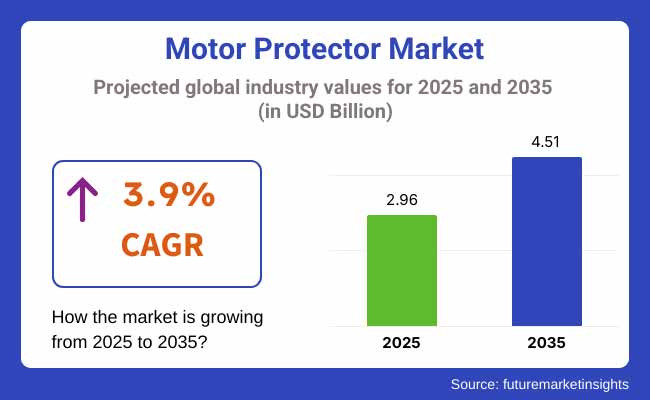

The motor protector market is projected to expand from USD 2.96 billion in 2025 to USD 4.51 billion by 2035, registering a CAGR of 3.9% during the forecast period. China remains the most lucrative country for motor protectors owing to its large industrial base and investments in smart factories, while the United States is projected to be the fastest-growing, with a CAGR of 5.5% between 2025 and 2035, supported by modernization in manufacturing and energy systems.

The market is witnessing strong demand from industries such as water and wastewater treatment, oil and gas, and manufacturing. Growing concerns about equipment safety, the rise of Industry 4.0, and increased investment in predictive maintenance are fueling adoption.

However, high upfront costs for smart motor protection systems and limited awareness among small manufacturers remain key constraints. The integration of IoT-based fault detection, energy-saving capabilities, and compact multi-functional devices continues to shape innovation.

Looking ahead, the market will benefit from broader adoption of AI-driven and cloud-connected motor protectors. Countries in Asia-Pacific and Latin America are expected to drive the next wave of industrial growth, requiring scalable and compliant protection systems. As regulations tighten globally and energy conservation becomes a strategic priority, demand for advanced, predictive, and regulation-compliant motor protection technologies will accelerate.

Motor protection circuit breakers (MPCBs) dominate the market in 2025 due to their robust overload and short-circuit protection, compact design, and wide use in industrial applications. Overload relays continue to be preferred in traditional low-voltage systems due to simplicity and cost-effectiveness. However, smart motor protectors are projected to witness the fastest growth, supported by the rise of Industry 4.0 and demand for remote diagnostics, energy monitoring, and predictive failure alerts.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Smart Motor Protectors | 6.4% |

In 2025, the 1-5 HP segment holds the largest share, driven by its broad applicability across pumps, compressors, HVAC units, and conveyor systems. This segment benefits from moderate cost, high usage, and energy-saving upgrades. While protectors below 0.5 HP remain common in residential and small commercial applications, the fastest growth is anticipated in the 1-5 HP range, due to higher adoption across SMEs and infrastructure modernization projects.

| Power Rating | CAGR (2025 to 2035) |

|---|---|

| 1-5 HP | 4.5% |

Industrial end use dominates in value terms due to high motor density in manufacturing, mining, and oil & gas. The commercial segment is growing steadily with increased HVAC usage in buildings. However, the utilities segment is expected to witness the fastest growth, driven by power grid modernization, smart water management, and the integration of electric pumping stations. Protectors in these applications must comply with grid safety standards and handle variable loads.

| End Use Segment | CAGR (2025 to 2035) |

|---|---|

| Utilities | 5.1% |

A recent FMI survey with influential stakeholders across the motor protector industry provided precious information on the current trends, issues, and emerging opportunities for the industry.

With increasing perceptions of greater participants from manufacturing enterprises, consumers, and vendors, motor protection requirement is developing with rapid speed at the industrial level of automation.

More than 70% of the participants generally discovered that reliability and energy efficiency were the top two driving determinants propelling investment in future-generation motor protection technology.

In addition, the survey highlighted that businesses are aggressively seeking products with the ability to carry out real-time monitoring and predictive maintenance in order to reduce downtime. Growth in regulatory compliance needs was also mentioned by stakeholders as a significant growth driver for the industry. In addition, emerging industries respondents mentioned the growing uptake of motor protectors in small and medium-sized businesses (SMEs), as industrial growth continues to take root in developing economies.

In the future, industry leaders believe that motor protection technologies will develop further, specifically with the combination of IoT-driven solutions. More than 80% of them are convinced that cloud-based analysis and AI-led diagnostics enabled in smart motor protectors will reach widespread usage over the next couple of years.

As industries want to achieve better efficiency and lesser maintenance expenses, manufacturers will prioritize the creation of user-friendly, scalable, and affordable motor protection solutions.

Government regulations and mandatory certifications significantly influence the motor protector industry across various countries. Below is a summary of these impacts by country:

| Country/Region | Government Regulations and Mandatory Certifications |

|---|---|

| European Union (EU) | Products must comply with the CE marking, indicating adherence to EU safety, health, and environmental protection requirements. Additionally, the E-Mark certification is mandatory for motor vehicles and their components, ensuring conformity with EU directives. |

| United States | Motor vehicles and related components must meet the Federal Motor Vehicle Safety Standards (FMVSS) set by the National Highway Traffic Safety Administration (NHTSA). Compliance ensures that vehicles and equipment meet safety performance requirements. |

| China | The China Compulsory Certification (CCC) is required for specific products, including motor vehicle components, to ensure compliance with safety and quality standards before entering the Chinese industry. |

| Brazil | Products must obtain certification from the National Institute of Metrology, Standardization, and Industrial Quality (INMETRO), ensuring compliance with Brazilian safety and performance standards. |

| Eurasian Economic Union (EAEU) (including Russia, Belarus, Kazakhstan, Armenia, and Kyrgyzstan) | Products must comply with the Eurasian Conformity (EAC) mark, indicating adherence to unified safety and quality standards across member countries. |

These regulations and certifications are crucial for manufacturers to ensure product safety, quality, and industry access in the respective countries.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Rising adoption of electric motors in manufacturing, increasing regulatory pressure on energy efficiency, and growing need for equipment longevity. | Further industrial automation, integration of IoT-based predictive maintenance, and stringent energy conservation mandates will drive demand. |

| Introduction of advanced motor protection solutions, including real-time monitoring and remote diagnostics. Initial adoption of AI-based protection systems. | Widespread adoption of smart motor protectors with cloud analytics, AI-driven fault detection, and increased use of wireless monitoring solutions. |

| High demand in North America and Europe due to stringent safety regulations. Rapid industrialization in China, India, and Brazil increased adoption. | Emerging economies in Asia-Pacific and Latin America will drive the next growth phase, with governments investing in energy-efficient industrial infrastructure. |

| Supply chain disruptions due to the COVID-19 pandemic, high costs of advanced protection systems, and lack of awareness in small industries. | Initial costs of IoT-enabled motor protectors may slow adoption in price-sensitive industries, but declining hardware costs and regulatory pushes will drive long-term adoption. |

| Established players expanded product portfolios through mergers and acquisitions. Entry of new players offering cost-effective solutions. | Industry consolidation will continue, with major players focusing on innovation, AI-driven analytics, and expansion in untapped industries. |

| Countries | CAGR |

|---|---|

| USA | 5.5% |

| UK | 3.5% |

| France | 4.0% |

| Italy | 3.8% |

| Germany | 3.5% |

| South Korea | 5.0% |

| Japan | 4.2% |

| China | 6.0% |

The USA motor protection industry is anticipated to expand at a CAGR of around 5.5% during the period 2025 to 2035.

This is driven by the strong industrial backbone of the nation, comprising sectors like manufacturing, oil and gas, and water treatment plants.

The growing utilization of automation and intelligent technologies within these sectors calls for sophisticated motor protection solutions in order to support operational efficiency as well as the longevity of equipment.

Furthermore, the strict energy efficiency and safety regulations imposed by authorities such as the Occupational Safety and Health Administration (OSHA) and the Department of Energy (DOE) fuel demand for compliant motor protection devices.

The transition towards renewable energy and the upgrading of the power grid are also pushing the industry further, as new infrastructure needs robust motor protection mechanisms to sustain them.

In the UK, the industry for motor protection is expected to expand at a CAGR of approximately 3.5% by 2035.

The UK's focus on energy efficiency and sustainability has contributed to the rising investments in the modernization of industrial equipment, including the incorporation of advanced motor protection systems.

Water and wastewater management, food and beverage processing, and infrastructure development are among the leading sectors driving growth.

The government's initiatives in carbon emission reduction and the development of green technologies further fuel the use of energy-efficient motor protection solutions.

In addition, the UK's leadership in Industry 4.0 initiatives fosters the adoption of smart motor protectors with real-time monitoring and predictive maintenance features, increasing operational reliability.

The French motor protection industry is expected to expand at a CAGR of around 4.0% during the period from 2025 to 2035.

The robust manufacturing sector in the country, such as automotive, aerospace, and energy production, fuels the industry for efficient motor protection solutions.

Environmental consciousness and energy saving in France harmonize with embracing innovative motor protection technologies that lower energy consumption and operating expenses. Government programs that encourage industrial modernization and digitalization further augment the incorporation of smart motor protection systems, further driving the industry's steady expansion.

The motor protection industry in Germany is likely to expand at a CAGR of approximately 3.5% during the period until 2035. With its dominant role in global industrial manufacturing and engineering, Germany's widespread utilization of electric motors across different industries makes it a prerequisite for having effective motor protection systems.

The nation's emphasis on Industry 4.0 and the adoption of state-of-the-art technologies in manufacturing processes fuel the use of smart motor protectors. Furthermore, Germany's regulatory requirements for energy efficiency and safety force industries to invest in adaptive motor protection devices.

The change in the automotive industry towards electric cars also throws up new challenges and opportunities for motor protection solutions for production units as well as charging stations.

Italy's motor protection industry is also expected to advance at a CAGR of about 3.8% between 2025 and 2035. The industrial diversity in the nation, with sectors such as textiles, machinery, and food processing, is heavily dependent on electric motors, thereby fueling the demand for efficient motor protection solutions.

Italy's emphasis on increasing industrial efficiency and competitiveness supports the implementation of more sophisticated motor protection technologies.

Government subsidies for energy-efficient replacements and the upgrading of industrial machinery also drive industry expansion. The growing adoption of automation and smart manufacturing techniques also fuels the growing demand for intelligent motor protection systems.

South Korea's motor protection industry is expected to develop at a CAGR of about 5.0% between 2025 and 2035. South Korea's advanced manufacturing industry, especially in the electronics, automotive, and shipbuilding sectors, is the driver for motor protection solutions.

South Korea's emphasis on technological advancements and smart factory programs encourages the use of smart motor protection systems that improve efficiency and predictive maintenance.

Government initiatives favoring industrial automation and energy conservation further add to the growth of the industry, as companies want to maximize processes and minimize energy usage.

The Japanese motor protection industry is likely to expand at a CAGR of approximately 4.2% between 2025 and 2035. The nation's established industrial sector, with automotive production, robotics, and electronics, depends on effective motor protection products to ensure productivity and equipment durability.

Japan’s emphasis on automation and the creation of intelligent manufacturing systems fuels the use of sophisticated motor protection technologies. Also, Japan's high standards for quality and emphasis on energy efficiency fuel the implementation of motor protection devices that meet regulatory demands and enable environmentally friendly industrial operations.

China's motor protection industry is expected to expand at a CAGR of around 6.0% during the period of five years from 2025 to 2035. Being one of the world's biggest manufacturing centers, China's widespread application of electric motors in sectors like manufacturing, construction, and energy requires proper motor protection strategies.

The government's push to update industrial infrastructure, encourage energy efficiency, and adopt smart manufacturing practices fuels the need for sophisticated motor protection solutions.

Increasing urbanization and infrastructural development add to the strong growth of the industry, with new buildings necessitating dependable motor protection systems for maintaining continuity of operation and protection.

The international motor protector industry is driven by a variety of macroeconomic variables that include industrial development, energy policies, automation, and investment in infrastructure.

During industrial development and industrialization, the need for functional motor protection systems grows to reduce the likelihood of equipment failure and downtime. Emerging industries of Asia-Pacific and Latin America are experiencing major industrial growth, and this promotes greater utilization of motor protectors.

Regulations concerning energy efficiency are a industry growth driver. Countries across the globe are adopting more stringent efficiency levels, which are forcing industries to embrace next-generation motor protection devices that minimize power wastage and reduce running expenses. Furthermore, Industry 4.0 and IoT-based automation are forcing businesses to incorporate intelligent motor protectors with real-time monitoring and predictive maintenance features.

Nonetheless, supply chain interruptions, unstable raw material costs, and smart motor protectors' high up-front costs present challenges.

Irrespective of these challenges, continuous investments in infrastructure, green energy, and intelligent manufacturing will propel steady industry growth, which will make motor protection solutions a vital part of industrial development.

Expansion into Growth Industries

Rapid industrialization is being observed in developing economies in Southeast Asia, Latin America, and Africa. Stakeholders must concentrate on delivering cost-competitive, scalable motor protection solutions suited to these industries, which are price sensitive but have a robust industrial expansion.

Collaboration with regional distributors and EPC (Engineering, Procurement, and Construction) companies will facilitate a solid foothold.

Integration with Smart Manufacturing & Industry 4.0

The need for IoT-capable motor protectors is increasing as industries shift towards predictive maintenance and automated operations. Firms need to invest in cloud analytics and AI-based protection systems capable of offering real-time monitoring and failure prediction.

Strategic partnerships with automation leaders such as Rockwell Automation, Siemens, and Schneider Electric can help in fortifying smart motor protection product offerings.

Regulatory Compliance & Energy Efficiency Solutions

With tighter and tighter energy codes in industrys such as Europe and North America, motor protectors that meet the IEC 60947, UL 508, and NEMA standards will have a competitive advantage.

With respect to product type, the market is classified into contactors, overload relays, combination starters, and motor protection circuit breaker.

In terms of motor type, the market is divided into conventional motor and smart motor.

In terms of voltage type, the market is divided into low voltage, medium voltage, and high voltage

In terms of rated power, the market is divided into up to 75 Kw, 5 to 75 Kw, and above 75 Kw.

In terms of end-user, the segment is divided into oil and gas, agriculture, water and wastewater, infrastructure, metal and mining, food and beverages, and others.

In terms of region, the industry is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

Growing industrial automation, energy efficiency laws, and the demand for equipment reliability are major drivers.

Smart solutions provide real-time monitoring, predictive maintenance, and remote diagnostics, as opposed to traditional alternatives that simply offer standard overload and short-circuit protection.

Applications such as water and wastewater, oil and gas, manufacturing, and infrastructure depend heavily on these solutions to avoid motor failures and downtime.

The increasing popularity of IoT-enabled systems, cloud-based monitoring, and connectivity with renewable energy sources are influencing this development.

Conformity with energy efficiency standards as well as safety certifications like IEC and UL is compelling industries to enhance their motor protection systems.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Rated Power, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Rated Power, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by End User, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Rated Power, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Rated Power, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Rated Power, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Rated Power, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Rated Power, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Rated Power, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Rated Power, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Rated Power, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Rated Power, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Rated Power, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Rated Power, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Rated Power, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by End User, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Rated Power, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Rated Power, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Rated Power, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Rated Power, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Rated Power, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Rated Power, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Rated Power, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 21: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Rated Power, 2024 to 2034

Figure 23: Global Market Attractiveness by End User, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Rated Power, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Rated Power, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Rated Power, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Rated Power, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Rated Power, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 45: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Rated Power, 2024 to 2034

Figure 47: North America Market Attractiveness by End User, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Rated Power, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Rated Power, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Rated Power, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Rated Power, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Rated Power, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Rated Power, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Rated Power, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Rated Power, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Rated Power, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Rated Power, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Rated Power, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Rated Power, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Rated Power, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Rated Power, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Rated Power, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Rated Power, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Rated Power, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Rated Power, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Rated Power, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Rated Power, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Rated Power, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Rated Power, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Rated Power, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Rated Power, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Rated Power, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Rated Power, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Rated Power, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Rated Power, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Rated Power, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Rated Power, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Rated Power, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Rated Power, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Rated Power, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Rated Power, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Rated Power, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Rated Power, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Integrated Motor Protector Market Size and Share Forecast Outlook 2025 to 2035

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Motorhome Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorized Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Motorized Pool Tube Market Size and Share Forecast Outlook 2025 to 2035

Motor Generator Set Market Size, Growth, and Forecast 2025 to 2035

Motorized Decoiler Machine Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Chain Market Analysis - Size, Share, and Forecast 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motor Control IC Market by Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA