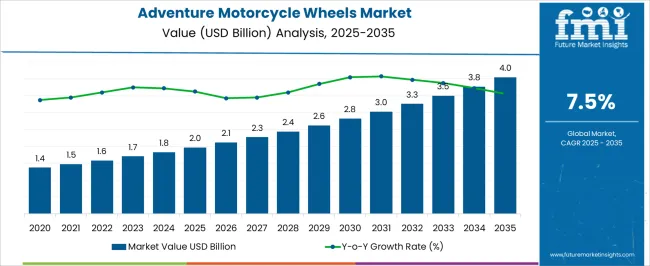

The adventure motorcycle wheels market is set for consistent growth, with an estimated value of USD 2.0 billion in 2025 projected to reach USD 4.0 billion by 2035, advancing at a CAGR of 7.5%.

This growth is strongly influenced by the rising popularity of adventure touring and dual-sport motorcycles, particularly across Asia-Pacific, Europe, and North America. Consumers are increasingly drawn to motorcycles capable of both on-road comfort and off-road endurance, boosting demand for specialized wheels that combine strength, lightweight performance, and durability. The trend toward longer-distance motorcycle touring, coupled with improved global road infrastructure, has widened the consumer base.

Key manufacturers are focusing on developing spoked wheels with enhanced rim strength, tubeless compatibility, and corrosion resistance, meeting the needs of rugged terrains. Meanwhile, alloy wheels are gaining attention for urban and light off-road riders seeking low maintenance and style. Replacement demand is also a major driver, as adventure motorcycles often endure harsh environments, leading to higher wheel wear.

| Metric | Value |

|---|---|

| Adventure Motorcycle Wheels Market Estimated Value in (2025 E) | USD 2.0 billion |

| Adventure Motorcycle Wheels Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The adventure motorcycle wheels market is experiencing sustained growth, driven by the rising popularity of off-road and long-distance touring motorcycles. Demand is being influenced by the increasing adoption of adventure motorcycles for both leisure and competitive sports, with riders prioritizing wheel designs that enhance durability, handling, and adaptability to varied terrains.

Manufacturers are investing in lightweight yet high-strength materials, advanced rim designs, and optimized wheel geometries to improve performance in challenging riding conditions. The market is also benefiting from technological advancements in wheel manufacturing processes, such as precision forging and CNC machining, which enhance structural integrity while reducing overall weight.

Additionally, the surge in global adventure touring events, expanding motorcycle adventure tourism, and growing rider communities are fostering replacement and customization demand Over the coming years, integration of performance-oriented materials with rider-centric design innovations is expected to drive further adoption, supported by premiumization trends and an expanding distribution network for aftermarket wheel upgrades.

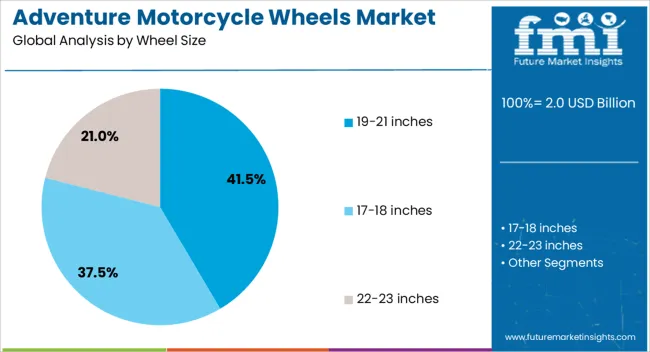

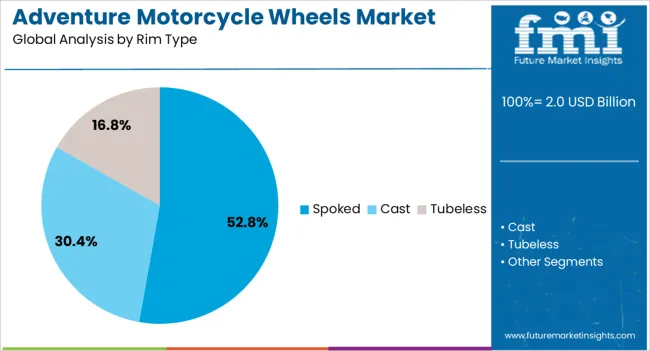

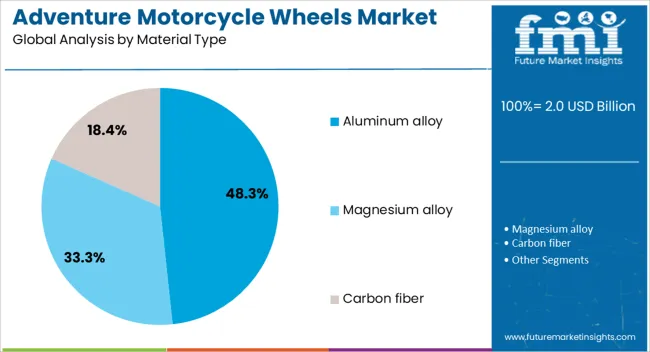

The adventure motorcycle wheels market is segmented by wheel size, rim type, material type, distribution channel, sales channel, end-use, and geographic regions. By wheel size, adventure motorcycle wheels market is divided into 19-21 inches, 17-18 inches, and 22-23 inches. In terms of rim type, adventure motorcycle wheels market is classified into Spoked, Cast, and Tubeless. Based on material type, adventure motorcycle wheels market is segmented into Aluminum alloy, Magnesium alloy, and Carbon fiber. By distribution channel, adventure motorcycle wheels market is segmented into Aftermarket and OEM. By sales channel, adventure motorcycle wheels market is segmented into Offline and Online. By end-use, adventure motorcycle wheels market is segmented into Recreational riders, Professional riders, and Commercial users. Regionally, the adventure motorcycle wheels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 19-21 inches wheel size segment is anticipated to account for 41.5% of the adventure motorcycle wheels market revenue share in 2025, reflecting its dominance in balancing on-road stability with off-road capability. This size range is favored for its ability to navigate rugged terrains while maintaining handling efficiency at higher speeds. Its versatility in both trail and highway conditions has made it a preferred choice for adventure riders seeking multi-surface adaptability.

The segment’s growth is supported by the increasing production of adventure motorcycles designed with larger front wheels for improved obstacle clearance and ride comfort. The geometry offered by 19-21 inch configurations enhances traction in loose or uneven surfaces, making it well-suited for mixed-terrain touring.

Advancements in tire technology and the availability of specialized adventure tires for this wheel size have further reinforced its market position. The combination of performance versatility and compatibility with a wide range of motorcycle models continues to underpin its strong adoption rates.

The spoked rim type segment is projected to hold 52.8% of the overall revenue share in the adventure motorcycle wheels market in 2025, making it the leading rim type. This dominance is attributed to the segment’s proven resilience and flexibility, which are critical for absorbing shocks and impacts during off-road riding. Spoked rims have been widely adopted in adventure motorcycles due to their superior ability to handle extreme terrains without compromising wheel integrity.

Their modular construction allows for easier repairs and maintenance, an important consideration for riders in remote or challenging environments. The segment has further benefited from technological improvements such as stainless steel spokes and corrosion-resistant coatings, enhancing durability and extending service life.

Compatibility with tubeless tire systems in modern spoked wheel designs has also improved their convenience and performance. The combination of ruggedness, adaptability, and evolving engineering refinements ensures that spoked rims maintain a strong presence in the adventure motorcycle segment.

The aluminum alloy material type segment is expected to account for 48.3% of the adventure motorcycle wheels market revenue share in 2025, supported by the material’s balance of strength, weight, and cost-effectiveness. Aluminum alloy wheels offer significant advantages in reducing unsprung weight, which enhances handling responsiveness and ride comfort on both paved and unpaved surfaces.

Their resistance to corrosion and ability to be manufactured with precision make them a preferred choice for riders seeking performance-oriented upgrades. Advancements in alloy composition and heat-treatment processes have improved structural integrity, allowing aluminum wheels to withstand the demands of heavy touring loads and off-road impacts.

The aesthetic appeal of aluminum alloy finishes, combined with their compatibility with a wide range of motorcycle designs, has further supported their adoption. With the ongoing trend toward lightweight, high-performance components in the adventure motorcycle segment, aluminum alloy wheels are expected to retain a leading position in both OEM and aftermarket applications.

The adventure motorcycle wheels market is expanding due to touring popularity, material improvements, OEM collaboration, and regional lifestyle trends. Performance-driven wheels remain central to long-term demand and aftermarket growth

The adventure motorcycle wheels market is strongly influenced by the rapid growth of long-distance and dual-sport riding across diverse geographies. Riders increasingly seek durable and reliable wheels capable of handling both on-road and off-road conditions. Spoked wheels remain the most dominant choice in this category due to their flexibility and shock absorption, while alloy variants are gaining traction for their lighter weight and easier maintenance. Adventure motorcycling as a lifestyle has encouraged OEMs to expand offerings with specialized wheels that balance strength and agility. This trend is particularly pronounced in Europe and North America, where organized tours and adventure rallies are boosting wheel upgrades and aftermarket sales.

A key dynamic shaping the adventure motorcycle wheels market is the shift toward advanced alloys and reinforced materials. Manufacturers are prioritizing corrosion resistance, lightweight design, and impact tolerance, which are essential for harsh terrains. Riders also demand customization options such as tubeless compatibility, anodized finishes, and varied rim sizes, creating opportunities in the aftermarket. Growth is driven by premium motorcycle brands offering tailor-made wheel solutions to enhance both aesthetics and performance. The replacement cycle for adventure wheels is shorter than that of conventional motorcycles, reflecting higher exposure to challenging terrains, which in turn stimulates recurring demand in this niche segment.

Partnerships between adventure motorcycle OEMs and wheel manufacturers have become a driving force for market growth. Leading brands are equipping their touring and dual-sport bikes with factory-fitted wheels designed for endurance, safety, and performance. This has established a standard for reliability while also encouraging aftermarket suppliers to provide competitive alternatives. The aftermarket is experiencing a surge in upgrades, with riders seeking lightweight alloys or stronger spoked wheels as replacements. Distribution through e-commerce platforms has expanded accessibility, making it easier for consumers worldwide to purchase specialized wheels. This dual channel of OEM supply and aftermarket expansion sustains strong market momentum across regions.

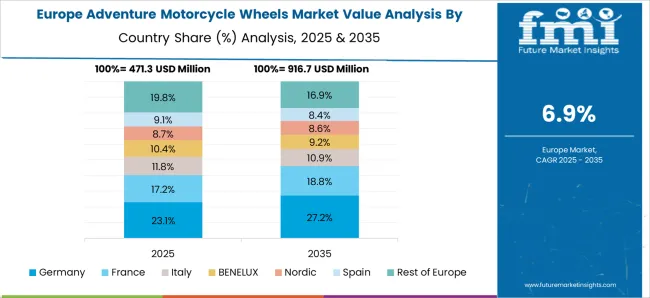

Regional variations play a significant role in shaping adventure motorcycle wheel adoption. Europe remains a leader due to high sales of premium dual-sport models, while Asia-Pacific is growing rapidly, fueled by younger riders adopting touring culture. North America shows steady growth with a focus on long-distance touring and off-road recreational biking. Lifestyle adoption of adventure motorcycling, including organized tours and adventure clubs, has further elevated the visibility of wheel upgrades. Increased disposable income in emerging markets has also contributed to aftermarket growth. The emphasis on wheel performance, durability, and aesthetic appeal highlights their role in shaping brand loyalty and rider satisfaction.

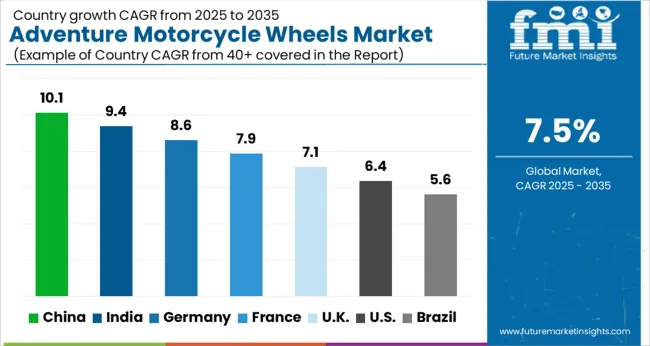

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The adventure motorcycle wheels market is projected to expand globally at a CAGR of 7.5% between 2025 and 2035, supported by rising dual-sport demand, OEM partnerships, and increasing rider preference for performance-focused wheel designs. China leads with a CAGR of 10.1%, driven by strong domestic adventure bike production, aftermarket expansion, and rising middle-class touring adoption. India follows at 9.4%, fueled by younger rider demographics, growing popularity of long-distance biking, and affordability of dual-sport models. France grows at 7.9%, reflecting greater adoption of off-road touring and higher consumer investment in aftermarket wheels. The United Kingdom records 7.1%, driven by niche sport-touring demand and growing adventure touring events. The United States posts 6.4%, reflecting a mature but steady market where wheel upgrades are linked to long-distance touring and off-road customization. The analysis spans more than 40 countries, with these six serving as primary benchmarks for OEM integration, aftermarket expansion, and consumer lifestyle-driven adoption in the global adventure motorcycle wheels market.

China’s adventure motorcycle wheels market is set to grow at 10.1% CAGR during 2025–2035, outpacing the global 7.5% path. For 2020–2024, CAGR is estimated near 8.8%, when model launches and rider club growth supported early upgrades but metal price swings limited broader replacement cycles. The step-up comes from higher output of middleweight ADVs, wider dealer networks in inland provinces, and more gravel-touring itineraries that stress rims and hubs. Spoked sets with heavier gauge stainless spokes and tubeless conversions are moving quickly, while alloy kits target commuters adding weekend trails. E-commerce has shortened delivery times for rim sizes from 17–21 inches. China will keep anchoring volume, with OEM fitments seeding a lively replacement market.

India is projected to advance at 9.4% CAGR during 2025–2035. For 2020–2024, CAGR stood around 8.1%, when entry-ADV adoption rose and tier-two cities opened multi-brand workshops. The next phase benefits from long-distance rides on national corridors, more rally events, and growth of 300–450 cc ADVs that ship with upgrade-ready hubs. Riders are shifting to stronger 36-spoke sets, reinforced rims, and cush-drive hubs after early wear on OEM parts. Rental fleets for Himalayan routes and coastal tours refresh wheels frequently, lifting replacement cadence. Local suppliers shorten lead times for nipples, spokes, and bearings, while finance plans encourage packaged upgrades with tires and brake kits.

France is forecast to grow at 7.9% CAGR during 2025–2035. For 2020–2024, CAGR was about 6.7%, supported by steady sales of 650–1200 cc tourers and expanding gravel routes in the south. The uplift is linked to rider clubs favoring mixed-surface trips, which drives swaps to stronger rims and sealed spoke systems. Aftermarket distributors report higher orders for anodized rims that resist corrosion from winter salt and sea air. Touring groups prefer quick-release axle kits that speed roadside fixes, lifting accessory baskets per rider. Insurance partners promote preventive wheel checks, creating paid service touchpoints at dealers before peak season. France’s mix skews to premium, where wheel upgrades pair with luggage, crash bars, and lighting.

The United Kingdom is expected to post 7.1% CAGR during 2025–2035, slightly under the global 7.5% rate. For 2020–2024, CAGR is calculated near 6.3%, a period marked by cautious spending and fewer multi-day events that muted replacement cycles. The rise to 7.1% follows more organized trail riding, renewed adventure festivals, and dealer-led packages that pair spoke services, rim truing, and tubeless tapes with tire changes. Private owners of mid- and large-capacity ADVs are shifting from soft rims to hardened alloys, while rural tour operators refresh fleets ahead of holiday seasons. Subscription service plans add scheduled wheel checks, improving safety and encouraging timely replacements. The UK market moves on reliability, weight savings, and quick-fit solutions for wet trails.

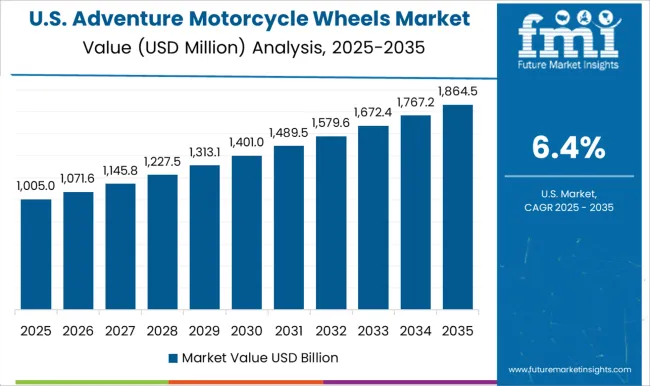

The United States is projected to grow at 6.4% CAGR during 2025–2035. For 2020–2024, CAGR was near 5.7%, when long-distance touring led activity but broader off-road travel lagged in some regions. The forecast improves with BDR route popularity, desert rallies, and growth in 700–900 cc twins that invite wheel upgrades. Riders favor wider 19/17 sets for pavement bias and narrow 21/18 sets for dirt bias, stimulating SKU variety. Dealers report higher attachment of bead-lock-style rims and heavy-duty spokes for rocky terrain. Subscription boxes that bundle spokes, nipples, and seal kits are gaining fans among DIY owners, supporting recurring spend.

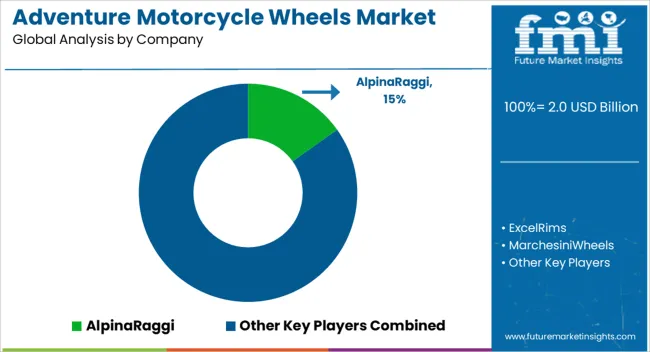

The adventure motorcycle wheels market features a strong mix of global specialists and performance-focused manufacturers, each competing through design innovation, material strength, and compatibility with diverse motorcycle platforms. Alpina Raggi stands out with its tubeless spoked wheel technology, delivering both off-road durability and on-road reliability. Excel Rims dominates with high-performance aluminum rims widely used in both OEM and aftermarket applications, prized for strength-to-weight balance. Marchesini Wheels leverages racing heritage, producing forged wheels that combine lightweight design with endurance, increasingly adapted for adventure motorcycles. Kineo Wheels is known for modular spoked wheel systems that offer easy maintenance and high customization for riders.

DID Motorcycle Chain and Rims extends its global recognition in chains to premium-quality rims that emphasize impact resistance and performance in extreme riding conditions. Haan Wheels has carved a niche through its robust, hand-built wheels favored by professional riders for motocross and adventure touring. SM Pro Rims competes with strong aftermarket penetration, offering anodized rims with advanced finishes tailored to harsh environments. Talon Engineering delivers hubs and wheel components known for precision machining, supporting riders seeking both performance and aesthetics. Warp 9 Racing emphasizes affordability and customization in off-road and adventure wheelsets, making it a popular choice among enthusiasts. Buchanan’s Spoke & Rim Inc. remains a trusted name in custom-built wheel solutions, focusing on high-quality spokes and tailored wheel builds that cater to demanding riders.

The competitive environment is shaped by rising demand for lightweight alloys, tubeless spoked solutions, and customizable aesthetics. Strategies include closer collaboration with OEMs, aftermarket expansion through e-commerce, and innovation in corrosion-resistant coatings and modular wheel systems. Companies are also investing in regional service support to meet replacement demand and reduce downtime for riders engaged in long-distance touring.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Wheel Size | 19-21 inches, 17-18 inches, and 22-23 inches |

| Rim Type | Spoked, Cast, and Tubeless |

| Material Type | Aluminum alloy, Magnesium alloy, and Carbon fiber |

| Distribution Channel | Aftermarket and OEM |

| Sales Channel | Offline and Online |

| End-Use | Recreational riders, Professional riders, and Commercial users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AlpinaRaggi, ExcelRims, MarchesiniWheels, KineoWheels, DIDMotorcycleChainandRims, HaanWheels, SMProRims, TalonEngineering, Warp9Racing, and BuchanansSpoke&RimInc. |

| Additional Attributes | Dollar sales, share, CAGR, OEM vs aftermarket demand, regional adoption patterns, material cost trends, spoked vs alloy preference, competitor launches, rider lifestyle influence, distribution channels. |

The global adventure motorcycle wheels market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the adventure motorcycle wheels market is projected to reach USD 4.0 billion by 2035.

The adventure motorcycle wheels market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in adventure motorcycle wheels market are 19-21 inches, 17-18 inches and 22-23 inches.

In terms of rim type, spoked segment to command 52.8% share in the adventure motorcycle wheels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adventure Tourism in Africa Market Size and Share Forecast Outlook 2025 to 2035

Adventure Tourism Market Analysis - Growth & Forecast 2025 to 2035

Market Share Insights of Adventure Tourism Providers

UK Adventure Tourism Market Trends – Growth, Demand & Forecast 2025-2035

GCC Adventure Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA Adventure Tourism Market Analysis – Size, Share & Industry Growth 2025-2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Japan Adventure Tourism Market Report – Demand, Size & Forecast 2025–2035

Jordan Adventure Tourism Market Size and Share Forecast Outlook 2025 to 2035

Africa Adventure Tourism Market Analysis - Growth & Forecast 2025 to 2035

Market Leaders & Share in the Winter Adventures Tourism Industry

Winter Adventures Tourism Market Analysis by Activity, by Destination, by Experience Type, and by Region - Forecast for 2025 to 2035

Germany Adventure Tourism Market Report – Size, Growth & Forecast 2025–2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Chain Market Analysis - Size, Share, and Forecast 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA