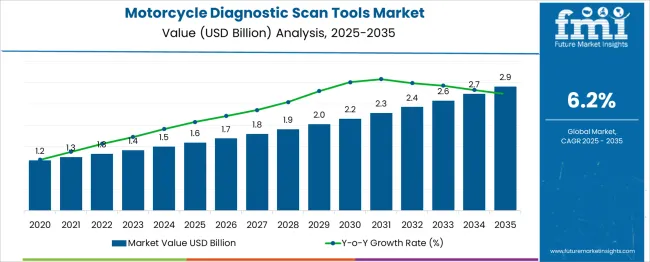

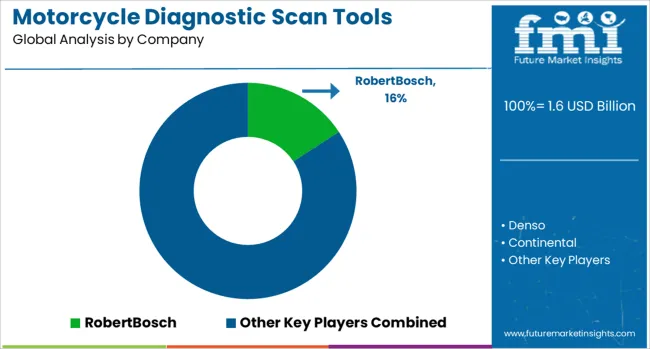

The Motorcycle Diagnostic Scan Tools Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The motorcycle diagnostic scan tools market is projected to create an absolute dollar opportunity of USD 1.3 billion over the forecast period at a CAGR of 6.2%. Phase-wise analysis reveals a balanced yet slightly back-loaded growth structure.

The first half (2025-2030) sees the market increase from USD 1.6 billion to 2.2 billion, adding USD 0.6 billion, which accounts for approximately 46% of the total incremental value. This stage is driven by rising adoption of electronic control units in motorcycles, regulatory mandates for emission compliance, and the growing need for diagnostic accuracy in premium and performance bikes. The second half (2030-2035) contributes USD 0.7 billion, or 54% of cumulative growth, reflecting intensified demand as connected motorcycles, IoT-based health monitoring, and electric two-wheelers become mainstream.

Annual absolute increments progress from USD 0.1 billion in early years to nearly USD 0.2 billion by the end of the forecast period, indicating sustained momentum supported by dealership service integration and aftermarket expansion. Manufacturers that invest in cloud-enabled diagnostic platforms, AI-driven fault prediction, and portable wireless scanners will capture the largest share of this back-weighted opportunity as motorcycle technology complexity continues to rise globally.

| Metric | Value |

|---|---|

| Motorcycle Diagnostic Scan Tools Market Estimated Value in (2025 E) | USD 1.6 billion |

| Motorcycle Diagnostic Scan Tools Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The motorcycle diagnostic scan tools segment accounts for 6–8 % of the overall automotive and motorcycle diagnostic equipment market, where passenger vehicle scan tools hold the dominant share. Within the motorcycle aftermarket tools and service equipment market, its share is 12–15 %, reflecting rising adoption of specialized scan tools by independent and franchise repairers focusing on two-wheeler diagnostics.

In the vehicle electronics and telematics tools market, which includes OBD readers, ECU programmers, and fleet tracking hardware, motorcycle scanners capture about 5–6 %, as car diagnostics and telematics solutions lead spending. The motorcycle maintenance and repair services market allocates roughly 3–4 % to diagnostic scan tools, since the majority of service revenue is derived from parts, labor, and scheduled maintenance rather than tool investment. In broader vehicle workshop automation systems, spanning lift control, alignment, and diagnostic installation, the share for motorcycle scan tools is modest at 2–3 %.

Though percentages remain small compared with car diagnostics, demand is growing due to increasingly complex ECUs, rising electronic fuel injection systems, and compliance with Euro 5 and Euro 6 emission protocols for motorcycles. Manufacturers are introducing Bluetooth-connected handheld scanners, OEM-specific firmware updates, and bi-directional testing capabilities to support professional workshops and enthusiast mechanics in accurate fault detection and system calibration.

As manufacturers incorporate more complex technologies such as ABS, ride-by-wire, traction control, and emission management systems, the need for advanced diagnostic solutions has become essential to ensure performance and compliance.

Regulatory shifts focused on emission standards and vehicle safety across both developed and emerging regions have also contributed to the market’s forward momentum. The shift toward preventive maintenance practices among service providers and individual users is promoting the use of diagnostic scan tools that offer real-time insights and efficient fault isolation.

In addition, the growth of multi-brand service workshops and aftermarket repair ecosystems is facilitating wider accessibility to these tools. The adoption of software-upgradeable and cloud-connected scan tools is expected to further shape the future landscape, enabling remote diagnostics and integration with digital maintenance platforms across diverse geographies.

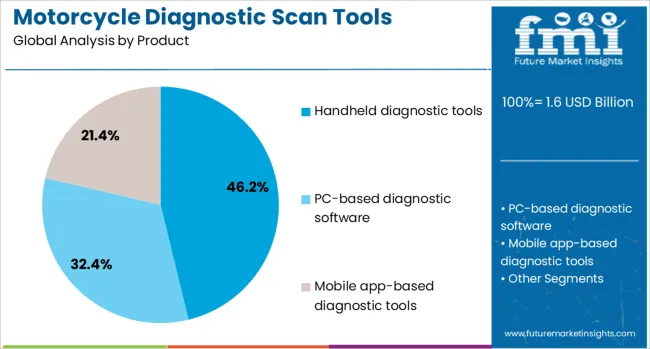

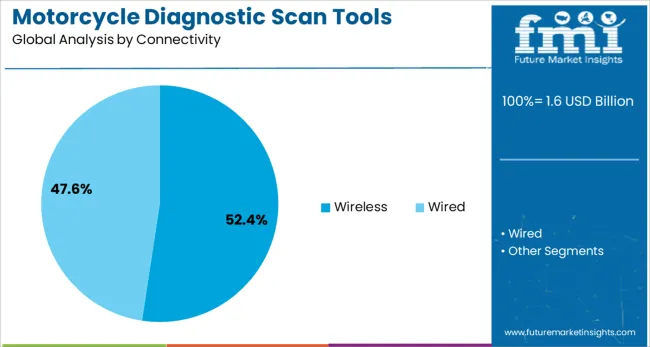

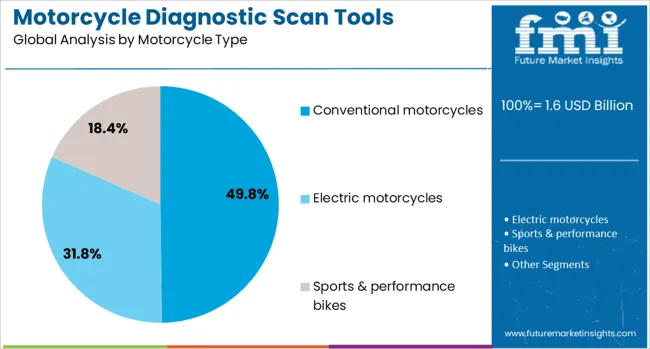

The motorcycle diagnostic scan tools market is segmented by product, connectivity, motorcycle type, end use, and geographic regions. The motorcycle diagnostic scan tools market is divided into Handheld diagnostic tools, PC-based diagnostic software, and Mobile app-based diagnostic tools. In terms of connectivity, the motorcycle diagnostic scan tools market is classified into Wireless and Wired. Based on the motorcycle type, the motorcycle diagnostic scan tools market is segmented into Conventional motorcycles, Electric motorcycles, and Sports & performance bikes. The motorcycle diagnostic scan tools market is segmented by end use into OEM service centers, Independent repair shops, and Individual riders & enthusiasts. Regionally, the motorcycle diagnostic scan tools industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The handheld diagnostic tools segment is projected to account for 46.2% of the overall motorcycle diagnostic scan tools market revenue share in 2025. This leadership position is being supported by their portability, user-friendly interface, and compatibility with a wide range of motorcycle brands and models. Handheld devices are widely adopted in both workshop and roadside service environments due to their plug-and-play nature and ability to perform core diagnostic functions without the need for external computing infrastructure.

The affordability and availability of multi-functional handheld scanners have made them a go-to solution for small-scale service operators and individual enthusiasts. These tools provide quick access to error codes, real-time parameter monitoring, and guided troubleshooting, which significantly reduce service time and improve maintenance accuracy.

Their effectiveness in both urban and rural service scenarios, combined with growing awareness among end users about proactive vehicle health monitoring, has reinforced their dominance. As motorcycles become more electronics-driven, handheld tools continue to evolve with software compatibility and firmware update features, ensuring long-term usability.

The wireless connectivity segment is expected to represent 52.4% of the motorcycle diagnostic scan tools market revenue share in 2025, highlighting a shift toward more flexible and connected diagnostic environments. This growth is being driven by the widespread use of Bluetooth and Wi-Fi enabled scanners that pair with smartphones, tablets, and dedicated diagnostic apps.

The elimination of wired interfaces has improved mobility and convenience during diagnostics, allowing technicians to monitor systems while performing physical checks without being tethered to the vehicle. Wireless tools also offer real-time data logging, cloud-based fault reporting, and remote access capabilities, which are increasingly valued in professional garage settings and service chains.

The rising availability of app-based diagnostic ecosystems, supported by OEMs and third-party developers, has further accelerated the adoption of wireless tools among tech-savvy users. Additionally, the ability to receive over-the-air updates and sync with digital service records is contributing to long-term value creation, positioning wireless connectivity as a key enabler of next-generation vehicle servicing.

The conventional motorcycles segment is projected to capture 49.8% of the motorcycle diagnostic scan tools market revenue share in 2025, maintaining its dominance across end-user categories. The segment’s strength is attributed to the vast installed base of internal combustion engine motorcycles, particularly in Asia Pacific, Latin America, and parts of Europe.

As emissions norms tighten and engine management systems become more sophisticated, diagnostic tools are playing a crucial role in enabling accurate detection of faults and compliance validation. Conventional motorcycles, despite facing a gradual shift toward electrification, continue to represent the primary mode of personal transportation in many countries, thereby sustaining aftermarket demand for compatible diagnostic solutions.

The continued reliance on fuel injection systems, ignition modules, and ECU-controlled subsystems across various motorcycle classes supports the need for frequent diagnostics and maintenance checks. The cost-effectiveness of tailored scan tools for conventional platforms and the presence of widespread servicing networks ensure ongoing relevance, reinforcing the segment's leading position in the market.

Motorcycle diagnostic scan tools are being utilized to support maintenance, service diagnostics and fault detection across motorcycle repair workshops and dealerships. These tools offer fault code reading support fuel system testing and component-level diagnostics via onboard ECU interfaces. Wireless Bluetooth or USB connectivity with mobile apps and PC software has increased user convenience. Demand has been observed in both OEM service centers and independent garages for tools offering multi-make compatibility and software updates. Suppliers providing diagnostic kits with robust firmware, vehicle coverage libraries and built-in repair guidance are positioned to serve this growing two wheeler maintenance support segment.

Diagnostic scan tools are being selected because they enable efficient identification of engine, transmission and emission faults across multiple motorcycle brands. Tool features such as live data streaming fault code retrieval and graphical parameter display have improved technician productivity and reduced diagnosis time. Wireless connectivity via Bluetooth or Wi Fi has simplified tool use offline or within service bays. Integrated software that includes maintenance schedules service bulletins and LED-guided repair steps has elevated usability for both trained mechanics and DIY users. As motorcycles from multiple OEMs with varying ECU protocols have become common, universal diagnostic toolkits with regular firmware updates have been adopted to support service networks and aftermarket specialist providers.

Adoption of diagnostic scan tools has been slowed by software compatibility issues across different motorcycle manufacturers. Varying ECU protocols and proprietary code formats have required frequent firmware updates and licence agreements, increasing cost and complexity. Tool performance may be degraded if database versions are outdated or in case of lack of calibration for newer model years. Technical staff require training to interpret diagnostic data graphs error code definitions and troubleshooting flows accurately. Tool reliability may also be affected by Bluetooth connection instability or USB port inconsistencies in workshop environments. As independent garages and smaller service centres operate with limited budgets, the upfront cost of advanced toolkits and software licence renewals has restricted widespread deployment.

Strong opportunities have been realized through increasing adoption of advanced diagnostic tools by independent motorcycle repair workshops and aftermarket service providers. Demand from electric motorcycle OEMs and e-mobility adopters is driving need for specialized scan tools compatible with battery management systems and charging diagnostics. Distribution has been expanded via mobile repair vans equipped with portable scanning units, enabling on-site diagnostics for roadside services. Partnerships with training institutes and vocational technical schools are fostering tool standardization and operator certification. Subscription models offering software updates and cloud-based fault code libraries are being introduced to generate recurring revenue. Regional growth in Asia-Pacific and Latin America, supported by rising motorcycle ownership and regulatory inspection mandates, is reinforcing market opportunities globally.

Prevailing trends include widespread deployment of IoT-enabled diagnostic tools that connect via Wi-Fi or mobile networks to update fault code databases in real time. Companion smartphone apps and cloud dashboards are being used to analyze fault data, predict maintenance needs, and share diagnostics across service networks. Modular hardware platforms supporting multi-brand compatibility are gaining traction, enabling support for diverse manufacturers from two‑wheel to three‑wheel and light‑commercial configurations. Firmware-over‑the‑air updates are being offered to ensure access to new diagnostic functions without hardware replacement. Integration with fleet management systems is emerging for rental bike platforms and delivery fleets, enabling centralized monitoring of service alerts, performance metrics, and recall notifications.

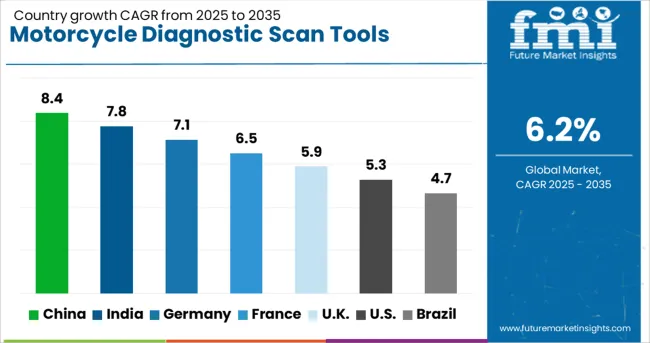

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The global motorcycle diagnostic scan tools market is projected to grow at a 6.2% CAGR between 2025 and 2035, fueled by the adoption of advanced onboard diagnostics, rising electronic content in two-wheelers, and stricter emission regulations worldwide. China leads with an 8.4% CAGR, driven by rapid growth in high-performance motorcycles and demand for connected diagnostic systems. India follows at 7.8%, supported by BS-VI norms, a strong aftermarket ecosystem, and increasing digitization in service centers. Among OECD countries, Germany posts 7.1% CAGR with advanced diagnostic integration for premium motorcycle brands. France grows at 6.5%, benefiting from high adoption of electronic fuel injection systems, while the UK records 5.9%, influenced by growing demand for digital diagnostic platforms. The analysis includes data from over 40 countries, with five profiled below.

China is forecast to register an 8.4% CAGR, supported by rapid adoption of diagnostic tools in OEM service networks and independent garages. The motorcycle diagnostic scan tools market in China is expanding as domestic brands introduce advanced models with ABS, fuel injection, and connectivity features requiring electronic diagnostics. Rising demand for wireless scan tools compatible with smartphone apps is reshaping aftermarket offerings. Chinese manufacturers are investing in multi-brand diagnostic platforms to cater to both domestic and export markets. Integration of real-time fault detection and cloud-based service data sharing is becoming common across dealer networks. Growth is also linked to regulatory compliance for emission standards, requiring frequent electronic diagnostics during periodic inspections.

India is projected to grow at a 7.8% CAGR, driven by BS-VI compliance, expansion in premium motorcycles, and rising automation in service facilities. The motorcycle diagnostic scan tools market in India benefits from increasing use of electronic fuel injection systems in commuter and performance bikes, necessitating precise fault detection. Local tool manufacturers are introducing cost-effective handheld scanners tailored for multi-brand workshops, improving accessibility in semi-urban markets. Partnerships between diagnostic equipment firms and training institutes are enhancing technician expertise. Smartphone-enabled diagnostic solutions are gaining traction in authorized service centers, where real-time updates support quick turnaround. Government emphasis on clean mobility regulations continues to influence diagnostic requirements across both ICE and hybrid motorcycles.

Germany is expected to post a 7.1% CAGR, supported by the dominance of premium motorcycle brands and stringent Euro 6 emission norms. The motorcycle diagnostic scan tools market in Germany thrives on demand from OEM-authorized service centers deploying high-end diagnostic platforms with advanced software interfaces. Bluetooth-enabled scanners integrated with predictive maintenance algorithms are gaining traction in the ury motorcycle segments. German tool makers are leading innovation in CAN and K-Line protocol compatibility for faster fault detection in multi-electronic module systems. Demand from independent workshops remains strong, especially for modular diagnostic kits with subscription-based software updates. Integration with remote diagnostics and telematics for real-time monitoring is further accelerating market expansion.

France is forecast to grow at a 6.5% CAGR, supported by increasing adoption of electronic fuel injection systems and connected vehicle technologies in motorcycles. The motorcycle diagnostic scan tools market in France benefits from regulatory mandates for emission testing, requiring advanced diagnostic systems in both authorized and independent service networks. Demand for compact, wireless diagnostic devices with multilingual interfaces is strong among small workshops. French distributors are importing smart diagnostic kits compatible with Euro 6 standards for motorcycles and scooters. Software-driven solutions capable of delivering over-the-air (OTA) updates are gaining traction in premium segments. The aftermarket is seeing growth in diagnostic subscription packages for fleet operators and rental businesses.

The United Kingdom is projected to expand at a 5.9% CAGR, influenced by growing demand for electronic diagnostics in motorcycles equipped with advanced safety and connectivity features. The motorcycle diagnostic scan tools market in the UK is shaped by adoption in both OEM networks and independent garages, where multi-protocol compatibility is essential. Diagnostic tools supporting live data streaming and component coding functions are seeing strong demand in premium motorcycle service segments. Increased penetration of hybrid and electric two-wheelers is creating a new market for EV-specific diagnostic modules. Partnerships between tool manufacturers and telematics service providers are enabling remote fault reporting and predictive maintenance for fleet applications.

The motorcycle diagnostic scan tools market is highly competitive, dominated by key players such as Robert Bosch, Denso, Continental, BorgWarner, and HELLA, alongside emerging brands like Autel Intelligent Technology, Launch Tech, Dynojet Research, iCarsoft Technology, and Eautotools. The industry operates in a moderately concentrated structure where technological expertise, regulatory compliance, and strong OEM partnerships act as primary entry barriers.

Porter’s Five Forces highlight low substitution risk, as advanced diagnostics are integral for modern motorcycles with complex ECUs and electronic systems. Supplier power remains balanced due to availability of hardware components, while buyer power is increasing as independent repair shops and aftermarket service providers seek cost-effective, multi-brand tools. Strategic groups are formed by premium OEM-linked suppliers like Bosch and Denso, which offer integrated solutions, versus aftermarket specialists such as Autel and Launch Tech that focus on affordability and universal compatibility.

Competitive differentiation revolves around software integration, real-time data analytics, cloud-based connectivity, and support for advanced functions like ABS, EFI, and ride-by-wire systems. Cost leadership is achieved through scale and modular designs, while differentiation is driven by proprietary diagnostic algorithms, multilingual support, and periodic software updates.

Value chain analysis shows advantage for firms with strong R&D pipelines, in-house software development, and global distribution partnerships. Future competition will center on AI-powered diagnostics, wireless connectivity, and predictive maintenance solutions as motorcycles adopt more electronic components.

Benchmarking performance focuses on coverage range, update frequency, user interface, and adaptability to next-generation models, positioning tech-driven companies to capitalize on growing demand from workshops and connected mobility solutions.

The motorcycle diagnostic scan tools market is witnessing significant advancements driven by the growing complexity of modern two-wheelers and the rising adoption of electric motorcycles. Manufacturers are focusing on mobile-based and wireless diagnostic solutions for enhanced portability and ease of use. Integration of AI-powered software and predictive analytics is enabling precise fault detection and preventive maintenance.

User-friendly designs and affordability are making these tools more accessible for independent workshops. Expanding aftermarket and OEM partnerships, coupled with regional penetration, continue to shape the industry’s competitive dynamics.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Product | Handheld diagnostic tools, PC-based diagnostic software, and Mobile app-based diagnostic tools |

| Connectivity | Wireless and Wired |

| Motorcycle Type | Conventional motorcycles, Electric motorcycles, and Sports & performance bikes |

| End Use | OEM service centers, Independent repair shops, and Individual riders & enthusiasts |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | RobertBosch, Denso, Continental, BorgWarner, HELLA, AutelIntelligentTechnology, LaunchTech, DynojetResearch, iCarsoftTechnology, and Eautotools |

| Additional Attributes | Dollar sales by system type (static risers, dynamic risers, umbilicals, flowlines) and material (steel, thermoplastic, composite), driven by demand in deepwater oil, subsea processing, and offshore wind. Regional leaders include North America and Europe, with Asia‑Pacific accelerating demand through new offshore field development. Innovation targets light‑weight materials, sensor-enabled subsea monitoring, and carbon capture-ready flowlines. Environmental drivers include leak-resistant design and regulatory compliance for subsea installations. |

The global motorcycle diagnostic scan tools market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the motorcycle diagnostic scan tools market is projected to reach USD 2.9 billion by 2035.

The motorcycle diagnostic scan tools market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in motorcycle diagnostic scan tools market are handheld diagnostic tools, pc-based diagnostic software and mobile app-based diagnostic tools.

In terms of connectivity, wireless segment to command 52.4% share in the motorcycle diagnostic scan tools market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Chain Market Analysis - Size, Share, and Forecast 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Motorcycle Boots Market Analysis - Size, Share, and Forecast 2025 to 2035

Motorcycle Chain Sprocket Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Insights for Motorcycle Boots Providers

Motorcycle Horn Market Analysis - Size, Share, and Forecast 2024 to 2034

Motorcycle Headlight Bracket Market Growth – Trends & Forecast 2024-2034

Motorcycle Exhaust Mounting Brackets Market

Motorcycle Side Box Market

Motorcycle Hub Motor Market

Motorcycle Sensors Market

Motorcycle Shock Absorbers Market

Motorcycle Lighting Market

Motorcycle Start Stop Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA