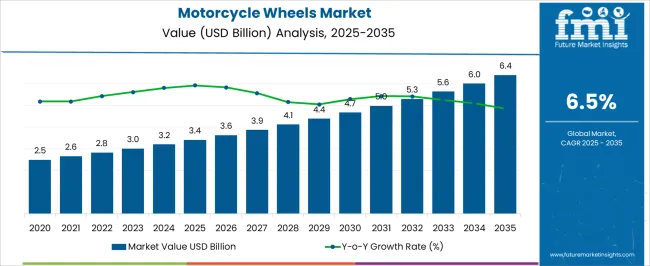

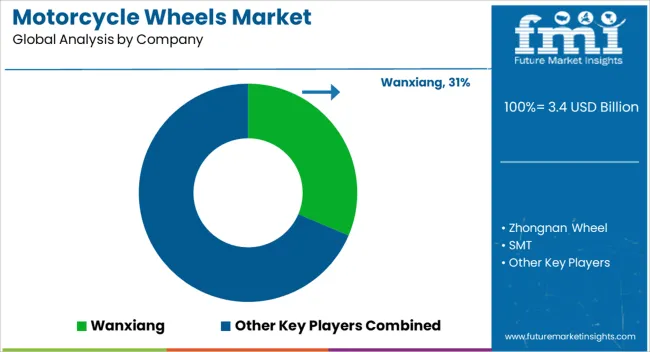

The Motorcycle Wheels Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Motorcycle Wheels Market Estimated Value in (2025 E) | USD 3.4 billion |

| Motorcycle Wheels Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The Motorcycle Wheels market is experiencing significant growth, driven by increasing demand for lightweight, durable, and performance-oriented wheels in both domestic and international markets. The current market scenario is shaped by a surge in motorcycle sales, growing preference for high-performance motorcycles, and rising urbanization in developing regions. Innovations in material technology, particularly the adoption of aluminum alloy wheels, have contributed to improved ride quality, fuel efficiency, and handling, further supporting market expansion.

Consumer preference for aesthetically appealing and reliable wheel options has also influenced demand across segments. Growth opportunities are being created by rising investments in automotive manufacturing, expansions of motorcycle dealerships, and increasing awareness of aftermarket customization.

The integration of advanced manufacturing technologies and precision engineering has facilitated consistent product quality, enhancing consumer confidence As motorcycle ownership continues to increase and the industry focuses on sustainability and performance, the market is expected to witness steady growth, with aluminum alloy wheels and efficient distribution networks playing a pivotal role in driving future revenue.

The motorcycle wheels market is segmented by type, distribution channel, sales channel, application, and geographic regions. By type, motorcycle wheels market is divided into Aluminum Alloy Wheels and Steel Wheels. In terms of distribution channel, motorcycle wheels market is classified into Offline and Online. Based on sales channel, motorcycle wheels market is segmented into Oem (Original Equipment Manufacturer) and Aftermarket. By application, motorcycle wheels market is segmented into Sports, Motorcycle Standard, Cruiser, Mopeds, Electric, Scooter Standard, Maxi, Enclosed, Three-Wheeled, and Electric (Scooter). Regionally, the motorcycle wheels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

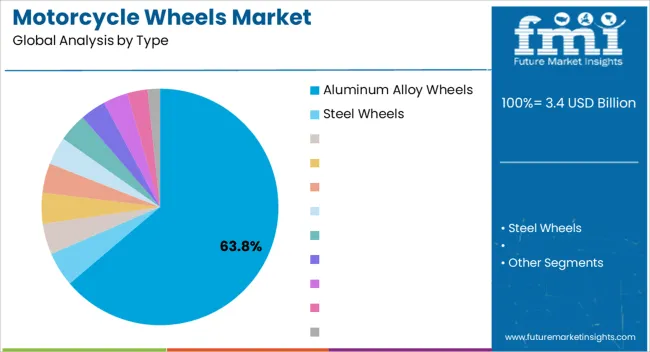

The aluminum alloy wheels segment is projected to hold 63.80% of the Motorcycle Wheels market revenue in 2025, making it the leading type. This dominance is being attributed to its favorable characteristics, including reduced weight, high strength, and improved thermal conductivity, which enhance performance, fuel efficiency, and handling stability. The segment’s growth has been supported by increasing adoption in premium and mid-range motorcycles, where performance and durability are prioritized.

Aluminum alloy wheels have also benefited from the expanding aftermarket industry, which allows consumers to upgrade or replace wheels easily. The combination of aesthetic appeal, corrosion resistance, and cost-effectiveness has made aluminum alloy wheels a preferred choice among manufacturers and consumers.

Additionally, advancements in casting and forging processes have enabled scalable production, meeting rising demand without compromising quality The ease of integration with advanced braking systems and compatibility with modern tire designs further reinforces the market leadership of aluminum alloy wheels.

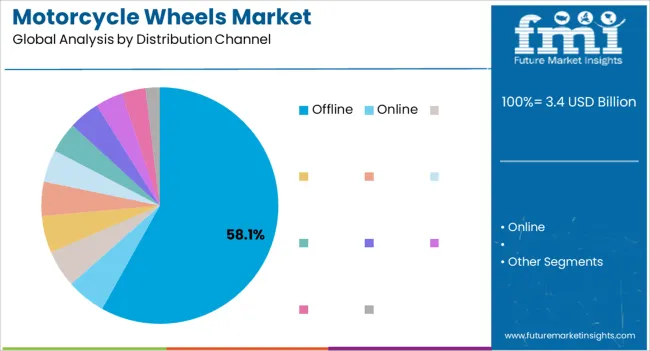

The offline distribution segment is expected to account for 58.10% of market revenue in 2025, establishing it as the primary distribution channel. This leading position is being driven by the strong presence of motorcycle dealerships, specialized wheel retailers, and authorized service centers, which facilitate direct consumer interaction and purchase assurance. Offline channels allow consumers to inspect product quality, fitment, and finish, which is critical for high-value wheel investments.

The segment has also benefited from strategic dealer networks and regional distribution hubs, which improve product accessibility and reduce delivery lead times. In addition, offline distribution supports after-sales services, installation assistance, and warranties, enhancing consumer trust and encouraging repeat purchases.

Despite the growth of e-commerce, the preference for offline buying remains strong due to the tangible evaluation of product features and professional guidance provided at the point of sale Continued investments in dealer training, showroom expansion, and regional penetration are expected to sustain the leadership of offline distribution in the motorcycle wheels market.

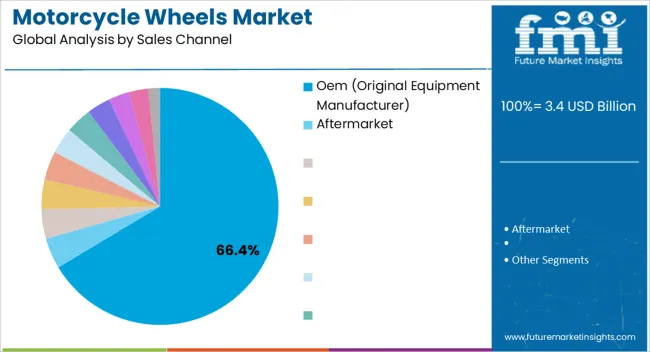

The OEM sales channel segment is projected to capture 66.40% of market revenue in 2025, making it the dominant sales channel. This leadership is being attributed to the integration of wheels directly into new motorcycles during manufacturing, which ensures compatibility, reliability, and compliance with regulatory and performance standards. The OEM channel supports long-term partnerships between wheel manufacturers and motorcycle brands, facilitating bulk production, standardized quality control, and efficient supply chain management.

Growth in this segment has been reinforced by the increasing production of motorcycles globally and the emphasis on factory-installed components for safety and performance. OEM sales channels provide manufacturers with predictable demand, reduced inventory risks, and higher margins, while consumers benefit from guaranteed fitment and product warranties.

Additionally, as motorcycle brands invest in premium features and advanced wheel designs, the OEM channel remains the preferred route for high-quality, performance-oriented wheels Continued collaboration between OEMs and wheel producers is expected to drive market expansion in the coming years.

A motorcycle is a two-wheeler vehicle, primarily driven by an internal combustion engine and built with a durable metallic and fiber frame, which is integrated with many mechanical and electronic components and the engine. One of the essential components is the wheel, which is made to cope with radial and axial forces. Motorcycle wheels also provide a platform for mounting other components, such as final drive, brakes, suspension, etc. Different types of motorcycle wheels are available in the market, including steel wheels and aluminum alloy wheels. Among these, aluminum alloy wheels are anticipated to gain traction in the coming years.

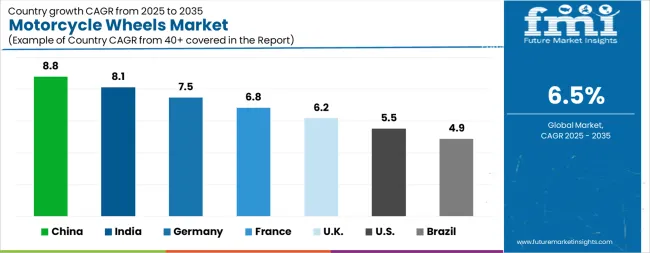

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The Motorcycle Wheels Market is expected to register a CAGR of 6.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.8%, followed by India at 8.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.9%, yet still underscores a broadly positive trajectory for the global Motorcycle Wheels Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.5%. The USA Motorcycle Wheels Market is estimated to be valued at USD 1.2 billion in 2025 and is anticipated to reach a valuation of USD 2.1 billion by 2035. Sales are projected to rise at a CAGR of 5.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 168.7 million and USD 104.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Type | Aluminum Alloy Wheels and Steel Wheels |

| Distribution Channel | Offline and Online |

| Sales Channel | Oem (Original Equipment Manufacturer) and Aftermarket |

| Application | Sports, Motorcycle Standard, Cruiser, Mopeds, Electric, Scooter Standard, Maxi, Enclosed, Three-Wheeled, and Electric (Scooter) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wanxiang, Zhongnan Wheel, SMT, and Central Wheel |

The global motorcycle wheels market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the motorcycle wheels market is projected to reach USD 6.4 billion by 2035.

The motorcycle wheels market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in motorcycle wheels market are aluminum alloy wheels and steel wheels.

In terms of distribution channel, offline segment to command 58.1% share in the motorcycle wheels market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adventure Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Chain Market Analysis - Size, Share, and Forecast 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Motorcycle Boots Market Analysis - Size, Share, and Forecast 2025 to 2035

Motorcycle Chain Sprocket Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Insights for Motorcycle Boots Providers

Motorcycle Horn Market Analysis - Size, Share, and Forecast 2024 to 2034

Motorcycle Headlight Bracket Market Growth – Trends & Forecast 2024-2034

Motorcycle Exhaust Mounting Brackets Market

Motorcycle Side Box Market

Motorcycle Hub Motor Market

Motorcycle Sensors Market

Motorcycle Shock Absorbers Market

Motorcycle Lighting Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA