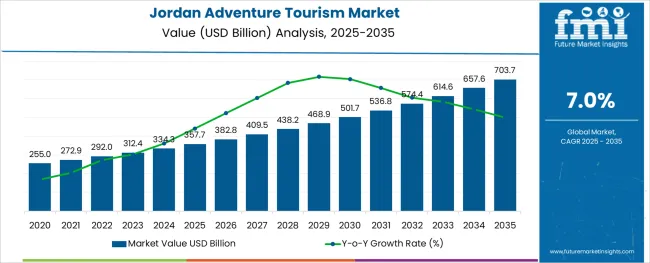

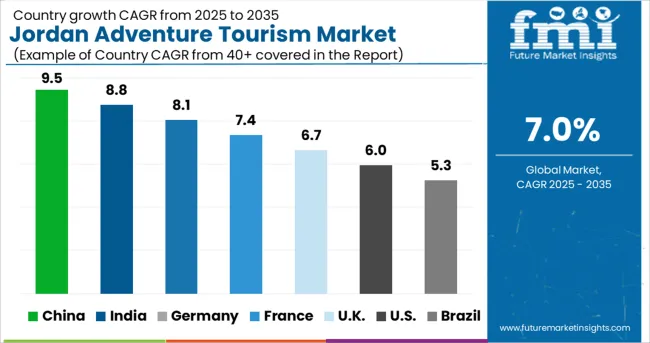

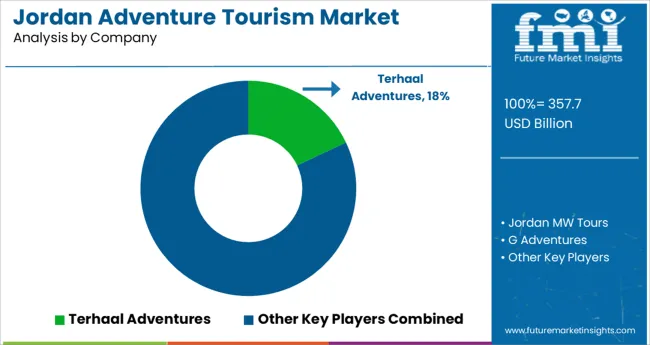

The Jordan Adventure Tourism Market is estimated to be valued at USD 357.7 billion in 2025 and is projected to reach USD 703.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The Jordan adventure tourism market is undergoing rapid evolution, influenced by a growing global appetite for immersive travel, enhanced tourism infrastructure, and targeted government efforts to position Jordan as a premier Middle Eastern destination. Rising awareness of Jordan’s natural and cultural heritage, coupled with demand for experiential, off-the-beaten-path travel, has significantly increased inbound and domestic participation in adventure tourism.

Key drivers include investments in regional connectivity, youth-focused branding campaigns, and environmental sustainability frameworks that protect natural reserves and heritage trails. Adventure tourism is increasingly being aligned with wellness and cultural engagement trends, attracting diverse traveler profiles seeking meaningful outdoor experiences.

The digitalization of tour booking, improvements in safety protocols, and diversification of adventure offerings are also reshaping market dynamics. Continued support through public-private partnerships and cross-border tourism corridors is expected to further expand Jordan’s adventure tourism footprint in the coming years.

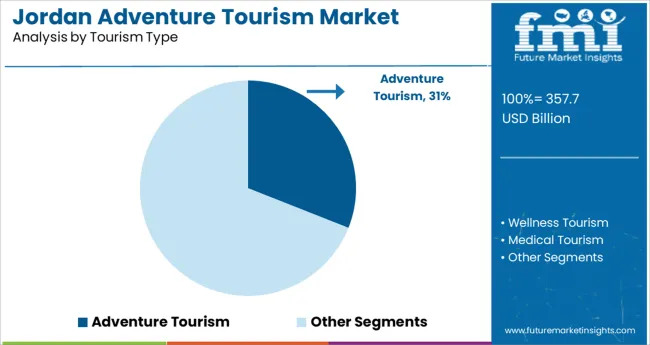

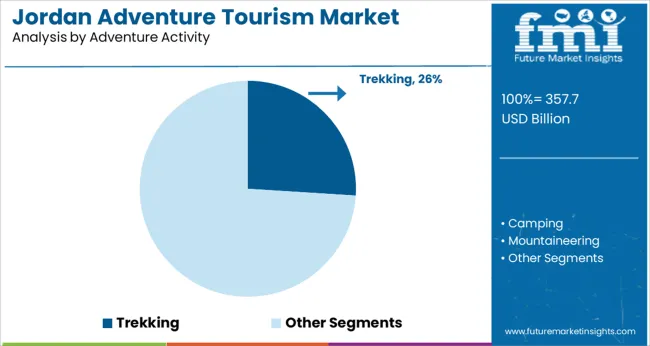

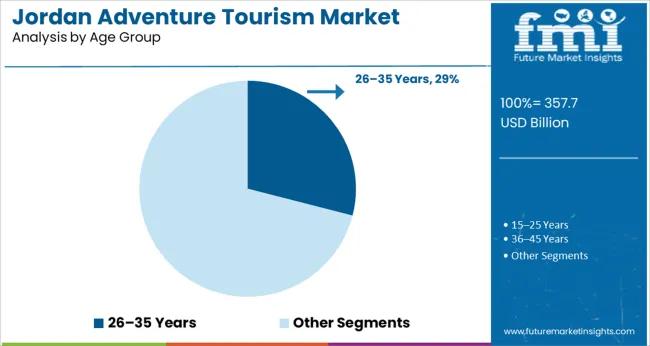

The market is segmented by Tourism Type, Adventure Activity, Age Group, Booking Channel, and Tourist Type and region. By Tourism Type, the market is divided into Adventure Tourism, Wellness Tourism, Medical Tourism, Faith-Based Tourism, and MICE Tourism. In terms of Adventure Activity, the market is classified into Trekking, Camping, Mountaineering, Safaris, and Diving. Based on Age Group, the market is segmented into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, 56-65 Years, and 66-75 Years.

By Booking Channel, the market is divided into Online Booking, Phone Booking, and In-Person Booking. By Tourist Type, the market is segmented into International and Domestic. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Adventure tourism is expected to hold 31.0% of the total market share in 2025, positioning it as the dominant tourism type. This leadership is being driven by the region’s diverse topography, which supports a broad spectrum of activities that appeal to thrill-seeking and culturally curious travelers.

Jordan’s unique positioning between desert landscapes, mountain ranges, and historical landmarks enhances its appeal for multi-activity itineraries, encouraging longer stays and higher spending. Government initiatives under national tourism strategies have prioritized adventure travel as a core growth area, incentivizing local operators to develop certified, safety-compliant experiences.

The rise in interest from millennial and Gen Z travelers has further boosted this segment, as these demographics prioritize active, Instagram-worthy experiences rooted in nature, history, and challenge. Strong promotion via digital storytelling and influencer campaigns has solidified adventure tourism as a key pillar of Jordan’s overall tourism narrative.

Trekking is projected to contribute 26.0% of the market revenue in 2025, making it the leading adventure activity in the Jordan adventure tourism market. The country’s extensive trail networks-ranging from desert crossings to mountain passages-have supported the growth of this segment. Routes like the Jordan Trail have gained international attention, attracting independent and guided trekkers from across the globe.

The activity’s growing popularity is being supported by investments in signage, rest stops, guide training, and localized accommodation. Demand has been further amplified by the post-pandemic shift toward outdoor recreation and wellness tourism, with trekking offering both health benefits and immersive cultural experiences.

Strategic partnerships between local communities and tourism boards have ensured authentic, sustainable treks that align with global ecotourism trends. As safety, accessibility, and international recognition continue to improve, trekking is expected to sustain its lead as a preferred adventure activity in Jordan.

The 26-35 years age group is anticipated to account for 29.0% of the total market revenue in 2025, making it the largest contributing demographic in Jordan’s adventure tourism market. This segment’s leadership is being reinforced by its strong affinity for active lifestyles, digital planning tools, and flexible travel patterns.

Travelers in this age range exhibit a preference for authentic, shareable experiences that combine physical activity with cultural discovery-characteristics well-matched by Jordan’s adventure offerings. High social media engagement, peer-to-peer travel inspiration, and increased use of booking platforms have made this cohort highly influential in shaping tourism trends.

The availability of budget-to-premium adventure packages, coupled with improved access to travel financing and workplace flexibility, has allowed this group to travel more frequently and more purposefully. Government and private sector campaigns that highlight offbeat, adventurous, and sustainable travel options are resonating strongly with this demographic, solidifying its position as a growth-driving segment.

Jordan is one of the most tourist-active countries in Middle Eastern Countries. Archaeological sites, natural structures, and a variety of cultural attractions are the main drivers of tourism in Jordan. The tourist industry is regarded as the foundation of the economy and also is a significant source of employment, foreign exchange, and economic expansion. Jordan received 8 million tourists in 2010. The majority of visitors to Jordan come from Arab and European nations. But a sharp decline was observed in the number of tourists from 2011 to 2020, recovering in 2020.

Jordan has shared borders with Saudi Arabia, Israel, Syria, and Iraq. Both the number of terrorists and the tensions between some of these countries are growing. Armed conflict and terrorism are common in the areas close to the borders. Numerous tourism advisories advise travelers to avoid these areas and to be aware of these situations.

With a wide variety of five-star hotels and resorts, state-of-the-art transportation systems, a variety of activities and cultural events, and wellness facilities, and with various tour companies operating there, Jordan has a well-developed tourist infrastructure. More than 2,200 businesses, including hotels, resorts, restaurants, and entertainment venues, make up Jordan's well-established leisure and tourist cluster, which supports approximately 50,000 jobs across the entire industry and multiple jobs in the lodging sub-sector.

Jordan has more than 500 hotels, both classified and unclassified, including well-known international hotel chains. Jordan is one of the Middle East's top medical tourism destinations, and in the future years, more expansion is projected to occur as a result of factors such as rising medical travel to Yemen, Sudan, Saudi Arabia, and other Gulf Cooperation Council (GCC) nations.

Despite all this, adventure tourism in Jordan is not much developed. There are unique locations all around Jordan, which have the potential to be adventure tourism spots. There is much development and research required for Jordan to be an adventure travel destination.

All these unique factors make Jordan a potential market for a variety of tours, and many travel agencies are starting to provide tours in Jordan.

ENI CBC Med and EU are funding the project ‘MEDUSA’ to evolve adventure tourism in Mediterranean countries.

One of the most popular travel locations worldwide is the Mediterranean region. The destination has seen signs of a slowdown due to increasing competition and a deterioration in the political and security environment, making the sector's recovery a top economic priority. To develop tourism in Mediterranean countries, ENI CBC Med has launched a program named ‘MEDUSA’, including Spain, Jordan, Lebanon, Italy, and Tunisia.

This program will focus on the development and promotion of sustainable adventure tourism and the development of related businesses in participant countries. This project is funded by European Union, and the project duration is till mid-2025.

Edom Adventures gets awarded for actively promoting adventure tours.

The MEDUSA Sub-Grant was given to ‘Edom Adventures’ by the Royal Society for the Conservation of Nature, the project's partner in Jordan. Edom Adventures, a tour company with offices in Jordan, organizes eco-tours as well as adventure expeditions and activities including canyoning, mountaineering, hiking, and climbing to promote adventure tourism in Jordan.

Edom Adventures was founded by Islam Al-Ma'ani, a guide with expertise in adventure tourism, who also discussed the company's future objectives of expanding adventure tours in the Wadi Rum region.

Many local tour operators are offering unique expeditions around the country.

There are hundreds of Jordanian tour companies that deal with foreign tourists, but the majority are very traditional and offer nearly identical seven-day tours that circle the country's top attractions, from Amman to Petra, Wadi Rum, Jerash, Madaba, Karak, Aqaba, and the Dead Sea.

Few tour operators will take tourists to places never discovered before, and even fewer can take you away from the tourist crowds for one-on-one interactions with locals. There are some operators with ‘Voluntourism’ and ‘Responsible tourism’ that offers visitors unique experiences.

These tour operators take tourists for trekking, camping, safaris, and bird-watching activities in nature-conserved areas. These operators also work with local businesses, helping communities around the tourist spots.

Tourists are preferring Wellness tourism and cultural tourism to explore heritage sites and release the stress of urban life.

People around the world come to Jordon to relax and heal the mind, soul, and body. There are multiple businesses and organizations working in wellness tourism around Jordan. People coming to Jordan prefer relaxing activities such as spas and massage, along with activities focusing on self-development and mindfulness. There are also community development activities included in wellness tours, such as farming and environmental tours. People come to visit sites like Petra, Wadi Rum, the Dead sea, Baptism Site Amman, and some secondary locations having a cultural heritage.

Along with this tourism, adventure tourism is also gaining popularity among international travelers coming to Jordan. But, adventure tourism requires research and development for being a popular tourism type.

Websites are used by most travelers to choose destinations and make hotel reservations while in Jordan from all over the world.

Visitors check and choose their preferred places utilizing the websites of tour-organizing organizations and businesses. The majority of travelers utilize internet travel agencies to book tours and locations, including lodging and travel, due to their flexibility and convenience of use. Some well-known brands provide combo packages that cover lodging and meal costs and offer the option to choose between standard and deluxe options. In order to find a location to stay, eat, or visit a nearby attraction known for anything, visitors can also check a variety of web resources.

Many local and international tour organizers are providing adventure tours in Jordan, offering tourists adventures like mountain climbing and trekking along with canyoning at Wadi Rum, Snorkeling in the Red Sea, Diving in Aquba, and cycling tours from the deserts of Jordan.

But most of these tours are similar and have the same destinations and activities, which might make tourists less interested in these activities. Few tour operators are trying to give unique experiences to tourists, by involving them in local interactions and taking them on jungle safaris and camping, and bird watching in season.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Region Covered | Southwest Asia |

| Key Countries Covered | Jordan |

| Key Segments Covered | Tourism Type, Adventure Activity, Booking Channel, Tourist Type, Tour Type |

| Key Companies Profiled | Jordan MW Tours; G Adventures; Jordan Direct Tours; Sherazade Travel Jordan; Trip500 Tours; Jordan Experience; Jordan Classical Tours; Jordan Travel Agency; Petra Tours; Terhaal Adventures; Wild Jordan; Raami Tours; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global jordan adventure tourism market is estimated to be valued at USD 357.7 USD billion in 2025.

It is projected to reach USD 703.7 USD billion by 2035.

The market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types are adventure tourism, wellness tourism, medical tourism, faith-based tourism and mice tourism.

trekking segment is expected to dominate with a 26.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Jordan Faith-Based Tourism Market Analysis – Trends & Forecast 2025 to 2035

Adventure Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Adventure Tourism in Africa Market Size and Share Forecast Outlook 2025 to 2035

Adventure Tourism Market Analysis - Growth & Forecast 2025 to 2035

Market Share Insights of Adventure Tourism Providers

UK Adventure Tourism Market Trends – Growth, Demand & Forecast 2025-2035

GCC Adventure Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA Adventure Tourism Market Analysis – Size, Share & Industry Growth 2025-2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Japan Adventure Tourism Market Report – Demand, Size & Forecast 2025–2035

Africa Adventure Tourism Market Analysis - Growth & Forecast 2025 to 2035

Market Leaders & Share in the Winter Adventures Tourism Industry

Winter Adventures Tourism Market Analysis by Activity, by Destination, by Experience Type, and by Region - Forecast for 2025 to 2035

Germany Adventure Tourism Market Report – Size, Growth & Forecast 2025–2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA