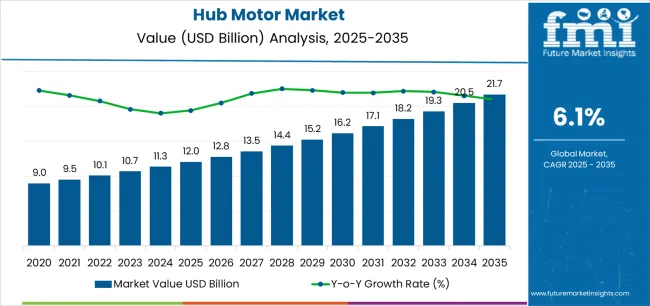

The Hub Motor Market is estimated to be valued at USD 12.0 billion in 2025 and is projected to reach USD 21.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The hub motor market is expanding rapidly, supported by the electrification of personal mobility and the growing adoption of e-bikes, electric scooters, and light electric vehicles. Hub motors offer compact design, direct drive efficiency, and reduced drivetrain complexity, making them ideal for modern urban transportation solutions.

The market’s growth is fueled by rising environmental awareness, supportive government incentives for electric mobility, and continuous technological improvement in motor efficiency and power density. Manufacturers are focusing on integrating regenerative braking systems and advanced control electronics to enhance performance.

The increasing availability of affordable electric two-wheelers, coupled with expanding charging infrastructure, has strengthened adoption across major regions. With growing consumer preference for sustainable and cost-effective mobility, the hub motor market is poised for long-term expansion.

| Metric | Value |

|---|---|

| Hub Motor Market Estimated Value in (2025 E) | USD 12.0 billion |

| Hub Motor Market Forecast Value in (2035 F) | USD 21.7 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

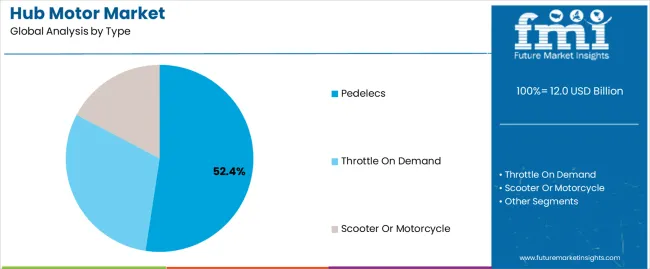

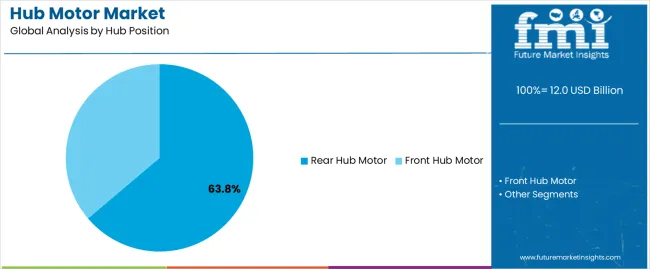

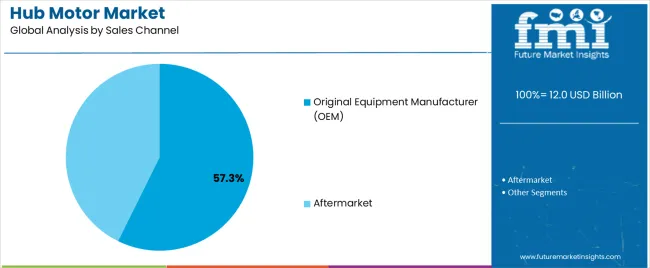

The market is segmented by Type, Hub Position, and Sales Channel and region. By Type, the market is divided into Pedelecs, Throttle On Demand, and Scooter Or Motorcycle. In terms of Hub Position, the market is classified into Rear Hub Motor and Front Hub Motor. Based on Sales Channel, the market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pedelecs segment leads the type category, holding approximately 52.4% share, driven by the surge in popularity of pedal-assist electric bicycles across urban and recreational markets. Pedelec systems combine manual pedaling with electric assistance, providing extended range and reduced physical strain for riders.

This segment’s growth is supported by government incentives promoting cycling as an eco-friendly commuting option and by increasing consumer interest in fitness-oriented mobility solutions. Hub motors used in pedelecs offer silent operation, low maintenance, and smooth torque delivery, enhancing user experience.

As cities continue to invest in cycling infrastructure and micromobility initiatives, the pedelecs segment is expected to maintain a leading position, reinforcing its role in sustainable urban transport.

The rear hub motor segment dominates the hub position category with approximately 63.8% share, primarily due to its ability to deliver efficient torque transfer and improved traction. Rear-mounted hub motors provide better weight distribution and stability, making them the preferred choice for performance-oriented electric bicycles and scooters.

The design’s simplicity and compatibility with existing drivetrain configurations have facilitated widespread adoption among manufacturers. The segment’s growth is further supported by technological advancements that reduce weight and enhance power output without compromising efficiency.

As consumer expectations for higher speed and climbing capability increase, rear hub motor systems are expected to retain their dominance across mid- and high-end electric vehicle models.

The original equipment manufacturer (OEM) segment holds approximately 57.3% share in the sales channel category, reflecting strong integration of hub motors into factory-assembled electric mobility products. OEM partnerships enable streamlined production, standardized quality control, and efficient supply chain management, ensuring reliability and performance consistency.

The segment benefits from growing collaborations between motor manufacturers and vehicle OEMs to develop customized, application-specific propulsion solutions. Increasing production of electric bicycles and scooters for both domestic and export markets has reinforced OEM demand.

With expanding global manufacturing capacity and greater emphasis on vertically integrated supply chains, the OEM segment is projected to maintain its leadership through the forecast period.

The hub motor market was valued at USD 9 billion in 2020. In the following five years, sales of hub motors increased at a CAGR of 8.1% annually.

EV incentives provided by governments in many developing economies also played a significant role in the development of the two-wheeler hub motor market during the historical period. By 2025, the net worth of total hub motors sold globally was USD 10.5 billion.

| Attributes | Details |

|---|---|

| Hub Motor Market Value (2020) | USD 9 billion |

| Historical Market Revenue (2025) | USD 10.5 billion |

| Historical CAGR (2020 to 2025) | 8.1% CAGR |

To fulfill the rising demand for electric mobility, automotive manufacturers are encouraged by national and international organizations. A significant share of this aid is earmarked to be invested in hub motor technology with supportive regulations and incentives in progressive countries.

Constant improvements in hub motor efficiency due to high power density battery technology are expected to popularize the in-hub electric propulsion systems. However, limited sources of lithium and the rising cost of lead-acid batteries are anticipated to be a possible hindrance in the coming days.

The table below lists five countries that are expected to be frontrunners in sales of hub motors for mobility scooters.

| Regional Market Comparison | CAGR (2025 to 2035) |

|---|---|

| United States | 6.7% |

| Japan | 7.9% |

| United Kingdom | 7.5% |

| South Korea | 8.5% |

| China | 6.9% |

The United States hub motor market is likely to advance at a rate of 6.7% from 2025 to 2035. The net worth of this regional market is forecasted to reach USD 21.7 billion by 2035.

Some of the prominent reasons that are expected to retain the dominance of the United States in the global market include:

Sales of hub motors in the United Kingdom are likely to rise at a 7.5% CAGR from 2025 to 2035. The net worth of the United Kingdom market is expected to reach USD 835.8 million by 2035.

Key factors that are propelling sales of hub motors in the country include:

The production of hub motors in China is expected to surge at a CAGR of 6.9% through 2035. The net worth of the hub motor industry in the country is forecasted to reach USD 3.3 billion by 2035.

Key reasons for the dominance of China in the Asian market include:

The demand for e-bike hub motors in Japan is expected to rise at a CAGR of 7.9% over the forecast period. The market value is anticipated to reach USD 2.3 billion by 2035.

Prominent factors fueling hub motor sales and supply in Japan include:

The demand for hub motors in South Korea is expected to rise at a lucrative rate of 8.5% through 2035. This regional industry value is projected to reach USD 1.4 billion by 2035.

Key factors driving sales of in-wheel hub motors in South Korea include:

| Attributes | Details |

|---|---|

| Top Product Type | Pedelecs |

| CAGR (2025 to 2035) | 6.2% |

| CAGR (2020 to 2025) | 7.9% |

Based on the product type, the pedelecs segment is more popular than other types of direct-drive hub motors. This segment is likely to grow at a CAGR of 6.2% from 2025 to 2035. Key reasons driving the segment’s growth are:

| Attributes | Details |

|---|---|

| Top Sales Channel Type | Original Equipment Manufacturer (OEM) |

| CAGR from 2025 to 2035 | 6% |

| CAGR from 2020 to 2025 | 7.7% |

Based on the sales channel, original equipment manufacturers currently achieve more sales of in-wheel motors than other segments. Sales of in-wheel hub motors through OEMs are expected to register a CAGR of 6% from 2025 to 2035.

The overall competition in the wheel hub motor market intensified only in the last few years. The rising number of industrial equipment manufacturers entering this sector can be attributed to the vital role that hub motors play in electric bikes and scooters.

On the other hand, exclusive hub motor manufacturers can benefit from partnerships with electric vehicle makers, having the potential for mass manufacturing and distribution.

Recent Developments

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 12.0 billion |

| Projected Market Size (2035) | USD 21.7 billion |

| Anticipated Growth Rate (2025 to 2035) | 6.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Product Type, By Hub Position, By Sales Channel, and By Region |

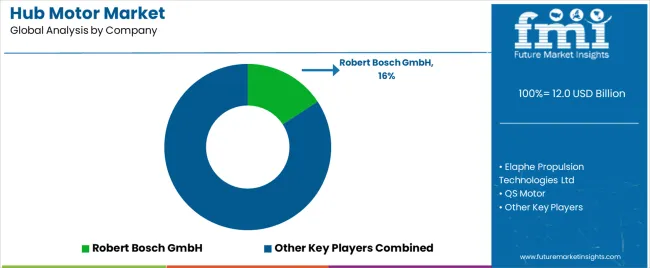

| Key Companies Profiled |

Elaphe Propulsion Technologies Ltd.; QS Motor; TDCM; Robert Bosch GmbH; MAC Shanghai Electric Motor Company Ltd. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global hub motor market is estimated to be valued at USD 12.0 billion in 2025.

The market size for the hub motor market is projected to reach USD 21.7 billion by 2035.

The hub motor market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in hub motor market are pedelecs, throttle on demand and scooter or motorcycle.

In terms of hub position, rear hub motor segment to command 63.8% share in the hub motor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motorcycle Hub Motor Market

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Hub Market

Bicycle Front Hub Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Hub Bearing Aftermarket Analysis by Product Type, Inner Diameter, Vehicle Type, Sales Channel, and Region Forecast through 2035

Customer Engagement Hub (CEH) Market Size and Share Forecast Outlook 2025 to 2035

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Motorhome Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorized Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Motorized Pool Tube Market Size and Share Forecast Outlook 2025 to 2035

Motor Generator Set Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA